Transcription

MBA (Financial Management)University of CalcuttaAdvisory BoardVice-ChancellorProfessor Sonali Chakravarti BanerjeePro Vice-Chancellor (Academic)Professor Dipak Kumar KarPro Vice-Chancellor (B.A. & Finance)Professor Minakshi RayRegistrarDr. Soumitra SarkarSecretary, UCACProf. Jayanti DasCo-ordinator, MBA in FinanceProfessor. Snehamay BhattacharyyaFirst Co-ordinator, MBA in FinanceProfessor Bhabatosh BanerjeeProf. Ratula Chakraborti,East Anglia UniversityDr. P.K.Ghosh,Former Professor of Commerce, Delhi School of Economics, Delhi University,and Former Vice-Chancellor, North Bengal University.Important DatesIssue and Receipt of Application Forms: 15.11.2018 (Thursday) to28.02.2019 (Thursday)Publication of the List of Eligible Candidates: 14.03.2019 (Thursday)Admit Cards (for GD & PI) to be distributed: 21.03.2019 (Thursday)Group Discussion & Viva Voce (at Kolkata): 04.04.2019 (Thursday)Publication of list of Successful Candidates: 25.04.2019 (Thursday)Admission to be completed by: 30.05.2019 (Thursday)Inauguration and Commencement of the Class: 01.07.2019 (Monday)Prospectus 2019-21 q 1

Our Faculty MembersNameQualificationsDesignation3.Prof. Swagata SenM.Com., Ph.D., AICWAProfessor4.Prof. Malayendu SahaM.Com., Ph.D., AICWAProfessor5.Prof. Dipti Kumar ChakravortyM.Com., Ph. DProfessor6.Prof. Dhrubaranjan DandapatM.Com., Ph.D., AICWAProfessor9.Prof. Jadab Krishna DasM.Sc. (Stat), Ph.D.Professor10. Prof. Rajib DasguptaM.Com., M.Phil. Ph.D.Professor8.M.Com, Ph.D.Professor12. Prof. Asish K. SanaM.Com. Ph.DProfessor15. Prof. Siddhartha Sankar SahaM. Com., Ph.D.Associate Professor11. Prof. Snehamay BhattacharyyaM.Com.,Ph.D., ACAProfessor (Coordinator)13. Prof. Tanupa ChakrabortyM.Com., M.Phil., Ph.D., ACSAssociate Professor14. Dr. Sajal DasM. Com., M.B.A., Ph.D.Associate Professor16. Dr. Ram Prahlad ChoudharyM. Com., M.B.A., Ph.D.Assistant Professor17. Dr. Bikram SinghM.Com., M.Phil., Ph.D.Assistant Professor18. Mr. Pema LamaM.Com., M.PhilAssistant Professor19. Mr. Atanu PramanickM.Com., ACSAssistant Professor20. Dr. Bappaditya BiswasM.Com., M.Phil; Ph.DAssistant Professor21. Dr. Swapan SarkarM.Com., M.Phil, Ph.D, CMA,Assistant ProfessorCFA, MFS22. Md. Sarique ImrozeM.Com.Assistant Professor23. CA Anandaraj SahaM.Com., ACAAssistant ProfessorProf. Kanika ChatterjeeProspectus 2019-21 q 2

