Transcription

The Only Current Affairs YouNeed to Ace CSE Mains 2022MK YadavEx-IB Vigilance Officer, GoISpecial FocusHow Namrata (AIR - 73)used INA to Score2nd Highest Marks inGS 3 in 2021Orientation Session16th JuneBatch Starts23rd JuneSAMPLE HANDOUT

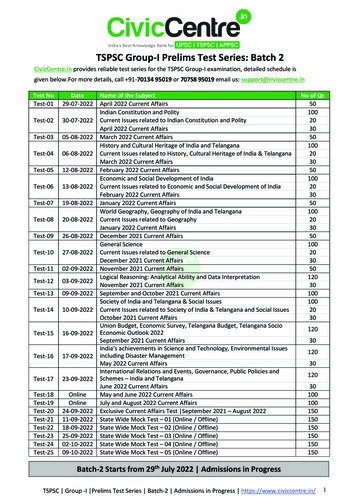

INA CURRENT AFFAIRS – 160 IMPORTANT TOPICS: TARGET MAINS 2022Under the Guidance of M K YADAVTABLE OF CONTENTS123456789GIG ECONOMY: OPPORTUNITIES & CHALLENGESNEW BAD BANK - NEED & CHALLENGESASPIRATIONAL DISTRICTS PROGRAMME: A CRITICAL ASSESSMENT- 3[B] ASPIRATIONAL DISTRICTS: BEST PRACTICESCOOPERATIVE SOCIETIES: STATUS & RECENT DEVELOPMENTSSILVER ECONOMYWOMEN LED DEVELOPMENT MODELINDIAN DIASPORA: ROLE IN MAKING INDIA SELF RELIANTASSESS YOUR READINESS: IN-CLASS ANSWER PRACTICENAMRATA CHOUBEY (AIR - 73): GS 3 ANSWER COPY357111315171921OUR UPSC CSE MAINS 2022 ENRICHMENT COURSES200 TOTALSELECTIONSPublished by: www.theiashub.com I Contact: Delhi – 9560082909, Bengaluru – 8826073092, Bhopal/Indore – 9289785379, Mumbai/Pune – 9222333999theIAShub 2021 All Rights Reserved1

INA CURRENT AFFAIRS – 160 IMPORTANT TOPICS: TARGET MAINS 2022Under the Guidance of M K YADAVPublished by: www.theiashub.com I Contact: Delhi – 9560082909, Bengaluru – 8826073092, Bhopal/Indore – 9289785379, Mumbai/Pune – 9222333999theIAShub 2021 All Rights Reserved2

INA CURRENT AFFAIRS – 160 IMPORTANT TOPICS: TARGET MAINS 2022Under the Guidance of M K YADAV1GIG ECONOMY: OPPORTUNITIES & CHALLENGES1.1 NEWS IN FOCUS As per a recent report (Titled ‘Unlocking the Potential of the Gig Economy in India’), the gig economyhas the potential to serve up to 30% of India’s non-farm workforce and add up to 1.25% to India’s GDP.1.2 BACKGROUNDERGIG ECONOMY AND RELATED DEFINITIONSINDIA’S GIG ECONOMY: KEY FACTSA) Gig Economy India is 5th largest in flexi-staffing It is a free and global market where companies and contractorsglobally, after the US, China, Brazil(independent workers) set short-term and on-demandandJapan(IndiaStaffingprofessional relationships that are both flexible and skill-based.Federation, 2019 Report). It is also known by various phrases: “flexible economy” “sharing Freelance workers in India –economy", “collaborative economy", “on-demand economy", etc.about 15 millionB) Gig Workers The Code on Social Security, 2020 defines gig worker as a person who performs work, and earns fromsuch activities, outside the traditional employer-employee relationship. Thus, they are workers who are engaged "on-demand" by the companies on short-term contracts orfreelance work, instead of full-time basis. For eg. independent contractors & temporary workers like freelance software developers & graphicdesigners, part time teachers, etc.C) Platform Workers The Code on Social Security, 2020 defines them as workers engaged in work outside of a traditionalemployer-employee relation where organisations/individuals use an online platform to provideservices. For eg. Uber drivers, Zomato Delivery staff, on-call workers on Urban Company etc.1.3 NEWS ANALYSISKEY DRIVERS OF GIG ECONOMY – To be Discussed in the ClassBENEFITS OF GIG ECONOMY: Benefits to the organisations- Reduced fixed cost – Gig economy allows organisations to engage the best talent & specialists, fora specific period & task, without the necessity to pay fixed costs like pension & insurance benefits.- Greater overall efficiency - By outsourcing other tasks to gig workers, regular employees can focuson doing more high-value work.- Greater Agility – Ability of the organisation to quickly increase/decrease team size and compositionto better respond to the market unpredictabilities. Benefits to the workers- Flexibility - As the work is job-specific, workers have the flexibility to work for more than onecontractor, improve earning, and choose the hours of work.- Non-discriminatory access - There are no entry barriers (caste, religion, gender, and location),anyone and everyone can participate from anywhere. This has led to a demand for bloggers,researchers and consultants from developing countries such as India, Philippines and Bangladesh.Published by: www.theiashub.com I Contact: Delhi – 9560082909, Bengaluru – 8826073092, Bhopal/Indore – 9289785379, Mumbai/Pune – 9222333999theIAShub 2021 All Rights Reserved3

