Transcription

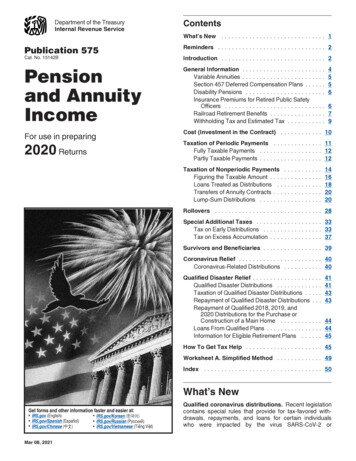

Department of the TreasuryInternal Revenue ServicePublication 946ContentsFuture Developments . . . . . . . . . . . . . . . . . . . . . . . 2What’s New for 2020 . . . . . . . . . . . . . . . . . . . . . . . 2Cat. No. 13081FWhat's New for 2021 . . . . . . . . . . . . . . . . . . . . . . . . 2How ToDepreciatePropertyReminders . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2 Section 179 Deduction Special DepreciationAllowance MACRS Listed PropertyFor use in preparing2020 ReturnsIntroduction . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2Chapter 1. Overview of Depreciation . . . .What Property Can Be Depreciated? . . . .What Property Cannot Be Depreciated? . .When Does Depreciation Begin and End?What Method Can You Use To DepreciateYour Property? . . . . . . . . . . . . . . . . . .What Is the Basis of Your DepreciableProperty? . . . . . . . . . . . . . . . . . . . . . .How Do You Treat Repairs andImprovements? . . . . . . . . . . . . . . . . .Do You Have To File Form 4562? . . . . . .How Do You Correct DepreciationDeductions? . . . . . . . . . . . . . . . . . . . .Chapter 2. Electing the Section179 Deduction . . . . . . . . . . . . . . . . . . .What Property Qualifies? . . . . . . . . . . . . .What Property Does Not Qualify? . . . . . .How Much Can You Deduct? . . . . . . . . . .How Do You Elect the Deduction? . . . . . .When Must You Recapture the Deduction?Chapter 3. Claiming the SpecialDepreciation Allowance . . . . . . . . . . . .What Is Qualified Property? . . . . . . . . . . .How Much Can You Deduct? . . . . . . . . . .How Can You Elect Not To Claim anAllowance? . . . . . . . . . . . . . . . . . . . .When Must You Recapture an Allowance?. IRS.gov (English) IRS.gov/Korean (한국어) IRS.gov/Spanish (Español) IRS.gov/Russian (Pусский) IRS.gov/Chinese (中文) IRS.gov/Vietnamese (Tiếng Việt)Mar 17, 2021.3467. 8. . . . . 11. . . . . 13. . . . . 13. . . . . 13.151517172222. . . . . 23. . . . . 23. . . . . 26. . . . . 27. . . . . 27Chapter 4. Figuring DepreciationUnder MACRS . . . . . . . . . . . . . . . . . . . .Which Depreciation System (GDS or ADS)Applies? . . . . . . . . . . . . . . . . . . . . . . .Which Property Class Applies Under GDS?What Is the Placed in Service Date? . . . . . .What Is the Basis for Depreciation? . . . . . .Which Recovery Period Applies? . . . . . . . .Which Convention Applies? . . . . . . . . . . . .Which Depreciation Method Applies? . . . . .How Is the Depreciation Deduction Figured?How Do You Use General Asset Accounts?When Do You Recapture MACRSDepreciation? . . . . . . . . . . . . . . . . . . . .Get forms and other information faster and easier at:. . . . 28.282932323235353648. . . . 52Chapter 5. Additional Rules forListed Property . . . . . . . . . . . . . . . . . . . . . . . . 53What Is Listed Property? . . . . . . . . . . . . . . . . . . 53Can Employees Claim a Deduction? . . . . . . . . . 54

