Transcription

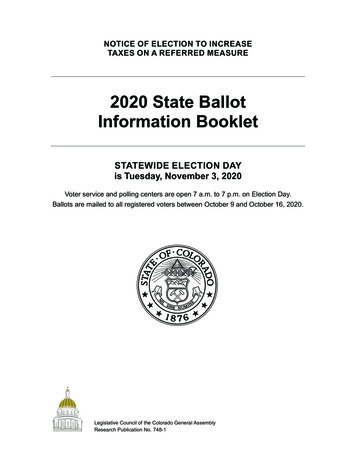

NOTICE OF ELECTION TO INCREASETAXES ON A REFERRED MEASURE2020 State BallotInformation BookletSTATEWIDE ELECTION DAYis Tuesday, November 3, 2020Voter service and polling centers are open 7 a.m. to 7 p.m. on Election Day.Ballots are mailed to all registered voters between October 9 and October 16, 2020.Legislative Council of the Colorado General AssemblyResearch Publication No. 748-1

A full fiscal impact statement for each measure can be found sAn audio version of the book is available through the ColoradoTalking Book Library -bookFind judicial performance evaluations for statewide, district, andcounty judges up for retention in your judicial district at:http://www.ojpe.orgLocal election offices can provide voter information, includingwhere to vote, how to register to vote, and what is on your ballot.Find contact information for local election offices on the insideback cover of this book.

COLORADO GENERAL ASSEMBLYLEGISLATIVE COUNCILEXECUTIVE COMMITTEERep. KC Becker, ChairSen. Leroy Garcia, Vice-ChairSen. Stephen FenbergRep. Alec GarnettSen. Chris HolbertRep. Patrick NevilleROOM 029 STATE CAPITOLDENVER, COLORADO 80202-1784E-mail: lcs.ga@state.co.usPhone: 303-866-4799STAFFNatalie Mullis, DirectorCathy Eslinger, Research ManagerCOMMITTEESen. John CookeSen. Kerry DonovanRep. Monica DuranRep. Dominique JacksonRep. Susan LontineSen. Vicki MarbleSen. Dominick MorenoRep. Kyle MullicaRep. Lori SaineSen. Ray ScottRep. Kevin Van WinkleSen. Angela WilliamsSeptember 11, 2020This booklet provides information on the 11 statewide measures on the November 3, 2020, ballotand on the judges who are on the ballot for retention in your area. Following a quick ballot referenceguide, the information is presented in four sections.Section One — Analyses. Each statewide measure receives an analysis that includes a descriptionof the measure and major arguments for and against. Careful consideration has been given to thearguments in an effort to fairly represent both sides of the issue. Each analysis also includes anestimate of the fiscal impact of the measure. More information on the fiscal impact of measures canbe found at leg.colorado.gov/bluebook. The state constitution requires that the nonpartisan researchstaff of the General Assembly prepare these analyses and distribute them in a ballot informationbooklet to registered voter households.Section Two — Titles and Text. For each measure, this section includes the title that appears onthe ballot and the legal language of each measure, with new laws in capitalized letters and laws thatare being eliminated in strikeout type.Section Three — Judicial Performance Evaluations. The third section contains information aboutthe performances of the Colorado Supreme Court justices, the Colorado Court of Appeals judges,and district and county court judges in your area who are on this year’s ballot. The information wasprepared by the state commission and district commissions on judicial performance. The narrative foreach judge includes a recommendation on whether a judge “Meets Performance Standards” or “DoesNot Meet Performance Standards.”Section Four — Information on Local Election Offices. The booklet concludes with addressesand telephone numbers of local election offices. Your local election offices can provide you withinformation on voter service and polling centers, absentee ballots, and early voting.Statewide Measures on the 2020 BallotTable 1 lists the measures on the 2020 ballot. Of the 11 measures on the ballot, 3 propose changesto the state constitution, 5 propose changes to the state statutes, and 1 proposes changes to both thestate constitution and state statutes. Of the remaining two measures, one is a referendum petitionon whether to approve a bill passed during the 2019 legislative session, and one is a question toapprove new taxes, referred to voters through 2020 legislation.Referred measures. A measure placed on the ballot by the state legislature that amends the stateconstitution is labeled an “Amendment,” followed by a letter. A measure placed on the ballot by

