Transcription

Comprehensive AnnualFinancial ReportFor Fiscal Year Ended June 30, 2019Virginia Beach, Virginia

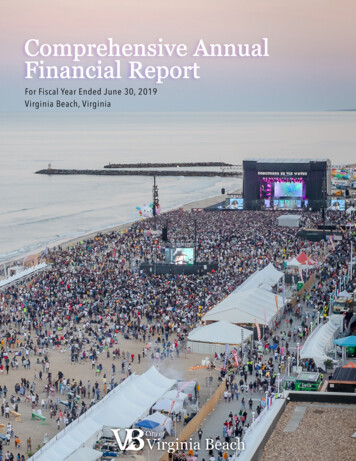

Covers: In April 2019, Pharrell Williams launched the first ever Something In The Water, amulti-day music festival and cultural experience on the beach in his hometown of VirginiaBeach. The festival sold 30,000 tickets and drew a much larger crowd to the Resort Area toenjoy not only the concerts, but seminars, art, community events and activities.Something In The Water benefited the entire region. Results of the economic impactstudy conducted following the inaugural event concluded that the first-year festival wasprofitable, not only for Virginia Beach, but for every city in the Hampton Roads region – arare feat for a large-scale, first-time event, especially one that was planned and executedin just six months.

COMPREHENSIVEANNUALFINANCIAL REPORTOF THECITY OF VIRGINIA BEACH, VIRGINIAFOR THE FISCAL YEAR ENDEDJUNE 30, 2019PREPARED BYDEPARTMENT OF FINANCEALICE M. KELLY, CPADIRECTOR

ACKNOWLEDGEMENTSThe preparation of this report has been accomplished by the efficient and dedicated services ofthe staff of the Department of Finance. I would also like to thank the City Auditor's Office fortheir assistance in managing the audit and audit contract. The contributions of all are invaluableand sincerely appreciated and clearly reflect the high standards which have been set by the Cityof Virginia Beach.CAFR PREPARATION TEAM(in alphabetical order)Kristin Bradley, Stacy Hershberger, Blake Huffman, Patricia Kephart, Kevin Kielbasa, JamesLeary, Sean Murphy, Andrew Oliver, Jumel Stuart, Murat Tosunoglu, Miryam WoodsonSTAFF SUPPORTLoretta Brown, Bonnie Castellow, Kimberly MattosCOVERPhotographer: Craig McClure Layout: Anna Kristina Alfaro, Jeanette RomeroIt is also appropriate to thank the City Manager, Mayor and Members of City Council for makingpossible the excellent financial position of the City through their interest and support in planningand conducting the financial affairs of the City.Sincerely,Alice M. Kelly, DirectorDepartment of Finance

CITY OF VIRGINIA BEACH, VIRGINIACOMPREHENSIVE ANNUAL FINANCIAL REPORTFOR THE YEAR ENDED JUNE 30, 2019TABLE OF CONTENTSPAGE NO.INTRODUCTORY SECTIONElected and Appointed OfficialsCity Organization ChartLetter of TransmittalCertificate of Achievement for Excellence in Financial ReportingvviviixxiiiFINANCIAL SECTIONIndependent Auditors’ ReportManagement’s Discussion and AnalysisBasic Financial Statements:Government-Wide Financial StatementsStatement of Net PositionStatement of ActivitiesGovernmental Funds Financial Statements:Balance SheetReconciliation of Balance Sheet to the Statement of Net PositionStatement of Revenues, Expenditures, and Changes in Fund BalanceReconciliation of the Statement of Revenues, Expenditures, and Changes in Fund Balancesof Governmental Funds to the Statement of ActivitiesProprietary Funds Financial Statements:Statement of Net PositionStatement of Revenues, Expenses and Changes in Net PositionStatement of Cash FlowsFiduciary Funds Financial Statements:Statement of Fiduciary Net PositionStatement of Changes in Fiduciary Net PositionNotes to Financial Statements:1. Summary of Significant Accounting Policies2. Fund Balances – General Fund and Nonmajor Governmental Funds3. Receivables and Accrued Liabilities4. Unearned Revenue5. Capital Assets and Land Held for Resale6. Long-Term Debt7. Assets and Obligations under Leases8. Deposits and Investments9. Commitments and Contingencies10. Tax Abatements11. Interfund Balances and Transactions, Fund Results and Reconciliations12. Risk Management13. Retirement14. Other Postemployment BenefitsRequired Supplemental Information other than Management’s Discussion and Analysis:Schedule of Revenues, Expenditures, and Changes in Fund Balance – Budget and Actual – GeneralFundSchedule of Changes in the Net Pension Liability and Related RatiosSchedule of Employer Pension ContributionsSchedule of Employer's Share of Net Pension LiabilitySchedule of Employer's Share of Net OPEB Liability and Related RatiosSchedule of OPEB Annual ContributionsSchedule of Employer's Share of the Net OPEB LiabilitySchedule of OPEB Group Life Insurance Annual ContributionsSchedule of OPEB Line of Duty Annual ContributionsSchedule of OPEB Virginia Local Disability Program Annual ContributionsSchedule of OPEB Health Insurance Credit Program Annual 46

