Transcription

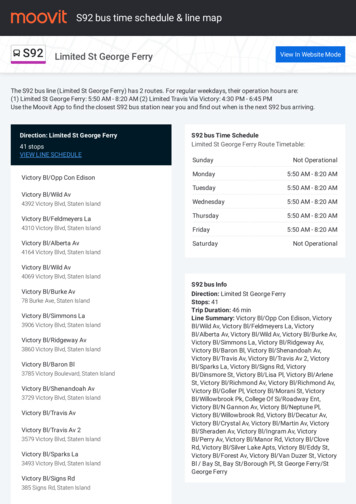

2.95FEBRUARY 2021LOOK FOR YOUR BONUS PUBLICATION INSIDE!RHJ’s Annual Guide to Local Products & Servicesfor Property ManagersPORTLAND VANCOUVERrentalhousingjournal.com Rental Housing Journal, LLCPublished in association with Multifamily NW, Rental Housing Alliance Oregon, IREM & Clark County AssociationPandemic Will Inflict More Painon Rental Housing Before RecoveryrentaL HoUsinG JoUrnaLThe pandemic continues to burdenmultifamily rental housing as rentscontinue to fall, and more pain incoming, Yardi Matrix says in their U.S.Multifamily Outlook for winter 2021.How to Tellif ApplicantWill be aGood TenantkeePeWe all strive to find good tenants,so here are five signs that an applicantwill be a good tenant for your rentalproperty from Keepe, the on-demandmaintenance and repair company.“After a year ravaged by a globalpandemic and political division, nothingwould be more satisfying in 2021 thana return to normal” but “it will takesome months to get most of the countryvaccinated and get businesses operatingas normal,” the report says.“Despite the COVID-19 pandemic,national rent growth remained relativelyflat on a year-over-year basis, ending theyear at -0.8 percent. There was a largedivergence in performance betweenmarkets, though. High-cost gatewaymarkets struggled the most, while manytech hub and tertiary markets thrived,”the Yardi Matrix report says. Somehighlights of the report: “Job growth has been mostlypositive since the summer, but theeconomy remains nearly 10 millionjobs off its peak.See ‘Pandemic’ on Page 11Portland RentsContinue DownBut May BeBottoming OutWhen you’re receiving lots ofapplications for tenant positions at yourrental properties, sometimes it can bedifficult and overwhelming trying tosift through everything.After all, with so many applicationsin front of you, where do you begin?How do you know which applicantswill make good tenants?A new report from ApartmentList indicates the area’smonths-long decliningrent picture may be finallybrightening.There are a few telling signs as towhether or not your applicants will begood tenants.P A I DALBANY, ORPERMIT NO. 188PRSRT STDUS PostageSee ‘5 Signs’ on Page 15Rental Housing Journal, LLC4500 S. Lakeshore Drive, Suite 300Tempe, Arizona 85282“Nationally, rent growth fell onlyslightly in 2020, but there wasa huge variation among metros.Rents and occupancy levels fellSee Story on Page 13FREESign up today for1031 propertylistings delivered to your inbox!DST, TIC, and NNN PROPERTY LISTINGS.You will also get a free book on 1031 Exchanges!Sign Up for Free at WWW.KPI1031.COMOr Call (855)899-4597

Rental Housing Journal MetroCONSIDERING A1031 EXCHANGE?Get FREE DST, TIC and NNN 1031 ExchangeListings Delivered to Your Inbox!SIGN UP FOR FREE at www.KPI1031.comor call 1.855.899.45971031 E XCHANGFOR THETypes of DST, TIC andNNN Properties available: Management Free - No More Tenants,Toilets and Trash!Monthly Income PotentialFULL LIST PLEASELOGIN ATWWW.KPI1031.COM ORCALLE OPPO(855)899-4597TACOMACENT DATAER DSTLocation: TacomaTotal Offering , WAAmount 8,398,000.00Leverage0.00%Type of AssetData CenterOffering StatusFully FundedASHEVILLE DSTLocation: AshevilTotal Offering le, NCAmount 4,9Leverage00,000.000.00Type of Ass%etSelf StorageOffering StatusHEALTHCAREIV DSTLocation: MultipleTotal Offering Locations 1Amount 13,183,211.00Leverage50.24%Type of AssetMedical OffiOffering StacetusFully FundedFully FundedPORT OWALGRERCHARDENS DSTLocation: Port OrcTotal Offering hard, WAAmount 5,925,5LeverageType of AssetOffering Status00.000.00%PharmacyFully FundedBE ACHRTUNITIHOUSETenants include Amazon, FedEx,Dollar General, Walgreens, CVS,Fresenius, and MoreClose your 1031 in 2-3 DaysMultifamily, Self Storage, Industrialand Mobile HomesAll-Cash/Debt-Free OfferingsNon-Recourse Financing from 40-85%Loan to ValueCash Out Refinance - Defer Your Taxesand Receive Liquidity PotentialO OD DFully FundedAX IS WEST DSTLocation: OrlandoTotal Offering , FLAmount 69,900,683LeverageType of AssetOffering Status54.93%MultifamilyFully Funded.00HEALTPORTFO HCARELIO 2 DSTDIVERLocation: MultipleDIALYSISIFIEDTotal Offering Locations 2S DSTAmount 15Location: Mul,661,000.00LeveragetipleTotal Offering Locations 