Transcription

June 06, 2022To,The National Stock Exchange of India Ltd.Exchange Plaza, 5th Floor,Plot No. C/1, G- Block,Bandra Kurla Complex,Bandra (E), Mumbai- 400051BSE Limited25th Floor, Phiroze Jeejeebhoy Towers,Dalal Street,Mumbai- 400001Scrip Symbol “MINDSPACE” (Units)Scrip Code “543217” (Units) andScrip Code “960104”, “960327”, “973069”, “973070”and “973754” (Debentures)Subject: Submission of the 2nd Annual Report of Mindspace Business Parks REIT (“Mindspace REIT”)along with the Notice of 2nd Annual Meeting of unitholders for the financial year ended March 31, 2022.Dear Sir/Madam,Pursuant to Regulation 23 of the Securities and Exchange Board of India (Real Estate Investment Trusts)Regulations, 2014 and other applicable rules, regulations and circulars, please find enclosed herewith 2 ndAnnual Report of Mindspace Business Parks REIT (“Mindspace REIT”) along with the Notice of 2nd AnnualMeeting of unitholders for the financial year ended March 31, 2022.Please take the same on your record.Thanking you,For and on behalf of K Raheja Corp Investment Managers LLP(acting as the Manager to Mindspace Business Parks REIT)signed byNARENDR DigitallyNARENDRAA VASANT VASANT RAHALKARDate: 2022.06.06RAHALKAR 18:19:35 05'30'Authorised SignatoryName: Narendra RahalkarDesignation: Compliance OfficerEncl.: As aboveK Raheja Corp Investment Managers LLPLLP Identification Number (LLPIN): AAM-1179Regd. Office: Raheja Tower, plot No. C-30, Block ‘G’, Bandra Kurla Complex, Bandra (E), Mumbai – 400 051Phone: 91 – 22- 2656 4000 mindspacereit.com

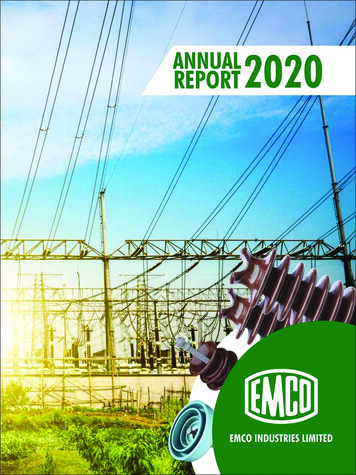

Inclusive ecosystemsResponsible growthMindspace Business Parks REITAnnual Report 2021-22

ContentWHO WE ARE 2OUR ESG PRIORITIES 40Mindspace REIT at a Glance 2Overview 40Sponsors 6Environment 48Organization Structure 8Social 52Governance 56Governing Board 10Portfolio 12Diversified Tenant Partnerships 14INDUSTRY LANDSCAPE Business Drivers 16APPRECIATIONS AND RECOGNITIONS 65HOW WE PERFORMED 1858OUR PROPERTIES 66INVESTOR ASSOCIATION 8488Message from the CEO 18Key Highlights 22Leasing Highlights 24STATUTORY REPORTS Continuous Developments 26Management Discussion and Analysis Asset Enhancements 30Risk Factors 107Acquisition Updates 32Material Litigations and Regulatory Actions 111Key Performance Indicators 34Report on Corporate Governance 14936FINANCIAL STATEMENTS 169OUR VALUE CREATION APPROACH 88Stakeholder Engagement 36Standalone 169Strategy 38Consolidated 218SUMMARY VALUATION REPORT 311Inclusive ecosystemsResponsible growthIndia’s modern workforce is moving towards spaces that are collaborativeand efficient. Building these thoughtful spaces takes more than just bricksand mortar.At Mindspace Business Parks REIT (Mindspace REIT), we are constantlyevolving to shape spaces that promote emotional and physical wellbeing andfoster growth. Our philosophy is simple – build with prudence and providea symbiotic system for all our enterprising tenants to leverage the best fromtheir formidable workforce.The year gone by – FY22 highlights31.8 msfTotal Leasable AreaAbout this ReportReporting scope and boundaryThe Annual Report FY22 ofMindspace Business Parks REIT(Mindspace REIT) reflects ourcontinued commitment to transparentstakeholder communication.This is the report on performance of Mindspace BusinessParks REIT which covers its business, along with associatedactivities, which enable short,medium and long-term valuecreation.The statutory sections, includingManagement Discussion and Analysisare presented as per Schedule IV ofSEBI (Real Estate Investment Trusts)Regulations, 2014 (REIT Regulations)as amended from time to time.Mindspace REIT is managed by K Raheja Corp InvestmentManagers LLP (Manager). Senior management ofthe Manager, under the supervision of the CEO, hasreviewed the Annual Report’s content. Governing Boardof the Manager has approved this report at its meetingheld on May 12, 2022.6.9 yearsWALE4.5 msfGross leasingc.77%Received 9 awardsacross 7 parksGreen building footprintCommitted to 100%Renewable PowerResponsibility of those charged with governance 17,501 mnRevenue (7.4% y-o-y growth) 14,864 mnNOI (8.2% growth y-o-y)36 buildingsacross portfolio 10,941 mnDistribution for FY22( 18.4 p.u.)