Some of our Visiting FacultiesNameCurrent DesignationProf. Ashis BhattacharyyaFinance and Control AreaInstitution to whichattachedIMIProf. Ashok BanerjeeFinance and Control AreaIIMCProf. Amitava SarkarDirectorIISWBMProf. Kalyan RoyHead, MBAIISWBMProf. R.P.BanerjeeDirectorEIILMProf. Tanmoy DattaDirector, MBATripura UniversityProf. Sunil GandhiDepartment of CommerceUniversity of KalyaniProf. Pranab BhattacharyaFormerly of Commerce DepttUniversity of KalyaniProf Satyajit DharDepartment of MBAUniversity of KalyaniProf. Sharmistha BanerjeeDepartment of MBMUniversity of CalcuttaProf. Ananda Mohan PalDepartment of MBMUniversity of CalcuttaProf. Munis KumarDept. of Financial StudiesUniversity of DelhiProf. D.V. RamanaAccounting & FinanceXIM, BhubaneswarProf. Ranjan K. BalDean, P.G. CommerceUtkal University,BhubaneswarMr. Timir Baran ChatterjeeDIC India Ltd.Vice-President & Company SecretaryMr. Harijiban BanerjeeDirectorSenbo EngineeringLtd.Mr. Subrato GhoshGeneral Manager, Marketing (ER)IOCLMr. Malay SenguptaChairman & MDMSTC Ltd.Dr. Melkote ShivaswamyAccounting & FinanceBall State University,USAProf. Rajendra SrivastavaAuditing & Information CentreUniversity of Kansas,USAProf. Shyam SunderYale School ofManagement, USAEconomics, Management& AccountingProspectus 2019-21 q 3

About the Commerce DepartmentThe Department of Commerce, University of Calcutta, from its inception in 1922, has traverseda long way before resting on the laurels of becoming the first UGC-acclaimed Centre ofAdvanced Study (CAS) among Commerce Departments of UGC-approved Indian universities. TheDepartment takes pride in its commendable performance vis-à-vis major developmental indicatorssuch as student intake, number of teachers, published research work, updated curricula andcourseware. Since a long time, the Department has been utilizing the services of numerousguest faculty members drawn from both academic institutions and industrial organizationsof repute. At present, it has 20 whole time teachers and 39 guest faculty members. Many ofthe distinguished faculty members have done Ph.D. and are members of various professionalinstitutions. Some of them have also travelled abroad for attending national and internationalseminars and conferences.The Department, in keeping with the advancements in different branches of Commerceeducation, has revised the curriculum from time to time to make it compatible withcontemporary challenges in the world of business practice. The immense popularity of the M.Comprogramme among students compels the Department to hold classes both, during the Day andthe Evening shifts. The department also runs a M.Phil programme since 1988.The Ph.D. programme of the Department is one of its strongest areas. A large number ofresearchers have got their Ph.D. degrees in accounting, finance, management and other alliedareas in commerce under the supervision of distinguished members of the faculty. At present,many research scholars are carrying on research work in various fields of studies under theguidance of faculty members.The Department publishes a refereed bi-annual journal, Business Studies (ISSN 0970-9657),based upon contributions from reputed academicians and researchers across the country.Research and teaching performance of the teachers of the Department had earned all Indiarecognition leading to sanction of Special Assistance Programme by the University Grantscommission in 1987. The third phase of the SAP concluded in March 2009. A number of researchvolumes have been published by the Department under this programme during the last two phases.National Seminars and Conferences on contemporary issues are held periodically in each year. InApril 2005, the Department in recognition of its contribution to academic and research activitieswas granted financial support under ASIHSS—an Infrastructure Development Programme,by the University Grants Commission. Since April 2009 the Department has earned the uniquedistinction in the country by being awarded the Centre of Advanced Study (CAS).Aware of the pressing need of the hour to have a Masters Degree in Finance, theDepartment launched a two-year full-time Master of Business Administration in Finance (MBA.in Finance) in September 2005 renamed, as per UGC direction, as MBA(Financial Management)from 2017. This programme has proven successes both in academic attainments and in placement.The fifteenth batch of students (2019-2021) will be admitted. Particulars about the course structure,fees payable and the Regulations are given overleaf for information of the interested students.The course adopted Choice Based Credit System (CBCS) and Grading System from theSession: 2018-20)Prospectus 2019-21 q 4

