Transcription

http://ebooks.cambridge.org/ebook.jsf?bid CBO9781107585676Cambridge Books Online Cambridge University Press, 2014

IDownloaded from Cambridge Books Online by IP 130.60.206.74 on Thu Dec 25 16:52:43 GMT 2Cambridge Books Online Cambridge University Press, 2014

Léon Walras, Elements ofheoretical Economicsor he heory of Social WealthTranslated and edited byDONALD A. WALKERIndiana University of PennsylvaniaJAN VAN DAALTriangle, University of Lyons-2Downloaded from Cambridge Books Online by IP 130.60.206.74 on Thu Dec 25 16:34:38 GMT 2014.http://ebooks.cambridge.org/ebook.jsf?bid CBO9781107585676Cambridge Books Online Cambridge University Press, 2014

LÉON WALRAS, ELEMENTS OF THEORETICAL ECONOMICSIn his fourth edition of Éléments d’économie politique pure (1900), Léon Walrasintroduced the device of written pledges to eliminate path dependency: sellersof products and services write out commitments to supply certain quantities atsuggested prices. He tried unsuccessfully to show thereby that no commoditiesare actually produced and supplied until a set of prices is found at which supplyand demand are equal simultaneously in every market. his brought about veryserious alterations to the character of the book. Unfortunately, these changesresulted in an incomplete, internally contradictory, and occasionally incoherent text. his translation, therefore, by two leading scholars of Léon Walras’swork, Donald Walker and Jan van Daal, revisits the third edition of his seminalwork, including his brilliant explanation of his mature comprehensive model,with all its richness derived from reality. Growing research indicates that it wasthis third edition that contained his best theoretical research, so a translation ofthis edition of the book is therefore now a necessity.Donald A. Walker received a Ph.D. in Economics from Harvard University. Hespecializes in microeconomic theory and the history of neoclassical economicthought. Dr. Walker was the president of the History of Economics Society(1987–1988), named Distinguished Fellow of that Society (2006), editor of theJournal of the History of Economic hought (1990–1998), and founder and irstpresident of the International Walras Association (1997–2000). Among numerous other publications, he is the author of many articles on the writings of LéonWalras, and of Walras’s Market Models (Cambridge University Press, 1996) andWalrasian Economics (Cambridge University Press, 2006).Jan van Daal received a Ph.D. from Erasmus University in Rotterdam. Hehas researched and taught in the area of mathematical economics and published on demand systems, aggregation problems, and the theory and historyof general economic equilibrium. Dr. van Daal specializes in research on thelife and works of Léon Walras and has published, among other writings, heEquilibrium Economics of Léon Walras (with Albert Jolink, 1993), the translation of Walras’s Études d’économie appliquée (2005), and the translation ofWalras’s Études d’économie sociales (with Donald Walker, 2010).Downloaded from Cambridge Books Online by IP 130.60.206.74 on Thu Dec 25 16:34:38 GMT 2014.http://ebooks.cambridge.org/ebook.jsf?bid CBO9781107585676Cambridge Books Online Cambridge University Press, 2014

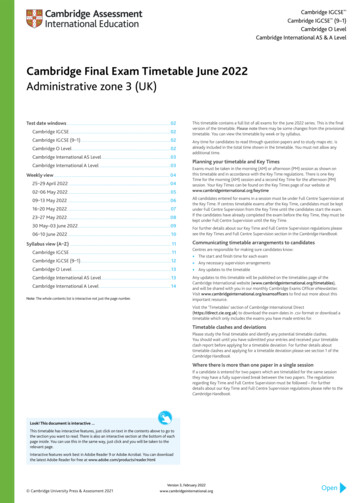

ContentsTranslators’ introductionPreface to the second editionpage ixIIIPART I OBJECT AND DIVISIONS OF ECONOMICSLesson 1 Adam Smith’s and J.-B. Say’s deinitionsLesson 2 Distinction between science, the arts, and ethicsLesson 3 Social wealth. Triple consequences of scarcity. hefact of value in exchange and of economic theoryLesson 4 he fact of industry and applied economics. hefact of property and social economics3112029PART II THEORY OF EXCHANGELesson 5 he market and competition. he problem of theexchange of two commodities for each otherLesson 6 Curves of efective demand and efective supplyLesson 7 Discussion of the solution of the problem ofexchange of two commodities for each otherLesson 8 Utility or want curves. he theorem ofmaximum satisfactionLesson 9 Discussion of demand curves. General formulafor the mathematical solution of the problem ofexchange of two commodities for each otherLesson 10 Rareté, or the cause of value in exchangevDownloaded from Cambridge Books Online by IP 130.60.206.74 on Thu Dec 25 16:36:07 GMT 2014.http://ebooks.cambridge.org/ebook.jsf?bid CBO9781107585676Cambridge Books Online Cambridge University Press, 20144152687797110