30%Type of AssAmount 22et,449,000.00LeveragePor tfolioOffering Status55.45%Type of AssFully FundingetMedical PorOffering StatfoliotusFully FundedFRESLOUIS ENIUSMARYLMEDIC ANDAL DSTLocation: BaltimoTotal Offering re, MDAmount 2,Leverage314,580.000.00%Type of AssetMedical OffiOffering StacetusFully FundedSTGRANLocation: Atlanta,WESTSIDD ATTotal Offering GAE DSTAmount 55Location: KissLeverage,403,834.00immTotal Offering ee, FL58.95%Type of AssAmount 74et,44 4,763.00LeverageMultifamilyOffering Status55.82%Type of AssFully FundedetMultifamilyOffering StatusBURG DLocation:STTotal OfferingAmountLeverageType of AssetOffering StatusDSTLocation: JackBIG CREEsonTotal Offering ville Beach, FLK DSTAmount 51Location: Alph,576,436.00LeveragearetTotal Offering ta, GA58.61%Type of AssAmount 84etLeverage,455,103.00MultifamilyOffering Status57.86%Type of AssFully FundedetMultifamilyOffering StatusFully FundedGLENWESWINCHESTERMOB DSTLocation:Total OfferingAmountLeverageCHARWALGRELOTTEENS DSTLocation: CharlotTotal Offering te, NCAmount 5,Leverage436,250.000.00%Type of AssetPharmacyOffering StatusFully FundedFAIRWAYLocation:Total OfferingAmountDSTGRADOMIN NDION DSTLocation: SanSONOAntoPOIN TEMATotal Offering nio, TXAmount 56DSTLocation: KissLeverage,898,729.00immee, FLTotal59.OffeType of Ass17%ring Amountet 44,533,951.0LeverageMultifamilyOffering Sta0tus57.7Typ7%eFully Fundedof AssetMultifamilyOffering StatusFully FundedFRESENPORTFO IUSLIOPlus get a FREEbook on 1031Exchanges!Call today at1.855.899.4597This material does not constitute an offer to sell nor a solicitation of an offer to buy any security. Such offers can be made only by theconfidential Private Placement Memorandum (the “Memorandum”). Please read the entire Memorandum paying special attention to therisk section prior investing. IRC Section 1031, IRC Section 1033 and IRC Section 721 are complex tax codes therefore you should consultyour tax or legal professional for details regarding your situation. There are material risks associated with investing in real estate securitiesincluding illiquidity, vacancies, general market conditions and competition, lack of operating history, interest rate risks, general risks of owning/operating commercial and multifamily properties, financing risks, potential adverse tax consequences, general economic risks, developmentrisks and long hold periods. There is a risk of loss of the entire investment principal. Past performance is not a guarantee of future results.Potential cash flow, potential returns and potential appreciation are not guaranteed. Securities offered through Growth Capital Servicesmember FINRA, SIPC Office of Supervisory Jurisdiction located at 582 Market Street, Suite 300, San Francisco, CA 94104.2Rental Housing Journal Metro ·February 2021

Rental Housing Journal MetroSponsored ContentUnderstanding the Potential Advantagesof the 200% Rule in a 1031 ExchangeBY DWIGHT KAY, FOUNDER & CEO; BETTY FRIANT,SENIOR VICE PRESIDENT; AND THE KAY PROPERTIESTEAM“Is that your final answer?” You may recognizethe question made famous by the popular TVgame show Who Wants to Be a Millionaire?Choosing the right answer in this game givesyou a shot at winning big money, while thewrong answer leaves you with nothing. Investors conducting a 1031 Exchange face a similarmake or break decision when it comes to identifying suitable replacement properties.The right choices can help streamline a smoothand successful execution of a 1031 Exchange.Choosing wrong with properties that may not beviable or deals that are unable to close withinthe 180-day time period can derail the entire1031 Exchange. The good news is that investorsdo get to identify more than one replacementproperty. However, just like the gameshow,once that 45-day deadline hits for identifyingreplacement options, those answers are final.Making the most of that short list is one reasonthat the 200% Rule is a popular choice for manyinvestors. The 200% Rule allows an investorto identify the largest number of replacementoptions with four or more properties or DelawareStatutory Trust (DST) replacement investments.Under Section 1031 of the Internal RevenueCode, taxpayers who are seeking to deferrecognition of capital gains and related