Transcription

Tax briefJuly 2017Punongbayan & Araullo (P&A) is the Philippine memberfirm of Grant Thornton International Ltd.

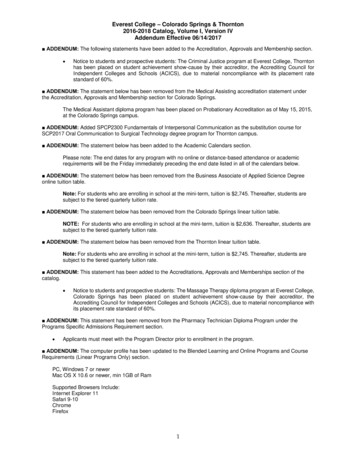

BIR ISSUANCESRMO 42 &BIR Form 2305 for claiming PWDs as dependents43-2017RMC 45- 2017Condonation of RPT of IPP facilitiesRMC 48-2017IRR on positions reserved for PWDsBIR RULINGSBIR Ruling 268& 269 - 2017Importation of cargo vessels for LPG transport/hauling services is VAT-exemptSEC OPINIONSSEC-OGCNo. 17-05Nationality requirement for an online English tutorial and driving schoolCTA DECISIONSCTA EB No. 1415 Validity of waiver cannot be questioned if both parties are in pari delictoCTA Case No.Documentation of input VAT from prior periods in a claim for VAT refund8859CTA AC No. 152 Dividends and income from money market placements from government ownedshares not subject to LBTCTA No. 8710Reckoning the prescription period to collect deficiency taxesCTA EB No. 8965 Refunding erroneously withheld taxes on income derived by foreign governmentCTA No. 8818Approval of request for reinvestigation suspends the 5-year prescription periodfor collectionCTA No. 8372Determination of prescriptive period for collectionCTA Crim.Proof of receipt of tax assessment required to prove willful non-paymentCase No. 0-394CTA EB Nos.Corporate personality is distinct from its owners1428 & 1439

BIR IssuancesBIR Form 2305 for claiming PWDs asdependents BIR Issuances BIR Rulings SEC Opinions CTA Decisions Highlight onP&A GrantThorntonservices(Revenue Memorandum Circular Nos. 42and 43-2017, June 14, 2017)5. Medical Certificate attesting todisability issued in accordance with theIRR of RA 10754; and6. Brgy. Certificate attesting to the factthat the PWD is living with the benefactor.BIR has issued a new version of Form2305 to accommodate the declarationof persons with disability (PWD) asdependents. The new version providesfor the columns for claiming of a PWDas dependent to entitle the taxpayer tothe additional exemption pursuant to RANo. 10754 (An Act Expanding the Benefitsand Privileges of PWD). The name andbirthdate of the qualified dependent shallbe encoded in Part III of the revised form.It is also important to tick the “Mark ifPWD/Mentally/Physically Incapacitated”box and indicate the PWD IdentificationNumber.Employers shall ascertain if the claimedPWD qualifies as an additional dependentby satisfying the following conditions,regardless of age:1. Filipino citizen;2. Within 4th civil degree of consanguinityor affinity to the taxpayer/benefactor;3. Not gainfully employed; and4. Chiefly dependent upon and living withthe taxpayer/benefactor.To claim the PWD as dependent, thefollowing documents shall be submitted bythe employees to their employers, for thefirst year of claiming the exemption andthree years thereafter or upon renewal ofthe PWD ID whichever comes first:1. Duly accomplished BIR form No. 2305;2. Photocopy of PWD Identification Cardissued by the PDAO or the C/MSWDO ofthe place where the PWD resides or theNCDA;3. Sworn Declaration/ Identification ofQualified Dependent PWD, Support andRelationship;4. Birth Certificate of PWD;(Revenue Memorandum Circular No. 452017, June 20, 2017)Tax brief – July 2017The maximum number of qualifieddependents remains at four (4).Condonation of RPT of IPP facilitiesBIR has circularized the full text ofExecutive Order No. 19, Reduction andCondonation of Real Property Taxes(RPT) and Interests/Penalties assessedon the Power Generation Facilities ofIndependent Power Producers (IPP) underBuild Operate Transfer (BOT) Contractswith Government-Owned and ControlledCorporations (GOCC). This is pursuant toSec. 277 of RA No. 7160 which vests poweron the President to condone or reduce RPTand interest for any year.Local governments have taken theposition that IPPs are not entitled to thereal property tax exemption privilege ofGOCCs. These LGUs have assessed theIPPS for deficiency RPT and threatenedenforcement actions such as publicauction of the properties. It was notedthat substantial part of the RPT beingcharged against affected IPPS havebeen contractually assumed by NPC,PSALM and other GOCCs. EO No. 19seeks to address this concern on GOCC’scontractual assumption of the IPP’s taxliabilities which has a negative impacton their financial stability, government’sfiscal consolidation efforts and energyprices.Under the EO, RPT and any special leviesaccruing to the Special Education Fund for2015 and 2016 on the property, machineryand equipment used by IPPs for electricityproduction are reduced. Instead of theassessment levels provided under the LocalGovernment Code of 1991, computationis based on an assessment level of 15% ofthe fair market value (FMV) of property,machinery and equipment depreciatedat 2% per annum less any amount paidby IPPs. Furthermore, all interests ondeficiency RPT liabilities are condoned.RPT payments in excess of the reducedamount for 2015 and 2016 will be appliedto the succeeding years.IPPs which are not GOCCs are notentitled to the abovementioned privileges.3

