Transcription

CRE Diversified Income Fund2021InvestorPresentationCONFIDENTIALFor use in one-on-one presentationsonly. Not for public distribution.Delivering income and capital appreciation for accredited investors within theTechnology and Industrial Commercial Real Estate sector

2CRE Diversified Income FundDisclaimersDisclaimersTHE SUMMARY DESCRIPTION OF CRE DIVERSIFIED INCOME FUND AND FUNDS MANAGED BY CREINCOMEFUND.COM INCLUDED HEREIN, AND ANY OTHER MATERIALS PROVIDED ARE INTENDED ONLY FOR DISCUSSION PURPOSESAND ARE NOT INTENDED AS AN OFFER TO SELL OR SOLICITATION OF AN OFFER TO BUY WITH RESPECT TO THE PURCHASE OR SALE OF ANY SECURITY AND SHOULD NOT BE RELIED UPON BY YOU IN EVALUATING THE MERITS OFINVESTING IN ANY SECURITIES. THESE MATERIALS ARE NOT INTENDED FOR DISTRIBUTION TO, OR USE BY, ANY PERSON OR ENTITY IN ANY JURISDICTION OR COUNTRY WHERE SUCH DISTRIBUTION OR USE IS CONTRARY TOLOCAL LAW OR REGULATION. THIS INFORMATION IS CONFIDENTIAL AND SHOULD NOT BE DISTRIBUTED BEYOND THE INITIAL RECIPIENT AND ITS ADVISORS.THIS PRESENTATION IS BEING FURNISHED TO YOU ON A CONFIDENTIAL BASIS TO PROVIDE PRELIMINARY SUMMARY INFORMATION REGARDING AN INVESTMENT IN CRE DIVERSIFIED INCOME FUND (THE “FUND” OR “FUNDS”)MANAGED BY CRE DIVERSIFIED INCOME FUND AND MAY NOT BE USED FOR ANY OTHER PURPOSE. ANY REPRODUCTION OR DISTRIBUTION OF THIS PRESENTATION OR ACCOMPANYING MATERIALS, IF ANY, IN WHOLE OR IN PART,OR THE DIVULGENCE OF ANY OF ITS CONTENTS IS PROHIBITED. THE INFORMATION SET FORTH HEREIN DOES NOT PURPORT TO BE COMPLETE AND NO OBLIGATION TO UPDATE OR OTHERWISE REVISE SUCH INFORMATION ISBEING ASSUMED. IT IS MEANT TO BE READ IN CONJUNCTION WITH THE CONFIDENTIAL MEMORANDUM PREPARED IN CONNECTION HEREWITH, AND DOES NOT CONSTITUTE AN OFFER TO SELL, OR A SOLICITATION OF AN OFFERTO BUY, BY ANYONE IN ANY JURISDICTION IN WHICH SUCH AN OFFER OR SOLICITATION IS NOT AUTHORIZED OR IN WHICH THE MAKING OF SUCH AN OFFER OR SOLICITATION WOULD BE UNLAWFUL. THE INFORMATIONCONTAINED HEREIN DOES NOT PURPORT TO CONTAIN ALL OF THE INFORMATION THAT MAY BE REQUIRED TO EVALUATE AN INVESTMENT IN THE FUND. THE OFFERING IS MADE ONLY BY THE CONFIDENTIAL MEMORANDUM ANDGOVERNING AND SUBSCRIPTION DOCUMENTS OF THE FUND, WHICH SHOULD BE READ IN THEIR ENTIRETY AND CONSTITUTES THE ONLY BASIS ON WHICH SUBSCRIPTIONS MAY BE MADE. THE INFORMATION HEREIN IS QUALIFIEDIN ITS ENTIRETY BY REFERENCE TO THE CONFIDENTIAL MEMORANDUM, INCLUDING, WITHOUT LIMITATION, THE RISK FACTORS THEREIN. A PROSPECTIVE INVESTOR SHOULD ONLY COMMIT TO AN INVESTMENT IN THE FUND IFSUCH PROSPECTIVE INVESTOR UNDERSTANDS THE NATURE OF THE INVESTMENT AND CAN BEAR THE ECONOMIC RISK OF SUCH INVESTMENT. THE FUND IS SPECULATIVE AND INVOLVES A HIGH DEGREE OF RISK. THE FUND MAYBE LEVERAGED AND MAY LACK DIVERSIFICATION, THEREBY INCREASING THE RISK OF LOSS. THE FUND'S PERFORMANCE MAY BE VOLATILE. THERE CAN BE NO GUARANTEE THAT THE FUND'S INVESTMENT OBJECTIVES WILL BEACHIEVED, AND THE INVESTMENT RESULTS MAY VARY SUBSTANTIALLY FROM YEAR TO YEAR OR EVEN FROM MONTH TO MONTH. AS A RESULT, AN INVESTOR COULD LOSE ALL OR A SUBSTANTIAL AMOUNT OF ITS INVESTMENT.IN ADDITION, THE FUND'S FEES AND EXPENSES MAY OFFSET ITS PROFITS. THERE IS NO