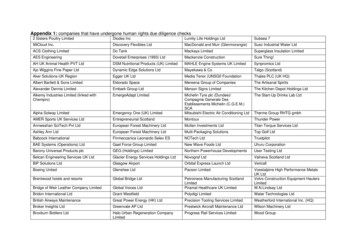

Transcription

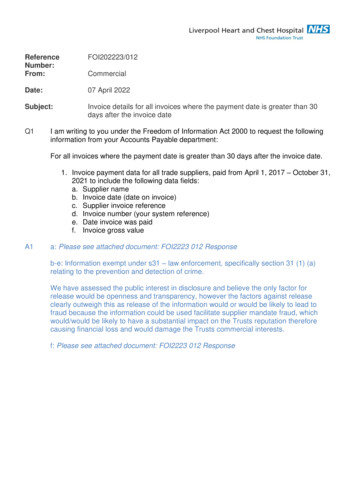

To,The Assistant Manager,National Stock Exchange of India LimitedListing Department, ‘Exchange Plaza’,Bandra Kurla Complex,Bandra (East),Mumbai – 400051To,The General Manager,BSE Limited,Corporate Relationship Department,1st floor, Phiroze Jeejeebhoy Towers,Dalal Street,Mumbai – 40000123 August 2021Sub: Submission of Annual Report FY 2020-21Ref: NSE Symbol and Series: KOLTEPATIL and EQBSE Code and Scrip Code: 9624 and 532924Dear Sir/Madam,Please find attached herewith Annual Report for the Financial Year 2020-21.We wish to inform you that the 30th Annual General Meeting of the Company will be held onFriday, 17 September 2021 at 11.30 AM through two-way Video Conferencing (“VC”) or OtherAudio Visual Means (“OAVM”).This is for your information and record.Thanking you,For Kolte-Patil Developers LimitedsignedVINOD Digitallyby VINODEKNATHPATILEKNAT Date: 2021.08.2321:06:24 05'30'H PATILVinod PatilCompany Secretary and Compliance OfficerMembership No. A13258Encl: as above.KOLTE-PATIL DEVELOPERS LTD.CIN : L45200PN1991PLC129428Pune Regd. Office: 2nd Floor, Ci ty Point, Dhole Patil Road, Punc 411001. Maharashtra, India. Tel.: 91 20 6622 6500 Fax : 91 20 6622 6511Bangalore Office: 121, The Estate Building, 10th floor, Dickenson Road, Bangalore 560042, India. Tel.: 080- 4662 4444 / 2224 3135/ 2224 2803Web.: www.koltepatil.com

POWER OFDISCIPLINEDoing more with less to deepenour anti-fragile foundationKolte-Patil Developers LimitedIntegrated Annual Report 2020-21

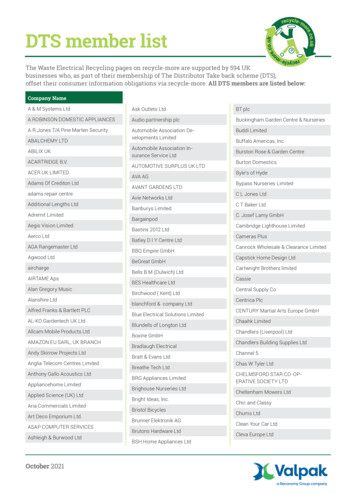

Disclaimer: Certain statements inthis communication may be ‘forwardlooking statements’ within themeaning of applicable laws andregulations. These forward-lookingstatements involve a number of risks,uncertainties and other factors thatcould cause actual results to differmaterially from those suggestedby the forward-looking statements.Important developments that couldaffect the Company’s operationsinclude changes in the industrystructure, significant changes inpolitical and economic environmentin India and overseas, tax laws,import duties, litigation and labourrelations. Kolte-Patil DevelopersLimited (KPDL) will not be in anyway responsible for any action takenbased on such statements andundertakes no obligation to publiclyupdate these forward-lookingstatements to reflect subsequentevents or circumstances.CONTENTSDiscipline and Kolte-PatilCorporate snapshot . 06Our transformative journey . 10Our performance over the years . 14Our financial position . 16Our strategic direction andperformanceChairman's overview . 20Performance analysis by Group CEO . 24Our robust marketing engine . 28Our healthy operating cashflows . 30Our moderated debt . 32Preparing for our next growth round . 34Optimal geographic mix . 36Betting on Mumbai . 38Our strategic assetsThe perspective of our leadership team . 48The soul of Kolte-Patil . 50Transforming the lives of customers . 52A growing focus on ESGOur environment commitment . 56Our responsible safety culture . 57Our CSR engagement . 62Management discussion and analysis . 64Abbreviations used in the Annual ReportStatutory reportsIOD: Intimation of Disapproval orAuthorisation (first permit for construction);key approval or milestone in redevelopmentprojectsFinancial statementsOC: Occupation Certificate (facilitatingapartment handover)OCF: Operating Cash FlowDirectors' report . 71Report on corporate governance . 91Standalone accounts . 113Consolidated accounts . 167Notice . 224

