Transcription

7 Years to 7 Figure Wealth:!"# %&'%(") "*% ,-,."/ 0 "1- 23"4-55- ,"6 55% 2"78"9,:;23-,."-,"#;%5"*23%3;"9,"/ 0 " (% ;")-'; 8" %,& ,")0 ,; " "BiggerPockets.com!"# %&'(()%# %*&*# ,-&*%-(%./%0#1&2%3&,-"&45%6(74% 7884(4-2%&9 (74,:&.&9-2%,9*% .#;&%.&,9 %.(4&%-(%.&%-",9%,9/-"#9:5!",9) %'7:5%!"# %&'()* ,%(& -(&, %&#. %& ,"%/ 01%.# %/ '() %&'()* ,%(& 2 31)3(/#/ (&245 6 * &(, 2 74#) () & --(1&, &,5 8&4 2#0 2 () '%& &-% 2 .9%-# ," , 6 0%9# %/ *4 (3%&%(& : /#. (& *4 (7& #;3#)%#&-#5 (1 /"(12. 27 4/ /## ,"# .9%-# (' 3)('#//%(& 2 :#'()# -,%&0 (& /(*#,"%&0 ," , 6 " 9# 31:2%/"#. () )#-(**#&.#.5 8&4 *(1&, (' # )&%&0/ .%/-2(/#. %& ,"%/ 01%.# /"(12. &(, :# -(&/%.#)#. 9#) 0#5 2# /# 1&.#)/, &. ," , ,"#)# )# /(*# 2%& / -(&, %&#. %& ,"%/ 01%.# ," , 6 * 4 :#&#'%, ')(* '%& &-% 2245!"# * ,#)% 2 %& ,"%/ 01%.# * 4 %&-21.# %&'()* ,%(&? 3)(.1-,/ () /#)9%-#/ :4 ,"%). 3 ),%#/5 !"%). ),4 @ ,#)% 2/ -(*3)%/# (' ,"# 3)(.1-,/ &. (3%&%(&/ #;3)#//#. :4 ,"#%) (7&#)/5 8/ /1-"? 6 .( &(, //1*# )#/3(&/%:%2%,4 () 2% :%2%,4 '() &4 !"%). ),4 * ,#)% 2 () (3%&%(&/5 !"# 31:2%- ,%(& (' /1-" !"%). ),4 @ ,#)% 2/ .(#/ &(, -(&/,%,1,# *4 01 ) &,## (' &4 %&'()* ,%(&? %&/,)1-,%(&? (3%&%(&? 3)(.1-,/ () /#)9%-#/ -(&, %&#. 7%,"%& ,"# !"%). ),4 @ ,#)% 25 !"# 1/# (' )#-(**#&.#. !"%). ),4 @ ,#)% 2 .(#/ &(, 01 ) &,## &4 /1--#// &. () # )&%&0/ )#2 ,#. ,( 4(1 () 4(1) :1/%&#//5 1:2%- ,%(& (' /1-" !"%). ),4 @ ,#)% 2 %/ /%*324 )#-(**#&. ,%(& &. & #;3)#//%(& (' *4 (7& (3%&%(& (' ," , * ,#)% 25A( 3 ), (' ,"%/ 31:2%- ,%(& /" 22 :# )#3)(.1-#.? ,) &/*%,,#.? () /(2. %& 7"(2# () %& 3 ), %& &4 '()*? 7%,"(1, ,"# 3)%() 7)%,,#& -(&/#&, (' ,"# 1,"()5 822 ,) .#* ) / &. )#0%/,#)#. ,) .#* ) / 33# )%&0 %& ,"%/ 01%.# )# ,"# 3)(3#),4 (' ,"#%) )#/3#-,%9# (7&#)/5 B/#)/ (' ,"%/ 01%.# )# .9%/#. ,( .( ,"#%) (7& .1# .%2%0#&-# 7"#& %, -(*#/ ,( * %&0 :1/%&#// .#-%/%(&/ &. 22 %&'()* ,%(&? 3)(.1-,/? /#)9%-#/ ," , " 9# :##& 3)(9%.#. /"(12. :# %&.#3#&.#&,24 9#)%'%#. :4 4(1) (7& C1 2%'%#. 3)('#//%(& 2/5 D4 )# .%&0 ,"%/ 01%.#? 4(1 0)## ," , *4/#2' &. *4 -(*3 &4 %/ &(, )#/3(&/%:2# '() ,"# /1--#// () ' %21)# (' 4(1) :1/%&#// .#-%/%(&/ )#2 ,%&0 ,( &4 %&'()* ,%(& 3)#/#&,#. %& ,"%/ 01%.#5 ?5%'4,9*(9%!749&45%@;;%AB:"- %A& &4C&*5

!!!"# %&!'(!)'* &* ,!A Tale of Two Landlords2Living Life on Your TermsInvesting is Dull, Boring, and ExplosiveWhy Real Estate Beats Other InvestmentsSaving the Princess & Knowing the GameUnderstanding the Rules of the GameHow to Make a MillionWhy I Invest in Multifamily PropertiesFinal PreparationsHow to Read the Road MapYears One – Seven Road MapWrapping UpFinal Thoughts from Brandon2344557889-161718!!!!"# %!&!!!!!!!!!!!!'!(%#)*! ,!'!-. /)%!0%#1 !9* # %!:5!(,/)!7;%5 .%* ,

