Transcription

March 14, 2022Council File:21-1183Council Districts: 15Contact Persons: Conny Griffith:Andre’ C. Perry:(213) 808-8895(213) 808-8978Honorable Members of the City CouncilCity of Los Angelesc/o City Clerk, City Hall200 N. Spring StreetLos Angeles, CA 90012COUNCIL TRANSMITTAL: REQUEST FOR AUTHORITY TO ISSUE A TAX-EXEMPT MULTIFAMILY CONDUITREVENUE NOTE IN THE AMOUNT UP TO 21,213,423 AND A TAXABLE MULTIFAMILY CONDUIT REVENUE NOTEIN THE AMOUNT UP TO 772,095 FOR THE BANNING, A SUPPORTIVE HOUSING PROJECTSUMMARYThe General Manager of the Los Angeles Housing Department (“LAHD”) respectfully requests authority to issuea tax-exempt multifamily conduit note in the amount not to exceed 21,213,423 and a taxable multifamilyconduit note in the amount not to exceed 772,095 for the development of The Banning (“Project”). The Projectconsists of 64 residential units to be located at 841 N. Banning Boulevard, Los Angeles, CA 90744 in CouncilDistrict 15, to be developed by Century Affordable Development, Inc., with a total per-unit development cost of 679,249 and a per-unit HHH subsidy of 125,000. The California Debt Limit Allocation Committee (“CDLAC”)has designated June 6, 2022 as the bond issuance deadline date for the Project.RECOMMENDATIONSI. That the City Council, subject to the approval of the Mayor:A. ADOPT the Resolution, provided as Attachment A to this report, authorizing the issuance of up to 21,213,423,000 in tax-exempt multifamily conduit revenue note and 772,095 in taxable multifamilyconduit revenue note for the development of The Banning project; and,B. AUTHORIZE the General Manager of LAHD, or designee, to negotiate and execute the relevant bonddocuments for the Project, subject to the approval of the City Attorney as to form.An Equal Opportunity Employer

LAHD Request for Authority to Issue a Note for The BanningPage 2BACKGROUNDProject SummaryThe proposed supportive housing development is located at 841 N. Banning Boulevard, Los Angeles, CA, inCouncil District 15. The project will be a Type V new construction in vacant lots comprised of two buildings: onetwo-story building containing 19 units and one three-story building containing 45 units. An elevator will servethe three-story building. The project will have 57 one-bedroom units averaging 635 square feet and 7 twobedroom units averaging 941 square feet. One of the two-bedroom units will be designated for the manager’sunit. The project will have 45 parking spaces which will include five Americans with Disabilities Act parkingspaces. The project will provide 32 units for chronically homeless individuals, 31 units for mentally ill homelessindividuals. The unit amenities will include storage space and contemporary kitchens and bathrooms. Each unitwill include a full bathroom with low flow water fixtures and kitchens that will include a refrigerator, microwave,and range. All of the units will be furnished with living essentials including a bed, mattress, and nightstand inthe bedroom, a dining table with two chairs, and a couch in the living area. The onsite amenities will includeprivate open spaces, a large community room with a full kitchen, a lounge area for watching television andmoveable tables and chairs to accommodate workshops or group events. Other site amenities will include alarge outdoor courtyard with landscaping and barbecues and shaded seating areas, bicycle storage room, acommunal laundry room, an exercise room and outdoor terraces. Supportive services will be provided byCentury Villages at Cabrillo, Inc. in three dedicated Case Management offices.Financing HistoryOn August 18, 2021, LAHD executed an inducement letter in the amount not to exceed 26,516,000. The letterevidenced the official intent of the City of Los Angeles (“City”) to issue bond(s) for the development. The letterwas executed pursuant to previous authority granted to LAHD by the City Council and Mayor (C.F. No. 04-2646).On September 9, 2021, on behalf of The Banning LP (“Borrower”), LAHD submitted a bond application to CDLACrequesting a 21,213,423 bond allocation. A copy of the inducement letter was included as part of the bondapplication.Per the Tax Equity and Fiscal Responsibility Act of 1982 (“TEFRA”) requirements, on October 27, 2021, a TEFRAResolution was approved by the City Council and the Mayor (C.F. No. 21-1183). The TEFRA Resolutionsummarized that a public hearing was publicized, took place, and the hearing minutes were provided to the CityCouncil and the Mayor. On December 8, 2021, CDLAC awarded the 21,213,423 bond allocation and requiresthat the bond be issued by June 6, 2022.Sources and UsesTables 1, 2, and 3, below, provide a summary of the sources and uses for the Project, including cost per unit andcost category percentages.

