Transcription

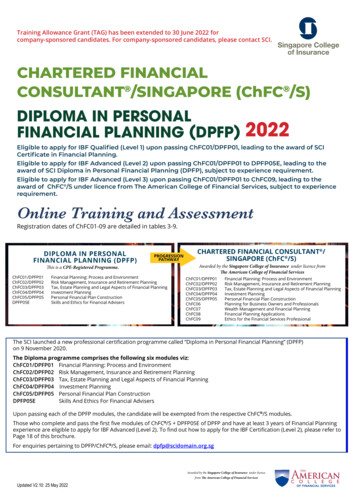

Training Allowance Grant (TAG) has been extended to 30 June 2022 forcompany-sponsored candidates. For company-sponsored candidates, please contact SCI.CHARTERED FINANCIALCONSULTANT /SINGAPORE (ChFC /S)DIPLOMA IN PERSONALFINANCIAL PLANNING (DPFP)2022Eligible to apply for IBF Qualified (Level 1) upon passing ChFC01/DPFP01, leading to the award of SCICertificate in Financial Planning.Eligible to apply for IBF Advanced (Level 2) upon passing ChFC01/DPFP01 to DPFP05E, leading to theaward of SCI Diploma in Personal Financial Planning (DPFP), subject to experience requirement.Eligible to apply for IBF Advanced (Level 3) upon passing ChFC01/DPFP01 to ChFC09, leading to theaward of ChFC /S under licence from The American College of Financial Services, subject to experiencerequirement.Online Training and AssessmentRegistration dates of ChFC01-09 are detailed in tables 3-9.DIPLOMA IN PERSONALFINANCIAL PLANNING (DPFP)PROGRESSIONPATHWAYThis is a CPE-Registered hFC04/DPFP04ChFC05/DPFP05DPFP05EFinancial Planning: Process and EnvironmentRisk Management, Insurance and Retirement PlanningTax, Estate Planning and Legal Aspects of Financial PlanningInvestment PlanningPersonal Financial Plan ConstructionSkills and Ethics for Financial AdvisersCHARTERED FINANCIAL CONSULTANT /SINGAPORE (ChFC /S)Awarded by the Singapore College of Insurance under licence fromThe American College of Financial ancial Planning: Process and EnvironmentRisk Management, Insurance and Retirement PlanningTax, Estate Planning and Legal Aspects of Financial PlanningInvestment PlanningPersonal Financial Plan ConstructionPlanning for Business Owners and ProfessionalsWealth Management and Financial PlanningFinancial Planning ApplicationsEthics for the Financial Services ProfessionalThe SCI launched a new professional certification programme called “Diploma in Personal Financial Planning” (DPFP)on 9 November 2020.The Diploma programme comprises the following six modules viz:ChFC01/DPFP01 Financial Planning: Process and EnvironmentChFC02/DPFP02 Risk Management, Insurance and Retirement PlanningChFC03/DPFP03 Tax, Estate Planning and Legal Aspects of Financial PlanningChFC04/DPFP04 Investment PlanningChFC05/DPFP05 Personal Financial Plan ConstructionDPFP05ESkills And Ethics For Financial AdvisersUpon passing each of the DPFP modules, the candidate will be exempted from the respective ChFC /S modules.Those who complete and pass the first five modules of ChFC /S DPFP05E of DPFP and have at least 3 years of Financial Planningexperience are eligible to apply for IBF Advanced (Level 2). To find out how to apply for the IBF Certification (Level 2), please refer toPage 18 of this brochure.For enquiries pertaining to DPFP/ChFC /S, please email: dpfp@scidomain.org.sgAwarded by the Singapore College of Insurance under licencefrom The American College of Financial ServicesUpdated V2.10: 25 May 2022

TABLE 1: MODULE FEES & RETAKER FEES (TRAINING & ASSESSMENT)Note: A one-time non-refundable registration fee of S 32.10 (with 7% GST) is applicable at the time of first admissioninto the programme. The registration fee is not fundedFEE FOR CHFC/S MODULES (SELF-SPONSORED PARTICIPANTS ONLY).COMPANY-SPONSORED CANDIDATES PLEASE CONTACT SCI.FOR ASSESSMENT-ONLY ROUTE (FIRST-TIMERS), PLEASE REFER TO THE SELF-STUDY BROCHURE HEREModuleFee Per Module(with 7% GST)First Attempt Fee Per Module(with 7% GST)Clawback AmountPer Module*Retaker Fee PerModule (with 7%GST)Full Fee(BeforeFunding)Net Fee payable to SCI(After Funding)Funding notapplicableChFC01/DPFP01ChFC05/DPFP05S 1,070.00Per ModuleS 107.00 (1 Jan 2022 to 30 Jun 2022) #S 963.00 (90% of module fee)S 214.00 (1 Jan 2022 to 30 Jun 2022)S 856.00 (80% of module fee)DPFP05E (OnlineLearning &Examination)S 107.00ChFC06-ChFC07S 1,070.00Per Module##S 10.70 (1 Jan 2022 to 30 Jun 2022) #S 96.30 (90% of module fee)S 21.40 (1 Jan 2022 to 30 Jun 2022) ##S 85.60 (80% of module fee)S 107.00 (1 Jan 2022 to 30 Jun 2022) #S 963.00 (90% of module fee)S 214.00 (1 Jan 2022 to 30 Jun 2022)S 856.00 (80% of module fee)##ChFC0814-hour Tutorial(Online in 2022)1-hour PracticumAssessment (Online)S 192.60S 107.00S 192.60S 160.50 (Tutorial)S 695.50S 69.55 (1 Jan 2022 to 30 Jun 2022) #S 139.10 (1 Jan 2022 to 30 Jun 2022) ##S 625.95 (90% of module fee)S 556.40 (80% of module fee)S 160.50 (PracticumAssessment)S 80.25 (Case StudyWritten Assessment)3-hour Written CaseStudy AssessmentChFC09(Online Learning &Examination)S 107.00Total for ChFC08and ChFC09S 802.50S 10.70 (1 Jan 2022 to 30 Jun 2022) #S 96.30 (90% of module fee)S 21.40 (1 Jan 2022 to 30 Jun 2022)S 85.60 (80% of module fee)##S 722.25 (90% of module fee)S 80.25 (1 Jan 2022 to 30 Jun 2022) #S 160.50 (1 Jan 2022 to 30 Jun 2022)##S 642.00 (80% of module fee)S 53.50-* See page 3 for details.#For Singapore Citizens aged 40 and above.##For Singapore Citizens aged below 40 and Singapore Permanent Residents.Payment must be made at the time of registering for the examination(s) at the SCI website at: https://www.scicollege.org.sg via credit card.SkillsFuture Credit is not applicable for all modules under the DPFP/ChFC/S Programmes.FUNDING(only for first examination attempt)- Funded Under IBF Standards Training Scheme (IBF-STS)Only Singapore Citizens or Singapore Permanent Residents who are physically based in Singapore are eligible for funding.For 90% subsidy for Singapore Citizens aged 40 and above:Course to commence between 1 January 2022 and 30 June 2022 and candidates to fulfil all the course requirements and pass allthe examinations/assessments no later than 30 September 2022.For 80% subsidy for Singapore Citizens aged below 40 and Singapore Permanent Residents:Course to commence between 1 January 2022 and 30 June 2022 and candidates to fulfil all the course requirements and pass allthe examinations/assessments no later than 30 September 20222

The course fee subsidies under both IBF-Standards Training Scheme (IBF-STS) and Financial Training Scheme (FTS) will be extendedby 6 months to 30 June 2022, with 80% of course fees subsidised. This will apply to courses that commence on or after 1 January2022, up to 30 June 2022, and must be completed no later than 30 September 2022. To help mature workers acquire industryrelevant skills as the industry transform, Singapore citizens aged 40 and above will continue to receive the enhanced subsidy at90% from 1 January 2022, for training under IBF-STS and FTS.The Training Allowance Grant (TAG) will also be extended for employees sponsored by eligible financial institutions and FinTechfirms by one year to 30 June 2022 at a rate of 10 per training hour. This will apply to IBF recognised courses that commence onor after 1 July 2021 till 30 June 2022 and must be completed no later than 30 September 2022.CL AWBACK PROVISION, ADVISORY NOTE, STUDENT CONTRACT &WITHDRAWAL POLICY DURING AND AFTER COOLING- OFF PERIODFOR CHFC01/DPFP01 - CHFC05/DPFP05 AND DPFP05EClawback ProvisionFor the avoidance of any doubt and in the event that the Candidate should fail and/or neglect to pass the examinations forwhatever reason(s) within the specified deadline, and therefore not be eligible to receive funding for the gross fees under theIBF-STS, SCI will issue an invoice to the Candidate to claw back the funded portion of the gross fee amount. The Candidate isliable to pay SCI the clawback amount stated on the invoice within 7 working days from the invoice date.Signing of