Transcription

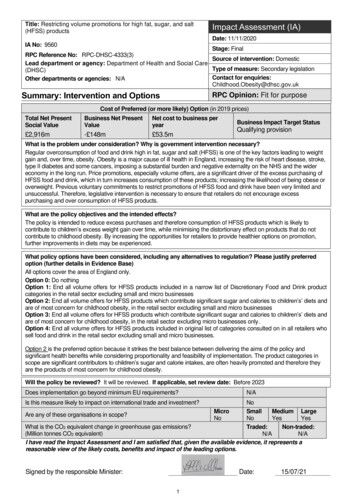

Title: Restricting volume promotions for high fat, sugar, and salt(HFSS) productsImpact Assessment (IA)Date: 11/11/2020IA No: 9560Stage: FinalRPC Reference No: RPC-DHSC-4333(3)Source of intervention: DomesticLead department or agency: Department of Health and Social CareType of measure: Secondary legislation(DHSC)Contact for enquiries:Other departments or agencies: N/AChildhood.Obesity@dhsc.gov.ukSummary: Intervention and OptionsRPC Opinion: Fit for purposeCost of Preferred (or more likely) Option (in 2019 prices)Total Net PresentSocial ValueBusiness Net PresentValueNet cost to business peryear 2,916m- 148m 53.5mBusiness Impact Target StatusQualifying provisionWhat is the problem under consideration? Why is government intervention necessary?Regular overconsumption of food and drink high in fat, sugar and salt (HFSS) is one of the key factors leading to weightgain and, over time, obesity. Obesity is a major cause of ill health in England, increasing the risk of heart disease, stroke,type II diabetes and some cancers, imposing a substantial burden and negative externality on the NHS and the widereconomy in the long run. Price promotions, especially volume offers, are a significant driver of the excess purchasing ofHFSS food and drink, which in turn increases consumption of these products; increasing the likelihood of being obese oroverweight. Previous voluntary commitments to restrict promotions of HFSS food and drink have been very limited andunsuccessful. Therefore, legislative intervention is necessary to ensure that retailers do not encourage excesspurchasing and over consumption of HFSS products.What are the policy objectives and the intended effects?The policy is intended to reduce excess purchases and therefore consumption of HFSS products which is likely tocontribute to children’s excess weight gain over time, while minimising the distortionary effect on products that do notcontribute to childhood obesity. By increasing the opportunities for retailers to provide healthier options on promotion,further improvements in diets may be experienced.What policy options have been considered, including any alternatives to regulation? Please justify preferredoption (further details in Evidence Base)All options cover the area of England only.Option 0: Do nothingOption 1: End all volume offers for HFSS products included in a narrow list of Discretionary Food and Drink productcategories in the retail sector excluding small and micro businessesOption 2: End all volume offers for HFSS products which contribute significant sugar and calories to children’s’ diets andare of most concern for childhood obesity, in the retail sector excluding small and micro businessesOption 3: End all volume offers for HFSS products which contribute significant sugar and calories to children’s’ diets andare of most concern for childhood obesity, in the retail sector excluding micro businesses only.Option 4: End all volume offers for HFSS products included in original list of categories consulted on in all retailers whosell food and drink in the retail sector excluding small and micro businesses.Option 2 is the preferred option because it strikes the best balance between delivering the aims of the policy andsignificant health benefits while considering proportionality and feasibility of implementation. The product categories inscope are significant contributors to children’s sugar and calorie intakes, are often heavily promoted and therefore theyare the products of most concern for childhood obesity.Will the policy be reviewed? It will be reviewed. If applicable, set review date: Before 2023Does implementation go beyond minimum EU requirements?N/AIs this measure likely to impact on international trade and investment?NoSmallMedium LargeAre any of these organisations in scope?NoYesYesWhat is the CO2 equivalent change in greenhouse gas emissions?Traded:Non-traded:(Million tonnes CO2 equivalent)N/AN/AI have read the Impact Assessment and I am satisfied that, given the available evidence, it represents areasonable view of the likely costs, benefits and impact of the leading options.MicroNoSigned by the responsible Minister:Date:115/07/21