Who We AreMindspace REIT at a glanceMindspace REIT at a GlanceQuick factsA responsible growth story builton prudence and trust31.8 msf24.2 msf5736175 61.7 psf6.9 years 264 bn 364.9 p.u.Mindspace REIT – Pioneer of world-class business districtsMindspace REIT, a pioneer in shapingworld‑class business districts,has grown with a vision of being aresponsible leader, creating enduringexperiences for all its stakeholders.The entity's growth has been aboutembracing change, to invigoratecreativity and innovation.With high emphasis on built-to-suitfacilities, Mindspace REIT has aheterogenous portfolio combiningGrade A integrated business districtsand independent office buildingsspread across premium commercialmicro-markets of Mumbai Region,Hyderabad, Pune, and Chennai.Endorsed by prestigious corporates,global MNCs and Fortune 500companies, the portfolio is valued at 264 billion, with safety, prudence,sustainability, and governance at itscore. Each asset in the portfolio offersthe right mix of bespoke workspaceswith a modern design philosophy,keeping in mind the evolving urban andsustainable needs of tenants and theirworkforce.At Mindspace REIT, we are cognizantof these needs and a bigger corporatepurpose as we strive to responsiblybuild engaging, community-basedecosystems to create lasting value.Total Leasable AreaGreen buildingsWALECompleted AreaMarquee tenantsMarket Value (1)(2)Premium buildings across10 office assetsIn-place rentNet Asset Value3As diverse tenants get back to thephysical workplace, they seekconscious, safe, and aesthetic spacesthat treasure the physical and mentalwellbeing of their new‑age workforce.Marquee brandsNote:All above figures are as on March 31, 2022.1. The Market Value of Mindspace Madhapur is with respect to 89.0% ownership2. As valued by Independent ValuerMindspace REIT welcomesyou to the future of efficientand equitable workspacesBusiness driversLeverage acrossfour key Indianoffice marketsBolsteringpartnerships withmarquee tenantsPrudent fiscalmanagementOn the back ofexpertise andexperienceStable cashflowswith sustainedgrowthPage 162MINDSPACE BUSINESS PARKS REITANNUAL REPORT 2021-223