Advisory Note & Student Contract For ChFC01/DPFP01 - ChFC05/DPFP05 and DPFP05EAll candidates whether self-sponsored or company-sponsored are required to sign an Advisory Note as well as an electronicStudent Contract with SCI before registering for the DPFP modules. The SCI offers a Cooling-Off Period of 7 working days fromthe date of signing the Student Contract. Should a candidate decide to withdraw from the DPFP programme within the CoolingOff Period, he must notify SCI by way of electronic mail (email). A full refund of Net Fee paid including one-time registrationfee of S 32.10 (inclusive of 7% GST) paid by the Candidate, if any, will be made by the SCI to the Candidate within 14 days fromthe date of withdrawal in such instance. The date of withdrawal must fall within the 7 working days from the contract signeddate by both parties. No withdrawal is allowed after the cooling-off period, for whatsoever reasons. Candidates are advisedto check the course/examination details, including the exemption policy, before submission.To sign the Advisory Note and Student Contract, Candidates will contact SCI via email at talk2us@scidomain.org.sg or callthe SCI officer during office hours at 62212336 to request for the Advisory Note and Student Contract to be sent to them viaDocuSign. Candidates must pass their examination(s) by the dates as stipulated in the Contract.SIGNING OF CL AWBACK CONTRACT FOR ChFC06-ChFC09Candidates who wish to register for ChFC06 to ChFC09 are required to sign the Clawback Contract electronically pertainingto Clawback Provision, Registration Policy, Rescheduling Policy and Refund Policy before the registration can be confirmed.CLAWBACK AMOUNT FOR CHFC01-09 AND DPFP05EThe SCI will clawback 80% of the module fee (ie S 856.00 per module: ChFC01/DPFP01 - ChFC07, S 556.40 for ChFC08, S 85.60 forChFC09, S 85.60 for DPFP05E) or 90% of the module fee (ie S 963.00 per module: ChFC01/DPFP01 - ChFC07, S 625.95 for ChFC08,S 96.30 for ChFC09, S 96.30 for DPFP05E), depending on the subsidies granted, IF the candidate DOES NOT fulfil any of the following:1. Fulfil 100% of the ChFC08 tutorials in attendance; in this regard, the student has to agree to having theirvideo on throughout the tutorials.2. Fulfil at least 75% of the tutorials for ChFC01/DPFP01 to ChFC07 in attendance; in this regard, the studenthas to agree to having their video on throughout the tutorials.3. Adhere to the Tutorial Schedule.4. Pass the examinations by the dates stipulated in the Contract.3

EXAMINATIONDetailsTABLE 2: EXAMINATION / ASSESSMENT FORMAT & STRUCTUREModuleExaminationDurationExamination FormatTotal Marks/Grade AllocatedPassRequirementChFC01/DPFP01 Financial Planning:Process and Environment2 Hours100 Multiple-Choice Questions100 Marks70 MarksChFC02/DPFP02 Risk Management,Insurance and Retirement Planning2 Hours100 Multiple-Choice Questions100 Marks70 MarksChFC03/DPFP03 Tax, Estate Planning andLegal Aspects of Financial Planning2 Hours100 Multiple-Choice Questions100 Marks70 MarksChFC04/DPFP04 Investment Planning2 Hours100 Multiple-Choice Questions100 Marks70 MarksChFC05/DPFP05 Personal Financial PlanConstruction2 Hours50 Multiple-Choice Questions(case-based)50 Marks35 MarksDPFP05E Skills and Ethics for FinancialAdvisers30 Minutes30 Multiple-Choice Questions30 Marks24 MarksChFC06 Planning for Business Ownersand Professionals2 Hours100 Multiple-Choice Questions100 Marks70 MarksChFC07 Wealth Management andFinancial Planning2 Hours100 Multiple-Choice Questions100 Marks70 MarksChFC08 Financial Planning Applications –Practicum Assessment1 HourOne-on-one Presentation ofFinancial Plan to the AssessorOnly “Competent” or“Not-Yet-Competent”To be assessed as“Competent”ChFC08 Financial Planning Applications –Case Study Written Assessment3 Hours2 Case Studies (6 Short EssayQuestions each)150 Marks105 MarksChFC09 Ethics for the Financial ServicesProfessional (Online)45 Minutes30 Multiple-Choice Questions30 Marks24 MarksSCHEDULENote: Dates are subject to changes.Tutorial Schedule for ChFC01/DPFP01 - ChFC07 (2021 Intake 5)TABLE 3: TUTORIAL DATES AND TIMEExam Date and TimeModuleRegistrationClosesTutorial Dateand TimeChFC01/DPFP01Closed4, 6, 8 Oct 20219.00am-5.00pmChFC03/DPFP03Closed24, 26, 28 Jan 20229.00am-5.00pmChFC04/DPFP0431 Jan 2022ChFC05/DPFP0514 Feb 2022LecturerStudents will be pre-assignedeither one of the exam timings onexam datesSCIClawbackDate29 Oct 20211.00pm-3.00pm, 3.30pm5.30pm90% by 31March 202231 March2022RogerChua10 Feb 20229.00am-11.00am,11.30pm-1.30pm80% / 90% by30 Sep 202230 September202214, 16, 18 Feb 20229.00am-5.00pmRogerChua3 March 20229.00am-11.00am,11.30pm-1.30pm80% / 90% by30 Sep 202230 September202228 Feb, 2, 4 Mar 20229.00am-5.00pmAllen Lim17 March 20229.00am-11.00am,11.30pm-1.30pm80% / 90% by30 Sep 202230 September2022(Note: Tutorials for ChFC02/DPFP02 for 2021 Intake 5 were cancelled.)4FundingAmt By IBF

Tutorial Schedule for ChFC01/DPFP01-ChFC07 (Intake 1)TABLE 4: TUTORIAL DATES AND TIMEExam Date and TimeStudents will be preassigned to either one ofthe exam timings on sTutorial Date andTimeLecturerChFC01/DPFP01Opened7 Feb 202221, 23, 25 Feb 20229.00am-5.00pmRoger Chua10 Mar 20229.00am-11.00am, 11.30pm1.30pmChFC02/DPFP02Opened7 Mar 202221, 23, 25 Mar 20229.00am-5.00pmAllen Lim7 Apr 20229.00am-11.00am, 11.30pm1.30pmChFC03/DPFP03Opened4 Apr 202218, 20, 22 Apr 20229.00am-5.00pmChan Keng Leong5 May 20229.00am-11.00am, 11.30pm1.30pmChFC04/DPFP0418 Feb 202225 Apr 20229, 11, 13 May 20229.00am-5.00pmKoh Siew Min26 May 20229.00am-11.00am, 11.30pm1.30pmChFC05/DPFP054 Mar 202217 May 202230 May, 1, 3, Jun 20229.00am-5.00pmAllen Lim16 Jun 20229.00am-11.00am, 11.30pm1.30pmChFC0628 Jan 202221 Feb 20227, 9, 11 Mar 20229.00am-5.00pmChan Keng Leong24 Mar 20229.00am-11.00am, 11.30pm1.30pmChFC0728 Jan 202221 Mar 20224, 11, 14 April 20229.00am-5.00pmKoh Siew Min21 Apr 20229.00am-11.00am, 11.30pm1.30pmTutorial Schedule for ChFC01/DPFP01-ChFC07 (Intake 2)TABLE 5: TUTORIAL DATES AND TIMEModuleRegistration RegistrationStartsClosesTutorial Date andTimeExam Date and TimeStudents will be pre-assigned either one ofthe exam timings on exam datesChFC01/DPFP0125 Feb 202211 Apr 202225, 27, 29 Apr 20229.00am-5.00pm12 May 20229.00am-11.00am, 11.30pm-1.30pmChFC02/DPFP0225 Mar 202223 May 20226, 8, 10 Jun 20229.00am-5.00pm22 Jun 20229.00am-11.00am, 11.30pm-1.30pmChFC03/DPFP0322 Apr 202220 Jun 20224, 6, 8 Jul 20229.00am-5.00pm21 Jul 20229.00am-11.00am, 11.30pm-1.30pmChFC04/DPFP0413 May 202212 Jul 202225, 27, 29 Jul 20229.00am-5.00pm18 Aug 20229.00am-11.00am, 11.30pm-1.30pmChFC05/DPFP053 Jun 20228 Aug 202222, 24, 26 Aug 20229.00am-5.00pm8 Sep 20229.00am-11.00am, 11.30pm-1.30pmChFC0611 Mar 20226 Jun 202220, 22, 24 Jun 20229.00am-5.00pm7 Jul 20229.00am-11.00am, 11.30pm-1.30pmChFC078 Apr 20224 Jul 202218, 20, 22 Jul 20229.00am-5.00pm4 Aug 20229.00am-11.00am, 11.30pm-1.30pm5

Tutorial Schedule for ChFC01/DPFP01 - ChFC07 (Intake 3)TABLE 6: TUTORIAL DATES AND TIMEExam Date and rial Date andTimeChFC01/DPFP0129 Apr 202218 Jul 20221, 3 , 5 Aug 20229.00am-5.00pm18 Aug 20229.00am-11.00am, 11.30pm-1.30pmChFC02/DPFP0210 Jun 202222 Aug 20225, 7, 9 Sep 20229.00am-5.00pm22 Sep 20229.00am-11.00am, 11.30pm-1.30pmChFC03/DPFP038 Jul 202219 Sep 20223, 5, 7 Oct 20229.00am-5.00pm20 Oct 20229.00am-11.00am, 11.30pm-1.30pmChFC04/DPFP0429 Jul 202217 Oct 202231 Oct, 2, 4 Nov 20229.00am-5.00pm17 Nov 20229.00am-11.00am, 11.30pm-1.30pmChFC05/DPFP0526 Aug 202214 Nov 202228, 30 Nov, 2 Dec 20229.00am-5.00pm15 Dec 