Transcription

IntroductionChebyshev techniquesNumerical investigationsSmooth Greeks with Chebyshev InterpolationStefano ScoleriJoint work with Andrea Maran and Andrea Pallavicini1st December 2021 - Bayes Business SchoolS. ScoleriChebyshev Greeks

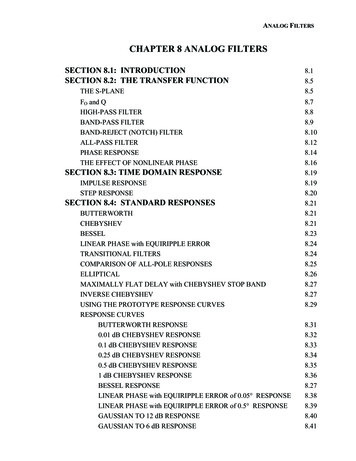

IntroductionChebyshev techniquesNumerical investigationsIndex1IntroductionMotivationBias vs VarianceSmoothing2Chebyshev techniquesPolynomial interpolation toolsChebyshev interpolationChebyshev Greeks3Numerical investigationsTarget Redemption ForwardsAutocallablesWindow Barriers4ConclusionsS. ScoleriChebyshev Greeks

IntroductionChebyshev techniquesNumerical investigations1IntroductionMotivationBias vs VarianceSmoothing2Chebyshev techniquesPolynomial interpolation toolsChebyshev interpolationChebyshev Greeks3Numerical investigationsTarget Redemption ForwardsAutocallablesWindow Barriers4ConclusionsS. ScoleriMotivationBias vs VarianceSmoothingChebyshev Greeks

IntroductionChebyshev techniquesNumerical investigationsMotivationBias vs VarianceSmoothingProblem StatementA fast and accurate evaluation of Greeks is a fundamental task forboth Front Office (for effectively managing risks) and RiskManagement (see sensitivity-based regulations such as FRTB,SIMM, SA-CVA).When a financial product is priced via Monte Carlo simulation,Greeks computation tend to be lengthy and noisy and particularcare must be used. Second order derivatives (e.g. Gamma) sufferfrom the highest instabilities.Adjoint Algorithmic Differentiation is a powerful technique tospeed-up and smooth first-order Greeks, but in general situations itcannot be applied to second order Greeks. Moreover, singularitiesin the payoff must be smoothed at the cost of adding a bias.S. ScoleriChebyshev Greeks

IntroductionChebyshev techniquesNumerical investigationsMotivationBias vs VarianceSmoothingProblem StatementIn [Maran et al.(2021)] we propose a methodology based onChebyshev interpolation, able to tame the numerical instabilitiesof Monte Carlo Greeks, including second order Greeks, withoutincreasing the overall computational burden.Chebyshev techniques have recently gained new interest in Finance,because of their ability to boost the performance of complexpricing tools. See e.g. [Gaß et al.(2018), Zeron-Ruiz(2018)].Typical applications focused, so far, on situations where a heavypricing function has to be called many times. This is the case ofcalibration, XVA pricing, FRTB and CCR computations, etc.[Glau et al.(2020), Zeron-Ruiz(2020), Zeron-Ruiz(2021a),Zeron and Ruiz(2021b)].S. ScoleriChebyshev Greeks

IntroductionChebyshev techniquesNumerical investigationsMotivationBias vs VarianceSmoothingFinite Differences: Bias-Variance TradeoffFinite Differences (FD): The original pricing function f (x) iscalled on an equispaced grid given by the following 3 points{ x0 h,x0 ,x0 h }to obtain Greeks approximations with the following formulasi1h f (x0 h) f (x0 h)f 0 (x0 ) 2hhi1f 00 (x0 ) 2 f (x0 h) 2f (x0 ) f (x0 h)hThe bump h should be fine-tuned to minimize the FD bias withoutincreasing too much the variance of the MC result. Note that:Bias[f 0 , f 00 ] O(h2 ),Var[f 0 ] O(h 1 ),S. ScoleriChebyshev GreeksVar[f 00 ] O(h 3 )

