Transcription

CaliforniaDepartment ofCorrections:The Cost of Incarcerating Inmates inState-Run Prisons Is Higher Thanthe Department’s Published CostSeptember 199897125

The first copy of each California State Auditor report is free.Additional copies are 3 each. You can obtain reports by contactingthe Bureau of State Audits at the following address:California State AuditorBureau of State Audits555 Capitol Mall, Suite 300Sacramento, California 95814(916) 445-0255 or TDD (916) 445-0255 x 248Permission is granted to reproduce reports.

CALIFORNIA STATE AUDITORKURT R. SJOBERGMARIANNE P. EVASHENKSTATE AUDITORCHIEF DEPUTY STATE AUDITORSeptember 15, 199897125The Governor of CaliforniaPresident pro Tempore of the SenateSpeaker of the AssemblyState CapitolSacramento, California 95814Dear Governor and Legislative Leaders:As requested by the Joint Legislative Audit Committee, the Bureau of State Audits presents itsaudit report concerning the annual cost to the State for incarcerating inmates under thejurisdiction of the Department of Corrections (department). The report reviews the department’sown calculation of inmate costs at the 32 prisons and determines whether the included costfactors are appropriate and reasonable. We also calculated the annual incarceration costs perinmate for each of the 32 state-run prisons operating during fiscal year 1996-97, as well as astatewide cost per inmate. This report concludes that the department’s calculation appropriatelyincludes most of the direct and indirect operating costs but lacks certain indirect operating costsas well as capital costs for prison construction and expansion. Our calculation includes alloperating (direct and indirect) costs and capital costs. We found that per-inmate costs varysignificantly from one prison to another. Annual costs per inmate for the 32 prisons ranged from 18,562 to 38,554 for fiscal year 1996-97. The statewide average was 24,807.In conclusion, we recommend that, to accurately determine the cost of incarceration, thedepartment should include all costs, both operating and capital, when calculating how much theState pays annually to incarcerate criminals.Respectfully submitted,KURT R. SJOBERGState AuditorBUREAU OF STATE AUDITS660 J Street, Suite 300, Sacramento, California 95814 Telephone: (916) 445-0255 Fax: (916) 327-0019

CONTENTSSummary1Introduction3Audit ResultsThe Department’s Calculationof Annual Incarceration CostsPer Inmate Does Not ReflectAll Costs Incurred by the State7Recommendation16AppendixOur Calculation of AnnualIncarceration Costs Per Inmatefor Fiscal Year 1996-9717Response to the AuditCALIFORNDepartment of Corrections21California State Auditor’s Commentson the Response From the Department of Corrections23IASTATEAUDITOR

SUMMARYRESULTS IN BRIEFThe California Department of Corrections (department)was established in 1944 and is responsible for incarcerating criminals. Its operation includes work, academiceducation, vocational training, and medical, dental, and psychiatric care for California’s approximately 146,000 inmates, as wellas parole services, such as supervision and surveillance.Audit Highlights . . .We found that the CaliforniaDepartment of Correctionspublished annualincarceration costsEach fiscal year, the department calculates and publishes theamount of incarceration costs per inmate. The department’scalculation focuses primarily on those operating costs directlyrelated to housing and supporting inmates, such as food, clothing, health care, and inmate activities. For fiscal year 1996-97,the department calculated annual incarceration costs at 21,012per inmate.þ Of 21,012 areunderstated by 3,795 per inmateþ Do not include 437million in capital costsþ Exclude 15 million paidto local governmentsrelated to state inmates,and 84 million of thedepartment’s share ofstate overhead costsWe reviewed the department’s calculation and found that,although it appropriately reflects many of the operating costs,it does not include all costs incurred by the State. When weincluded all of the costs, we found that annual incarcerationcosts were 24,807 per inmate for fiscal year 1996-97, 3,795higher per inmate than the department’s published figure. Thetotal difference of costs to incarcerate inmates between thedepartment’s calculation and our estimate is 517 million.Further, we found the cost perinmate for the 32 prisonsranged from 18,562 to 38,554 per year.The primary reason for this difference is the department’scalculation does not include capital costs, such as lease-purchasepayments, debt-service costs for new construction, and costsof improving and renovating existing prisons. The department’scalculation also does not include reimbursements to localgovernments for transportation costs, court fees, and countycharges related to state inmates. Finally, the department’scalculation does not include its share of state central-servicecosts, such as costs of various accounting functions performedby the State Controller’s Office for other state departments.We calculated the annual incarceration costs per inmate foreach of the 32 state-run prisons operating during fiscal year1996-97, as well as a statewide cost per inmate. Our calculationincludes all operating and capital costs. We found that annualCALIFORNIASTATEAUDITOR1