LAHD Request for Authority to Issue a Note for The BanningPage 3TABLE 1 – CONSTRUCTION SOURCESConstructionTotal SourcesPer UnitTax-Exempt Loan - Wells Fargo Bank, N.A. (WFB) 21,213,423 331,460Taxable Loan – WFB 772,095 12,064LAHD - HHH Loan 7,200,000 112,500LACDA - NPLH* 7,080,000 110,625FHL Bank San Francisco - AHP** 945,000 14,766Costs Deferred Until Completion 2,015,192 31,487General Partner Capital Contribution 2,364,968 36,953General Partner Equity 100 1Tax Credit Limited Partner Equity 1,881,127 29,393TOTAL 43,471,905 679,249* Los Angeles County Development Authority (“LACDA”) No Place Like Home Program (“NPLH”)** Federal Home Loan (“FHL”) Affordable Housing Program (“AHP”)TABLE 2 – PERMANENT SOURCESPermanentTotal SourcesPer UnitPermanent Funding Loan - Citibank 6,009,000 93,891LAHD - HHH Loan 8,000,000 125,000LAHD - HHH Accrued Interest 211,563 3,306LACDA - NPLH* 7,130,000 111,406FHL Bank San Francisco – AHP** 945,000 14,766General Partner Capital Contribution 2,364,968 36,953General Partner Equity 100 1Tax Credit Limited Partner Equity 18,811,274 293,926TOTAL 43,471,905 679,249* Los Angeles County Development Authority (“LACDA”) No Place Like Home Program (“NPLH”)** Federal Home Loan (“FHL”) Affordable Housing Program (“AHP”)Uses of FundsAcquisition CostsConstruction Hard CostsArchitecture & EngineeringConstruction Interest Fees and ExpensesPermanent Financing CostsTotal Hard Contingency CostsTotal Soft Contingency CostsLegal CostsCapitalized ReservesPermits and Local FeesDeveloper FeeOther Project CostsRelocation (only if applicable)TOTALTABLE 3 – USES OF FUNDSTotal Uses 3,100,000 24,652,982 1,004,000 1,175,263 366,833 2,470,589 184,196 189,013 643,859 722,930 4,864,968 4,097,272 0 43,471,905The total development cost of 679,249 per unit reflects several factors:Cost/Unit 48,438 385,203 15,688 18,363 5,732 38,603 2,878 2,953 10,060 11,296 76,015 64,020 0 679,249% Total49%2%17%16%2%5%5%0%4%100%% Total14%19%0%17%2%5%0%43%100%% TDC7%57%2%3%1%6%0%0%2%2%11%9% 0100%

