Transcription

CONTACT USSandhya Mukkamala, CPASandhya@ThinkAstute.comAshwini VasudevaAshwini@ThinkAstute.comwww.ThinkAstute.com (925) 452-2205

who we areAstute is a value-add CertifiedAccounting and Business Advisoryfirm, focused on enabling companies tomaintain compliance, recover lost revenues,and increase profitabilityHeadquartered in Silicon Valley, Astuteadvises and serves growth-focusedglobal companies in the technology(HW/SW), Semiconductor, Biotech/Pharma, Consumer Goods, Power andUtilities, Manufacturing, Construction,Non-profit and Professional ServicesSectors.With more than four decades ofcombined experience, Astute bringsin the knowledge and expertise toinnovative solutions like R&D TaxCredit, Accounting for Income Taxes,Technical Accounting, Internal Audit(SOX Compliance), Royalty/LicensingAudits, Accounts Payable and Time& Expense Audits.Astute is a Certified Accounting Corporation underthe California Board of Accountancy (CBA)Astute is Certified Women-owned and Minority-ownedBusiness2 www.thinkastute.com

what we offerLarge or small, enterprise or start-up; no matter what thesize of organization is, we offer specialized services to fityour needs.Business Advisory Servicesyy Royalty/Licensing AuditKey Service Categories:yy Internal Audit AssistanceTechnical Accounting and Tax»» Business Process Documentation»» Sarbanes-Oxley ComplianceControls Testingyy Revenue Recognition (ASC 606)powered by Ayara-AutomatedRevenue Management Platformyy Forensic Audit Services»» Accounts Payable Audit»» Time & Expense Audit»» Vendor/Supplier Audityy Research and Development Tax Credit(IRC. Sec. Code 41)yy Outsourced CFO/Controller Servicesyy Accounting for Income Taxes (ASC 740)CFO ADVISORYACCURATE FINANCIAL REPORTINGInnovation& cognitionIP/LicenseComplianceRoyaltyAuditR&D Tax CreditRoyalty AuditsAccounts PayableAudit3 www.thinkastute.comRevenue Recognition

our accomplishmentsOur industry experts have conducted more than 100 R&D Tax Credit studiesfor Manufacturing, Technology, Pharmaceutical & Energy Companies, resultingin over 75 Million in tax incentives.Instrumental in building Licensing/Royalty Compliance Audit program for LifeTechnologies, a giant Biotech company.Our CPAs and Technical Accountants have overseen Merger &Acquisitionactivities with publicly held companies like Microsoft and Cisco.Saved more than 10 Million in royalty payments and recovered Millions in lostroyalty revenue for Life Science, Entertainment & Technology Clients.Our Internal Audit specialists have assisted many Manufacturing & TechnologyCompanies to build and evaluate internal audit programs and create effectivecontrols to reduce fraud risks, resulting in the protection of key assets andimproved operational efficiencies.4 www.thinkastute.com

why astuteChoosing a right accounting and business advisory firmis a significant decision, not arrived at lightly, nor to beundertaken without knowing what can be expected fromyour Accountants. This decision can have a major impacton an organization’s future success. Our clients have oftencomplimented us as being “the most valued accountants/advisors” on their team.Several key aspects of our firm that sets us apart:yy A technology driven firm with competitiveindustry pricing and cost-effective solutions.yy High degree of partner, manager andsupervisor interaction and involvement.yy Industry knowledge and experience acquiredover the course of more than four decades.yy Trustworthy accountants and business advisorspassionate about assisting our clients to achievetheir financial growth.Experienced PartnerInvolvementLARGE FIRMEXPERTISEWITHBOUTIQUE FIRMEXPERIENCEA Detailed ProcessDriven ApproachExpertise - Big 4And CPAsClient FocusedResult Oriented5 www.thinkastute.com