incarceration costs per inmate vary significantly from one prisonto another, depending on each prison’s security levels, facilitytypes, and age. Annual costs per inmate for the 32 prisonsranged from 18,562 to 38,554 per year.The Appendix contains our complete cost model, detailingthe various components of incarceration costs for fiscal year1996-97, and a discussion of the methodology we used toconstruct our model.RECOMMENDATIONTo accurately determine the relevant cost of prison operations,the department should include all operating and capital costsin its calculation of how much the State pays annually toincarcerate criminals.AGENCY COMMENTSThe Department of Corrections generally agrees with ourfindings and our recommendation that all operating andcapital costs should be included in its calculation of annualincarceration costs. n2CALIFORNIASTATEAUDITOR

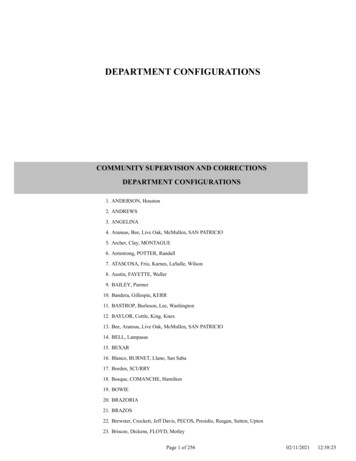

INTRODUCTIONBACKGROUNDThe California Department of Corrections (department),established in 1944, is responsible for incarceratingcriminals. In terms of staffing, it is the largest departmentin state government, with approximately 45,000 employees,28,000 of them sworn correctional peace officers. Thedepartment’s 4 billion budget for fiscal year 1998-99 is primarily funded by the State’s General Fund. The department alsoprovides work, academic education, vocational training, andmedical, dental, and psychiatric care for California’s inmatepopulation, as well as parole services, such as supervision andsurveillance.OVERVIEW OF THE DEPARTMENT ANDCORRECTIONAL FACILITIESThe department directly operates 331 minimum- to maximumsecurity state prisons, which currently house over 146,000inmates throughout the State. Refer to Figure 1 for a map ofthe 33 state prisons. It also monitors parolees and overseescommunity correctional facilities. The department primarilyconsists of three programs: Institution, Health Care Services,and Community Correctional. Through the Institution Program,the department operates state prisons classified by security leveland facility type. Security levels range from Level I (minimum)to Level IV (maximum).Types of facilities include isolated housing units for high-profileand condemned criminals, and reception centers. In its reception centers, the department evaluates inmates for various casefactors, such as personal and criminal history, medical andpsychiatric conditions, and educational needs, before assigning each inmate to a specific prison with the appropriatesecurity level.1CALIFORNThe department operated 32 prisons during fiscal year 1996-97; anadditional prison was completed in fiscal year 1997-98.IASTATEAUDITOR3

FIGURE 1The Locations of the 33 State PrisonsPelican Bay State PrisonCrescent CityHigh Desert State PrisonCalifornia Correctional CenterSusanvilleCalifornia Medical FacilityCalifornia State Prison,SolanoSacramentoFolsom State PrisonCalifornia State Prison, SacramentoMule Creek State PrisonSierra Conservation CenterVacavilleCalifornia State Prison,San QuentinStocktonSan FranciscoJamestownTracyNorthern California WomenWomen’s FacilityWomen’sDeuel VocationalVocational InstitutionValley State Prison for WomenCentral California Women’s FacilityChowchillaSalinasFresnoCorrectional Training FacilityCorcoran II - State Prison andSubstance Abuse Treatment FacilityCalifornia State Prison, CorcoranSalinas Valley State PrisonPleasant Valley State PrisonAvenal State PrisonCalifornia Men’s ColonyNorth Kern State PrisonWasco State PrisonBakersfieldSan Luis ObispoCalifornia Correctional InstitutionCalifornia State Prison, Los Angeles CountyIronwood State PrisonChuckawalla Valley State PrisonSanta BarbaraLos AngelesChinoCalifornia Institution for MenCalifornia Institution for WomenCalifornia Rehabilitation CenterSan DiegoR.J. Donovan Correctional FacilityCalipatria State PrisonCentinela State Prison4CALIFORNIASTATEAUDITOR