A Tale of TwoLandlords.The phone rings for the second time thatnight, waking him from his less-thanrestful sleep. A sink is plugged and thetenants need it fixed. Now. He gets up,drives thirty-miles, and quietly knocks onthe door of the tenants who called. Theywelcome him in with a look dirtier thanthe floor he needs to wade across to getto the kitchen.The giant hole in the wall is larger thanthe last time he was here and the smellof cat urine is clearly evident above thesmell of fresh cigarette smoke. The leaktakes only seconds to locate but almostan hour to fix while thetenants pace through thekitchen complaining ofthe ant problem that won'tgo away and the “dirty,loud neighbors” who livedownstairs.He walks out the door into the cold nightand decides he can continue making thepayment for a few more months beforehe will have to give this property back tothe bank as well and file for bankruptcy.After all, this was the life he signed up forwhen he took on the role of “landlord.”-----------------------------She wakes up at 8:30 in the morning,excited for another day. She puts on herjogging shoes and starts her morning runaround the neighborhood of the condoshe is staying in. She notices a newhome for sale nearby and makes amental note to call her agent about itlater.The sun is already hot but the oceanbreeze ads the cool touch she needs tofinish her jog. Back at the condo shechecks her email while staring out at thewaves breaking upon the shore. A heavysnowstorm was raging back at home, andthree tenants moved out this week, buttwo were quickly replaced and the thirdwould be soon.Finally, he wraps up his gear and headsfor the door. He passes the new 52” flatscreen TV, turns before leaving, and asksHer manager sends her the weekly reportif they have any of the rent they havewhich she reviews and sends a quickneglected to pay for the past threereply with a few marketing strategies shemonths.would like to implement to attract higherThey look at him with disgust and explain paying tenants. She gets on a quickagain how difficult it is to find work since video chat with her real estate agent andbeing fired from the factory, and that they learns about a new apartment complexfor sale, and within twenty minutes sheneed to buy clothes and food for theirhas an offer submitted to purchase thechildren first, so he would have to wait.property.Page 2She sends an email to her accountant,acquisition supervisor, and several “birddogs” to wrap up her work for the day bynoon. She begins her walk in the warmsun to her daily Spanish lesson anddecides that she might stay here forseveral more months before headingback home.7 Years to 7 Figure WealthBy Brandon TurnerAfter all, this was the life shesigned up for when she took onthe role of “landlord.”Choosing to Live Life onYour TermsDo you want to be landlord #1?Does answering calls at all hours of thenight, chasing rent, and flirting withbankruptcy make you stand up and shout“me!”?Of course not!No one gets into real estate investing tobe landlord #1, yet for some reason –most landlords end up this way. Thereare rumors about investors who make akilling off real estate and spend moretime watching their golf ball than theirinvestments, but this is not the life thatactually occurs. Why the disconnect?Let me give you a hint – its not luck. Realestate investing is a proven technique toReal Estate In Your Twenties.com!