Who We AreMindspace REIT at a glanceMindspace REIT at a GlanceSustainablepillars ofgrowthMindspace REIT has alwaysbeen ahead of the curve inidentifying the upcoming trendsin premium business spacesthat cater to the ever evolvingneeds of global employers andtheir millennial workforce.This has been the drivingprinciple, in curatingcommunity-based,ecosystems that are dynamic,smart and guided by the pillarsof sustainability.Financial disciplineRobust portfolioOur human capitalWe always prioritise ourapproach towards financialmanagement by ensuringcomfortable leverage,generating free cash flowand ensuring long-term valuecreation for our unit holders.We invest in our people andcare deeply about our humanand intellectual resources. Wevalue the expertise our dynamicteam brings in and celebrate thediversity they offer.Distribution yield(Annualized)The Mindspace REIT portfolioencompasses finest assets thatare sustainably built and curated toprovide an engaging experiencefor our tenants. Our reach acrossimportant micro-markets isreflective of a strong portfolio thatprovides strategic value created ontenant retention and addition andfootprint expansion. We continueto explore strategic value-accretiveorganic and inorganic opportunitiesto strengthen our presence.15.7%31.8 msf6.7%Net Debt to Market ValuePage 34Total leasable area4.5 msfGross leasingValued partnerships andcommunity initiativesWe work closely with ourstakeholders, business partners,and tenants alike to forge anengaging and mutually beneficialpartnership.We also believe in nurturing andempowering our communities,especially women and children,through education, training,upskilling and reskilling.3,400 hours 175 Total tenantsTraining hours(All trainings including functional,behavioral and ESG)Page 53Page 255,900 Students benefited from‘Room to Read’, and “DeedsPublic Charitable Trust”,literacy initiatives supported byMindspace REITPage 54Key stakeholdersBusiness partnersEmployeesRating Agencies4As a responsible corporate citizen,it is our mission to constantly worktowards judiciously using naturalresources and adopting smart andsustainable practices across ourproperties. We are committedto the sustenance needs of ourfuture generations and have madesustainability a way of work andlife at Mindspace REIT. We striveto create a meaningful impact onthe ecology by adopting efficientpractices like electric mobility,energy and water conservation,renewable energy, etc.1.8 MWInstalled capacity of Solar PVCommitment to 100% renewableenergy usage by 2050StrategyCommunitiesLendersTenantsPage 36UnitholdersOwning our actionsS1Target the right set of occupiers andbecome their partner of choiceCommitted to 100% electricmobility within the parksPage 48S2Optimize capital structureS3Proactive asset managementand enhancementS4Sustainability as abusiness philosophyPage 38MINDSPACE BUSINESS PARKS REITANNUAL REPORT 2021-225

Who We AreSponsorsSponsorsKRC group encompasses the entire real estate value chain, ranging from land acquisition, development, operatingassets across offices, hospitality, malls and residential. It also has other business forays such as multi-brand retail.Over the years, the KRC group has witnessed participation from some of the marquee institutional investors includingBlackstone, GIC, among others.Our support system formaximizing growthKRC GROUPAn over four-decade legacy imbibing the tenets ofsustainability, efficiency, and responsibilityOfficeDeveloped 34.2 msfGrowing with dynamic synergiesMindspace REIT is sponsored by Cape Trading LLP and AnbeeConstructions LLP, which are part of K Raheja Corp Group (KRCGroup). KRC Group with a legacy of 4 decades, has a proven trackrecord of developing micro-markets via mixed-use ecosystemsthrough its strong institutional experience and focus on promotingsustainable development.HospitalityOperational hotel keys3,000 Malls4Operational malls(owned/managed)ResidentialDeveloped residentialprojects across5 citiesRetailKRC GROUP: Quick facts (Information as on March 31, 2022)OperatesDevelopment footprintacross asset classesGreen buildingfootprintListedentities 50 msf 22 msf36259retail outlets across IndiaVarious entities in KRCgroup are certified as‘Great Place To Work’MINDSPACE BUSINESS PARKS REITANNUAL REPORT 2021-227

Who We AreCorporate structureOrganisational StructureAssetSPVA portfolio driven byTrust – Efficacy – FortitudeIn-house facilityteam offering holisticsolutions to businessrequirementsK Raheja CorpInvestment Managers LLPMindspace BusinessParks REITAxis TrusteeServices LimitedManagerREITTrusteeKRIT Intime SundewMindspace Madhapur,HyderabadAvacadoMBPPL Paradigm Mindspace Malad,Mumbai Region Mindspace Airoli (E),Mumbai Region The Square Avenue 61 (BKC),Mumbai Region Commerzone Yerwada andThe Square Signature BusinessChambers (Nagar Road), PuneGigaplexMindspace Airoli (W),Mumbai Region100%100%Single layered taxefficient holdingstructureKRC InfraGeraCommerzoneKharadi, PuneHorizonviewCommerzone Porur,ChennaiFacilitymanagementdivision Mindspace Pocharam,Hyderabad89% (1)100% holdingacross SPVs except11% held by TSIIC100%100%100%Notes:1. 11% shareholding in these Asset SPVs is held by Telangana State Industrial Infrastructure Corporation Limited (TSIIC).All % indicate Mindspace REIT’s shareholding in respective Asset SPVs.8MINDSPACE BUSINESS PARKS REITANNUAL REPORT 2021-229

