Transcription

2017 ANNUAL REPORTBUILDING TOWARDSTHE FUTURE

RECOGNIZINGPOTENTIALWE BELIEVE IN INVESTING IN TOMORROW —THROUGH OUR CUSTOMERS, COMMUNITIES ANDTEAM MEMBERS — MODERN BANKING WITH ACOMMUNITY PERSPECTIVE.Cynthia C. Merkle PRESIDENT & CEOINSPIRED BY OUR MISSION, in 2017 we took many steps toward helpingour customers, communities and USB team members plan, grow and succeed.On the inancial front, I am pleased to report that we had another strong year,with net income totaling 11.4 million.Among the many successes we were able to achieve this year, here are a fewof the highlights:Originating a record 251.7 million in commercial loans, a 43% increasefrom 2016Growing our commercial portfolio by 52.4 million or nearly 7%Increasing our small business lending by 10%Increasing our new home inancing by 25%Donating a total of 537,182 to charitable organizationsDonating an additional 4 million to the Union Savings FoundationIt was a pivotal year for Union Savings Bank, largely deined by the successfulupgrade of our core banking system; one of the largest initiatives any bank canundertake. Upgrading the bank platform is an investment in our future, leavingus better positioned to deliver the latest products and services. This new systemlaunched this past fall, and it’s already simplifying and enhancing our customerexperience, and providing us with a strong technological foundation.This upgrade effort would not have been possible without the vision of themanagement team and the dedication of our team members — who loggedextra hours and late nights to make it happen. I would like to personally thankeveryone for their commitment to this project and to providing our customersa best-in-class banking platform.Along with our back-end system upgrade, we presented a fresh face in theform of a re-imagined unionsavings.com site. We created an improveduser experience so customers and prospects alike could ind informationquickly, while also delivering a “look and feel” more aligned to our brand andcore values.