BIR IssuancesIRR on positions reserved for PWDs(Revenue Memorandum Circular No. 482017, June 30, 2017) BIR Issuances BIR Rulings SEC Opinions CTA Decisions Highlight onP&A GrantThorntonservicesBIR circularized the IRR of RA No. 10524, anAct Expanding the Positions Reserved forPersons with Disability (PWD), amendingRA No. 7277, Magna Carta for PWDs.Hereunder are the salient provisions:1. Employment of PWDsAll qualified PWDs should be given equalopportunity in the selection process andsuitable employment and with the sameterms and conditions of employment,benefits and compensation as the nonPWD employee;All government agencies should reserveat least 1% of their regular and nonregular positions available to PWDs.Private corporations with more than 100employees are encouraged to do thesame. In the determination of the fitnessof the PWD, qualification standardsestablished for the positions should applyto all PWD applicants as well as labor lawsgoverning employment in both governmentand private entities.to the PWD employees. To qualify for theincentive, the company should secure aDOLE certification on its employment ofthe PWD and retain proof that PWD isaccredited by DOH and DOLE as to hisskills, qualification and disability.Private entities shall also be entitledto an additional deduction from netincome equivalent to 50% of directcost of improvement or modification tophysical facilities to provide reasonableaccommodation to PWDs. However,this does not apply to improvements offacilities under BP Blg. 344.A simplified system for providing taxincentives to private entities will bedeveloped by DOLE, DOH, NCDA andthe National Anti-Poverty Commission –Persons with Disability Sectoral Council(NAPC-PWDSC).3. The IRR will be effective 15 daysafter complete publication in 2 nationalnewspapers.2. Incentives for Private CorporationsPrivate entities employing PWDs shallbe entitled to additional deduction fromgross income equivalent to 25% of thetotal amount paid as salaries and wagesTax brief – July 20174

BIR RulingsImportation of cargo vessels for LPGtransport/hauling services is VATexempt BIR Issuances BIR Rulings SEC Opinions CTA Decisions Highlight onP&A GrantThorntonservices(BIR Ruling Nos. 268 and 269-2017, June5, 2017)Section 109 (1) (T) of the 1997 TaxCode, as amended, provides that sale,importation or lease of passenger orcargo vessels and aircraft, includingengine, equipment and internationaltransport operations shall be exemptfrom the value-added tax.In relation to the above-cited provision,Section 4.109-1 (B) (1) (t) of RR No. 162005 as amended by RR No. 15-2015,provides that VAT exemption for theseimportations shall be subject to thestrict compliance of the conditionscontained in the letter of approvalissued by Maritime Industry Authority(MARINA) for the importation of thevessel.In the case at bar, the vessel is newlyimported and is backed up with anauthority to import issued by MARINA.Hence, it is assumed that the vesselcomplies with the conditions imposedby MARINA.Tax brief – July 20175

