Transcription

Insurance Law AlertApril 2021In This IssueIndiana Supreme Court Rules That Ransomware Losses May Be SubjectTo “Computer Fraud” CoverageThe Indiana Supreme Court reversed an appellate court decision that granted an insurer’ssummary judgment motion, holding that issues of fact existed as to whether the policyholder’sransomware payment was covered under a commercial policy’s Computer Fraud provision.G&G Oil Co. of Indiana, Inc. v. Continental Western Ins. Co., 165 N.E.3d 82 (Ind. 2021).(Click here for full article)SEC Investigation Is Not A Covered Securities Claim, Says New York Court“Renownedin the marketas accomplished triallawyers and coverageexperts who offer qualityrepresentation to clients inthe insurance industry.”– Chambers USA2020A New York federal district court dismissed a policyholder’s breach of contract suit against itsinsurer, finding that a Securities and Exchange Commission investigation was not a coveredSecurities Claim under the D&O policy. Hertz Global Holdings, Inc. v. National Union FireIns. Co. of Pittsburgh, 2021 WL 1198802 (S.D.N.Y. Mar. 30, 2021). (Click here for full article)New York Appellate Court Rules That Follow Form Excess Insurer Is NotBound By Prior Ruling Regarding Scope Of Coverage For UnderlyingPolicyA New York appellate court ruled that an excess insurer is not bound by a prior judicial rulingfinding coverage under the primary policy underlying the follow form excess policy. AspenSpecialty Ins. Co. v. RLI Ins. Co., Inc., 2021 WL 1259156 (N.Y. App. Div. 1st Dep’t Apr. 6,2021). (Click here for full article)Kentucky Appellate Court Declines To Apply Notice-Prejudice Rule ToClaims Made PolicyAddressing a matter of first impression under Kentucky law, a Kentucky appellate court ruledthat a notice provision in a claims-made-and-reported policy was unambiguous and was notsubject to the notice-prejudice rule. Darwin National Assurance Co. v. Kentucky State Univ.,2021 WL 1045716 (Ct. App. Ky. Mar. 19, 2021). (Click here for full article)Florida Appellate Court Addresses Application Of Separability And LimitOf Liability ClausesA Florida appellate court ruled that an insurance policy provided only 1 million in coverage(rather than 2 million) for a mid-air collision between two airplanes based on language in thepolicy’s limit of liability provision. Endurance Assurance Corp. v. Hodges, 2021 WL 1115452(Dist. Ct. App. Fla. Mar. 24, 2021). (Click here for full article)Texas Supreme Court Rules That Breach Of Insurance Policy IsPrerequisite To Insurance Code ClaimsThe Texas Supreme Court held that a plaintiff must establish an insurer’s liability under aninsurance policy in order to seek recovery on Insurance Code claims and that bifurcation of thebreach of contract and Insurance Code claims is necessary. In re State Farm Mutual Auto. Ins.Co., 2021 WL 1045651 (Tex. Mar. 19, 2021). (Click here for full article) Simpson Thacher & Bartlett LLP1

Texas Supreme Court To Consider Exception To Eight Corners RuleThe Texas Supreme Court agreed to consider whether courts may use certain informationoutside the allegations in the complaint and the insurance policy in evaluating an insurer’s dutyto defend. BITCO General Ins. Corp. v. Monroe Guaranty Ins. Co., No. 19-51012 (Tex. Mar. 19,2021). (Click here for full article)California Court Refuses To Dismiss Claims Against Entities ThatAcquired ReinsurerA California federal district court refused to dismiss claims alleging that companies thatacquired a reinsurer intentionally interfered with the reinsurance contract between theacquired reinsurer and the plaintiff insurance companies. California Capital Ins. Co. v. EnstarHoldings US LLC, 2021 WL 1406028 (C.D. Cal. Apr. 14, 2021). (Click here for full article)Rejecting Tolling Argument, California Court Rules That Insurer’sContribution Claim Is Time BarredA California federal district court dismissed an insurer’s equitable contribution claim againstanother insurer, finding that the claim was time barred by the applicable statute of limitations.Lexington Ins. Co. v. QBE Specialty Ins. Co., 2021 WL 735665 (N.D. Cal. Feb. 25, 2021).