Transcription

W h i t e Pa p e EnvisionWRITTEN BYRobert L. Phillips, Ph.D.Talus Solutionshttp://phillips.CRMproject.comPricing and Revenue Management –Driving Profit Improvement from CRMPricing and Revenue Management has been used successfully in a a variety ofindustries for over 15 years. Yet its core concept – using advanced analytictechniques to optimize the prices being offered for all products and servicesto all customers through all channels – is relatively new in most industries.Robert Phillips is responsible forcreating new businessopportunities by identifying anddeveloping products and servicesPRM decisions have often been made in an uncoordinated fashion, based onthat deliver high customer valueinconsistent or incomplete data, and with little or no analysis. Now, with theinternationally recognized expertassistance of CRM and ERP systems, a new generation of PRM tools, and therise of the Internet as a selling channel, it is likely that PRM will remain thehighest-value IT investment for many companies for some time to come.in all areas of PRM. Anin PRM, Phillips has workedwithcompanies in a wide variety ofindustries, including hotels, andelectric power to help themimprove profitability. Phillipspioneered the application ofrevenue management in theConsider the following activities: A sales representative is negotiating an agreementwith a customer for discounts that will be appliedto all purchases by that customer for the next year. The Pricing Department is determining list pricesfor the next catalog release. A sales representative is deciding what price topropose in a competitive bid for a major order. The marketing department is planning a promotional campaign aimed at gaining market shareamong large customers in the Northeast region. The E-Commerce Team is trying to determine whatprices to display for key products on the corporateWeb site, as well as how to respond to buyerrequests coming through an e-commerce broker. A Special Sales Team is analyzing options for disposing of distressed inventory. Options includewholesale outlets and brokers as well as severalInternet auction sites.What do these decisions have in common? They areall market-based activities focused on determiningwhat products and services should be offered, towhich customers, at what prices, through whichchannels. This broad corporate function is termedPricing and Revenue Management (PRM). Note thatthe definition of PRM goes well beyond the ”pricingfunction” as it is defined at many companies. Itencompasses all the ways in which products and services are offered (and priced) to potential customers.Furthermore, PRM is far from static – these decisionsneed to be updated continually over time as marketconditions, inventory conditions, and competitiveconditions change.Viewed in this light, Pricing and RevenueManagement decisions are among the most criticaldecisions that a company makes. They are a majordeterminant of both corporate profitability and theability of a company to achieve its strategic goals.Yet, too often, these decisions are made in an uncoordinated fashion, in disconnected parts of the organization, with inconsistent or incomplete data, andwith little or no analysis. The result is lost profitability as well as a reduced ability to execute strategically. The PRM discipline and PRM Solutions enable acompany to coordinate these decisions and ensurethat they are being performed in a way that maximizes profitability consistent with strategic goals.rental car, freight, andmanufacturing industries andsupervised the development ofthe first airline origin anddestination revenuemanagement system. He iscurrently helping companiesmake pricing decisions throughe-commerce channels.Phillips received his doctorate inEngineering-Economic Systemsfrom Stanford University andholds undergraduate degrees inMathematics and Economicsfrom Washington StateUniversity.He has published numerousarticles and papers on revenuemanagement and holds a patenton "A Method and Designfor Determining Marginal Valuesfor Use in a RevenueManagement System."Pricing and Revenue Management is a disciplinepredicated on two fundamental principals:http://phillips.CRMproject.com1