SEC OpinionsNationality requirement for an onlineEnglish tutorial and diving school BIR Issuances BIR Rulings SEC Opinions CTA Decisions Highlight onP&A GrantThorntonservices(SEC-OGC Opinion No. 17-05, June 8,2017)Educational institutions are subject to the40% foreign ownership requirement underthe Constitution. There are, however,exceptions such as in the case of schoolsestablished by religious orders andmission boards, and those established forforeign diplomatic personnel and theirdependents and for other temporaryresidents.technical vocational education, hence,under the jurisdiction of TESDA. It followsthat, being an educational institution, itmust comply with the 60%-40% Filipinoforeign ownership requirement, subject tolimitation and exceptions prescribed bylaw.The rule also applies if the school providesdiving lessons, and regardless of whetherthe students are Filipinos or foreigners, orwhether the courses are conducted onlineor within a regular classroom atmosphere.The entity subject of the opinion is adomestic corporation catering purelyto foreign clients abroad who wish toenhance their English language skillsthrough informal on-line tutorial classinstruction.Based on previous SEC opinions, learningthe English language is considered askill proficiency to which a diploma orcertificate can be issued by the school.As such, the school can be considered asengaged in formal technical-vocationaleducation or training activities, hence,under the jurisdiction of TESDA.Applied to the case of the companyoffering online courses, if the schoolshall issue any Certificate of Trainingor Diploma for Program Completion totheir successful on line students, it willbe considered as engaged in formalTax brief – July 20176

CTA DecisionsValidity of waiver cannot be questionedif both parties are in pari delicto BIR Issuances BIR Rulings SEC Opinions CTA Decisions Highlight onP&A GrantThorntonservices(Hon. Commissioner Kim S. Jacinto-Henares,Hon. Ricardo B. Espiritu, Revenue DistrictOfficer, RDO 50 v. IP Contact CenterOutsourcing, Inc., CTA EB No. 1415 re: CTACase No. 8537, June 5, 2017)A waiver of the statute of limitations must becarefully and strictly construed consideringthat it is a derogation of the taxpayer’sright to security against prolonged andscrupulous investigations. Hence, it shouldstrictly follow the format and requisites asprescribed in BIR issuances.However, if both the BIR and the taxpayerdid not challenge the waiver’s defect inorder to pursue their own interest, they arealready estopped from raising the issue ofthe waiver’s defect.In this case, the first waiver was issuedbeyond the prescription period. TheCourt, however, noted that, by virtue ofthe waiver, the taxpayer was given time tosubmit additional documents and argueits case. It was also able to defer paymentof the assessed taxes. Yet, the taxpayerchallenged the validity when the effect isnot in its favor. The BIR, on the other hand,despite having knowledge of the rulesTax brief – July 2017governing waivers, did not raise the issueon the defect and proceeded to issue anassessment. Considering that a waiver ofstatute of limitations is, in law and in fact,a bilateral agreement between the CIRand the taxpayer, both of them should thusbe held responsible in ensuring that theiragreement faithfully complies with the law.Failing which, they should both suffer theconsequences.Documentation of input VAT from priorperiods in a claim for VAT refund(BJ Well Services Company (Philippines),Inc. v. Commissioner of Internal Revenue,CTA Case No. 8859, June 5, 2017)In order to prove that the taxpayer applyingfor refund has excess unutilized input VATin the current year, it must also prove thevalidity of its excess input VAT from priorperiods which were carried forward andutilized as credit against current output VAT.Hence, in a claim for refund, it is importantfor the taxpayer to prove that it has enoughprior year’s excess input tax credits whichare valid to cover its output tax liability.Pursuant to Section 110 (A) (1) and (B), inputtax is creditable against the output tax ifit is evidenced by a VAT invoice or officialreceipt. Failure to support prior year’s inputVAT with the corresponding invoices andofficial receipts can result to a denial of theclaim for refund of input VAT from currentperiod.Tax refunds/credits are construed strictlyagainst the taxpayer. Tax refunds are inthe nature of tax exemptions, hence thetaxpayer has the burden of proof throughsubmission of evidence that he hascomplied with the requirements in the NIRCand revenue regulations.Dividends and income from moneymarket placements from governmentowned shares not subject to LBT(Toda Holdings Inc. v. City of Davao andHon. Rodrigo S. Riola, in his official capacityas the City Treasurer of Davao City, CTA ACNo. 152, June 14, 2017)Section 133 (o) of the Local GovernmentCode (LGC) limits the taxing powers oflocal government units (LGUs). No localbusiness taxes (LBTs) shall be imposed ontaxes, fees or charges of any kind on theNational Government, its agencies andinstrumentalities, and LGUs.In this case, the LBT was imposed on thedividends and money market placementearnings from the dividends derived fromthe San Miguel Corporation (SMC) shares.7

