Transcription

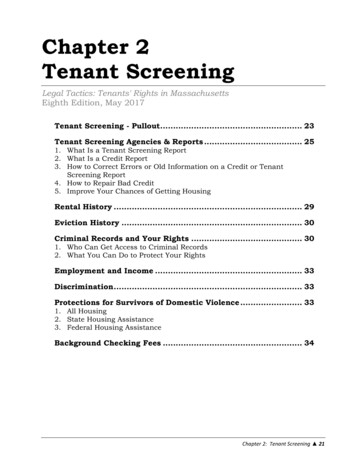

Chapter 2Tenant ScreeningLegal Tactics: Tenants' Rights in MassachusettsEighth Edition, May 2017Tenant Screening - Pullout. 23Tenant Screening Agencies & Reports . 251. What Is a Tenant Screening Report2. What Is a Credit Report3. How to Correct Errors or Old Information on a Credit or TenantScreening Report4. How to Repair Bad Credit5. Improve Your Chances of Getting HousingRental History . 29Eviction History . 30Criminal Records and Your Rights . 301. Who Can Get Access to Criminal Records2. What You Can Do to Protect Your RightsEmployment and Income . 33Discrimination . 33Protections for Survivors of Domestic Violence . 331. All Housing2. State Housing Assistance3. Federal Housing AssistanceBackground Checking Fees . 34Chapter 2: Tenant Screening 21

22 Chapter 2: Tenant Screening

Pullout 2Tenant ScreeningTenants’ Rights in MassachusettsWhen you are looking for an apartment it isimportant to understand how landlords screentenants. They screen tenants in different ways.Landlords want to know if tenants will: Pay the rent on time. Keep an apartment in good condition. Be a good neighbor.Protect YourselfIf Your ApplicationIs DeniedIf landlords or property managers denyyour application for an apartment: Ask them why. You may be able to convince them thatthey should not reject you. They may have information from atenant screening report, court record,or criminal record (CORI) which doesnot tell the whole story or is wrong. You may need to correct wrong ormisleading information in your tenantscreening report, your court record, oryour CORI. You may be able to show them yourcircumstances have changed. Forexample, you lost your job and wereunable to the rent, but now you have ajob and can pay the rent.How Landlords ScreenCredit reportsLandlords use credit reports to predict if youcan and will pay the rent. Credit reports showhow you borrow and repay money. They alsoshow how much debt you have.Tenant screening reportsLandlords can buy tenant screening reportsfrom private companies. These reports caninclude eviction history, court cases, formeraddresses, social security number verification,and criminal record searches.Criminal record informationLandlords and property managers can getsome information about your criminal record,called "Criminal Offender RecordInformation" or CORI.Court informationMassachusetts trial courts make informationabout court cases available to the public onthe Internet.Rental historyLandlords may ask you for references fromyour current and former landlords.Credit ReportBefore you look for a place, get a copy ofyour credit report. You can get 1 free copyonce a year by filling out the Annual CreditReport Request Form. To get this form: Call 877-322-8228 orGo to www.AnnualCreditReport.comClick “Request your free credit reports”Chapter 2: Tenant Screening 23

