Transcription

Enhance YourFinancial SecurityWith a Home Equity Conversion MortgageLibertyReverseMortgage.com 800.218.1415

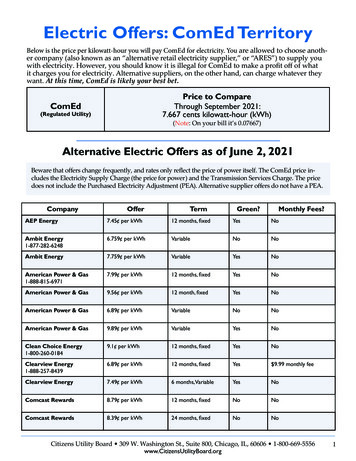

Unlock Your Home’s EquityAt Liberty Reverse Mortgage (Liberty), we know you want to transitioneasily into the retirement lifestyle of your choice. We are here to helpyou access a portion of your home’s equity and make the most ofyour retirement years.Explore Your OptionsWhether you are planning on retiring soon or have already startedretirement, take a moment to think about how you envision yourretirement lifestyle. Even if you have planned, saved and investedcarefully, you may have fewer funds than you had expected to meetyour goals. Now is the time to consider all of your financial optionsand make the right decisions for your future.OptionPros1. Delay retirementor return to workYou continue earning incometo pay for your financialobligations.2. Sell your houseand downsizeLiberty Reverse Mortgage10951 White Rock Road, Suite 200Rancho Cordova, CA 95670800.218.1415LibertyReverseMortgage.com3. Obtain a homeequity loan orrefinance yourexistingmortgage4. Decreaseexpenses andmodify yourlifestyle5. Obtain a HomeEquity ConversionMortgage (HECM)ConsYou may be unable orunwilling to continue workingbecause of poor health orother reasons.You eliminate or reduce yourYou may want to stay in yourcurrent mortgage payment and current home.maintenance.You may still have a mortgage.Closing costs add to yourfinancial burden.You remain in your home.You must still pay yourYou may be able to lower your monthly mortgage, plusmonthly mortgage paymentsclosing costs for the equityand even pay off other debts.loan.You eliminate unnecessaryexpenses and reduce yourmonthly cash outflow.You remain in your home.You eliminate your monthlymortgage payment and mayhave additional funds forexpenses or financial goals.1It may be difficult to cut back ifyou are already living frugally,or you may not want tosacrifice some comforts.The loan balance grows overtime and the value of yourestate may decrease overtime. Closing costs add to yourfinancial burden.1 You must live in the home as your primary residence, continue to pay required property taxes, homeowners insurance andmaintain the home according to Federal Housing Administration (FHA) requirements. Failure to meet these requirementscan trigger a loan default that may result in foreclosure.1

A HECM Loan DefinedEligibilityA Home Equity Conversion Mortgage (HECM), commonly knownas a reverse mortgage, is a Federal Housing Administration (FHA)insured loan1 which enables you to access a portion of your home’sequity without having to make monthly mortgage payments.2 If youare 62 years of age or older and have sufficient home equity, youmay be able to get the cash you need to:To be eligible for a HECM loan, some key requirements are: Pay off your existing mortgage2 Continue to live in your home and maintain the title2 Pay off medical bills, vehicle loans or other debts Improve your monthly cash flow Fund necessary home repairs or renovations Build a “safety net” for unplanned expenses The youngest borrower must be at least 62 years of age You must live in your home as your primary residence andhave sufficient equity You cannot be delinquent on any federal debt Property must be a single family residence, an owner occupied2-4 unit home, a condominium approved by the Departmentof Housing and Urban Development (HUD), or a manufacturedhome that meets FHA guidelines Must meet financial assessment requirements asestablished by HUDObligationsA Few of the Loan Benefits Eliminates your existing monthly mortgage payments You can stay in your home and maintain the title2 Loan proceeds are not taxed as income or otherwise and canbe used any way you choose3 Heirs inherit any remaining equity after paying offthe HECM loan The HECM loan is FHA insured12It has made things easier. When I need money itis there. I couldn’t be happier with my decision.– Jane C.Once you obtain your HECM loan, you must continue to meet thefollowing conditions to maintain your loan in good standing. Complete a HUD approved counseling session Maintain your home according to FHA requirements Continue to pay property taxes and homeowners insurance Continue to own and live in your home as your primary residenceThe loan becomes due and payable if youfail to meet any of the above obligationsor the last borrower or non-borrowingspouse passes away. The heirsmust repay the loan in orderto inherit the property.Failure repay theloan may result inforeclosure.1 As required by the Federal Housing Administration (FHA), you will be charged an up-front mortgage insurance premium (MIP) at closingand, over the life of the loan, you will be charged an annual MIP based on the loan balance.2 Your current mortgage, if any, must be paid off using the proceeds from your HECM loan. You must still live in the home as your primaryresidence, continue to pay required property taxes, homeowners insurance, and maintain the home according to FHA requirements.Failure to meet these requirements can trigger a loan default that may result in foreclosure.3 Generally, money received is not considered income and should be tax free, though you must continue to pay required property taxes.Consult your financial advisor and appropriate government agencies for any effect on taxes or government benefits.23