CTA Decisions BIR Issuances BIR Rulings SEC Opinions CTA Decisions Highlight onP&A GrantThorntonservicesSince the SMC shares are owned bythe government, any earnings of theSMC shares therefore belong to thegovernment. Any local tax imposed onSMC, is deemed imposed on the nationalgovernment.within 3 years after last day prescribedby law for the filing of the return. Further,Section 223 provides that the BIR has 3years after issuance of the assessmentwithin which to collect tax by distraint orlevy or by a proceeding in court.This is clearly in violation of Section 133(o) of the LGC. Hence, the erroneouslypaid local business tax must be refunded.In the case at bar, the taxpayer was issuedan assessment which it protested. The BIRapproved the request for reinvestigationbut subsequently issued a Collection Letterfor the deficiency taxes. The Collectionletter can be constituted as the finaldecision of the BIR on the protest/requestfor reinvestigation. Hence, the threeyear-period to collect the deficiency taxassessments should be counted from thisdate. Two years after issuing the collectionletter, the BIR issued a Warrant of Distraintand Levy (WDL). A Final Notice BeforeSeizure (FNBS) was later issued but beyondthe 3-years from the date of the CollectionLetter.Reckoning the prescription period tocollect deficiency taxes(Island Quarry and AggregatesCorporation v. Commissioner of InternalRevenue, CTA Case No. 8710, June 19,2017)A Final Assessment Notice and FormalLetters of Demand were received by thepetitioner, finding it liable for deficiencyincome tax, VAT, withholding tax oncompensation for TY 1995, 1996 and 1997.The issue at hand is whether the BIR’sright to collect the deficiency taxes arealready barred by prescription.The CTA decided that assessment for theyears 1995, 1996 and 1997 shall still begoverned by the 1977 Tax Code. Pursuantto Section 203 of the 1977 Tax Code,internal revenue taxes are to be assessedTax brief – July 2017The CTA ruled that prescription has alreadyset in. The period to collect had alreadyprescribed as more than 3 years hadpassed from the date of the issuance ofthe final decision (deemed the date of theCollection Letter), barring the BIR fromcollection of the said taxes.Refunding erroneously withheld taxes onincome derived by foreign government(GIC Private Limited v. Commissioner ofInternal Revenue, CTA Case No. 8965, June22, 2017)Under Sec. 32(B)(7)(a) of the NIRC,investment income of the following areexcluded from gross income and exemptedfrom tax: foreign governments; financing institutions controlled, ownedor enjoying refinancing from foreigngovernments or international or regional financialinstitutions established by foreigngovernments.Pursuant to the above provision, theCompany, as a financial institution whollyowned and controlled by the Government ofSingapore, is exempt from payment of the20% final withholding tax (FWT) on incomederived from investments in PhilippineT-Bonds. Consequently, the income taxcollected was erroneously collected and therefund was granted.To prove its entitlement to and the amountof refund due, the Company submitted thefollowing to the CTA:8

