Transcription

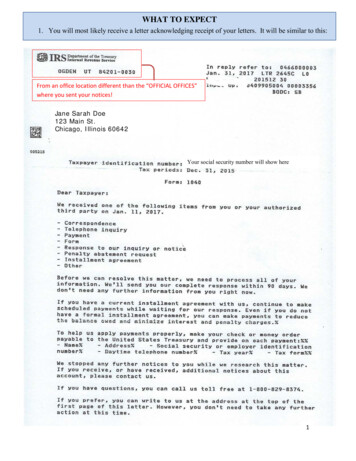

TAX1GENERAL PRINCIPLES Every person who is able to pay mustcontribute his share in the running of thegovernment. The Government, for his part, isexpected to respond in the form of tangible andintangible benefits intended to improve the livesof the people and enhance their moral andmaterial values. This symbiotic relationship isthe rationale of taxation and should dispel theerroneous notion that is an arbitrary method ofexaction by those in the seat of power. (Algue v.CIR, GR L-28896, 17 February 1988)PART ONE: BASIC CONCEPTS OF TAXATION1.Definition; 5 Elements Taxation may refer to either the power to tax or theact or process by which the taxing power isexercised.It is the inherent power of the sovereign exercisedthrough the legislative to impose burdens uponsubjects and objects within its jurisdiction for thepurpose of raising revenues to carry out thelegitimate objects of the government. Taxes are enforced proportional contributions fromproperties and persons levied by the State by virtueits sovereignty for the support of the governmentand for public needs.Elements of Taxation (S-L-I-P-R)a.b.c.d.It is an Inherent power of the State.It is essentially Legislative in characterIt should be for a Public purposeEither the person or property taxed bewithin the jurisdiction of the taxing authority.(Situs of taxation)e.The purpose is to Raise revenues or thepromotion of general welfare, regulation,reduction of social inequality and to encourageeconomic growth. (public purpose)2.State Policy on Taxationa.RA 8424 (Tax Reform Act of 1997)Section 2. State Policy. - It is hereby declared thepolicy of the State to promote sustainableeconomic growth through the rationalization of thePhilippine internal revenue tax system, including taxadministration; to provide, as much as possible, anequitable relief to a greater number of taxpayersin order to improve levels of disposable income andincrease economic activity; and to create a robustenvironment for business to enable firms tocompete better in the regional as well as the globalmarket, at the same time that the State ensures thatGovernment is able to provide for the needs ofthose under its jurisdiction and care. 3.b.The state policy looks into 3 entities:1)The Government2)The person or ations in entering a business.Theories and Basis of Taxationa.Necessity Theory Existence of a government is a necessityand cannot continue without any means to payfor expenses For those means, the government has theright to compel all citizens and property withinits limits to contribute.Benefits-Protection Theory (Symbiotic) Reciprocal duties of protection and supportbetween State and inhabitants. Inhabitants paytaxes and in return receive benefits andprotection from the StateSotelo, MS4. Nature of the Power of TaxationAttribute of sovereignty and emanates fromnecessity, relinquishment of which is neverpresumedLegislative in characterScope of Legislative Taxing Power (P-A-P-M-A-S-K)a. The persons, property and excises to be taxed,provided it is within its jurisdictionb. Amount or rate of taxc.Purposes for its levy, provided it be for a publicpurposed. Kind of tax to be collectede. Apportionment of the taxf.Situs of taxationg. Method of collectionIs the power to tax the power to destroy? "The power to tax is the power to destroy."A state cannot have authority under the Constitutionto destroy or tax any agency that has been properlyset up by the government – Chief Justice Marshall(McCulloch v. Maryland 17 US 318) “ (The Court), so often has defeated theattempt to tax in certain ways, can defeat anattempt to discriminate or otherwise go too farwithout wholly abolishing the power to tax. Thepower to tax is not the power to destroy while thisCourt sits. The power to fix rates is the power todestroy if unlimited, but this Court while itendeavors to prevent confiscation does notprevent the fixing of rates. A tax is not anunconstitutional regulation in every case where anabsolute prohibition of sales would be one.” - JusticeHolmes (Panhandle Oil v. Mississippi 277 US 218) To say that “the power to tax is the power todestroy” is to describe not the purpose for which thetaxing power may be used but the degree of vigorwith which the taxing power may be employed inorder to raise revenue. (1 Cooley 179-181) The power to tax is an incident ofsovereignty and is unlimited in its range,acknowledging in its very nature no limits, so thatsecurity against its abuse is to be found only in theresponsibility of the legislature which imposes thetax on the constituency who are to pay it.Nevertheless, effective limitations thereon may beimposed by the people through their Constitutions.Our Constitution provides that the rule of taxationshall be uniform and equitable and Congress shallevolve a progressive system of taxation. So potentindeed is the power that it was once opined that “thepower to tax involves the power to destroy.” Verily,taxation is a destructive power which interferes withthe personal and property rights of the people andNOTES 1