Tenant ScreeningReportsLandlords must tell you if they deny yourrental application because of the informationin a tenant screening report. But they do notalways tell you why they deny you.If landlords deny your rental application, askif they used a tenant screening report. If theydid, ask them for the name of the company.Contact the company and get the informationthat is wrong or misleading changed.Criminal RecordInformationA landlord cannot automatically disqualifyanyone with a criminal record. Landlords needto assess each individual applicant.Before a landlord can deny your applicationbecause of your CORI, the landlord must: Notify you that they plan to deny youhousing because of what is in the CORI. Give you a copy of the CORI they got ortenant screening report if it has CORI. Tell you the part of your CORI or tenantscreening report that is a problem. Give you information about how to fixmistakes on your CORI and give you achance to get mistakes corrected. Give you a copy of their CORI Policy, ifthey are required to have one.If you applied for certain types of subsidizedhousing, they must give you informationabout how to challenge the denial of housingbased on CORI. See Challenging a Denialwww.MassLegalHelp.org/cori/housing/denial.24 Chapter 2: Tenant ScreeningCourt InformationMassachusetts’ trial courts make someinformation about court cases available to thepublic on the Internet. Tenant advocates haveconcerns about this because this informationmay contain errors. It also may not tell thewhole story.For example, the information online will notshow that you came to an agreement with aformer landlord and you followed thatagreement.If you have been involved in a housing case,make sure there are no errors online. Look upyour case on the court's website atwww.masscourts.org. If you find an error, useError Correction Form (Booklet 11).Rental HistoryA landlord may want to get information fromyour current and former landlords to find outif you are a good tenant. Before you apply forapartments, contact former landlords and tellthem that another landlord may request areference from them. If you are afraid that aformer landlord may give you a bad reference,ask them for a simple reference letter that saysyou paid the rent on time.If you have no rental history, try to use otherinformation that shows you can pay rent ontime and take care of an apartment. Forexample, get letters from clergy, shelter staff,or employers saying that you will take care ofthe apartment and respect the rights of others.iMassLegalHelp.org/TenantScreeningLegal Tactics: Tenants Rights inMassachusettsMay 2017

Chapter 2Tenant Screeningby Paul SchackBefore you look for a place to live it is importantto understand how landlords do tenant screeningand what rights you have.The proper purpose of tenant screening is for alandlord to determine if you will be a responsibletenant who will pay the rent on time, keep anapartment in good condition, and not disturbneighbors or damage property.Every landlord screens tenants differently.Because so much information is available nowon the internet some landlords may use thatinformation to reject tenants just because theywere at some point involved in a court caseregardless of the result of the case.This chapter gives you information to help youprotect yourself during the tenant screeningprocess if you are searching for an apartment inthe private market.If you are applying for public or subsidizedhousing there are specific rules about tenantscreening. Read Finding Public andSubsidized Housing, Chapter 6: TenantScreening.Tenant ScreeningAgencies & ReportsThere are companies, called "consumer reportingagencies" that supply landlords with informationabout tenants. These companies collect and sellinformation about tenants including court cases,credit checks, employment verification, formerrental addresses, and criminal record checks.Sometimes the information in these reports isvery misleading. It may also be flat out wrong.Italicized words are in the Glossary“Consumer reports” are provided by “consumerreporting agencies” to third parties, such aslandlords and property managers. They then usethe information to make decisions includingwhether to grant credit or residential rentalhousing. “Consumer reports” is a broadcategory that includes what are popularlyreferred to as “credit reports.” The term alsoincludes tenant screening and backgroundreports.There are two major types of consumerreporting agencies: Credit Reporting AgencyCredit reporting agencies provide “creditreports,” which consist of information onyour credit and bill paying history. Theseinclude Equifax, Experian and TransUnion. Specialty Consumer Reportingor Tenant Screening AgencySpecialty consumer reporting agenciescollect information for a specific purposelike screening tenants. These will be referredto as “tenant screening agencies.”Landlords do not need your permission toobtain a tenant screening or other consumerreport.1 However, if a landlord denies youhousing based on the report, she must giveyou a written notice telling you the name of thetenant screening agency that provided the reportand how to contact that agency to obtain a copyof the report.2If your application for an apartment is denied,ask the landlord why. You may be able toChapter 2: Tenant Screening 25