CTA Decisions1. Confirmations of Sale/TradeConfirmations44 and relevant BondExchange Offer issued by various banks asproof of its Philippine T-Bond holdings BIR Issuances BIR Rulings SEC Opinions CTA Decisions Highlight onP&A GrantThorntonservices2. Entitlement Report and Swift MT566Confirmation Advices issued by itscustodian to show the amount of interestincome earned and final tax withheld3. To prove the withholding and remittanceof the taxes, Bureau of Treasury’s (BTR)Statements of Taxes Withheld on theCoupon Due on the T-Bond Holdings ofCustodian and Journal Entry Vouchers(JEVs) covering the remittance of the FWTsto the BIR; Certificates of Final Tax Withheld(BIR Forms No. 2306) issued by the BTR infavor of Citibank ; BIR Revenue AccountingDivision (RAD) Certification No. RAD-15- 06139-Cert. confirming receipt of the FWTs onthe Bureau of Treasury’s coupon paymentsto Custodian Account.Approval of request for reinvestigationsuspends the 5-year prescriptionperiod for collection(Prime Steel Mill, Incorporated v.Commissioner of Internal Revenue, CTACase No. 8818, June 21, 2017)Tax brief – July 2017Pursuant to Sec. 222 (c) of the NIRC, theBIR is given 5 years following the taxassessment to collect internal revenue taxby distraint or levy or by proceeding incourt. The Supreme Court held that theperiod for collection begins to run on thedate the assessment has been released,mailed or sent to the taxpayer. However,Sec. 223 provides that the running of thestatute of limitations will be interruptedonce the Commissioner grants thetaxpayer’s request for reinvestigation.The Supreme Court has clarified thatrequest for reinvestigation alone will notsuspend the statute of limitations. Clearly,two things must concur: there must be arequest for reinvestigation and the CIRmust have granted it.In this case, the taxpayer filed a letterdisputing the final assessment andsubmitting explanations and supportingdocuments to show that the assessmenthas no basis in fact. This was considereda request for reinvestigation by the BIRand approval was signified through theissuance of a Tax Verification Notice.Hence, the 5-year period to collect cannotbe reckoned from the date of the FAN.Determination of prescriptive periodfor collection(Acer Philippines, Inc. v. Commissioner ofInternal Revenue, CTA Case No. 8372, June23, 2017)Section 203 of the NIRC provides that taxshould be assessed within 3 years fromfiling of return or the last day prescribedby law for filing of return, whichever islater. Thereafter, the BIR has 5 years withinwhich to enforce collection of the taxassessed.In this case, no warrant of distraint and/or levy has been served upon the taxpayernor any judicial proceedings has beeninitiated by the BIR. However, when thetaxpayer protested the assessment at theCTA, the BIR was able to incorporate inits answer a prayer for the payment ofthe tax deficiency before the lapse of theprescriptive period.The CTA ruled that BIR’s answer withdemand for tax payment before the courtshould suffice to toll the running of theprescriptive period to collect, even withoutissuing a Warrant of Distraint and/or Levyor initiating judicial proceedings.9

CTA DecisionsProof of receipt of tax assessmentrequired to prove willful non-payment BIR Issuances BIR Rulings SEC Opinions CTA Decisions Highlight onP&A GrantThorntonservices(People of the Philippines v. Neil S.Bautista and Cecilia V. Aquino, CTACrim. Case No. 0-394, June 28, 2017)Criminal charges were filed against thepartners/co-owners of a company forfailure to pay the deficiency taxes froman assessment which has become finaland executory.According to the BIR, the Company didnot submit the required accountingrecords requested under the LOA. Hence,deficiency taxes were assessed basedon the best evidence obtainable. A PostReporting Notice (PRN), PreliminaryAssessment Notice (PAN) and FinalAssessment Notice (FAN) were issued andsent by registered mail, which were neverrefuted by the taxpayer.Since the assessment became final andexecutory, collection proceedings wereinitiated. Preliminary Collection Letterand Final Notice Before Seizure wereserved but the two owners cannot befound. A Warrant of Distraint and Levywas subsequently prepared and servedand was received by one of the twoowners. However, there were noTax brief – July 2017properties found of the Company.Hence, judicial proceedings were initiated, acriminal case was filed.However, the accused denied receipt of theassessment notices.The CTA cited provisions of the Tax Codewhich requires among others that, to beliable for the alleged crime, the accusedshould have willfully failed to pay thecorporate taxes. Willfulness is a state ofmind and it is imperative for the court tocarefully determine whether the failure topay the tax was willful or just due to nonreceipt of notice of assessment. Shouldthe taxpayer deny having received anassessment, the burden of proof lies uponthe BIR to prove by contrary evidence thatthe taxpayer received the assessment in thedue course of mail.To prove the fact of mailing, it is essentialto present the Registry Return Notices.However, the latter showed that the onewho received the PAN, FAN and FLD isneither the accused nor the duly authorizedrepresentative of the partnership. Hence,without any proof of receipt, the element ofwillfulness cannot be proven. The guilt ofthe accused has not been proven beyondreasonable doubt.Corporate personality is distinct from itsowners(The City of Makati and the City Treasurerof Makati City v. Cityland, Inc., CTA EB No.1428, Cityland, Inc. v. The City of Makatiand the City Treasurer of Makati City, CTAEB No. 1439, June 28, 2017)Sec. 129 of the Local Government Code(LGC) of 1991 vests LGUs with the power tocreate their own sources of revenue andlevy taxes, fees and charges.The City of Makati reclassified theCompany as a real estate developer fromits registration as real estate dealer, andsubjected it to a higher local business tax.Pursuant to Sec. 3A.02(m) of the revisedMakati Revenue Code, local business taxshall be imposed on owners or operators ofreal estate developer.The provision of the Makati Revenue Code isclear that the tax is imposed on the “ownersor operators”. While the Company can beconsidered a real estate developer, it is not,however, the owner or operator of the realestate developer. Sec. 131(s) of the LGCincludes in the definition of operator, theowner, manager, administrator or any otherperson who operates or is responsible forthe operation of a business establishment.10