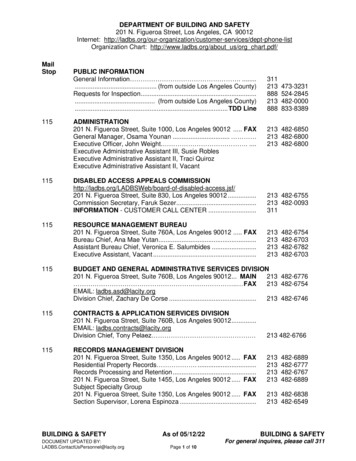

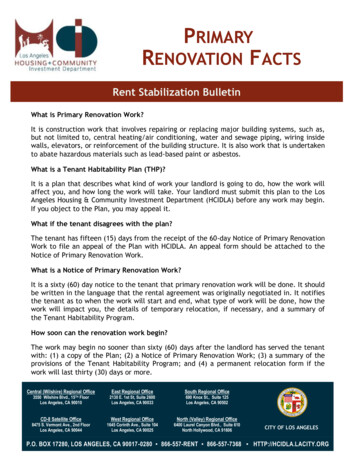

LAHD Request for Authority to Issue a Note for The BanningPage 4 Changes in Design: A significant factor for the increase in hard costs was a change in design based onrequirements from the Los Angeles Department of Building and Safety (LADBS) and the CaliforniaGeologic Energy Management Division (CalGEM) regarding three underground plugged oil wells thatexist on the project site. The initial design of the project consisted of a single building containing all 64units, but after discussion with LADBS and CalGEM, the developer had to transition the project design toa two-building layout to avoid having any portion of the building footprint over any of the existing oilwells. The change of the design increased the hard cost an additional 6,426,531 to the totaldevelopment costs. This averages out to 100,415 per unit. Methane Mitigation: LADBS requires a methane mitigation system. The additional cost is 350,000 or 5,469 per unit.Affordability RestrictionsPursuant to the City of Los Angeles Affordable Housing Bond Policies & Procedures (“AHBPP”) for Private ActivityBonds for Multifamily Rental Properties, approved September 24, 2019, the Project must provide long-termaffordable housing in the City of Los Angeles. Therefore, in connection with the issuance of the tax-exemptbond(s), one or more Bond Regulatory Agreements will be executed and recorded in the official records of theLos Angeles County Recorder’s Office. Each Bond Regulatory Agreement will include affordability restrictionsthroughout a term ending no sooner than the later of: 1) 15 years after the date on which 50% of the dwellingunits are first occupied; 2) the date such bond(s) are paid in full; or, 3) the date on which any Section 8 assistanceterminates, if applicable. In addition to the above, the bond award includes a CDLAC Resolution, which requiresthat the Project’s affordable housing units remain affordable for 55 years.Additionally, on December 8, 2021, the Project was awarded an allocation of 4% Low Income Housing Tax Credits(“LIHTC”) from the California Tax Credit Allocation Committee (“CTCAC”). On December 1, 2020, the City Counciland Mayor approved this Project for Proposition HHH Permanent Supportive Housing Loan Program funding(“HHH”, see C.F. No. 17-0090-S8). As a result of this award, the project will have affordability restrictions for aterm of 55 years. Affordability restrictions mean that for at least 55 years at least 40% of the units have to berented at or below 60% of the area median income. Please see Table 4, below, for the specific affordabilityrestrictions.Supportive housing units will be targeted toward persons experiencing homelessness and chronic homelessnessat or below 50% of Area Median Income (“AMI”); 31 units will be reserved for persons experiencinghomelessness and 32 units will be reserved for persons experiencing chronic homelessness. Table 4, below,provides a summary of the project unit mix, pursuant to the CDLAC Resolution.

LAHD Request for Authority to Issue a Note for The BanningPage 5Unit TypeOne-BedroomTwo-BedroomTotalTABLE 4 – CDLAC AFFORDABILITY RESTRICTIONSUn-restrictedUnits at or below 50% AMI(Manager’s Unit)5761631Total Number of Units57764Development TeamThe Borrower/Sponsor is The Banning LP, a California limited partnership, comprised of CADI XIII, LLC, as theGeneral Partner (GP) having 51% ownership interest, and Century Housing Corporation, a California nonprofitcorporation, as the initial Limited Partner (LP) of the Partnership, having 49% interest. The General Partner iscomprised of Century Housing Corporation as the sole managing member. Prior to or concurrently with theclose of the construction financing and issuance of the bond(s), the initial LP will be replaced by a to-bedetermined tax credit investor sponsored by Wells Fargo Affordable Community Lending and Investment asthe limited partner who will own 99.99% of the limited partnership and the GP ownership stake will be 0.01%.The Borrower entity is currently in compliance with LAHD’s Business Policy (C.F. No. 99-1272).Century Affordable Development, Inc.’s key members include: Brian D’Andrea, President; Oscar Alvarado, VicePresident; Howard Chan, Treasurer; and Beulah Ku, Secretary.Century Affordable Development, Inc. has been involved with the housing development industry for over 20years, and has been directly engaged in the development of 7 affordable rental housing projects, consisting ofa total of 262 affordable housing units in the City of Los Angeles.Borrower:The Banning LPc/o Century Affordable Development, Inc.1000 Corporate PointeCulver City, CA 90230Contact: Oscar AlvaradoPhone: (310) 642-2079Additional Project development team members are:Developer:Century Affordable Development, Inc.1000 Corporate PointeCulver City, CA 90230Contact: Oscar AlvaradoPhone: (310) 6422079Architect:Gonzalez Goodale Architects135 W. Green Street, #200Pasadena, CA 91105