viContentsLesson 11 he problem of the exchange of severalcommodities for one another. heorem ofgeneral equilibriumLesson 12 General formula of the mathematical solutionof the problem of the exchange of severalcommodities for one another. Law of thedetermination of the prices of the commoditiesLesson 13 Law of the variation of the prices of thecommoditiesLesson 14 heorem of equivalent redistributions. Choiceof a standard of measurement and of a medium ofexchangeLesson 15 Purchase curves and sales curves. Price curvesLesson 16 Exposition and refutation of Adam Smith’s andJ.-B. Say’s doctrines of the origin of value in exchange118132145156169179PART III THEORY OF PRODUCTIONLesson 17 Capital and income. he three servicesLesson 18 Elements and mechanism of productionLesson 19 he entrepreneur. Business accounting andinventoryLesson 20 Equations of productionLesson 21 Solution of the equations of production. Law of thedetermination of the prices of products and servicesLesson 22 he principle of free competition. Law of thevariation of the prices of products and services.Price curves191201211222231247PART IV THEORY OF CAPITAL FORMATION AND CREDITLesson 23 Gross and net income. he rate of net income. heexcess of income over consumptionLesson 24 Equations of capital formation and creditLesson 25 Solution of the equations of capital formation andcredit. Law of the determination of the rate of netincomeDownloaded from Cambridge Books Online by IP 130.60.206.74 on Thu Dec 25 16:36:07 GMT 2014.http://ebooks.cambridge.org/ebook.jsf?bid CBO9781107585676Cambridge Books Online Cambridge University Press, 2014259273281

ContentsLesson 26 heorem of the maximum utility of new capitalgoods. Law of the variation of the rate of net incomeLesson 27 Laws of the determination and variation of theprices of capital goods. he permanent marketLesson 28 Increase of the quantity of products. Laws of thegeneral variation of prices in a progressive societyLesson 29 Critique of the doctrine of the PhysiocratsLesson 30 Exposition and refutation of the English theory ofthe prices of productsLesson 31 Exposition and refutation of the English theory of rentLesson 32 Exposition and refutation of the English theories ofwages and interestvii297310319331337345362PART V THEORY OF MONEYLesson 33 he problem of the value of moneyLesson 34 Mathematical theory of bimetallismLesson 35 Relative stability of the value of the bimetallicstandardLesson 36 Fiduciary money and ofsetting claims. Foreignexchange377390405420PART VI PRICE FIXING, MONOPOLY, AND TAXATIONLesson 37 Price ixing and monopolyLesson 38 TaxationAppendixesAppendix I Geometrical theory of the determination of pricesI. he exchange of several commodities for one anotherII. he exchange of products and services for one anotherIII. he exchange of savings for new capital goodsAppendix II Observations on the principle of Messrs. Auspitz’sand Lieben’s theory of pricesAppendix III Note on Mr. Wicksteed’s refutation of the Englishtheory of rentIndexDownloaded from Cambridge Books Online by IP 130.60.206.74 on Thu Dec 25 16:36:07 GMT 2014.http://ebooks.cambridge.org/ebook.jsf?bid CBO9781107585676Cambridge Books Online Cambridge University Press, 2014437455469480489495501511