“DISCIPLINEIS CHOOSINGBETWEEN WHATYOU WANT NOWAND WHAT YOUWANT MOST”ABRAHAM LINCOLN

02 Kolte-Patil Developers LimitedDISCIPLINE ANDKOLTE-PATIL1

Integrated Annual Report 2020-21 03CORPORATE OVERVIEWPOWER OFDISCIPLINEThe first half of FY 2020-21 was one of the mostchallenging for the Indian economy in general andthe country’s real estate sector in particular.India’s Gross Domestic Product de-grew 7.3%, a rareeconomic occurrence in decades.Kolte-Patil responded to this challengingenvironment by doing what it always had: offereda wide consumer choice, delivered propertieson schedule, marketed smarter, diversified anddeepened its footprint, augmented its projectsportfolio, entered into global partnerships,accelerated collections and moderated debt.In doing so, KPDL maintained its dominant positionin its largest market (Pune), strengthened its brandpresence in Mumbai and Bengaluru and protectedthe integrity of its Balance Sheet.The Company’s response can be encapsulated inone word.Discipline.

04 Kolte-Patil Developers At Kolte-Patil, discipline is the practice of makingconsidered choices and staying true to them acrossmarket cycles.Discipline is the commitment to invest prudently inthese select choices with the objective to generatelong-term business upsides.Discipline is the resolve to stay true to our focuson creation - not construction – that translatesinto the building of communities, aggregatingneighbours for life, creating homes and spacesthat grow on residents, providing sustainablevalue to communities, graduating employees intoentrepreneurs and seeing in every associate along-term stakeholder.

Integrated Annual Report 2020-21 05CORPORATE OVERVIEWTHE D3 CONVICTION:DISCIPLINE DELIVERSDIVIDENDSSpread thickGrow the businessin locations withmulti-decadepotentialSpoil theconsumerOffer a wide choiceof home acrosssizes, locations andbudgetsEnhancepredictabilityDeliver propertieson scheduleFight for recallMarket propertiessmarter; make iteasier to buyGlobalpartnershipsSeek globalpartners – capitalor buildersFiscal disciplineModerate debt;acceleratecollections

06 Kolte-Patil Developers LimitedKolte-Patil Developers Limited.AHEAD OFTHE CURVE.The Company was faced with thechallenge of growing its presence inone city but extended to three.It encountered diverse growth optionsbut entered India’s financial capitalwith a niche strategy.It encountered a slowing market butprotected its liquidity.It invested in growth but enhancedaccruals and deleveraged.Result: Stronger brand, respect andcompetitiveness.Protected by values.Driven by discipline.

Integrated Annual Report 2020-21 07CORPORATE OVERVIEWFootprintPromotersKolte-Patil Developers Ltd. is oneof India’s leading residential realestate companies. The Companywas formed nearly three decades agowith the philosophy of ‘Creation, notConstruction’. Over the years, theCompany has established itself as oneof the leading residential real estatedevelopers in the country.The promoters of Kolte-Patil DevelopersLimited possess three decades ofrich sectorial experience. Their ablestewardship empowered the Companyto weather market cycles, validating itscompetitiveness in some of the mostchallenging economic phases. Thepromoters validated their employees-firstcommitment when they voluntarily tooka 50% salary reduction in FY 2020-21 totide over COVID-19 uncertainties.Even as the Company is headquarteredin Pune, it is present in three Indianmarkets with attractive potential – Pune,Mumbai and Bengaluru. The Companyhas been enjoying a dominant positionin Pune for years, holding its groundagainst national builders of repute.The Company has developed andconstructed over 50 projects, includingresidential complexes, commercialcomplexes and IT parks, covering asaleable area of over 20 Million squarefeet across the markets of its presence.Track recordThe Company had delivered over 20Million sq. ft of residential units acrossPune, Bengaluru and Mumbai in itsexistence by the close of FY 2020-21.The Company had about 9.13 Million sq.ft under execution (sold and unsold) bythe close of FY 2020-21.Credit ratingThe Company is not only a respected developer; it is also one of the least leveraged,with an established track record of positive operating cash flows. The Companyenjoys CRISIL A / Stable rating, one of the highest ratings accorded to an Indianresidential real estate developer by CRISIL.