Summary: Analysis & EvidencePolicy Option 0Description: Do nothing optionFULL ECONOMIC ASSESSMENTPrice BaseYear 2019PV BaseYear2020COSTS ( m)Time PeriodYears 25Net Benefit (Present Value (PV)) ( m)Low:High:Total Transition(Constant Price)YearsBest Estimate:Average AnnualTotal Cost(excl. Transition) (Constant Price)(Present nalOptionalBest EstimateDescription and scale of key monetised costs by ‘main affected groups’No costs have been monetised under this option. Businesses who currently continue to voluntarilyremove volume offers of certain HFSS products, and those currently offering volume promotions wouldbe expected to continue doing so.Other key non-monetised costs by ‘main affected groups’No non-monetised costs have been outlined under this option.BENEFITS ( m)Total Transition(Constant Price)YearsAverage AnnualTotal Benefit(excl. Transition) (Constant Price)(Present nalOptionalBest EstimateDescription and scale of key monetised benefits by ‘main affected groups’No benefits have been monetised under this option.Other key non-monetised benefits by ‘main affected groups’No non-monetised benefits have been outlined under this option. The benefits as a result of other policiesannounced from the ‘Childhood obesity: A plan for action’ or any other possible future actions by governmenthave not been monetised and considered in this option due to the considerable number of uncertainties. Theimpact SDIL has had on products in scope of this policy has been considered in the counterfactual but hasnot been factored into the calculations. This is due to the impact to benefits being less than 1% and tostreamline calculations, this has not been factored in.Key assumptions/sensitivities/risksDiscount rate (%)There are a number of implicit assumptions about the counterfactual that are key to the calculations for otheroptions relative to this: (1) industry’s use of volume promotions would stay roughly constant without thispolicy, (2) the effectiveness of volume promotions on HFSS products would stay roughly constant withoutthis policy, (3) the discounted costs of treating obesity-related conditions, and the impact on QALYs, isroughly constant over the 25-years projected in this analysis.BUSINESS ASSESSMENT (Option 0)Direct impact on business (Equivalent Annual) m:Costs:Benefits:Score for Business Impact Target (qualifyingprovisions only) m:Net:2

Summary: Analysis & EvidencePolicy Option 1Description: End all volume offers for HFSS products included in a narrow list of Discretionary Food and Drink productcategories in the retail sector excluding small and micro businessesFULL ECONOMIC ASSESSMENTPrice BaseYear 2019PV BaseYear 2020COSTS ( m)Time PeriodYears 25Net Benefit (Present Value (PV)) ( m)Low: OptionalTotal Transition(Constant Price)YearsHigh: OptionalBest Estimate: 2,488Average AnnualTotal Cost(excl. Transition) (Constant Price)(Present Value)4.8126LowHighBest Estimate4.6Description and scale of key monetised costs by ‘main affected groups’The expected transition costs to retailers include familiarisation costs ( 0.2m), product assessment costs ( 1m),knowledge sharing costs ( 1.5m) and IT system costs ( 2m). Over the 25-year appraisal period, retailers will also haveongoing product assessment costs, for new and modified products, which is estimated to be 6.3m. Retailers’ lost profitsare expected to be around 17.1m per year (direct cost), after considering temporary price cuts replacing volumepromotions and further sales offsetting (indirect benefit), retailers’ lost profit is expected to be around 2.6m per year(direct cost plus indirect benefit). Manufacturers’ lost profits are expected to be around 3m per year (direct cost plusindirect benefit). The enforcement cost to Government is expected to be 106k in the first year with an on-goingcost of 67k per year.Other key non-monetised costs by ‘main affected groups’A reduction in sales, and hence profits, for the suppliers of ingredients to the food and drink manufacturers of HFSSproducts has not been monetised due to it being a second order effect and therefore not in scope of the IA. Ifbusinesses, choose to reformulate their products, there may be additional indirect costs associated with this – althoughwe expect businesses to do this only if it increases their profits.BENEFITS ( m)Total Transition(Constant Price)YearsAverage AnnualTotal Benefit(excl. Transition) (Constant Price)(Present Value)LowHighBest Estimate2,614Description and scale of key monetised benefits by ‘main affected groups’Expected direct benefits are the health benefits that would accrue because of lower calorie consumption amongstoverweight and obese people – equivalent to 2,038m over the 25-year assessment period. Social care benefits wouldamount to 181m, NHS cost savings of 154m and reduced premature mortality would be expected to deliver anadditional 241m of economic output.Other key non-monetised benefits by ‘main affected groups’Consumers may experience an increase in