Transcription

Siemens VDO: Solid Progressin a Challenging EnvironmentWolfgang Dehen, Group President and CEOCapital Market DaysFebruary 23-24, 2006

Safe harbor statementThis presentation contains forward-looking statements and information – that is, statements related tofuture, not past, events. These statements may be identified either orally or in writing by words as“expects”, “anticipates”, “intends”, “plans”, “believes”, “seeks”, “estimates”, “will” or words of similarmeaning. Such statements are based on our current expectations and certain assumptions, and are,therefore, subject to certain risks and uncertainties. A variety of factors, many of which are beyondSiemens’ control, affect its operations, performance, business strategy and results and could cause theactual results, performance or achievements of Siemens worldwide to be materially different from anyfuture results, performance or achievements that may be expressed or implied by such forward-lookingstatements. For us, particular uncertainties arise, among others, from changes in general economic andbusiness conditions, changes in currency exchange rates and interest rates, introduction of competingproducts or technologies by other companies, lack of acceptance of new products or services bycustomers targeted by Siemens worldwide, changes in business strategy and various other factors. Moredetailed information about certain of these factors is contained in Siemens’ filings with the SEC, whichare available on the Siemens website, www.siemens.com and on the SEC’s website, www.sec.gov. Shouldone or more of these risks or uncertainties materialize, or should underlying assumptions proveincorrect, actual results may vary materially from those described in the relevant forward-lookingstatement as anticipated, believed, estimated, expected, intended, planned or projected. Siemens doesnot intend or assume any obligation to update or revise these forward-looking statements in light ofdevelopments which differ from those anticipated.Siemens Capital Market Days, February 23-24, 2006Page 2

A merger that pays off: Highlights fromthe last 5 years at Siemens VDO In difficult market conditions, Siemens VDO is delivering above its target marginand securing its long-term success Profitable organic and exogenous growth in all major regions Portfolio: 95% of our products are in positions # 1-3 Innovation: approx. 1,000 new patents in FY 2005 Customer basis has been improved by adaptation to worldwide market needs andby acquisitions Foothold in the Chinese market strengthened by new contracts Major acquisitions in the U.S. and Korea Constant improvement of cost base and performance Quick turnaround after merger Achieved positive EVA in FY 2004 for the first time Increase in quality, productivity and financial performanceÆ WE DELIVER WHAT WE PROMISESiemens Capital Market Days, February 23-24, 2006Page 3

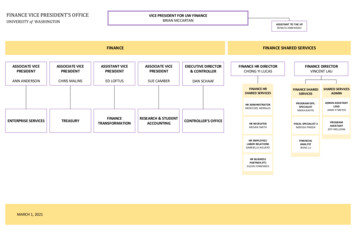

We have a strong organization focusedon our customersCustomersKey Account ManagementPowertrainGasoline SystemsDiesel SystemsEngine Actuators,Air & EmissionsManagementFuel SupplySystemsChassis &CarbodyInterior &InfotainmentService &Special SolutionsRestraint Systems,Safety ElectronicsInformation SystemsPassenger CarsSpecial OEM &InfotainmentBody & ChassisElectronicsCommercial VehiclesService & PartsCockpit Modules &SystemsTransportation &Fleet TelematicsElectric MotorDrivesInfotainmentSolutionsSensorsElectronics &Drivetrain50,800 EmployeesSiemens Capital Market Days, February 23-24, 2006Page 4

We improved our performance for ourcustomers in all crucial fieldsLogisticsQualitySalesR&DProductionCSS*CSS* FY04FY04CSS*CSS* FY02FY02 1.51.411.411.381.381.081.08 1.01.131.131.061.060.910.910.630.63 0.5Equal tothe bestcompetitor1.091.091.351.350.170.170In the survey the informant was asked to evaluate the division on a scale from -5 to 5 comparedto the most important competitor. The above results show the aggregated data for Siemens VDO.* Customer Satisfaction Survey We achieved major success with 4 initiatives(quality, design-to-cost, software, project management)We optimized our Customer Relationship Managementthrough Business Excellent Account Management (BEAM) projectWe are driving progress by entering innovation partnerships with lead customersDrivers in the automotive business:quality - costs - innovations - flawless executionSiemens Capital Market Days, February 23-24, 2006Page 5

Heading for "zero ppm" quality rates167ppm(parts per million)8970306-monthsaverageFY 2002Siemens Capital Market Days, February 23-24, 2006FY 2003FY 2004FY 2005Page 6

We are well on track to reach next CMMI levelSurvey of assessment in Siemens VDOCMMICapability Maturity Model Integration3Division 1: 3.00Division 2: 3.00Division 3: 2.752Division 4: 2.75Division 5: 2.50Division 6: 2.50Division 7: 2.25 1FY 2002Siemens Capital Market Days, February 23-24, 2006FY 2003FY 2004FY 2005FY 2006EPage 7

