Transcription

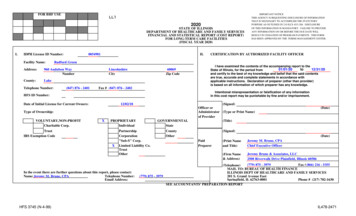

FOR BHF USELL12020STATE OF ILLINOISDEPARTMENT OF HEALTHCARE AND FAMILY SERVICESFINANCIAL AND STATISTICAL REPORT (COST REPORT)FOR LONG-TERM CARE FACILITIES(FISCAL YEAR 2020)I.IDPH License ID Number:Facility Name:0054981II.CERTIFICATION BY AUTHORIZED FACILITY OFFICERRadford GreenAddress:960 Audubon WayNumberCounty:LakeTelephone Number:(847) 876 - 2401LincolnshireCity60069Zip CodeFax # (847) 876 - 2402Date of Initial License for Current Owners:12/02/18Type of Ownership:VOLUNTARY,NON-PROFITCharitable Corp.I have examined the contents of the accompanying report to the01/01/20to12/31/20State of Illinois, for the period fromand certify to the best of my knowledge and belief that the said contentsare true, accurate and complete statements in accordance withapplicable instructions. Declaration of preparer (other than provider)is based on all information of which preparer has any knowledge.Intentional misrepresentation or falsification of any informationin this cost report may be punishable by fine and/or imprisonment.HFS ID Number:XPROPRIETARYIndividualTrustIRS Exemption " Corp.Limited Liability Co.TrustOtherIn the event there are further questions about this report, please contact:Name: Jeremy M. Brune, CPATelephone Number:Email Address:HFS 3745 (N-4-99)IMPORTANT NOTICETHIS AGENCY IS REQUESTING DISCLOSURE OF INFORMATIONTHAT IS NECESSARY TO ACCOMPLISH THE STATUTORYPURPOSE AS OUTLINED IN 210 ILCS 45/3-208. DISCLOSUREOF THIS INFORMATION IS MANDATORY. FAILURE TO PROVIDEANY INFORMATION ON OR BEFORE THE DUE DATE WILLRESULT IN CESSATION OF PROGRAM PAYMENTS. THIS FORMHAS BEEN APPROVED BY THE FORMS MANAGEMENT CENTER.(Signed)Officer orAdministrator (Type or Print Name)of Preparer(Print Nameand Title)Jeremy M. Brune, CPAChief Executive Officer(Firm Name& Address)Jeremy Brune & Associates, LLC2508 Riverwalk Drive Plainfield, Illinois 60586(779) 875 - 3979Fax #(866)(216) - 5355(Telephone)MAIL TO: BUREAU OF HEALTH FINANCEILLINOIS DEPT OF HEALTHCARE AND FAMILY SERVICES(779) 875 - 3979201 S. Grand Avenue EastSpringfield, IL 62763-0001Phone # (217) 782-1630SEE ACCOUNTANTS' PREPARATION REPORTIL478-2471