(Click here for full article)Cities Cannot Use State Tort Law To Sue Companies For Climate ChangeIn Federal Court, Says Second CircuitThe Second Circuit ruled that municipalities may not use state tort law to hold multi-nationalcompanies liable in federal court for climate change-related costs. City of New York v. ChevronCorp., 2021 WL 1216541 (2d Cir. Apr. 1, 2021). (Click here for full article)Pennsylvania Court Rules That Dental Practice Is Entitled To CoverageFor COVID-19-Related LossesA Pennsylvania trial court granted a dental practice’s summary judgment motion, finding thatit was entitled to coverage under Business Income, Extra Expense and Civil Authority coverageprovisions, and that several policy exclusions did not apply. Timothy A. Ungarean, DMD v.CAN, 2021 WL 1164836 (Pa. Ct. Comm. Pl. Allegheny Cnty. Mar. 22, 2021). (Click here forfull article)Pennsylvania Court Dismisses Class Action Suits Seeking BusinessInterruption CoverageA Pennsylvania federal district court dismissed four class action suits seeking coverage forCOVID-19-related losses, finding that the insured properties did not incur any “direct physicalloss.” Chester County Sports Arena v. Cincinnati Specialty Underwriters Ins. Co., 2021 WL1200444 (E.D. Pa. Mar. 30, 2021). (Click here for full article)In Trio Of Rulings, New Jersey Federal District Courts Dismiss COVID-19Related Coverage SuitsThree federal district courts in New Jersey dismissed suits seeking coverage for business lossesstemming from government shutdown orders issued in response to the COVID-19 pandemic.Dezine Six, LLC v. Fitchburg Mutual Ins. Co., 2021 WL 1138146 (D.N.J. Mar. 25, 2021);Benamax Inc. LLC v. Merchant Mutual Ins. Co., 2021 WL 1171633 (D.N.J. Mar. 29, 20210);7th Inning Stretch LLC v. Arch Ins. Co., 2021 WL 1153147 (D.N.J. Mar. 26, 2021). (Click herefor full article)STB News AlertsClick here to read more about the Firm’s insurance-related news and honors.2

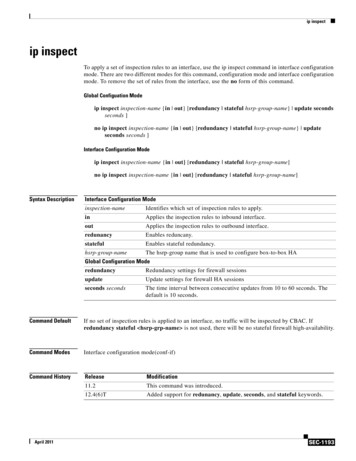

Cyber AlertIndiana Supreme Court Rules ThatRansomware Losses May Be SubjectTo “Computer Fraud” CoverageThe Indiana Supreme Court reversed anappellate court decision that granted aninsurer’s summary judgment motion, holdingthat issues of fact existed as to whetherthe policyholder’s ransomware paymentwas covered under a commercial policy’sComputer Fraud provision. G&G Oil Co. ofIndiana, Inc. v. Continental Western Ins. Co.,165 N.E.3d 82 (Ind. 2021).G&G Oil, the victim of a ransomware attack,paid approximately 35,000 to regain accessto its computer systems. Continental deniedcoverage for the loss, noting that G&G Oildeclined computer hacking coverage. G&GOil sued Continental and the parties crossmoved for summary judgment. The trialcourt granted Continental’s motion and anappellate court affirmed. (See April 2020Alert). The Indiana Supreme Court reversed.The Computer Fraud provision coveredloss “resulting directly from the use of anycomputer to fraudulently cause a transfer ofthat property.” The Indiana Supreme Courtruled that “fraudulently cause a transfer”was unambiguous and means “to obtainby trick.” Applying this interpretation, thecourt held that factual disputes existed as towhether G&G Oil’s computer systems wereaccessed “by trick.” While G&G Oil allegedthat a targeted spear-phishing email was thesource of attack, the factual record was notconclusive as to the manner in which thehackers obtained access to the company’scomputer system. As such, the court ruledthat summary judgment was inappropriate.Furthermore, the court held that factualissues existed as to whether G&G Oil’s losses“resulted directly from the use of a computer.”The Indiana Supreme Court held that the trialcourt erred in ruling as a matter of law thatG&G Oil’s voluntary payment of ransom wasan intervening cause that severed the causalchain of events. Instead, the Indiana SupremeCourt held that “resulting directly” requiresloss that resulted either “immediately orproximately without significant deviationfrom the use of a computer” and that G&GOil’s loss satisfied that standard.D&O AlertSEC Investigation Is Not A CoveredSecurities Claim, Says New YorkCourtA New York federal district court dismissed apolicyholder’s breach of contract suit againstits insurer, finding that a Securities andExchange Commission (“SEC”) investigationwas not a covered Securities Claim under theD&O policy. Hertz Global Holdings, Inc. v.National Union Fire Ins. Co. of Pittsburgh,2021 WL 1198802 (S.D.N.Y. Mar. 30, 2021).In 2013, a securities class action was filedagainst Hertz. In 