Our high-cost reduction rates enable usto still outplay rising OEM price pressureTotal cost reduction rate: 9% on averageFY 2003FY 2004Admin.& Others15%Material50%Production25%OEM price reduction 3% - 4% p.a.FY 2002R&D10%FY 2005Total cost reductionFY 2002 - 2005: 3.4 bnSiemens Capital Market Days, February 23-24, 2006Page 8

We deliver what we promise:Solid progress in a challenging environment 9.6 bn 9.0 bn 8.5 bn 8.4 bn 5.7 bn*6.6%6.2%SV target margin5 - 6%5.0%0.8% 65 mn 418 mn 562 mn 630 mnSalesGroup ProfitEVAGroup Profit margin %* including VDO May-September 2001- 261 mn- 4.6%FY 2001FY 2002Siemens Capital Market Days, February 23-24, 2006FY 2003FY 2004FY 2005Page 9

Our strategic direction and systematicapproach ensure continuous successRegions: Optimize global R&D andInteriorInteriorFahrdynamikDriving rtfolioAmregion 1region 2Asiaregion 3CustomerportfolioRegionalportfoliomanufacturing footprint Strategic focus on AsiaKarosserieBodyCustomers: Maintain / increase market shareInit iativeregion 4region 5region 6regio 7region 8region 9region 10region 11in Europe and Americas Become a "Global Keiretsu"supplier to Asian ng DynamicsComm.VehiclesAntriebPowertrainAmregion 1region 2region 3region 4region 5region 6region 7region 8region 9region 10SV I&IVery low SalesLow SalesMedium SalesHigh Salesinnovation - no m arket / sales yetSV C&CSV C&CSV Pproduct 27product 26product 25product 24product 23product 22product 21product 19product 20product 18product 17product 16product 15product 14product 13product 12product 11product 9product 10product 8product 7product 6product 5product 4SV I CVproduct 3product 27product 26product 25product 24SV PBest estimation; current databases (SGI, ART) do not provide approriate details.product 2SV C&Cproduct 23product 22product 21product 20product 19product 18product 17product 16product 15product 14product 13product 11product 10product 9product 12SV C&Cproduct 1SV I&IVery low SalesLow SalesMedium SalesHigh Salesproduct 8product 7product 6product 5product 4product 3product 2product 1region 11SV I CVBest estimation; current databases (SGI, ART) do not provide approriate details.innovation - no market / sales yetTechnology: Strengthen leadership in upcominggrowth applications Focus on safety / comfort, advancedpropulsion and communication78 %product 28product 27product 26product 24product 25product 23product 21product 22product 20product 19product 17product 18product 16product 14product 15product 13product 11product 12product 10product 9product 7product 8product 6product 4product 5product 3product 2product 1Search Areas for Growth. and weconstantly reviewand streamline ourportfolio22 %1) Entertainemt2) for integrated func tions of Clus ters3) in a narrower sense "HMI"SV Com petence (E/E only) - mediumAreas for External GrowthSV Competence (E/E only) - highSource: Siemens VDOSiemens Capital Market Days, February 23-24, 2006Page 10

We are diversifying our customer base2005Siemens Capital Market Days, February 23-24, 2006DC GroupBMW GroupFord GroupVW GroupGM GroupPSA GroupRenault GroupHyundai GroupHonda GroupFiat GroupOthersTop 3 38% ofsalesTop 5 53% ofsalesTop 10 68% ofsalesPage 11

Siemens VDO is growing fasterthan the marketWorld vehicle production 2005: Moderate growth on high levelSiemens VDO*Market**MillionunitsAsia 11% 6.9%NAFTA 26%- 0.3%Europe-0.5%- 0.5%World 6.7% 2.7%* Sales FY 2005 vs. FY 2004** Light vehicle productionLight vehicleproductionHeavy vehicleproductionWorld 9.8% 2.7% 2.2%AsiaNAFTA 15.9% 6.9% 1.1% 3.1% 4.8% 0.2% 1.4%2005 14.7%Europe 27.9%2006E 2010E 4.5%-0.3%-0.9% 2.6% 4.4%20052006E 2010E-5.3%-0.5% 1.7% 5.5% 6.9% 1.8% 6.1%20052006E 2010E20052006E 2010ESource: Global Insight (September 2005)Siemens Capital Market Days, February 23-24, 2006Page 12

Our target: Regional balanceto improve our competitivenessSales to ove regional split by increasing salesin Asia-Pacific33%1% OthersFY 200561%27%10%Major improvements have been made inNAFTA business2% OthersFY 200271%21%7%Bigger market share in European coremarkets due to merger of Siemens AT with VDO1% OthersSiemens Capital Market Days, February 23-24, 2006Page 13