IntroductionChebyshev techniquesNumerical investigationsMotivationBias vs VarianceSmoothingFinite Differences: Bias-Variance TradeoffexactFD 3 pts (25 bps bump)FD 3 pts (1% bump)17.50.615.00.512.5error (dotted 250.9500.9751.000spot1.0251.0501.0751.100Finite Difference Delta of a digital option for different spot levels. Black-Scholes exactformulas are compared with MC results using 300K paths and two different bumpsizes: the higher bump produces significant bias.S. ScoleriChebyshev Greeks

IntroductionChebyshev techniquesNumerical investigationsMotivationBias vs VarianceSmoothingFinite Differences: Bias-Variance TradeoffexactFD 3 pts (25 bps bump)FD 3 pts (1% bump)800250600400200error (dotted lines)gamma2001500100 20050 400 100Finite Difference Gamma of a digital option for different spot levels. Black-Scholesexact formulas are compared with MC results using 300K paths and two differentbump sizes: the lower bump produces significant variance.S. ScoleriChebyshev Greeks

IntroductionChebyshev techniquesNumerical investigationsMotivationBias vs VarianceSmoothingFinite Differences: Smoothing SingularitiesAnother source of numerical instabilities in MC Greeks is thepresence of discontinuities in the price or in some of its derivatives.One trivial way to deal with this problem is to smooth the payofffunction, however this adds another hyperparamter (the smoothingparameter) and leads to a bias in the results.In practice this is achieved by replacing indicator functions withtrigger functions (tight call 8S. Scoleri1.001.021.04Chebyshev Greeks

IntroductionChebyshev techniquesNumerical investigationsMotivationBias vs VarianceSmoothingFinite Differences: Smoothing SingularitiesexactFD 3 pts (no smoothing)FD 3 pts (1% smoothing)17.50.70.615.00.512.5error (dotted 250.9500.9751.000spot1.0251.0501.0751.100Finite Difference Delta of a digital option for different spot levels. Black-Scholes exactformulas are compared with MC results using 300K paths, 0.0025 bump and differentsmoothing parameters: the smoothed Greek is biased.S. ScoleriChebyshev Greeks

IntroductionChebyshev techniquesNumerical investigationsMotivationBias vs VarianceSmoothingFinite Differences: Smoothing SingularitiesexactFD 3 pts (no smoothing)FD 3 pts (1% smoothing)800250600400200error (dotted lines)gamma2001500100 20050 400 100Finite Difference Gamma of a digital option for different spot levels. Black-Scholesexact formulas are compared with MC results using 300K paths, 0.0025 bump and twodifferent smoothing parameters: the smoothed Greek is biased.S. ScoleriChebyshev Greeks

IntroductionChebyshev techniquesNumerical investigations1IntroductionMotivationBias vs VarianceSmoothing2Chebyshev techniquesPolynomial interpolation toolsChebyshev interpolationChebyshev Greeks3Numerical investigationsTarget Redemption ForwardsAutocallablesWindow Barriers4ConclusionsS. ScoleriPolynomial interpolation toolsChebyshev interpolationChebyshev GreeksChebyshev Greeks

IntroductionChebyshev techniquesNumerical investigationsPolynomial interpolation toolsChebyshev interpolationChebyshev GreeksLagrange Polynomial InterpolatorThe idea of using Chebyshev techniques stems from using as a goodapproximation of the sensitivity the derivative of a polynomialinterpolating the price function.We start by defining the Lagrange polynomial interpolant of afunction f on an interval [a, b] based on interpolation grid{xk }k 0,.,n 1 aspn 1 (x) n 1Xf (xk ) k (x)k 0where k (x) Y x xjxk xjj6 kis the k-th Lagrange polynomial.S. ScoleriChebyshev Greeks

IntroductionChebyshev techniquesNumerical investigationsPolynomial interpolation toolsChebyshev interpolationChebyshev GreeksBarycentric FormulaThe Lagrange polynomial interpolant can be efficiently evaluatedthrough the barycentric formulaPn 1wk f (xk )k 0 x xkPn 1 wkk 0 x xkpn 1 (x) where {wk } are the barycentric weights1j6 k (xk xj )wk : QFor details on Chebyshev interpolation techniques we refer to[Trefethen(2020)] and references therein.S. ScoleriChebyshev Greeks