2014, the SEC demandeddocuments relating to the company’sfinancial statements and issued an orderof investigation stating that the SEC had“information that tends to show” violationsof securities laws. National Union agreedthat the class action was a “Securities Claim”under the policy, but argued that the SECinvestigation did not trigger coverage. Hertzultimately settled with the SEC, agreeing topay a 16 million penalty. Thereafter, Hertzsued National Union for breach of contractand sought a declaration that National Unionwas obligated to pay the expenses of the SECinvestigation and settlement costs. The courtgranted National Union’s motion to dismiss.The policy covers “Securities Claims” against“Hertz the Organization,” as well as “Claimsagainst Individual Insureds.” SecuritiesClaim is defined as “a Claim, other than aninvestigation of an Organization . . . allegingviolation of securities laws or regulations.”The court ruled that this languageunambiguously excludes the SECinvestigation from coverage, rejecting Hertz’sassertion that the investigation was a covered“administrative or regulatory proceeding.”3

The court also rejected Hertz’s contention thatthe SEC order issued in connection with theinvestigation was a claim alleging a violationof securities laws. The court explained thatlanguage in the order stating that the SEChas information that tends to show multiplepossible violations is not equivalent to anactual claim.In addition, the court dismissed Hertz’sargument that the costs of the SECinvestigation should be included as part ofthe covered securities class action, notingthat the SEC investigation did not arisefrom that action. Finally, the court deemedunpersuasive Hertz’s assertion that theinvestigation was covered as a “claim” againstInsured Individuals. The court emphasizedthat the investigation targeted Hertz as anorganization, rather than any individualexecutives, and held that the cooperation ofexecutives or their participation in tollingagreements is not equivalent to claims againstthose individuals.not a party to the original action. A New Yorktrial court ruled in Aspen’s favor, and theappellate court reversed.The appellate court ruled that RLI is notbound by the prior ruling under the law ofthe case doctrine because it was not a partyto that action. For the same reason, thecourt declined to apply the doctrines of resjudicata or collateral estoppel. Apsen arguedthat the prior judicial determination as toadditional insured coverage under Ironshore’sprimary policy is binding on RLI becauseRLI’s excess policy is a “follow form” policythat incorporates the terms of Ironshore’spolicy. Rejecting this argument, the courtstated: “[a] follow-form policy was neverintended to bind an excess carrier to a judicialinterpretation of an underlying policy in arelated but wholly non-controlling decision.”Excess AlertNew York Appellate Court RulesThat Follow Form Excess InsurerIs Not Bound By Prior RulingRegarding Scope Of Coverage ForUnderlying PolicyReversing a trial court decision, a New Yorkappellate court ruled that an excess insureris not bound by a prior judicial ruling findingcoverage under the primary policy underlyingthe follow form excess policy. AspenSpecialty Ins. Co. v. RLI Ins. Co., Inc., 2021WL 1259156 (N.Y. App. Div. 1st Dep’t Apr.6, 2021).The coverage litigation arose out of a bodilyinjury suit. In a separate case arising out ofthe same accident, a New York trial courtruled that Ironshore Indemnity, a primaryinsurer, owed coverage for the underlyingclaims based on an additional insuredendorsement. In the present suit, Aspensought a declaration that RLI, an excessinsurer whose policy follows form to theIronshore primary policy, is bound by thatjudicial determination. In response, RLIargued that it was entitled to relitigate theissue of whether Ironshore’s policy providedadditional insured coverage because RLI wasNotice AlertKentucky Appellate Court DeclinesTo Apply Notice-Prejudice Rule ToClaims Made PolicyAddressing a matter of first impression underKentucky law, a Kentucky appellate courtruled that a notice provision in a claimsmade-and-reported policy was unambiguousand was not subject to the notice-prejudicerule. Darwin National Assurance Co. v.Kentucky State Univ., 2021 WL 1045716 (Ct.App. Ky. Mar. 19, 2021).On September 2, 2015, former employeesof a university sued for wrongful discharge,among other claims. The university soughtcoverage under a professional liability policyin effect from July 1, 2014 to July 1, 2015. Thepolicy stated that a claim was deemed to havebeen made on the date that the universityreceived notice of the claim, and required theuniversity to give the insurer written notice4

