Transcription

Topic No. 1:The Basics of MarketProfileMay 25, 2010Blog: http://www.futurestrader71.comTwitter: http://twitter.com/futurestrader71Email: futurestrader71@gmail.com

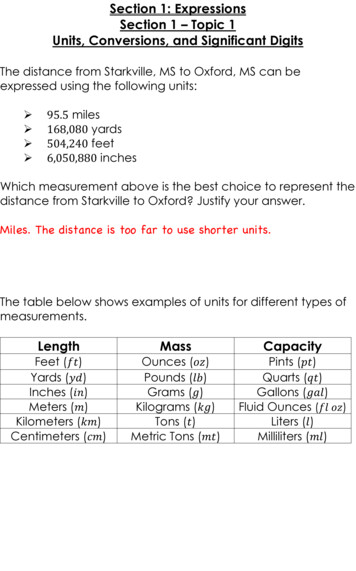

UNDERSTANDING THE MARKETDid you know that all prices are set through anauction process? Price is the tool used to advertise value PriceP i auctionstiup tto motivateti t sellers;llitauctions down to motivate buyers When buyers and sellers find an acceptableprice, they trade in large volume and “value” iscreated in that area This is simple but important to understand There are NEVER more buyersythan sellers. Justmore aggressive ones.

A QUICK OVERVIEW OF PROFILING Traditional Market Profile (MP):««««««Consistsoff lettersthatCi t off TPOsTPO ini theth formfl ttth t representt 3030minute increments of time but offset to the left and in theshape of a histogramIs not a trading system or methodology.methodology MP is simply away of organizing dataAdvantages: Makes it easy to see where the market hasspentpthe most timeDisadvantages: Does not give you any perception of “howmuch” traded anywhere. There are also manymisconceptions about what it is telling the traderI do not believe in “value“areas”” in the traditional sense.This area has been misapplied in existing literatureMuch of the theory and application of MP revolves aroundthe time bracketsbrackets. After viewing it this way for yearsyears, I seea better approach

A QUICK OVERVIEW OF PROFILING The Volume Profiling (VP) Approach:««««Simply displays Volume At Price data for any given timeframe or durationOrganizesgthe volume information in the same wayy asMP does but is not restricted by time. Time is alreadyrepresented in the bars overlaid on the VPAdvantages: Does not change the outcome of the profileeven if ththe titime fframe iis changed.hd ThThe ddatat iis ththe samefor all participants assuming that the tick data is accurateand not aggregatedDi dDisadvantages:tRRequiresia very hihighh qualitylit ddatat ffeeddfrom a reliable source. Your volume profile is not asuseful if the volume is simply distributed over 1-minutebars

WHAT IS THE MARKET TRYING TO DO? 2 Modes to the Market:« HorizontalDevelopment:² Marketis accepting a price area as mostly fair and iswilling to continue to do business there« VerticalDevelopment:² Marketis in price discovery mode and is trying to pricein new information« What²Ido these look like?thought you would ask .

PARTS OF THE PROFILE TPO – Time Price Opportunity. A letter representing a setperiod of time (normally 30 minutes)IB – Initial Balance. The 1st hour of trading. Why is thisimportant?HVN – High Volume NodeLVN – Low Volume NodePOC – Point of Control (VPOC for Volume POC)V l AreaValueA– ThisThi iis ththe area ththatt representst 70% (1Standard Deviation) of all of the data in the profile. Is thisimportant?CCompositeit PProfilefil – A ProfileP fil maded up off 2 or more ddaysto capture a bigger perspective on current action (seeingthe forest from the hill)

TYPES OF PARTICIPANTS OtherTime Frame Participant:Other-Time« Howdo we detect this participant?« Why does it matter?« Initiative Buyer/Seller vs. ResponsiveBuyer/Seller: What this means to our next tradetrade. Compound Auction Market:« Theycome in all timetime-frames.frames