STATE OF ILLINOISFacility Name & ID NumberRadford GreenIII.STATISTICAL DATAA. Licensure/certification level(s) of care; enter number of beds/bed days,(must agree with license). Date of change in licensed beds12Beds atBeginning ofReport Period1234568478910111213LicensureLevel of Care84N/AE. List all services provided by your facility for non-patients.(E.g., day care, "meals on wheels", outpatient therapy)Assisted Living, Independent Living, Clinic, & Home Health34Beds at End ofReport PeriodLicensedBed Days DuringReport PeriodSkilled (SNF)Skilled Pediatric (SNF/PED)Intermediate (ICF)Intermediate/DDSheltered Care (SC)ICF/DD 16 or LessTOTALS848430,66030,660B. Census-For the entire report period.12345Level of CarePatient Days by Level of Care and Primary Source of PaymentMedicaidRecipientPrivate DSCDD 16 OR LESS14 TOTALS9249,890C. Percent Occupancy. (Column 5, line 14 divided by total licensedbed days on line 7, column 4.)66.74%HFS 3745 (N-4-99)9,650Page 2#0054981Report Period Beginning:01/01/20Ending:12/31/20D. How many bed reserve days during this year were paid by the Department?0(Do not include bed reserve days in Section B.)20,464F. Does the facility maintain a daily midnight census?1234567YesG. Do pages 3 & 4 include expenses for services orinvestments not directly related to patient care?YESXNOH. Does the BALANCE SHEET (page 17) reflect any non-care assets?YESXNOI. On what date did you start providing long term care at this location?Date started11/18/10J. Was the facility purchased or leased after January 1, 1978?YESX Date11/18/10NOK. Was the facility certified for Medicare during the reporting year?YESXNOIf YES, enter numberof beds certified84and days of care provided891011121314Medicare Intermediary8,379Novitas SolutionsIV. ACCOUNTING BASISACCRUALXMODIFIEDCASH*Is your fiscal year identical to your tax year?CASH*YESXNOTax Year:12/31/20Fiscal Year:12/31/20* All facilities other than governmental must report on the accrual basis.SEE ACCOUNTANTS' PREPARATION REPORTIL478-2471

STATE OF ILLINOISFacility Name & ID NumberRadford Green#0054981Report Period Beginning:V. COST CENTER EXPENSES (throughout the report, please round to the nearest dollar)Costs Per General LedgerReclassReclassifiedAdjustOperating lmentsA. General 9852,218,985(1,859,146)Food Heat and Other 662,277)Other (specify):* See 4567891010a1112131415TOTAL General ServicesB. Health Care and ProgramsMedical DirectorNursing and Medical RecordsTherapyActivitiesSocial ServicesCNA TrainingProgram TransportationOther (specify):* See Supplemental16 TOTAL Health Care and Programs1718192021222324252627C. General AdministrationAdministrativeDirectors FeesProfessional ServicesDues, Fees, Subscriptions & PromotionsClerical & General Office ExpensesEmployee Benefits & Payroll TaxesInservice Training & EducationTravel and SeminarOther Admin. Staff TransportationInsurance-Prop.Liab.MalpracticeOther (specify):* See Supplemental28 TOTAL General AdministrationTOTAL Operating ExpenseFOR BHF USE ONLYHFS 3745 E ACCOUNTANTS' PREPARATION REPORT*Attach a schedule if more than one type of cost is included on this line, or if the total exceeds 1000.NOTE: Include a separate schedule detailing the reclassifications made in column 5. Be sure to include a detailed explanation of each reclassification.29 (sum of lines 8, 16 & age 312/31/2001/01/202829IL478-2471

Radford GreenMedicaid Cost Report01/01/20 - 12/31/20Page 3 Supplemental ScheduleDescriptionLine 7 - Other General 6092,489423,6092,489Total-426,098426,098Line 15 - Other Health Care ServicesSub-Total------Line 27 - Other General AdministrationSub-TotalHFS 3745 (N-4-99)--IL478-2471

Radford GreenMedicaid Cost Report01/01/20 - 12/31/20Page 3 Supplemental Schedule - Reclassification DetailDescriptionResident MealsResident Census - NHResident Census - ALResident Census - ILEmployee MealsEmployeesTotalHFS 3745 (N-4-99)Census Days20,46410,265172,628EmployeesFactorMeals Served3.001.751.75% of Food CostAllowable Resident PortionEmployee IL478-2471

Facility Name & ID NumberSTATE OF ILLINOIS#0054981#Radford GreenReport Period ge 412/31/20V. COST CENTER EXPENSES (continued)30313233343536Capital ExpenseD. OwnershipDepreciationAmortization of Pre-Op. & Org.InterestReal Estate TaxesRent-Facility & GroundsRent-Equipment & VehiclesOther (specify):* See SupplementalSalary/Wage1Cost Per General 154418,364,2584537 TOTAL Ownership383940414243Ancillary ExpenseE. Special Cost CentersMedically Necessary TransportationAncillary Service CentersBarber and Beauty ShopsCoffee and Gift ShopsProvider Participation FeeOther (specify):* See Supplemental44 TOTAL Special Cost CentersGRAND TOTAL COST45 (sum of lines 29, 37 & 5640,243,856(21,879,598)175,18156,321FOR BHF USE ONLY9103031323334353637*Attach a schedule if more than one type of cost is included on this line, or if the total exceeds 1000.SEE ACCOUNTANTS' PREPARATION REPORTHFS 3745 (N-4-99)IL478-2471