create large sums of wealth over time. Byfollowing simple rules and guidelines,investing can be profitable, fun, andrewarding. However, most would-beinvestors simply jump into the gamebecause of a television show they haveseen or a get-rich-quick course they sawon late night television.it down to its basic parts.In the book “Rich Dad's Guide toInvesting,” the author writes, “Investing isa plan, often a dull, boring, and almostmechanical process of getting rich.”How can this be? Why do so manypeople fail at making money in RealTake notice that the title of this e-book is Estate then? The answer is one of two,not “Thirty Days To Seven Figure Wealth” and surprisingly simple:but “Seven Years to Seven Figure1.) They don't have a planWealth.” Building wealth takes time2.) They get bored and try to getand it takes hard work. You do not getfancyto be “landlord #2” without putting inyears of hard work and dedication.That's it. If you want to build wealth, youHowever, you do not need to “passsimply need to overcome those twothrough” the life of landlord #1 first inproblems. In other words, to build wealthorder to get to landlord #2.you need to:The goal of my real estate blog , found at1.) Have a Planwww.RealEstateInYourTwenties.com is2.) Stick to that Plan.to teach you ways to invest in real estatewithout slaving away at maintenancecalls, hassling tenants, and chasing rent.Yes, there are examples ofindividuals who have madehuge sums of money in realestate in little time, but thoseare the exception and not the rule.Investing is Dull, Boring,and ExplosiveInvesting in real estate does not have tobe difficult. It does not have to becomplicated. In fact, investing in realestate is incredibly simple when you boilPage 3That is what this book is about. Creatinga (good) plan and learning to stick withthat plan. Once you have a plan, gettingfrom where you are now to where youwant to be is as simple as following apath.You've probably seen the investmentfirm Fidelity's television commercials inwhich people walk around their daily lifewith a path at their feet made out ofgreen arrows, illustrating the importanceof creating a financial plan for yourselfand simply sticking to that plan. This is7 Years to 7 Figure WealthBy Brandon Turnerthe exact concept I am referring to, but Iadvocate using real estate investing toget there.The good news is – that if you can stickby a simple plan of investing, you willsucceed. You will build wealth and findfinancial freedom. Real estate investingis explosive, in that each year you willearn more and more wealth. This is thepower of compound interest. Real estateenables not only you to earn money, butwill allow your money to earn money.!"# %&'( !) *& , -#."(/ #0 -# 1"&, 2(/&/"!"# %&'() *&') ',- )& .-/0'1"# %&'() *&''-*) 2 )3 &)3-0 '4-5)&056"# %&'() 7/8- / 9./':"# ;'. . 5)-' )& ,0,5?@"# %&'() . 5)-' )& 5-/5&'-A '4-5)&05B"# C, 2 )3 &,0 -7&) &'D"# -) E/'* /'A *&79. */)-A"F"# G9-'A 7&'- &, A&'() 3/4-"H"# %&'() 5) *8 )& &,0 I, 'J 5)/'A/0A5!K"# L/ ) ,') . )&7&00&2Real Estate In Your Twenties.com!