Who We AreGoverning BoardGoverning BoardTorchbearers ofEthos – Integrity – GovernanceCMCCDeepak Ghaisas is an Independent member and Chairperson of the GoverningBoard of the Manager. He is also the Chairman of Gencoval Group ofCompanies. He is currently Chairperson on the Board of Governors of IndianInstitute of Information Technology & Design, Jabalpur and also of IIIT, Gwalior.Deepak Ghaisas is Director on the Board of Stemade Biotech Private Limited.He holds a bachelor’s degree in commerce from the University of Bombay. He isa qualified Chartered Accountant, Cost Accountant, Company Secretary, andan alumnus of London Business School.DEEPAK GHAISASMANISH KEJRIWALIndependent MemberIndependent MemberMMMManisha Girotra is the CEO of Moelis & Company in India, and an Independentmember of the Governing Board of the Manager. She has more than 28 yearsof investment banking experience, with extensive cross-border M&A expertiseacross a broad range of industries. She was previously the Chairperson andCountry Head of UBS in India. She is on the Boards of Ashok Leyland Limitedand Naspers and a trustee of the Neurology Foundation and Trust. She holds aBachelor’s degree in Economics from St. Stephen’s College and a Master’s inEconomics from Delhi School of Economics. She was named one of the ‘Top50 Women to Watch’ by The Wall Street Journal Report.MANISHA GIROTRAMMMMRavi Raheja is Group President of KRC group, he has over 27 years ofexperience across the real estate, retail and hospitality sectors, andhas steered KRC group’s business towards building a robust portfolioof rent-yielding assets. An alumnus of the London Business School,Ravi is an active contributor to the industry through premier forums suchas Indian Green Building Council, where he served as the Chairman(Mumbai Chapter) and pushed for the construction of green buildingsway back in 2007. He plays a key role in KRC group’s philanthropicinitiatives through K Raheja Corp Foundation, Sadhana EducationSociety, and S. L. Raheja Hospital.RAVI RAHEJAIndependent MemberNon-Executive MemberMCCMBobby Parikh is the Founder of Bobby Parikh Associates, a boutiquefirm providing strategic tax and regulatory advisory services. He worksextensively with private equity funds, other institutional investors, ownersand managers of businesses as well as regulators and policy formulators.Bobby has been a co-founder of BMR Advisors, former CEO of Ernst &Young in India and Country Managing Partner of Arthur Andersen. Heis member of a number of trade and business associations, and Boardmember of several NGOs and listed Indian companies. He is a graduate incommerce from the University of Mumbai and a Chartered Accountant.BOBBY PARIKHMMMMNeel Raheja is Group President, KRC group where he has helped indiversification beyond the realms of real estate. He has spearheadedthe advent of organized retail in India. He is Co-chair at CII-NationalCommittee on Real Estate and Housing, the Chairman, IndiaChapter of APREA, and was President, NAREDCO West. He is alsoVice Chairman of CORENET, and Advisory Committee member ofMCHI‑CREDAI. Neel graduated in Law from the Mumbai University andis an alumnus of the Harvard Business School.NEEL RAHEJAIndependent MemberBoard CommitteesMManish Kejriwal is the Managing Partner of Kedaara Capital, a privateequity investment fund focused on India. Earlier, Manish foundedthe India office of Temasek Holdings Pte. Ltd., where he headed allits investments and other activities. Before that he was a Partner atMckinsey & Company Inc. Manish received an AB from DartmouthCollege and an MBA from Harvard University (Baker Scholar). Manish iscurrently the lead Independent Director at Bharti Airtel, a member of theboard of various Bajaj group companies and various Kedaara investeecompanies. He is a founder trustee of Ashoka University and a formermember of the Harvard Alumni Board.Non-Executive MemberNomination and RemunerationAuditInvestmentStakeholders’ RelationshipExecutiveGoverning BoardCChairpersonMMemberMr. Alan Miyasaki, Non-Independent Non-Executive Member of the Governing Board of K Raheja Corp Investment Managers LLP, Manager“Mindspace REIT” has resigned from the Governing Board of the Manager with effect from December 27, 202110MINDSPACE BUSINESS PARKS REITANNUAL REPORT 2021-2211