INA CURRENT AFFAIRS – 160 IMPORTANT TOPICS: TARGET MAINS 2022Under the Guidance of M K YADAV Socio-economic Benefits- Catalyzing economic recovery by providing labour on-demand even if employers remain tentativeabout hiring workers full-time.- Expanding labour participation - Especially for women and students who may only be available forpart-time work to supplement household income.- Boost to Start-up ecosystem - Companies such as Google, Facebook and Microsoft are nowinvesting in start-ups, and even training workers, to make the best use of the online market.- Multiplier effect – Increased competition & lower price of service has generated consumer surplus,which can be spent on other sectors, with a multiplier effect on income & employment generation. For eg. Greater competition among taxi services like Uber and Ola, have reduced taxi fares.- New sustainable lifestyle - Carpool & car-sharing services lower carbon footprint & TrafficCongestion.CHALLENGES OF GIG ECONOMY: Lack of social security net – such as Health, pension benefits etc, leading to informalisation of labour. Irregular income & Poor job security – The uncertain employment terms and low payment often pushesworkers to work for longer hours, leading to physical and mental health problems. Lower bargaining power – Due to individualistic nature of work, and geographically scattered gigworkers, unionization of workers becomes difficult. Limited avenues for skill upgradation - While companies routinely invest in training employees, gigeconomy workers have to upgrade their skills on their own, and at their own cost. Regulatory challenges - Gigs are one-to-one relationships between the contractor and the contracteewhich is easy to abuse by the companies and hard to monitor by the regulators.- No adequate forums for dispute settlements between workers and the companies. Regional disparity - Gig economy may not be accessible for people in many rural areas where internetconnectivity and electricity are unavailable. Socio-psychological impact – Feeling of isolation, alienation, & stress associated with nature of gig job.WAY FORWARDRELATED WELFARE PROVISIONS UNDER CODE ON SOCIAL Regulatory & Legal Measures SECURITY, 2020Expeditiousimplementationof Social security funds to be set up for unorganised workers,provisions of Social Security Code, 2020.gig workers and platform workers by Centre & StateGovernments.- Mandating basic labour protection National Social Security Board – To recommend and monitorlike minimum wages, maximumschemes for welfare of unorganised workers, gig workers andworking hours, paid leaves etc.platform workers. Social Security - Mandatory coverage Role of aggregators - Schemes for gig workers and platformunder the Pradhan Mantri Jan Arogyaworkers may be funded through a combination ofYojana, Pradhan Mantri Suraksha Bimacontributions from the central government, stateYojana and Pradhan Mantri Jeevan Jyotigovernments, and aggregators.Bima Yojana may be considered. Strengthening Skills-based programs to make gig workers future ready, with a focus on life-longlearning approach. Apart from government, companies can take these up under CSR activity. Empowering the gig workers - Companies can introduce peer-to-peer mentoring and establish sharingplatforms, both offline and online, to enable workers to connect with each other. Formalised contracts – Replacing verbal agreements with written contract agreements.Published by: www.theiashub.com I Contact: Delhi – 9560082909, Bengaluru – 8826073092, Bhopal/Indore – 9289785379, Mumbai/Pune – 9222333999theIAShub 2021 All Rights Reserved4