Why Real Estate BeatsStocks, Gold, and OtherInvestmentsreal. It is not some concept I aminvesting in or a .0001% ownershiprole in a mega-corporation. It is aphysical object that can bechanged, altered, or improved atthe whim of me. If I want toimprove income, I can improve theproperty. With stocks or otherinvestments, I am merely apassenger. With real estate, I amthe driver.There is a plethora of investmentvehicles in our world today.From stocks to gold tocommodities, wealth can bebuilt using nearly all of thesetechniques. So why do Iadvocate using real estateto fund your life? There arethree major reasons:1.) Leverage: If you had 20,000dollars to invest, you could buy 20,000 worth of gold or stocks. Ifthe investment increases in value,it does so in relation to the exactamount you put in. However, if youinvest that 20,000 in real estate,you could purchase a 100,000property and get the fullinvestment benefits from the 100,000 not just the 20,000.2.) Dual Purpose: You cannot live inyour stocks, gold, or oil. You can,however, live in your investments.This is especially helpful for thosewho are just starting out. Everyoneneeds a roof over their heads, so ifyou can use that roof as part ofyour investment strategy, wealthcan be built even faster.Saving the Princess IsAll About Knowing TheGameYou should see me play the Nintendo.Do you remember Mario Bros?Yes, the original Nintendo NESgame where Mario speedsthrough 8 worlds (each withfour sub-worlds) in an effort to save theprincess from the evil king Bowser. Thisgame was life for me growing up and Istill play it to this day. The first time Ibeat the game, it took me hours. Thesecond time it was quicker.The game never changed. Themushroom guys came at the same timeand at the same place. The levelsprogressed in logical order, and theshortcuts were always there. The reasonI could beat the game so quickly isbecause I memorized the patterns. Ilearned the rules, and I learned how toexploit them to get me to the end assoon as possible.I realized one day that Mario Bros wasjust like investing. The game neverchanges. Yes, there are ups and downsin the market but the fundamentals donot change. As long as a person sticks tothose fundamentals, getting to the end isnot only possible but inevitable.The only time I “die” anymore when Iplay Mario Bros is when I try to get fancy.I want to explore those levels I havenever explored before, or try to play alevel with my eyes shut (yes, I've tried).This is exactly the same concept wheninvesting in real estate. Following a basicplan will get you to the end because theplan works and never changes. Whenyou try to get fancy and complicated, yourun the high risk of failing.The more I played, the more shortcuts Ilearned and better I became (remember“But that's so boring,” you complain.the unlimited life hack in level three orwarping from level four to level 8!?)Exactly. That's what makes it so easy toToday, I can beat the entire game in less create wealth.than 8 minutes, and I'm sure there arepeople out there who can do it faster thanthat.3.) Directly Actionable: My favoriteaspect of real estate is that it isPage 47 Years to 7 Figure WealthBy Brandon TurnerReal Estate In Your Twenties.com!

Understanding TheRules of the Gamedifferent. In addition, you can alsoforce the property to appreciate invalue by improving the condition ofthe property or increasing theincome it produces. There aremany techniques you can use tobuy properties at steep discountsor force appreciation, and you canread about many of them at myblog.By now, you must be wondering whatthose patterns and rules are that makeinvesting so easy.Its not a secret and this is not a“program” like those late nightinfomercials. This is simply the rules thatI, and thousands of other successfulinvestors, have used to create passiveincome from real estate. Like knowingwhere the hidden bricks are in Mario thatgive you “fire bullets,” these are thesimple fundamental rules you need tofollow when investing in real estate.That's it.Those are the two major rules you needto follow when buying real estate.The exact pattern may change, and I willbe soon discussing some specif ic rulesthat will govern how much cashflow andequity we will1.) Cashflow is King:need to have inNever buy a property!"# %&'%anypropertythat loses money each month. I'll()*& ,%purchased, butrepeat that again: Never buy atheproperty that loses money eachfundamentals“Equity” means themonth. If you live in an area thatare simple.amount of profi tpositive cashflow is impossible,you have in ainvest in a different area. If youBuypropertyproperty.It is thewant to build wealth faster, reinvestthat has bothdifference betweenthat cashflow. If you want tocashflow andhow muchsupplement your income, live offsomething is worththat cashflow. The choice is yours. equity. It reallyis that simple.and how much isowed.2.) Buy at aDiscount/ForceAppreciation – thesimplest explanation ofgood business is this: buy low, sell It's time to go from “theory” into “practice”high. Another term you may have and learn how to make a million dollars inheard is to buy wholesale and sell seven years buying only five properties.retail. Real estate should be noPage 57 Years to 7 Figure WealthBy Brandon TurnerHow to Make a MillionAs the title of this book suggested, Iam going to explain the exact steps tomake over a million dollars in realestate while part time investing in justseven years.The rest of this book will focus on theexact steps needed to get to this point.While the names and addresses aremade up, each of properties are realexamples of properties I have eithermyself purchased or have seen at theseprices. They are real-world examples butin order to find them, you need to dig.Not every property is worth buying. Inreality, less than 1% of propertiescurrently for sale are worth buying.Yes, you can buy almost any property attoday's low prices and still make averagereturns on your money. However, as thephrase goes, average returns are foraverage investors. We want to let themasses blindly invest in normal propertyand you are going to focus only on thebest deals.By focusing only on the best propertiesat the lowest prices, you will take lesssteps to build financial stability andwealth. As I discussed above, this planrequires only five purchases over aseven year timeline. This is, on average,less than one each year.This plan is a conservative strategy atReal Estate In Your Twenties.com!