IntroductionChebyshev techniquesNumerical investigationsPolynomial interpolation toolsChebyshev interpolationChebyshev GreeksBarycentric DerivativesDifferentiating the barycentric formula on the interpolation nodesleads to(m)pn 1 (xi ) n 1X(m)f (xk ) k (xi ) k 0n 1X(m)Dik f (xk )k 0where D (m) is called differential matrix of order m. They dependonly on the grid points and can be computed by the followingrecursive formula ((m 1)wk (m 1)mD Dif i 6 k(0)(m)ikwi iiDik δik , Dik xi xPk(m) j6 i Dijotherwise(m)The value of pn 1 (x) at a generic point can then be obtained via the(m)barycentric formula, replacing f (xk ) with pn 1 (xk ) as given above.S. ScoleriChebyshev Greeks

IntroductionChebyshev techniquesNumerical investigationsPolynomial interpolation toolsChebyshev interpolationChebyshev GreeksChebyshev PointsThe optimal choice for the interpolation nodes is represented byChebyshev points, which on the base interval [ 1, 1] are defined as ikπ kπ, k 0, . . . , n 1xk Re e n 1 cosn 1The corresponding barycentric weights are simply given by:( 1)k2( 1)kif k 0, k n 1otherwiseS. ScoleriChebyshev Greeks(wk

IntroductionChebyshev techniquesNumerical investigationsPolynomial interpolation toolsChebyshev interpolationChebyshev GreeksRunge PhenomenonConsider the polynomial interpolation of the following function:f (x) 0.10110 x 20.10original functionuniform interpolatornodal points0.080.080.06yy0.060.040.040.020.02 10.0 7.5 5.0 2.50.0x2.55.07.510.0original functionchebyshev interpolatornodal points 10.0 7.5 5.0 2.50.0x2.55.07.510.0Lagrange interpolators of f (x) in [ 10, 10] for n 11 points. Left panel: equispacedgrid. Right panel: Chebyshev grid. As n increases, the uniform interpolator divergesclose to the boundary of the interpolation domain, while the Chebyshev interpolatorconverges everywhere to f (x).S. ScoleriChebyshev Greeks

IntroductionChebyshev techniquesNumerical investigationsPolynomial interpolation toolsChebyshev interpolationChebyshev GreeksRunge PhenomenonConsider the polynomial interpolation of the following function:f (x) 110 x 20.1000.100.0750.080.0500.025yy0.060.0000.04 0.025original functionuniform interpolatornodal points 0.050 0.075 10.0 7.5 5.0 2.50.0x2.5original functionchebyshev interpolatornodal points0.025.07.510.0 10.0 7.5 5.0 2.50.0x2.55.07.510.0Lagrange interpolators of f (x) in [ 10, 10] for n 13 points. Left panel: equispacedgrid. Right panel: Chebyshev grid. As n increases, the uniform interpolator divergesclose to the boundary of the interpolation domain, while the Chebyshev interpolatorconverges everywhere to f (x).S. ScoleriChebyshev Greeks

IntroductionChebyshev techniquesNumerical investigationsPolynomial interpolation toolsChebyshev interpolationChebyshev GreeksRunge PhenomenonConsider the polynomial interpolation of the following function:f (x) 110 x 20.100.120.080.100.06yy0.080.060.040.04original functionuniform interpolatornodal points0.020.00 10.0 7.5 5.0 2.50.0x2.5original functionchebyshev interpolatornodal points0.025.07.510.0 10.0 7.5 5.0 2.50.0x2.55.07.510.0Lagrange interpolators of f (x) in [ 10, 10] for n 15 points. Left panel: equispacedgrid. Right panel: Chebyshev grid. As n increases, the uniform interpolator divergesclose to the boundary of the interpolation domain, while the Chebyshev interpolatorconverges everywhere to f (x).S. ScoleriChebyshev Greeks