Outsourced And Fractional CFO ServicesApart from the annual reporting, a savvy CFO maintains tax compliance across all functions, while establishing clarityand transparency through periodic financial statements. The CFO should work in concert with the CEO to performrisk assessment and performance monitoring. For growing companies like start-ups and early stage businesses,hiring an in-house CFO or Controller may be cost-prohibitive. Yet without their expertise, it’s impossible to accuratelycapture financial data.Astute’s Outsourced and Fractional CFO/Controller Services work as an extension of your financial team. Ourobjective is to provide you with excellent professional financial advice – just like you would expect by hiring afull-time CFO/Controller.Fractional orPart-time CFO/ControllerYouThe Every business needs a strong financial leader – one who can establishbest accounting practices, providing financial planning insights neededto fuel growth.6 www.thinkastute.comRiskManagementand Compliance

How A Fractional CFO Can HelpProjections and Financial AnalysisImplement Best Practices»» Perform financial analysis»» Calculate key financial ratios»» Assess and improve operational processes»» Identify key and high-risk processesMonthly Financial Closing and ReportingTax and Cash Management Planningand Strategy»» Ensures accurate, timely accounting»» Access to financial records»» Identify tax strategy»» Provide cash flow analysisProfessional Financial StatementsBudgeting and Forecasting»» Deliver concise, transparent data»» Compare current growth to growth projectionsMonthly FinancialClosing andReporting»» Create budgets and forecastsPresent FinancialStatements toManagementand BoardBudgeting andForecastingFRACTIONAL CFO/CONTROLLER servicesProjections andFinancial AnalysisImplement BestPracticesTax and CashManagementPlanning andStrategyAstute’s Outsourced CFO team assists with all CFO/Controllerresponsibilities, including review of strategy, financial planning,budgeting, and reporting, building a true value-added partnership7 www.thinkastute.com

NAVIGATING STARTUP FUNDINGStakes are high in startups – or any early-stage company – regardless of industry or sector. Complexities within anorganization vary; solutions for one will not apply to another. Regardless of the stage, strategic planning is vital if aventure is to be successful.Venture Capital Financing (Series Band Beyond)Venture Capital Financing (Series A)Seed-CapitalFinancingYour survival depends on innovation. Astute has the right resources withthe credentials, and can create customizable reports so you can makesmart business decisions.8 www.thinkastute.com

Scenario PLANNINGScenario planning is a process of examining possible events and drawing assumptions of how the business environmentcan change in the light of future events. With scenario planning you can identify likely impacts on the P&L, Balance sheetand Liquidity, and open doors to new opportunities.Astute’s forecast scenario templates (Best, Mid, Worst case) can help you build a sustainable planning processthat is more robust, flexible, and shock-resistant.120010008006004002000Total RevenueTotal ExpendituresTotal Net Income2020 Actual ’0002021 WorstCase ’0002021 MidCase ’0002021 BestCase ’000Total Revenue7946988751065Total Expenditures713661783934Total Net Income813692131Astute’s proprietary Scenario Analysis Template is the most easy-to-use toolfor calculating financial impacts (favorable and unfavorable) to the business.9 www.thinkastute.com

Research and Development Tax CreditResearch & Development tax credit is an incentive thatrewards taxpayers for conducting research in the UnitedStates. Its goal is to promote and incentivize innovation byallowing tax credits for their research expenditures. It is forbusinesses of all sizes, not just for research labs and largercorporations.Substantiating research activities, documenting researchexpenses, and computing research tax credits in a waythat meets the stringent audit requirements of the IRS andstate tax authorities isn’t easy. As a result, we find manytaxpayers don’t receive the R&D tax credit they deserve.TAX CREDITS10 www.thinkastute.com

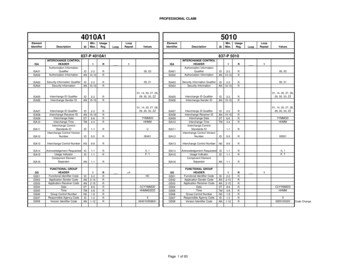

r&d tax credit savingsHere’s how companies with different revenue sizes saved taxes from Astute’s R&D tax credit study(federal computation facturingWithout R&D tax credit benefits:Taxable income 500K 5.0M 6.0M 105K 1.05M 1.26M 500K 5.0M 6.0MFederal Taxes paid 105K 1.05M 1.26MLess: R&D Tax Credit( 20K)( 260K)( 370K) 85K 790K 890K 105K 1.05M 1.26MTotal taxes paid with R&D tax credit benefit 85K 790K 890KTotal taxes saved 20K 260K 370KFederal Tax rate 21%Federal Taxes paidWith R&D tax credit benefits:Taxable incomeFederal Tax rate 21%Net Federal Taxes paidTotal taxes paid without R&D tax credit benefitR&D Tax Credit is not a deduction; it is an actual dollar-for-dollar credit againsttaxes owed or taxes paid.Note: This is an example of R&D Tax credit workingsAstute has helped save millions of dollars in R&D tax incentivesthrough our R&D tax credit study.11 www.thinkastute.com