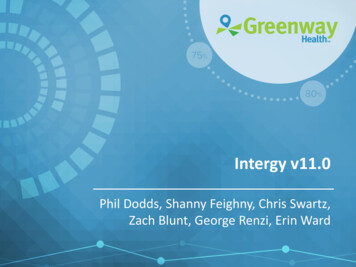

W h i t e Pa p e r1.0Envision2.01) All Pricing and Revenue Managementdecisions within a company should beperformed consistently, with the bestinformation available, in order to maximize corporate profit while meetingstrategic he Evolution of Pricing and Revenue Management1900 - : Pricing and Revenue Management 2) In most cases, Pricing and RevenueManagement decisions can be substantially improved by the applicationof forecasting and optimizationtechniques.Bid PricingPromotion PricingDynamic PricingBase Pricing1995-1997 : Expansion of Revenue Mgmt. Techniques- Micro market segmentation capabilities- Channel management- Business-to-business demand optimization1985-1995 : Adaptation of Revenue Mgmt. to Similar EnvironmentsTaken together, these two principles implya PRM function that both coordinates decisions and applies appropriate analytic techniques to specific decisions. In concept,profitability for individual decisions can beimproved independently, but the greatestimprovement ultimately comes from theeffective coordination of all PRM decisions.Pricing and Revenue Managementrepresents a major opportunity for manycompanies seeking to increase profitabilityand achieve strategic advantages. PRMsolutions incorporate forecasting and optimization technologies to enable the rapidand accurate determination of the rightprices to offer in each situation. CRM andERP systems are providing consistent,reliable sources of data to feed thesetechnologies. CRM and SFA systems enablethe rapid dissemination of recommendedprices to the right players within theorganization. The rise of e-commerce isexponentially increasing the speed at whichPricing and Revenue Management decisionsneed to be made and updated, drasticallyraising the stakes. Furthermore, many companies have already made substantialprogress in reducing costs and increasingefficiencies – in this case, Pricing andWEB LINKW3Pricing and Revenue Management isalso discussed at the following h.CRMproject.comtalus.CRMproject.com2- Car Rental, Hotels, Cargo, Broadcasting1982: Airline Deregulation1978: Production Yield Management Systems - AirlinesFIGURE 1.0The Evolution of Pricing and Revenue ManagementRevenue Management often provides thehighest leverage for improving profitability.Depending upon the industry and the company, successful PRM implementations haveled to improvements in top-line revenue of2-10%. Since the majority of this improvement drives directly to the bottom line,PRM often represents the highest return ITinvestment available to a company.The Evolution of Pricing andRevenue ManagementFigure 1.0 illustrates the evolution ofPricing and Revenue Management technologies. While companies have long appliedvarious types of mathematical analyses totheir pricing decisions, the current generation of PRM applications can trace theirorigins to the airline industry – specificallythe response of the domestic U.S. industryto its ”big bang” deregulation following thepassage of the Airline Deregulation Act of1978. Literally overnight, the airline industry went from a fully regulated environmentto one in which pricing and schedulingwere ”up for grabs”. A wave of mergers andconsolidations followed, as well as challenges from upstart low-cost airlines. Theradically new environment meant that themajor carriers needed to adopt newapproaches to their business if they were tosurvive. Pricing and Revenue ManagementDefying the Limits: Reaching New Heights in Customer Relationship Managementwas one of these new approaches.While the need for Pricing andRevenue Management was driven bycompetitive and market needs, the specificcharacter of its implementation in thepassenger airlines was driven by twocharacteristics of the industry: The instantaneous perishability of inventory (airline seats) and the fixed natureof capacity (aircraft sizes) meant thatpricing was virtually the only ”lever” thatairlines had to match supply and demandin the short run. There was no way toadjust inventory to make up for ”overproduction” or ”under-production” – theairlines have to manage their demandand they have to get it right. Electronic price distribution provided bythe global Computerized ReservationSystems such as SABRE and Apollo. Thesegiant mainframe systems – the ”Internet”of their day – enabled the airlines to distribute prices with a keystroke, monitorcustomer responses, and update instantaneously. An airline whose price was toohigh might see bookings plummet. Aprice that was too low price might resultin a surge of more bookings than theairline could handle. Clearly, advancedsystems were needed to monitor booking