20229.00am-11.00am, 11.30pm-1.30pmChFC0624 Jun 20225 Sep 202219, 21, 23 Sep 20229.00am-5.00pm6 Oct 20229.00am-11.00am, 11.30pm-1.30pmChFC0722 Jul 20223 Oct 202217, 19, 21 Oct 20229.00am-5.00pm2 Nov 20229.00am-11.00am, 11.30pm-1.30pmStudents will be pre-assigned either one ofthe exam timings on exam datesTutorial Schedule for ChFC01/DPFP01 - ChFC07 (Intake 4)TABLE 7: TUTORIAL DATES AND TIMEModuleRegistration RegistrationStartsClosesTutorial Date andTimeExam Date and TimeStudents will be pre-assigned either one ofthe exam timings on exam datesChFC01/DPFP015 Aug 202212 Sep 202226, 28, 30 Sep 20229.00am-5.00pm13 Oct 20229.00am-11.00am, 11.30pm-1.30pmChFC02/DPFP029 Sep 202231 Oct 202214, 16, 18 Nov 20229.00am-5.00pm1 Dec 20229.00am-11.00am, 11.30pm-1.30pmChFC03/DPFP037 Oct 202227 Dec 20229, 11, 13 Jan 20239.00am-5.00pm26 Jan 20239.00am-11.00am, 11.30pm-1.30pmChFC04/DPFP044 Nov 202216 Jan 202330 Jan, 1, 3 Feb 20239.00am-5.00pm16 Feb 20239.00am-11.00am, 11.30pm-1.30pmChFC05/DPFP052 Dec 202220 Feb 20236, 8, 10 Mar 20239.00am-5.00pm23 Mar 20239.00am-11.00am, 11.30pm-1.30pmExamination Schedule for DPFP05E (CSE Onsite)TABLE 8: SCHEDULE FOR DPFP05EModuleExamination DateExamination time13, 27 January 202210, 24 February 202210, 24 March 202214, 28 April 202212, 26 May 2022DPFP05E9, 23 June 20227, 21 July 202211, 25 August 20228, 22 September 202213, 27 October 202210, 24 November 20228, 22 December 202265:00pm - 5:30pm

For ChFC08 (For Jan- Nov 2022 Intake)Note: Dates are subject to changes.TABLE 9: SCHEDULE FOR ChFC08IntakeReleaseof SMARTCertificateofCompletionfor ChFC08(by 5pm)Release ofChFC /SSMARTCertificateParchment(by 5pm)25 Feb202211 Mar 20228 Apr 202225 Mar 20221 Apr202218 Apr 20226 May 202211,12,13Apr 202222 Apr 202229 Apr202213 May20223 Jun 20228 May 2022- Submit by11:59pm23, 24, 25May 20223 June 202210 Jun202224 Jun 20228 Jul 202219, 20May20225 June 2022- Submit by11:59pm13, 14, 15June 202224 June 20221 Jul202215 Jul 20225 Aug 202214 June 202216,17June20223 July 2022- Submit by11:59pm12,13,14July 202222 July 202229 Jul202212 Aug 20222 Sep 202222 June 202212 July 202214, 15July 202231 July 2022- Submit by11:59pm15,16,17Aug 202226 Aug 20222 Sep202216 Sep 20227 Oct 202227 July 20228 Aug 202211,12Aug 202228 Aug 2022- Submit by11:59pm12,13,14Sep 202223 Sep 202230 Sep202214 Oct 20224 Nov 202210,11,12Oct 202221 Oct 202228 Oct202211 Nov 20222 Dec 202214-hourTutorial(Online)*9am mAssessment(via VirtualPlatform)ChFC083-hourCase StudyWrittenAssessment(9am 22 Dec 202111 Jan 202213,14 Jan202230 Jan 2022- Submit by11:59pm7,8,9Feb 202218 Feb 2022Feb202226 Jan 20228 Feb 202217,18 Feb20226 Mar 2022- Submit by11:59pm14,15,16Mar 2022Mar202223 Feb 20228 Mar 202217,18Mar 20223 Apr 2022- Submit by11:59pmApr202223 Mar 202212 Apr 202221,22 Apr2022May202227 Apr 202217 May 2022Jun202225 May 2022Jul2022Aug20222 Oct 2022- Submit by11:59pmChFC09(OnsiteExam)Sep202224 Aug 202213 Sep 202215, 16Sep 2022Oct202228 Sep 202211 Oct 202213, 14Oct 202230 Oct 2022- Submit by11:59pm7, 8, 9Nov 202218 Nov 202225 Nov20229 Dec 202230 Dec 2022Nov202226 Oct 20228 Nov 202210,11Nov 202227 Nov 2022- Submit by11:59pm5, 6, 7Dec 202216 Dec 202223 Dec20226 Jan 202327 Jan 2023At the end of the 14-hour tutorial, candidates will be provided with instructions on how to book the 1-hour Practicum Assessment.*7