SECONDARY MARKET FOR INVESTORS' INTERESTS IN THE FUND AND NONE IS EXPECTED TO DEVELOP. THERE ARE RESTRICTIONS ONWITHDRAWING AND TRANSFERRING INTERESTS FROM THE FUND. A PORTION OF THE INVESTMENTS EXECUTED FOR THE FUND MAY TAKE PLACE IN NON-U.S. MARKETS. IN MAKING AN INVESTMENT DECISION, YOU MUST RELYON YOUR OWN EXAMINATION OF THE FUND AND THE TERMS OF THE OFFERING. THE INFORMATION HEREIN IS NOT INTENDED TO PROVIDE, AND SHOULD NOT BE RELIED UPON FOR, ACCOUNTING, LEGAL, OR TAX ADVICE ORINVESTMENT RECOMMENDATIONS. YOU SHOULD CONSULT YOUR TAX, LEGAL, ACCOUNTING, OR OTHER ADVISORS ABOUT THE MATTERS DISCUSSED HEREIN. NO OFFER TO PURCHASE INTERESTS IN THE FUND WILL BEACCEPTED PRIOR TO THE RECEIPT BY THE OFFEREE OF ALL APPROPRIATE DOCUMENTATION. THE FUND'S ABILITY TO ACHIEVE ITS INVESTMENT OBJECTIVES MAY BE AFFECTED BY A VARIETY OF RISKS NOT DISCUSSED HEREIN.PLEASE REFER TO EACH FUND'S CONFIDENTIAL MEMORANDUM AND RELATED DOCUMENTS FOR ADDITIONAL INFORMATION REGARDING RISKS AND CONFLICTS OF INTEREST. PAST PERFORMANCE IS NOT INDICATIVE OR AGUARANTEE OF FUTURE RESULTS.AN INVESTMENT IN THE FUND WILL BE SUITABLE ONLY FOR CERTAIN ACCREDITED INVESTORS WHO HAVE NO NEED FOR IMMEDIATE LIQUIDITY IN THEIR INVESTMENT. SUCH AN INVESTMENT WILL PROVIDE LIMITED LIQUIDITYBECAUSE INTERESTS IN THE FUND WILL NOT BE FREELY TRANSFERABLE AND MAY BE WITHDRAWN ONLY AT CERTAIN INTERVALS. THERE WILL BE NO PUBLIC OR SECONDARY MARKET FOR INTERESTS IN THE FUND, AND IT ISNOT EXPECTED THAT A PUBLIC OR SECONDARY MARKET WILL DEVELOP. THE INTERESTS IN THE FUND WILL NOT BE REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED NOR UNDER ANY STATE’S BLUE SKY LAW INRELIANCE UPON EXEMPTIONS AVAILABLE UNDER SUCH LAWS. AMONG OTHER REQUIREMENTS, SUCH EXEMPTIONS REQUIRE THAT THE TRANSFER OF INTERESTS IN THE FUND MUST BE RESTRICTED. AN INVESTMENT IN THEFUND HAS NOT BEEN RECOMMENDED BY ANY U.S. FEDERAL OR STATE SECURITIES COMMISSION OR ANY OTHER GOVERNMENTAL OR REGULATORY AUTHORITY. FURTHERMORE, THE FOREGOING AUTHORITIES HAVE NOT PASSEDUPON THE ACCURACY, OR DETERMINED THE ADEQUACY, OF THIS DOCUMENT. ANY REPRESENTATION TO THE CONTRARY IS UNLAWFUL. CERTAIN INFORMATION CONTAINED IN THIS DOCUMENT CONSTITUTES “FORWARDLOOKING STATEMENTS” WHICH CAN BE IDENTIFIED BY USE OF FORWARD-LOOKING TERMINOLOGY SUCH AS “MAY,” “WILL,” “TARGET,” “SHOULD,” “EXPECT,” “ATTEMPT,” “ANTICIPATE,” “PROJECT,” “ESTIMATE,”“INTEND,” “SEEK,” “CONTINUE,” OR “BELIEVE” OR THE NEGATIVES THEREOF OR OTHER VARIATIONS THEREON OR COMPARABLE TERMINOLOGY. DUE TO THE VARIOUS RISKS AND UNCERTAINTIES, ACTUAL EVENTS OR RESULTSIN THE ACTUAL PERFORMANCE OF THE FUND MAY DIFFER MATERIALLY FROM THOSE REFLECTED OR CONTEMPLATED IN SUCH FORWARD-LOOKING STATEMENTS. NOTWITHSTANDING ANYTHING TO THE CONTRARY CONTAINEDHEREIN, ANY PROSPECTIVE INVESTOR (AND EACH EMPLOYEE, REPRESENTATIVE, OR OTHER AGENT OF SUCH PROSPECTIVE INVESTOR), MAY DISCLOSE TO ANY AND ALL PERSONS, WITHOUT LIMITATION OF ANY KIND, THE TAXTREATMENT AND TAX STRUCTURE OF (I) THE FUND, AND (II) ANY OF ITS TRANSACTIONS, AND ALL MATERIALS OF ANY KIND (INCLUDING OPINIONS OR OTHER TAX ANALYSES) THAT ARE PROVIDED TO THE PROSPECTIVEINVESTOR RELATING TO SUCH TAX TREATMENT AND TAX STRUCTURE.