Base PricingChannelFIGURE 2.0ImportancePromotion PricingDynamic ePromotionsLowCorporate/Group ghFleet/Volume Order SalesHighTelesales,InternetHighDomesticPassenger lesaleElectronicsDistributorCatalogChannelBid PricingPricing and Revenue Management issues by industryactivity and adjust price and productofferings with precision.Initially, the airlines grappled manually withthe complexities of revenue management.But, in 1985, American Airlines unleashedthe first automated revenue management (or”yield management”) system. This systemforecast demand for each future flight andused optimization techniques to determinewhich prices should be offered on whichflightstomaximizeprofitability.Furthermore, the system monitored bookingsas they came in and adjusted the price availabilities in response to changes in demand.This system was immediately successful indriving substantial improvements inAmerican’s bottom line. Furthermore, itenabled American to compete successfullyagainst highly aggressive low-cost/low-pricecarriers such as Peoples Express. Other majorairlines such as United and Continentalquickly followed American in developingsystematic revenue management systems. Bythe mid-1980s, every major U.S. airline hadan internal revenue management departmentsupported by a sophisticated decisionsupport system and the use of revenuemanagement capabilities was beginning tospread to Europe and Asian characters.Following its success at the airlines,companies in other travel industries suchas hotels, rental cars, and cruise linesestablished Revenue Management programs. Like the airlines, these industrieswere characterized by perishable capacityand access to electronic price distribution.Hertz adopted the first Rental Car RevenueManagement system in 1989 and Marriottthe first hotel system in 1991. The earlyadopters in these industries saw the samemagnitude of revenue improvements astheir airline counterparts and within thenext six years; revenue managementbecame ubiquitous within these industries.In the 1990s, companies across abroad range of industries began to look fornew ways to grow their revenues and profits. With richer sources of customer andmarket information becoming availablethrough ERP and CRM systems, PRM beganto move beyond its origins in the travelrelated industries. The basic principles ofPRM were adapted to situations in whichcapacity was neither constrained nor immediately perishable. The essential steps inthis evolution were the development ofmore sophisticated techniques for customersegmentation and calculation of price sensitivity combined with incorporation ofthose into the basic optimization. It alsorequired extending PRM to account pricing,bid pricing, and promotions managementsituations and dealing with product lifecycle considerations in a sophisticatedfashion. These steps have enabled PRM tobe successful in a wide range of settingsfrom automotive to parcel service to retailto electronic equipment sales. In essence,PRM has become a critical businesscapability with broad-based application.Fundamentals of RevenueManagementCase StudyA regional division of a national healthinsurance company wants to provide itsclients with the ability to search forphysicians in their network by specialtyor location via the Internet.SolutionUse legacy extension to provide clientswith the information stored in mainframesystems.BenefitsProvide clients with 24x7 access to providerdirectories previously available only viain-house customer services duringtraditional business hours.ResultsReduced calls to customer services; realtime response to client questions; competitive advantage over other regional healthinsurance companies; and increasedcustomer satisfaction.ConclusionThe health insurance company has beenable to leverage its legacy systems whileproviding increased value to its clients. Thecompany intends to extend the amount ofinformation clients can access via theInternet to further reduce costs andprovide additional added value.The fundamental PRM issue is: what products and services should we be offering towhich customers at what prices throughwhich channels, now? The basic goal of PRMhttp://phillips.CRMproject.com3

W h i t e Pa p e r1.0Envisionis to ensure that this decision is being madebased in a fashion that maximizes overallprofitability consistent with the strategicgoals of the company. Elements that needto be considered in this decision include:2.0Discover3.0Personalizeof these elements (as well as others) tomake a set of pricing and product availability recommendations that maximizeprofitability while considering all currentand future opportunities for selling theThe rise of e-commerce is exponentially increasing thespeed at which Pricing and Revenue Managementdecisions need to be made and updated, drasticallyraising the stakes.4.0Interact5.0Connectsive

Pricing and Revenue Management has been used successfully in a a variety of industries for over 15 years. Yet its core concept – using advanced analytic techniques to optimize the prices being offered for all products and services to all customers through all channels – is relatively new in most industries. PRM decisions have often been made in an uncoordinated fashion, based on .