Who We ArePortfolioPortfolioStrong presence inprominent geographies40.6%Mumbai12.9 msfPortfolio snapshotUnderconstruction/ ProposeddevelopmentArea cupancy(%)WALE(years)based onareaIn-placebase rent(psf)Mindspace Airoli (E)4.72.16.886.386.35.2Mindspace Airoli (W)3.91.35.257.466.0Mindspace Malad0.7-0.793.6The Square BKC0.1-0.1Mumbai Region9.53.412.9Asset40.0% 101 bnCompletedarea(msf)Hyderabad12.7 msf 99 bn17.0%2.5%Pune5.4 msfTotal Leasable Area0.8 .05.970.09,0433.4Commerzone 497.998.06.768.050,10019.0Mindspace space 787.388.48.058.499,48337.7Commerzone 00Portfolio24.282.284.3Portfolio market value mix (%)(1)2.919.0Hyderabad91.7Mumbai RegionPuneCompleted% split by Total Leasable Area1. Comprises 24.2 msf Completed Area, 3.0 msf of Under-Construction area and 4.6 msf Future Development Area2. Estimated by Valuer 61.7 psf16.3%6.9 yearsMindspace MadhapurMindspace Airoli (East)Completed areaMark to Market Potential(1)Committed occupancyWALENote: All above information is as on March 31, 20221. Market Rent of 71.7 psf considered for calculating MTM potential (basis valuer estimates)122.437.7Market Value84.3%61.7Portfolio market value mix (%)(1)4.2 264 bn (2)24.2 msf6.9 1. The Market Value of Mindspace Madhapur is with respect to 89.0% ownership of REIT in respective Asset SPVsTotal Market Value 8 bn53.70.74.1Chennai 56 bn(% oftotal)Gera Commerzone KharadiFacility Management31.8 msf (1)ValueThe Square Nagar RoadHyderabadTotal Leasable AreaMarket Value as ofMar-22 ( million)ChennaiUnder construction acility managementFdivisionFuture development38.11. Above information is as on March 31, 2022In-place rentThe largest business parks in therespective marketsMINDSPACE BUSINESS PARKS REITANNUAL REPORT 2021-2213

Who We AreDiversified Tenant PartnershipsDiversified Tenant PartnershipsDiversified tenant mix across sectors (%)Dynamic partnerships forfuture-ready spaces113Building the business with the finest partners7Our tenants, some of the leading global corporates and Fortune-500 companies, arereturning to physical working spaces with renewed vigour. This has accelerated demandfor spaces that center around highest safety protocols, security, and hygiene.3426We have reimagined our spaces to be integrated with technology, reflect inimitabledesign, facilitate engagement, wellbeing, and overall camaraderie for the new-ageworkforce, while being accountable to our ecology and community.Key highlights77.2%Share of foreign MNCsin rental(1)42.3%Contribution by technologysector in rentals36.5%Share of top 10 tenantsin rentals (1)29.4%Share of Fortune 500companies in rentals (2) 99%Collection of GrossContracted Rentals (1)1811Technology (Development and Processes)Professional servicesFinancial ServicesEngineering & ManufacturingTelecom & MediaE-CommerceOthersTop 10 tenants across our portfolio:Notes:1. Represents % of Gross Constructed Rentals as on March 31, 20222. Fortune 500 Global List of 2021TenantSector% Gross Contracted Rentals# Parks Present inAccentureTechnology6.02QualcommTelecom & iproTechnology3.42IDFCFinancial Services3.22SmartworksOthers3.02VerizonTelecom & Media2.71AmazonE-Commerce2.63BarclaysFinancial Services2.61Total12 yearsAverage duration of top 10 tenants’association with us14Healthcare & PharmaMINDSPACE BUSINESS PARKS REITANNUAL REPORT 2021-2236.515Tenants have office space in morethan one park of the portfolio15