Radford GreenMedicaid Cost Report01/01/20 - 12/31/20Page 4 Supplemental ScheduleDescriptionSalariesSuppliesOtherTotalLine 36 - Other Capital CostsSub-TotalLine 43 - Other Special Cost CentersAssisted LivingClinicCommunity Home HealthMarketingSub-TotalHFS 3745 24,673IL478-2471

STATE OF ILLINOISPage 5Facility Name & ID Number Radford Green# 0054981Report Period Beginning:01/01/20Ending:12/31/20VI. ADJUSTMENT DETAILA. The expenses indicated below are non-allowable and should be adjusted out of Schedule V, pages 3 or 4 via column 7.In column 2 below, reference the line on which the particular cost was included. (See instructions.)123ReferBHF USEB. If there are expenses experienced by the facility which do not appear in theNON-ALLOWABLE EXPENSESAmountenceONLYgeneral ledger, they should be entered below.(See instructions.)1 Day Care 1122 Other Care for Outpatients2AmountReference3 Governmental Sponsored Special Programs331 Non-Paid Workers-Attach Schedule* 4 Non-Patient Meals(7,379) 02432 Donated Goods-Attach Schedule*5 Telephone, TV & Radio in Resident Rooms(161,344) 215Amortization of Organization &6 Rented Facility Space(6,881) 06633 Pre-Operating Expense7 Sale of Supplies to Non-Patients7Adjustments for Related Organization8 Laundry for Non-Patients834 Costs (Schedule VII)9 Non-Straightline Depreciation935 Other- Attach Schedule10 Interest and Other Investment Income(844) 321036 SUBTOTAL (B): (sum of lines 31-35) 11 Discounts, Allowances, Rebates & Refunds11(sum of SUBTOTALS12 Non-Working Officer's or Owner's Salary1237 TOTAL ADJUSTMENTS (A) and (B) ) (696,600)13 Sales Tax(7,684) 211314 Non-Care Related Interest14*These costs are only allowable if they are necessary to meet minimum15 Non-Care Related Owner's Transactions15licensing standards. Attach a schedule detailing the items included16 Personal Expenses (Including Transportation)16on these lines.17 Non-Care Related Fees1718 Fines and Penalties18C. Are the following expenses included in Sections A to D of pages 319 Entertainment19and 4? If so, they should be reclassified into Section E. Please20 Contributions(180) 2020reference the line on which they appear before reclassification.21 Owner or Key-Man Insurance21(See instructions.)123422 Special Legal Fees & Legal Retainers22Yes NoAmountReference23 Malpractice Insurance for Individuals2338 Medically Necessary Transport. 24 Bad Debt(512,288) 21243925 Fund Raising, Advertising and Promotional2540 Gift and Coffee ShopsIncome Taxes and Illinois Personal41 Barber and Beauty Shops26 Property Replacement Tax2642 Laboratory and Radiology27 CNA Training for Non-Employees2743 Prescription Drugs28 Yellow Page Advertising284429 Other-Attach Schedule2945 Other-Attach Schedule30 SUBTOTAL (A): (Sum of lines 1-29) (696,600) 3046 Other-Attach Schedule47 TOTAL (C): (sum of lines 38-46) BHF USE ONLY4849505152SEE ACCOUNTANTS' PREPARATION REPORTHFS 3745 71

