Transcription

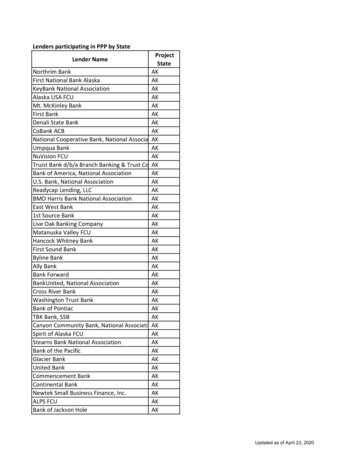

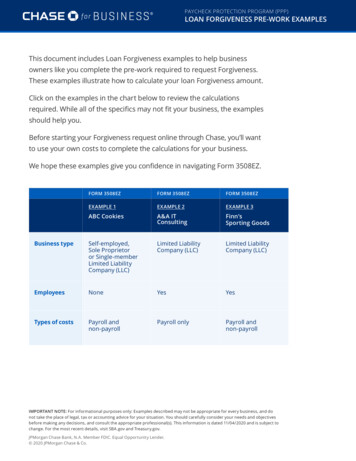

PAYCHECK PROTECTION PROGRAM (PPP) LOAN FORGIVENESS PRE-WORK EXAMPLESThis document includes Loan Forgiveness examples to help businessowners like you complete the pre-work required to request Forgiveness.These examples illustrate how to calculate your loan Forgiveness amount.Click on the examples in the chart below to review the calculationsrequired. While all of the specifics may not fit your business, the examplesshould help you.Before starting your Forgiveness request online through Chase, you’ll wantto use your own costs to complete the calculations for your business.We hope these examples give you confidence in navigating Form 3508EZ.FORM 3508EZFORM 3508EZFORM 3508EZEXAMPLE 1EXAMPLE 2EXAMPLE 3ABC CookiesA&A ITConsultingFinn’sSporting GoodsBusiness typeSelf-employed,Sole Proprietoror Single-memberLimited LiabilityCompany (LLC)Limited LiabilityCompany (LLC)Limited LiabilityCompany (LLC)EmployeesNoneYesYesTypes of costsPayroll andnon-payrollPayroll onlyPayroll andnon-payrollIMPORTANT NOTE: For informational purposes only: Examples described may not be appropriate for every business, and donot take the place of legal, tax or accounting advice for your situation. You should carefully consider your needs and objectivesbefore making any decisions, and consult the appropriate professional(s). This information is dated 11/04/2020 and is subject tochange. For the most recent details, visit SBA.gov and Treasury.gov.JPMorgan Chase Bank, N.A. Member FDIC. Equal Opportunity Lender. 2020 JPMorgan Chase & Co.

PAYCHECK PROTECTION PROGRAM (PPP)LOAN FORGIVENESS PRE-WORK EXAMPLESPRE-WORK EXAMPLE 1ABC CookiesABC Cookies received 20,833.00 in a PPP loan onBusiness typeMay 4, 2020, and spent the funds across an 8-weekSELF-EMPLOYEDSCHEDULE CSOLE PROPRIETORCovered Period, which ended on June 29.Employeesand can check Box 1 on Form 3508EZ Instructions,Because ABC Cookies is a Schedule C Sole ProprietorshipNONEit can use the SBA Form 3508EZ.Covered PeriodWe’ll show how this business calculated its Loan8 WEEKSForgiveness amount. We’ll walk you through ABC Cookies’Eligible payroll costsYESEligible non-payrollcostsYESSBA Form used3508EZSBA Form as well as additional calculations it needs tomake along the way.You’ll want to complete the steps below for your ownbusiness before starting your Forgiveness requestonline through Chase. When you’re ready, you’ll usethis pre-work for your Chase online request. Keep in mindthat Chase’s online request closely mirrors the SBA Formyou choose.Chase for Business Loan Forgiveness pre-work examples2