INA CURRENT AFFAIRS – 160 IMPORTANT TOPICS: TARGET MAINS 2022Under the Guidance of M K YADAV2NEW BAD BANK - NEED & CHALLENGES2.1 NEWS IN FOCUS Union Cabinet recently approved the Rs 30,600 crore guarantee to back Security Receipts (SRs) issuedby National Asset Reconstruction Company Limited (NARCL) for acquiring stressed loan from the banks.NARCL is one of the 2 legs of the proposed bad bank, a key initiative announced in the Budget 2021-22.2.2 BAD BANK STRUCTUREWHAT IS A BAD BANK OR ASSET RECONSTRUCTION COMPANY? Bad banks, formally called Asset Reconstruction Companies (ARC), are specialized financial institutionsthat buy the stressed and non-performing assets (NPA) of the bank to help clean up their balance sheet. Establishment and Regulations of ARC- ARC is incorporated under the Companies Act and registered with RBI under the Securitization andReconstruction of Financial Assets and Enforcement of Security Interest (SARFAESI) Act, 2002.- ARCs are regulated by RBI as a Non-Banking Financial Company (NBFC) under RBI Act, 1934.WHAT IS THE NEW BAD BANK STRUCTURE? Announced in Budget 2021-22 – It proposes the following dualRELATED DEFINITIONSstructure of the New Bad Bank: Security Receipts (SR) means a1. National Asset Reconstruction Company Ltd (NARCL) – Set upreceipt or security, issued by an ARCas an Asset Reconstruction Company (ARC) to acquire stressedto any Qualified Buyers (QBs) onassets worth Rs 2 lakh crore from various commercial banks.purchase or acquisition of anundivided right, title or interest in the- Incorporated under the Companies Act & has been set upfinancial asset.by the banks. Public Sector Banks (PSBs) will maintain Qualified Buyers (QBs) include51% ownership.entities like Financial Institutions,- NARCL will acquire the bad debts from the lead bank andInsurance companies, Banks, ARCs,pay 15% upfront in cash, and issue the balance 85% asAMCs etc. that invest on behalf ofgovernment-guaranteed tradable security receipts (SR).mutual funds, pension funds, FIIs, etc.2. India Debt Resolution Company Ltd (IDRCL) – Set up as anAsset Management Company (AMC) to then sell these stressed assets in the market.- IDRCL is a service company to manage the asset and engage market professionals and turnaroundexperts. PSBs & Public Financial Institutions - 49% stake; Private sector lenders - 51% stake. Role of Government Guarantee - Government guarantee will be invoked if the bad bank is unable tosell bad loan, or sells it at a loss. Government will not hold any equity in the Bad Bank.2.3 NEWS ANALYSISPOTENTIAL BENEFITS OF SETTING UP THE NEW BAD BANK Provides additional option - Existing ARCs have helped in resolution of NPAs for smaller value loans. Butconsidering the large stock of legacy NPAs, NARCL will enable resolution of large NPAs above 500 crore Multiplier impact – With the existing undercapitalised ARCs reluctant to take up NPAs, the New BadBank aims to fill this void, entailing several economy wide benefits:- Improved banks’ liquidity, free up management bandwidth to focus on core business etc. enhanced lending to productive sectors to ‘jump start’ economy & employment.Published by: www.theiashub.com I Contact: Delhi – 9560082909, Bengaluru – 8826073092, Bhopal/Indore – 9289785379, Mumbai/Pune – 9222333999theIAShub 2021 All Rights Reserved5