convince the landlord that you should not berejected for that reason.Also, ask the landlord whether she used a tenantscreening agency and, if so, what the name of thecompany is. There are many tenant screeningagencies and this may be your only real way offinding out what company is distributinginformation about you so that you can either getwrong information corrected or try to changeinformation that is misleading. See the section inthis chapter: Your Right to Challenge theAccuracy of a Consumer Report.31. What Is a TenantScreening ReportTenant screening reports can includeinformation about eviction histories, court casesprior addresses, social security numberverification, bankruptcy cases, and criminalrecord searches. Sometimes there may becomments from former property managers.If you have ever had an eviction case broughtagainst you, you might discover that one of theseagencies has a file about you in its computer. Alandlord may not want to rent to you becauseshe thinks you will not pay your rent or are atroublemaker (even though your previouslandlord violated the law or your case wasdismissed).How to Get a Copyof a Tenant Screening ReportThere are many tenant screening agencies.Consumers have the right to a free report from atenant screening agency once every 12 months.There is no centralized source for obtaining freetenant screening reports. Requests must be madedirectly to each tenant screening agency.Each company must establish a toll-freetelephone number for requesting consumerreports. Some, but not all, companies allowonline, faxed, or mail-in requests. The onlyrequirement is that they establish a toll-freenumber, published anywhere the company doesbusiness.26 Chapter 2: Tenant ScreeningTo obtain a free copy of your report, you mustfill out a Consumer Disclosure Request Form.Your report should include a list of any personwho has requested a report on you.When making a request, you may be asked toprovide your name, social security number,current and previous address, driver’s license,and current employer. For a list of somespecialty consumer reporting companies andtheir contact information click:http://files.consumerfinance.gov/f/201604 cfpb list-of-consumer-reporting-companies.pdf.2. What Is a Credit ReportCredit histories are one of the main items thatlandlords may look at when screening tenants.There are three national credit reportingcompanies: Experian Equifax TransUnion.Credit reports show how you have borrowedmoney and repaid it and what money youcurrently owe. The vast majority of adults have acredit file.Your credit file has basic information about you,such as your Social Security Number, birth date,current and former addresses, and employers. Italso lists any amounts that you owe and anyaccounts that have been turned over to acollection company. It could also contain publicinformation about court judgments, tax liens,and bankruptcies.4Your credit report should not includeinformation about your race, religiouspreference, medical history, personal lifestyle, orpolitical preference. Income and driving recordsare rarely included.5

How to Get a Copyof a Credit ReportBefore you start looking for housing, it is a goodidea to get a copy of your credit report to makesure there are no mistakes or old informationthat will hurt you as your search for housing.Your report should also include a list of anyperson who has requested a report on you.Under federal law, you are entitled to one freecopy of your credit report once every 12 monthsfrom each of the national credit reportingagencies. They have set up one central website,toll free telephone number, and mailing addressthrough which you can order your free annualreport. To order: Click on www.AnnualCreditReport.com; Call 877-322-8228; or Complete the Annual Credit Report RequestForm and mail it to:Annual Credit Report Request ServiceP.O. Box 105281Atlanta, GA 30348-5281You can find the form ort-request-form.pdf .Do not contact the national credit reportingagencies individually for your free annual report.They only provide free annual credit reportsthrough the centralized request service listedabove. If you contact them directly, you may endup with a “free” report that converts to anexpensive paid subscription service.Massachusetts residents are entitled to anadditional free credit report a year from each ofthese credit reporting companies.6 You are alsoentitled to a free report if: You are receiving public welfare assistance; You have been denied credit or housingwithin the last 60 days; You are unemployed and will be applyingfor a job in the next 60 days; or You have reason to believe that your creditreport contains inaccurate information dueto fraud.7If you are not entitled to a free copy, thereporting companies cannot charge you morethan 12 for a copy of your credit report.83. How to Correct Errors orOld Information on aCredit or TenantScreening ReportOnce you get a copy of your credit or tenantscreening report, take a careful look at it. Checkto see if there are any mistakes. For example,there might be information from anotherperson’s account on your report. Or it may showthat you still owe a debt that has been paid. Alsocheck for outdated information. Negativeinformation can only be reported for 7 years,except for information about bankruptcies,which can remain on your report for 10 years.9Criminal convictions can stay on forever.a.Your Right to Challenge theAccuracy of a Consumer ReportIf you believe that your consumer reportcontains incorrect or old information, you have aright to challenge the accuracy of the report.10 Ifyour challenge is unsuccessful, you also have theright to add to the file your own statement aboutwhat happened, so that whenever a new landlordchecks your file, she will see your explanation.For example, if an eviction case was broughtagainst you but was later dismissed, you shouldchallenge it by asking that the dismissal beincluded. If the tenant screening agency does notcorrect the information, you can add anexplanation that the action was dismissedbecause your landlord made an accounting errorand claimed that you owed rent when you didnot.Chapter 2: Tenant Screening 27