Who We AreBusiness DriversWhat’s driving our growth story –Strong Foothold, Sustained OutlookMindspace REIT’s top-notch assets across a spectrum of businesses in the country are ahallmark of the entity's unmatched amenities and quality. They are clearly indicative of anexpanding scope, in addition to the wherewithal to curate the best‑in‑class spaces. Theyalso demonstrate how the entity is a partner of choice for prominent global corporates.We focus on coalescing our purpose of sustainability into our business strategy and are committedto grow our portfolio that is engaging, efficient and synergising for our partners.Our growth story is a confluence of several parameters or growth drivers that have helped us stay buoyantacross real estate cycles and gain foothold in the industry.Leverage across four key Indianoffice marketsBolstering partnerships with marqueetenantsThe Mindspace REIT pillars of global qualitystandards, robust infrastructure, modern andsustainable design, and scale of assets, putus in pole position to bankroll on the demandsurge for quality workspaces. Our establishedleadership in key portfolio markets, arising out ofour strategically located land parcels and campusstyle business parks, makes us a partner of choicefor these companies. Our Mindspace Madhapurand Mindspace Airoli East assets are the largestparks in the respective micro markets, giving usan unassailable edge. Replicating these assets inthose business districts is an insurmountable task.Our consistent growth can be attributed to its focus onsetting newer benchmarks in tenant partnerships throughconcerted efforts, while retaining existing tenants.Our proactive tenant engagement initiatives helps uscreate a customized experience and build promisingpartnerships. We constantly work towards offeringmore facilities to our tenants in our assets by addingrecreational zones, landscaping, clubhouse, skywalks,open areas, revamping lobbies, and foodcourts, amongothers. We also organize a host of recreational activitiesand workshops for our tenants and their employees atour parks. Our tenants associate huge value with ourofferings and prefer us as their partner of choice for theirexpansion plans. The expansion of marquee tenantssuch as Qualcom, BA Continuum, and Barclays withinour portfolio is a testament to our efforts.Important milestones in FY22: Redevelopment of asset has allowed us toincrease footprint of certain buildings at theMindspace Madhapur Park by 3.5x (rebuildingfrom 0.36 to 1.31 msf) Evaluating ROFO asset of 1.8 msf at CommerzoneMadhapur post receipt of notice in February 2022 Commenced construction of B4 with a potentialleasable area of 1.0 msf at Gera CommerzoneKharadi, Pune to cater to upcoming demand Commenced construction of Club House at theMindspace Madhapaur, Hyderabad16Business driversPrudent fiscal managementStable cashflow with sustained growthAt Mindspace REIT, we believe that ourbalance sheet with low leverage willenable us to drive growth by undertakingvalue-accretive growth oppurtunities. Westrategically moved towards creating abalance of fixed cost and variable cost debt,with 45.9% of our total outstanding debt ason March 31, 2022 being fixed cost.Mindspace REIT’s long-term leases coupled withembedded escalations ensures visibility on a stable,future cash flow. Our current portfolio has a WALE of6.9 years as of March 31, 2022 and over the last fiscalwe have re-leased approximately 2.8 msf at rents,on an average, 31.0% higher than in-place rents. Wefurther stand to benefit from the Right of First Offer(ROFO) agreement with KRC group that provides anoption to acquire certain projects that are developedby the Sponsors. We are currently evaluating a ROFOasset with a total leasable area of 1.8 msf atthe Commerzone Madhapur.Important milestones in FY22: Raised 9 billion via NCD at REIT and SPVslevel in the current financial year Cost of debt has reduced by c.50 bps fromc.7.1% p.a. at the end of March 2021, toc.6.6% at the end of March 2022 Net Debt to Market Value remains low at 15.7% Corporate credit rating by CRISIL Ratings andICRA stands at CCR AAA/ Stable and [ICRA]AAA (Stable) respectivelyImportant milestones in FY22: As of March 31, 2022, our business parksdemonstrate an expansion potential of 7.6 msf, ofwhich 3.0 msf constitutes an Under ConstructionArea and 4.6 msf of Future Development Area Of our current under-construction area of 3.0msf, 1.7 msf is scheduled to be completed inFY23, out of which c.70% is already pre-leasedOn the back of expertise and experience Average work experience of 21 yearsMindspace REIT’s core team brings a collective experience of21 years across areas of development, leasing, operations,and management of commercial real estate assets acrossIndia. Our management’s deep understanding of the marketdynamics aids in creating long-term value forour stakeholders. Strong management team with unmatchedexpertise in development, assetmanagement, and fund raising, among others Strong relationship with tenants, lenders and,capital providersImportant milestones in FY22: WALE of 6.9 years – a testimony to oursteadfastness A diverse mix of tenants thatstand at 175 as of March 31, 2022 Gross Contracted Rentals as of March31, 2022 stands at 77.2% with regards tomultinational corporations and 29.4% forFortune 500 companies Of the 13.4 msf of area leased since April2018, 61.6% was leased to existing tenants On an average, our top 10 tenants havestayed with us for over 12 yearsMINDSPACE BUSINESS PARKS REITANNUAL REPORT 2021-2217