CITY OF VIRGINIA BEACH, VIRGINIACOMPREHENSIVE ANNUAL FINANCIAL REPORTFOR THE YEAR ENDED JUNE 30, 2019FINANCIAL SECTION (continued)Other Supplemental InformationPAGE NO.Combining Schedules Nonmajor Governmental Funds:Combining Balance Sheet – Nonmajor Governmental FundsCombining Statement of Revenues, Expenditures, and Changes in Fund Balance –Nonmajor Special Revenue FundsGeneral Fund Budget to Actual:Schedule of Revenues Compared to Final BudgetSchedule of Expenditures Compared to Final BudgetCombining Schedules and Individual Funds:Combining Balance Sheet – Nonmajor Special Revenue FundsCombining Statement of Revenues, Expenditures, and Changes in Fund Balance –Nonmajor Special Revenue FundsStatements of Revenues, Expenditures, and Changes in Fund Balance – Budget and ActualAgriculture Reserve Program Special Revenue FundCentral Business District South Tax Increment Financing Special Revenue FundCombined Area Dredging Projects Special Revenue FundEmergency FEMA Special Revenue FundFederal Section Eight Program Special Revenue FundForfeited Assets Special Revenue FundHousing and Neighborhood Preservation Special Revenue FundLaw Library Special Revenue FundOpen Space Special Revenue FundParks and Recreation Special Revenue FundSandbridge Special Service District Special Revenue FundSandbridge Tax Increment Financing Special Revenue FundSheriff's Department Special Revenue FundTourism Advertising Program Special Revenue FundTourism Investment Program Special Revenue FundTown Center Special Service District Special Revenue FundWetlands Board Mitigation Special Revenue FundDebt Service FundSchedule of Revenues, Expenditures, and Changes in Fund Balance – Budget and ActualCapital Projects:Schedule of General Government Capital ProjectsEnterprise Funds:Statement of Net Position – Water and Sewer Enterprise FundStatement of Revenues, Expenses and Changes in Net Position – Water and Sewer Enterprise FundStatement of Cash Flows – Water and Sewer Enterprise FundSchedule of Operating Expenses – Budget and Actual – Water and Sewer Enterprise FundSchedule of Water and Sewer Fund Capital ProjectsStatement of Net Position – Storm Water Enterprise FundStatement of Revenues, Expenses and Changes in Net Position – Storm Water Enterprise FundStatement of Cash Flows – Storm Water Enterprise FundSchedule of Operating Expenses - Budget and Actual – Storm Water Enterprise FundSchedule of Storm Water Fund Capital ProjectsStatement of Net Position – Waste Management Enterprise FundStatement of Revenues, Expenses and Changes in Net Position – Waste Management Enterprise FundStatement of Cash Flows – Waste Management Enterprise FundSchedule of Operating Expenses - Budget and Actual – Waste Management Enterprise FundStatement of Net Position – Development Authority Enterprise FundStatement of Revenues, Expenses and Changes in Net Position – Development Authority EnterpriseFundStatement of Cash Flows – Development Authority FundInternal Service Funds:Combining Statement of Net PositionCombining Statement of Revenues, Expenses and Changes in Net PositionCombining Statement of Cash 209210211213216217218219222223224226228230