If you have been denied housing, you have aright to see and obtain a free copy of yourreport. To obtain a free copy, you must ask forthe information within 60 days of receivingnotice that you were denied housing.11You have the right to dispute the accuracy orcompleteness of the information in your report.After you have reviewed your file, contact thereporting agency to dispute information you feelit is inaccurate or incomplete.To challenge the accuracy or completeness of areport, write a letter to each reporting agencythat has reported incorrect information. Tell thereporting agency what you believe is incompleteor inaccurate, why, and request that they correctthe item. Include with the letter copies of anydocuments that show that the information iswrong or misleading.12 Keep a copy of your letterand the originals of any supporting documents.For example, if the tenant screening reportclaims you did not pay rent and you did and youstill have receipts for rent, send the agencycopies of these receipts. Do not send the originalreceipts. If you don't have receipts, get canceledchecks from your bank or a bank statementshowing you paid the rent.By law, the reporting agency must reinvestigateand correct erroneous information.13 In mostcircumstances, the company is required to getback to you with the results of the investigationwithin 30 days.14If the company determines that information inthe report is inaccurate or that it can no longerbe verified, the company must delete thisinformation within 3 business days.15 Thecreditor or other information provider thatsupplied the information has a duty to correctand update the information.16 If the reportingagency does not resolve the dispute to yoursatisfaction, you have a right to include astatement (in 100 words or less) explaining yourside of the story.17 This statement must beattached to your report and provided to anyonewho accesses your report in the future.1828 Chapter 2: Tenant ScreeningIf the reporting agency modifies or removes badinformation from your file, you have a right torequest that they send the new report to anyperson who has received your report within thepast 6 months.19 The agency must send acorrected report to you, the consumer within 10business days of your request and must send it toanyone who has requested it within 15 days ofyour request. The company cannot charge a feefor this service.20While all of this is a lot of work, it may benecessary as you search for housing.b.Are You Victim of Identity FraudIf you have negative information on your creditreport because someone has stolen your personalor financial information, you may be the victimof identity fraud. For more information, go to:www.ago.state.ma.us/filelibrary/ident4.pdf andwww.consumer.gov/idtheft/.4. How to Repair Bad CreditCredit counseling services, which are oftennonprofit organizations, can help you get yourdebt under control. These services have trainedcounselors who arrange repayment plans that areacceptable to you and your creditors, and theymay be able to persuade creditors to lower oreliminate interest and late payments. Thecounselors can also help you set up a realisticbudget. These counseling services are offered atlittle or no cost. You may want to look for acredit counselor certified by the NationalFoundation for Credit Counseling:www.nfcc.org.IMPORTANT: BEWARE OF SCAMS. Creditrepair companies are not the same as creditcounseling services. Many companies charge youmoney and say they will “fix” your credit report.If you have bad credit, a credit repair companycannot legally remove accurate and timelyinformation from a credit report. If there isinaccurate information on your report, you canchallenge the inaccurate information yourself. Itis not worth paying someone to do it for you.For more information about the dangers of