STATE OF ILLINOISPage 5ARadford GreenID#Report Period BLE EXPENSES123456789Miscellaneous IncomeBank ChargesBoard ChargesAmortizationInterest Rate SWAP101112131415161718Amount Sch. V dryUtilitiesMaintenanceSecurityActivitiesSocial 82930TransportationAdministrationProfessional FeesDues and SubscriptionsOffice and ClericalInservice TrainingSeminar and TravelOther Staff Administration TravelInsuranceDepreciationInterestReal Estate 25262728293031Equipment Rental(168,951)3531Non-Allowable Costs (Non-Care 434445464041424344454647474849 TotalHFS 3745 (N-4-99)(20,726,998)4849IL478-2471

Radford GreenMedicaid Cost Report01/01/20 - 12/31/20Direct Nursing HomePage 5 - Non-Care Supplemental Allocation ScheduleDesciptionCost CenterDietaryFoodHousekeepingLaundryHeat and Other UtilitiesMaintenanceOtherMedical DirectorNursing and Medical RecordsTherapyActivitiesSocial ServicesCNA TrainingTransportationOtherAdministrativeDirectors FeesProfessional FeesDues and SubscriptionsOffice and ClericalEmployee BenefitsInservice Training and ExpenseTravel and SeminarOther Staff onInterestReal Estate TaxesRent - Facilities and GroundsRent - Equipment and VehiclesOtherMedically Necessary TransportationAncillary Service CentersBarber and Beauty ShopCoffee and Gift ShopsProvider Participation 62730313233343536383940414243HFS 3745 8112,966,369TotalAllow. rSalaryExpenses for 2187,855020,137,239StatisticsAlloc.MethodMeals ServedMeals ServedUnits / SchedUnits / SchedSQFTSQFTPat. DaysDir. StaffingDir. StaffingPat. DaysPat. Days (2)Pat. Days (2)Dir. StaffingPat. DaysPat. DaysNet. Pat. Rev.N/ANet. Pat. Rev.Net. Pat. Rev.Net. Pat. Rev.Alloc. SalaryPat. DaysNet. Pat. Rev.Net. Pat. Rev.Net. Pat. Rev.N/ASQFTSQFTSQFTSQFTSQFTPat. 996849,59217,271,328IL478-2471

STATE OF ILLINOIS# 0054981Facility Name & ID Number Radford GreenSUMMARY OF PAGES 5, 5A, 6, 6A, 6B, 6C, 6D, 6E, 6F, 6G, 6H AND 6I1234567891010a1112131415Operating ExpensesA. General ServicesDietaryFood PurchaseHousekeepingLaundryHeat and Other UtilitiesMaintenanceOther (specify):*TOTAL General ServicesB. Health Care and ProgramsMedical DirectorNursing and Medical RecordsTherapyActivitiesSocial ServicesCNA TrainingProgram TransportationOther (specify):*16 TOTAL Health Care and Programs1718192021222324252627C. General AdministrationAdministrativeDirectors FeesProfessional ServicesFees, Subscriptions & PromotionsClerical & General Office ExpensesEmployee Benefits & Payroll TaxesInservice Training & EducationTravel and SeminarOther Admin. Staff TransportationInsurance-Prop.Liab.MalpracticeOther (specify):*28 TOTAL General AdministrationReport Period Beginning:01/01/20Summary ARYTOTALS(to Sch V, col.7)(1,859,146) 1(1,193,096) 2(586,106) 3(91,601) 4(1,079,562) 5(1,662,277) 6(383,219) 7(6,855,007) 5)0000000000(272,165) 16PAGES5 & 000(3,557,576) 28(10,228,748)(456,000)000000000(10,684,748) 291718192021222324252627TOTAL Operating Expense29 (sum of lines 8,16 & 28)HFS 3745 (N-4-99)IL478-2471