Loan OptionsDetermining Your ProceedsThere are two types of Home Equity Conversion Mortgage(HECM) loans. It is important to select the one that best meetsyour needs.The amount of funds available, also known as the Principal Limit,from a HECM loan is determined by:Liberty offers fixed and adjustable rate HECM options. Eitheroption can be used to access equity on a home you already ownor to purchase a new home. If you have an existing lien on theproperty, it must be paid off as part of the HECM transaction.Both options eliminate monthly mortgage payments and do notrequire repayment as long as the loan obligations1 are met.1 You must live in the home as your primary residence, continue to pay required property taxes, homeowners insurance, and maintainthe home according to FHA requirements. Failure to meet these requirements can trigger a loan default that may result in foreclosure. Age of the youngest borrower or eligiblenon-borrowing spouse1 The lesser of the appraised value of your home,sale price or the FHA national lending limit Current interest rates Balance of your existing mortgage (if applicable)and all mandatory obligations2The funds available to you may be restricted for the first 12months after loan closing, due to HECM requirements. You mayneed to set aside additional funds from the loan proceeds to payfor taxes and insurance. Consult a reverse mortgage advisor forfurther details.1 A spouse must meet the following requirements to be considered eligible: 1) Be the spouse of the reverse mortgage borrower at thetime of loan closing and remain the spouse of the borrower for the duration of the borrower’s lifetime. 2) Be properly disclosed to thelender at origination and specifically named as a Non-Borrowing Spouse in the loan documents. 3) Occupy, and continue to occupy, theproperty securing the reverse mortgage as the principal residence.2 Mandatory obligations are those fees and charges, as defined by HUD, incurred with the origination of the HECM loan that are paid atclosing or during the first 12-month disbursement period. This includes but is not limited to: the loan origination fee; counseling fee;up-front MIP; third-party closing costs; customary fees and charges for warranties, inspections, surveys, engineer certifications; repairset-asides; set-aside for property taxes and insurance; and delinquent federal debt.It will be going on two years now since wegot a HECM. I have just been so relieved that allof my bills are paid off. I have a fair amount ofmoney in my savings and I am secure.- Gary T.45

Disbursement OptionsOur 5-Step Loan ProcessWith a fixed-rate HECM loan, you can receive the cash in a lump sum.With an adjustable-rate HECM loan, you can select:We provide an easy 5-step process to obtain a HECM loan.TenureEqual monthly payments.TermEqual monthly payments for a fixed period of months selectedby the borrower.Line of CreditDraw at any time and in any amount of your choosing until the lineof credit is exhausted.Modified TenureCombination of line of credit plus scheduled monthly payments.Modified TermCombination of line of credit plus monthly payments for a fixedperiod of months selected by the borrower.The amount that can be disbursed at closing (fixed- and adjustablerate) and during the first 12 months (adjustable-rate only) is limitedto the greater of 60% of the principal limit amount or the sum ofmandatory obligations plus 10% of the principal limit. Consult areverse mortgage advisor for further details.1Meet with an advisor by phone or in person to discussyour financial needs and goals.2Decide if a HECM loan is right for you. If so, completethe application with the help of an Advisor.3Speak with an Independent, third-party,HUD approved counselor.4We will obtain a property appraisal to determine thevalue of your home. This is a key factor in determininghow much money you may qualify for as a loan.5We will process your paperwork and determine youreligibility. Once all loan conditions are met, you will signthe final paperwork to close your loan. You can receiveyour loan proceeds any way you choose – a lump sum,1monthly payment, a line of credit, or any combination ofthese options. In addition, any outstanding liens on yourproperty will need to be satisfied at this time.1Only available on a fixed-rate loanOnce your loan funds and all existing mortgages and mandatoryobligations are satisfied, you may choose how you want to spendthe remaining loan proceeds. This could include paying off otherdebt(s), funding medical expenses, stretching your retirementsavings, remodeling your home or building a “safety net”;spend it however you like.67