CITY OF VIRGINIA BEACH, VIRGINIACOMPREHENSIVE ANNUAL FINANCIAL REPORTFOR THE YEAR ENDED JUNE 30, 2019FINANCIAL SECTION (continued)PAGE NO.Trust and Agency Funds:Combining Statement of Fiduciary Assets and Liabilities – Agency FundsCombining Statement of Changes in Assets and Liabilities – Agency FundsCombining Statement of Fiduciary Net Position – Trust FundsCombining Statement of Changes in Fiduciary Net Position – Retirement Trust FundsDiscretely Presented School Board Component Unit:Statement of Net PositionStatement of ActivitiesBalance Sheet – Governmental FundsReconciliation of the Balance Sheet to the Statement of Net PositionStatement of Revenues, Expenditures, and Changes in Fund Balances – Governmental FundsReconciliation of the Statement of Revenues, Expenditures, and Changes in Fund Balancesof Governmental Funds to the Statement of ActivitiesCombining Balance Sheet – Nonmajor Governmental Funds – Special Revenue FundsCombining Statement of Revenues, Expenditures, and Changes in Fund Balances –Nonmajor Governmental Funds – Special Revenue FundsCombining Statement of Net Position – Internal Service FundsCombining Statement of Revenues, Expenses and Changes in Fund Net PositionInternal Service FundsCombining Statement of Cash Flows – Internal Service FundsCombining Statement of Changes in Assets and Liabilities – Agency FundsStatement of Fiduciary Net PositionStatement of Changes in Fiduciary Net 250251252253STATISTICAL SECTIONTable1234567891011121314151617181920Net Position by Component – Last Ten Fiscal YearsChanges in Net Position – Last Ten Fiscal YearsFund Balances of Governmental Funds – Last Ten Fiscal YearsChanges in Fund Balance of Governmental Funds – Last Ten Fiscal YearsGovernmental Funds Tax Revenue by Source – Last Ten Fiscal YearsAssessed Value and Estimated Actual Value of Taxable Property – Last Ten Fiscal YearsRevenue Rates for Real Estate and for Personal Property – Last Ten Fiscal YearsPrincipal Property Taxpayers – Assessed ValueProperty Tax Levies and Collections – Last Ten Fiscal YearsRatios of Outstanding Debt by Type – Last Ten Fiscal YearsRatios of Outstanding General Bonded Debt by Type – Last Ten Fiscal YearsLegal Debt Margin Information – Last Ten Fiscal YearsPledged – Revenue Coverage – Last Ten Fiscal Years – Water and SewerPledged – Revenue Coverage – Last Ten Fiscal Years – Storm WaterDemographic and Economic Statistics – Last Ten Fiscal YearsPrincipal EmployersFull-Time Equivalent Government Employees by Function – Last Ten Fiscal YearsOperating Indicators by Function – Last Ten Fiscal YearsCapital Asset Statistics by Function – Last Ten Fiscal YearsSchedule of the Treasurer’s Cash Accountability 3274275276277278279

CITY OF VIRGINIA BEACH, VIRGINIACOMPREHENSIVE ANNUAL FINANCIAL REPORTFOR THE YEAR ENDED JUNE 30, 2019PAGE NO.SINGLE AUDIT SECTIONIndependent Auditors' Report on Internal Control Over Financial Reporting and on Compliance andOther Matters Based on an Audit on Financial Statements Performed in Accordance withGovernment Auditing StandardsIndependent Auditors' Report on Compliance with Requirements That Could Have a Direct andMaterial Effect on Each Major Federal Program and on Internal Control over Compliance inAccordance with OMB Circular A-133Schedule of Findings and Questioned CostsSchedule of Expenditures of Federal AwardsNotes to Schedule of Expenditures of Federal Awards281283286292296CONTINUING 63-13-23-33-43-53-6Principal TaxpayersProperty Tax Rates and Change in Tax LevyHistorical Assessed ValueProperty Tax Levies and CollectionsPrincipal Tax Revenues by SourceTen Largest Utility (Water) CustomersWater and Sewer Enterprise Fund Outstanding Debt by IssueWater Resource Recovery Fees History of Receipts and DisbursementsWater and Sewer Enterprise Fund System Operating Revenues, Expenses, and CoverageWater and Sewer Enterprise Fund Debt Service REquirementsWater and Sewer Enterprise Fund Water and Sewer Rate HistoryTen Largest Storm Water Utility AccountsStorm Water Utility Distribution by Type of PropertyStorm Water Utility Fee CollectionsStorm Water Utility Fund Pro Forma Calculation of Revenue CovenantsStorm Water Utility Fund Debt Service RequirementsStorm Water Utility Fund Rate 3314315316