STEP 1Calculate payroll costsOn Line 1, ABC Cookies enters the payroll costs incurred or paid during theCovered Period.There are caps on the salaries for owner employees making more than 100,000.00.If your business is using the 8-week Covered Period (as ABC Cookies is), ownercompensation is capped at 15,385.00. If using the 24-week Covered Period, ownerNOTEYour incurred or paidpayroll costs could bemore than your PPP loanamount. That’s OK.compensation is capped at 20,833.00.While completing the request online, remember to click on all the dropdown arrowsto view important information such as “eligible payroll costs and instructions.” Wecreated the dropdowns to help you along the way. Because ABC Cookies is a SoleProprietorship and has no employees, it uses only owner compensation as cashcompensation for employees, and employee benefits are not eligible for Forgiveness.ABC Cookies only has one owner who makes more than 100,000.00 annually, so itenters 15,385.00 (the capped amount) on Line 1.LINE 1. Payroll Costs 15,385.00Because ABC Cookies does not have employees and its payroll costs are lower thanits loan amount, it will move on to Lines 2–4.STEP 2Calculate non-payroll costs (Lines 2 through 4)Eligible non-payroll costs include business mortgage interest payments, businessrent or lease payments and business utility payments. Your business must have takenon these obligations before Feb. 15, 2020.TIPIf your calculatedpayroll costs onLine 1, including Salary/Hourly Wage Reductionand FTE information (ifapplicable), are equalto or greater than yourPPP loan amount, youcan request Forgivenessfor your full PPP loanwithout submittingyour non-payroll costs.Keep in mind: Once wesubmit your Forgivenessrequest to the SBA,you might not be ableto submit additionalsupporting payroll ornon-payroll costs ordocuments in support ofyour request.On Lines 2 through 4, enter the eligible costs paid or incurred during yourCovered Period.For ABC Cookies:LINE 2. Business mortgage interest payments: 0.00Line 3. Business rent or lease payments: 7,000.00Line 4. Business utility payments: 3,000.00Total non-payroll costs: 10,000.00Chase for Business Loan Forgiveness pre-work examples3

STEP 3Potential Forgiveness amountsChase will pre-populate Lines 5 through 7.For ABC Cookies:LINE 5. The sum of Lines 1 through 4: 25,385.00LINE 6. PPP loan amount: 20,833.00Using the SBA’s formula, Line 7 is calculated by dividing your payroll costs (Line 1) by 0.60.If Line 7 is equal to or greater than Line 6 (your PPP loan amount), you’ve spent at least60% of your loan on payroll costs.For ABC Cookies:LINE 7. Payroll cost calculation: 25,641.67Line 7 ( 25,641.67) is greater than Line 6 ( 20,833.00), so ABC Cookies spent at least 60%of its loan on payroll costs.STEP 4Your Forgiveness amountWe’ll pre-populate Line 8.Line 8 will be the lowest of Lines 5, 6 or 7.For ABC Cookies:LINE 8. Forgiveness amount: 20,833.00TIPIf your Forgiveness amount requested is less than your loan amount and you think you stillhave time to use the extra funds, you may want to consider submitting your request later.Chase for Business Loan Forgiveness pre-work examples4

PAYCHECK PROTECTION PROGRAM (PPP)LOAN FORGIVENESS PRE-WORK EXAMPLESPRE-WORK EXAMPLE 2A&A IT ConsultingA&A IT Consulting received 100,962.00 in a PPP loan onBusiness typeLIMITED LIABILITYCOMPANY (LLC)EmployeesYESCovered Period24 WEEKSJune 22, 2020 and used the funds across 19 weeks. It is readyto request Forgiveness before the end of its Covered Period.A&A is structured as a Limited Liability Companywith employees. All of its employees earn under 100,000.00 annually.A&A can use the SBA Form 3508EZ because it can checkBox 2 on Form 3508EZ Instructions and had no reductionEligible payroll costsin employees, employee hours or employee salaries/YEShourly wages.Eligible non-payrollcostsWe’ll show how this business calculated its LoanNOSBA Form used3508EZForgiveness amount. We’ll walk you through A&A’s SBAForm as well as additional calculations it needs to makealong the way.You’ll want to complete these steps for your own businessbefore starting your Forgiveness request online throughChase. When you’re ready, you’ll use this pre-work foryour Chase online request. Keep in mind that Chase’sonline request closely mirrors the SBA Form you choose.Chase for Business Loan Forgiveness pre-work examples5