STATE OF ILLINOISFacility Name & ID NumberRadford Green#0054981Report Period Beginning:01/01/20Summary B12/31/20Ending:SUMMARY OF PAGES 5, 5A, 6, 6A, 6B, 6C, 6D, 6E, 6F, 6G, 6H AND 6I30313233343536Capital ExpenseD. OwnershipDepreciationAmortization of Pre-Op. & Org.InterestReal Estate TaxesRent-Facility & GroundsRent-Equipment & VehiclesOther (specify):*37 TOTAL Ownership383940414243Ancillary ExpenseE. Special Cost CentersMedically Necessary TransportationAncillary Service CentersBarber and Beauty ShopsCoffee and Gift ShopsProvider Participation FeeOther (specify):*44 TOTAL Special Cost CentersGRAND TOTAL COST45 (sum of lines 29, 37 & 44)HFS 3745 0000000000000000000000000000SUMMARYTOTALS(to Sch V, col.7)(5,700,779) 30(786,209) 31(3,738,010) 32(800,901) 330 34(168,951) 350 360000000000(11,194,850) 000000000PAGES5 & 79,598) 45IL478-2471

Facility Name & ID NumberSTATE OF ILLINOIS#0054981Radford GreenReport Period Beginning:01/01/20Ending:Page 612/31/20VII. RELATED PARTIESA. Enter below the names of ALL owners and related organizations (parties) as defined in the instructions. Use Page 6-Supplemental as necessary.123OWNERSRELATED NURSING HOMESOTHER RELATED BUSINESS ENTITIESNameOwnership %NameCityNameCityType of BusinessSenior Village VIIHolding Company, LLC89.33%Chicago CCRC Partners II, LLC10.67%Monarch LandingNaperville, IllinoisSenior CareArcapita, LLCHarrison, NYDevelopment Co.B. Are any costs included in this report which are a result of transactions with related organizations? This includes rent,management fees, purchase of supplies, and so forth.YESX NOIf yes, costs incurred as a result of transactions with related organizations must be fully itemized in accordance withthe instructions for determining costs as specified for this form.123 Cost Per General Ledger45 Cost to Related OrganizationSchedule VLineVVVVVVVVVVVVV14 Total1712345678910111213ItemManagement FeesAmount 456,000 456,000* Total must agree with the amount recorded on line 34 of Schedule VI.HFS 3745 (N-4-99)Name of Related OrganizationSenior Care Arcapita, LLC678 Difference:PercentOperating CostAdjustments forofof RelatedRelated OrganizationOwnershipOrganizationCosts (7 minus 4)100.00% (456,000) *12345678910111213(456,000) 14SEE ACCOUNTANTS' PREPARATION REPORTIL478-2471

Facility Name & ID NumberSTATE OF ILLINOIS0054981#Radford GreenReport Period Beginning:01/01/20Ending:Page 712/31/20VII. RELATED PARTIES (continued)C. Statement of Compensation and Other Payments to Owners, Relatives and Members of Board of Directors.NOTE: ALL owners ( even those with less than 5% ownership) and their relatives who receive any type of compensation from this homemust be listed on this rshipInterestCompensationReceivedFrom OtherNursing Homes*6Average Hours Per WorkWeek Devoted to thisFacility and % of TotalWork WeekHoursPercent78Compensation Includedin Costs for thisReporting Period**DescriptionAmount Schedule V.Line &ColumnReference123456789101112N/A13TOTAL 13* If the owner(s) of this facility or any other related parties listed above have received compensation from other nursing homes, attach a schedule detailing the name(s)of the home(s) as well as the amount paid. THIS AMOUNT MUST AGREE TO THE AMOUNTS CLAIMED ON THE THE OTHER NURSING HOMES' COST REPORTS.** This must include all forms of compensation paid by related entities and allocated to Schedule V of this report (i.e., management fees).FAILURE TO PROPERLY COMPLETE THIS SCHEDULE INDICATING ALL FORMS OF COMPENSATION RECEIVED FROM THIS HOME,ALL OTHER NURSING HOMES AND MANAGEMENT COMPANIES MAY RESULT IN THE DISALLOWANCE OF SUCH COMPENSATION.SEE ACCOUNTANTS' PREPARATION REPORTHFS 3745 (N-4-99)IL478-2471