takes from them a portion of their property for thesupport of the government. (MCIAA v. Marcos GR120082, 11 September 1996)Power of Judicial Review in TaxationAs long as the legislature, in imposing a tax, strictions, the courts have no concern with the wisdomor policy of the exaction, the political or other collateralmotives behind it, the amount to be raised, or thepersons, property or other privileges to be taxed.The court’s power in taxation is limited only to theapplication and interpretation of law.Manifestations of the Lifeblood Doctrinea.Purpose and Objective of Taxationb.Revenuec.Regulationd.Reduction of Social Inequalitye.Encourage Economic Growthf.ProtectionismTaxes are Personal to the Taxpayer1.A corporation’s tax delinquency cannot beenforced against its stockholder. (Corporate EntityDoctrine).EXCEPT:a.If it appears that the corporateassets have passed into their hands; orb.When the stockholders have unpaidsubscriptions to the capital of thecorporation.2.Estate taxes are obligations that must bepaid by the executor or administrator out of the netassets and cannot be assessed against the heirs.EXCEPT:If prior to the payment of the estate taxdue, the properties of the deceased aredistributed to the heirs, then the latter issubsidiary liable for the payment of such portionof the estate tax as his distributive share bearsto the total value of the ent estate.Judicial Review, DefinedJudicial power includes the duty of the courts ofjustice to settle actual controversies involving rightswhich are legally demandable and enforceable, and todetermine whether or not there has been a grave abuseof discretion amounting to lack or excess of jurisdictionon the part of any branch or instrumentality of thegovernment.5. Importance of TaxesLifeblood Doctrine Taxes are the lifeblood of the nation Without revenue raised from taxation, thegovernment will not survive, resulting in detrimentto society. Without taxes, the government would beparalyzed for lack of motive power to activate andoperate it. Taxes are the lifeblood of the government and thereprompt and certain availability is an imperious need. Taxes are the lifeblood of the nation through whichthe agencies of the government continue to operateand with which the state effects its functions for thebenefit of its constituents Taxes are the lifeblood of government, and theirprompt and certain availability an imperious need.Time out of mind, therefore, the sovereign hasresorted to more drastic means of collection. Theassessment is given the force of a judgment, and ifthe amount assessed is not paid when due,administrative officials may seize the debtor'sproperty to satisfy the debt.In recognition of the fact that erroneousdeterminations and assessments will inevitablyoccur, the statutes, in a spirit of fairness, invariablyafford the taxpayer an opportunity at some stage tohave mistakes rectified (Bull v. US, 295 US 247)Illustrations of the Lifeblood TheoryBasic is the principle that "taxes are the lifeblood ofthe nation." The primary purpose is to generate funds forthe State to finance the needs of the citizenry and toadvance the common weal. Due process of law under theConstitution does not require judicial proceedings in taxcases. This must necessarily be so because it is upontaxation that the government chiefly relies to obtain themeans to carry on its operations and it is of utmostimportance that the modes adopted to enforce thecollection of taxes levied should be summary andinterfered with as little as possible. (PBCom v. CIR GR112024, 28 January 1999)Sotelo, MSTAX16.Purpose and Objective of TaxationPRIMARY Revenue – the purpose of taxation is toprovide funds or property with which the statepromotes the general welfare and protection of itscitizens Taxes are for revenue, whereas fees areexactions for purposes of regulation and inspection,and are for that reason limited in amount to what isnecessary to cover the cost of the services renderedin that connection. It is the object of the charge, andnot the name, that determines whether a charge is atax or a fee. (PAL v. EDU, GR L-41383, 15 August1988)SECONDARY1)Regulation - it has a regulatory purpose as in thecase of taxes levied on excises or privileges likethose imposed on tobacco and alcoholic products, oramusement places, etc.2)3)Promotion of General Welfare4)Encourage Economic Growth – in the realm of taxexemptions and tax reliefs, the purpose is to granttax incentives or exemptions in order to promote thecountry’s economic growth.5)Protectionism – in some sectors of the economy, asin the case of foreign importations, taxes sometimesprovide protection to local industries like protectivetariffs and customs duties.7.Characteristics or Attributes of TaxesReduction of Social Inequality – made possiblethrough the progressive system of taxation wherethe objective is to prevent undue concentration ofwealth in the hands of a few individuals.NOTES 2