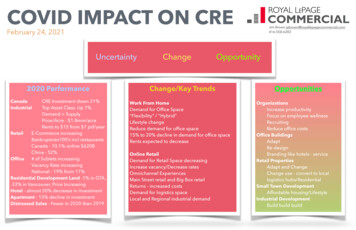

3CRE Diversified Income FundExecutive Summary Follow a three point scalable and repeatable investment process in order to place the Fund in thebest position to capitalize on opportunities in the Commercial Real Estate sector.strategydistinguishedleadership Employ the Fund’s bottom-up, fundamentals based investment process. Management believes thisprocess has a competitive advantage, allowing it to evaluate risk and reward intelligently across theentire Commercial Real Estate infrastructure universe. The Funds management team has 20 years of combined accounting and financial servicesexperience. Prior work experience includes C-suite executive management experience with SEC reportingFortune 100 Companies such as Federal Express and KPMG. Responsibilities included debt financing,forecasting and analyzing cash positions, budgeting and fieldwork. Prior roles include ChiefFinancial Officer, Chief Accounting Officer and Director. Generate distribution income and long-term capital appreciation through the acquisition ofTechnology and Industrial Commercial Real Estate.objectivesdifferentiators Key Investment Objectives of the Fund are to (i) Preserve Investor Capital, (ii) Make Regular CashDistributions, (iii) Realize Moderate Capital Appreciation and (iv) Provide Liquidity ThroughRepurchase Agreements. The Fund believes that the combination of continued growth in corporate investment in research anddevelopment and the increase in onshoring of manufacturing operations in the U.S. will driveattractive demand fundamentals for the Technology and Industrial Commercial Real Estate assetclass over the next 5 to 10 years.

4CRE Diversified Income FundManagement TeamRoger Scott, Chief Financial Officer, CPA20 Years of Financial Services Experience Chief Financial Officer – Albaad USA Chief Financial Officer – GDS Transnational Senior Financial Analyst- Federal Express Controller – Strata SolarReal Estate and FinanceprimaryfocusGrant Baker, Chief Accounting Officer, CPAPublic and Private Corporate Audit Experience Senior Audit Experience - KPMG Proficient in Audits of Financial Statements in Accordance with GAAP Holds Bachelors and Masters in Accounting Certified Public Accountant