08 Kolte-Patil Developers Limited

Integrated Annual Report 2020-21 09CORPORATE OVERVIEWMarquee investorsThe Company attracted prominent global investment firms to invest in its projects, validating the Company’scompetence and credibility. For instance, the prominent Kohlberg-Kravis Roberts (KKR) committed H193 Crore inR1 sector of Life Republic, Pune; the Company entered into a H120 Crore agreement with an affiliate of J.P. MorganAsset Management for its redevelopment project Jay-Vijay Society in Vile Parle (E), Mumbai. Planet Smart Citybought 10.4 acres of land at Sector R10 at Life Republic and partnered KPDL to launch the project at Sector R10 in aprofit-sharing agreement. The real estate investment firm ASK is a profit-sharing (70%) partner in the Three Jewelsproject.BrandsRecognitionKolte-Patil markets projects under twobrands: ’Kolte-Patil’ (addressing the midpriced and affordable residential segment)and ‘24K’ (addressing the premiumluxury segment). The Company executedprojects in multiple segments – standaloneresidential buildings and integratedtownships.Kolte-Patil is a respected industry player, reflected in variousawards received from institutions in recognition of itsachievements.EcosystemFY 2020-21Top Developer Of The Year- Times Real Estate IconsWest 2020The Company is driven by a holisticecosystem of competence thatincludes: construction timeliness, saleseffectiveness, customer relationshipmanagement, investment in cuttingedge technologies, strong processes andinformed decision-making. The Companyinvested in benchmark technologies likeAluform technology from Korea, adhesivetechnology from Italy, water-proofingtechnology from Germany, pre-fabricateddoor technology from Japan and enteredinto collaboration with Dulux to provideworld-class service. The Companywas also among the first to implementadvanced CRM SAP-based ERP in India’sreal estate sector.India’s Top Challengers2019-20 - Construction WorldGlobal Awards OnlineInstitutional frameworksResidential High RiseArchitecture India to 24KOpula - Asia Pacific PropertyAwardsKolte-Patil is listed on the National StockExchange (NSE) and Bombay StockExchange (BSE). Several of the Company’sprojects were certified by the Indian GreenBuilding Council (IGBC).Integrated Township ofthe Year to Life Republic- Realty Conclave &Excellence Awards- West2020Top Township projects(above 350 acres) to LifeRepublic - Times Real EstateIcons West 2020Project Launch of the Year– Universe at Life Republic- Realty Conclave &Excellence Awards- Pune’21Kolte-Patil wasacknowledged as India’sMost Trusted Real EstateBrand by TRA’s BrandTrust Report 2020. TheCompany was accordedthe highest rank in the‘Construction’ supercategory (real estatecompanies and EPCcontractors) in the 10thedition of TRA’s BrandTrust Report. The BrandTrust Report is a result ofcomprehensive primaryresearch across 16 citieson TRA’s proprietary 10brand behaviors; 8,000unique brands wereanalysed.