the state legislature that amends the state statutes or that is referred as a tax question is labeled a“Proposition,” followed by a double letter.Initiated measures. A measure placed on the ballot through the signature-collection process thatamends the state constitution is labeled an “Amendment,” followed by a number between 1 and99. A measure placed on the ballot through the signature-collection process that amends the statestatutes is labeled a “Proposition,” followed by a number between 100 and 199.Voter approval is required in the future to change any constitutional measure adopted by the voters,although the legislature may adopt statutes that clarify or implement these constitutional measures aslong as they do not conflict with the state constitution. The state legislature, with the approval of theGovernor, may change any statutory measure in the future without voter approval.Under provisions in the state constitution, passage of a constitutional amendment requires at least55 percent of the votes cast, except that when a constitutional amendment is limited to a repeal, itrequires a simple majority vote. In 2020, Amendment C and Amendment 76 require 55 percent of thevote to pass. The remaining measures require a simple majority vote to pass.Table 1Statewide Measures on the 2020 BallotAmending the ConstitutionAmendment BRepeal Gallagher AmendmentLegislature /bSimple MajorityVote to PassAmendment CConduct of Charitable GamingLegislature /b55% Vote toPassAmendment 76Citizenship Qualification of VotersCitizens /a55% Vote toPassCitizens /aSimple MajorityVote to PassLegislature /bSimple MajorityVote to PassCitizens /aSimple MajorityVote to PassAmending the Constitution and State StatutesAmendment 77Local Voter Approval of Casino Bet Limitsand Games in Black Hawk, Central City,and Cripple CreekQuestion to Approve New TaxesProposition EETaxes on Nicotine ProductsReferendum Petition on Whether to Approve a BillPassed by the State Legislature in 2019Proposition 113Adopt Agreement to Elect U.S. Presidentby National Popular VoteAmending State StatutesProposition 114Reintroduction and Management of GrayWolvesCitizens /aSimple MajorityVote to PassProposition 115Prohibit Abortions After 22 WeeksCitizens /aSimple MajorityVote to PassProposition 116State Income Tax Rate ReductionCitizens /aSimple MajorityVote to PassProposition 117Voter Approval for Certain New StateEnterprisesCitizens /aSimple MajorityVote to PassProposition 118Paid Family and Medical Leave Insurance Citizens /aProgramSimple MajorityVote to Pass/a Placed on the ballot through the citizen signature process./b Referred to the ballot by the state legislature.

Quick Ballot Reference Guide.1Amendment B: Repeal Gallagher Amendment.7Summary and Analysis.8Arguments For and Against.12Estimate of Fiscal Impact .13Title and Text.61Amendment C: Conduct of Charitable Gaming.14Summary and Analysis.15Arguments For and Against.16Estimate of Fiscal Impact .16Title and Text.62Amendment 76: Citizenship Qualification of Voters.17Summary and Analysis.18Arguments For and Against.19Estimate of Fiscal Impact .19Title and Text.63Amendment 77: Local Voter Approval of Casino Bet Limits andGames in Black Hawk, Central City, and Cripple Creek.20Summary and Analysis.21Arguments For and Against.22Estimate of Fiscal Impact .23Title and Text.63Proposition EE: Taxes on Nicotine Products.24Summary and Analysis. 25Arguments For and Against. 28Estimate of Fiscal Impact . 29State Spending and Tax Increases. 30Title and Text. 65Proposition 113: Adopt Agreement to Elect U.S. President ByNational Popular Vote.32Summary and Analysis.33Arguments For and Against.34Estimate of Fiscal Impact .35Title and Text.66