LAHD Request for Authority to Issue a Note for The BanningPage 6Contact: Ali BararPhone: (626) 568-1428Attorney:Bocarsly Emden Cowan Esmail and Arndt LLP633 W. Fifth StreetLos Angeles, CA 90071Contact: Nicole DeddensPhone: (213) 239-8029General Contractor:(proposed)Walton Construction, Inc.358 E. Foothill Blvd.San Dimas, CA 91773Contact: Blake JacksonPhone: 909-267-7820Property Manager:Century Villages Property Management2001 River AvenueLong Beach, CA 90810Contact: Brett MoralesPhone: (562) 388-8198Tax Credit Investor:Wells Fargo Affordable Community Lending and Investment2030 Main Street, Suite 800Irvine, CA 92614Contact: Paul BucklandPhone: (949) 251-6065Financial StructureWells Fargo Bank, N.A. (“Lender”) has proposed a “back-to-back loan” structure that allows Lender to betterachieve its required goals under the Community Reinvestment Act (“CRA”). The proposed tax-exempt back-toback loan structure characterizes Lender’s involvement as the funding of a tax-exempt and taxable “loans”rather than a purchase of a tax-exempt and taxable bonds (replacing the terms “bond” and “bonds” with “note”and “notes”). Lender’s ability to achieve its goals under CRA is fundamental to its ability to continue to allocatesignificant levels of capital to affordable housing in the City.The City, as Issuer, will issue a tax-exempt note (the “Tax-Exempt Note”) and a taxable note (together, “Notes”),which will be unenhanced and unrated but subject to the City’s AHBPP, in one or more series. The Notes will beprivately placed and initially purchased by the Lender. Lender will, by purchasing the Notes, fund a loan(“Funding Loan”) to the City and the City will issue the Notes to the Lender. The proceeds of the Funding Loanwill be used by the City to make a loan to the Borrower (“Borrower Loan”) in the amount not to exceed 21,213,423, pursuant to the terms of a Borrower Loan Agreement among the City, a to-be-named corporate

LAHD Request for Authority to Issue a Note for The BanningPage 7fiscal agent (“Fiscal Agent”), the Lender, and the Borrower. The Borrower will execute promissory notes(“Borrower Note”) as evidence to repay the Borrower Loan. The City will assign the Borrower Note to the FiscalAgent, as security for the Notes. Among its various functions, the Fiscal Agent will receive funds advanced byLender in exchange for additional principal amount of the Notes and release such funds to the Borrower for theProject construction. The Borrower Loan will have a term of 26 months and shall bear interest equal to theSecured Overnight Financing Rate (“SOFR”), with an index floor rate of 1.8%; the current indicative rate is 2.30%.At conversion from construction financing to permanent financing, a portion of the Borrower Loan will be paiddown with sources available at the permanent financing phase, including investor equity. The remaining balanceof the Borrower Loan will convert to a fixed-rate tax-exempt permanent loan, evidenced solely by the TaxExempt Note, from the permanent lender, Citibank, N.A., in an amount up to 6,009,000, which will have a 20year term from the date of conversion and bear a fixed interest rate currently estimated to be 4.00%.The financing structure will include financing or loans from HHH as noted above, the Los Angeles CountyDevelopment Authority (“LACDA”) No Place Like Home (“NPLH”), FHL Bank San Francisco Affordable HousingProgram (“AHP”), 4% federal tax credit equity, and the Housing Authority of the City of Los Angeles (“HACLA”)Section 8 program.LAHD requires that the Lender meet the City’s Responsible Banking Ordinance #182138 reporting requirements.At closing, bond counsel will provide the required legal opinions as to the tax-exempt status of the interest onthe Notes, under federal and state law. The legal and financing documents will include language that establishesthe Note structure as a limited obligation and strictly payable from Project revenues. The Project financingcomplies with both the City’s AHBPP and Financial Policies. Additionally, the legal and financing documents willrequire the Borrower to provide annual statements and information as requested by LAHD.LAHD’s Bond Team for the financing of the Project is as follows:Bond Issuer MunicipalAdvisor:CSG Advisors, Inc.315 W. 5th Street, Suite 302Los Angeles, CA 90013Bond Issuer Counsel:Los Angeles City Attorney200 N. Spring Street, 21st FloorLos Angeles, CA 90012Bond Counsel:Kutak Rock LLP777 S. Figueroa Street, Suite 4550Los Angeles, CA 90017FISCAL IMPACT