credit repair companies, go -scamsyour disability. Accommodations caninclude requests to ignore credit historyfrom a time when you were untreated, ifyou are currently receiving treatment, or toapprove your application on the conditionthat you get a representative payee who willpay your rent.5. Improve Your Chances ofGetting HousingTo improve your chances of getting housing,there are a number of steps you can take if youhave bad credit: Supply positive unreported paymenthistory to the landlord so that they cansee you pay your billsGather documentation of accounts whichare in good standing, like medical copays orpremiums, car insurance bills, child supportpayments, phone bills, cell phone bills, rent,utilities, program fees at shelters, storagefacilities, or furniture rentals. Creditreporting agencies do not usually includethis information in their reports, althoughthey are beginning to include some types ofrental payments.Explain damaging informationWhen you are applying for housing and youknow the landlord will do a credit check,include a letter and documentation to thelandlord explaining your negative credithistory. For example, you can show that aperiod in which you fell behind on bills wasdue to illness, unemployment, interruptionof public benefits, or divorce.Demonstrate positive income changesPoint out any increases in income, stabilizedincome (for example, getting approved forSSI), or increased earning power due toeducation or job training. Point out whypaying rent will not be a problem if the rentis subsidized. Or, if you had a disablingillness that resulted in falling behind on yourbills, but you are no longer ill, this would beimportant to explain.Seek a reasonable accommodationIf your poor credit is due to a disability, youshould request that a housing authority orlandlord make a reasonable accommodation of Offer to have someone else pay the rentConsider offering to arrange for arepresentative payee (if you are on SSI) orprotective payments (if you receive welfarebenefits) or a co-signer on a lease. Be awarethat, once you get a representative payee, thepayee will have control over how all yourmoney is spent. Apply to different types of landlordsLandlords who have larger multifamilydevelopments are most likely to check yourcredit records. If you apply to manydifferent types of landlords and housingprograms, you may find some landlords whowill not look into your credit report. Forexample, multifamily owners often usecredit reports to screen out applicationsbecause they cannot afford to hire sufficientstaff to screen applicants, while largerhousing authorities rely more on CORIreports and extensive review of priorhousing history.Rental HistoryA landlord may want to get information fromcurrent and prior landlords to determine whetheryou will be a good tenant.Prospective landlords may ask you to list whereyou have lived in recent years, including contactinformation for prior landlords. They may alsoask you to sign a form giving them permission tocontact a former landlord in order to askinformation about you as a tenant, although theydo not have to ask you permission to do this.However, refusing permission may result inbeing rejected.Before contacting prospective landlords, it maybe a good idea to contact former landlords andChapter 2: Tenant Screening 29

tell them that they may be receiving a referencerequest from another landlord. If you are afraidthat a former landlord may unfairly give you abad reference, one thing to do is to ask thatformer landlord for a simple reference letter thatsays you paid the rent on time. You can alsoshow them that certain circumstances havechanged. For example, if you lost your job andwere unable to pay the rent, but now you have ajob and can pay the rent, this is importantinformation to provide.If there were times when you were not renting,you should identify those gaps on yourapplication. A landlord may deny you housing ifshe believes that gaps are an attempt to hide anegative landlord reference. So explain gaps inyour rental history, such as if you were livingwith family or friends, living in an emergencyshelter, or some other situation.If you have no rental history, try to use othersources of information that demonstrates yourability to pay rent on time and take care of anapartment. For example, car loan or insurancepayments can show that you will pay the rent ontime and letters of reference from clergy, shelterstaff, or employers can show that you will takecare of the apartment and respect the rights ofothers.Eviction HistoryMassachusetts trial courts have begun makinginformation about court cases available to thepublic on the internet,21 including informationabout housing cases. While the specific details ofhousing cases are not currently available online,landlords can see if an eviction case has everbeen brought against you in a particular courtand the reason for the case. Landlords can alsosee whether you have ever brought a case againstyour landlord, for example, to get bad conditionsin your home fixed.Some landlords have begun using this databaseas a tenant screening tool to decide whether theywant to rent to a particular tenant. Tenantadvocates and members of the legal community30 Chapter 2: Tenant Screeninghave concerns about the online use of theMassachusetts trial court's database. Forexample, there can mistakes in the database.If you have been involved in a housing case andyou plan to move, you should look your case upon the court's website to see what information isthere. Go to: www.masscourts.org. If you findinaccurate information, contact the court to getthe information corrected. See Error CorrectionForm (Booklet 11). For example, if the case wasbecause the landlord wanted to move her soninto the apartment, but the online informationsays it was for non-payment of rent, contact thecourt and ask them to change this.Criminal Records andYour RightsMassachusetts criminal court records are called"Criminal Offender Record Information"(CORI, pronounced COR'-EE).22 When a personis charged with a crime in a Massachusetts stateor federal court, that person has a CORI. Even ifthe case is dismissed or if the person is foundnot guilty, there is still a CORI.A CORI report includes the history of eachcriminal charge - all court proceedings - fromarraignment to sentencing. They can be long.For example, even though there may be only onecriminal incident, there may be a lot of entries ormultiple charges on a CORI report.One of the original purposes of the CORI lawwas to protect the privacy of people withcriminal records so that people would have achance to turn over a new leaf. In 2012, CORIlaws were substantially changed in ways thathave had a harmful impact on the privacy offormer offenders who apply for rental housing.More people can get more access.But in 2016, the U.S. Department of Housingand Urban Development released importantguidelines that prohibit landlords fromautomatically disqualifying anyone with acriminal record. Landlords need to assess eachindividual applicant.23