IntroductionChebyshev techniquesNumerical investigationsPolynomial interpolation toolsChebyshev interpolationChebyshev GreeksChebyshev ConvergenceTheorem (Chebyshev Approximation)Let f be an analytic function on [ 1, 1] which is analytically continuable to theclosed Bernstein ellipse Ē (ρ) of radius ρ 1. Then, m, n N C 0 s.t. f (m) pn 1 C ρ n(m)10110510 2103101ErrorsErrors10 510 810 1110 14price unif.price cheb.delta unif.delta cheb.gamma unif.gamma cheb.510price unif.price cheb.delta unif.delta cheb.gamma unif.gamma cheb.10 110 310 51520num nodes25305101520num nodes2530L errors vs number of interpolation nodes for a call with K 1, T 0.1, r 0,σ 7% and S0 [0.94, 1.01]. Left panel: analytical pricer. Right panel: MC pricer.S. ScoleriChebyshev Greeks

IntroductionChebyshev techniquesNumerical investigationsPolynomial interpolation toolsChebyshev interpolationChebyshev GreeksChebyshev GreeksLet f (x) be the price of a financial product as a function of theparameter x.We approximate f (m) at some point x̄ through the derivative p (m) (x̄)of the Chebyshev interpolant of f in some interval including x̄.The procedure can be be split out in the following phases:12Choose the interpolation domain H 3 x̄ and the number n ofChebyshev points.Build the Chebyshev interpolator. This amounts to:iiiiiiiv3compute Chebyshev points {xk }k 0,.,n 1 on H using an affine map;compute barycentric weights {wk }k 0,.,n 1 ;compute the differential matrices up to the desired order m;evaluate the original pricing function on the Chebyshev points toobtain the interpolation nodes {f (xk )}k 0,.,n 1 .Obtain the desired Greeks as p (m) (x̄).S. ScoleriChebyshev Greeks

IntroductionChebyshev techniquesNumerical investigationsPolynomial interpolation toolsChebyshev interpolationChebyshev GreeksAdaptive DomainsParticular attention should be paid to handle possible singularities, e.g. barriers,in the price function or its derivatives.We leverage on the following heuristics: close to a singularity, the derivatives ofthe price function show some peaks, which are higher and more localized themore the barrier date approaches in time. In this case we reduce the interpolationdomain. Away from the singularity, we can always use a wider domain.Therefore, we employ different methods to adapt the size of the interpolationdomain H : [ξ a, ξ a] (for some ξ) to the presence of a singularity at b:12time adaptivity:space adaptivity: a x̄ σ τa x̄ b where σ is the underlying ATM volatility, τ is the time to next singularity and ais the half-size of the interpolation domain, with appropriate bounds amin andamax . Moreover, if ξ x̄ we say that H is centered.If the singularity appears also in the price function, then we need to avoid that itfalls inside H: in this case, we apply a translation to H, without reducing it(uncentered space-adaptivity).S. ScoleriChebyshev Greeks

IntroductionChebyshev techniquesNumerical investigationsPolynomial interpolation toolsChebyshev interpolationChebyshev GreeksAdaptive DomainsThe above formula for time adaptivity is motivated by the following argument:assuming that singularities are generated by digital features,for digital options in Black model the scale of the singularity is given by σ τ .Graphical representation of the Chebyshev adaptive domain H(T ) in dependence onthe time to next barrier T compared to the behaviour of digital price (left panel),delta (middle panel) and gamma (right panel). Results shown for a Black digital callwith K 1, σ 0.4, r 0.S. ScoleriChebyshev Greeks

IntroductionChebyshev techniquesNumerical investigationsPolynomial interpolation toolsChebyshev interpolationChebyshev GreeksExampleIn order to assess the accuracy of Chebyshev methodology w.r.t. other techniques, weconsider a digital option in Black model and evaluate the following numerical errors:0ε (S) pn 1(S) BS (S) ,exactFD 3 pts (25 bps bump)FD 3 pts (1% bump)FD 7 ptschebyshev 7 pts17.500εΓ (S) pn 1(S) ΓBS (S)exactFD 3 pts (25 bps bump)FD 3 pts (1% bump)FD 7 ptschebyshev 7 pts8000.660025015.00.540012.50.40.37.5error (dotted lines)gammaerror (dotted lines)delta10.020020015001000.2 2002.50.1 01.07550 0751.100Method# nodesAvg ε Std ε Max ε Avg εΓStd εΓMax εΓFD 25bps bumpFD 1% bumpFD 1% bumpadaptive 0.6S. ScoleriChebyshev Greeks