Proposition 114: Reintroduction and Management of GrayWolves.36Summary and Analysis.37Arguments For and Against.39Estimate of Fiscal Impact .40Title and Text.69Proposition 115: Prohibit Abortions After 22 Weeks.41Summary and Analysis.42Arguments For and Against.43Estimate of Fiscal Impact .43Title and Text.71Proposition 116: State Income Tax Rate Reduction.45Summary and Analysis.46Arguments For and Against.47Estimate of Fiscal Impact .47Title and Text.73Proposition 117: Voter Approval forCertain New State Enterprises.49Summary and Analysis.50Arguments For and Against.52Estimate of Fiscal Impact .52Title and Text.74Proposition 118: Paid Family and Medical LeaveInsurance Program.53Summary and Analysis.54Arguments For and Against.59Estimate of Fiscal Impact .60Title and Text.75Contact Information forLocal Election Offices. Inside Back Cover

Amendment B: Repeal Gallagher AmendmentPlaced on the ballot by the legislature Passes with a majority voteBallot TitleWhat Your Vote MeansWithout increasing property tax rates, to help preservefunding for local districts that provide fire protection,police, ambulance, hospital, kindergarten throughtwelfth grade education, and other services, and toavoid automatic mill levy increases, shall there be anamendment to the Colorado constitution to repeal therequirement that the general assembly periodicallychange the residential assessment rate in order tomaintain the statewide proportion of residential propertyas compared to all other taxable property valued forproperty tax purposes and repeal the nonresidentialproperty tax assessment rate of twenty-nine percent?YESA “yes” vote on Amendment B repealssections of the Colorado Constitutionthat set a fixed statewide ratio for residentialand nonresidential property tax revenue.Assessment rates for all property types willremain the same as they are now, projectedfuture decreases in the residential assessmentrate will not be required, and any futureincreases in assessment rates would require avote of the people.NOA “no” vote on Amendment B leavesconstitutional provisions related toproperty taxes in place, maintaining currentrequirements for setting the assessment ratesused to calculate property taxes. This isexpected to result in a decreasing residentialassessment rate over time and in automaticlocal mill levy increases in jurisdictions whererequired by law.Amendment C: Conduct of Charitable GamingPlaced on the ballot by the legislature Passes with 55 percent of the voteBallot TitleShall there be an amendment to the Coloradoconstitution concerning the conduct of charitablegaming activities, and, in connection therewith, allowingbingo-raffle licensees to hire managers and operatorsof games and reducing the required period of acharitable organization’s continuous existence beforeobtaining a charitable gaming license?What Your Vote MeansYESA “yes” vote on Amendment Callows nonprofit organizationsoperating in Colorado for three years toapply for a bingo-raffle license, permits thesegames to be conducted by workers whoare not members of the organization, andallows workers to receive compensation up tominimum wage.NOA “no” vote on Amendment C maintainsthe current requirements that nonprofitorganizations must operate in Colorado for fiveyears prior to applying for a bingo-raffle license,and that workers must be unpaid volunteers whoare members of the nonprofit organization.1