“as soon as possible” but no less than ninetydays after the policy’s end date. The universitynotified its insurer of the claim on October 2,2015—93 days after the policy’s end date. Theinsurer denied coverage based on untimelynotice. In ensuing litigation, a Kentuckytrial court granted the university’s summaryjudgment motion. The trial court ruled thatthe notice provision was unambiguous,but that the notice-prejudice rule applied,and that notice was arguably timely underKentucky’s three-day mailbox rule. Theappellate court reversed.The appellate court agreed with the trialcourt that the ninety-day notice provisionwas unambiguous, but overturned the trialcourt’s ruling as to the notice-prejudice rule.The court explained that imposing a prejudicerequirement would “rewrite the Policy” and“grant KSU coverage it did not purchase.”The appellate court also held that Kentucky’smailbox rule applies only to the service ofcertain court-related papers, not to noticerequirements imposed by contract.Coverage AlertsFlorida Appellate Court AddressesApplication Of Separability AndLimit Of Liability ClausesReversing a trial court decision, a Floridaappellate court ruled that an insurance policyprovided only 1 million in coverage (ratherthan 2 million) for a mid-air collisionbetween two airplanes based on languagein the policy’s limit of liability provision.Endurance Assurance Corp. v. Hodges,2021 WL 1115452 (Dist. Ct. App. Fla. Mar.24, 2021).A mid-air collision between two airplanesresulted in the death of four individuals. Theirestates filed wrongful death claims againstDean Aviation, the flight school that ownedboth airplanes. Dean Aviation was insured byEndurance under a policy with a 1 millionper-occurrence limit. The plaintiffs arguedthat the policy provided a total of 2 millionin coverage, 1 million for each airplaneinvolved in the accident. Plaintiffs relied ona separability clause that stated “[w]hen twoor more Aircraft are insured under this Policythe terms of [the] Policy will apply separatelyto each.” The trial court agreed and issued adeclaratory judgment in plaintiffs’ favor.The appellate court reversed, ruling that theseparability clause did not alter the 1 millionlimit on liability. In particular, the court reliedon a “regardless” clause in the limit of liabilityprovision which stated that “[r]egardless ofthe number of Insureds under this Policy,persons or organizations who sustain BodilyInjury or Property Damage,” total liability islimited by the per-occurrence limits stated inthe policy. The court noted that under Floridalaw, inclusion of “qualifying [regardless]clauses evidences an established custom inthe insurance industry . . . where the intent isto limit liability coverage to a single amount,even though multiple insured vehicles areinvolved in an accident.”Texas Supreme Court Rules ThatBreach Of Insurance Policy IsPrerequisite To Insurance CodeClaimsThe Texas Supreme Court granted aninsurer’s petition for writ of mandamus,holding that a plaintiff must establish aninsurer’s liability under an insurance policyin order to seek recovery on Insurance Codeclaims and that bifurcation of the breachof contract and Insurance Code claims isnecessary. In re State Farm Mutual Auto. Ins.Co., 2021 WL 1045651 (Tex. Mar. 19, 2021).The Plaintiffs, who held underinsuredmotorist coverage with State Farm, wereinvolved in automobile accidents and receivedsettlement payments from other drivers’insurers. Following those settlements, StateFarm refused to pay additional amountssought by the plaintiffs. The plaintiffs sued,alleging failure to settle in good faith andfailure to provide a reasonable explanationfor claim denial, in violation of the TexasInsurance Code. The plaintiffs did not assertany common law breach of contract claims,but sought damages in the amounts owedunder their respective State Farm policies.State Farm moved to bifurcate trial, arguingthat an initial trial to establish liability underthe policies was a prerequisite to liabilityunder the Insurance Code. The TexasSupreme Court agreed.The court rejected the plaintiffs’ assertionthat they could recover UIM benefits asextra-contractual damages without first5