SafeguardsA HECM loan has built in safeguards that protect you.Federal Housing Administration (FHA) Insured¹HECM loans are FHA insured.1 You are always protected againstlender insolvency and will continue to have access to youravailable equity.2Mandatory Mortgage InsuranceOne of the requirements for FHA insurance, is that the borroweris charged an up-front mortgage insurance premium (MIP) fee atclosing and, over the life of the loan, is charged an annual MIP feeon the loan balance. This insurance protects the borrower and theirheirs in the event the loan balance is higher than the home’s valuewhen the loan becomes due and payable.Independent CounselingIndependent counselors which are approved by HUD provide youwith objective information, and help you understand the process.Capped Interest RatesIf your loan has an adjustable interest rate, there is a limit on howmuch the interest rates can change each time it adjusts, as well asover the life of the loan.No Prepayment PenaltyThe HECM loan can be repaid at any time in part or in full,without penalty.Eligible Non-Borrowing Spouse ProtectionFrequently Asked QuestionsDo I still own my home?Yes. You will retain the title and ownership during the life of theHECM loan, and you can sell your home at any time (at which timethe loan becomes due and payable). The loan will not become dueas long as you continue to meet loan obligations such as living in thehome as your primary residence, maintaining the home according tothe FHA requirements, and paying property taxes and homeownersinsurance. Failure to meet these requirements can trigger a loandefault that may result in foreclosure.Does my home need to be clear of anyexisting mortgages in order to qualify?No. You do not need to own your home free and clear. However,any existing mortgages or liens against the property must be paidat or before closing. This is most often done with the HECMloan proceeds.1Do I have to repay the loan?Yes, eventually. However, repayment is not due during the lifeof the loan, provided you meet the loan obligations such as livingin the home as your primary residence, maintaining the homeaccording to FHA requirements, and continuing topay required property taxes andinsurance. Repayment is limited tothe lesser of the value of your homeor the loan balance.Upon passing of the last remaining borrower, an eligible nonborrowing spouse may be able to have the repayment of the reversemortgage deferred if certain requirements are met.31 As required by the Federal Housing Administration (FHA), you will be charged an up-front mortgage insurance premium (MIP) at closing and,over the life of the loan, you will be charged an annual MIP based on the loan balance.2 Access to available equity after closing only applies to adjustable rate HECMs loans.3 A spouse must meet the following requirements to be considered eligible: 1) Be the spouse of the reverse mortgage borrower at the timeof loan closing and remain the spouse of the borrower for the duration of the borrower’s lifetime. 2) Be properly disclosed to the lender atorigination and specifically named as a Non-Borrowing Spouse in the loan documents. 3) Occupy, and continue to occupy, the propertysecuring the reverse mortgage as the principal residence.1 You must still live in the home as your primary residence,continue to pay required property taxes, homeownersinsurance, and maintain the home according to FHArequirements. Failure to meet these requirementscan trigger a loan default that mayresult in foreclosure.9