Through its Institution Program, the department also operatescamps throughout the State that primarily train inmatesas wildland firefighters. In addition, the department supervisesinmates placed in Department of Mental Health hospitals.The Institution Program also has a correctional officertraining center.The Health Care Services Program provides medical, dental,and psychiatric services to state prison inmates. The department employs approximately 170 health care providers andsupport staff. The program operates four licensed hospitals,a skilled-nursing facility, and a hospice care facility. It alsocontracts with community health care providers—includinghospitals, physician groups, and individual care providers—forspecialty care and supplemental health services. Health CareServices was established as a separate program during fiscalyear 1997-98. Prior to that, these services were included in theInstitution Program.Through the Community Correctional Program, the departmentsupervises parolees who have been released to the community.It also oversees community correctional facilities operatedthrough contracts with local governments and private entities.The primary objective of the Community Correctional Programis to increase the degree of successful reintegration of criminalsinto society and to reduce the level of recidivism. Communitycorrectional facilities house approximately 6,000 paroleesand minimum- to medium-security inmates. Additionally,through the Community Correctional Program, the departmentadministers contracts with local government detention facilities,re-entry centers, community programs for incarcerated mothers,restitution centers, and a substance abuse treatment program.SCOPE AND METHODOLOGYThe Joint Legislative Audit Committee requested that theBureau of State Audits determine the actual annual cost tothe State for incarcerating inmates under the department’sjurisdiction. Specifically, we were asked to ensure that all relevant costs be considered. Our audit focused on incarcerationcosts of state-operated prisons. We did not review the costs ofcommunity correctional facilities, or include these costs in ourmodel, because these facilities are operated by private entitiesand local governments, not by the department.CALIFORNIASTATEAUDITOR5

To obtain an understanding of the department’s responsibilitiesand the environment in which it operates, we reviewed pertinent federal and state laws and regulations, governor’s budgets,studies regarding prisons and incarceration costs preparedby other state and federal governments, and other relevantbackground information.Each fiscal year, the department calculates and publishes theannual cost of incarceration per inmate in the governor’sbudget and in department fact sheets. Before performing ourown calculation of annual incarceration costs, we reviewedthe department’s calculation to understand its methodology.We also interviewed appropriate staff and reviewed documentssupporting the department’s calculation. We additionallyreviewed the department’s budget and certain accountingrecords and procedures. We identified the types of coststhe department included and excluded in its calculationand ascertained whether these costs were appropriatelyincluded or excluded.The department’s calculation of annual incarceration costsincludes operating costs but not capital costs. The departmentincurs capital costs for designing and building its prisons. Indeveloping our own estimate of annual incarceration costs perinmate, we included both operating and capital costs. We usedinformation from the department’s accounting records as well asthe governor’s budget to construct our cost model. Using ourmodel, we calculated the annual incarceration costs per inmatefor each of the 32 state-run prisons operating during fiscal year1996-97, as well as a statewide cost per inmate. We used fiscalyear 1996-97 data because it was the most current availableduring our audit.To verify the accuracy and completeness of the cost informationin our model, we reviewed pertinent accounting records. Wealso verified the accuracy of the costs in our model by performing an analytical review of labor costs, which represent thelargest element of incarceration costs. Specifically, we verifiedthe accuracy of salaries, wages, and retirement benefit costs inour model by comparing these amounts taken from thedepartment’s records to the records maintained by the StateController’s Office, which disburses payroll payments to stateemployees. We noted no material differences. n6CALIFORNIASTATEAUDITOR

AUDIT RESULTSThe Department’s Calculationof Annual Incarceration CostsPer Inmate Does Not ReflectAll Costs Incurred by the StateSUMMARYEach fiscal year, the Department of Corrections (department) calculates and publishes the amount of incarceration costs per inmate. In this calculation, the departmentincludes primarily operating costs directly related to housingand supporting inmates, such as food, clothing, health care,and inmate activities. For fiscal year 1996-97, the departmentcalculated annual incarceration costs at 21,012 per inmate.Although the department’s calculation of incarceration costsappropriately reflects many of the operating costs, it does notinclude all costs incurred by the State. Our calculation, whichconsidered all costs, placed annual incarceration costs at 24,807per inmate for fiscal year 1996-97.The department’s calculation of incarceration costs per inmatedid not include capital costs, reimbursements to local governments, or its share of state central-service costs. Therefore, wedeveloped our own estimate of annual incarceration costs perinmate for each of the 32 state-run prisons operating duringfiscal year 1996-97, which includes both operating and capitalcosts. Our calculation of cost per inmate for the 32 prisonsranged from 18,562 to 38,554 per year.Our calculation indicates that the State paid a total of 517 million more than the department calculated to incarcerate criminals in fiscal year 1996-97.THE COST OF INCARCERATING INMATES INSTATE-RUN PRISONS IS HIGHER THAN THEDEPARTMENT’S PUBLISHED AMOUNTThe department appropriately included certain operatingcosts in its calculation and properly excluded certain costs, suchas expenses related to the Community Correctional Program,CALIFORNIASTATEAUDITOR7