MBA (Financial Management)1.Name of the Course :A two-year post-graduate degree course called Master of Business Administration (FinancialManagement) or MBA(Financial Management).2.Course Objectives:To provide high quality education in business finance to the students who are expectedto: join industry and business seek entrepreneurial or self-employment positions pursue research and teaching as a career.3.Intake:38 Indian students, plus 5 foreign students, at the beginning of the first semester4.Eligibility: Candidates must have qualified in CAT, 2018 or MAT, June 2018, September 2018 andDecember 2018 Selection will be based on an overall score comprised of the following:(i)(ii)(iii)(iv)(v)Past academic achievementsCAT or MATGroup Discussion (G.D.)InterviewWork experienceTotal::::::100 marks50 marks20 marks20 marks10 marks200 marksN.B. The Department may screen applications based on weighted scores of (i) and (ii)above for GD and interview.5.On Eligibility Criteria (Group Discussion and Interview):(a) Group Discussion (20 marks)i.A topic will be written on the board for the candidates [Total number of candidateswould be divided into several convenient groups].ii. The candidates will get two minutes for jotting down relevant points on the topic[preparatory time].iii. Candidates, on getting signal from the faculty coordinator, will participate the groupdiscussion for 20 minutes.Prospectus 2019-21 q 5

iv. Evaluation of the candidates will be made with respect to the following criteria:Communication: 4marksAnalysis: 4marksParticipation: 4marksLeadership: 4marksTeamwork: 4marksTotal: 20 marksv.For holding the G.D. there will be a team of 3 members, of which at least one will befrom outside the Department of Commerce.vi. Marks given by the panel members for G.D. may be reviewed, if necessary, by theCoordinator to reduce diversity.vii. Marks given by each of the expert members will be taken into consideration indetermining the average marks of each student in G.D.(b) Interview (20 marks)i. For final interview there will be one panel of experts comprising:q Coordinator of the course (Convener)q Dean of the Facultyq At least two experts from industry nominated by the Vice-Chancellorii. In the viva voce, candidates will be evaluated with regard to the following criteria :General and subject knowledgeCommunication ability and personalityTotal:::10 marks10 marks20 marksG.D. and viva will be held in the Department of Commerce, Calcutta University.6. Application Money (Prospectus & Form):Indian StudentsRs.1,000 (Rs.500 for S.C / S.T candidates of West Bengal only)Foreign Students US 100Candidates may download the application form including the prospectus and send it bypost, along with a Demand Draft of Rs. 1,000/- (Rs.500 for S.C / S.T candidates ofWest Bengal only) payable in Kolkata, in favour of “Coordinator, MBA in Finance,Calcutta University”7.Course Fee:Indian Students : Rs. 40,000 per semesterForeign Students : US 2,000 per semesterIn addition, students will have to pay for course materials of Rs. 8000/-per annum.Caution Deposit (refundable on completion of the course):Indian Students : Rs. 10,000Foreign Students : US 1,000Prospectus 2019-21 q 6

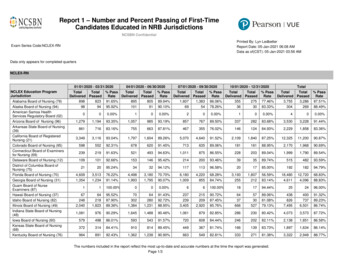

9.Total Amount Payable:First Year(i.e., at the time of admission)for Indian students Rs.98,000 [Course fee Rs. 80,000 (forSemester I & II) CautionDeposit 10,000/- Study material 8,000] & for foreign students US 5000 (Course FeeUS 4000 for Semester I & II Caution Deposit US 1000)Second Yearfor Indian students Rs. 88,000/- (Course fee Rs. 80,000 for Semester III & IV Studymaterial, Rs.8000) for foreign students US 4,000 Semester III & IV).10. Classes will be ordinarily held at the Asutosh Building, College Street Campus, CalcuttaUniversity. The classes are held in day session11. Placement:The Department has been maintaining rapport with many commercial and industrialorganizations through its former students who are well placed. Placement will largelydepend on the value addition of the students, the opportunities available in theeconomy and the efforts of both the students and the Department.The placement of the earlier batches of students is extremely encouraging. Our studentsobtained good offers from IDBI, Dena Bank, Reliance Industries, Axis Bank, AllahabadBank, United Bank of India, Canara Bank, HSBC, HDFC Bank, Yes Bank, Bank ofIndia, Corporation Bank, Bank of Baroda, Union Bank of India, UCO Bank, SimplexInfrastructure, Haldia Petrochemicals, CMIE, Bandhan Bank, Titagarh WagonsLtd.,PWC, Senbo, Zacks Equity Research and SREI. The Department expects many otherreputable organizations to collaborate in the near future.12. Hostel accommodation: Availability of hostel accommodation will be on acompetitive basis as per University rules. Private accommodations are also available inthe City at a reasonable cost.13. Basic Structure (papers are of 100 marks or 4 credits each):No. of PapersFirst yearSemester I8 core papersSemester II8 core papersSecond year16Semester III8 core papersSemester IV4 DSE papers4 core papers*16* includingCompulsory Dissertation 2Comprehensive Viva132The course adopts Choice Based Credit System (CBCS) and Grading System from the Session: 2018-20.Prospectus 2019-21 q 7