industry iveEnergy uticalandBiotechnologyWineriesand VineyardsMedicalDevices andInstrumentationFood andBeverageAerospaceand DefenseManufacturingand ConsumerProductsConstructionEntertainmentOur industry experts have conducted more than 100 R&D Tax Credit Studiesfor companies of all sizes resulting in over 75 million in tax incentives.12 www.thinkastute.com

BENEFITS AND How to qualifyBENEFITS:yy Reduction in federal & state income tax liabilityyy Immediate cash flow.yy Tax credit carried forward up to 20 years.yy Unclaimed credit for open tax years, generallylast three to four years.QUALIFIED EXPENSESyy Salaries paid to employees and supervisorsinvolved in the research.yy Payments made to US-based contractors assistingin the qualified research.yy Supplies used and consumed in the R&D process.QUALIFYING RESEARCH ACTIVITIES MUST MEET THE “FOUR-PART TEST”:Relate to thedevelopment of new orimproved products orprocesses.13 www.thinkastute.comRely on fundamentalprinciples of sciencesand engineering.Intend to entations.

Royalty/licensing complaince auditRoyalties are payments that you are entitled to. While it sounds simple enough, getting your ‘fair share’ can becomplicated. An audit will ensure all parties involved are playing by the same rules.A Royalty/Licensing Compliance Audit verifies if the Licensee (user of a Patent, License or Franchise) is complyingwith the agreement or contract and thus determine if the Licensor is receiving the agreed-upon fees.Our industry experts have been successfully performing Royalty Compliance Audits for companies that havedeveloped and continue to develop IP. We provide quantifiable findings that can aid in the strategic negotiationand collection of unreported royalties/licensing revenues.Reveal differences in interpretation,improving key business partnerrelationships.Better protect Intellectual Property(IP) and mitigate risk enterprisewide.Improve control and better internalanalysis of royalty reports.Enhance Return on Investment(ROI), including recovering cashdue from previous period.Astute has build large scale Royalty/Licensing compliance programs toidentify errors in contracts and prevent loss of revenue.14 www.thinkastute.com

Key FindingsPercentage findingson the causesof errors forunderreportedroyalties.60%Underreported sales30%Questionable License Interpretation26%Disallowed Deductions13%Math Errors11%Royalty Rate Errors5%Transfer Prices5%Unreported Sublicenses5%Unreported BenchmarksSource: InvotexIP Audit Statistics 1997-2016We have saved more than 10M in royalty payments and recoveredmillions in lost royalty revenue.15 www.thinkastute.com

key BENEFITSAn independent Royalty/Licensing Compliance Audit provides you with quantifiable data, which is essential incollecting underreported royalties/licensing revenues.Recover lostrevenue dueto royaltyunderpaymentEnhancecommunicationsbetween bothpartiesDemystify thelicense languageand termsROYALTY/LICENSING AUDITBENEFITSBring transparencyto contractinterpretationsWe have helped Licensors renegotiate their royalty or licensingcontracts to recover lost revenues.16 www.thinkastute.comSafeguard IPand mitigatemishandling risksCreate a morerobust complianceprogram

Incorrect reporting of RoyaltiesOften unintentoinal mistakes can happen that may cause errors in reporting revenue from Royalties.Misunderstanding or misinterpreting of thelicense agreementRoyalty bearing newproducts were notincluded in the reportingRoyalty accountants wereunaware that SKUs / productnumbers may have changedCOMMONREASONS FORINCORRECTREPORTING OFROYALTIESFailure to include royaltybearing products in thebundleInefficient systems in place to document and calculateroyaltiesManual errors lead toinaccurate calculations inroyalty and/or exchange ratesLicensor could exercise his rights over Intellectual Properties andtrigger the audit clause outlined in licensing agreement.17 www.thinkastute.com