10 Kolte-Patil Developers LimitedOUR TRANSFORMATIVEJOURNEY19911994The Companywas incorporatedas Kolte-PatilDevelopers PrivateLimited in Pune.2007-112011The Companylaunched its 390acre townshipLife Republic nearHinjewadi, Pune2017The Company received aninvestment of H193 Crorefrom global investmentfirm KKR for R1 sector ofLife Republic.The Companyentered theBengaluru realestate market.The Company signed jointventures with ICICI Ventures,Portman Holdings and IL&FS fornumerous projects.2013The Company enteredthe Mumbai real estatemarket and signed threesociety redevelopmentprojects in the first year ofoperations2019The Company reported record sales of 2.7Million square feet during FY 2018-19.The Company crossed the milestoneof completing 20 Million square feet ofdevelopment

Integrated Annual Report 2020-21 11CORPORATE OVERVIEW200720102015The Company went public following asuccessful IPO, raising H275 Crore. It waslisted on the Bombay Stock Exchange andNational Stock Exchange.The Company launched‘24K’ to cater to theincreasing demand forluxury real estate.The Company crossed themilestone of developing10 Million square feet ofresidential area2020The Company recorded the highest collectionof H1,368 Crore in its three-decade existenceThe Company received OC for Jai Vijay,a milestone in its Mumbai property redevelopment journey. Jai Vijay is theCompany’s flagship project in Mumbai andone of the largest redevelopment projects inthe Vile Parle East micro-market.The Company entered into a H120Crore transaction with a JP MorganIndia subsidiary for its redevelopmentproject Jay-Vijay in Vile Parle, Mumbai2021The Company entered into an agreement with Planet Smart City, a UKbased real estate developer, for the strategic land monetisation of SectorR10 in Life Republic for H172 Crore. This land parcel in Sector R10 willbe developed by KPIT and Planet Smart City around a profit-sharingmodel; the project Universe was launched within nine months of theagreementThe Company’s Mumbai portfolio delivered sales of H180 Crore (H19.8Crore in FY 2019-20). The aggregate contribution from Mumbai andBengaluru projects increased to the targeted value of H300 Crore( 25% of FY 2020-21 sales value of H1,200 Crore).

12 Kolte-Patil Developers LimitedWE COULD HAVE ADDRESSEDTHE MOST EXTENDEDSLOWDOWN IN INDIA’S REALESTATE INDUSTRY WITHCONVENTIONAL RESPONSESWE SELECTED TO ADDRESSTHE CHALLENGE WITH ADIFFERENT WAY OF DOINGBUSINESS INSTEAD

Integrated Annual Report 2020-21 13CORPORATE OVERVIEWTHE LASTSEVENYEARS WERETHE MOSTCHALLENGINGFOR THEREAL ESTATESECTOR ININDIA Land prices plateaued and selectivelydeclinedProperty launches and sales became slowerReal estate realisations encounteredresistanceCustomers stayed away; most felt priceswould declineThere was a premium on having cash on theBalance SheetThe Indian government implemented thelandmark RERADemonetisation affected consumer sentimentTHE LASTSEVEN YEARSWERE ALSOOUR MOSTPRODUCTIVEDUE TO ADIFFERENTWAY OF DOINGBUSINESSWe focused on controlled growthWe invested in our brand around timely andpromised deliveryWe selected to build cash flows over toplineWe digitalised, automated andprofessionalised fasterWe asked contractors ‘How fast can youconstruct?’We focused on the mid-income residentialsegmentWe invested in technology to increase processconsistencyWe grew our business through financialpartners for specific projectsWe allocated proprietary resources to buildour marketing teamWe continued to focus on the growth comingout of Pune, Mumbai and BengaluruWe maximised the use of accruals with noequity dilution

14 Kolte-Patil Developers LimitedTHIS IS HOW WE WERE EMPOWEREDBY DISCIPLINE AND GREW THROUGHTHE MOST EXTENDED DOWNTREND ININDIA’S REAL ESTATE 8FY19FY20FY21Collections (H Crore)Sales (Million sq. ft)Sales value (H Crore)DefinitionCollections are a financial indicator thatmeasure a Company’s ability to collectoutstandings on schedule. The higher thecollections, the stronger the cash flow.DefinitionSales are influenced by the quantum of realestate sold in a financial year, indicatingthe life-cycle of the project (until handover).DefinitionSales indicate the value of real estate soldin a financial year, indicating existing andprospective revenues (until handover to thecustomer).Why we measureCollections provide an index of theCompany’s cash comfort in quantumterms.PerformanceThe Company reported H1128 Crore incollections in FY 2020-21 following a strongcontrol on receivables leading to sustainedliquidityWhy we measureSales provide an index of prospectiverevenues, collections and profit.PerformanceThe Company reported 2.08 Million sq.ft of sales in FY 2020-21. The Companymade only two launches - Evara andUniverse during the year on account ofthe pandemic; it focused on inventoryliquidation instead.*Includes DM collections H62.8 Crore inFY 2018-19, H55.5 Crore in FY 2019-20 and H37.2 Crore in FY 2020-21Why we measureSales by value provide an index ofprospective revenues and profits.PerformanceThe Company reported H1,201 Crore ofsales in FY 2020-21 through the benefitof two launches and sustained inventoryliquidation.