COMPLETION REQUIREMENTSCandidates must take note that you will be required to: Attend a compulsory 14-hour tutorial for ChFC08 which willbe conducted by the SCI according to the course schedule inTable 9.forChFC08Achieve 100% Class Attendance.Submit a Financial Plan for Practicum Assessment online.Pass a 1-hour Practicum Assessment.Pass a 3-hour Case Study Written Assessment.Candidates are also be required to provide a verbal consent of the following before the Tutorial, Practicum Assessmentand Case Study Written Assessment: Consent to be photographed, videoed and recorded while attending the Tutorial, Practicum Assessment and Case StudyWritten Assessment. Consent given to SCI officer(s) to sight the NRIC (front & back) for ID verification purpose, to capture and match the last 4characters of the NRIC with those registered in the SCI system.REGISTRATION LINK FOR CHFC08To register, please click here: nChFC/S View Details & Schedule Register For ChFC08: Click HereSUBMISSION OF FINANCIAL PLANSCI Portal Dashboard upload ChFC08 Financial Plan Select File (upload your zipped file, not exceeding 25MB) Submit Confirmation Page BOOKING PROCEDURE FOR PRACTICUM ASSESSMENTSCI Portal Dashboard Register for ChFC08 PracticumAssessment (Select your timeslot) Submit Confirmation EmailEach candidate is given 2 weeks to complete the financial plan after the tutorial.If the submission deadline is missed, the candidate is deemed to have failed the ChFC08 module and he is required toretake the Practicum Assessment with a retake fee of S 160.50 (inclusive of 7% GST) within the same intake and fulfilcompletion requirements of ChFC08 by the stipulated deadline. If not, the clawback provision kicks in.As certain tablets, including the iPad, do not permit the usage of the camera function and screen-sharing functionsimultaneously, tablets are discouraged during the Practicum Assessment.The system allows submission of only 1 file, which can be a zipped one containing multiple files.Submission can only be done ONCE.Files should not contain any password.File size cannot exceed 25 MB.ITEMS TO PREPAREFor the Tutorial, please prepare your Identification Document (NRIC/Passport), pen, paper, and a non-programmable financialcalculator. For the Practicum Assessment, please prepare your Identification Document (NRIC/Passport) and a digital copy ofyour financial plan. For the Case Study Written Assessment, please bring your Identification Document (NRIC/Passport), nonprogrammable financial calculator. You may also bring your financial plan, one piece of double-sided A4-sized crib sheet and a penwhen you sit for the Case Study Written Assessment.COURSE REQUIREMENTSforChFC09Candidates must complete and pass the online course before taking the on-site examination as stipulated in Table 9.If a candidate fails the on-site examination or fails to fulfil the course requirements for ChFC09, the candidate will berequired to re-register for ChFC09 at the retaker fee of S 53.30 (inclusive of 7% GST). Retaker fee is not eligible forfunding.RELEASE OF SMART RESULT SLIPS, SMART CERTIFICATEOF COMPLETION FOR CHFC08 & CHFC09 AND SMARTOVERALL CERTIFICATE PARCHMENT FOR CHFC /SFor ChFC01/DPFP01 - ChFC05/DPFP05 and ChFC06 - ChFC08, a Certificate of Attendance will be issued upon fulfillingthe attendance requirement for the tutorials five working days after the last tutorial.For ChFC01/DPFP01-ChFC07, DPFP05E & ChFC09 examinations, candidates will receive their examination resultsimmediately upon completion of the computer mode examinations.Candidates will receive a SMART Certificate Parchment for the Diploma in Personal Financial Planning (DPFP) withina month after all the required modules, ChFC01/DPFP01 - ChFC05/DPFP05 and DPFP05E have been completed andpassed. (Note: ChFC01/DPFP01 is exempted for Cert FPC holders).For ChFC08, upon fulfilling all completion requirements for ChFC08 on page 8, a SMART Certificate of Completion will8