NET INCOMEWhile our branch banking team dedicated much of their time to acclimatingthemselves and our customers to our new system, core deposits continued torise — increasing 34 million over 2016. By providing superior customer serviceas well as products and services that beneit each customer’s unique inancialsituation, we continue to solidify relationships, including attracting greatercore deposits.Our Solutions Teams also continued to grow — bringing customized solutionsto area businesses, business owners and their employees. The Solutions Teamswelcomed Canton as a new member in 2017, complementing our existingteams in Monroe, Ridgeield and Southbury.Early in the year, we unveiled our newly renovated branch on Grassy PlainStreet in Bethel. The new design features a more inviting and open space,complete with teller pods, video capabilities and a community roomavailable free of charge to non-proit organizations. We have already seencountless organizations take advantage of this meeting space — placingcommunity at the core of the branch. This branch also serves as theheadquarters of FutureTrack, our life stage inancial planning program aimedat helping our customers reach their inancial goals, wherever they may be ontheir inancial journey.With record returns for many of the market indexes, 2017 was an excitingyear in the stock market. As in previous years, our trust and investment areasdelivered strong performances, generating nearly 3.9 million in revenue. We’vealso seen steady growth from our Raymond James division, and feel they arepoised for continued success in the coming year. This is especially evident as wesee more and more customers taking advantage of our inancial managementprograms, such as goal-based planning.Treasury Services also had a strong year, and our system upgrade enabledus to offer customers greater access control and security. We also now offercustomers a more robust reporting system for electronic payments, andcontinue to aid our customers in monitoring transactions and minimizing loss.COMMUNITY CONTINUES TO BE A VITAL CORNERSTONE OF OURBANK’S MISSION. In 2017, we again earned an outstanding CommunityReinvestment rating from the FDIC based upon our performance for lending,providing service, and making investments in the communities we serve.We received recognition for our community work from a number of differentorganizations. The United Way of Western Connecticut presented us withtheir Corporate Philanthropy Award for contributing over 6 million and over100,000 hours to local non-proits over the past six years. Additionally, wewere recognized by the Western Connecticut Health Network for ourphilanthropic partnership in relation to the educational support of the hospital’sLyme Disease program.We also built upon the initial success of the USB Teachers’ Closet program whichwe introduced in 2016. We continue to focus on providing free school suppliesto children and teachers in the community schools who need them most. In2017, Vogel-Wetmore School in Torrington and Morris Street School in Danburywere among the irst to receive supplies through the program. We continue toexpand this initiative and engage corporate partners who will collaborate withus on our mission to provide children with the tools they need to succeed.For the second year in a row, we collected over 1,400 books in our “Share theLove of Reading” book drive, encouraging our team members and customers todonate new and gently used books to our community partners and the childrenthey serve. These books helped promote summer reading and encouragedchildren to explore their own love of reading.Our community commitment continued with the United Way Week of Action.Team members dedicated an entire week of activities to beneit JerichoPartnership, supporting their mission to serve the at-risk community of Danbury.WE ARE ALWAYS PROUD TO SEE OUR TEAM MEMBERS RECOGNIZEDFOR THEIR ACCOMPLISHMENTS AND DEDICATION. In 2017, MicheleBonvicini, Director of Community Relations and the Executive Director of theUnion Savings Bank Foundation, was named a New Leader in Banking by theConnecticut Bankers Association. Michele continues the tradition of USB teammembers being recognized by the CBA for their leadership. Michele’s passionand dedication to our communities is an inspiration to us all. We congratulateMichele on this prestigious achievement.Jo-Anne Smith, Senior Vice President, Commercial Banking Regional Manager,was elected to The Foundation Board of the Western Connecticut HealthNetwork. The Foundation provides philanthropic support to advance programsand services at Danbury Hospital, New Milford Hospital, Norwalk Hospital, andtheir Network.Jason Ginsberg, Vice President, Head of Treasury Services, graduatedfrom the American Banker Association‘s Stonier Graduate School programat Wharton. Stonier prepares today’s banking leaders for tomorrow’sopportunities by providing the nation’s premier executive education program.Although we welcomed much new talent in 2017, we also said goodbyeto longtime board member Greg Oneglia. I’d like to thank Greg for his hardwork, dedication and insight while serving on the Board of Trustees. Greg willbe missed and we wish him all the best.I’d also like to welcome Frank Rowella, Jr., as our newest Trustee. We lookforward to Frank’s help as we shape the vision of the bank in years to come.Finally I’d like to once again thank all our USB team members, customers andcommunity partners for their patience and perseverance in making our systemupgrade a success. Together, we’ve created a bridge that will allow us to buildtowards an exciting future. 11.4 MILLIONCOMMERCIAL LENDINGGrew commercial portfolio by 52.4 MILLIONa nearly 7% increase from 2016CONTRIBUTIONSSince 2011, we've donated over 6 MILLIONto local non-proits, and over 100,000collective employee volunteer hoursOn behalf of the Board of Trustees and all of us at Union Savings Bank, I thankyou for your continued support.TRUST & INVESTMENTSincerely,Revenues totalling nearly 3.9 MILLIONCynthia C. MerklePresident and CEONEW INITIATIVESEnhanced banking platformRe-imagined unionsavings.com websiteBethel Grassy Plain Street unveiling