federalincome tax liability from the sale of a propertyare required to formally identify a replacementproperty or properties within 45-days from thedate that the original property is relinquished(the day they closed the escrow on the propertythey sold). The tax code gives taxpayers threedifferent options for identifying replacementproperties on that 45-Day Property IdentificationForm – the 200% Rule, the 3-Property Rule orthe 95% Rule.So, which is the best option to use? Every situation is different. However, for those investorswho want to maximize their potential optionsand identify four or more replacement proper-ties, the 200% Rule is a good choice to explore.HOW DOES THE 200% RULE WORK?Exchangers can identify any number of properties as long as the gross price does not exceed200% of the fair market value of the relinquishedproperty (twice the sale price). It is typicallyused when an investor wants to identify fouror more properties. This is the most commonlyused rule for investors considering DST investments, because of the flexibility in being able tolist multiple properties to build a diversified DSTportfolio. The minimum investment amount forDSTs typically starts at 100,000 whereas mostcommercial real estate properties are pricedabove 1 million. So, for an investor who has 1 million to reinvest, they could opt to put allof that 1 million into one DST (which is typically not recommended even when the DST hasmany properties inside of it), or they can dividethat 1 million into as many as 10 completelyseparate DSTs.An important mistake to avoid is to make surethe list of identified properties does not exceedthe 200% limit. The IRS is a stickler for rules. Ifthe combined price of the identified replacement properties exceeds the 200% maximumlimit – even by a fraction of a percent – it won’tbe accepted.HYPOTHETICAL EXAMPLE:EXPANDING YOUR OPTIONSA married couple sold their manufacturingbusiness that included the sale of the propertythat housed the business, giving the couple 2million to invest in a 1031 Exchange. The coupleplans to retire and both agree that they don’twant a replacement property or properties thatwill require hands-on management. The husband wants to buy a Triple Net Leased (NNN)fast food restaurant for 1.2 million, while thewife is in favor of a 1.5 million NNN dollar store.Both properties are listed on the 45-Day Form,bringing the total to 2.7 million. They decide touse the 200% Rule, which allows for up to 1.3million in additional property listings.About Kay Properties and www.kpi1031.comKay Properties is a national Delaware Statutory Trust (DST) investment firm.The www.kpi1031.com platform provides access to the marketplace of DSTsfrom over 25 different sponsor companies, custom DSTs onlyavailable to Kay clients, independent advice on DST sponsor companies, full due diligence and vetting on each DST(typically 20-40 DSTs) and a DST secondary market. KayProperties team members collectively have over 115 years ofreal estate experience, are licensed in all 50 states, and haveparticipated in over 15 Billion of DST 1031 investments.This material does not constitute an offer to sell nor a solicitation of an offerto buy any security. Such offers can be made only by the confidential PrivateVice President/SalesJohn TriplettTerry HokensonEditor-in-ChiefAccounting ManagerLinda WienandtPatricia SchluterAssociate EditorDiane PorterRental Housing Journal Metro · February 2021 100,000 in a multifamily apartment DSTproperty located in Denver 200,000 in a multifamily apartment DSTproperty located in Dallas 250,000 in a debt free DST portfolio ofNNN leased pharmacies and e-commercedistribution facilities 250,000 in a NNN dialysis facility DST portfolio with locations nationwide 500,000 in a DST portfolio of NNN dollarstoresOverall, the 200% Rule allows the couple toidentify these seven possible options within their45-Day period. The DSTs are all packaged andready to go with closings that can easily closewithin a week. The couple uses the remainingtime to conduct more research and due diligence on the NNN Dollar General and KFC. Inthe end, they decide to buy the KFC for 1.2million, but they like the diversity of being aboutto buy a 500,000 DST interest in a portfolio