be issued to candidates on the "Release of SMART Certificate of Completion for ChFC08 Dates" as shown on page 7.For ChFC09, a SMART Certificate of Completion will be issued within 5 working days once all the online courserequirements are fulfilled. A Result Slip will be issued immediately upon completion of the on-site examination.All SMART Certificates will be sent to the email address of the candidate in the SCI system.USE OF DPFP DESIGNATIONCandidates need not apply for the DPFP Designation. Upon successful completion of the examination modules fromChFC01/DPFP01 to DPFP05E within the specified time frame, you will be eligible to use the certification designation:Dip SCI (DPFP).USE OF ChFC /S DESIGNATIONThere is no need to apply for the ChFC /S designation. You may start to use your ChFC /S designation on the day whenyou have received the overall SMART Certificate Parchment and SMART Code of Ethics Certificate.OVERALL CERTIFICATE PARCHMENT FOR ChFC /SWith effect from ChFC08 March 2021 intake, for those who have successfully attained their ChFC /S, we will no longerissue hard copy of the Overall Certificate Parchment for ChFC /S. Instead, the ChFC /S holder will receive an overallSMART Certificate Parchment together with the SMART Code of Ethics Certificate on the "Release of ChFC /S SMARTCertificate Parchment Dates" as shown on Page 7. An email will be sent to the ChFC /S holder from our third-partyvendor CV Trust (academies@cvtrust.com) on the date as shown in Table 9.The SMART Code of Ethics Certificate is issued to the ChFC /S holder who is deemed to agree to abide by the Code ofEthics for as long as he is a holder of the designation. If the ChFC /S holder fails to abide by the Code of Ethics, theSCI has the right to deny the award of the designation and/or suspend the use of the designation in the event that theSCI determines that the ChFC /S holder has violated the Code of Ethics.If the ChFC /S holder wishes to practise in the US, he will need to take the US equivalent papers for the ChFC /US title.The ChFC /S title is not transferable in this case.For details on the “Guidelines For Designation Trademark Use”, please refer to: https://www.scicollege.org.sg/docs/Guidelines for ChFC CLU Designations.pdfTARGET Financial Planners / Life Insurance Advisers;Relationship Managers;Bancassurance Staff; andOther insurance professionals whose job responsibilities require in-depth knowledge of financial planningprinciples, practices and products, and those wishing to obtain a professional financial planning qualificationfor their career advancement.ENTRY AudienceRequirementsAt least 18 years of age;A minimum of 10 years of formal education; andPreferably be in financial services activities.REGISTRATIONPoliciesThe Order By Which Modules Must Be Passed1. ChFC01/DPFP01-ChFC04/DPFP04 can be taken in any order. However, ChFC05/DPFP05 and DPFP05E can only be taken uponpassing ChFC01/DPFP01-ChFC04/DPFP04.2. Candidates can register for ChFC06 and/or ChFC07 only upon passing ChFC01/DPFP01-ChFC05/DPFP05 or having beenexempted from ChFC01/DPFP01-ChFC05/DPFP05 (see Exemption section).3. Candidates can register for ChFC08 only upon passing ChFC01/DPFP01-ChFC07.4. ChFC09 must be registered for together with ChFC08.Otherwise, candidates will encounter registration issues if the above order is not followed.5. If candidates want to pursue the DPFP qualification, they are required to take and pass DPFP05E which can only be takenafter passing DPFP01-DPFP05 and they must pass by the clawback deadline.6. Maximum number of modules allowed to register for is TWO.9