Facility Name & ID NumberSTATE OF ILLINOIS# 0054981 Report Period Beginning:Radford GreenPage 801/01/20Ending:12/31/20VIII. ALLOCATION OF INDIRECT COSTSName of Related OrganizationStreet AddressCity / State / Zip CodePhone NumberFax NumberA. Are there any costs included in this report which were derived from allocations of central officeor parent organization costs? (See instructions.)YESNOXB. Show the allocation of costs below. If necessary, please attach worksheets.1Schedule 32425 TOTALS2Item3Unit of Allocation(i.e.,Days, Direct Cost,Square Feet)4Total Units5Number ofSubunits BeingAllocated Among6Total IndirectCost BeingAllocated((7Amount of SalaryCost Containedin Column 6))89FacilityUnitsAllocation(col.8/col.4)x col.6 12345678910111213141516171819202122232425SEE ACCOUNTANTS' PREPARATION REPORTHFS 3745 (N-4-99)IL478-2471

Facility Name & ID NumberSTATE OF ILLINOIS# 0054981Report Period Beginning:Radford GreenIX. INTEREST EXPENSE AND REAL ESTATE TAX EXPENSEA. Interest: (Complete details must be provided for each loan - attach a separate schedule if necessary.)12345Name of LenderA. Directly Facility RelatedLong-TermHarris BMOVillage of LincolnshireSpecial Area Tax Obligation12345Related**YES NOPurpose of LoanXNote PayableXBond PayableMonthlyPaymentRequired6Date ofNote08/03/187Amount of NoteOriginalBalance 51,000,000 e(4 Digits)09/01/23Page 912/31/2010ReportingPeriodInterestExpenseL 2.5% 2,863,191123451,050,000Working Capital6786789TOTAL Facility RelatedB. Non-Facility Related*10 Interest Income11 Non-Allowable (Rate Swap)12 Non-Allowable (Non-Care)13 14 TOTAL Non-Facility Related 15 51,000,000 TOTALS (line 9 line14)16) Please indicate the total amount of mortgage insurance expense and the location of this expense on Sch. V.51,000,000 51,000,000 3,913,1919(844) 10(1,246,056) 11(2,491,110) 1213 51,000,000 (3,738,010) 14175,18115Line #* Any interest expense reported in this section should be adjusted out on page 5, line 14 and, consequently, page 4, col. 7.(See instructions.)SEE ACCOUNTANTS' PREPARATION REPORT** If there is ANY overlap in ownership between the facility and the lender, this must be indicated in column 2.(See instructions.)HFS 3745 (N-4-99)IL478-2471

Page 1012/31/20STATE OF ILLINOISFacility Name & ID NumberRadford GreenIX. INTEREST EXPENSE AND REAL ESTATE TAX EXPENSE (continued)B. Real Estate Taxes#0054981Report Period Beginning:01/01/20Important, please see the next worksheet, "RE Tax". The real estate taxstatement and bill must accompany the cost report.Ending: 82,18512. Real Estate Taxes paid during the year: (Indicate the tax year to which this payment applies. If payment covers more than one year, detail below.) 68,36723. Under or (over) accrual (line 2 minus line 1). (13,818)34. Real Estate Tax accrual used for 2020 report. (Detail and explain your calculation of this accrual on the lines below.) 70,13941. Real Estate Tax accrual used on 2019 report.5. Direct costs of an appeal of tax assessments which has NOT been included in professional fees or other general operating costs on Schedule V, sections A, B or C.(Describe appeal cost below. Attach copies of invoices to support the cost and a copy of the appeal filed with the county.) 56. Subtract a refund of real estate taxes. You must offset the full amount of any direct appeal costsclassified as a real estate tax cost plus one-half of any remaining refund.TOTAL REFUND ForTax Year.(Attach a copy of the real estate tax appeal board's decision.) 67. Real Estate Tax expense reported on Schedule V, line 33. This should be a combination of lines 3 thru 6. 56,3217Real Estate Tax History:Real Estate Tax Bill for Calendar 7191,040,56289101112FOR BHF USE ONLYThe balances for Questions 1 - 7 above represent the portion allocated to the nursing home based on square footage of 7,056square feet to the total complex square footage of 107,394.NOTES:13FROM R. E. TAX STATEMENT FOR 2019 1314PLUS APPEAL COST FROM LINE 5 1415LESS REFUND FROM LINE 6 1516AMOUNT TO USE FOR RATE CALCULATION 161. Please indicate a negative number by use of brackets( ). Deduct any overaccrual oftaxes from prior year.2. If facility is a non-profit which pays real estate taxes, you must attach a denial of anapplication for real estate tax exemption unless the building is rented from a for-profit entity.This denial must be no more than four years old at the time the cost report is filed.SEE ACCOUNTANTS' PREPARATION REPORTHFS 3745 (N-4-99)IL478-2471