Frequently Asked Questions (continued)Do I have to make monthly mortgage payments?No. Unlike a traditional home mortgage loan or equity loan, you donot make monthly mortgage payments, and any existing mortgagewill be paid off using the loan proceeds.1What are the options for receiving my proceeds?You can receive your money in a lump sum,2 a monthly payment, aline of credit or a combination of the monthly payment and creditline options.Do I have to pay income taxes on the proceeds?Does the HECM loan affect my eligibilityfor Social Security or Medicare benefits?A HECM loan usually does not affect eligibility for entitlementprograms, such as Medicare or Social Security benefits. Someneeds-based government benefits, such as Medicaid andSupplemental Security Income (SSI), may be affected by a HECMloan. You should consult a qualified professional to determine ifthere would be any impact to your government benefits.What is the main difference betweena HECM and a HELOC loan?No. HECM loan proceeds are not taxed as income or otherwise(though you must continue to pay required property taxes).However, it is recommended that you consult your financial advisorand appropriate government agencies for any effect on taxes orgovernment benefits.With a traditional mortgage loan or Home Equity Line of Credit(HELOC), you have to make monthly loan payments. However,with a HECM loan, you do not need to make monthly mortgagepayments.1Is the use of my loan proceeds restricted?The HECM loan will come due when the home is no longer yourprimary residence. Below are additional examples of situationswhich would trigger HECM repayment:No. The net cash proceeds from the HECM loan can be used forany reason. Many borrowers use it to supplement their retirementincome, pay off other debt(s), pay for medical expenses or remodeltheir home.How much do I have to pay out of pocket?This will vary based on your specific circumstances. While thecounseling fee and appraisal fee are typically paid after the serviceis completed, these and other closing costs can be financed into theHECM loan.1 You must live in the home as your primary residence, continue to pay required property taxes, homeownersinsurance and maintain the home according to Federal Housing Administration requirements. Failure to meetthese requirements can trigger a loan default that may result in foreclosure.2 Lump sum disbursement is only available on a fixed-rate loan.10When will I be required to repay my HECM loan? You sell your house or transfer the title to another person If you do not occupy your home for a period of more than twelveconsecutive months because of physical or mental illness You do not maintain the home according to FHA requirements You do not pay required property taxes and/or homeownersinsurance1 You must live in the home as your primary residence, continue to pay required property taxes, homeownersinsurance and maintain the home according to Federal Housing Administration requirements. Failure to meetthese requirements can trigger a loan default that may result in foreclosure.11

About UsA strong and stable companyTo learn more, contact:For more than a decade, Liberty Reverse Mortgage (Liberty) hasbeen committed to helping seniors gain financial freedom throughHome Equity Conversion Mortgages (HECMs). Liberty is one of thelargest and most experienced HECM lenders in the United Stateshaving funded over 60,000 HECM loans. We are a direct lenderunlike many other HECM loan providers.800.218.1415Consistent and dedicated serviceLiberty has an A Better Business Bureau rating and is a memberof the National Reverse Mortgage Lenders Association (NRMLA).When you work with us you can expect: Dedicated licensed loan professionals Competitive loan pricing In-house underwriting and processing Fast and efficient loan processNo up-front lender feesWe do not charge any up-front lender fees and closing costs canbe financed into the mortgage itself.12LibertyReverseMortgage.comSee reverse side for licensing information and additional disclosures.

Liberty Reverse Mortgage10951 White Rock Road, Suite 200Rancho Cordova, CA 95670800.218.1415LibertyReverseMortgage.comHome Equity Conversion Mortgage customer testimonials were obtained via a phone survey questionnaire conductedFebruary 2012 by Liberty with release of survey results and statements authorized by the borrower.This material is not provided by, nor was it approved by the Department of Housing & Urban Development (HUD)or by the Federal Housing Administration (FHA). PHH Mortgage Corporation, d/b/a Liberty Reverse Mortgage, 1 Mortgage Way, Mt. Laurel, NJ 08054; NMLS ID #2726 (www.nmlsconsumeraccess.org); 800-446-0964; Arizona Residential Mortgage Licensee 0903164; Licensedby the Department of Financial Protection and Innovation under the California Residential Mortgage Lending Act#41DBO-100264; Colorado Mortgage Company Registration - PHH Mortgage Corporation as Responsible Party;Georgia Residential Mortgage Licensee #6266; Ohio Certificate of Registration MB804016.000; MassachusettsMortgage Lender License #ML2726; Licensed by the N.J. Department of Banking and Insurance; Licensed MortgageBanker - NYS Department of Financial Services; Rhode Island Licensed Lender. Equal Housing Lender.LRM-R-101819-B Rev. 01/29/2021

for taxes and insurance. Consult a reverse mortgage advisor for further details. 1 A spouse must meet the following requirements to be considered eligible: 1) Be the spouse of the reverse mortgage borrower at the time of loan closing and remain the spouse of the borrower for the duration of the borrower's lifetime. 2) Be properly disclosed to the