ofdollar stores versus a single location. The remaining 300,000 is spent in the two apartmentDSTs.In this case, the ability to leverage the 200%rule was advantageous in giving the couplemore options and more time to make a finalinvestment decision. The outcome also wassuccessful in that their 1031 Exchange was fullyexecuted, and their 2 million is now investedacross a diversified portfolio of multiple differentincome-producing properties versus only one ortwo. However, it also is important to note that every situation is unique. Individuals should reviewall three 1031 identification options to choosethe rule that works best for your particular situation as well as always should speak with theirCPA prior to making any decisions.Placement Memorandum (the “Memorandum”). Please read the entire Memorandum paying special attention to the risk section prior investing. IRC Section1031, IRC Section 1033 and IRC Section 721 are complex tax codes thereforeyou should consult your tax or legal professional for details regarding your situation. There are material risks associated with investing in real estate securitiesincluding illiquidity, vacancies, general market conditions and competition, lackof operating history, interest rate risks, general risks of owning/operating commercial and multifamily properties, financing risks, potential adverse tax consequences, general economic risks, development risks and long hold periods.There is a risk of loss of the entire investment principal. Past performance is nota guarantee of future results. Potential cash flow, potential returns and potential appreciation are not guaranteed. Securities offered through Growth CapitalServices, member FINRA, SIPC, Office of Supervisory Jurisdiction located at582 Market Street, Suite 300, San Francisco, CA 94104.Rental Housing Journal is amonthly publication of RentalHousing Journal, LLC.Publisher/General ManagerThe couple agrees to split the remaining 1.3million across multiple DST investments, andthey choose to identify:Mailing Address4500 S. Lakeshore Drive, Suite300Tempe, AZ rentalhousingjournal.comPhone(480) 454-2728 - main(480) 720-4385 - ad salesThe statements and representationsmade in advertising and news articlescontained in this publication are those of theadvertisers and authors and as such do notnecessarily reflect the views or opinions ofRental Housing Journal, LLC. The inclusionof advertising in this publication does not,in any way, comport an endorsement of orsupport for the products or services offered.To request a reprint or reprint rights, contactRental Housing Journal, LLC at the addressabove. 2021, Rental Housing Journal, LLC. Allrights reserved.3

Rental Housing Journal MetroLook to the Past for a Glimpse of the FutureBy DaviD PickronWith the advent of DNA testing, moreand more people are looking at theirancestry and learning vital information.What is their heritage? Do they have adirect line to royalty? Are there certainmarkers in their genetics that exposethem to specific illnesses or maladies? Itis often by looking backward that we candiscover and prepare for our future.By applying that same methodology tothe business of being a landlord, I havediscovered the answer to the question Iam repeatedly hearing from hundreds oflandlords: What do you think 2021 willbring?Let me begin with a positive response:Great things are around the corner. Ialso caution that we must prepare forchallenges, as the liberal policies thatwill inevitably come from seeminglyunited legislative and executive branchesof government will directly affect ourindustry. As a private investigator, if Iwere hired to do a background check onthe more liberal parts of our country inan effort to better understand the howand why of where they are in relation tolandlords, I’d simply need to look backat the recent history of actions of citycouncils, state legislatures and federalagencies across the United States todetermine what we can expect in thefuture.THE DEGRADATION OFAMERICA’S GREAT CITIESIf you’ve recently visited some of4the most notable cities in the country,you see they are riddled with homelessindividuals, many mentally ill, someaddicted to drugs, some with lengthycriminal records. While it’s an