STEP 1Calculate payroll costsOn Line 1, A&A will enter the payroll costs it incurred or paid during theCovered Period.The SBA salary caps are based on an 8-week or 24-week Covered Perioddepending on when you received your funds. However, if your business,like A&A’s, spent your loan funds in less time, you calculate the salarycap based on the number of weeks during which you spent the funds.For example, if an employee made over 100,000.00 annually, you wouldcalculate their salary cap by dividing 100,000.00 by 52 weeks, thenNOTEThere are caps on salaries foremployees making more than 100,000.00. If your businessis using the 24-week CoveredPeriod, eligible individual salariesare capped at 46,154.00. Ifusing the 8-week Covered Period,eligible individual salaries arecapped at 15,385.00.Owner compensation is cappedat 20,833.00 for 24 weeks and 15,385.00 for 8 weeks.multiplying by the number of weeks the money was spent. In this case,it was 19 weeks. 100,000.00 52 1,923.08NOTEWhile completing the Chaserequest online, remember toclick on all the dropdown arrowsto view important informationsuch as “eligible payroll costsand instructions.” We createdthe dropdowns to help you alongthe way. 1,923.08 x 19 36,538.46Because A&A Consulting has employees, it will include: Employee cash compensation Employee benefits like health insurance and retirement plans Employer state and local taxes paid by the business and assessed onemployee compensation Owner compensationTo calculate how much it has spent on employee cash compensation, A&A willuse Table 1 from the Schedule A Worksheet found in SBA Form 3508.To submit its request, A&A will use Form 3508EZ.Step 1-AA&A fills in Columns 1 and 2 for all employees who are paid less than or equalto 100,000.00 annually. The Employee Identifier in Column 2 is the last 4 digitsof each employee’s Social Security number.Example SBA Form 3508, Table 1, Schedule A Worksheet:Column 1Column 2Employee’s HidekoSam1234567891011121314151617181FTE Reduction Exceptions:Totals:Column 3Column 4Cash Compensation Average FTEBox 1Chase for Business Loan Forgiveness pre-work examplesBox 2Column 5Salary/Hourly WageReductionBox 36

Step 1-BA&A then calculates payroll costs at an annualized rate during the Covered Period inColumn 3. This takes some extra work because the calculations aren’t included on theSBA Table 1. To help you, we’ve created a sample worksheet.Chase sample worksheet 1 (not included in the SBA instructions):COLUMN 1COLUMN MN 3ANNUAL SALARIES 0.0067,000.00COLUMN 4WEEKLY SALARIES NUMBER OF WEEKSA&A IS REQUESTINGFORGIVENESS 11,288.4619191919191919COLUMN 5COLUMN 6ANNUALIZED SALARYDURING THE 19 WEEKSACTUAL CASHCOMPENSATION A&AINCURRED OR PAIDDURING THE 19 WEEKS 3.8924,480.74 0.0020,000.00Column 1: Employee names. If you need more rows for your business, add them.Column 2: Shows the annual salary of each employee. In this example, all A&Aemployees earn less than 100,000.00 annually. If you had employees whoearned more than 100,000.00 annually, you would need to also fill out Table 2in the Schedule A Worksheet in SBA Form 3508.For example:Kimberly’s annual salary of 60,000.00 52 1,153.85Column 3: Enter the weekly salaries for each employee by dividing Column 2by 52 for the number of weeks in a year.Column 4: Enter 8 or 24 for the number of weeks during which you spent thefunds, unless you spent the money faster. A&A spent all its funds in 19 weeks,so it enters 19.Column 5: Calculate the annualized salary of each employee during the time inwhich you spent the funds. A&A multiplies Column 3 by Column 4 to calculate whatFor example:Kimberly’s weekly salary of 1,153.85 x 19 21,923.15each employee would have been paid during the 19 weeks at their normal rate.Column 6: In your payroll documents, locate the actual cash compensationyou incurred or paid each employee and enter it in Column 6. A&A’s payrolldocuments show the amount it paid each employee during the 19 weeks. Inthis example, A&A kept Elsie and Rafael at their pre-PPP loan salary levels.Take the numbers from Column 6 from the Chase worksheet and fill in Column 3“Cash Compensation” in SBA Table 1.Example SBA Form 3508, Table 1, Schedule A Worksheet (continued):Column 1Column 2Employee’s HidekoSamFTE Reduction mn 3Column 4Cash Compensation Average FTE Box 1Chase for Business Loan Forgiveness pre-work .0030,000.0020,000.00176,230.74Box 2Column 5Salary/Hourly WageReductionBox 37