the Prison Industry Authority (PIA), and the Inmate WelfareFund. However, the department did not include capital costs,reimbursements to local governments, and its share of statecentral-service costs, and included costs associated with theSanta Rita Jail that should have been excluded. When weincluded all relevant costs, we calculated annual incarcerationcosts at 24,807 per inmate for fiscal year 1996-97. Table 1illustrates the difference between the department’s calculationand ours.TABLE 1The Department’s Calculationof Annual Incarceration CostsPer Inmate for Fiscal Year 1996-97Total Institution Program Costs1Our Calculationof Annual Incarceration CostsPer Inmate for Fiscal Year 1996-97 3,226,411,000Less Local AssistanceLess Lease-Purchase PaymentsLess Inmate Welfare Fund(15,419,000)(211,705,000)(37,926,000)Total Incarceration Costs 2,961,361,000Divided by AverageDaily Prison Population2140,934Department Calculated CostPer Inmate 21,012Direct Operating Costs1 2,606,769,428Indirect Operating CostsLocal Assistance3State Central-Service Costs3Headquarters’ OverheadMcGee Training al Operating Costs13,040,680,948Capital CostsGeneral-Obligation Bonds Debt Service3Lease-Purchase Payments(includes insurance)3Capital Outlay Funded by General Fund3Total Capital al Incarceration Costs 3,477,943,867Divided by AverageDaily Prison Population2140,202Our Calculated CostPer Inmate 24,8071Institution Program costs and direct operating costs may include a small amount of costs incurred to care for theinmates incarcerated in a community correctional facility. For example, an inmate in a community correctionalfacility may be temporarily transferred to a state prison for medical treatment. However, the department couldnot provide the specific amount for such situations.2The average daily prison population used in the department’s calculation is higher than ours because it includesinmates held in the Santa Rita Jail.3 These8costs are not included in the department’s calculation.CALIFORNIASTATEAUDITOR

OPERATING COSTS ARE THE KEY COMPONENTS OFTHE DEPARTMENT’S CALCULATIONThe department’s calculation of annual incarceration costs perinmate appropriately included the operational costs of guarding,feeding, educating, and attending to the health care needs ofinmates. The department accounts for these operational costsin the Institution Program. This program also includes externalprofessional-services costs, such as medical and psychiatricservices provided through contracts or interagency agreements,and legal services provided by the department’s in-housecounsel, external law firms, and the attorney general. As indicated in Table 1, most of the 3.2 billion cost of the InstitutionProgram was included in the department’s calculation.The department’s calculation appropriately excluded costsrelated to the Community Correctional Program, the PIA, andthe Inmate Welfare Fund. Through the Community CorrectionalProgram, the department supervises parolees released to thecommunity and oversees community correctional facilities thatare operated through contracts with local governments andprivate entities. The department did not include the costs of theCommunity Correctional Program in its calculation. We agreethat these costs should not be included because they relate toreleased parolees and facilities that are run by private entitiesand local governments.Appropriately, thedepartment excludescosts from theCommunity CorrectionalProgram, the PrisonIndustry Authority, andthe Inmate Welfare Fundfrom its computation ofannual incarcerationcosts.Moreover, although the PIA currently operates manufacturing,service, and agricultural facilities at 23 of the 33 state prisons,the department excluded PIA-related costs from its calculation.The PIA operation is intended to reduce the department’s operating costs and to be self-supporting. However, the departmentsubsidizes the PIA’s operation by charging the PIA less-thanmarket rent for facilities and warehouse space. On the otherhand, the PIA also provides a form of subsidy to the departmentby performing services the department does not reimburse, suchas searches and standing counts. We also excluded these costsbecause the rent subsidies and the PIA-provided services mayoffset each other, and it would be difficult to quantify anydifference.Finally, the department excluded expenditures of the InmateWelfare Fund in its calculation, as it is a self-supporting fundused to run prison canteens. All expenditures, including costsof goods sold, labor costs, equipment, and utilities, are fullyCALIFORNIASTATEAUDITOR9