INVESTING INCOMMUNITY2017FINANCIALSFINANCIAL STATEMENTSFINANCIAL TRENDSCORPORATORSTRUSTEESBRANCH LOCATIONS

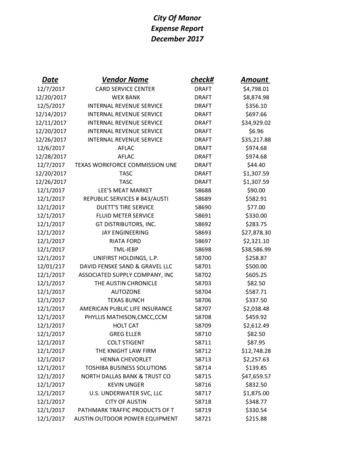

FINANCIAL STATEMENTSFINANCIAL TRENDSAssets (in millions)BALANCE SHEETSINCOME STATEMENTSat December 31 (amounts in thousands) (unaudited)Years ended December 31 (amounts in thousands) (unaudited)AssetsCash and due from banksSecuritiesFederal Home Loan Bank stockLoans, netPremises and equipmentOther assetsTotal assets20162017 45,545311,3326,8441,670,73546,799124,420 73,474267,5764,8121,673,44445,696116,550 2,205,675 2,181,552Liabilities and CapitalDepositsRepurchase agreementsFederal Home Loan Bank advancesOther liabilitiesCapital 1,665,637216,18360,91935,274227,662 1,682,225214,02312,19735,885237,222Total liabilities and capital 2,205,675 2,181,552Interest and dividend incomeInterest expenseNet interest and dividend incomeProvision for loan losses20162017 73,7478,477 75,4867,10165,2701,59568,3851,192Net interest and dividend incomeafter provision for loan lossesNoninterest incomeNoninterest expense63,67516,49762,35767,19323,32269,535Income before income taxesProvision for income taxes17,8155,49720,9809,550 12,318 11,430Net income20172,182Loans, net (in 920132,289Core Deposits (in millions)1,6601,6261,5131,6931,6761,4491,390Core DepositsRegulatory Capital Ratio10.80%10.12%9.70%8.67%7.90%Regulatory Capital RatioRepresent the highest level ofcustomer relationshipRepresents the “strength” ofthe balance sheetFiduciary responsibility tosafeguard customerdeposits is paramountGrowth is impressive since, asa mutual bank, we can onlygrow capital through earnings