investing in real estate, but maximized toproduce the highest results the fastest. Ifyou have more money to invest or moretime to commit you can really speed upthis plan.On my blog, I discuss several differentstrategies to invest in real estate, takenfrom many different perspectives.However, for now I am going to assumethe investor in this plan has a stable fulltime job, a small amount of savings, andgood credit. If this is different than you,thats okay. This plan is tailorable if youjust put your head to it. For example, ifyou don't have the initial down paymentamount of 20,000 – thats okay. Yourstrategy will require a little bit oftweaking, but the end result can be thesame.real estate to earn signif icant passiveincome over the next several years, justput your mind to it.It's time to get into the details of what theseven year plan will look like. Thefollowing six items are rules I am going tofollow in mapping out the seven-yearplan. These are not lofty, unattainablegoals but actual rules that I live by. Theseare requirements that every property Iwant to buy must fit within.You could earn that initial 20,000 byflipping a home, saving like crazy for thenext year, forcing more equity doing aremodel, grabbing a partner to help fundthe down payment, using a Home EquityLine of Credit, or simply make your firstinvestment your primary residence, usinga 3.5% down FHA loan – thus needingonly 3500 for a down payment. Checkout my article on ways to invest in realestate when you are broke.Tony Robbins says, “You don't lackresources, you lack resourcefulness.” Ilove this quote and use it all the time forinspiration. It is never more true than inreal estate investing. Just like your momtold you as a child – you can do anythingyou put your mind to. If you want to usePage 67 Years to 7 Figure WealthWe will start with 20,000.00investment. As we just talkedabout, there are many ways to startthis plan without the initial 20,000.However, this is the simplest way.Also note – this is the only moneyever needed to be used in thisplan. If you have more than 20,000 to invest, or can add moreeach year – you can work this planeven faster.We will purchase properties for20% discount from their value.Again, it is important to always buyat discount. When I buy, I usuallytry to buy for 30% to 40% discount,but in order to make this plan workyou would not have to be that strict(but if you can, do!) This mightmean it takes twenty or thirty offerson different properties before youget one accepted, but if you askany seasoned investor, 20%discount is not a difficult number toachieve.By Brandon TurnerWe will put 20% on eachproperty we purchase. Mostbanks today require 20% of thepurchase price. Yes, it is possibleto put less than 20% or more than20%, but for the purpose of thisdemonstration it is a good numberto use.We will force a 10% appreciationduring the first year: Allproperties have room forimprovement. I will make sure thatby decreasing expenses,increasing rents, and improvingthe property, the value willincrease by 10% during the firstyear. Again, ask any seasonedinvestor - this is not a difficult featto accomplish.We will assume that theproperties will appreciate 4%per year. Except for the first year,the property will appreciate at 4%per year. Economists at FreddieMac and Fannie Mae have used5% as an average number, but tobe conservative, I will use 4%.The properties will cashflow 200 per unit, per month: This isanother actual rule I have whenbuying property. A single familyhome needs to cashflow at 200per month. A duplex needs tocashflow at 400 per month. Afour-plex needs to cashflow at 800 per month. This means afterReal Estate In Your Twenties.com!