establishing that they were legally entitledto recover under the policy if they were notasserting a breach of contract claim. Thecourt explained that in order to seek damagesunder the Insurance Code, a party musteither establish “a right to receive benefitsunder the policy,” or “an injury independentof a right to benefits”—neither of which wereestablished here.In order to assert independent injuries,a party must establish that the insurer’sviolations “caused an injury apart from[its] failure to pay as much as the insuredsbelieve they should have been paid undertheir UIM policies.” The court deemed itirrelevant that plaintiffs’ Insurance Codeclaims were not premised on a denial ofbenefits, and instead were based on failureto settle or provide reasonable explanationfor denying the claims. The court explained:“the question is not whether the insured’sclaims are independent of the right to receivepolicy benefits. The question is whether thealleged ‘damages are truly independent ofthe insured’s right to receive policy benefits.’”(Emphasis in original). Because the onlydamages sought by plaintiffs were predicatedon State Farm’s contractual obligation underthe policies, the court ruled that “plaintiffs’‘independent injury’” theory failed.Having concluded that plaintiffs mustestablish their right to policy benefits inorder to recover under their InsuranceCode claims, the court further held thatState Farm was entitled to bifurcation oftrial. The court explained that bifurcationwas warranted because it preserves judicialresources, eliminates conflicts relating tothe admissibility of evidence, and avoidsunnecessary prejudice to the insurer.Duty To DefendAlertTexas Supreme Court To ConsiderException To Eight Corners RuleThe Texas Supreme Court agreed to considerwhether courts may use certain informationoutside the allegations in the complaint andthe insurance policy in evaluating an insurer’sduty to defend. BITCO General Ins. Corp.v. Monroe Guaranty Ins. Co., No. 19-51012(Tex. Mar. 19, 2021).The coverage dispute arose out of a negligentlawsuit against a drilling company. Thecompany tendered defense of the suit to twoinsurers, one of which agreed to defend.The other insurer refused, arguing it had noduty to defend because the parties stipulatedthat the alleged property damage occurredoutside the policy’s coverage period. Thedrilling company sued both insurers, seekinga declaration that they were obligated todefend the suit. A Texas district court grantedthe drilling company’s summary judgmentmotion. On appeal, the Fifth Circuit askedthe Texas Supreme Court to address twoissues of law. Bitco Gen. Ins. Corp. v. MonroeGuaranty Ins. Co., 2021 WL 955155 (5th Cir.Mar. 12, 2021).First, the Fifth Circuit asked the TexasSupreme Court to address whether the narrowexceptions to the eight corners rule, as setforth in Northfield Ins. Co. v. Loving HomeCare, Inc., 363 F.3d 523 (5th Cir. 2004), arepermissible under Texas law. In Northfield,the Fifth Circuit agreed to consider extrinsicevidence in evaluating an insurer’s dutyto defend “when it is initially impossibleto discern whether coverage is potentially6

implicated,” and “when the extrinsic evidencegoes solely to a fundamental issue of coveragewhich does not overlap with the merits of orengage the truth or falsity of any facts allegedin the underlying case.”Second, the court sought guidance as towhether it is permissible for a court toconsider evidence of a stipulated date relatedto the underlying occurrence to determinean insurer’s duty to defend. The Fifth Circuitnoted that “a definitive answer to thisquestion is important because ascertainingthe date of an occurrence is a frequentlyencountered ‘gap’ in third party pleadings,”and “the omitted date can be key to thequestion of the duty to defend.”Last month, the Texas Supreme Courtaccepted certification. We will keep youposted on developments in this matter.However, plaintiffs claimed that when thedefendant companies acquired Maiden, theyinterfered with Maiden’s performance underthe treaty. In particular, plaintiffs allege thatthe defendants fabricated coverage