Amendment 76: Citizenship Qualification ofVotersPlaced on the ballot by citizen initiative Passes with 55 percent of the voteBallot TitleWhat Your Vote MeansShall there be an amendment to the Coloradoconstitution requiring that to be qualified to vote at anyelection an individual must be a United States citizen?YESA “yes” vote on Amendment 76 willchange constitutional language tospecify that only U.S. citizens age 18 and olderare eligible to participate in Colorado elections.NOA “no” vote on Amendment 76 meansthe current constitutional languageallowing every eligible U.S. citizen to vote inColorado elections will remain unchanged.Amendment 77: Local Voter Approval of CasinoBet Limits and Games in Black Hawk, CentralCity, and Cripple CreekPlaced on the ballot by citizen initiative Passes with a majority voteBallot TitleShall there be an amendment to the Coloradoconstitution and a change to the Colorado RevisedStatutes concerning voter-approved changes to limitedgaming, and, in connection therewith, allowing thevoters of Central City, Black Hawk, and Cripple Creek,for their individual cities, to approve other games inaddition to those currently allowed and increase amaximum single bet to any amount; and allowinggaming tax revenue to be used for support services toimprove student retention and credential completion bystudents enrolled in community colleges?2What Your Vote MeansYESA “yes” vote on Amendment 77means that the voters of BlackHawk, Central City, and Cripple Creek will beallowed to increase or remove casino bet limitsand approve new casino games to help fundcommunity colleges.NOA “no” vote on Amendment 77 meansthat current casino bet limits and gameswill remain in the constitution, and a statewidevote will continue to be required to make anychanges to these restrictions.

Proposition EE: Taxes on Nicotine ProductsPlaced on the ballot by the legislature Passes with a majority voteBallot Questionshall state taxes be increased by 294,000,000annually by imposing a tax on nicotine liquidsused in e-cigarettes and other vaping productsthat is equal to the total state tax on tobaccoproducts when fully phased in, incrementallyincreasing the tobacco products tax by upto 22% of the manufacturer’s list price,incrementally increasing the cigarette taxby up to 9 cents per cigarette, expanding theexisting cigarette and tobacco taxes to applyto sales to consumers from outside of thestate, establishing a minimum tax for moist snufftobacco products, creating an inventory taxthat applies for future cigarette tax increases,and initially using the tax revenue primarilyfor public school funding to help offsetrevenue that has been lost as a result of theeconomic impacts related to covid-19 and thenfor programs that reduce the use of tobaccoand nicotine products, enhance the voluntarycolorado preschool program and make it widelyavailable for free, and maintain the fundingfor programs that currently receive revenuefrom tobacco taxes, with the state keepingand spending all of the new tax revenue as avoter‑approved revenue change?What Your Vote MeansYESA “yes” vote on Proposition EEincreases taxes on cigarettes andother tobacco products, and creates a new taxon nicotine products, including vaping products.The new tax revenue will be spent on education,housing, tobacco prevention, health care, andpreschool.NOA “no” vote on Proposition EE meanstaxes on cigarettes and other tobaccoproducts will stay the same, and there will be nonew taxes on nicotine or vaping products.Proposition 113: Adopt Agreement to ElectU.S. President By National Popular VotePlaced on the ballot by referendum petition Passes with a majority voteBallot TitleShall the following Act of the General Assembly beapproved: An Act concerning adoption of an agreementamong the states to elect the President of the UnitedStates by national popular vote, being Senate BillNo.19-042?What Your Vote MeansYESA “yes” vote on Proposition 113approves a bill passed by thelegislature and signed by the Governor joiningColorado with other states as part of anagreement to elect the President of the UnitedStates by national popular vote if enough statesenter the agreement.NOA “no” vote on Proposition 113 rejects abill passed by the legislature and signedby the Governor and retains Colorado’s currentsystem of awarding all of its electors for thePresident of the United States to the winner ofthe Colorado popular vote.3