Sandhya Mukkamala, CPA(Partner and Co-Founder)IntroductionSandhya Mukkamala, CPA, Partner and Co-Founder at Astute,advises clients on R &D Tax incentives, strategizing Tax planning,Technical accounting, Forensic Audits, and other corporatecompliance related matters. She has more than 15 years ofexperience in audit and review engagements, complex M&Adue diligence audits, Accounting for Income Tax Provisions (ASC740) and Corporate Tax planning for private and public sectors.CertificationsProfessional Experience Certified Public Accountant, CaliforniaProfessional Associations California Society of Certified PublicAccountantsEducation San Jose State University.Certification in International Taxation University of Mangalore, IndiaMaster’s in Business Administration (MBA) inFinance and Accounting University of Mangalore, India.Bachelor’s in commerce and economicsPrior to founding Astute, Sandhya has served as Merger &Acquisition due diligence auditor for several years in areputed public accounting firm in Silicon Valley. She has ledthe audit team in planning, structuring, and performed M&A duediligence activities across all functional areas such as financial,products, operations, and technology etc. As an acumen auditor,she helped companies uncover millions of dollars lost due tofraudulent activities or lack of control over processes, addressedcomplex accounting and financial reporting challenges.Besides Auditing and Corporate finance, Sandhya has anextensive experience in R&D tax credit consulting projects (IRC.Sec. 41), SEC reporting, internal controls, and fraud testing overfinancial reporting for multitude of industries from early Startup’sto Pre-IPO to Publicly held companies. Astute NA&G CPA’s LLP Viteos Capital Market Services Ltd, (formerly ViteosTechnologies), India Toyota Kirloskar Motor Ltd. (Subsidiary of Toyota Motors,Japan), IndiaSpecializationHer unique understanding, problem-solving skills andproviding reliable solutions has benefited clients in thefollowing industry sectors Technology (softwareand hardware)18 www.thinkastute.com Food and Beverage Real Estate Manufacturing Medical Services Construction Telecommunications Semiconductor Automotive

Ashwini Vasudeva(Partner and Co-Founder)IntroductionEducation California State University, East BayBachelor’s Degree, Accounting University of Mumbai, IndiaCommerce and EconomicsAshwini Vasudeva, Partner and Co-Founder at Astute, advicesclients on Financial stability, Sustained growth and Financialrecovery. She assists companies on varies Licensing/RoyaltyCompliance Audit, Technical Accounting, R&D Tax Incentive andForensic Audit related work as well as works closely with clients’CFOs/Controllers to develop stronger processes and controlswithin business. She has more than 15 years of experience inpublic accounting and various industries.Professional ExperiencePrior to founding Astute, Ashwini has served some of the mostreputable publicly held companies in Silicon Valley as a financialand internal auditor with KPMG, LLP. Besides technical accountingand auditing, Ashwini has a broad knowledge of internal audits,business processes, internal controls, Intellectual PropertyCompliance Audits and Forensic Audits.Ashwini has also developed Internal Audit and IntellectualProperty/Royalty/Licensing Compliance Audit Programs for avariety of industries. She has played a key role developing“Royalty Compliance Audit Program” within a giant Life ScienceCorporation and helped save 10M in royalty payment andrecover millions of lost royalty revenue. Astute Morpho Detection (now Smiths Group) Life Technologies (now ThermoFisher Scientific) KPMG, LLPSpecializationHer business acumen along with her strong ability tocommunicate effective has reaped financial benefits to clients inthe following industry sectors: Technology (softwareand hardware) Manufacturing Pharmaceutical andBiotechnology Medical Devices19 www.thinkastute.com Semiconductor Entertainment Gaming Construction Telecommunications

4695 Chabot Dr., Ste 200,Pleasanton, CA 94588www.ThinkAstute.com (925) 452-2205

CONTACT US Sandhya Mukkamala, CPA Sandhya@ThinkAstute.com Ashwini Vasudeva Ashwini@ThinkAstute.com www.ThinkAstute.com (925) 452-2205