INA CURRENT AFFAIRS – 160 IMPORTANT TOPICS: TARGET MAINS 2022Under the Guidance of M K YADAV Government support – Banks will be more willing to sell their NPAs to government-backed ARCs.- Government’s guarantee for the security receipts (SRs) helps in improving the value of SRs, theirliquidity and tradability unlocks the value of stressed assets.Quicker resolution - The aggregation of bad assets at one place will make it easy for the buyer to dealwith one unified ARC rather than dealing with multiple lenders, improving the chances of resolution.Domain Expertise - The management of the AMCs in the proposed Bad Bank structure will comprise ofthe well-trained professionals which will contribute to better management and realization of the assets.KEY CHALLENGES Lack of buyer demand - The success of the bad bank depends on its ability to sell the stressed assets inthe market. However, the current economic distress and lack of liquidity may discourage the buyers. PSBs will be both shareholders & customer - It leads to the danger of the bad bank being nothing morethan a means to shift some bad debt from one book to another.- It also means a mere shift of bad loans from government owned banks (PSBs) to government backedBad Bank (NARCL). Ethical & moral hazard – Some experts have raised concerns that, in effect, government will beindirectly guaranteeing the NPAs of private enterprises, ultimately taking a toll on taxpayers’ money. Scarcity of resolution professionals – The success of New Bad Bank will also critically depend on itsability to hire highly specialised turnaround professionals and experts to revive the assets. Governance concerns & Implementation delays – No clarity on exactly how the new bad bank will bestructured and how its functioning will be governed. No sunset clause - it is not clear whether the bad bank has a finite end date.- For eg. in the US, the bad banks had a sunset clause and worked with a finite timeline (a reason fortheir success). Uncertainty over the secondary market - Banks will have the freedom to sell the security receipts, butsecondary market for such securities is not yet evolved. Does not address core issue - The bad bank will not help in preventing future NPAs, nor does it aim toimprove the ‘credit culture’ of the PSBs.WAY FORWARD Multi-pronged measures - For the bad bank to work as intended will require strong and impartialleadership, a high degree of financial expertise, and roping in relevant professionals with right skill set. Setting up an NPA transaction platform - that would act as a central repository of data on stressedassets from participating banks. This will serve to enhance liquidity by making transaction datastandardized & transparent & allowing investors to take informed decisions. Learning from successful international experiences- Malaysia government-owned Bad bank, Danaharta, established after the Asian crisis in 1998.- US launched Troubled Asset Relief Program (TARP) just after the Lehman crisis in 2008.- UBS of Switzerland transferred bad assets to a government fund after the Global Financial Crisis. Sunset Clause - After a predefined period, when the company’s operations are no longer deemednecessary, it should be wound up. Holistic reforms - The bad bank is a one-time solution and cannot be in perpetuity. Holistic bankingsector reforms, including improved governance of PSBs, is critical to avert another cycle of bad loans. Published by: www.theiashub.com I Contact: Delhi – 9560082909, Bengaluru – 8826073092, Bhopal/Indore – 9289785379, Mumbai/Pune – 9222333999theIAShub 2021 All Rights Reserved6