admirableposition to help where we can, theprograms and allowances given to theseindividuals has created a very challengingenvironment for landlords in thesecities. The shortcomings of governmentassistance and programs is they rarelyfix anything. The government shut downmental institutions in the ‘70s, leavingno alternative for many who ended up onthe streets. Programs to eliminate illegaldrugs seem ineffective, as drugs pourover our borders in record numbers. Withthe legalization of gateway drugs, moreand more users could end up committingcrimes and eventually joining the ranksof the homeless. On the legal side, courtsare deferring and dismissing most casesthat come through the court, removingthe consequences of illegal behaviors. Forexample, if you steal something in SanFrancisco that is valued under 750 andclaim it was an act of survival, then in theeyes of the law, no crime was committed.So, who pays for these changes of the past?Not the government. Business owners,like landlords, are seen as the source offunds to subsidize for the effects of thesecriminal acts. It’s a modern-day RobinHood if I’ve ever seen one. Its almost asif these government entities are saying“we can’t fix it,” so let’s make landlordsresponsible for the fix.Here are a few examples of howlandlords are being treated in citiesgoverned by liberal policies around thecountry: Chicago: Windy City landlordshave to follow a preciseonboarding process dictated bythe city. A landlord must first runan applicant’s credit and give apreliminary approval. After thatthey can run a criminal history, butif you deny them as a tenant, youmust provide a reason as to whythat crime would affect the rental. Portland: Rose City landlordsmay raise rent only seven percentper year. Landlords can terminatea month-to-month lease for anyreason for the first year, but afterthat, you must have a justifiedreason to ask your tenant to leaveor you will be forced to pay thetenant’s relocation cost, which is 4,500 for a three-bedroom. Seattle: Landlords in the EmeraldSee ‘A Look’ on Page 8Rental Housing Journal Metro ·February 2021

WE SPECIALIZEIN SIDING REPAIR& REPLACEMENT Siding Windows DeckingEXPERIENCEDSINCE 1994 Painting WaterproofingDo You Have a ProjectWe Can Help With?Call Today fora Free ly Licensed, Bonded, and InsuredWA LIC# ournalMetroMetro· October· February2021OR LIC# 21589735

Rental Housing Journal Metro7 Ways to Get Smoking UnderControl in Non-Smoking RentalsBy JUstin Beckerto work as a community.Landlords and building managers have to deal withseveral kinds of issues daily. Most of these are routine: aleaky faucet, a faulty smoke alarm, and so on. However,in view of the current pandemic, the issue of smoking(especially when you have a non-smoking building) ismore serious than ever.Start by releasing educational messages that willaffect the residents’ way of thinking and also preparethem mentally for the changes. Include information onhow secondhand smoke affects the health of the wholefamily. Getting secondhand smoke under control mighteven help reduce asthma in children. Once you wakepeople up to their basic right to a clean, healthy, and safeliving environment, it will signal a lot of ease for futurerules.Here’s what’s going on right now: A lot more people areat home every single day. The concept of remote workingwill become even more common in the future. Plus,people are becoming more attuned to their health issues,especially when it comes to their respiratory system.Previously, it wasn’t exactly ethical when secondhandsmoke from one tenant affected the apartment of theirneighbors. Today, a landlord could get sued for the same.Not sure how to get that smoking issue under control?Here are a few ways to get you started.1. CONDUCTING RESIDENT SURVEYSYou can start off by conducting resident surveys aboutthe issues of secondhand smoke and how to combat it.This way, you can learn what your residents think aboutthe smoking policy as it stands now.You’ll also be able to receive feedback on any potentialrestrictions on smoking in the future. By collectingthis information, it will be possible to learn about theconcerns, potential points of conflict, and questionsthat your residents might have. When you do startimplementing