IMPORTANT NOTE:You will need to provide your full name (as shown in your NRIC/passport), personal mobile number and RNF number at thetime of registration. No cancellation or withdrawal of registration is allowed once registration is submitted unless the Cooling-offPeriod is applicable.All registrations are subject to review and SCI reserves the right to reject any applications.SWITCHING OF ROUTESQ: If I am registered for self-study for ChFC01/DPFP01 but I failed, can I switch to T&A for my retake & to pay net fee for T&Apathway?A: Yes. If you have registered from 1 January 2022 till 30 June 2022, there will be 80% or 90% claw-back (quantum depends onthe subsidy you are eligible for). You will sign a new Student Contract for the T&A pathway. You will pay an administrative feeof S 53.50 (inclusive of 7% GST) and you will be treated as a First-Timer.Q: I am registered for the T&A pathway for ChFC01/DPFP01 but I failed. My retaker fee is S 192.60 (inclusive of 7% GST). Can Iswitch to Self-Study as a first-timer and pay a net fee of S 38.52?A: No, you are not allowed to.HOW TORegisterFor ChFC01/DPFP01 - ChFC07 (Training and Assessment)To register for ChFC01/DPFP01 - ChFC07 (Training and Assessment), please go to the SCI website at https://www.scicollege.org.sg/ and click on the green tile for "Register for Diploma in Personal Financial Planning (DPFP) DPFP01/ChFC01- DPFP05EChartered Financial Consulant / Singapore (ChFC /S) ChFC06-ChFC07" on the homepage. (Please see screenshot below)You will see in the Screenshot 1.0, click on the tab: ChFC/S and CLU/S, ChFC/S modules will be shown.Please click on "View Details & Schedule" button for the brochures. When you are ready to register, please click on the "Register"button to proceed. Before you register and pay for ChFC01/DPFP01 - ChFC07, you are required to sign the Student Contract orClawback Contract whichever is applicable.For ChFC08 & ChFC09To register for ChFC08, please go to the SCI website at https://www.scicollege.org.sg/ and click on "Professional Education"navigation link on the homepage. You will see the Screenshot 2.0, go to "Series" filter, select "Professional Designations" in thedropdown list and click on the "Search Course" button on your right. A list of ChFC/DPFP registration links will appear. Please clickon the ChFC08 module link to register. When you register for ChFC08, ChFC09 will also be registered together. Before you registerand pay for ChFC08 and ChFC09, you are required to sign the Clawback Contract (refer to Page 3).Screenshot 1.0For ChFC01/DPFP01 - ChFC07 (Training and Assessment)Screenshot 2.0For ChFC08 & ChFC09"Series" filterSelect "ProfessionalDesignations"ChFC08 module link10

RESCHEDULING POLICYFOR ChFC01/DPFP01 - ChFC07FOR TUTORIALSThere is no rescheduling allowed once Candidates register for the programme regardless of the reason. Candidates should,therefore, make sure that they are able to attend the tutorials on the specified dates. There are no make-up tutorials.FOR EXAMINATIONSIf Candidates Submit Their Request*:Administrative Fee Payable7 or more working days (excluding weekendsand public holidays) before examination date No fee is payable for the first time a request to change the examinationdate/time is made for a particular examination. An administrative fee of S 32.10 (inclusive of 7% GST) per request ispayable for subsequent request to change the examination date/time forthat particular examination.Less than 7 working days but more than 2working days (excluding weekends and publicholidays) before examination date An administrative fee of S 32.10 (inclusive of 7% GST) per request ispayable.2 working days or less (excluding weekends andpublic holidays) before examination date No re-scheduling i

The course fee subsidies under both IBF-Standards Training Scheme (IBF-STS) and Financial Training Scheme (FTS) will be extended by 6 months to 30 June 2022, with 80% of course fees subsidised. This will apply to courses that commence on or after 1 January 2022, up to 30 June 2022, and must be completed no later than 30 September 2022.