Transcription

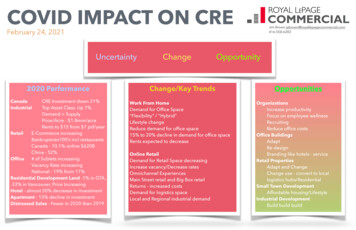

COVID IMPACT ON CREJim Brown ary 24, 2021Uncertainty2020 PerformancefififififiCRE Investment down 21%Top Asset Class. Up 7%Demand SupplyPrice/Acre - 1.8mm/acreRents to 15 from 7 psf/yearRetailE-Commerce increasingBankruptcies100’s incl restaurantsCanada - 10.1% online 620BChina - 52%Of ce# of Sublets increasingVacancy Rate increasingNational - 19% from 17%Residential Development Land -1% in GTA,-33% in Vancouver, Price IncreasingHotel - almost 50% decrease in investmentApartment - 15% decline in investmentDistressed Sales - Fewer in 2020 than 2019fiCanadaIndustrialChangeOpportunityChange/Key TrendsWork From HomeDemand for Of ce Space“Flexibility” / “Hybrid”Lifestyle changeReduce demand for of ce space15% to 20% decline in demand for of ce spaceRents expected to decreaseOnline RetailDemand for Retail Space decreasingIncrease vacancy/Decrease ratesOmnichannel ExperiencesMain Street retail and Big Box retailReturns - increased costsDemand for logistics spaceLocal and Regional industrial demandOpportunitiesOrganizationsIncrease productivityFocus on employee wellnessRecruitingReduce of ce costsOf ce BuildingsAdaptRe-designBranding like hotels - serviceRetail PropertiesAdapt and ChangeChange use - convert to locallogistics hubs/ResidentialSmall Town DevelopmentAffordable housing/LifestyleIndustrial DevelopmentBuild build build

COVID IMPACT ON CREFebruary 24, 2021INVESTMENTDistressed SalesJim Brown jabrown@royallepagecommercial.com416-558-6283

COVID IMPACT ON CREFebruary 24, 2021Jim Brown EFlexible Working

COVID IMPACT ON CREJim Brown ary 24, 2021OFFICECompanies Changing to HybridfiRemote WorkingBoutique Of ce Space

COVID IMPACT ON CREFebruary 24, 2021OFFICEfiRedesigned Of ce SpaceJim Brown jabrown@royallepagecommercial.com416-558-6283

COVID IMPACT ON CREFebruary 24, 2021Jim Brown LINDUSTRIAL

COVID IMPACT ON CREFebruary 24, 2021Jim Brown enge ExampleRETAILCEO Brian Kingston said on the conference call that, whilethere would still be bankruptcies in 2021, they would likely beamong smaller retailers and therefore be less detrimental forretail property owners than major bankruptcies of 2020, suchas JCPenney, Neiman Marcus and Ascena Retail Group.Nevertheless, BPY’s results laid bare the issues facing mallowners in 2020. Occupancy in its portfolio fell from 96% in2019 to 92% at the end of last year. Retailers occupying 3.9MSF of its 120M SF portfolio went bankrupt during the year, andonly 54% of that space had been re-leased.SolutionMore and more of BPY's retail tenants were fulfilling online orders from stores in itsmalls, Kingston said, which would support their value and rental levels long-term.As a result, the company is working to convert lower-value areas of malls wheretenants had vacated space into shared fulfillment centers for retailers, as rents forthe space converged with those in the last-mile logistics sector.

COVID IMPACT ON CREFebruary 24, 2021Jim Brown jabrown@royallepagecommercial.com416-558-6283

COVID IMPACT ON CRE February 24, 2021 Jim Brown jabrown@royallepagecommercial.com 416-558-6283 CEO Brian Kingston said on the conference call that, while there would still be bankruptcies in 2021, they would likely be among smaller retailers and therefore be less detrimental for retail property owners than major bankruptcies of 2020, such as JCPenney, Neiman Marcus and Ascena Retail