A powerful product portfoliocovering the most attractive market segmentsAvg. market profitability (in %, 2004)Advanced propulsion9 - 10Infotainment7 - 12Active safety6-8Passive safety6-8ADASComm. Veh.SV coverage6-74-6Cockpit/Interior 3 - 53333333Siemens VDO is well positioned in themost promising market segmentsDivisions underimprovement"Market entry"divisionsBelowpeer groupprofitabilityAbove / atpeer groupprofitability 75% of Siemens VDO s salescome from divisions withat / above-average profitabilityother divisions are on their way topeer-group standardsSiemens Capital Market Days, February 23-24, 2006Page 14

We continuously review and streamlineour portfolio: M & A strategyMergers & AcquisitionsTechnology / ProductPortfolio2001Regional PortfolioCustomer PortfolioMannesmann VDO2004Huntsville ns Capital Market Days, February 23-24, 2006Bontec / AutonetAECPage 15

We continuously review and streamlineour portfolio: DivestmentsDivestmentsTechnology / ProductPortfolioRegional Portfolio2001Exit of wiringharness production2001Sale of air outletmanufacturing to Reum2002Sale of Hydraulik-Ring toHilite2003Disposal of bowden cablesbusiness to Capro Inc.2003Exit of assembly forcomplete tank systems2003Exit of cockpit assemblyOverall sales volume of divestmentsNumber of employeesSiemens Capital Market Days, February 23-24, 2006Customer Portfolio 1.5 bn12,500Page 16

The advantage of automotive electronics:Good prospects for suppliers on a long-term basisAutomotivesupplier marketaverage growth rate for entire supplier market: 3.4%720 3.4%513356417CAGR587 6.4%304 Share (%)182122252833SuppliersShare (%)65VehiclesProduced(mn units p.a.)4575 2.3% Electronics contentoutgrows vehicleproduction by far,increasingmarket share ofautomotiveelectronics Automotivesupplier marketgrows faster thanvehicle productiondue to outsourcingby OEM to suppliers230168EUR billionsElectrics / electronicscomponents & systems79Source: Strategy Analytics, Research Insight, McKinsey, Siemens VDOSiemens Capital Market Days, February 23-24, 2006Page 17

Global trends offer excellent opportunities forSiemens VDO: We care for sustainable mobilityTrendsShift ofeconomic gravityamongst regionsGrowingdemand forsafety & securityIncreasingmobilityGrowing needfor environmental careShorteningof naturalresourcesKey less cockpitActive SafetyImproved DiagnosticsE/E standardsAugmented RealityE/E standardsE/E standards1st gen ADASNew productionconceptsHW standardsZero emissionsHMIGasoline/DieselAlternative Fuels/PropulsionAffordabilityChassisHW standardsAlways onDamping SteeringZeroaccidentsADAS-Safety Platforms(passive safety)Electric energy mgmt.Workload managerInfotainment/NavigationCommunicationIntra CarPassive pulsionPropulsionComfort & SafetyCommunicationPowertrainChassis & CarbodyInterior & InfotainmentService & Special Solutions"Zero emissions""Zero accidents""Always on"Source: Siemens VDOSiemens Capital Market Days, February 23-24, 2006Page 18

We are realizing the car of the future - todayTrendsDriversTypical applications "Zero accident" Customer demand for pro.pilot "Zero emission"safer vehiclesRegulations to enforcedriver and pedestrianprotection Increasing fuel costs andfleet consumption regulations Regulations to reducevehicle emission(e.g. EURO V) "Always on" Customer demand for betterguidance and permanentconnectivity Demand for integration ofconsumer electronic devicesSiemens Capital Market Days, February 23-24, 2006- a network of driverassistance systems Advanced Propulsion Systems- e.g. Piezo injection- e.g. Hybrids CESAR- the cockpit for thecar of the futurePage 19

Our vision of "Zero accidents":Advanced Driver Assistance Systems (ADAS)94 % of all road traffic accidents could be prevented by intelligent assistants Siemens VDO is providing a variety of products to enhance safety: Radar technology for blind spot detection,Lidar technology for adaptive cruise control Lane departure warning Night Vision (with electronic pedestrian warning assistant) Driver monitoring Intelligent pedestrian protectionSiemens Capital Market Days, February 23-24, 2006Page 20

Towards "Zero emissions":Advanced propulsion systems Siemens VDO's systems know-how from tank to tail ensures efficientsolutions for entire powertrain Additional advantage through joint venture with EMITEC on exhaust treatment Siemens VDO drives progress by improving existing technologies to reduceconsumption of gasoline engines and lower diesel emissions Further target: Increase powertrain energy efficiencythrough new technologies In 2006, start of production of piez

CSS* FY04CSS* FY04 CSS* FY02CSS* FY02 1.5 1.0 0.5 Equal to the best competitor 0 * Customer Satisfaction Survey We achieved major success with 4 initiatives (quality, design-to-cost, software, project management) We optimized our Customer Relationship Management through Business Excellent Account Management (BEAM) project