OPENING TYPES Open Drive:« Open Test Drive:« Market attempts to continue in a prior direction and is met with fierce opposition and off to the races itgoes. This is like an open drive, but it has gone to an area that did not meet with acceptance. OTF hasffoundd an area off convictioni i to participanti iiin theh oppositei didirection.iOpen Auction In-Range:« Market opens,p, moves a short distance in one direction and then another tryingy g to advertise for one side orthe other to step in. This will usually test a prior key area and then push once it has gained conviction thatnobody is left to oppose it. OTF waited for a test and has stepped in to execute in a fixed directionOpen Rejection Reverse:« If the market opens above or below prior days range or value area,day’sarea then an Open Drive is dominated byresponsive buying or selling back to prior accepted value. If the market moves away from the prior day’srange, then the open is dominated by initiative buying or selling. You want to detect this early and nottrade against it. OTF is highly active and is accumulating/distributing aggressivelyScalper’s paradise. Nothing has changed between this session and last. Market will likely be unfriendly tobreakout traders and will reward those who trade from the extremes in. OTF is not present.Open Auction OutOut-of-Rangeof Range:«Market opens outside of the previously traded range. There is a high probability of OTF action and thesecan be BIG days. There will be a higher level of conviction by responsive as well as initiative buyers orsellers

HOW DO I PROCESS THE PROFILE? What is my approach?««I makecompleteframethatk sure thatth t I havehl t tickti k datad t forf theth timetifth t I amusingI break down the information into:²²²«««Overnightg tradingg ((O/N))Regular Trading Hours (RTH)Composite Profile of all data going back to the last swing high and low ofinterestMy hypothesis is based on a top-downtop down approach of all 3 starting withthe composite; which I display using daily bars but which still containstick-volume dataOnce I discover the bigger “areas to do business”, I drill down to theRTH sessions and look for detail that is reflected in the composites butalso take into account prior close, current open, highs, lows, etcI integrate into the RTH session the information provided by the O/Nsession. Specifically, I look for O/N Volume Point of Control (VPOC),hi h llows, etc.highs,t andd notet ththem on ththe RTH charth t

MY APPROACH y approach?What is myOnce I have all of these pieces, I use these datapoints for major decision making and then watch forthe market action as these areas are approachedpp« I have an expectation of what might happen. If theexpectation is not met, then this is an additional,immediate and real-timereal time data point that I use« Once RTH trading is on its way, the current intradayVP becomes a dominating factor and I will continue touse that for ensuing trade decisions while keeping thecomposite in mind as a major guide« I do not pay attention to “value areas” except underspecific circumstances«

WHAT ARE MY CORE TRADING PRINCIPLES? Here are my core directives:1.12.3.4.5.6.7.I only trade during RTH and do not hold O/N positionsI am not interested in O/N structure or data once I have transposed it ontoRTH. O/N data trades based on correlated spreads and does not have the500 stocks trading for the ES at that timeI am a discretionary trader with rules that allow me to play anywhere in thefield, but with the constraint that force me back in line if I’m trading what Iwant to see rather than what isI trade based on auction market theory and my entire approach is basedon the fact that the market is a simple auction processprocess. I follow the storyand can then create sound hypotheses of what to expectSimplicity is king!No lagging indicators or derivatives of price. I want to see the auction aspurely as I canRisk management, journaling, research and homework are the holy grail.My daily stop limits are set. My risk is accepted and mitigated throughscaling and I press my trades that are supported by the market

THE PRINCIPLES OF TRADING SUCCESS Treat trading as a business because that is what it is. There is nominor league and it is no different than running a corporationKeep track of your victories and defeats. Nothing will provide youwith more feedback and protect you from self-deception than agood journal and chart logDo not trade for gains. Trade to execute your homework andplan. The will come on their own. Keep your P&L out of sightDon’t trust anyoneyelse’s homework. Ultimately,y, it is yourytrade,,your money, your time and your gain or loss. Trade and be proudof the fruit of your own labor, not someone else’s approachPay it forward. Attachment to money is the reason for the rollercoaster that causes traders to loselose.

WHAT DO YOU WANT FROM THIS? This is your chance to:« Askquestions« Provide comments« Decide if you want to learn more and continueyour support

Traditional Market Profile (MP): . «Market opens outside of the previously traded range. There is a high probability of OTF action and these can be BIG days. There will be a higher level of conviction by responsive as well as initiative buyers or sellers. HOW DO I PROCESS THE PROFILE? What is my approach? «I k th tIh l tI make sure that I have complete ti ktick dt f th ti f thtIdata .