1. Who Can Get Accessto Criminal Recordsa.Access to CORI for Market RateHousingIf you are applying to public or subsidizedhousing the CORI rules are different. SeeCriminal Background Checks in FindingPublic and Subsidized Housing, Chapter 6:Tenant Screening.Private landlords (whether individuals ororganizations), property management companieswith market-rate housing, and real estate agentshave what is called "Standard" access to CORIto screen potential tenants. They must first havepermission from the state’s Criminal HistorySystem’s Board. When a landlord with Standardaccess requests a CORI report, the report willinclude:24 Criminal cases still going on.25 Conviction for a misdemeanor when theconviction date or incarceration release dateis less than 5 years prior to the CORIRequest Date. (The CORI system willreport the offense and all other convictedoffenses. Conviction for a felony when the convictiondate or incarceration release date occurredless than 10 years prior to the CORIRequest Date. Convictions for murder, manslaughter orsex offense no matter how old.The landlord must not get: Juvenile cases if a person younger than 17years old and they were not convicted as anadult, Civil cases, or Non-incarcerable cases.b.Access to CORI for PrivateSubsidized HousingWhile landlords and property managementcompanies renting to tenants with housingvouchers can only get Standard Access to CORIas outlined above, landlords and propertymanagement companies that manage multifamily subsidized housing have what is called"Required 1" CORI access. A CORI report for aRequired 1 access will include all adult andyouthful offender convictions regardless of dateand all pending offenses.26c.What If You Are Denied HousingBefore any landlord, property managementcompany, or real estate agent can reject yourhousing application based on your CORI, itmust: Notify you that they plan to deny youhousing; Give you a copy of the CORI or tenantscreening report with the CORI that theygot; Give you a copy of the landlord's CORIPolicy, if applicable;27 Tell you what part of your CORI orbackground report is a problem. Give you the opportunity to dispute theaccuracy of the information contained inthe CORI;Provide you with information about how tofix mistakes.28 Any sealed cases, Cases where there was no conviction, Misdemeanor convictions more than 5 yearsold Felony convictions more than 10 years oldA landlord can only request your CORI as thefinal step in the application process.29Chapter 2: Tenant Screening 31

Sometimes landlords authorize tenant screeningagencies to decide whether to accept or reject ahousing applicant. If the tenant screening agencyis acting as the decision maker the agency has tofollow the same CORI rules as landlords.30b.If you have applied for subsidized housingthrough a property management company theymust also provide information about how tochallenge or appeal the denial of housing basedon CORI.31 See Challenging a Denial at:www.MassLegalHelp.org/cori/housing/denial.ATTN: Self AuditMassachusetts Department of Criminal JusticeInformation Services200 Arlington Street, Suite 2200Chelsea, MA 021502. What You Can Do toProtect Your Rightsa.Ask for a MeetingA landlord, property management company, orreal estate agency many check your CORI only ifyou sign a form that says you know they arerequesting your CORI. This form is called aCORI Acknowledgment Form.Sometimes a landlord will ask a person applyingto rent to get a copy of her own CORI and bringit to the landlord. This is illegal. If a landlordasks you to get your own CORI, you should tellher that such a request is illegal, and that, if shewants access to your criminal record, she shouldrequest it from the state agency that has CORI.Landlord must be certified to access CORI.If you feel that your rights have been violated,you can file a complaint with the Civil RightsDivision of the Massachusetts Attorney General.A complaint form is available at:www.mass.gov/ago/criminalrecordsrightsIf you know the landlord or propertymanagement company will do a criminalbackground check, ask them to review the CORIor background information with you so th

"Consumer reports" is a broad category that includes what are popularly referred to as "credit reports." The term also includes tenant screening and background reports. There are two major types of consumer reporting agencies: Credit Reporting Agency Credit reporting agencies provide "credit reports," which consist of information on