disputesand directed Maiden to refuse payment forlosses and to demand the return of funds forpayments already made. Defendants moved todismiss the complaint.The court denied the motion, finding thatthe complaint sufficiently alleged claims forintentional interference with contractualrelations and inducing breach of contract. Thecourt noted that while plaintiffs “do not allegeexactly how Defendants directed Maiden tobreach the Treaty,” the complaint nonethelessmet the federal notice pleading standardsso as to survive dismissal. Additionally, thecourt refused to dismiss the complaint onthe ground that defendants were agents ofMaiden and thus could not be held liable forinterference with or inducing breach of thereinsurance treaty. Because the court declinedto take judicial notice of the agreementsbetween Maiden and the defendants, thosedocuments could not be used to supportdefendants’ agency argument.Contribution AlertReinsurance AlertCalifornia Court Refuses ToDismiss Claims Against EntitiesThat Acquired ReinsurerA California federal district court refused todismiss claims alleging that companies thatacquired a reinsurer intentionally interferedwith the reinsurance contract between theacquired reinsurer and the plaintiff insurancecompanies and induced a breach of thatcontract. California Capital Ins. Co. v. EnstarHoldings US LLC, 2021 WL 1406028 (C.D.Cal. Apr. 14, 2021).Plaintiff insurance companies alleged thatthey entered into a reinsurance treatywith non-party Maiden Reinsurance andthat for several years, Maiden fulfilled itscontractual obligations under the treaty.Rejecting Tolling Argument,California Court Rules ThatInsurer’s Contribution Claim IsTime BarredA California federal district court dismissedan insurer’s equitable contribution claimagainst another insurer, finding that the claimwas time barred by the applicable statuteof limitations. Lexington Ins. Co. v. QBESpecialty Ins. Co., 2021 WL 735665 (N.D. Cal.Feb. 25, 2021).A policyholder tendered defense of aconstruction defect suit to LexingtonInsurance Company. The policyholder optednot to seek coverage from another insurer,QBE, because it wished to preserve limitson the QBE policy for future claims andbecause the QBE policy included a deductible.Lexington agreed to defend and ultimatelysettled the suit. Thereafter, Lexington madeseveral requests to QBE for contributionof defense and indemnity expenses, whichQBE refused. More than two years after the7

underlying settlement, Lexington filed anaction for equitable contribution.The court dismissed the action, ruling thatit was time-barred under California’s twoyear statute of limitations for equitablecontribution claims. Under California law, thelimitation period for an equitable contributionclaim accrues when the non-contributinginsurer first refuses the demand to contribute,but is tolled until all defense obligationsin the underlying action are terminated byfinal judgment. Applying this standard, thecourt held that Lexington’s claim againstQBE accrued in 2016, when QBE refused toparticipate in the policyholder’s defense—nearly three years before Lexington filedsuit. Further, the court held that the statuteof limitations was tolled only from the dateof underlying settlement, which was morethan two years before Lexington filed suit.The court rejected Lexington’s assertion thatthe statute of limitations is tolled until thedate of last underlying payment for which theinsurer seeks contribution. The court notedthat the argument had “some support” inCalifornia case law, but was not binding bypersuasive authority.QBE also argued that dismissal was warrantedbased on a “selective tender” rule, whichrecognizes a policyholder’s right to selectan insurer for tender. The court declined toaddress the merits of the “selective tender”argument based on its finding that dismissalwas warranted on statute of limitationsgrounds, but noted that it would be“extremely reluctant” to apply the rule basedon its apparent inconsistency with California’srecognition of equitable contribution claimsamong insurers. The court stated: “The rightto seek equitable contribution is predicatedon the commonsense principle that wheremultiple insurers or indemnitors share equalcontractual liability . . . the selection of whichindemnitor is to bear the loss should not beleft to the often