all the bills and the mortgage arepaid – and reserves for repairs andbig-ticket items are set aside –there is still 200 per unit permonth cashflow left over.!"# %"&' (")'* , -.!"#"# "%&'()* ',-./'* '(.*-0%. -"'(0'102%'03/' *(2.(*0/4'5 '-0/6'. '102' (*78' 1'()" "' . *7',%*/7*,-" '09',0 *(*:"'7. );03'./ ' 2*- */6'" 2*(1&'102'.%"'60*/6'(0' 277"" 4Why I Invest inMultifamilyProperties toSupercharge myReal EstateInvestingWhile there are many different typesof real estate investments, the smallmultifamily property works best forgaining wealth quickly with this roadmap.We are going to start with a four-plex.This is a property type that has four units.Page 7This does not mean you need to live inthis property. In fact, this road mapdoesn't require you to live in yourinvestments. If you choose to do so, itis a great plan and you can build wealtheven quicker. The down paymentrequirements, interest rates, and ease offinancing is much easier if you live in theproperty. However, most investors do notwant to mix personal and business life,so the steps outlined below utilize simplya twenty percent down payment on apurely multifamily investment property.There are many reasons why I choosemultifamily properties to invest in, andwhy we are going to start with a four-plex.The following are three of the mainreasons we start with a four-plex:Higher Cashflow – remember, we areshooting for 200 per unit, per monthin cashflow. If we began with a singlefamily home, our cashflow would onlybe 200 per month. However, we wantto supercharge our investing to buildwealth as quickly as possible. There isnothing wrong with single-familyhomes – and in fact, they are mucheasier to manage and learn thebusiness with. However, if you trulywant to gain cashflow and equityquickly, starting with a multifamily is agreat way to go.Less competition – Mosthomeowners (the vast majority ofbuyers) do not consider multifamilyproperties. This means there issignif icant less competition for the7 Years to 7 Figure WealthBy Brandon Turnermultifamily properties. Your maincompetition are other investors whoare also looking for a killer deal.Easy financing – Banks and otherfinancial lenders (including thegovernment) look at multifamilyproperties up to four units in almostthe exact same way as single familyhomes. If you can qualify for a singlefamily home, you can qualify for afour-plex.Less holding costs- When it comestime to sell your properties and “tradeup” to larger investments, amultifamily property does not sitempty for months while it is on themarket to sell. Instead, it continues togenerate income every month. Thisadds a huge degree of security, asyou can wait for a good offer to comein and not feel the need to sell tosomeone quickly just because youneed to stop losing money eachmonth. This results in higher salesprices for you as well.If you are sincerely interested ininvesting in real estate but would ratherfocus only on commercial, single family,or other types of investments – great!Real estate is a game of math, and mathalways works. If you can follow the samerules as I outlined above (20% down,force 10% appreciation, and minimumcashflow requirements) with anotherform of investing – by all means do it.Multifamily is simply the vehicle I enjoymost to invest with.Real Estate In Your Twenties.com!