Preface to the second edition1I wrote, in June 1874, at the beginning of the irst part of the irstedition of the present work, the lines that I would like now toreproduce:I am in debt to the enlightened initiative of the Council of State of Vaudthat created a chair of economics in the School of Law of the Academyof Lausanne in 1870, and instituted a competition to select an occupantof the chair. It is especially to the benevolent conidence in me of Mr.Louis Ruchonnet, who is head of the Department of Public Education andWorship and member of the Swiss National Council, and who, ater havinginvited me to enter the competition for obtaining that chair, has not ceasedto encourage me unsparingly since my occupancy of it, that I owe beingable to begin the publication of a treatise on the elements of economics,arranged in accordance with a new plan, developed according to a novelmethod, and reaching conclusions that, I must state, will also difer on certain points from those of the present science.his treatise is divided into three parts each forming a volume publishedin two fascicles. he books will be the following:1st part: ― Éléments d’économie politique pure or héorie de la richesse sociale.1his third edition difers from the second only by the elimination of the fourlessons on the applied theory of money mentioned on page lvi, and by the addition of three appendixes. – he second and the third parts, discussed on page liv,will be replaced by two volumes, Études d’économie sociale and Études d’économiepolitique appliquée. he applied theory of money will appear in the latter. I beg ofmy readers to be so kind as to accept this plan, which seems to me very nearly toachieve my œuvre more promptly, while relieving me of a task that I fear I am nolonger capable of undertaking. (February 1896).IIIDownloaded from Cambridge Books Online by IP 130.60.206.74 on Thu Dec 25 16:52:43 GMT 2Cambridge Books Online Cambridge University Press, 2014

IVPreface to the second editionPart I. object and divisions of economics. ― Part II. Mathematical theoryof exchange. ― Part III. he numerairei and money. ― Part IV. Natural theory of the production and the consumption of wealth. Part V. Conditionsand consequences of economic progress. ― Part VI. Natural and necessaryefects of the various modes of the economic organization of society.2nd part: ― ÉlÉments d’Économie politique appliquÉe or héorie de laproduction agricole, industrielle et commercial de la richesse.3rd part: ― ÉlÉments d’Économie sociale or héorie de la répartition dela richesse par la propriété et l’impôt.he irst fascicle of the irst volume is presented here. It contains a mathematical solution of the problem of the determination of equilibrium pricesand also a scientiic formulation of the law of supply and demand in thecase of the exchange of any number of commodities for one another. I realize that the notations used there will at irst appear a little complicated, butI beg the reader not to be discouraged by this complexity, which is inherentin the subject and which, besides, constitutes the only mathematical dificulty. his system of notation once understood, the system of economicphenomena is, in a way, also thereby understood.his half-volume was completely written and almost completely printed,and I had already communicated the principle of the theory expoundedin it to the Académie des sciences morales et politiques in Paris,2 when, amonth ago, my attention was drawn to a work on the same subject entitled he heory of Political Economy, published in 1871 by Macmillan &Co. in London by Mr. W. Stanley Jevons, Professor of Political Economy atManchester. hat author applies, as I do, mathematical analysis to economictheory, especially to the theory of exchange; and, what is really remarkable,he bases the whole of that application on a fundamental formula that hecalls the equation of exchange, and that is rigorously identical to the formula that serves as my point of departure and that I call the condition ofmaximum satisfaction.Mr. Jevons is above all concerned with developing a general and philosophical exposition of the new method, and with laying down the foundations of its application to the theory of exchange, and to the theories of labor,land services, and capital. For my part, I have especially made an efort in thepresent half-volume to give a thorough exposition of the mathematical theoryof exchange. It is only proper that I restore to Mr. Jevons the priority of hisformula while retaining the right of priority for certain important deductionsfrom it. I will not enumerate these points, which a competent public will beperfectly able to recognize. Let it suice for me to say that, in my opinion,2See the Report of the sessions and work of the Académie, January 1874, or theJournal des Économistes, April 1874.Downloaded from Cambridge Books Online by IP 130.60.206.74 on Thu Dec 25 16:52:43 GMT 2Cambridge Books Online Cambridge University Press, 2014