2019 LONG TERM CARE REAL ESTATE TAX STATEMENTFACILITY NAMERadford GreenFACILITY IDPH LICENSE NUMBERCOUNTYLake0054981CONTACT PERSON REGARDING THIS REPORT Jeremy M. Brune, CPATELEPHONE (779) 875 - 3979A.FAX #: (866) 215 - 5355Summary of Real Estate Tax CostEnter the tax index number and real estate tax assessed for 2019 on the lines provided below. Enter only the portion of thecost that applies to the operation of the nursing home in Column D. Real estate tax applicable to any portion of the nursinghome property which is vacant, rented to other organizations, or used for purposes other than long term care must not beentered in Column D. Do not include cost for any period other than calendar year 2019.(A)Tax Index Number(B)(C)Property Description(D)TaxApplicable toNursing HomeTotal Tax1.15 - 23 - 302 - 049Complex - NG, IL, and AL 1,021,255.92 67,098.552.15 - 22 - 406 - 059Complex - NG, IL, and AL 1,268.473.19,306.34 4.Non - Care Allocation 5.Based on Square Footage 6. 7. 8. 9. 10. 1,040,562.26 TOTALSB.68,367.02Real Estate Tax Cost AllocationsDoes any portion of the tax bill apply to more than one nursing home, vacant property, or property which is not directlyused for nursing home services?YESNOIf YES, attach an explanation and a schedule which shows the calculation of the cost allocated to the nursing home.(Generally the real estate tax cost must be allocated to the nursing home based upon sq. ft. of space used.)C.Tax BillsAttach copies of the original 2019 tax bills which were listed in Section A to this statement. Be sure to use the 2019tax bill which is normally paid during 2020.PLEASE NOTE: Payment information from the Internet or otherwise is not considered acceptable tax billdocumentation . Facilities located in Cook County are required to provide copies of their original secondinstallment tax bill.Page 10AHFS 3745 (N-4-99)IL478-2471

STATE OF ILLINOIS# 0054981 Report Period Beginning:Facility Name & ID Number Radford GreenX. BUILDING AND GENERAL INFORMATION:A.Square Feet:C.Does the Operating Entity?107,394B. General Construction Type:X (a) Own the FacilityExteriorBrickFrame01/01/20Steel and Concrete(b) Rent from a Related Organization.Ending:Page 1112/31/20Number of Stories(c) Rent from Completely UnrelatedOrganization.(Facilities checking (a) or (b) must complete Schedule XI. Those checking (c) may complete Schedule XI or Schedule XII-A. See instructions.)D.Does the Operating Entity?X (a) Own the Equipment(b) Rent equipment from a Related Organization.X (c) Rent equipment from CompletelyUnrelated Organization.(Facilities checking (a) or (b) must complete Schedule XI-C. Those checking (c) may complete Schedule XI-C or Schedule XII-B. See instructions.)E.List all other business entities owned by this operating entity or related to the operating entity that are located on or adjacent to this nursing home

for bhf use important notice ll1 this agency is requesting disclosure of information that is necessary to accomplish the statutory 2020 purpose as outlined in 210 ilcs 45/3-208. disclosure state of illinois of this information is mandatory. failure to provide department of healthcare and family services any information on or before the due date will financial and statistical report (cost .