consumer surplus as they no longer have to make extra purchases and arestill able to profit from price cuts. This is an indirect benefit as consumers should be spending less on HFSS products.There would also be an indirect non-monetised health benefits if manufacturers reformulate their HFSS products as aresult of the policy.Key assumptions/sensitivities/risksDiscount rate (%) 3.5/1.5%Key assumptions in the analysis are: (1) Retailers switch to using price cuts to promote HFSS products such that theaverage price of HFSS products previously sold on volume promotion will remain the same but sales are reduced, (2)Consumers will adopt compensatory behaviour meaning 40% of calories removed through this policy will be replaced bycalories from other products (3) Costs to industry are based on limited data on profit margins due to the commercialsensitivity of this information. (4) A discount rate of 1.5% is applied on health impacts and 3.5% on all other monetisedimpacts.BUSINESS ASSESSMENT (Option 1)Direct impact on business (Equivalent Annual) m:Costs: 44.4Benefits: NAScore for Business Impact Target (qualifyingprovisions only) m:Net: -44.43

Summary: Analysis & EvidencePolicy Option 2Description: End all volume offers for HFSS products which contribute significant sugar and calories to children’s’ dietsand are of most concern for childhood obesity, in the retail sector excluding small and micro businessesFULL ECONOMIC ASSESSMENTPrice BaseYear 2019PV BaseYear 220COSTS ( m)Time PeriodYears 25Net Benefit (Present Value (PV)) ( m)Low: 50High: 8,579Total Transition(Constant Price)YearsBest Estimate: 2,916Average AnnualTotal Cost(excl. Transition) (Constant Price)(Present Value)Low2.1 2.150High2112.6336Best Estimate4.65.8149Description and scale of key monetised costs by ‘main affected groups’The expected transition costs to retailers include familiarisation costs ( 0.2m), product assessment costs ( 1m),knowledge sharing costs ( 1.5m) and IT system costs ( 2m). Over the 25-year appraisal period, retailers will also haveongoing product assessment costs, for new and modified products, which is estimated to be 6.3m over 25 years.Retailers’ lost profits are expected to be around 20.6m per year (direct cost), after considering temporary price cutsreplacing volume promotions and further sales offsetting (indirect benefit), retailers’ lost profit is expected to be around 3.1m per year (direct cost-plus indirect benefit). Manufacturers’ lost profits are expected to be around 4.1m per year(direct cost plus indirect benefit). The enforcement cost to Government is expected to be 106k in the first year withan on-going cost of 67k per year.Other key non-monetised costs by ‘main affected groups’A reduction in sales, and hence profits, for the suppliers of ingredients to the food and drink manufacturers of HFSSproducts has not been monetised due to it being a second order affect and therefore not in scope of the IA. Ifbusinesses choose to reformulate their products, there may be additional indirect costs associated with this – althoughwe expect businesses to do this only if it increases their profits.BENEFITS ( m)Total Transition(Constant Price)YearsAverage AnnualTotal Benefit(excl. Transition) (Constant Price)(Present Value)Low0High8,915Best Estimate3,065Description and scale of key monetised benefits by ‘main affected groups’Expected direct benefits are the health benefits that would accrue because of lower calorie consumption amongstoverweight and obese people – equivalent to 2,390m over the 25-year assessment period. Social care benefits wouldamount to 212m, NHS cost savings of 180m and reduced premature mortality would be expected to deliver anadditional 283m of economic output.Other key non-monetised benefits by ‘main affected groups’Consumers may experience an increase in consumer surplus as they no longer have to make extra purchases and arestill able to profit from price cuts. This is an indirect benefit as consumers should be spending less on HFSS products.There would also be an indirect non-monetised health benefits if manufacturers reformulate their HFSS products as aresult of the policy.Key assumptions/sensitivities/risksDiscount rate (%) 3.5/1.5%Key assumptions in the analysis are: (1) Retailers switch to using price cuts to promote HFSS products such that theaverage price of HFSS products previously sold on volume promotion will remain the same but sales are reduced, (2)Consumers will adopt compensatory behaviour meaning 40% of calories removed through this policy will be replaced bycalories from other products (3) Costs to industry are based on limited data on profit margins due to the commercialsensitivity of this information. A discount rate of 1.5% is applied on health impacts and 3.5% on all other monetisedimpacts.BUSINESS ASSESSMENT (Option 2)Direct impact on business (Equivalent Annual) m:Costs: 53.5Benefits: NAScore for Business Impact Target (qualifyingprovisions only) m:Net: -53.54