5CRE Diversified Income FundInvestment Philosophywe take afundamentalsbased approachbased on theknowledgethat. With an increase in U.S. e-commerce sales (1), e-commerce willcontinue to drive demand for industrial properties, e-commerce hasserved as a primary demand driver for distribution and logistics spaceas consumers’ preferences for online shopping has increased.we focuson industrylevel factorsbased on. Industrial and technology companies utilize R&D/flex facilities todevelop, test and improve new and existing products and services.Corporations in these sectors prefer R&D/flex facilities as they offerthe ability to house multiple space types (i.e. office, lab andmanufacturing space) within one facility, which can offer thesecorporations efficiency and cost savings relative to these corporationsoccupying multiple, separate facilities.Reshoring of US supply chains. We expect a high level of reshoring willlikely take place in the U.S. as companies move operations todomestic locations to maintain greater control and oversight of theirsupply chains. Over the past ten years, the industrial flex asset class hasexperienced significant growth due to increased tenant demand from(1) Rakuten Intelligence, electronic receipts - U.S. e-commerce salesa variety of industries. This growth is evidenced by the total squarerose 24% from March 1-17, 2020footage of R&D/flex space increasing from 44 million SF in Q1 2010 to171 million SF in Q1 2020. Additionally, over the same period, flextransaction volume increased from 3.4 billion to 24.6 billion.(2) (2) Real Capital Analytics

6CRE Diversified Income FundProperty InformationTechnology SpaceIndustrial SpaceGiven the highly digitized nature ofmodern commerce, most companiesrequire some degree of data storagethat requires specific facilities tohouse the storage equipment, run ITsystems, and facilitate cloud storageand computing, including climatecontrol and security protocols.Distribution warehouses function ascritical hubs in logistics networks.The space must allow companies toeffectively serve their customer baseand add efficiencies to the overallprocessthroughautomatedtechnologies, sufficient dock space,and proximity to freeways, railways,or airports if needed.

7CRE Diversified Income FundStrategy and Approach Thethe team has aproven ability togenerate returnsby using a timetested strategybased on.Funds investments focus is on Commercial Real Estate properties that are designed to generate longterm results.By employing a bottom-up fundamental-based approach, we are able to evaluate each investmentopportunity independently. This in-depth fundamental analysis we conduct compares quantitative,qualitative, and relative value factors for each opportunity under review. We employ three strategies –1. Buy It2. Grow the Operating Income3. Sell It We assess several aspects of each investment:Expense ControlProperty ImprovementsIncreased OccupancyRevenue GrowthAppraised ValueAs part of our strategy, the Fund seeks North American Commercial Real Estate investments with thesethree characteristics: Attractive Current Income Stable Rent Rates Credit Worthiness of Tenants

8CRE Diversified Income FundInvestment ProcessObjective: conduct in-depth,multifaceted industry analysiskey industrydrivers assess critical factors driving the industry toinclude diversifying of supply chains away fromtraditional brick and mortar tenants with existing space overseasreturning to the U.S. in response to thevolatility abroadstrategicallyselectassetsresults CONTINUOUS PARALLEL PROCESSES location e: conduct rigorous,bottom-up fundamental analysis tenants need for both labor cost and occupancy focus on geographic areas mostcost savingsimpacted by industry and growth in R&D spendingpopulation changes R&D facilities represent the 3rd largest category stability and potential growth ofof Commercial Real Estate and have seen a 288%the assets cash flowincrease in occupancy in the last ten years credit worthiness of tenantsObjective: seek investmentopportunities with certaincharacteristics 30.00 to 60.00 per square foot incore markets 20.00 per square foot in secondarymarketsObjective: monitor investmentswith vigilance disciplined monitoring fordeviations from initial analysis continuous review of operatingexpenses, monitoring forunexpected increases monitoring for changes in tenantcredit risk conduct regular onsite inspections

9CRE Diversified Income FundFund InformationMinimum Investment 10,000.00Share Price 10.00Qualification AccreditedDistributions QuarterlyDividend Yield 10%Targeted IRR 12%Management Fee 1%Liquidity Semi-AnnualShared Interest 30%NAV Calculation AnnuallyTax Benefits LongInvestorsto 14%Term Capital Gains & Depreciation

10CRE Diversified Income FundContact InformationCRE Diversified Income FundCrescent Court100 Crescent Ct. Suite 700Dallas, Texas 75201Toll Free: 866-427-3386Office: 214-586-0510Fax: 214-586-0498Email: info@creincomefund.com

cre diversified income fund and funds managed by creincomefund.com included herein, and any other materialsprovided are intended only for discussionpurposes and are not intendedas an offerto sellor solicitationof an offerto buy with respectto the purchaseor saleof any securityand