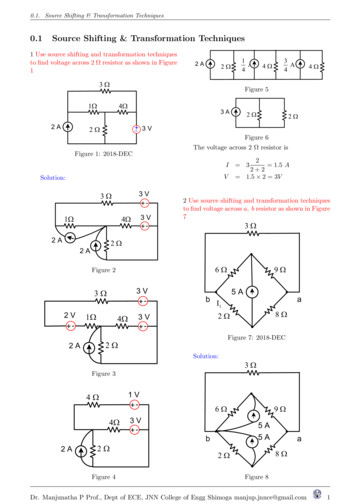

Final PreparationsA journey of a thousand miles beginswith a single step.As you work your way through the nextseveral pages, and years, take your time.Truly seek to understand each phase.This is not a complicated path, but it iseasy to get lost in themath.I also recommend thatyou print this guide out,as you will get a lot moreout of it. Furthermore,make sure to take notesso you can properly remember all youare learning and apply it later.How to Read the RoadMapTo begin year one, wewill make our firstpurchase.I am going to use very simple, roundednumbers for the purpose of explainingthis plan. Obviously, the homes that youwill buy in the real world may not be theexact prices we will use here, but thatsokay. It's the principles that matter.ValueLoan Equity SavedAmountCashflowYearI will be using the above chart as astarting point to explain the seven yearroad map. The chart consists of severalimportant numbers that change eachyear:The best way to really learn this is toshare it with someone you know. Learnby teaching. Get excited about thepossibilities and share it with yourspouse, your family, or your friends. SeekValue: The value is the cost that theto internalize what you are learning.property is worth.Then, go out and do it.Loan amount: The total owed on themonthly mortgage to the lender.For the rest of this book, one page hasbeen dedicated to each year of the seven Equity: The total value minus the loanamount.year guide. If you have any trouble orwould like to know more specif ics, check Saved Cashflow: The total amount ofcashflow collected, in savings.out my blog athttp://www.RealEstateInYourTwenties.coThis plan requires saving all cashflow tom.invest in later purchases. While you couldchoose to live off the monthly cashflowand still invest, investing your profits backinto your business is the best way toPage 87 Years to 7 Figure WealthBy Brandon Turnergrow a strong and stable portfolio.Each year I will add a row, showing thechanges for that particular property. Ourinitial purchase begins the process,starting at the beginning of year one.Furthermore, each page of the sevenyear plan includes a section titled, “WhatHappened”. This section – found in a redbox – explains exactly what took placeduring the year in case you get lost.Finally, each year includes a green boxthat shows what our current real estateportfolio looks like. This box helps keeptrack of what properties we own in whichyears.If you are ready, feel free to continueahead to year one. We are about tomake our first real estate purchase – 123Main Street.Real Estate In Your Twenties.com!

!"# %&'"!"# %&'"%(%)*# * ',%-. */.0 .1123 Main StreetStart of Year One:In the beginning, we are going to search for our first property to buy. Wefind our first property located at 123 Main Street. This property is locatedin a family neighborhood and contains four units. See inside the houseto the right for details on the purchase:Placed on our chart, it looks like this:Number of Units:Income:All Expenses*:Cashfl ow:Asking Price (value):Purchase Price:Down Payment:Loan Amount:Four 2400/month 1600 800/month 100,000 80,000 20,000 60,000*expenses include mortgage (5% interest, 30 year fi xed),water, sewer, garbage, taxes, insurance, maintenance, andreserves for future big-ticket repairs and vacancies. For moreinformation, search for “The 50% Rule” onBiggerPockets.comAt the start of year one, our property was valued at 100,000 but we bought it for 80,000 and put 20,000 as a downpayment (slightly more than 20%, but I am assuming there would be a few thousand in deferred maintenance to takecare of, bringing our total investment to 20,000). Our total loan amount would be only 60,000, giving us 40,000 inequity. It is key that you understand these principles before we move on. Each year we will be building upon thisfoundation, so feeling secure at this point is imperative.23#*%4#55"'"61%End of Year One:23#*%4#55"'"61%By the end of year one, we have received twelve months of cashflow,paid down the loan a small amount, and increased the value 10% by!"