the changes, it will be easier to enforcethem when you keep all concerns in mind.2. EDUCATING THE RESIDENTSIt’s also a good idea to educate the people who willbe affected by the non-smoking policies. After all,having apartments for rent doesn’t mean that you justsit back and collect money. It also means that you have aresponsibility to give people the information they need3. CLEARING UP CONFUSIONWhen you tell a smoker that they can’t enjoy their pipeor cigarette, it often triggers some feelings of rebellion.Make sure that the smoking residents in your apartmentbuildings don’t feel like they’re being controlled or thatthe new policies are extreme.Instead, clarify how smokers don’t have to give up thathabit right away, nor do they have to find a new place tolive. All the new policies mean is that they won’t be ableto smoke in certain areas for the good of the community.The policy should also be worded in such a way that thesmoke is held up as the culprit, not the smokers.4. HOLDING MEETINGSIt’s helpful if you host community meetings to give outthe information we’ve mentioned above. This will alsoprovide a platform where concerned residents can askquestions, discuss answers, and generally reach a mutualagreement about making the air cleaner.Hold these meetings when you’re considering a certainpolicy or when the new policy is being implemented.Seek out partners who are working on related projectswithin the housing community already. This way, youhave trusted resources at your disposal. Some examplesinclude asthma programs, health workers, etc.residents information about cessation resources. You’llbe acknowledging their concerns and addressing them inthe best way possible. People living in your apartmentsfor rent will probably have a more closely knit communityas a result. There will be more related advantages whenthis occurs, including the smoke-free aspect.5. SHARING STORIESWhether it’s at these meetings or just when seeingthem in general, encourage your residents to sharewhatever stories they have about secondhand smoke.Their homes and everyday lives are being changed bythe new policies. So, they deserve to be empowered andacknowledged.What’s more, getting to know everyone’s perspectivewill also gain more traction for finally adopting thenew policies. This may result in more buy-in from theresidents’ part as well.6. HAVING APPROPRIATE OUTREACHAll the community meetings, information, surveys,and signage you use needs to be sensitive and culturallyappropriate. This means having the text printed indifferent languages. It also includes having bilingualand people of color invited to speak at the meetings.Neglecting this aspect of reaching out can alienate someresidents and weaken the impact of your efforts.See ‘How’ on Page 8Above all, these meetings will allow you to give5 REASONSTOTOUSE RENTEGRATIONREASONS54. Management Database - RentegraUSE RENTEGRATION1. Access - Rentegration.com is a webbased, multi-user software offering customers 24/7 access to forms generation,1. Access- Rentegration.comis aarchives,propertymanagement unting,vendororderinging cus- tomers 24/7 access to formsand other services.generation, archives, property managementdatabase,basic -accounting,2. RentalandLeaseFormsUnlimitedotherservices.use vendorof a fullorderingline of andstatespecificrentaland 2.leaseforms.AllRentegration.comRental and Lease Forms - Unlimitformsare ofcreatedattorneysed usea full linebyof s.leasehousingforms. AllRentegration.comforms are created by attorneys and/or3. Simplified Accounting - Ownerslocal rental housing associations.and managers can track income and ex3. forSimplified- Ownerspenseeach unit,Accountingproperty andcompaand managerscan smalltracksizeincomeandny. Perfectfor mid andpropertyex- penseeach unit, propertyandmanagersandforindependentrental owncompany. Perfectforneedmid orandsmallers, whoneitherhave thebudgetsize propertymanagerssoftware.and indepenfor larger,more expensivedent rental own- ers, who neither havethe need or budget for larger, more expensive software.tion.com is an easy to use, database driven software. Most form fields are auto4. ManagementDatabase- Rentepopulatedfrom thedatabase.The modgration.comis an easy touse,databaseulesare all integratedandworktogether.driven software.Most formarerentForexample,a customercan fieldsuse theautofunctionpopulatedthe alldatabase.Therollto fromidentifydelinquencies,mod- fees,ules tiontogether.Forexample,acustomera few simple clicks of the mouse. canuse the rent- roll function to identifyallValuedelinquencies,apply fees,managementand cre5.