How We PerformedMessage from the CEOMessage from the CEOCEO’s message“FY22 was the strongest year in terms ofleasing as the portfolio clocked leasing ofc.4.5 msf. We look towards FY23 with arenewed optimism, as we accelerate ourgrowth via anticipated favourable movementin occupancy, on campus expansion andexploring inorganic opportunities. Wecontinue to remain committed towardsbuilding an ESG-centric and experientialecosystem that occupiers aspire to beassociated with.”With each subsiding wave of COVID-19, we witnessed ahealthy bounce back in leasing activity, reiterating the integralrole of physical office spaces. While the third wave marginallydeferred the back-to-office momentum, we expect it to beback on track with many companies announcing return towork timelines with GCCs/GICs being the front runners.As employees start coming back to their workspaces, theyhave started to relish opportunity to collaborate, brainstorm,ideate, and build camaraderie while seamlessly weaving inKey highlights of FY22 Recorded NOI growth of 8.2% y-o-y Leased c.4.5 msf Won 9 ‘Sword of Honours’ First real estate entity to commit to RE100 initiative 24.4% returns (including distributions) during FY22the organization’s culture; an intangible which could not bereplicated in remote working models.Operational performanceWe have recorded one of our best year in terms of leasing.Our in-place rent increased by 10.3% y-o-y to 61.7per sq. ft. per month. In addition, our ROFO assets alsowitnessed elevated leasing momentum, recording leasingof c.2.9 msf during the year taking the cumulative leasing toc.7.5 msf across the REIT and ROFO portfolio.Dear Unitholders,It gives me immense pleasure to present to you our secondAnnual Report.The financial year began with the second wave of thepandemic which brought in stringent nationwide restrictionsto combat it. However, the year ended with the Centrepermitting states to ease most of the restrictions, allowingthem to march towards restoring balance in the economy.The government-led inoculation drives, coupled withlower infection rates, aided in creating a positive impactand reinstating normalcy. Despite the challenges, we haverecorded one of the best years of leasing, recording volumesof c.4.5 million square feet (msf) in FY22. We have achievedhealthy re-leasing spreads of 31% and our net operatingincome has grown by c.8.2% year-on-year (y-o-y).18As organizations are moving back to working from offices,we are ready with renewed vigour to partner with our tenantsand becoming integral to their growth stories. At MindspaceREIT, we are committed to build an ecosystem that helpsattract and retain employees and offer them a collaborativeplatform to think, connect and grow.Future of officeToday, both organizations as well as their employees havestarted appreciating their workspaces more than before.Companies have realized that a workspace plays animportant role in shaping the culture of the organization byfostering collaboration, innovation, and growth. Employeestoo have come to realize the importance of having adedicated and distinguished work environment.MINDSPACE BUSINESS PARKS REITLarge occupiers are leading the inquiries to scan themarketplace for their long-term back-to-office footprintstrategies. As a result, the demand for under-constructionassets is strengthening. To quote few examples, our entirebuilding of c.0.67 msf in Commerzone Kharadi, Punehas been pre-leased to a single tenant. Our ROFO assetCommerzone Madhapur, Hyderabad with a leasable area ofc.1.8 msf was also entirely leased to a marquee global tenantand an entire under-construction building of c.0.7 msf at ourROFO asset Commerzone Pallikaranai, Chennai was alsopre-leased. This demand for large spaces is encouraging usto advance our future development timelines.Our committed occupancy for the year was 84.3%.Additionally, if we include all the pre-leasing in our underconstruction assets the committed occupancy rises toc.85.0%.Augmenting assets, enhancing growthAs envisaged, occupiers today do not want to compromiseon asset quality and asset management, as they restartANNUAL REPORT 2021-22their journey towards office occupancy. There is a strongdesire to provide work environments to their employeeswhich promote wellness and offer ample recreationalspaces, entertainment zones, and hassle-free access totransportation nodes. Work-life balance today has becomefar more important and work environments that can providethis balance are witnessing traction. We h

Management Discussion and Analysis 88 Risk Factors 107 . The entity's growth has been about embracing change, to invigorate . mobility within the parks Page 48 4 MINDSPACE BUSINESS PARKS REIT ANNUAL REPORT 2021-22 5 Who We Are Mindspace REIT at a glance. Operational hotel keys