Preface to the second editionVthe work of Mr. Jevons and my own, far from destroying each other, conirm, complement, and markedly enhance each other. hat is my irm conviction, and I demonstrate it to be such by strongly recommending that eminentEnglish economist’s excellent book to everyone who is not familiar with it.he second part of the irst edition of my treatise was published in1877. In it, I developed a theory of the determination of the pricesof productive services (wages, rent, and interest) and a theory of thedetermination of the rate of net income very diferent from those ofJevons.3In 1879, Jevons, then professor at University College, London,published the second edition of his heory of Political Economy,and, in the preface of that edition (pp. XXXV–XLII), he partly conceded to Gossen, a German, the priority of discovering the startingpoint of mathematical economics, which I had already conceded toJevons, as indicated above. I consecrated to Gossen, in the Journaldes Économistes for April and May 1885, an article titled ‘Un économiste inconnu, Hermann-Henri Gossen’ in which I presented information about his life and work, and made an efort to determinewhat remained as my own contribution ater the work of my twopredecessors. At the end of lesson 16, which concludes part II of thisvolume, the reader will ind a section in which I return to this matter. It will be seen there that the importance of considering raretéii inthe theory of exchange was again discovered and stressed, independently of the three of us, by Mr. Carl Menger, professor of economicsat the University of Vienna, and, I hope it will be understood, that,given these circumstances, I feel it necessary to state with precisionthe respects in which my second edition difers from the irst.3Part I of the irst edition of the Éléments d’économie politique pure was summarized in two memoirs entitled: Principe d’une théorie mathématique de l’échangeand Équations de l’échange, the irst having been submitted to the Académie dessciences morales et politiques in Paris in August 1873, and the second to theSociété Vaudoise des sciences naturelles at Lausanne in December 1875. Part IIwas summarized before its publication in two memoirs entitled: Équations de laproduction and Équations de la capitalisation, both submitted to the Société vaudoise des sciences naturelles, the irst in January and February, and the secondin July 1876. hese four memoirs were translated into Italian as Teoria matematica della ricchezza sociale (Biblioteca dell’Economista, 1878) and in Germanas Mathematische heorie der Preisbestimmung der wirthschatlichen Güter(Stuttgart. Verlag von Ferdinand Enke, 1881).Downloaded from Cambridge Books Online by IP 130.60.206.74 on Thu Dec 25 16:52:43 GMT 2Cambridge Books Online Cambridge University Press, 2014

VIPreface to the second editionStocks of the irst edition had been exhausted for several years;the publication of the second was delayed only by the studies that Ihad undertaken on the question of money.4 In order to introduce theresults of my research in the present edition, I have placed ater thepart on capital formation and credit the part on money, a part that,in the irst edition, came immediately ater the part on exchange. Iput eight lessons into that part, numbered 33 to 40, of which fourare on theory and four on applied economics. Among the irst four,I included two lessons, numbered 34 and 35, that contain my theoryof bimetallism. Moreover, in the other lesson on economic theory,regarding the solution of the problem of the value of money, I substituted, in place of the demonstration founded on the concept of the‘needed monetary circulation’,iii which was an idea that I borrowedfrom the economistsiv and used in the irst edition of the Élémentsd’économie politique pure, the demonstration, completed in the necessary way, based on the concept of a ‘desired cash balance’ that I usedin the héorie de la monnaie. Among the latter four lessons, I put twolessons, numbered 39 and 40, one with the critique of the doctrine ofCournot on the changes of absolute and relative value, which I tookup from the part on exchange to introduce it in the part on money,and added to it the critique of Jevons’s doctrine on the same subject,and the other with the conclusions of my new theory regarding theregularization of the variation of the value of money. In all these lessons on applied theory, I substituted in place of the system of goldcoinage with divisible silver tokens of the irst edition of the Élémentsthe system of gold coinage with divisible silver tokens and the regulatory silver tokens of the héorie. If we leave on one side the fourapplied theory lessons, that perhaps should have been moved to theÉléments d’économie politique appliquée, we have, in the four lessonson economic theory, the solution of the fourth great problem thatarises in economic theory ater those of exchange, production, capital formation and credit: the problem of money.4Some of these are studies in economic theory: ― Note sur le 151/2 légal; ― héoriemathématique du bimétalisme; ― De la ixité de valeur de l’étalon monétaire(Journal des Économists, December 1876, May 1881, october 1882); they havebeen put into the present volume. he others, notably the héorie de la monnaie (1886), which are studies in applied economics, will be found in the Étudesd’économie politique appliquée. (February 1896).Downloaded from Cambridge Books Online by IP 130.60.206.74 on Thu Dec 25 16:52:43 GMT 2Cambridge Books Online Cambridge University Press, 2014