INA CURRENT AFFAIRS – 160 IMPORTANT TOPICS: TARGET MAINS 2022Under the Guidance of M K YADAV3ASPIRATIONAL DISTRICTS PROGRAMME: A CRITICAL ASSESSMENT3.1 NEWS IN FOCUS Five districts of Uttar Pradesh have made it to the list of top 10 best performing aspirational districts inthe latest ‘delta rankings’ released by NITI Aayog.3.2 BACKGROUNDERABOUT ASPIRATIONAL DISTRICTS PROGRAMMECORE STRATEGY Objective - to remove inter-state and inter-district variations through a States as main drivers.‘mass movement’ by making a dramatic improvement in overall socio Work on the strength ofeconomic development of backward districts.each district. Coverage - 112 backward districts identified by NITI Aayog. Make development as a Core Principles –mass movement.- Convergence (of Central & State Schemes) Real Time Monitoring and- Collaboration (of Central, State level ‘Prabhari’ Officers & DistrictRanking of states to spur aCollectors)sense of competition.- Competition among districts driven by a spirit of mass Movement. 5 key performance parameters- Health & Nutrition (antenatal/postnatal care, gender parity, health of new-borns, health infra)- Education (learning outcome, school infra, pupil-teacher ratio)- Agriculture & Water Resources (agri output/yield, inputs, insurance, market support)- Basic Infrastructure (Toilet, drinking water, electricity, road connectivity etc.)- Financial Inclusion & Skill Development (up-take of govt. schemes like Jan Dhan, Atal Pension Yojna;ease of financing, skilling of youth/marginalized section etc.) Institutional Arrangement- At GoI level - programme is anchored by NITI Aayog.- At State Level - committee under Chief Secretary of the state- At District level - Central Prabhari Officer of Additional Secretary/ Joint Secretary level3.3 NEWS ANALYSISSIGNIFICANCE OF THE PROGRAMME Catalyst for Expediting Development: Crucial areas for assessing development have seen majorimprovements. For eg. sectors such as Health & Nutrition, Education, Agriculture and Water Resources. Well defined framework: It brings together various stakeholders, right from central level to thepanchayat level, with clearly defined comprehensive framework, targets, & roles of each stakeholder. Better governance through convergence: it fostered moving away from working in silos towardssynchronised planning and ‘whole of the government’ approach to achieve the targets of programme. Cooperative & Competitive federalism: It has promoted better monitoring and created healthycompetition between districts & states motivating factor to increase their efforts and track progress. Constant real-time monitoring & data driven decision-making: chief contributor to better governance.- It has helped district administrations in identifying the strengths or weaknesses of a district,resulting in more strategic and informed approaches for development. Capacity building: strengthened the technical and administrative capacities of the districts.ASSOCIATED ISSUES AND CHALLENGES Developmental hurdles: Aspirational Districts are located in remote areas, and some even plagued withLeft Wing Extremist (LWE) conflicts difficult implementation of development programmes.Published by: www.theiashub.com I Contact: Delhi – 9560082909, Bengaluru – 8826073092, Bhopal/Indore – 9289785379, Mumbai/Pune – 9222333999theIAShub 2021 All Rights Reserved7

INA CURRENT AFFAIRS – 160 IMPORTANT TOPICS: TARGET MAINS 2022Under the Guidance of M K YADAV Lack of Human resources technical capacities at Block and District level.Poor Awareness & community participation: The intended benefit does not reach the target group dueto lack of knowledge about the government schemes.Disparity among the districts: which does not facilitate fair competition and comparison.Disparity among the sectors: Each sector contains multiple indicators with different weightage.Indicators with lesser weightage are many a times ignored.Lack of consistent motivation: The momentum gained at the inception of the programme is starting todiminish and efforts must be made to motivate the districts.Adverse impact of Competition: Extreme focus on a competitive approach has likely resulted inmisreporting of data by districts.WAY FORWARD Strengthening of internal capacities.- Need to Appoint dedicated personnel or Technical Support Units to collaborate with developmentpartners for providing technical expertise.- Provision of skills training for officials and staff, increased flexibility in hiring processes, and increasein incentives for promoting recruitment in these districts. Review of Sectors: Need to add more sectors or themes in Programme, like Environment and Gender. Streamlining the Data collection mechanisms: Accurate real-time mechanism of data collection anddissemination is required to avoid data discrepancies. Attracting investment through Partnership Ecosystem: Creating an interactive dashboard utilizing datavisualization and data analytics to facilitate partner engagement & CSR (corporate Social Responsibility) Leveraging Technology to design Effective evaluation system: Assessment of District should be donebased on its standing in comparative peer group. Awareness generation: Special focus needs to be given on Awareness generation, involving youngprofessionals at grass-root level and collaborations with locals. Flexible approach is required in updating the Plan based on new evidence-based learning. Published by: www.theiashub.com I Contact: Delhi – 9560082909, Bengaluru – 8826073092, Bhopal/Indore – 9289785379, Mumbai/Pune – 9222333999theIAShub 2021 All Rights Reserved8