REGULATIONS1. General1.01. The course of study leading to the Post-graduate Degree in MASTER OF BUSINESSADMINISTRATION (FINANCIAL MANAGEMENT) of the University of Calcutta shallbe conducted by the concerned Post Graduate Department / Constituent Colleges.1.02. The University shall lay down from time to time such subsidiary rules of admission/ coursesof study and methods of examination as may be deemed necessary for the maintenance ofadequate standards of University Education.1.03. The medium of instruction of the course shall be in English and the candidate shall have toanswer the examination paper including admission test in English only.2. Duration of the Course2.01. Two full academic years, which will include theoretical papers, project and dissertationwork, divided into four semesters.3. Admission3.01. The minimum qualification for admission to the course is a Bachelor’s Degree (10 2 3system) with Honours in Arts / Science / Commerce / Business Administration orBachelor’s Degree (10 2 4 system) in Engineering / Technology / Medical Science/ Law/ Professional Courses / or its equivalent from any University recognized by theUniversity of Calcutta.3.02. The last date for the receipt of applications, the last date for admission, the date ofcommencement of classes of the MBA (Financial Management) course shall be fixed eachyear by the University.3.03. The applicants for the admission to the MBA (Financial Management) course shall berequired to undergo UGC specified national entrance tests like CAT, MAT, XAT, JEMATor any recognised University admission test, etc. as decided by the concerned Departmenteach year.3.04. The candidates short-listed on the basis of certain cut-off marks in the above mentionedselection test shall be required to appear for Group Discussion and Personal Interview tobe conducted by a Selection Committee consisting of i) all full time faculty members andii) at least two external experts nominated by Departmental Committee / Advisory Board/Faculty Committee and approved by the Vice-Chancellor. The Head of the Department /Coordinator / Director shall be the ex-officio Chairman and the Secretary, UCAC shall bean ex-officio member of the selection committee.3.05. Each member present in the Selection Committee as stated in clause 3.04 will awardmarks to each candidate for Group Discussion & Personal Interview separately. The finaladmission test scores will be computed on the basis of the average of the marks awardedby all the members present. Marks will be awarded on the basis of various criteria as setby the Selection Committee. The candidates will be selected from that list of final scores inorder of merit.3.06. Total Number of seats (excluding re-admission) for the course would be as approved byA.I.C.T.E. and/or competent authority including reserved category as per University /Government rules and regulations.Prospectus 2019-21 q 8