Summary: Analysis & EvidencePolicy Option 3Description: End all volume offers for HFSS products which contribute significant sugar and calories to children’s’ dietsand are of most concern for childhood obesity, in the retail sector excluding micro businesses only.FULL ECONOMIC ASSESSMENTPrice BaseYear 2019PV BaseYear2020COSTS ( m)Time PeriodYears 25Net Benefit (Present Value (PV)) ( m)Low: OptionalTotal Transition(Constant Price)YearsHigh: OptionalBest Estimate: 2,881Average Annual(excl. Transition) (Constant Price)Total Cost(Present Value)9.8277LowHighBest Estimate31.2Description and scale of key monetised costs by ‘main affected groups’The expected transition costs to retailers include familiarisation costs ( 1.7m), product assessment costs ( 19m),knowledge sharing costs ( 2.9m) and IT system costs ( 7.7m). Over the 25-year appraisal period, retailers will alsohave ongoing product assessment costs, for new and modified products, which is estimated to be 102m over 25 years.Retailers’ lost profits are expected to be around 21.2m per year (direct cost), after considering temporary price cutsreplacing volume promotions and further sales offsetting (indirect benefit), retailers’ lost profit is expected to be around 3.2m per year (direct cost-plus indirect benefit). Manufacturers’ lost profits are expected to be around 4.2m per year(direct cost plus indirect benefit). The enforcement cost to Government is expected to be 163k in the first year withan on-going cost of 124k per year.Other key non-monetised costs by ‘main affected groups’A reduction in sales, and hence profits, for the suppliers of ingredients to the food and drink manufacturers of HFSSproducts has not been monetised due to it being a second order affect and therefore not in scope of the IA. This policycould impact the profitability of small businesses to the point of destabilising them due to the disproportional burden onsmaller businesses who may find it difficult to implement the policy. If businesses, choose to reformulate their products,there may be additional indirect costs associated with this – although we expect businesses to do this only if it increasestheir profits.BENEFITS ( m)Total Transition(Constant Price)YearsAverage AnnualTotal Benefit(excl. Transition) (Constant Price)(Present Value)LowHighBest Estimate3,158Description and scale of key monetised benefits by ‘main affected groups’Expected direct benefits are the health benefits that would accrue because of lower calorie consumption amongstoverweight and obese people – equivalent to 2,462 m over the 25-year assessment period. Social care benefits wouldamount to 219m, NHS cost savings of 186m and reduced premature mortality would be expected to deliver anadditional 291m of economic output.Other key non-monetised benefits by ‘main affected groups’Consumers may experience an increase in consumer surplus as they no longer have to make extra purchases and arestill able to profit from price cuts. This is an indirect benefit as consumers should be spending less on HFSS products.There would also be an indirect non-monetised health benefits if manufacturers reformulate their HFSS products as aresult of the policy.Key assumptions/sensitivities/risksDiscount rate (%) 3.5/1.5%Key assumptions in the analysis are: (1) Retailers switch to using price cuts to promote HFSS products such that theaverage price of HFSS products previously sold on volume promotion will remain the same but sales are reduced, (2)Consumers will adopt compensatory behaviour meaning 40% of calories removed through this policy will be replaced bycalories from other products (3) Costs to industry are based on limited data on profit margins due to the commercialsensitivity of this information. A discount rate of 1.5% is applied on health impacts and 3.5% on all other monetisedimpacts.BUSINESS ASSESSMENT (Option 3)Direct impact on business (Equivalent Annual) m:62.2Benefits: NAScore for Business Impact Target (qualifyingprovisions only) m:Net: -62.25