Integrated Annual Report 2020-21 15CORPORATE FY21Average selling price (H)Net debt (H Crore)Gearing (x)DefinitionAverage selling price (ASP) is arrived at bydividing the total sales value by the totalarea sold in sq. ft.DefinitionThe quantum of debt after deducting cashand OCD / CCD / OCRPS / Zero CouponNCD on the Company’s books.DefinitionThis ratio measures net debt to net worth(less revaluation reserves).Why we measureIt provides an index of prospectiverevenues, collections and profits.Why we measureThis number provides a true and fairpicture of the Company’s intrinsic liquidity.PerformanceThe Company reported an ASP of H5,785 inFY 2020-21, up 9% YoY through increasedsales contribution from Mumbai projects.PerformanceThe Company’s net debt declined fromH434 Crore in FY 2019-20 to H310 Crore inFY 2020-21, an achievement consideringthat the first half of the year under reviewwas marked by sluggish sectorial offtakeand liquidity crunch; H81 Crore outflowswere required for buyout of the partner’sstake in the Life Republic project.Why we measureThis is one of the defining measures of aCompany’s financial health, indicatingthe ability of the Company to remunerateshareholders after servicing debt providers(the lower the gearing the better).PerformanceThe Company’s gearing decreased from0.35 in FY 2019-20 to 0.24 in FY 2020-21.We recommend that this ratio be read inconjunction with net debt/operating profit(declining, indicating a growing ability toservice debt). The Company adopted IND AS 115 (Completion Contract Method, CCM) effectively from 1 April, 2018 and opted for a modified retrospective method. To facilitate alike-to-like comparison and continuity of information treatment, financials based on the erstwhile applicable Percentage of Completion Method (POCM) of accountingfor revenue recognition is shown.

16 Kolte-Patil Developers LimitedTHIS IS HOW WELEVERAGED A CULTUREOF DISCIPLINE TOIMPROVE OUR FINANCIALPOSITION IN FY 2020-21

Integrated Annual Report 2020-21 17Revenues declined 21.6% YoY toH962 Crore compared to H1226 Crorein FY 2019-20EBITDA declined by 43.8% YoY toH143.9 Crore compared to H256.1Crore in FY 2019-20EBITDA margin was 15% inFY 2020-21 compared with 20.9% inFY 2019-20PAT (post-minority interest)declined by 67% YoY to H45.2 Crorecompared to H137.4 Crore inFY 2019-20suspension of operations in H1 FY2020-21 due to COVID-19 - there wasnegligible construction activity forfirst four months.PAT margin (post-minority interest)was 4.7% in FY 2020-21 comparedwith 11.2% in FY 2019-20Net debt declined by H124 Crore toH310 Crore in FY 2020-21 from H434Crore in FY 2019-20Profitability was impacted by lowerrevenues on account of a temporaryOperational highlightsDespite operating in Pune andMumbai, two cities which have beenmost impacted by the pandemic, H2collections were up 2.7x to H823 Crorecompared with H1, H2 sales valueup 2.4x to H843 Crore and H2 salesvolume up 2x to 1.41 msf.FY 2020-21 sales bookings of 2.08msf, above the guidance of 1.8 msf by15.6%. Strong recovery was reportedin H2FY 2020-21 over H1 FY 2020-21 (byvolume and value). Mumbai portfolioreported a sales value of H180 Croreas against H19.8 Crore in FY 2019-20Achieved the highest sales volumesin six years in Q4 FY 2020-21 of0.85 msf, up 53% QoQ; the highestquarterly sales value of six years wasachieved in Q4 FY 2020-21 at H511Crore, up 54% QoQLaunched Evara at the end of Q3,the first new launch in Mumbai infour years; it sold 54 units till Q4, 75%of the project’s inventory.Achieved highest collections inthe Company’s three-decade historyin Q4 FY 2020-21; this followed Q3FY 2020-21, the best quarter forcollections till Q4 FY 2020-21In FY 2020-21, there has been areduction of H124 Crore in KPDL’s netdebt. This is the second consecutiveyear of net debt reduction at KPDL.Net debt to equity stands at 0.24* ason 31 March, 2021.Given collections growth andlower interest outgo, KPDL deliveredhealthy Operating Cash Flow of H413Crore despite FY 2020-21 being apandemic year.Completed the final tranchepayment of H81 Crore for the buyoutof ICICI Venture’s 50% stake in LifeRepublic (first tranche of H70 Crorewas paid in March 2019 and thesecond tranche of H70 Crore was paidin November 2019). Following thebuy-out, KPDL’s economic interest inLife Republic increased to 95% andthe Company’s economic interest inits entire portfolio grew from 60%to 90%.Undertook strategic landmonetisation of 10.4 acres of SectorR10 of Life Republic for H172 Crore.Residential development potentialis of 1.42 Million sq. ft. of saleablearea to be developed by Kolte-PatilIntegrated Townships Limited(KPIT) and Planet Smart City arounda profit-sharing model. A projectnamed Universe was launched withinnine months of the agreement.Signed three projects with acombined saleable area of 2.2 msfin Pune under capital-light models;projected topline of H1,500 Crore(projected KPDL PBT of H220 Crore)The big numbersleading 3Residential realestate playerin the Puneresidential marketNumber ofdecades ofsectorial presence2920 14 Million sf projectportfolio underexecution,approval and landbankMillion sf unitsdelivered acrossPune, Bengaluruand Mumbai% RoCE* returnsacross the last fiveyears avg*Based on Percentage of Completion Method (POCM). Please refer to page 68 for numbers on Completion Contract Method CCM basis.A /StableOne of the highestcredit ratingamong Indian realestate residentialplayers (byCRISIL)CORPORATE OVERVIEWConsolidated Financial highlights*, FY 2020-21