#%7#08" %& '() * ,-,,,.,,- )/%0/ %& ,1 !"#%7#08" %& '() * ,-,,,.,,- )/%0/ %& ,1 forced appreciation. I'm now going to add a row to show us the results /%2/3# 4/5' )/3' )3 6"#0/5&37 4/3 6#(63#48.of those changes./%2/3# 4/5' )/3' )3 6"#0/5&37 4/3 6#(63#48.!"# 0.#'%#9.8'* /5& 933' 65%7 7()' 4( !"# 0.#'%#9.8'* /5& 933' 65%7 7()' 4( *:;- ,,.,, *:;- ,,.,, 3 '() /5 3 *:,-?,, %' ":8 *;%@* ,-,,, A 3 '() /5 3 *:,-?,, %' ":8 *;%@* ,-,,, A *:;- ,,B. *:;- ,,B. 3 /5 3% #7"6%*3"% # 3 .? (C *?,, 63# D('4/ 3 /5 3% #7"6%*3"% # 3 .? (C *?,, 63# D('4/ C(# 5 4(45E (C *;F,, %' &5 %'2&. C(# 5 4(45E (C *;F,, %' &5 %'2&. Now that year one is complete, we will move on to year two.Page 97 Years to 7 Figure WealthBy Brandon TurnerReal Estate In Your Twenties.com

!"# %&'(!"# %& '()* ,- .-*/&-01-2123 Main Street 55,900 in Equity 19,200.00 in savingsYear two is a year of learning. No purchases, no sales.See, I told you this plan was simple! You simply spend the yearlearning how this whole “real estate” game is played. You willspend your time reading blogs likewww.RealEstateInYourTwenties.com to learn tips, tricks, andtechniques of how to manage rental property without turninginto “Landlord #1” from the story that started this book.During this year, however, the property has been cashflowing.Each month, you have been saving this money in a savingsaccount – a full 800 per month ( 200 per month per unit, aswas our requirement). We will now add a row to our financialchart, showing the changes during the second year:34)/ 5)66("(#2 34)/ 5)66("(#2 !"# 7)08( %& '() * ,-,./.- )0%10 %& ,2 0%304# !"# 7)08( %& '() * ,-,./.- )0%10 %& ,2 0%304# 506' 504 7#48%("& 946# :"4 5( 677#41%65%('/506' 504 7#48%("& 946# :"4 5( 677#41%65%('/!"# 0-)" )9-8"/ 06& ;44' 76%: :()' 5( !"# 0-)" )9-8"/ 06& ;44' 76%: :()' 5( * - ././ * - ././ 4 '() 0684 * -?. %' (:81/; @* ,-,. A 4 '() 0684 * -?. %' (:81/; @* ,-,. A * - .B/ * - .B/ 4 0684 )7(# 6' 6::%5%('6C * . 74# D('50 %' 4 0684 )7(# 6' 6::%5%('6C * . 74# D('50 %' 16&0E() F(# 6 5(56C (F * ?-G. %' &68%'3&/ 16&0E() F(# 6 5(56C (F * ?-G. %' &68%'3&/ Let's move on to year three, where we will make our second purchase.Page 107 Years to 7 Figure WealthBy Brandon TurnerReal Estate In Your Twenties.com

!"# %& ""!"# %& '()* ,*(( -.*/&.01.2At the start of year three (or end of year two, however you want tolook at it), it is time to make our second purchase, 987 Fir Avenue.For simplicity, this property is going to be identical to our firstpurchase in terms of equity, cashflow, and purchase price.123 Main Street 62,000 in Equity 9,600.00 in savings987 Fir Avenue 50,800 in Equity 9,600 in savingsThis purchase is going to require another 20% down payment, but asI mentioned earlier, this amount is not going to come from our wallets. If you personally want to contribute more to yourinvestment plan, by all means do it and you will build wealth even faster. However, we are going to purchase thisproperty using the saved cashflow we have from our first property. As the chart above shows, at the end of year two wehave saved a total of 19,200.You can start to see a pattern here. We will simply reinvest the profi

financial freedom. Real estate investing is explosive, in that each year you will earn more and more wealth. This is the power of compound interest. Real estate enables not only you to earn money, but will allow your money to earn money. Page 3 7 Years to 7 Figure Wealth By Brandon Turner Real Estate In Your Twenties.com!!"# %&'( !) *& ,