IntroductionChebyshev techniquesNumerical investigations1IntroductionMotivationBias vs VarianceSmoothing2Chebyshev techniquesPolynomial interpolation toolsChebyshev interpolationChebyshev Greeks3Numerical investigationsTarget Redemption ForwardsAutocallablesWindow Barriers4ConclusionsS. ScoleriTarget Redemption ForwardsAutocallablesWindow BarriersChebyshev Greeks

IntroductionChebyshev techniquesNumerical investigationsTarget Redemption ForwardsAutocallablesWindow BarriersApplications to Real PayoffsWe now assess the effectiveness of our methodology in the computationof spot Greeks Delta and Gamma for some exotic payoffs with differenttypes of singularities:1FX Target Redemption Forwards (TARFs) under the StochasticLocal Volatility (SLV) model by [Tataru-Fisher(2010)]2Equity Autocallable options under multi-asset Local Volatility (LV)model by [Dupire(1994), Derman-Kani(1994)]We compare Chebyshev Greeks with 3-point finite difference Greeks fordifferent pricing dates and spot levels. The efficiency of the methodologycan be assessed via the average MC error, defined as1 :εt (y ) L1 XSEy (Sp )L p 11 Here,t denotes the pricing date, {Sp }p 1,.,L is a grid of spot levels (L 200 inour tests), SE denotes the standard error. Finally, y denotes price, delta or gamma.S. ScoleriChebyshev Greeks

IntroductionChebyshev techniquesNumerical investigationsTarget Redemption ForwardsAutocallablesWindow BarriersTest 1: FX TARFsWe consider a TARF KO, i.e. an FX product which pays, at each fixingdate Ti , the following put-like coupons until a maximum payout θ(target) is reached:K S Ti K S Ti1{ST K } 1{ST BKI }iiii nXo n X 1(K STj ) θ1 min 1,1{STj 1j 1In particular, we specify the following contract data:underlying asset: S EUR/USD FX ratestrike: K 1.15knock-in barrier: BKI 1.19knock-out barrier: BKO 1.135number of coupons: 70coupon frequency: weeklyresidual target: θ 0.2coupon notionals: Ni 0.3 · 1{STi K }S. Scoleri 0.6 · 1{STiChebyshev Greeks K }o j BKO }Ni

IntroductionChebyshev techniquesNumerical investigationsTarget Redemption ForwardsAutocallablesWindow BarriersTest 1: FX TARFs - Delta1 day to next fixing0 10 10 15 15 20 25 30 30 35 351.101.151.20spots1.25FD 3 ptschebyshev 20 25 40fixing date, 1 week to next fixing 5deltadelta 5 0FD 3 ptschebyshev1.301.101.151.20spots1.251.30Greeks methodMC paths# nodesaminamaxε1d ( )ε1w ( )finite differencesadaptive 040.030.03centered space-time adaptivityS. ScoleriChebyshev Greeks

IntroductionChebyshev techniquesNumerical investigationsTarget Redemption ForwardsAutocallablesWindow BarriersTest 1: FX TARFs - Gamma1 day to next fixingfixing date, 1 week to next fixingFD 3 ptschebyshev 00 200 1000 400gammagamma1000 2000 600 3000 800 4000 10001.101.151.20spots1.251.30FD 3 ptschebyshev1.101.151.20spots1.251.30Greeks methodMC paths# nodesaminamaxε1d (Γ)ε1w (Γ)finite differencesadaptive 4centered space-time adaptivityS. ScoleriChebyshev Greeks

IntroductionChebyshev techniquesNumerical investigationsTarget Redemption ForwardsAutocallablesWindow BarriersTest 2: Equity AutocallablesWe now consider an autocallable with memory on a basket of twostocks, i.e. an option paying, at each time Ti , the following coupons,unless the basket performance crosses a level Bcall : "Π(Ti ) 1{τ Ti } Ni #i 1 XNj Π(Tj ) 1{P(Ti ) Bcoup } δiN (P(TN ) 1) 1{P(TN ) Bguar } j 1where τ min{Ti : P(Ti ) Bcall }.In particular, we specify the following contract data:underlying assets: TELECOM and VODAFONE share pricesnoperformance type: “worst-of”, i.e. P(t) min StTEL /0.48, StVOD /1.3call barrier: Bcall 100%coupon barrier: Bcoup 90%capital-guarantee barrier: Bguar 60%number of coupons: N 7coupon frequency: quarterlycoupon notionals: Ni 0.02S. ScoleriChebyshev Greeks