3.07.Admission of reserved categories students may be admitted as per existing University rulesand regulations, if the test is conducted by the University / constituent colleges.3.08. After the selection for the admission to the MBA (Financial Management) course, thecandidate shall, within the date fixed by the MBA (Financial Management) Departmentdeposit the necessary fees prescribed for the purpose. If the candidate fails to deposit thefees within the stipulated time, his/ her selection shall automatically be cancelled. Such acandidate shall not be admitted to the course unless fresh order for selection is made or anextension of the date of payment is granted by the competent authority.3.09. Admission to the MBA (Financial Management) course shall only be in the first semesterof the first year of the two-year academic programme.4. Course of Study4.01. A candidate admitted to the MBA (Financial Management) course shall register himself/herself as a student of the University of Calcutta/constituent college, as the case may be.4.02. The course of study for the MBA (Financial Management) course shall be two-year fulltime / three year part time course divided into four semesters / six semesters.4.03. Students admitted to the two-year/three year MBA (Financial Management) course shallpursue the regular courses of lectures, and other academic arrangements made for the twoyear/three year academic term.4.04. A student of the MBA (Financial Management) course shall not be permitted to seekadmission concurrently to any other equivalent or higher degree course in any university.4.05. A student shall be deemed to have pursued a regular course of study provided he/she hasattended at least 75 per cent of the lectures delivered in aggregate for each semester courseof study. If he/she has attended 65% but less than 75% of the total lectures delivered of his/her course of study treated as non-collegiate. Candidates attending less than 65% of totallectures delivered in a semester course of study will be treated as dis-collegiate.4.06. The attendance of a candidate shall be counted from the date on which the respectiveclasses begin/ or from the date on which he/she is admitted whichever is later.4.07. The University shall have the power to condone a deficiency in attendance, as per rule.4.08. A student who fails to pursue a regular course of study as stated in 4.05 to 4.07 may beallowed to take re-admission to the same course in the next year only. The re-admissionfees are to be decided by the respective departments/colleges (self-finance courses) to thesame course the next year only.4.09. Students of the two-year / three years Post Graduate Degree in MBA (Financial Management)course shall have to pursue a course of study of the papers distributed into four semestersor six semesters.The total marks of the course will be 3200 with the following semester-wise distribution.SemesterFirst SemesterSecond SemesterThird SemesterFourth SemesterTotalNo. of Papers0808080832Total Marks8008008008003200Prospectus 2019-21 q 9Total Credit32323232128

The course adopts Choice Based Credit System (CBCS) and Grading System. GradingSystem is provided in Annexure – I and the Syllabus under CBCS is shown in Annexure –IIFour Discipline Specific Elective (DSE) papers are offered during the fourth semester. Inshort, the semester-wise distribution of papers will be as follows:SemesterFirst SemesterSecond SemesterThird SemesterFourth SemesterPapers8 Core Papers (Paper No. CC1.1 to CC1.8)8 Core Papers (Paper No. CC2.1 to CC2.8)8 Core Papers (Paper No. CC3.1 to CC3.8)4 DSE Papers (Paper No. DSE4.1 & DSE4.4)4 Core Papers (Paper No. CC4.5 to CC4.8)4.10. Both the Syllabus under CBCS (shown in Annexure –II) and Grading System (provided inAnnexure – I) are amenable to changes by the Departmental Committee, Board of Studiesand Faculty Council from time to time.5. Examinations5.01. Semester Examinations in MBA (Financial Management) course shall be held within sixmonths in Kolkata and at such other places as shall be determined from time to time by theUniversity. The date of commencement of the examination shall be duly notified.5.02. In each academic session two semester course will be simultaneously conducted i.e. Iand III or II & IV for two different batches (for Day Session) and at the end of whichcorresponding semester examinations will be held. For the evening session, courses willbe distributed throughout the entire three-year period and in six semesters. However, thestudents of the evening session will appear for four semester examinations and their firstsemester examination will be held in the second year of their study period along with thefirst semester examination of the full time course.5.03. A student will be allowed to appear in a semester examination only after he/she completeshis/her regular MBA (Financial Management) course of study for that semester.5.04. 40% marks in any theoretical paper in any semester will be deemed as pass marks for thatpaper. A candidate who fails to secure 40% marks in any paper will be allowed to appearin that paper when the corresponding semester examination is held next. He / She will beallowed two such consecutive chances for each paper.5.05. Classes for the next semester course will start immediately as per notification by theconcerned Department.5.06. Students shall have to specialize, as applicable, in DSE papers, if any, offered in SemesterIV. Semester wise distribution of papers and the syllabus is provided in Annexure-II.5.07. Semester (I II III IV) examinations will be held in 3200 marks distributed in four/six semesters. 20% of marks in each theoretical paper of 100 marks / each module of 50marks will be reserved for internal assessment. The modalities of internal assessment shallbe decided by the concerned Department conducting the course.5.08. A candidate who fails in the viva voce examination / project / dissertation will have toreappear for the same when they are held next. He / she will be given two such consecutivechances.Prospectus 2019-21 q 10