CTA Decisions BIR Issuances BIR Rulings SEC Opinions CTA Decisions Highlight onP&A GrantThorntonservicesHowever, City of Makati failed to establishthat the Company is an operator of realestate developer. Hence, the subjectprovision in the Makati Revenue Code isinapplicable.On the contrary, Sec. 3A.02(m) of theRevised Makati Revenue Code is inviolation of Sec. 146 of the LGC whichprovides that “the tax on a business mustbe paid by the person conducting thesame”. A corporation has a separateand distinct personality apart fromits directors, officers or owners; mereownership by a single stockholder or byanother corporation of all or nearly allof capital stock is not sufficient groundfor disregarding the separate corporatepersonality. The Court, however, notedthat it does not have the power to deletethe “owners and operators” clausebecause such authority belongs to theSangguniang Panglungsod ng Makati.Tax brief – July 201711

Highlight on P&A Grant Thornton servicesCTA litigation support BIR Issuance BIR Ruling SEC Opinion CTA Decision Highlight onP&A GrantThorntonservicesTo avoid prolonged trials, we offer independent verification offinancial and other pertinent documents that are presented asevidence in tax cases/disputes or claims for refund before the Courtof Tax Appeals (CTA). This involves an evaluation of the completenessand validity of the documents and the correctness of the claimsinvolved or other representations made by the taxpayer based onthe requirements provided under applicable laws and regulations.If you would like to know more about our servicesEdward D. RoguelPartnerTax Advisory and ComplianceT 63 2 988 2255E Wowie.Roguel@ph.gt.com12

Tax brief is a regular publication of Punongbayan & Araullo(P&A) that aims to keep its clientele, as well as the generalpublic, informed of various developments in taxation andother related matters. This publication is not intended to bea substitute for competent professional advice. Even thoughcareful effort has been exercised to ensure the accuracyof the contents of this publication, it should not be used asthe basis for formulating business decisions. Governmentpronouncements, laws, especially on taxation, and officialinterpretations are all subject to change. Matters relating totaxation, law and business regulation require professionalcounsel.We welcome your suggestions and feedback so that the Taxbrief may be made even more useful to you. Please get intouch with us if you have any comments and if it would helpyou to have the full text of the materials in the Tax brief.Lina FigueroaPrincipal, Tax Advisory and Compliance DivisionT 632 988-2288 ext. 520E Lina.Figueroa@ph.gt.comgrantthornton.com.ph 2017 Punongbayan & Araullo. All rights reserved.Punongbayan & Araullo (P&A) is the Philippine member firm ofGrant Thornton International Ltd (GTIL). “Grant Thornton” refers tothe brand under which the Grant Thornton member firms provideassurance, tax and advisory services to their clients and/or refersto one or more member firms, as the context requires. GTIL andthe member firms are not a worldwide partnership. GTIL and eachmember firm is a separate legal entity. Services are delivered bythe member firms. GTIL does not provide services to clients. GTILand its member firms are not agents of, and do not obligate, oneanother and are not liable for one another’s acts or omissions.

BIR Issuances BIR Issuances BIR Rulings SEC Opinions CTA Decisions Highlight on P&A Grant Thornton services BIR Form 2305 for claiming PWDs as dependents (Revenue Memorandum Circular Nos. 42 and 43-2017, June 14, 2017) BIR has issued a new version of Form 2305 to accommodate the declaration of persons with disability (PWD) as dependents.