LAHD Request for Authority to Issue a Note for The BanningPage 8There is no fiscal impact to the General Fund as a result of the issuance of the note(s). The City is a conduit issuerand will not incur liability for repayment of the note(s). The note(s) is a limited obligation, payable strictly fromrevenue derived from the Project. The City will not be obligated to make payments on the note(s).Approved By:ANN SEWILLGeneral ManagerLos Angeles Housing DepartmentATTACHMENTS:Bond ResolutionBorrower Loan AgreementFunding Loan AgreementRegulatory Agreement

LAHD Request for Issuance of Bonds for The Banning ProjectAttachment ABond Resolution for The Banning on next page.

RESOLUTIONCITY OF LOS ANGELESA RESOLUTION AUTHORIZING THE ISSUANCE AND DELIVERY OF ONEOR MORE SERIES OF MULTIFAMILY NOTES BY THE CITY OFLOS ANGELES DESIGNATED AS ITS MULTIFAMILY MORTGAGEREVENUE NOTE (THE BANNING) SERIES 2022N-1 AND TAXABLESERIES 2022N-2 IN AN AGGREGATE MAXIMUM PRINCIPAL AMOUNTNOT TO EXCEED 21,985,518 CONSISTING OF UP TO 21,213,423 OFSERIES 2022N-1 NOTE AND UP TO 772,095 OF TAXABLE SERIES 2022N2 NOTE TO PROVIDE FINANCING FOR THE ACQUISITION,CONSTRUCTION AND EQUIPPING OF THE MULTIFAMILY HOUSINGPROJECT SPECIFIED IN PARAGRAPH 16 HEREOF AND APPROVING ANDAUTHORIZING THE EXECUTION AND DELIVERY OF RELATEDDOCUMENTS AND AGREEMENTS AND THE TAKING OF RELATEDACTIONS INCLUDING THE EXECUTION OF AMENDATORYDOCUMENTS THERETO.WHEREAS, the City of Los Angeles (the “City”) is authorized, pursuant to the provisionsof Section 248, as amended, of the City Charter of the City (the “City Charter”) and Article 6.3 ofChapter 1 of Division 11 of the Los Angeles Administrative Code, as amended (the “Law”) toissue its obligations for the purposes of providing financing for the acquisition, rehabilitation,construction, equipping and development of multifamily rental housing for persons of low andmoderate income (the “Program”) which will satisfy the provisions of Chapter 7 of Part 5 ofDivision 31 of the Health and Safety Code of the State of California (the “Act”); andWHEREAS, the City now desires to issue its revenue note pursuant to the Law, and inaccordance with the Act, to provide financing for the acquisition, construction and equipping ofthe multifamily rental housing project described in paragraph 16 below (the “Project”); andWHEREAS, the Project will be located wholly within the City; andWHEREAS, it is in the public interest and for the public benefit that the City authorize thefinancing of the Project, and it is within the powers of the City to provide for such a financing andthe issuance of such note; andWHEREAS, the City proposes to issue, pursuant to the Law and in accordance with theAct, its Multifamily Mortgage Revenue Note (The Banning) Series 2022N-1 (the “Series 2022N1 Note”) with a principal amount not to exceed 21,213,423; andWHEREAS, the City proposes to issue, pursuant to the Law and in accordance with theAct, its Multifamily Mortgage Revenue Note (The Banning) Taxable Series 2022N-2 (the“Taxable Series 2022N-2 Note” and together with the Series 2022N-1 Note, the “Note”) with aprincipal amount not to exceed 772,095; and4873-7984-1039.1