OUR STRATEGICDIRECTION ANDOUR PERFORMANCE18 Kolte-Patil Developers Limited2

Integrated Annual Report 2020-21 19CORPORATE OVERVIEWTHIS IS WHEREWE ARE Leading real estate brand in Pune 25% sales value from Mumbai andBengaluru Growing property developmentpartnerships Maturing Life Republic; point of take-off Stronger marketing engine Declining debtTHIS IS WHEREWE WISH TO GO Aspiration to emerge among India’sfive leading real estate players Double our sales while maintainingprofitability Grow our Pune presence and leadership Expand market share in Mumbai andBengaluru Deepen cash-light global partnerships Accelerate Life Republic sales Develop benchmark programmes on ESGand customer-centricity

20 Kolte-Patil Developers LimitedCHAIRMAN’S OVERVIEWKOLTE-PATIL’SOBJECTIVE:SELL 5 MILLIONSQ. FT. BY 2024

Integrated Annual Report 2020-21 21In today’s world, the biggest premiumis for stability.When businesses are run, there is nosaying what the next quarter will bring;the business must be invested withfunds and initiatives assuming thatwhat follows from that point onwards ispredictable.Some years ago, we had our momentof truth when we encountered debt onour books and the country’s real estatesector entered its longest downtrend.We had no way of knowing how longthe downtrend would sustain; however,we did know that the predictability ofthe sector had been interrupted andif it could happen once, then it couldhappen again.As an organisation committed toenhance sustainability, we recognisedthe importance of building a businessthat would be anti-fragile. And fromthat moment was redefined the waywe would run our business: with lessdebt, with less land on our books,more structured business developmenttransactions, higher customer advancesand greater speed in completingconstruction faster.In doing so, we were not just makinga nominal transformation in ourpersonality; we were fundamentallyredefining the way we would conductour business.PersonalityIn the past, real estate companiesinvested in land. This land wouldbe progressively developed. Sinceland generally appreciated in value,investment in land was justified ontwo counts – it would provide rawmaterial whenever the Companysought to develop the property; onmost occasions, the arbitrage involvedin holding and developing the landdelivered a superior value than propertydevelopment.When the sectorial slowdown emergedand land prices went into one of themost extended plateaus and declinesseen in living memory, the concept ofholding property as a hedge and valueaddition was discontinued. Kolte-Patilwas one of the first companies in itssector to recognise that the old orderwould no longer work; the Companyprogressively disengaged from theerstwhile practice of building a landbank; the debt that had been taken tobuild land assets was progressivelypared and the Company embarked on ajourney to emerge relatively asset-lightinstead.This asset lightness was markedby priorities: the Company wouldno longer hold finished apartmentinventory in the expectation of anappreciation in realisations; on thecontrary, the Company would see itsrole as an efficient builder committedto the accelerated sale of inventory.Gradually, the focus of the Companytransferred from portfolio value-additionto operational efficiency.If there is one reasonwhy Kolte-Patilhas survived andsucceeded throughthe most challengingsectorial downtrend inmemory, it is this: thespeed and extent withwhich the Companytransformed itspersonality.If there is one reason why KoltePatil has survived and succeededthrough the most challenging sectorialdowntrend in memory, it is this: thespeed and extent with which theCompany transformed its personality.The elements of thispersonalityAt Kolte-Patil, we recognised that aselective transformation in personalitywould do just so much and no more;what we required was a completereinvention.This reinvention warranted us toquestion every single practice andprecept