Preface to the second editionVIIIf I have enlarged considerably the part devoted to money, I have,on the other hand, made few important changes in the parts devotedto the three other problems. I have, in the part on exchange, addedto the proof of the theorem of the maximum satisfactionv in the caseof continuous utility curves, a proof for the case of discontinuouscurves. I have improved upon several matters of detail in the solutionof the equations of exchange, of production, of capital formation andof credit, while leaving it as it was in its overall presentation. I haveestablished, in a new theorem, that the condition of equality of therate of net income is also the condition of maximum utility for newcapital goods. When I published my irst edition, I had seen only oneof the two problems of the maximization of utility relative to the services of new capital goods: that which presents itself with referenceto the distribution by an individual of his income among his diversewants, if it is assumed that the quantities of capital goods are givenby the very nature of things or determined by chance. I call that, forshort, the problem of the maximization of satisfaction of wants; it issolved mathematically by the proportionality of raretés to the pricesof the services of the capital goods. However, in preparing the secondedition, I became aware that there is a second problem: that whichpresents itself with reference to the distribution by a society of theexcess of its income over its consumption among the diverse varietiesof capital goods, when one seeks the determination of the quantitiesof new capital goods in view of the maximum of efective utility oftheir services. I call that the problem of the maximum utility of newcapital goods; it is solved mathematically by the proportionality ofthe prices of the services to the prices of the goods, which is, subjectto a single qualiication, precisely the result to which free competition leads.I have slightly modiied the titles of my parts in order to markbetter the order of the four problems of which I have spoken; and Ihave oten melded two or three lessons into one, not thinking it moreuseful to deal, in the treatise, with the division of the course into veryshort lessons.Finally, I have added a mathematical introduction in which I havegiven the necessary guidance for the reading of the volume. I haveproited from the opportunity to give that guidance in regard toderivatives and deinite integrals, which has enabled me to furnishDownloaded from Cambridge Books Online by IP 130.60.206.74 on Thu Dec 25 16:52:43 GMT 2Cambridge Books Online Cambridge University Press, 2014

VIIIPreface to the second editionfrom time to time the true formula for certain fundamental theorems and to demonstrate the theorem of the maximum utility of newcapital goods. I preface my course at the Academy of Lausanne withan analogous introduction, and I ind that a useful practice: it permits those of my students who wish to do so to follow me withoutdiiculty. If the introduction that I provide here gains me a singleattentive reader more, my trouble will not be unrewarded.As a consequence of these modiications, the outline of the volumenow appears as follows:Functions and their geometrical representation. Mathematicaltheory of the law of gravity.ÉLÉMENTS D’ÉCoNoMIE PoLITIQUE PURE, or héorie de la richessesociale.Part I. object and divisions of economics. ― Part II. heory ofexchange. ― Part III. heory of production. ― Part IV. heory of capital formation and credit. ― Part V. heory of money. ― Part VI. Priceixing, monopoly, and taxation.However, the volume modiied in this way is still the second edition of the volume of 1874–1877. By that I mean that my presentdoctrine is just the same as it was iteen years ago. It can be summarized as follows.Economic theory is essentially the theory of the determination ofprices in a hypothetical regime of perfectly free competition. heensemble of all things, material or immaterial, on which a price canbe set because they are scarce, that is to say, are both useful and limited in quantity, constitutes social wealth. hat is why economic theory is also the theory of social wealth.Among the things that make up social wealth a distinction mustbe made between capital goods, or, durable goods, which can be usedmore than once, and income goods, or, non-durable goods, which cannot be used more than once. Capital goods comprise land, personalfaculties, and capital goods properly speaking. Income goods comprisenot only consumers’ goods and raw materials, which are, for the mostpart, material things, but they also include, under the name of services, the successive uses of capital goods, services that are, in mostinstances, immaterial things. he services of capital goods that havea direct utility are put in the same class as consumers’ goods underthe name consumers’ services; those services of capital goods thatDownloaded from Cambridge Books Online by IP 130.60.206.74 on Thu Dec 25 16:52:43 GMT 2Cambridge Books Online Cambridge University Press, 2014