TAX1Taxation and Eminent Domain – Subject tocertain constitutional limitations, including theprohibition against impairment of the obligation ofcontracts.Police Power – Relatively free from constitutionallimitations and superior to the non-impairmentprovisions thereof.a.It is an enforced contribution – payment ismandatory not discretionary.b.It is generally payable in money – someexceptions: (1) when law provides that backpaycertificates or government bonds are acceptablefor payment of taxes; (2) when property beingsold at public auction because of delinquenttaxes is declared forfeited and applied to thepayment of the tax.c.It is proportionate in character – the taxburden should be allocated on some reasonablebasis of apportionment, primarily on the basis ofability to pay and secondarily on benefitsreceived.d. It is levied on persons, property, or theexercise of a right or privilegee. It is levied by the State which hasjurisdiction over the subject or object of taxationf. It is levied by the law-making body of theStateg. It is levied for publics purpose or purposes8.1)2)3)4)5)6)Distinctionsa.Taxation From Other Inherent Powersof the StateTAXATION vs. POLICE POWER vs. EMINENTDOMAINAs to purpose:Taxation – for the support of the governmentEminent Domain - for public usePolice Power – to promote general welfare, publichealth, public morals, and public safety.As to compensation:Taxation – Protection and benefits received from thegovernment.Eminent Domain – just compensation, not to exceedthe market value declared by the owner oradministrator or anyone having legal interest in theproperty, or as determined by the assessor,whichever is lower.Police Power – The maintenance of a healthyeconomic standard of society.As to persons affected:Taxation and Police Power – operate upon acommunity or a class of individualsEminent Domain – operates on the individualproperty owner.As to authority which exercises the power:Taxation and Police Power – Exercised only by thegovernment or its political subdivisions.Eminent Domain – may be exercised by publicservices corporation or public utilities if granted bylaw.As to amount of imposition:Taxation – Generally no limit to the amount of taxthat may be imposed.Police Power – Limited to the cost of regulationEminent Domain – There is no imposition; rather, it isthe owner of the property taken who is just paidcompensation.As to the relationship to the Constitution:Sotelo, MSb.TaxationimpositionsFromOtherMonetary1)toll – amount charged for the cost and maintenanceof property used;2)penalty – punishment for the commission of acrime.3)compromise penalty – amount collected in lieu ofcriminal prosecution in cases of tax violations;4)special assessment – levied only on land basedwholly on the benefit accruing thereon as a result ofimprovements of public works undertaken bygovernment within the vicinity.5)license or fee – regulatory imposition in theexercise of the police power of the State;6)margin fee – exaction designed to stabilize thecurrency7)custom duties and fees – duties charged uponcommodities on their being imported into orexported from a country;8)debt – a tax is not a debt but is an obligationimposed by law.9)Subsidy – a legislative grant of money in aid of aprivate enterprise deemed to promote publicwelfare.10) Revenue– a broad term that includes taxes andincome from other sources as well.11) Impost– in its general sense, it signifies any tax,tribute or duty. In its limited sense, it means a dutyon imported goods and merchandise.License Fee v. TaxIf the purpose is primarily revenue, or if revenue is,at least, one of the real and substantial purposes, then theexaction is a tax.If the purpose is regulatory in nature, it is a license.Special assessment v. tax1.A special assessment tax is an enforcedproportional contribution from owners of landsespecially benefited by public improvementsA special assessment is levied only on land

(Situs of taxation) e. The purpose is to Raise revenues or the promotion of general welfare, regulation, reduction of social inequality and to encourage economic growth. (public purpose) 2. State Policy on Taxation a. RA 8424 (Tax Reform Act of 1997) Section 2. State Policy. - It is hereby declared the policy of the State to promote sustainable