Summary: Analysis & EvidencePolicy Option 4Description: End all volume offers for HFSS products included in original list of categories consulted on in all retailerswho sell food and drink in the retail sector excluding small and micro businesses.FULL ECONOMIC ASSESSMENTPrice BaseYear2019PV BaseYear2020COSTS ( m)Time PeriodYears 25Net Benefit (Present Value (PV)) ( m)Low: OptionalTotal Transition(Constant Price)YearsHigh: OptionalBest Estimate: 3,364Average Annual(excl. Transition) (Constant Price)Total Cost(Present Value)6.4165LowHighBest Estimate4.6Description and scale of key monetised costs by ‘main affected groups’The expected transition costs to retailers include familiarisation costs ( 0.2m), product assessment costs ( 1m),knowledge sharing costs ( 1.5m) and IT system costs ( 2m). Over the 25-year appraisal period, retailers will also haveongoing product assessment costs, for new and modified products, which is estimated to be 6.3m over 25 years.Retailers’ lost profits are expected to be around 23m per year (direct cost), after considering temporary price cutsreplacing volume promotions and further sales offsetting (indirect benefit), retailers’ lost profit is expected to be around 3.5m per year (direct cost-plus indirect benefit). Manufacturers’ lost profits are expected to be around 4.6m per year(direct cost plus indirect benefit). The enforcement cost to Government is expected to be 106k in the first year withan on-going cost of 67k per year.Other key non-monetised costs by ‘main affected groups’A reduction in sales, and hence profits, for the suppliers of ingredients to the food and drink manufacturers of HFSSproducts has not been monetised due to it being a second order affect and therefore not in scope of the IA. Ifbusinesses, choose to reformulate their products, there may be additional indirect costs associated with this – althoughwe expect businesses to do this only if it increases their profits.BENEFITS ( m)Total Transition(Constant Price)YearsAverage AnnualTotal Benefit(excl. Transition) (Constant Price)(Present Value)LowHighBest Estimate3,529Description and scale of key monetised benefits by ‘main affected groups’Expected direct benefits are the health benefits that would accrue because of lower calorie consumption amongstoverweight and obese people – equivalent to 2,752m over the 25-year assessment period. Social care benefits wouldamount to 244m, NHS cost savings of 208m and reduced premature mortality would be expected to deliver anadditional 325m of economic output.Other key non-monetised benefits by ‘main affected groups’Consumers may experience an increase in consumer surplus as they no longer have to make extra purchases and arestill able to profit from price cuts. This is an indirect benefit as consumers should be spending less on HFSS products.There would also be an indirect non-monetised health benefits if manufacturers reformulate their HFSS products as aresult of the policy.Key assumptions/sensitivities/risksDiscount rate (%) 3.5/1.5%Key assumptions in the analysis are: (1) Retailers switch to using price cuts to promote HFSS products such that theaverage price of HFSS products previously sold on volume promotion will remain the same but sales are reduced, (2)Consumers will adopt compensatory behaviour meaning 40% of calories removed through this policy will be replaced bycalories from other products (3) Costs to industry are based on limited data on profit margins due to the commercialsensitivity of this information. A discount rate of 1.5% is applied on health impacts and 3.5% on all other monetisedimpacts.BUSINESS ASSESSMENT (Option 4)Score for Business Impact Target (qualifyingprovisions only) m:Direct impact on business (Equivalent Annual) m:Costs:59.8Benefits: NANet: -59.86

ContentsImpact Assessment (IA) . 1Summary: Intervention and Options . 1RPC Opinion: . 1Summary: Analysis & Evidence Policy Option 0 . 2Summary: Analysis & Evidence Policy Option 1 . 3Summary: Analysis & Evidence Policy Option 2 . 4Summary: Analysis & Evidence Policy Option 3 . 5Summary: Analysis & Evidence Policy Option 4 . 6Executive summary . 8Problem under consideration . 10Types of price promotions . 12Rationale for intervention . 12Policy context and options . 16Impact of promotions on sales and profits. 25Current composition of the market . 30Costs and benefits of options . 37Equivalent annual net direct cost to business (EANDCB) . 67Sensitivity and risk analysis . 76Specific Impact Tests . 83Annex A – DHSC Calorie Model . 93Annex B – HFSS Food Definition . 99Annex C – Products included in the Soft Drinks Industry Levy and the Calorie and SugarReduction Programmes . 101Annex D – Revised product categories in scope post consultation . 103Annex E – Consultation Response Summary . 105Annex F – Post Implementation Review . 1077