recovered by canteen sales and other related revenues. Weagree that these expenditures should not be included in the costcalculation because there is no cost to the State.THE DEPARTMENT’S CALCULATION DID NOTINCLUDE SEVERAL COSTS THAT SHOULD HAVEBEEN INCLUDEDAlthough the department’s calculation of incarceration costsincluded many of the operating costs, it did not include all ofthe costs incurred by the State. The department’s calculationdid not include capital costs, such as lease-purchase payments,debt-service costs for new construction, and costs of improvingand renovating existing prisons. Additionally, the department’scalculation did not include reimbursements to local governments for transportation costs, court fees, and county chargesrelated to state inmates, or its share of state central-service costs.When we included all of these costs in our calculation, we foundthat annual incarceration costs were 24,807 per inmate forfiscal year 1996-97, 3,795 higher per inmate than thedepartment’s published figure.THE DEPARTMENT DID NOTINCLUDE CAPITAL COSTSThe department did not include any capital costs in its calculation of incarceration costs. During fiscal year 1996-97, thesecosts totaled approximately 437 million. Capital costs representthe expense of constructing new prisons, acquiring land andequipment, and improving and renovating existing prisons. Thedepartment finances capital costs in one of three ways: throughthe issuance of general-obligation bonds, lease-revenue bonds,or through General Fund expenditures.The department didnot include capitalcosts of 437 million inits calculation ofincarceration costs.General-obligation bond proceeds can be used for new prisonconstruction, as well as improvements to and renovationof existing facilities—for example, installing electric fences.Information was unavailable regarding the amount of generalobligation bond debt-service costs applicable to the departmentor to specific prisons. Therefore, we estimated the department’sallocated portion to be approximately 222 million for fiscalyear 1996-97. The Appendix describes the methodology we usedto estimate and allocate this amount among the prisons.10CALIFORNIASTATEAUDITOR

Lease-revenue bonds can also be used to finance constructionof new prisons and improvements to existing prisons. Thesubsequent lease-purchase payments represent debt-servicecosts of the bonds, including principal, interest, andbond-issuance costs. Lease-purchase payments also include costsof property and liability insurance for these prisons. Leasepayments represent capital costs because the State will ownthese prisons at the end of the lease term. During fiscal year1996-97, the department made lease payments of approximately 212 million for the construction of 11 new prisons. Duringthis period, the department also financed capital costs ofapproximately 4 million through General Fund expenditures.As the inmate population continues to grow, new prison construction and improvements to existing prisons become evenmore important. The department’s records show the averagedaily inmate population has increased more than 500 percentsince 1980. Additionally, during fiscal year 1996-97, prisonsoperated on average at 193 percent of designed capacity. Toaccommodate this population increase, many prisons now havedouble cells and bunks, and numerous emergency projects havebeen required to convert gymnasiums and activity rooms intoinmate housing. Furthermore, the department has built 21 newprisons in the last 15 years.These capital costs are necessary to keep pace with increasesin the inmate population and represent direct costs that shouldbe considered when calculating the relevant cost of incarceratinginmates in state-run prisons. Without prisons, the departmentcannot house inmates. We have therefore included these capitalcosts in our cost model.THE DEPARTMENT EXCLUDEDLOCAL ASSISTANCE COSTSThe department did not include local assistance in its calculation of incarceration costs as these costs are budgeted forand originally borne by local governments. Local assistance isbudgeted in the State’s General Fund for reimbursing localgovernments for transportation costs, court fees, and countycharges for state inmates. As shown in Table 1, the Statereimbursed local governments approximately 15 million forlocal assistance during fiscal year 1996-97. Transportationcosts include expenses incurred by counties for transportinginmates and returning fugitives from outside the State. CourtThe department excluded 15 million inreimbursements to localgovernments fortransportation, courtfees, and county chargesfor state inmates.CALIFORNIASTATEAUDITOR11