WHEREAS, the City proposes to use the proceeds of the Note to fund a loan to the owneridentified in paragraph 16 (the “Owner”) to finance a portion of the acquisition, construction andequipping of the Project and, if applicable, to pay certain costs of issuance in connection with theissuance of the Note; andWHEREAS, Wells Fargo Bank, National Association or a subsidiary or affiliate thereof(the “Funding Lender”) has expressed its intention to make a loan (the “Funding Loan”) to theCity and as evidence for such loan acquire (or to cause a subsidiary or affiliate to acquire) the Noteauthorized hereby in whole, and this Council (the “City Council”) finds that the public interest andnecessity require that the City at this time make arrangements for the issuance and delivery of suchNote; andWHEREAS, the interest on the Series 2022N-1 Note may qualify for a federal taxexemption under Section 142(a)(7) of the Internal Revenue Code of 1986, as amended (the“Code”) only if the Series 2022N-1 Note is approved in accordance with Section 147(f) of theCode; andWHEREAS, pursuant to the Code, the Series 2022N-1 Note is required to be approved,following a public hearing, by an elected representative of the issuer of the Series 2022N-1 Noteand an elected representative of the governmental unit having jurisdiction over the area in whichthe Project is located; andWHEREAS, this City Council is the elected legislative body of the City and is theapplicable elected representative required to approve the issuance of the Series 2022N-1 Notewithin the meaning of Section 147(f) of the Code; andWHEREAS, pursuant to Section 147(f) of the Code, the City caused a notice to appear inthe Los Angeles Times, which is a newspaper of general circulation in the City on September 10,2021 to the effect that a public hearing would be held on September 17, 2021 regarding theissuance of the Series 2022N-1 Note; andWHEREAS, the Los Angeles Housing Department held said public hearing on such date,at which time an opportunity was provided to present arguments both for and against the issuanceof the Series 2022N-1 Note; andWHEREAS, the minutes of such public hearing, and any written comments received withrespect thereto, have been presented to this City Council;WHEREAS, the Owner of the Project has engaged the Funding Lender to provide to theCity the following information as a good faith estimate of the cost of the Note financing and theCity disclosed such information in accordance with Section 5852.1 of the California GovernmentCode: (a) the true interest cost of the Note, (b) the finance charge of the Note, including all thirdparty expenses, (c) the amount of proceeds received by the City for the issuance and delivery ofthe Note less the finance charge of the Note and any reserves or capitalized interest paid or fundedwith proceeds of the Note and (d) the total payment amount, all as reflected on the attached ExhibitA (the “Financing Information”); and4873-7984-1039.12

WHEREAS, such Financing Information has been disclosed in connection with the CityCouncil meeting in which this Resolution is approved;NOW, THEREFORE, BE IT RESOLVED by the City Council of the City of Los Angeles,as follows:1.The recitals hereinabove set forth are true and correct, and this City Councilso finds. This Resolution is being adopted pursuant to the Law.2.Pursuant to the Law and in accordance with the Act and the Funding LoanAgreement (as hereinafter defined) a revenue note of the City, to be designated as “City ofLos Angeles Multifamily Mortgage Revenue Note (The Banning) Series 2022N-1” in aprincipal amount not to exceed 21,213,423 and a revenue note of the City, to be designatedas “City of Los Angeles Multifamily Mortgage Revenue Note (The Banning) TaxableSeries 2022N-2” in a principal amount not to exceed 772,095 are hereby authorized to beissued. The principal amount of the Note to be issued shall be determined by a DesignatedOfficer (as defined below) in accordance with this Resolution.3.The proposed form of Funding Loan Agreement (the “Funding LoanAgreement”), among the City, the Funding Lender as Funding Lender and such party asshall be designated by the City in the final form of Funding Loan Agreement, as fiscalagent (the “Fiscal Agent”), in substantially the form attached hereto, is hereby approvedalong with any additions or supplements which may, in the determination of a DesignatedOfficer, be necessary to document the issuance of the Note authorized hereunder. TheMayor of the City, the General Manager, any Acting General Manager or any InterimGeneral Manager, any Assistant General Manager, or any Acting Assistant GeneralManager, Interim Assistant General Manager, Executive Officer, Director or ActingDirector—Finance and Development Division of the Housing Development Bureau of theLos Angeles Housing Department (each hereinafter referred to as a “Designated Officer”)are hereby authorized and directed, for and in the name and on behalf of the City, to executeand deliver the Funding Loan Agreement, with such additions, changes or corrections asthe Designated Officer executing the same may approve upon consultation with the CityAttorney and Bond Counsel to the City and approval by the City Attorney, provided thatsuch additions or changes shall not authorize an aggregate principal amount of the Note inexcess of the amount stated above, such approval by the City Attorney to be conclusivelyevidenced by the execution and delivery of the Funding Loan Agreement with suchadditions, changes or corrections.Any Designated Officer shall be authorized to approve the appointment of theFiscal Agent.4.The proposed form of Borrower Loan Agreement (the “Loan Agreement”),by and between the City and the Owner, in substantially the form attached hereto, is herebyapproved. Any Designated Officer is hereby authorized and directed, for and in the nameand on behalf of the City, to execute the Loan Agreement, with such additions, changes orcorrections as the Designated Officer executing the same may approve upon consultationwith the City Attorney and Bond Counsel and approval by the City Attorney, such approval4873-7984-1039.13