5.09.A student will be declared to have passed the Course on the basis of the results in semestersI, II, III, IV examinations. The minimum qualifying marks for this will be 40 % in all thepapers. Students will be awarded Grades on the basis of credit weighted average gradepoints, where grade points for each course will be computed on the basis of percentage ofmarks as stated in Annexure – I. A student will be declared to have passed a Semester if atleast 40% marks (Grade P) is obtained in all the papers in that semester. A student will bedeclared to have passed the Course if at least 40% marks (Grade P) is obtained in all thepapers of the course fulfilling total 128 credits.5.10. Re-examination of only two papers per semester shall be allowed for the candidatesappearing at a semester examination as a whole provided he/she has secured at least 40%marks in aggregate in rest of the papers of that semester examination.5.11. The evaluation of field study, dissertation, project report and viva voce shall be conductedas decided by the Board of Studies / Advisory Committee.5.12. Candidates having passed as per 5.09 but scoring less than 60 per cent marks in theaggregate will be declared to have passed the examination in the 2nd class; those scoring 60% or more in the aggregate will be declared to have passed in the 1st class. A student willalso be declared to have been placed in the specified Grade based on his/her Final GPA asstated in Annexure – I.5.13. A candidate who fails to appear in one semester examination or in any paper in thatexamination may be allowed to appear for that examination /paper along with other semesterexamination (based on the syllabus in force at the time of examination) or separately whenthe corresponding examination is held next. He/she will be given next two consecutivechances.5.14. On the completion of the results the University shall publish a list of successful candidatesarranged in two classes and in order of merit.5.15. Each successful candidate shall receive his/her degree of MBA (Financial Management) inthe form of a certificate stating the year of passing and the class and Grade in which he/sheis placed along with FGPA5.16. In case any issue emerges in pursuance of this CSR or otherwise related to the CSR, thematter will be decided by the Departmental Committee and Board of Studies with theapproval of the Vice-Chancellor.5.17. This CSR of MBA (Financial Management) supersedes all other previous CSR of MBA(Financial Management) existing in any form.5.18. This CSR will be operative from 2018-2019 admitted batches of students onwards.Prospectus 2019-21 q 11

I.1:Annexure – I: Grading SystemGrade for a paper is specified as tVery GoodGoodAveragePassFailAbsent% of Marks90 – 10080 – 8970 – 7960 – 6950 – 5940 – 49Below 40Computation of Grade Point for a paper and Grade Point Weighted Average forSemesters and the Course:Grade Point GP % of marks in the paper10Grade Point Weighted Average GPA Weighted Average of GP of the papers where credit of the papers are the weights Sum total of Credit Weighted GPSum total of CreditsI.3: % CGP10SGPA is the Semester GPA i.e., the GPA of all the papers in one semesterCGPA is the Cumulative GPA i.e., the GPA of all the papers up to the currentsemester.FGPA is the Final GPA i.e., the GPA of all the papers of all the semesters of theCourse(i) Results under Grading System (where no GP is less than 4 in any paper)SGPA/CGPA/FGPA9 – 108 to less than 97 to less than 86 to less than 75 to less than 64 to less than 5GradeOEABCPMeaningOutstandingExcellentVery GoodGoodAveragePass(ii) Where GP is less than 4 in any of the papers, Grade will be F meaning Fail inSemester / Course Results.(iii) Where a candidate is absent in any of the papers, Grade will be Ab meaningAbsent and result of the Semester / Course will be Fail.Prospectus 2019-21 q 12