INA CURRENT AFFAIRS – 160 IMPORTANT TOPICS: TARGET MAINS 2022Under the Guidance of M K YADAV3BASPIRATIONAL DISTRICTS PROGRAMME: BEST PRACTICESCASE STUDIES & BEST PRACTICES Health Sector:- Malaria Mukt Bastar Abhiyan in Bijapur and Dantewada, Chhattisgarh: Resulted in reduction of incidenceof Malaria in these two districts by 71% and 54% respectively.- Bike Ambulances & Janani Auto vehicles, in aspirational district of Odisha, deployed in outreach pocketsto transport pregnant women to the Government health facilities. Agriculture:- Promoting local products through e-commerce portal – Goalpara district, Assam GoalMart initiative is an e-commerce portal introduced to promote ethnic and agrarian products ofdistrict in national and global market.- Enhancing Agriculture productivity through high profit products – Chandauli ,Uttar Pradesh Farmers were encouraged to produce high quality black rice as it fetches high profits. With success of initiative, high quality black rice is being exported to Australia and New Zealand. Skill Development and Financial Inclusion:- Yuva BPO: Dantewada district, Chhattisgarh Multi-pronged approach of providing skill development & employment opportunity for youth.- Engagement of Community members to improve Financial Inclusion: Ranchi, Jharkhand Initiative found that rural beneficiaries preferred Bank Sathis to address banking queries, due to theirexisting interpersonal relationship and use of local language. Education Sector:- ANNIE Smart Classes for visually impaired students – Ranchi district, Chhattisgarh- BALA (Building as Learning Aid): An innovative method of teaching in aspirational Districts of UttarPradesh through child-friendly learning by refurbishing the existing School and Anganwadi buildings. For eg, using window grills to practically depict simple mathematical concepts or using the classroomwalls to colourfully represent stories. Basic Infrastructure:- Utilisation of Green technologies for better connectivity – Goalpara, Assam Use of plastic waste in construction of roads.- Patsendri Model Colony: Patsendri village of Chhattisgarh - A Model Colony has been developed underthe PM Awas Yojana (PMAY) in through the convergence of various social sector schemes. It created a self-sustainable model for capacity building, employment generation in Patsendri Brought behavioral change among the owners towards a more cohesive and responsible community. Published by: www.theiashub.com I Contact: Delhi – 9560082909, Bengaluru – 8826073092, Bhopal/Indore – 9289785379, Mumbai/Pune – 9222333999theIAShub 2021 All Rights Reserved9

INA CURRENT AFFAIRS – 160 IMPORTANT TOPICS: TARGET MAINS 2022Under the Guidance of M K YADAVPublished by: www.theiashub.com I Contact: Delhi – 9560082909, Bengaluru – 8826073092, Bhopal/Indore – 9289785379, Mumbai/Pune – 9222333999theIAShub 2021 All Rights Reserved10

INA CURRENT AFFAIRS – 160 IMPORTANT TOPICS: TARGET MAINS 2022Under the Guidance of M K YADAV4COOPERATIVE SOCIETIES: STATUS & RECENT DEVELOPMENTS4.1 NEWS IN FOCUS The Supreme Court recently struck down certain provisions of Constitution (97th Amendment) Act,2011 and Part IXB of the constitution, that related to functioning & effective management of cooperative societies in India.Also, a new Ministry of Cooperation has been created to strengthen the cooperative movement andstreamline processes for cooperatives and realise the vision of 'Sahakar se Samriddhi'.A two-day National Conference on Cooperation Policy was organized at New Delhi (April 2022) in linewith government’s commitment to formulate a new robust National Cooperation Policy.4.2 BACKGROUNDERWHAT ARE COOPERATIVE SOCIETIES? A cooperative society is an autonomous association ofpersons, united voluntarily to meet commoneconomic, social, and cultural needs. Key Principles of Cooperative societies - Openvoluntary membership, democratic control, jointownership, autonomy & independence, equity, selfhelp, mutual help, and concern for community. People come forward as a group, pool their individualresources, utilise them in the best possible manner,and derive some common benefit out of it. Cooperatives in India have been operating in variousareas - credit, production, processing, marketing,input distribution, housing, dairying and textiles. Foreg. Amul, Shree Mahila Griha Udyog (Lijjat Papad),Indian Farmers Fertiliser Cooperative (IFFCO) etc.TYPES OF COOPERATIVE SOCIETIES Consumers’ Co-operative Society - For eg.Kendriya Bandhar, Apna Bazaar etc. Producers’ Co-operative Society - For eg.Handloom societies like APPCO, Bayanika etc. Co-operative Marketing Society - For eg.GujaratCo-operativeMilkMarketingFederation. Co-operative Credit Society - For eg. UrbanCooperative Banks. Co-operative Farming Society - For eg. Liftirrigation cooperative societies, panipanchayats etc. Housing Co-operative Society – For eg. TheEmployees’ Housing Societies.4.3 TO BE DISCUSSED IN THE CLASS CONSTITUTIONAL & STATUTORY PROVISIONSCONSTITUTION (97TH AMENDMENT) ACT, 2011 & RECENT SUPREME COURT’S (SC) VERDICTMINISTRY OF COOPERATION: Key Features, Mandates & Govt initiatives4.4 NEWS ANALYSISCOOPERATIVE SOCIETIES: ASSOCIATED CHALLENGES Restricted Coverage:- Small Size: Most of cooperative societies are confined to a few members and their operationsextend to only one or two villages.- Narrow Purpose: Most of the societies have been single purpose societies. Resource constraints - Lack of mobilization of internal resources and over-dependence on Governmentassistance, diluting the spirit of ‘self help’. Institutional constraints - Inadequacy of skilled personnel, lack of professional management, pooraccountability, absence of robust audit mechanism, delayed elections, and credibility crises.Published by: www.theiashub.com I Contact: Delhi – 9560082909, Bengaluru – 8826073092, Bhopal/Indore – 9289785379, Mumbai/Pune – 9222333999theIAShub 2021 All Rights Reserved11