What Is the Business-Use Requirement? . .Do the Passenger Automobile Limits Apply?What Records Must Be Kept? . . . . . . . . . .How Is Listed Property InformationReported? . . . . . . . . . . . . . . . . . . . . . . . . . 55. . . . 60. . . . 64. . . . 65Chapter 6. How To Get Tax Help . . . . . . . . . . . . . 66Appendix A . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 70Appendix B . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 98Glossary . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 109Index . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 111Future DevelopmentsFor the latest information about developments related toPub. 946, such as legislation enacted after this publicationwas published, go to IRS.gov/Pub946.What’s New for 2020Section 179 deduction dollar limits. For tax years beginning in 2020, the maximum section 179 expense deduction is 1,040,000 ( 1,075,000 for qualified enterprisezone property). This limit is reduced by the amount bywhich the cost of section 179 property placed in serviceduring the tax year exceeds 2,590,000. See Dollar Limitsin chapter 2.Also, the maximum section 179 expense deduction forsport utility vehicles placed in service in tax years beginning in 2020 is 25,900.The increased section 179 deduction for an enterprisezone business has been terminated for property placed inservice in tax years beginning after December 31, 2020.Extension of the treatment for certain race horses.The 3-year recovery period for race horses 2 years old oryounger has been extended to apply to horses placed inservice before January 1, 2022. See Which PropertyClass Applies in chapter 4.Extension of the treatment for qualified motorsportsentertainment complexes. The treatment of qualifiedmotorsports entertainment complexes as 7-year propertyunder MACRS has been extended to apply to complexesplaced in service before January 1, 2026. See WhichProperty Class Applies in chapter 4.Extension of the accelerated depreciation for qualified Indian reservation property. The accelerated recovery period for qualified Indian reservation property hasbeen extended to apply to property placed in service before January 1, 2022. See Indian Reservation Property inchapter 4.Depreciation limits on business vehicles. The totalsection 179 deduction and depreciation you can deductfor a passenger automobile, including a truck or van, youuse in your business and first placed in service in 2020 is 18,100, if the special depreciation allowance applies, orPage 2 10,100, if the special depreciation allowance does notapply. See Maximum Depreciation Deduction in chapter 5.What's New for 2021Section 179 deduction dollar limits. For tax years beginning in 2021, the maximum section 179 expense deduction is 1,050,000. This limit is reduced by the amountby which the cost of section 179 property placed in service during the tax year exceeds 2,620,000.Also, the maximum section 179 expense deduction forsport utility vehicles placed in service in tax years beginning in 2021 is 26,200.Recovery period for certain race horses. The 3-yearrecovery period for race horses 2 years old or younger willnot apply to horses placed in service after December 31,2021.Accelerated depreciation for qualified Indian reservation property. The accelerated recovery period forqualified Indian reservation property will not apply to property placed in service after December 31, 2021.RemindersPhotographs of missing children. The Internal Revenue Service is a proud partner with the National Center forMissing & Exploited Children (NCMEC). Photographs ofmissing children selected by the Center may appear inthis publication on pages that would otherwise be blank.You can help bring these children home by looking at 678) if you recognize a child.IntroductionThis publication explains how you can recover the cost ofbusiness or income-producing property through deductions for depreciation (for example, the special depreciation allowance and deductions under the Modified Accelerated Cost Recovery System (MACRS)). It also explainshow you can elect to take a section 179 deduction, instead of depreciation deductions, for certain property andthe additional rules for listed property.The depreciation methods discussed in this publication generally do not apply to property placed inCAUTION service before 1987. For more information, seePub. 534, Depreciating Property Placed in Service Before1987.!Definitions. Many of the terms used in this publicationare defined in the Glossary near the end of the publication. Glossary terms used in each discussion under themajor headings are listed before the beginning of eachdiscussion throughout the publication.Publication 946 (2020)