Step 1-CNOTEThe SBA has outlined two methods forcalculating FTE:A&A calculates its average Full-Time Equivalency (FTE).To show how, we created another sample worksheet below forA&A’s employees. Each A&A employee worked 40 hours or moreeach week during the Covered Period, so 1.0 is entered in Column 3for each employee.Chase sample worksheet 2 (not included in the SBA instructions):Each A&A employee worked 40 hours per week, andthe company elected to use the Simplified Method.COLUMN 1COLUMN 2COLUMN 3EMPLOYEEHOURS WORKEDSIMPLIFIED vier401.0Hideko401.0Sam401.0AVERAGE FTE (BOX 2): Simplified Method: Assign 1.0 for employeeswho worked 40 hours or more each weekand 0.5 for employees who worked fewer than40 hours. Detailed Method: For each employee,enter the average number of hours paid perweek, then divide by 40, and round the totalto the nearest 10th. The maximum for eachemployee is 1.0.7.0Step 1-DA&A now goes back to Payroll Table 1, Column 4 and enters a 1.0 nextto each employee and 7.0 in Box 2 (see below).Example SBA Form 3508, Table 1, Schedule A Worksheet (continued)Column 1Column 2Employee’s HidekoSamFTE Reduction mn 3Column 4Cash Compensation Average FTE Box 1Chase for Business Loan Forgiveness pre-work .07.0Box 2Column 5Salary/Hourly WageReductionBox 38

TIPThe SBA only requires businesses to includeWage Reduction totals for employees who make 100,000.00 or less in annualized Covered Periodsalary. Follow steps 1a through 1c within the chartto determine an answer for your own business.Step 1-EA&A calculates if it reduced any employee’s salary or hourlywages by more than 25% during the time the business spentits funds.Chase sample worksheet 3 (not included in the SBA instructions):STEP1HOW MUCH DID YOURBUSINESS REDUCE WAGES?1aEnter average annual salary or hourlywage during Covered Period orAlternative Payroll Covered Period 18,000.00 21,000.00 29,230.74 28,500.00 29,500.00 30,000.00 20,000.001bEnter average annual salary orhourly wage between Jan. 1, 2020,and March 31, 2020 21,923.15 23,750.00 29,230.74 28,500.00 31,788.52 32,153.89 24,480.741cDivide the value entered in 1a by EKO93%SAM82%If 1c is 0.75 or more, enter zero in the column above Box 3 for that employee; otherwise proceed to Step 2NOTE: If your business chose the 24-week Covered Period, 1b would be a reference period 24 weeks prior to obtaining your loanFor each A&A employee, divide 1a by 1b. In this example, no employee whomakes 100,000 or less was reduced by more than 25%. Therefore, A&A can skipSteps 2 and 3 in the SBA Schedule A Worksheet.Step 1-FA&A goes back to the SBA Form and enters a ”0” for each employee in Column 5“Salary/Hourly Wage Reduction.”Example SBA Form 3508, Table 1, Schedule A Worksheet (continued):Column 1Column 2Employee’s HidekoSamFTE Reduction mn 3Column 4Column 5Salary/Hourly WageReductionCash Compensation Average FTE Box x 2Box 300000000NOTEIf A&A paid any employees 100,000.00 or more annually, it would have filled out Columns1 through 4 of Table 2 in the Schedule A Worksheet, using the same calculation methodologyand recognizing the caps on compensation during the 8- or 24-week Covered Period. Thereis no Salary/Hourly Wage Reduction column on Table 2 because the SBA does not factor inreductions of employees who are paid 100,000.00 or more.Chase for Business Loan Forgiveness pre-work examples9