INTRODUCTORY SECTION

v

vi

xxiii

This Page Intentionally Left Blankxxiv

FINANCIAL SECTION

CliftonLarsonAllen LLPCLAconnect.comINDEPENDENT AUDITORS' REPORTThe Honorable Members of the City Council ofCity of Virginia Beach, VirginiaReport on the Financial StatementsWe have audited the accompanying financial statements of the governmental activities, business-typeactivities, the aggregate discretely presented component units, each major fund, and the aggregateremaining fund information of the City of Virginia Beach, Virginia (the City), as of and for the year endedJune 30, 2019, and the related notes to the financial statements, which collectively comprise theentity’s basic financial statements as listed in the table of contents.Management’s Responsibility for the Financial StatementsManagement is responsible for the preparation and fair presentation of these financial statements inaccordance with accounting principles generally accepted in the United States of America; this includesthe design, implementation, and maintenance of internal control relevant to the preparation and fairpresentation of financial statements that are free from material misstatement, whether due to fraud orerror.Auditors’ ResponsibilityOur responsibility is to express opinions on these financial statements based on our audit. We did notaudit the financial statements of the Virginia Beach Community Development Corporation, a discretelypresented component unit, which represents 3.5 percent of the assets, -7.5 percent of the net position,and 0.6 percent of the revenues of the aggregate discretely presented component units. Thosefinancial statements were audited by other auditors, whose reports thereon have been furnished to us,and our opinion, insofar as it relates to the amounts included for the Virginia Beach CommunityDevelopment Corporation is based solely on the reports of the other auditors. We conducted our auditin accordance with auditing standards generally accepted in the United States of America and thestandards applicable to financial audits contained in Government Auditing Standards, issued by theComptroller General of the United States and the Specifications for Audits of Counties, Cities andTowns, issued by the Auditor of Public Accountants of the Commonwealth of Virginia (Specifications).Those standards require that we plan and perform the audit to obtain reasonable assurance aboutwhether the financial statements are free from material misstatement.An audit involves performing procedures to obtain audit evidence about the amounts and disclosures inthe financial statements. The procedures selected depend on the auditors’ judgment, including theassessment of the risks of material misstatement of the financial statements, whether due to fraud orerror. In making those risk assessments, the auditor considers internal control relevant to the entity’spreparation and fair presentation of the financial statements in order to design audit procedures that areappropriate in the circumstances, but not for the purpose of expressing an opinion on the effectivenessof the entity’s internal control. Accordingly, we express no such opinion. An audit also includesevaluating the appropriateness of accounting policies used and the reasonableness of significantaccounting estimates made by management, as well as evaluating the overall presentation of thefinancial statements.xxv

The Honorable Members of the City Council ofCity of Virginia BeachPage 2We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis forour audit opinions.OpinionsIn our opinion, the financial statements referred to above present fairly, in all material respects, therespective financial position of the governmental activities, the business-type activities, the aggregatediscretely presented component units, each major fund, and the aggregate remaining fund informationof the City as of June 30, 2019, and the respective changes in financial position and, where applicable,cash flows thereof for the year then ended in accordance with accounting principles generally acceptedin the United States of America.Other MattersRequired Supplementary InformationAccounting principles generally accepted in the United States of America require that the managementdiscussion and analysis, the budgetary comparison schedules, notes to the budgetary comparisonschedules, and the Public Employee Retirement System-Primary Government schedules, as identifiedin the accompanying table of contents be presented to supplement the basic financial statements. Suchinformation, although not a part of the basic financial statements, is required by the GovernmentalAccounting Standards Board who considers it to be an essential part of financial reporting for placingthe basic financial statements in an appropriate operational, economic, or historical context. We haveapplied certain limited procedures to the required supplementary information in accordance withauditing standards generally accepted in the United States of America, which consisted of inquiries ofmanagement about the methods of preparing the information and comparing the information forconsistency with management’s responses to our inquiries, the basic financial statements, and otherknowledge we obtained during our audit of the basic financial statements. We do not express anopinion or provide any assurance on the information because the limited procedures do not provide uswith sufficient evidence to express an opinion or provide any assurance.Other InformationOur audit was conducted for the purpose of forming opinions on the financial statements thatcollectively comprise the City’s basic financial statements. The combining and individual nonmajor fundfinancial statements are presented for purposes of additional analysis and are not a required part of thebasic financial statements. The schedule of expenditures of federal awards, as required by Title 2 U.S.Code of Federal Regulations Part 200, Uniform Administrative Requirements, Cost Principles, andAudit Requirements for Federal Awards, is also presented for purposes of additional analysis and is nota required part of the basic financial statements.xxvi

The Honorable Members of the City Council ofCity of Virginia BeachPage 3The combining and individual nonmajor fund financial statements and the schedule of expenditures offederal awards are the responsibility of management and were derived from and relate directly to theunderlying accounting and other records used to prepare the basic financial statements. Suchinformation has been subjected to the auditing procedures applied in the audit of the basic financialstatements and certain additional procedures, including comparing and reconciling such informationdirectly to the underlying accounting and other records used to prepare the basic financial statementsor to the basic financial statements themselves, and other additional procedures in accordance withauditing standards generally accepted in the United States of America. In our opinion, the information isfairly stated, in all material respects, in relation to the basic financial statements as a whole.The introductory section and statistical section, as listed in accompanying table of contents, have notbeen subjected to the auditing procedures applied in the audit of the basic financial statements, andaccordingly, we do not express an opinion or provide any assurance on it.Other Reporting Required by Government Auditing StandardsIn accordance with Government Auditing Standards, we have also issued our report datedNovember 20, 2019, on our consideration of the City's internal control over financial reporting and onour tests of its compliance with certain provisions of law

the staff of the Department of Finance. I would also like to thank the City Auditor's Office for their assistance in managing the audit and audit contract. The contributions of all are invaluable and sincerely appreciated and clearly reflect the high standards which have been set by