Annexure IIMBA (Financial Management) CurriculumYEAR 1Semester ISr. No.PaperCC1.1 Macroeconomics and Business Environment (50 50)CC1.2 Managerial EconomicsCC1.3 Principles and Practice of Management andOrganisational Behaviour (50 50)CC1.4 Fundamentals of AccountingCC1.5 Direct and Indirect TaxesCC1.6 Statistical Techniques for Managerial DecisionsCC1.7 Management Information SystemCC1.8 Computer Applications in BusinessTotalSr. r IIPaperFundamentals of Marketing ManagementBusiness Regulatory FrameworkOperations ManagementInternational BusinessOperations ResearchManagerial AccountingFinancial ManagementResearch Methodology and Project Work (50 50)TotalFull ll ll Marks100100100100Credit444410041004YEAR 2Sr. No.CC3.1CC3.2CC3.3CC3.4CC3.5CC3.6Semester IIIPaperFinancial MarketStrategic ManagementBusiness Ethics and Corporate Governance (50 50)Corporate Financial Reporting and Financial StatementAnalysis (50 50)Strategic Cost Management and Investment Analysis (50 50)International Financial ManagementProspectus 2019-21 q 13

Sr. No.CC3.7CC3.8Sr. No.DSE4.1DSE4.2DSE4.3DSE4.4CC4.5CC4.6 &CC4.7CC4.8PaperSecurity Analysis and Portfolio Management (50 50)Financial EngineeringTotalFull Marks100100800Credit4432Semester IVPaperSelected Group Paper 1 (4.1A/4.1B)Selected Group Paper 2 (4.2A/4.2B)Selected Group Paper 3 (4.3A/4.3B)Selected Group Paper 4 (4.4A/4.4B)Risk Management: Tools and ApplicationsDissertationFull Marks100100100100100200Credit444448Comprehensive VivaTotal100800432Discipline Specific Elective GroupsGroup A (Corporate Finance)Sr. No.DSE4.1ADSE4.2ADSE4.3ADSE4.4APaperIndian Financial Institutions and Financial ServicesMergers, Acquisitions and Corporate RestructuringFund Management in Financial InstitutionsInternational AccountingGroup B (Banking and Insurance)Sr. No.DSE4.1BDSE4.2BDSE4.3BDSE4.4BPaperRegulatory Framework for Banking and Insurance InstitutionsManagement of Banking Products and ServicesManagement of Insurance Products and ServicesTreasury and Forex ManagementAcademic ScheduleSemester 1Semester 2Summer InternshipSemester 3Semester 4Final Results::::::Classes July – November 2019; Examination: December, 2019Classes January – May 2020; Examination:End May/Early June, 2020June – July ,2020Classes August – December 2020; Examination : Early January 2021Classes January – April 2021; Examination : May 2021by 30.06.2021Prospectus 2019-21 q 14

MBA (Financial Management)Department of CommerceSl. No.UNIVERSITY OF CALCUTTASl. No. .Affix stampsize Selfattested photoSession .Form sold by .Asutosh Building, Kolkata – 700 073Tel. No. (033) 2410071 (3 lines) (Extn. 337& 320)Fax : 91-033-241-3222Form of Application for Admission to MBA (Financial Management), (2019- 2021)Selection No. .Roll No. 1. (a) Full Name .(in block letters)(Surname)(First Name)(b) M/F . (c) Nationality . (d) SC/ST/OBC .(e) Physically Challanged . (f) Date of Birth.(g) Married/Single .*(Self Attested copies of the proof to be attached)2. (a) Father ’s/Guardian’s Name .(b) Occupation . (c) Gross Income (p.m.) Rs. .(c) Office Address .(d) PIN . (f) Tel. No./Fax .3. Mailing Address .PIN . Tel. No Resi. .Mob. .4. Permanent Address . PIN . Tel. No. .E – mail ID.5. (a) University Registration No. . of.(if already a student of Calcutta University)(b) Requirement of Hostel Accommodation (if admitted) : Yes/No .6. (a) Bank Draft No. .(Paya

Prof. D.V. Ramana Accounting & Finance XIM, Bhubaneswar Prof. Ranjan K. Bal Dean, P.G. Commerce Utkal University, . Aware of the pressing need of the hour to have a Masters Degree in Finance, the . Corporation Bank, Bank of Baroda, Union Bank of India, UCO Bank, Simplex Infrastructure, Haldia Petrochemicals, CMIE, Bandhan Bank, Titagarh .