that we had earlier held dear.For instance, the Company wasaccustomed to working with somedebt on the books; the Company nowcommitted to utilising whatever surplusthat it could generate and shrink thesize of its Balance Sheet.The Company was focused on buildingland assets on its books; the Companynow entertained the prospect ofentering alliances with landowners (ormaking an exception as in the caseof Life Republic where the decision toacquire translated into a multi-decadeownership, making it distinct fromshort-term arbitrage or development).The Company had consistently focusedon its traditional Pune market; theCompany now broadbased its risk byextending its business to Bangaloreand by entering a relatively capex-light niche of the vast Mumbai market(extending its revenues from one engineto three).The Company was focused onmoderating its risk through the sharingof ownership interest in properties withattractive development potential; theCompany began to gradually re-acquireits economic interests with the objectiveto consolidate its ownership and sendout a strong message to stakeholders ofits portfolio conviction.The Company focused on thereasonable construction, completionand turnaround of properties around thesectorial standard; it began to invest intechnologies and contractor pedigree toturn properties around faster, pleasantlysurprising customers with quicker andmore secure deliveries (a competitiveadvantage at a time when a numberof real estate players delayed oncommitments).What transpired in the last few yearsis that the Company’s brand began toevolve: from that of an enduring realestate developer in one market (Pune)to one of the most trusted (across Pune,Mumbai and Bangalore).CORPORATE OVERVIEWOverview

22 Kolte-Patil Developers LimitedThere is a greatertraction for ‘smart’homes. People donot only seek to livebetter; they seek tolive ‘smarter’. Thiscommitment wasencapsulated inUniverse, positionedas a ‘cradle of a digitallifestyle’.Competitive positioningThe description of how we transformedover the last number of years has abearing on where we stand in oursector.During the last few years, the risingRERA benchmark has made itincreasingly difficult for real estatecompanies to stay in business. TheBalance Sheets of most real estateplayers have been extensively impaired.Access to debt is restricted; there islow investor confidence to invest networth in the business. This indicatesthat the entry side into the business isrestricted with few players possessingthe resources to grow from this pointonwards.Now turn to the demand side of thebusiness. During the last seven years,real estate prices either stayed flat ordeclined even as incomes increased.Besides, mortgage rates declined toa point where they are probably attheir lowest in years. The governmentstepped in to secure the sector throughprovisions and thereafter sweetenedthe consumer’s proposition through taxincentives. The result is that there hasprobably never been a better time tobuy into a home than in the last coupleof years.Something transpired that transformedthe consumer’s intent to buy intovisible action: the pandemic. Whenthe pandemic broke and the lockdownwas announced in March 2020, therewas a premium in holding on to one’ssavings; the thought of buying into anew property was way down the listof priorities. However, the more peoplespent their time locked into theirresidences and the more office-workingyielded to work-from-home, there wasa growing realisation of the need to livebetter.Those who were living on rent nowsought to buy their own home;customers livi

advanced CRM SAP-based ERP in India's real estate sector. Institutional frameworks Kolte-Patil is listed on the National Stock Exchange (NSE) and Bombay Stock Exchange (BSE). Several of the Company's projects were certified by the Indian Green Building Council (IGBC). Recognition Kolte-Patil is a respected industry player, reflected in various