Executive summaryProblem and justification for action1. Childhood obesity is one of the biggest health problems this country faces1. Around a fifth of childrenin England are overweight or obese by the time they start primary school aged 4-5, and this rises toone third by the time they leave aged 10-112.2. Childhood obesity increases the risk of obesity in adulthood. Data shows an obese child is five timesmore likely to be an obese adult3. Obesity is a major determinant of ill health4, increasing the risk ofheart disease, stroke, type 2 diabetes and some cancers. This imposes a substantial burden on theNHS, with overweight and obesity costing the health service in England an estimated 5.1bn in2014/155. Some estimates place this cost higher. Obesity causes further costs to society throughpremature mortality, increased sickness absence and additional benefit payments.3. Obesity is caused by regularly consuming more calories than is expended. There is a consensus thatexcess calorie intake is the largest factor contributing to weight gain and obesity6.4. Price promotions, particularly volume promotions, have been found to drive excess consumption ofHFSS goods. Price promotions (volume and temporary price cuts) in the UK are the highest in Europe,accounting for around 34% of take-home food and drink expenditure7. Furthermore, higher sugar foodand drink items are more likely to be promoted and are more deeply promoted8 than lower sugar items.Government intervention is necessary to ensure businesses promote healthier environments andestablish shopping environments that do not encourage excess purchasing and consumption of foodand drink high in fat, sugar, salt and calories.Policy objective5. The restriction of volume promotions on HFSS food and drinks is intended to: Reduce overconsumption of HFSS products likely to lead to excess calorie intake and, over time,weight gain, while minimising the impact on food purchases that do not contribute to childhoodobesity; Shift the balance of promotions towards healthier options and maximise the availability of healthierproducts that are offered on promotion, to make it easier for parents to make healthier choiceswhen shopping for their families;1Time to Solve Childhood obesity: An Independent Report from the Chief Medical Officer, Professor Dame Sally Davies, rnment/uploads/system/uploads/attachment ty-october-2019.pdf (last accessed 05/03/2020)2NHS Digital (2019) National Child Measurement Programme- England, 2018/19: Tables3Simmonds M, Llewellyn A, Owen CG, Woolacott N. Predicting adult obesity from childhood obesity: a systematic review and meta-analysis.Obes Rev. 2016;17(2):95–1074Guh et al. (2009) The incidence of co-morbidities related to obesity and overweight: A systematic review and meta-analysis, BMC PublicHealth5Estimates for UK in 2014/15 are based on: Scarborough, P. (2011) The economic burden of ill health due to diet, physical inactivity, smoking,alcohol and obesity in the UK: an update to 2006–07 NHS costs. Journal of Public Health. May 2011, 1-9. Uplifted to take into account inflation.No adjustment has been made for slight changes in overweight and obesity rates over this period. We assume England costs account foraround 85% of UK costs.6Time to Solve Childhood obesity: An Independent Report from the Chief Medical Officer, Professor Dame Sally Davies, rnment/uploads/system/uploads/attachment ty-october-2019.pdf (last accessed 05/03/2020)7An analysis of the role of price promotions on the household purchases of food and drinks high in sugar, a research project for Public HealthEngland conducted by Kantar Worldpanel UK, 2020. Availble here: eduction-from-evidenceinto-actionIt is an update of Sugar Reduction: The evidence for action - Annexe 4: An analysis of the role of price promotions on the household purchasesof food and drinks high in sugar, Public Health England, rnment/uploads/system/uploads/attachment data/file/470175/Annexe 4. Analysis of price promotions.pdf (last accessed 05/03/2020).8An analysis of the role of price promotions on the household purchases of food and drinks high in sugar, a research project for Public HealthEngland conducted by Kantar Worldpanel UK, 2020. Availble here: eduction-from-evidenceinto-actionIt is an updat

assumptions in the analysis are: (1) Retailers switch to using price cuts to promote HFSS products such that the average price of HFSS products previously sold on volume promotion will remain the same but sales are reduced, (2) Consumers will adopt compensatory behaviour meaning 40% of calories removed through this policy will be replaced by