to be conclusively evidenced by the execution of said Loan Agreement with such additions,changes or corrections.5.The proposed forms of the Note, as set forth in the Funding LoanAgreement, are hereby approved, and the Mayor and City Treasurer, Interim CityTreasurer, or Deputy City Treasurer of the City are hereby authorized and directed toexecute, by manual or facsimile signatures of such officers under the seal of the City, andthe Fiscal Agent or an authenticating agent, is hereby authorized and directed toauthenticate, by manual signatures of one or more authorized officers of the Fiscal Agentor an authenticating agent, the Note in substantially such form and the Fiscal Agent ishereby authorized and directed to issue and deliver the Note to the Funding Lender inaccordance with the Funding Loan Agreement. The date, maturity dates, interest rate orrates (which may be either fixed or variable), interest payment dates, denomination, formof registration privileges, manner of execution, place of payment, terms of redemption, useof proceeds, series designation and other terms of the Note shall be as provided in theFunding Loan Agreement as finally executed; provided, however, that the principal amountof the Series 2022N-1 Note shall not exceed 21,213,423 and the principal amount of theTaxable Series 2022N-2 Note shall not exceed 772,095, the interest rate on the Note shallnot exceed 12% per annum, and the final maturity of the Note shall be no later than fortyyears after the date of Note issuance. The initial purchase price of the Note shall be 100%of the principal amount thereof to be paid as advances are made with respect to the Noteby the Funding Lender. The Note may, if so provided in the Funding Loan Agreement, beissued as a “draw-down” note to be funded over time as provided in the Funding LoanAgreement. Such Note may be delivered in temporary form pursuant to the Funding LoanAgreement if, in the judgment of the City Attorney, delivery in such form is necessary orappropriate until the Note in definitive form can be prepared.6.The proposed form of Regulatory Agreement and Declaration of RestrictiveCovenants (the “Regulatory Agreement”) to be entered into by and among the City, theFiscal Agent and the Owner, substantially in the form attached hereto, is hereby approved.Any Designated Officer is hereby authorized and directed, for and in the name and onbehalf of the City, to execute and deliver one or more Regulatory Agreements, with suchadditions, changes and corrections as the Designated Officer may approve uponconsultation with the City Attorney and Bond Counsel and approval of the City Attorney,such approval to be conclusively evidenced by the execution of said Regulatory Agreementwith such additions, changes or corrections. Any Designated Officer is hereby authorizedand directed for and in the name and on behalf of the City to execute amendments to theRegulatory Agreement in order that interest on the Series 2022N-1Note remains taxexempt.7.All actions heretofore taken by the officers and agents of the City withrespect to the issuance and delivery of the Note are hereby approved, confirmed andratified, and each Designated Officer of the City, the City Clerk and other properlyauthorized officers of the City are hereby authorized and directed, for and in the name andon behalf of the City, to do any and all things and take any and all actions and execute anddeliver any and all certificates, agreements and other documents, including, but not limitedto, those described in the Funding Loan Agreement, the Loan Agreement, the Regulatory4873-7984-1039.14

Agreement and the other documents herein approved, which they, or any of them, maydeem necessary or advisable in order to consummate the lawful issuance and delivery ofthe Note and the implementation of the Program in accordance with the Act and the Lawand this Resolution and resolutions heretofore adopted by the City.8.The City Clerk of the City or any deputy thereof is hereby authorized tocountersign or to attest the signature of any Designated Officer and to affix and attest theseal of the City as may be appropriate in connection with the execution and delivery of anyof the documents authorized by this resolution, provided that the due execution anddelivery of said documents or any of them shall not depend on such signature of the CityClerk or any deputy thereof or affixing of such seal. Any of such

An Equal Opportunity Employer March 14, 2022 Council File: 21-1183 Council Districts: 15 Contact Persons: Conny Griffith: (213) 808-8895 Andre' C. Perry: (213) 808-8978 Honorabl