Step 1-GNow A&A can fill out SBA Form 3508EZ. It starts by calculating the total CashCompensation for its employees (Column 3 on Payroll Table 1) during the 19 weeksof the Covered Period. A&A also will include any employee benefits and ownercompensation. We’ve outlined those below:Cash Compensation: 176,230.74Employee benefits: 10,000.00Gather this information from your payroll documentation for the weeksyou spent your funds.Owner compensation: 16,492.79This is the 19-week cap for compensation for an owner who is paid 100,000.00 or more annually.The calculation: Divide the owner compensation cap of 20,833.00by 24 weeks — because A&A is using a 24-week Covered Period — andFor example: 20,833.00 24 868.04 868.04 x 19 16,492.76multiply that by 19 for the number of weeks A&A spent their funds.A&A totals the above (Cash Compensation Employee Benefits OwnerCompensation) and enters it on Line 1.LINE 1. Payroll Costs: 202,723.53NOTEYour incurred or paid payrollcosts could be more thanyour loan amount. That is OK.NOTEIf your calculated payroll costs in Line 1, including Salary/Hourly Wage Reduction and FTEinformation (if applicable), are equal to or greater than your PPP loan amount, you canrequest Forgiveness for your full PPP loan without submitting your non-payroll costs.Step 1-HIf your payroll costs including Salary/Hourly Wage Reduction and FTE informationare equal or greater than your PPP loan amount, Chase will present you withthis option.Based on the payroll, Salary/Hourly Wage Reduction and FTE information youentered, you can request Forgiveness for the full PPP loan amount without enteringyour non-payroll costs. Would you like to proceed using payroll costs only? If youanswer “yes,” please skip Lines 2 through 4. Any information previously entered onthese lines will be removed if you choose “yes.”Because A&A has entered payroll costs greater than its loan amount, it alreadyqualifies for consideration of full Forgiveness and does NOT need to submit anynon-payroll costs. A&A would check “yes” below.YesKeep in mind: Once wesubmit your Forgivenessrequest to the SBA, youmight not be able to submitadditional supportingpayroll or non-payroll costsor documents in support ofyour request.NoChase for Business Loan Forgiveness pre-work examples10

STEP 2Calculate non-payroll costs (Lines 2 through 4)Eligible non-payroll costs include business mortgage interest payments, businessrent or lease payments and business utility payments. Your business must havetaken on these obligations before Feb. 15, 2020.On Lines 2 through 4, enter the eligible costs paid or incurred during yourCovered Period.For A&A IT Consulting:LINE 2. Business mortgage interest payments: SkippedLINE 3. Business rent or lease payments: SkippedLINE 4. Business utilities payments: SkippedSTEP 3Potential Forgiveness amountsChase will pre-populate Lines 5 through 7 for you when you submit your onlineForgiveness request.For A&A IT Consulting:LINE 5. The sum of Lines 1 through 4: 202,723.53LINE 6. PPP loan amount 100,962.00For A&A IT Consulting:LINE 7. Payroll cost 60% requirement 337,872.55Line 7 ( 337,872.55) is greater than Line 6 ( 100,962.00), so A&AUsing the SBA’s formula, Line 7 is calculated by dividingyour payroll costs (Line 1) by 0.60. If Line 7 is equal to orgreater than Line 6 (your PPP loan amount), you’ve spentat least 60% of your loan on payroll costs.IT Consulting has spent at least 60% of its loan on payroll costs.STEP 4Your Forgiveness amountWe’ll pre-populate Line 8.Line 8 will be the lowest of Lines 5, 6 or 7.For A&A IT Consulting:LINE 8. Forgiveness amount 100,962.00TIPIf your Forgiveness amount requested is less than your loan amount and you think you stillhave time to use the extra funds, you may want to consider submitting your request later.Chase for Business Loan Forgiveness pre-work examples11

PAYCHECK PROTECTION PROGRAM (PPP)LOAN FORGIVENESS PRE-WORK EXAMPLESPRE-WORK EXAMPLE 3Finn’s Sporting GoodsFinn’s Sporting Goods received 89,615.00 in a PPP loanBusiness typeLIMITED LIABILITYCOMPANY (LLC)EmployeesYESCovered Period8 WEEKSon August 3, 2020, and spent the funds across an 8-weekCovered Period. It is ready to r

PAYCHECK PROTECTIO PRORA (PPP) LN FGNSS P-WK XPLS Chase for Business Loan Forgiveness pre-work examples 5 A&A IT Consulting received 100,9