IntroductionChebyshev techniquesNumerical investigationsTarget Redemption ForwardsAutocallablesWindow BarriersTest 2: Equity Autocallables - Delta3 days to next fixing3 months to next fixingFD 3 350 0.375 0.400 0.425 0.450 0.475 0.500 0.525spots FD 3 ptschebyshev1.6deltadelta3.00.350 0.375 0.400 0.425 0.450 0.475 0.500 0.525spotsGreeks methodMC paths# nodesaminamaxε3d ( )ε3m ( )finite differencesadaptive 01centered space-time adaptivityS. ScoleriChebyshev Greeks

IntroductionChebyshev techniquesNumerical investigationsTarget Redemption ForwardsAutocallablesWindow BarriersTest 2: Equity Autocallables - Gamma3 days to next fixing3 months to next fixingFD 3 ptschebyshev5000 5gammagamma100 50 10 15 100 20 1500.350 0.375 0.400 0.425 0.450 0.475 0.500 0.525spots FD 3 ptschebyshev0.350 0.375 0.400 0.425 0.450 0.475 0.500 0.525spotsGreeks methodMC paths# nodesaminamaxε3d (Γ)ε3m (Γ)finite differencesadaptive Chebyshev1,000,000300,000371%3%1%10%7551centered space-time adaptivityS. ScoleriChebyshev Greeks

IntroductionChebyshev techniquesNumerical investigationsTarget Redemption ForwardsAutocallablesWindow BarriersTest 3 (Beyond MC Greeks): Window UOCThe benefits of Chebyshev Greeks are not limited to MC pricers: consider e.g. anup-and-out window barrier option under the SLV model by [Tataru-Fisher(2010)],priced with a PDE approach as described in [in ’t Hout-Foulon(2010)]:Π(T ) [ω (ST K )] 1{St B, Ts t Te }We perform a similar analysis as before2 on the following contract:underlying asset: S EUR/USD FX ratecall type: ω 1strike: K 1.1574barrier level: B 1.23barrier monitoring: continuousbarrier end date Te : 11Mexpiry T : 1Y2 Regarding the estimations of errors ε (y ), we consider here the average distance,ton 200 spot levels, with values of y computed with a double-sized PDE grid and7-point FD with a bump of 5bps. The barrier start date Ts can be either future orpast, depending on the test case.S. ScoleriChebyshev Greeks

IntroductionChebyshev techniquesNumerical investigationsTarget Redemption ForwardsAutocallablesWindow BarriersTest 3 (Beyond MC Greeks): Window UOC - Delta5 days to barrier start date5 days past barrier start dateFD 3 ptschebyshev0.100.050.050.00deltadelta0.00 0.05 0.05 0.10 0.10 0.15 0.15 0.20 0.201.00 1.05 1.10 1.15 1.20 1.25 1.30spots FD 3 ptschebyshev0.101.00 1.05 1.10 1.15 1.20 1.25 1.30spotsGreeks methodx-thickness# nodesaminamaxε 5d ( )ε5d ( )finite differencesadaptive .00005centered time-adaptivity before barrier start, uncentered space-adaptivity afterwards.S. ScoleriChebyshev Greeks

IntroductionChebyshev techniquesNumerical investigationsTarget Redemption ForwardsAutocallablesWindow BarriersTest 3 (Beyond MC Greeks): Window UOC - Gamma155 days past barrier start date640 20 4 5 61.00 1.05 1.10 1.15 1.20 1.25 1.30spots FD 3 ptschebyshev25gammagamma105 days to barrier start dateFD 3 ptschebyshev1.00 1.05 1.10 1.15 1.20 1.25 1.30spotsGreeks methodx-thickness# nodesaminamaxε 5d (Γ)ε5d (Γ)finite differencesadaptive red time-adaptivity before barrier start, uncentered space-adaptivity afterwards.S. ScoleriChebyshev Greeks