arbitrary choice of the lossclaimant.” (Citations omitted).ClimateChange AlertCities Cannot Use State Tort Law ToSue Companies For Climate ChangeIn Federal Court, Says SecondCircuitThe Second Circuit ruled that municipalitiesmay not use state tort law to hold multinational companies liable in federal courtfor climate change-related costs. City of NewYork v. Chevron Corp., 2021 WL 1216541 (2dCir. Apr. 1, 2021). As such, the court affirmedthe dismissal of a public nuisance lawsuitbrought by the City of New York against fiveoil companies to recover damages allegedlycaused by the companies’ global fossil fueloperations. The Second Circuit held thatfederal common law, rather than state law,governs claims arising out of global warming,which is a “uniquely international problemof national concern” that implicates foreignpolicy. Additionally, the court ruled thatfederal common law is displaced by the CleanAir Act, which grants the EnvironmentalProtection Agency (rather than federal courts)the authority to regulate domestic emissions.Finally, the Court held even with respect toclaims that are not subject to the Clean AirAct (e.g., claims arising out of non-domesticemissions), judicial caution and foreign policyconcerns mitigated against allowing suchclaims to proceed under federal common law.As the court noted, the Ninth Circuit similarlyaffirmed dismissal of a public nuisancesuit seeking damages for property damageallegedly caused by greenhouse gases emittedby gas, oil and utility companies. Kivalina v.ExxonMobil Corp., 2012 WL 4215921 (9thCir. Sept. 21, 2012) (see November 2012Alert).Few courts have addressed whether climatechange claims, if allowed to proceed, wouldimplicate coverage under general liabilitypolicies. As discussed in our May 2012 andOctober 2011 Alerts, the Virginia SupremeCourt ruled that an insurer owed no duty todefend or indemnify global warming-relatedclaims, finding that the underlying complaintdid not allege a covered “occurrence.” AESCorp. v. Steadfast Ins. Co., 2012 WL 1377054(Va. Apr. 20, 2012).8

COVID-19 AlertsThe Eighth Circuit and the Ohio SupremeCourt are poised to rule on whether propertyinsurers are obligated to indemnify businesslosses arising out of state-mandated closuresenacted to slow the spread of COVID-19.This month, the Eighth Circuit heard oralarguments in Oral Surgeons PC v. CincinnatiIns. Co., No. 20-3211 (8th Cir. argued Apr. 14,2021), in which an Iowa dental clinic seeksbusiness interruption coverage for pandemicrelated losses. And in Neuro-CommunicationServices Inc. v. Cincinnati Ins. Co., 2021WL 274318 (Ohio Apr. 14, 2021), the OhioSupreme Court agreed to accept the certifiedquestion of whether the existence of theCOVID-19 virus constitutes direct physicalloss or damage under a commercial propertypolicy. Other noteworthy rulings addressingthe scope of coverage for COVID-19-relatedclaims are discussed below.Pennsylvania Court Rules ThatDental Practice Is Entitled ToCoverage For COVID-19-RelatedLossesA Pennsylvania trial court granted a dentalpractice’s summary judgment motion,finding that it was entitled to coverageunder Business Income, Extra Expense andCivil Authority coverage provisions, andthat several policy exclusions did not apply.Timothy A. Ungarean, DMD v. CAN, 2021WL 1164836 (Pa. Ct. Comm. Pl. AlleghenyCnty. Mar. 22, 2021).The policyholder alleged that as a result ofCOVID-19 and state shutdown orders, hewas forced to cease most of his businessoperations, resulting in lost income. The courtruled that the policyholder was entitled tocoverage for those losses, rejecting numerousarguments asserted by the insurer.First, the court found that the policyholdersuffered “direct physical loss of or damageto property,” rejecting the contention thatsome physical alteration of or demonstrableharm to property is required. The court heldthat “loss” reasonably encompasses the lossof use of property. The court further foundthat the loss of use of property was “direct”and “physical” because the spread o

Indiana, Inc. v. Continental Western Ins. Co., 165 N.E.3d 82 (Ind. 2021). G&G Oil, the victim of a ransomware attack, paid approximately 35,000 to regain access to its computer systems. Continental denied coverage for the loss, noting that G&G Oil declined computer hacking coverage. G&G Oil sued Continental and the parties cross-