Proposition 114: Reintroduction andManagement of Gray WolvesPlaced on the ballot by citizen initiative Passes with a majority voteBallot TitleWhat Your Vote MeansShall there be a change to the Colorado RevisedStatutes concerning the restoration of gray wolvesthrough their reintroduction on designated lands inColorado located west of the continental divide, and, inconnection therewith, requiring the Colorado parks andwildlife commission, after holding statewide hearingsand using scientific data, to implement a plan to restoreand manage gray wolves; prohibiting the commissionfrom imposing any land, water, or resource userestrictions on private landowners to further the plan;and requiring the commission to fairly compensateowners for losses of livestock caused by gray wolves?YESA “yes” vote on Proposition 114means that the Colorado Parksand Wildlife Commission will develop a plan toreintroduce and manage gray wolves west of theContinental Divide.NOA “no” vote on Proposition 114 meansthat Colorado will not be required toreintroduce gray wolves.Proposition 115: Prohibit Abortions After 22WeeksPlaced on the ballot by citizen initiative Passes with a majority voteBallot TitleShall there be a change to the Colorado RevisedStatutes concerning prohibiting an abortion whenthe probable gestational age of the fetus is at leasttwenty‑two weeks, and, in connection therewith,making it a misdemeanor punishable by a fine toperform or attempt to perform a prohibited abortion,except when the abortion is immediately required tosave the life of the pregnant woman when her life isphysically threatened, but not solely by a psychologicalor emotional condition; defining terms related tothe measure including “probable gestational age”and “abortion,” and excepting from the definition of“abortion” medical procedures relating to miscarriage orectopic pregnancy; specifying that a woman on whoman abortion is performed may not be charged with acrime in relation to a prohibited abortion; and requiringthe Colorado medical board to suspend for at leastthree years the license of a licensee whom the boardfinds performed or attempted to perform a prohibitedabortion?4What Your Vote MeansYESA “yes” vote on Proposition 115prohibits abortions in Colorado after22 weeks gestational age, except when anabortion is immediately required to save the lifeof a pregnant woman.NOA “no” vote on Proposition 115 meansthat abortion in Colorado continues tobe legal at any time during a pregnancy.

Proposition 116: State Income Tax RateReductionPlaced on the ballot by citizen initiative Passes with a majority voteBallot TitleWhat Your Vote MeansShall there be a change to the Colorado RevisedStatutes reducing the state income tax rate from 4.63%to 4.55%?YESA “yes” vote on Proposition 116reduces the state income tax rate to4.55 percent for tax year 2020 and future years.NOA “no” vote on Proposition 116 keepsthe state income tax rate unchanged at4.63 percent.Proposition 117: Voter Approval for Certain NewState EnterprisesPlaced on the ballot by citizen initiative Passes with a majority voteBallot TitleShall there be a change to the Colorado RevisedStatutes requiring statewide voter approval at the nexteven-year election of any newly created or qualifiedstate enterprise that is exempt from the Taxpayer’sBill of Rights, Article X, Section 20 of the Coloradoconstitution, if the projected or actual combinedrevenue from fees and surcharges of the enterprise,and all other enterprises created within the last fiveyears that serve primarily the same purpose, is greaterthan 100 million within the first five fiscal years of thecreation or qualification of the new enterprise?What Your Vote MeansYESA “yes” vote on Proposition 117requires voter approval for new stategovernment enterprises with fee revenue over 100 million in the first five years.NOA “no” vote on Proposition 117 retainsthe state legislature’s authority to createnew enterprises as under current law.5

Proposition 118: Paid Family and Medical LeaveInsurance ProgramPlaced on the ballot by citizen initiative Passes with a majority voteBallot TitleShall there be a change to the Colorado RevisedStatutes concerning the creation of a paid familyand medical leave program in Colorado, and, inconnection therewith, authorizing paid family andmedical leave for a covered employee who has aserious health condition, is caring for a new child orfor a family member with a serious health condition,or has a need for leave related to a family member’smilitary deployment or for safe leave; establishing amaximum of 12 weeks of family and medical leave,with an additional 4 weeks for pregnancy or childbirthcomplications, with a cap on the weekly benefitamount; requiring job protection for and prohibitingretaliation against an employee who takes paid familyand medical leave; allowing a local government toopt out of the program; permitting employees of sucha local government and self-employed individuals toparticipate in the program; exempting employers whooffer an approved private paid family and medical leaveplan; to pay for the program, requiring a premium of0.9% of each employee’s wages, up to a cap, throughDecember 31, 2024, and as set thereafter, up to1.2% of each employee’s wages, by the director ofthe division of family and medical leave insurance;authorizing an employer to deduct up to 50% of thepremium amount from an employee’s wages andrequiring the employer to pay the remainder of thepremium, with an exemption for employers with fewerthan 10 employees; creating the division of family andmedical leave insurance as an enterprise within thedepartment of labor and employment to administer theprogram; and establishing an enforcement and appealsprocess for retaliation and denied claims?6What Your Vote MeansYESA “yes” vote on Proposition 118means the state will create aninsurance program to provide paid family andmedical leave benefits to eligible employeesin Colorado funded by premiums paid byemployers and employees.NOA “no” vote on Proposition 118 meansthe state will not create a paid familyand medical leave insurance program.