Do you need a different publication? The following table shows where you can get more detailed informationwhen depreciating certain types of property.For informationon depreciating:A carSee Publication:463, Travel, Gift, and Car Expenses1.Overview of DepreciationResidential rental 527, Residential Rental Propertyproperty(Including Rental of Vacation Home)IntroductionOffice space inyour home587, Business Use of Your Home(Including Use by Daycare Providers)Farm property225, Farmer's Tax GuideDepreciation is an annual income tax deduction that allows you to recover the cost or other basis of certain property over the time you use the property. It is an allowancefor the wear and tear, deterioration, or obsolescence ofthe property.This chapter discusses the general rules for depreciating property and answers the following questions.Comments and suggestions. We welcome your comments about this publication and your suggestions for future editions.You can send us comments through IRS.gov/FormComments. Or you can write to:Internal Revenue ServiceTax Forms and Publications1111 Constitution Ave. NW, IR-6526Washington, DC 20224Although we can’t respond individually to each comment received, we do appreciate your feedback and willconsider your comments as we revise our tax forms, instructions, and publications. Do not send tax questions,tax returns, or payments to the above address.Getting answers to your tax questions. If you havea tax question not answered by this publication or How ToGet Tax Help section at the end of this publication, go tothe IRS Interactive Tax Assistant page at IRS.gov/Help/ITA where you can find topics using the search feature or by viewing the categories listed.Getting tax forms, instructions, and publications.Visit IRS.gov/Forms to download current and prior-yearforms, instructions, and publications.Ordering tax forms, instructions, and publications.Go to IRS.gov/OrderForms to order current forms, instructions, and publications; call 800-829-3676 to orderprior-year forms and instructions. The IRS will processyour order for forms and publications as soon as possible.Do not resubmit requests you've already sent us. You canget forms and publications faster online. What property can be depreciated? What is the basis of your depreciable property?What property cannot be depreciated?When does depreciation begin and end?What method can you use to depreciate your property?How do you treat repairs and improvements?Do you have to file Form 4562?How do you correct depreciation deductions?Useful ItemsYou may want to see:Publication534 Depreciating Property Placed in Service Before1987534535 Business Expenses535538 Accounting Periods and Methods538551 Basis of Assets551Form (and Instructions)Sch C (Form 1040) Profit or Loss From BusinessSch C (Form 1040)2106 Employee Business Expenses21063115 Application for Change in Accounting Method31154562 Depreciation and Amortization4562See chapter 6 for information about getting publicationsand forms.Chapter 1Overview of DepreciationPage 3

What Property Can BeDepreciated?Terms you may need to know(see Glossary):Adjusted basisBasisCommutingDispositionFair market valueIntangible propertyListed propertyIncidents of ownership. Incidents of ownership inproperty include the following.Placed in service The legal title to the property. The legal obligation to pay for the property. The responsibility to pay maintenance and operatingTangible propertyTerm interestUseful lifeexpenses.You can depreciate most types of tangible property (except land), such as buildings, machinery, vehicles, furniture, and equipment. You can also depreciate certain intangible property, such as patents, copyrights, andcomputer software.To be depreciable, the property must meet all the following requirements. It must be property you own. It must be used in your business or income-producingactivity. It must have a determinable useful life. It must be expected to last more than 1 year.The following discussions provide information about theserequirements.Property You OwnTo claim depreciation, you must usually be the owner ofthe property. You are considered as owning property evenif it is subject to a debt.Example 1. You made a down payment to purchaserental property and assumed the previous owner's mortgage. You own the property and you can depreciate it.Example 2. You bought a new van that you will useonly for your courier business. You will be making payments on the van over the next 5 years. You own the vanand you can depreciate it.Leased property. You can depreciate leased propertyonly if you retain the incidents of ownership in the property(explained below). This means you bear the burden of exPage 4Chapter 1haustion of the capital investment in the property. Therefore, if you lease property from someone to use in yourtrade or business or for the production of income, generally you cannot depreciate its cost because you do not retain the incidents of ownership. You can, however, depreciate any capital improvements you make to the property.See How Do You Treat Repairs and Improvements, laterin this chapter, and Additions and Improvements underWhich Recovery Period Applies? in chapter 4.If you lease property to someone, you can generallydepreciate its cost even if the lessee (the person leasingfrom you) has agreed to preserve, replace, renew, andmaintain the property. However, if the lease provides thatthe lessee is to maintain the property and return to you thesame property or its equivalent in value at the expiration ofthe lease in as good condition and value as when leased,you cannot depreciate the cost of the property.Overview of Depreciation The duty to pay any taxes on the property. The risk of loss if the property is destroyed, con-demned, or diminished in value through obsolescenceor exhaustion.Life tenant. Generally, if you hold business or investmentproperty as a life tenant, you can depreciate it as if youwere the absolute owner of the property. However, seeCertain term interests in property under Excepted Property, later.Cooperative apartments. If you are a tenant–stockholder in a cooperative housing corporation and use yourcooperative apartment in your

Residential rental property 527, Residential Rental Property (Including Rental of Vacation Home) Office space in your home 587, Business Use of Your Home (Including Use by Daycare Providers) Farm property 225, Farmer's Tax Guide Comments and suggestions. We welcome your com-ments about this publication and your suggestions for fu-ture editions.