fees and county charges represent legal costs incurred by localgovernments. We disagree with the department’s treatment ofthese costs, and have included them in our calculation becausethe department ultimately pays these expenses.THE DEPARTMENT DID NOT INCLUDEITS SHARE OF CENTRAL-SERVICE COSTSThe department did not include its share of central-servicecosts in its calculation of incarceration costs per inmate.Central-service costs are those amounts expended bycentral-service departments and the Legislature for the overalladministration of state government and for providingcentralized services to state departments. These functions arenecessary for state operations and are centralized to provideefficient and consistent statewide policies and services. Forexample, the Department of Finance provides audits and budgetanalysis to other departments, and the State Controller’s Officeperforms various accounting functions, such as payroll,disbursements, and claims audits, for other state departments.The Department of Finance allocates a portion of thesecentral-service costs to each state department. The costs ofspecific services provided through interagency agreementsare not included in the allocated central-service costs. Additionally, only those departments that are not primarily funded bythe General Fund are actually charged for their portion ofcentral-service costs. Therefore, because almost all of thedepartment’s costs are paid from the General Fund, the department is not billed for its share of central-service costs, and itdoes not include them in its calculation of incarceration costs.Although the departmentis not billed for centralservice costs, its share forfiscal year 1996-97 was 84 million.Although the department is not billed for its share ofcentral-service costs, these are actual and necessary costsincurred by the State, and represent indirect costs of incarceration. We feel that these costs should have been included in thedepartment’s calculation, and we included them in our model,just as we included other departmental overhead costs. For fiscalyear 1996-97, the department’s share of central-service costs wasapproximately 84 million.12CALIFORNIASTATEAUDITOR

THE DEPARTMENT INCLUDED THE COSTOF THE SANTA RITA JAIL IN ITS CALCULATIONFOR FISCAL YEAR 1996-97The department contracts with Alameda County for use of theSanta Rita Jail. The jail houses inmates on a temporary basiswho are primarily parole violators waiting to be permanentlyassigned to state prisons. In the past, the department includedthe cost of the Santa Rita Jail in its inmate cost calculationbecause the jail originally was used as overflow for San QuentinState Prison. For fiscal year 1996-97, this cost amounted toapproximately 14 million. However, the department subsequently decided that it was more appropriate to classifythese costs under the Community Correctional Program becausethe inmates housed in the jail are primarily parolees. Therefore,beginning with its fiscal year 1997-98 calculation, thedepartment excluded these costs from its calculation.Because the Santa Ritajail is used primarily tohouse parolees, itscosts should be classifiedunder the CommunityCorrectional Programand excluded from thecalculation of annualincarceration costs.We agree with the department’s subsequent decision toaccount for the contract costs of the Santa Rita Jail under theCommunity Correctional Program and not the InstitutionProgram. Furthermore, because county jails are not operated bythe State, and as their function is limited, we have excluded thecosts of these jails from our cost model.ANNUAL INCARCERATION COSTSPER INMATE VARY SIGNIFICANTLYFROM ONE PRISON TO ANOTHERIn addition to calculating the statewide cost per inmate, wecalculated the annual incarceration costs per inmate for each ofthe 32 state-run prisons operating during fiscal year 1996-97.Table 2 illustrates that annual incarceration costs per inmatevary significantly from one prison to another, ranging from alow of 18,562 at Folsom State Prison to a high of 38,554 at theCalifornia Medical Facility, with a statewide average of 24,807.The Appendix shows our complete cost model detailing thevarious components of incarceration costs for fiscal year1996-97, as well as a discussion of the methodology we used toconstruct our model.CALIFORNIASTATEAUDITOR13

TABLE 2Our Calculation of Annual Incarceration Costs Per Inmate for Fiscal Year 1996-97YearOpenedCorrectional InstitutionTotal Cost Per Inmate: up to 22,0001 Folsom State Prison18802 California Correctional Center19633 Correctional Training Facility19474 Sierra Conservation Center (men & women)19655 California Rehabilitation Center (men & women) 19626 California Men’s Colony19547 Avenal State Prison1987Total Cost Per Inmate: 22,001 to 26,0008 California State Prison, Solano9 Deuel Vocational Institution10 Chuckawalla Valley State Prison11 California State Prison, San Quentin12 Wasco State Prison13 California Correctional Institution14 California Institution for Men15 North Kern State Prison16 Pleasant Valley State Prison17 Ironwood State

a skilled-nursing facility, and a hospice care facility. It also contracts with community health care providers—including hospitals, physician groups, and individual care providers—for specialty care and supplemental health services. Health Care Services was established as a separate program during fiscal year 1997-98.