Repeal GallagherAmendmentPlaced on the ballot by the legislature Passes with a majority voteAmendment B proposes amending the Colorado Constitution to:y repeal the Gallagher Amendment requiring residential and nonresidentialproperty tax revenues to make up the same portion of total statewide propertytaxes as when the Gallagher Amendment was adopted in 1982, including therequirement that sets the nonresidential assessment rate at 29 percent.What Your Vote MeansYESA “yes” vote on Amendment Brepeals sections of the ColoradoConstitution that set a fixed statewide ratiofor residential and nonresidential propertytax revenue. Assessment rates for allproperty types will remain the same asthey are now, projected future decreasesin the residential assessment rate will notbe required, and any future increases inassessment rates would require a vote ofthe people.NOA “no” vote on Amendment Bleaves constitutional provisionsrelated to property taxes in place,maintaining current requirements for settingthe assessment rates used to calculateproperty taxes. This is expected to resultin a decreasing residential assessment rateover time and in automatic local mill levyincreases in jurisdictions where required bylaw.7

Summary and Analysis for Amendment BIn Colorado, property taxes fund local government services, including services providedby cities, counties, and special districts, such as local police and fire protection,hospitals, transportation, and the local share of K-12 education. The GallagherAmendment sets statewide rules for property taxes funding these local services. Thisanalysis first summarizes what Amendment B does, then describes how propertytaxes are calculated, and finally discusses how the measure affects taxpayers andgovernments.What does Amendment B do?Amendment B removes provisions related to the residential and nonresidentialassessment rates from the constitution, including the provisions commonly known as theGallagher Amendment.The Gallagher Amendment currently requires that residential and nonresidential propertymake up constant portions of total statewide taxable property over time. Since adoptionin 1982, these provisions have required that the taxable value of residential propertymake up about 45 percent, and the taxable value of nonresidential property about55 percent of statewide taxable property. Actual property values have not matchedthe required ratios over time because residential property values have generallygrown faster than nonresidential property values. Since the taxable portion of mostnonresidential property values is fixed at 29 percent, the state legislature adjusts theresidential assessment rate to maintain the required ratio, as shown in Figure 1.Amendment B removes these provisions from the constitution, leaving the residentialand nonresidential assessment rates at their current rates in state statute. Undercurrent law, the residential assessment rate is expected to decrease in future years,reducing the amount of property taxes paid by property owners and collected by localgovernments. Amendment B would eliminate automatic tax increases adopted bysome local jurisdictions to offset revenue losses from the Gallagher Amendment. Injurisdictions that have not adopted automatic tax increases, Amendment B eliminatesprojected future decreases in the residential assessment rate, and any increase innonresidential or residential assessment rates would require voter approval.Figure 1Assessment Rate Adjustments Under Current Law* Actual property values are for 2019. The residential assessment rate is for 2019 and 2020. Thisas

colorado general assembly legislative council room 029 state capitol denver, colorado 80202-1784 e-mail: lcs.ga@state.co.us phone: 303-866-4799 executive committee

![API Ballot: [Ballot ID] – API 510 & API 570, Deferrals, Rev05](/img/5/api510andapi570deferralsrev5.jpg)