CORPORATORSMichael AckermanOwner, he Pantry, Inc.Michael J. AllenPresident, Danbury Square Box CompanyCheryl A. Bakewell, CPAPartner, Bakewell & Mulhare LLCEduardo BatistaPresident, Danbury Donuts, Inc.David BeginPresident & CEO, Chemical Marketing ConceptsJames J. BlansieldPresident, Blansield Builders, Inc.Patrick J. Boland**Retired Managing Director, Credit Suisse First BostonEmile BuzaidRetired Owner, Max Gun and Pawn LLCMaureen Casey GernertRetired Director, Career Development Center, WCSUJacqueline CassidyController, Koster Keunen, Inc.Anthony W. Cirone, Jr., CPAPartner, Cirone Friedberg LLPDavid M. CoelhoElectrical Instructor, Ridley-Lowell Business & Technical InstituteGeofrey DentSales, Electrical WholesalersDaniel B. DiBuonoPresident, Tower Realty CorporationCharles R. Ebersol, Jr., Esq.Partner, Ebersol & McCormick LLCMourad FahmiCEO/Principal Owner, Miller-Stephenson Chemical Corp.Philip M. FarmerPresident, Credit Resources, Inc.homas T. FitzsimonsExecutive Vice President, Channel SourcesClayton H. FowlerChairman & CEO, Spinnaker Real Estate Partners LLC* New Corporators to be elected March, 2018** Retired January 2018Ann. L. Fowler-Cruz, Esq.Attorney/Principal, Cohen & Wolf PCMartin Handshy*President, Charter Group PartnersKathleen A. HarrisonCo-Owner, Fazzone & Harrison Realty LLCMatthew KarpasManaging Member, Karpas Strategies LLCMichael R. Kaufman, Esq.Attorney, Jones, Damia, Kaufman, Borofsky & DePaul LLCKevin J. KelleherPresident & CEO, CartusJefrey B. KilbergVice President, Nicholas/Tobin Insurance, Inc.Scott LavelleReal Estate Broker/Owner, Remax ExperienceRichard J. Lipton, MDPhysician, Advanced Ear, Nose & hroat CareMark A. MalkinOwner, Malkin & Daigle LLCMartin MarolaPresident, Marola Motor Sales, Inc.Wanda McGarry*Vice President, Corporate Secretary, Kovacs Construction Corp.Stanley J. McKenneyVice President, McKenney Mechanical Contractors, Inc.Rute Mendes Caetano, Esq.Partner, Ventura LawAnthony Mercaldo, CPAMittler, Mercaldo & Braun PCBruce Minof**Owner, Hansen's Flower ShopAndrew W. MorinPresident, Servco Oil, Inc.Maurice A. NizzardoReal Estate Developer, Nizzardo Holdings LLChomas J. Oneglia*Assistant Vice President, O&G Industries, Inc.Sal PandoliReal Estate Services & Development, Pandoli PropertiesMatthew Paul, MDEye Surgeon/Ophthalmologist, Danbury Eye Physicians & SurgeonsLarry Pereira, Esq.Attorney, Baker Law FirmWilliam M. Petroccio, Esq.Attorney, Q & R Associates LLCZachary S. Rapp*President, Sydney A. Rapp Land Surveying, PCMaryJean RebeiroPresident & CEO, N Y-CONN CorporationEugene ReelickOwner, Hollandia NurseryM. Jefers RyerPresident, Ryer Associateshomas S. SantaPresident & CEO, Santa Energy CorporationLisa ScailsExecutive Director, Cultural Alliance of Western CTMary Schinke, Esq.Mary Schinke Attorney at Law LLCValerie SedelnickPresident & CEO, Washington Supply CompanyGregory L. SteinerPrincipal, Berkshire Corporate ParkMichael R. SturdevantLieutenant, Danbury Police DepartmentLuis TomasRetired Owner, European’s Furniture & GiftsLewis J. Wallace, Jr.Director, Common FundWilliam H. Webb, Jr.President, Pegasys, Inc.Arthur C. Weinshank, Esq.Partner, Cramer & Anderson LLPRalph Williams IIIPrincipal, Connecticut Business Services LLCJordan YoungPresident, Fairield ProcessingJack Zazzaro, DMDCosmetic & Family DentistryTRUSTEESBRANCH LOCATIONSCHAIRMAN OF THE BOARD OF TRUSTEESJef LevineOwner, Levine AutomotiveBethel24 Grassy Plain Street79 Stony Hill RoadBrookield200 Federal Road828 Federal RoadCanton188 Albany TurnpikeDanbury71 Newtown Road116 Main Street226 Main Street100 Mill Plain Road126 North StreetGoshen4 Sharon TurnpikeVICE CHAIRMAN OF THE BOARD OF TRUSTEESArnold E. Finaldi, Jr.Senior Vice President, Rose & Kiernan, Inc.Ray P. BoaOwner, A & J Construction CompanyJohn A. BrighentiVice President & Owner, Avon Plumbing &Heating Co., Inc.David S. HawleyPresident, Hawley ManagementKent15 Kent Green BoulevardCynthia C. MerklePresident & CEO, Union Savings BankLitchield13 North StreetJohn M. Murphy, MDPresident & CEO, Western Connecticut Healthcare NetworkMarble Dale253 New Milford TurnpikeMonroe411 Monroe TurnpikeNew Fairield24 Route 39New Milford169 Danbury Road41 East Street100 Park Lane Road (ATM only)Newtown1-A Commerce RoadRidgeield100 Danbury RoadRoxbury26 North StreetSouthbury406 Main Street SouthTorrington1057 Torringford Street397 Main StreetWashington Depot7 Bryan PlazaStephen G. Rosentel, CPAPresident, Leahy’s Fuels, Inc.Frank A. Rowella, Jr., CPAManaging Partner, Reynolds & RowellaCynthia StevensConsultantH. Ray UnderwoodSecretary & Treasurer, Underwood Services, Inc.Lucie H. VovesPresident, Church Hill ClassicsTrustees are also Corporators

PLANNING FORTOMORROWunionsavings.com8 6 6 . 8 72 .18 6 6Member FDIC. Equal Housing Lender.

Federal Home Loan Bank advances 60,919 12,197 Other liabilities 35,274 35,885 Capital 227,662 237,222 Total liabilities and capital 2,205,675 2,181,552 Core Deposits . President & CEO, Cartus Jefrey B. Kilberg Vice President, Nicholas/Tobin Insurance, Inc. Scott Lavelle Real Estate Broker/Owner, Remax Experience