IntroductionChebyshev techniquesNumerical investigations1IntroductionMotivationBias vs VarianceSmoothing2Chebyshev techniquesPolynomial interpolation toolsChebyshev interpolationChebyshev Greeks3Numerical investigationsTarget Redemption ForwardsAutocallablesWindow Barriers4ConclusionsS. ScoleriChebyshev Greeks

IntroductionChebyshev techniquesNumerical investigationsConclusions and Future PerspectivesWe presented a simple and general method, based on Chebyshevinterpolation techniques, for Greeks computation of arbitrarilycomplex payoffs, with different numerical pricing techniques.The number of interpolation nodes can be kept low (typically under10), while the size of interpolation domain can be adapted to thetime and space distance from singularities in the price or itsderivatives.In most situations, the methodology allows to significantly improvethe numerical stability of Greeks and, at the same time, to reducethe computational time, even though the number of repricings isslightly increased w.r.t. standard FD.The multi-dimensional extension3 of Chebyshev techniques wouldoffer the possibility to effectively compute also cross-gammas.3 seee.g. [Glau et al.(2020)]S. ScoleriChebyshev Greeks

IntroductionChebyshev techniquesNumerical investigationsReferencesDerman, E. and Kani, I., 1994. Riding on a smile, Risk. 7:32–39.Dupire, B., 1994. Pricing with a smile, Risk. 7(1):18–20.Glasserman, P., 2003. Monte Carlo Methods in FinancialEngineering, Springer.Gaß, M., Glau, K., Mahlstedt, M., Mair, M., 2018. Chebyshevinterpolation for parametric option pricing, Finance and Stochastics.22(3):701–731.Glau, K., Kressner, D., Statti, F., 2020. Low-rank tensorapproximation for Chebyshev interpolation in parametric optionpricing, SIAM Journal on Financial Mathematics. 11(3):897–927.in ’t Hout, K. J. and Foulon, S., 2010. ADI finite difference schemesfor option pricing in the Heston model with correlation, InternationalJournal of Numerical Analysis and Modeling, 7(2):303–320.S. ScoleriChebyshev Greeks

IntroductionChebyshev techniquesNumerical investigationsReferences (cont.)Maran, A., Pallavicini, A., and Scoleri, S., 2021. Chebyshev Greeks.Smoothing Gamma without Bias, preprint:https://ssrn.com/abstract 3872744.Tataru, G. and Fisher, T., 2010. Stochastic local volatility,Quantitative Development Group, Bloomberg.Trefethen, L.N., 2020. Approximation Theory and ApproximationPractice, SIAM – Society for Industrial and Applied Mathematics.Zeron Medina Laris, M. and Ruiz, I., 2018. Chebyshev methods forultra-efficient risk calculations, preprint:https://arxiv.org/abs/1805.00898.Zeron Medina Laris, M. and Ruiz, I., 2020. Tensoring volatilitycalibration, preprint: https://arxiv.org/abs/2012.07440.S. ScoleriChebyshev Greeks

IntroductionChebyshev techniquesNumerical investigationsReferences (cont.)Zeron Medina Laris, M. and Ruiz, I., 2021. Denting the FRTB IMAcomputational challenge via orthogonal Chebyshev sliding technique,Wilmott Magazine, 111:74–93.Zeron Medina Laris, M. and Ruiz, I., 2021. Tensoring dynamicsensitivities and dynamic initial margin, Risk, published online.DisclaimerThe opinions expressed in this work are solely those of the authors and donot represent in any way those of their current and past employers.S. ScoleriChebyshev Greeks

Finite Di erence Gamma of a digital option for di erent spot levels. Black-Scholes exact formulas are compared with MC results using 300K paths, 0.0025 bump and two di erent smoothing parameters: the smoothed Greek is biased. S. Scoleri Chebyshev Greeks. Introduction Chebyshev techniques Numerical investigations Polynomial interpolation tools Chebyshev interpolation Chebyshev Greeks 1 .