Preface to the second editionIXhave only indirect utility are put in the same class as raw materialsunder the name productive services. hat, in my opinion, is the keyto all of economic theory. If the distinction between capital goodsand income goods is neglected, and particularly if the immaterialservices of capital goods are not put among social wealth along withmaterial income, the possibility of a scientiic theory of the determination of prices is precluded. If, on the other hand, the proposeddistinction and classiication are accepted, then it becomes possibleto arrive successively, by means of the theory of exchange, at a determination of the prices of consumers’ goods and services; by meansof the theory of production, at a determination of the prices of rawmaterials and productive services; by means of the theory of capitalformation, at a determination of the price of ixed capital goods; and,by means of the theory of circulation, at a determination of the pricesof circulating capital goods. Here is how this is done.First, let us imagine a market in which only consumers’ goods andconsumable services are bought and sold; that is to say, exchanged,the sale of any service being done by the hiring out of a capital good.he prices or the ratios of exchange of all these goods and serviceshaving been cried at random in terms of one of them selected as thenumeraire, each party to the exchange ofers at these prices thosegoods or services of which he thinks he has relatively too much, andhe demands those articles or services of which he thinks he has relatively too little. he quantities of each item efectively demanded andsupplied having thus been determined, the prices of those things forwhich the demand exceeds the supply are raised, and the prices ofthose things of which the supply exceeds the demand are lowered. Atthe new prices that are cried, each exchanger ofers and demands newquantities. And again, prices are made to rise or fall until the demandand the supply of each good or service is equal. At that point, theprices are current equilibrium prices and exchange takes place.he problem of production is posed by introducing into the problem of exchange the circumstance that consumers’ goods are products resulting either from a combination of productive services aloneor from the application of these services to raw materials. In orderto take this circumstance into account, it is necessary to place thelandowners, workers, and capitalists, who are sellers of services andbuyers of consumable services and consumer goods, face to face withDownloaded from Cambridge Books Online by IP 130.60.206.74 on Thu Dec 25 16:52:43 GMT 2Cambridge Books Online Cambridge University Press, 2014

XPreface to the second editionsellers of products and buyers of productive services and raw materials. hose sellers and buyers are entrepreneurs, who seek a proit bytransforming productive services into products; that is to say, intoraw materials that they sell to one another, or into consumer goodsthat they sell to the landowners, workers, and capitalists from whomthey have bought productive services. In this connection, to betterunderstand these phenomena, instead of thinking of one market, wecan suppose there are two: a market for services on which servicesare ofered exclusively by landowners, workers, and capitalists, anddemanded as follows: the consumable services by the selfsame landowners, workers, and capitalists, and the productive services by theentrepreneurs; and a market for products on which these productsare ofered exclusively by entrepreneurs, and demanded as follows:the raw materials, by the selfsame entrepreneurs, and consumergoods by landowners, workers, and capitalists. on the two markets,at prices cried at random, the landowners, workers, and capitalists, intheir capacity as consumers, ofer services and demand consumableservices and consumer goods in such a way as to obtain the largestpossible sum total of utility, and the entrepreneurs, in their capacityas producers, ofer products and demand productive services or rawmaterials in the course of increasing their output in the case of anexcess of the price of the product over the average cost resulting fromthe productive services involved in their production; and they reducetheir output, on the other hand, in the case of the excess of the average cost resulting from the productive services used over the priceof the product. on each market, prices are raised in the case of anexcess of the demand over the supply and are lowered in the case ofthe excess of supply over demand. he current equilibrium prices arethose at which the demand and the supply of each service or productare equal and at which, moreover, the price of each product is equalto the average cost resulting from the productive services used.In order to pose the problem of capital formation, it must be supposed that there are landowners, workers, and capitalists who save;that is to say, who, instead of demanding consumers’ goods andservices equal to the total value of the services they ofer, demandnew capital goods for part of that value. And, facing these creators ofsavings, it must be assumed that there are entrepreneurs who produce new capital goods in lieu of raw materials or consumers’ goods.Downloaded from Cambridge Books Online by IP 130.60.206.74 on Thu Dec 25 16:52:43 GMT 2Cambridge Books Online Cambridge University Press, 2014

THEORY OF SOCIAL WEALTHPART IOBJECT AND DIVISIONS OFECONOMICSDownloaded from Cambridge Books Online by IP 130.60.206.74 on Thu Dec 25 17:07:06 GMT 2014.http://ebooks.cambridge.org/ebook.jsf?bid CBO9781107585676Cambridge Books Online Cambridge University Press, 2014

LESSON 1Adam Smith’s and J.-B. Say’s deinitionsSUMMARy: – Two-fold objective assigned to economics: 1o Toprovide the people with an income or an abundant level of living;2o To furnish the State or the community a suicient income. Firstobservation. Two goals, equally important, but neither of which isthe object of a proper science. here is another point of view foreconomics. Second observation. Two operations equally important, but of a diferent character, one a matter of economic advantageousness

v Contents Translators' introduction page ix Preface to the second edition III PART I OBJECT AND DIVISIONS OF ECONOMICS Lesson 1 Adam Smith's and J.-B. Say's deinitions 3 Lesson 2 Distinction between science, the arts, and ethics 11 Lesson 3 Social wealth.