INA CURRENT AFFAIRS – 160 IMPORTANT TOPICS: TARGET MAINS 2022Under the Guidance of M K YADAV Disparity in regional distribution: The cooperative structure has managed to flourish only in a handfulof states like Maharashtra, Gujarat, Karnataka etc.Bureaucratic interference - Bureaucratic control and interference in the management impacting‘democratic control’.Politicisation - Political interference and over-politicization with boards of cooperative societiesdominated by political leaders and affluent section. No representation to diverse section.Neglect of wider community interest - Predominance of vested interests resulting in non-percolationof benefits to a common member benefits cornered by rich and influential members.Lack of Awareness - People are not well informed about objectives of the cooperatives, thecontributions it can make in rebuilding the society and rules and regulations of cooperative institutions.POSITIVES OF THE 97TH CONSTITUTIONAL AMENDMENT ACT Commitment to reform – The act reflects seriousness of purpose by making the right to formcooperative a fundamental right. Professionalization and accountability of Management - Act provides for mandatory annual audit, rightof a member to get information, duty of state to ensure autonomy (Article 43B) and provide foreducation and training of the members. Timely conduct of elections under autonomous authority – Elections must be conducted before theexpiry of the term of previous board. Thus, officers/managers can't remain beyond their term of 5 years. Wider Representation – provides for reservation of 1 seat for SC/ST and 2 seats for women on the board. Infusing diverse expertise: The act provides for co-option of experts as members having experience inthe field of banking, management, finance etc Encourage democratic control & limit political interference – The act limits total number of Directorsto 21, all to be elected. Members co-opted by state govt cannot exceed two, with no voting rights. Safeguarding the interests of Members: Act provides for various penalties on officers and members tocheck nepotism, favouritism and partiality.OUTSTANDING CHALLENGES Although, 97th Amendment Act tries to correct the challenges faced by cooperative societies, but suchreforms are limited to administrative and management aspects.- Cooperative societies continue to face various economic and political problems like lack of funds,limitation of membership, political rivalry, lack of efficiency in functioning, poor adoption oftechnological innovation etc.- Vested interests and lack of political will continue to act as a roadblock to the reforms. Constitutional tenability – Both SC & Gujrat high court have struck down the provisions of amendment.WAY FORWARD Intensify efforts to Make cooperatives a pan India success - outside states like Gujarat, Maharashtra Ensure smooth and predictable credit supply, specially to hitherto laggard states in cooperatives. Ensure ‘Ease of doing business’ for co-operatives. Organise multi-purpose cooperatives to attain viability like cluster-based approach, or adoption of 'onedistrict-one-crop' for FPOs (Farmer Producer Organisations). Consolidation - Stand-alone small, inefficient cooperative units can be merged with larger, ef

The Only Current Affairs You Need to Ace CSE Mains 2022 MK Yadav Ex-IB Vigilance Officer, GoI SAMPLE HANDOUT Orientation Session 16th June 23rd June Batch Starts Special Focus How Namrata (AIR - 73)