- Large propertyate evictionformswithRentegration.coma fewforsimplecompaniesthatuseColorStandardsNational Tenant Nclicksof themouse.foronlyformsgeneration will save time Logos areoverprovidedotheron the CDmethods.in all three forms:andmoney5. Value- Large propertymanage- Midall black, reversed to white, or in PMS 280 Blue/PMS 7543 Gray spot or 4/coloandsmallsizepropertymanagersandPlease see belowthatfor specificexamples.ment anagetion.comonlyareforms No forother colorsacceptablegenerationfor use for the logo.theirentirebusinessat a fractionof thewill saveoverother Notimealteringandof the moneylogo is allowed.If youhave a special circumstance that requicostof otherandprovidedonandthe CD,pleasecallforms.NTNNATIONAL HEADQUARTERS 1.800.228.0methods.Midsoftwaresmallsizeproper Logos shouldbe put over a busy background.ty managersandnotindependentrentalowners can manage their entire business at a fraction ofBLACKthe cost of otherWHITE (withsoftware and forms.STATE SPECIFIC FORMS FORExclusiveIndustry PartnerofARIZONA,CALIFORNIA,COLORADO,INDIANA, KENTUCKY, NEW JERSEY,NEW YORK, OREGON, PENNSYLVANIA,TEXAS, UTAH, WASHINGTON & MORE.BluePMS280/Gray andPMS 7543ExclusiveIndustryPartnerState specificrentalleaseof:OR-RTG-20 OregonCHECK-IN/CHECK-OUT CONDITIONREPORTTENANT(S):OR-RTG-24 OregonADDRESS:UNIT:CITY:STATE: ZIP:PETAGREEMENTRating Scale (E)ExcellentTENANT INFORMATION(VG) Very Good(G)GoodINOutTENANT(S):DATE:LIVING AREASADDRESS:UNIT:KITCHENCITY:STATE: ZIP:Walls(F)Fair (P)PoorInOutBEDROOM 3WallsDESCRIPTION OF PET(S) WindowsStove/RacksBlinds/DrapesRodsLight FixturesDishwasherCounter TopsLocksUNIT:STATE:ZIP:48-HOUR NOTICEOF ENTRYPursuant to RCW59.18.150, this is yourWA-RTG-20 Washington48 hourentering the dwellingnotice that yourlandlord or their agentsunit andpremises located at (Address)will beCHECK-IN/CHECK-OUT CONDITION REPORTFloorCarpet/Vinyl/Wood3) Type BreedSize Age Weight ColorNameDisposalVaccinations: Yes No License Number:Doors/WoodworkBlinds/DrapesIce Trays2) Type Breed Size Age Weight Color NameVaccinations: Yes No FloorLicense Number:Shelves/DrawerAGREEMENTOut CITY:DATE:WindowsRefrigerator1) Type Breed Size Age Weight ColorNameVaccinations: Yes No RodsLicense Number:Additional Security Deposit Required: WA-RTG-40 Washington48-HOUR NOTICEOF ENTRYTENANT(S):ADDRESS:InWallsonLight FixturesTENANT(S):between the )CITY:Locks The entryUNwill occur for the followingSTATE: purpose:IT:RatingCeilingsScale (E)ExcellentZIP:(VG)Very Good(G)Good(F)Fair (P)PoorElectric OutletsINOutLIVING AREASInOutKITCHENInOutWallsCabinets Tenant(s)Tenant(s) certify that the above pet(s) are the only pet(s) on the premises.Ceilingsunderstands that the additionalpet(s) are not permitted unless the landlord gives tenSinkant(s) written permission. Tenant(s) agree to keep the above-listed pets in the premisesElectricalOutletssubject to the following termsand conditions:FloorGarbage CansWindows1) The pet(s) shall be on a leash or otherwise under tenant’s controlwhen it is outside theAntenna/Cabletenant’s dwelling TVunit.Blinds/Drapes2) Tenant(s) shall promptly pick up all pet waste from the premises promptly.Fireplace3) Tenant(s) are responsible for the conduct of their pet(s) at all times.4) Tenant(s) are liablefor all damages caused by their pet(s).Cleanliness5) Tenant(s) shall pay the additional security deposit listed above and/or their rentalagreement as a condition to keeping the pet(s) listed above.6) Tenant(s) shall notBEDROOMallow their pets to cause any sort of disturbance or injury to the1BEDROOM2other tenants, guests, land

commercial real estate properties are priced above 1 million. So, for an investor who has 1 million to reinvest, they could opt to put all of that 1 million into one DST (which is typical-ly not recommended even when the DST has many properties inside of it), or they can divide that 1 million into as many as 10 completely separate DSTs.