Transcription

lFlipping the Switch:Disparity between the United Statesand Rest of WorldWhat Disparity?When it comes to regulatory approval for prescriptionmedications that are available worldwide, the U.S.Food and Drug Administration (FDA) often leads theway. In fact, many smaller countries that do not havethe infrastructure to support such a rigorous approvalprocess closely follow the decisions made by the FDAto regulate prescription pharmaceuticals in their owncountries. While the FDA is regarded as a world leaderfor prescription medications, it is just the opposite fornonprescription medications. Numerous categorieswhere products have been approved for nonprescription use outside the United States have been rejectedfor nonprescription use by the FDA.TABLE OF CONTENTSSwitch Environment in the U.S. .1.Switch Environment Outside the U.S. .4.Why the Disparity in the U.S.? .9.NSURE Initiative . 12.Future of Switch .13.Future Potential Switches in the U.S. .14.Conclusion . 16.Current Switch Environment in the United StatesOver the past five years, a fair number of switches hasbeen introduced to the U.S. market; however, most ofthese switches have occurred in categories whereother drugs had already switched, and these weresimply new brands or active ingredients entering theexisting category. Since 2010, there have only beentwo first-in-class switches: Oxytrol for Women(Merck) for the treatment of overactive bladder andnasally inhaled steroids in the existing category ofallergy treatment by both Sanofi’s Nasacort Allergy 24www.klinegroup.comHour and GlaxoSmithKline’s Flonase Allergy Relief.Johnson & Johnson is expected to be the third to enterthis new segment of allergy treatment in 2015 with itsrecently approved OTC version of AstraZeneca’sRhinocort Allergy Spray inhaled nasal corticosteroid.Nexium OTC (Pfizer), Prevacid 24 Hour (Novartis), andZegerid OTC (Bayer Group) are proton pump inhibitorsthat have joined first-in-class Prilosec OTC (Procter &Gamble) PPI, which entered the market in 2003. 2015 Kline

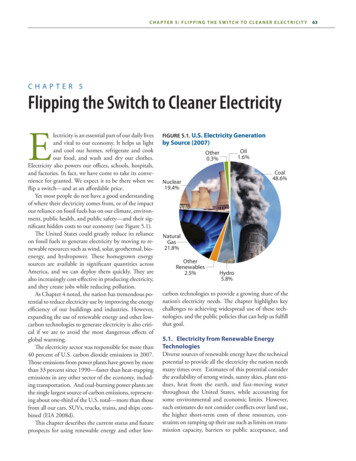

Figure 1: U.S.Rx-to-OTC Switch Progression1970sFDA establishes OTC REVIEW/MONOGRAPH systemRx-to-OTC switch of hydrocortisone approved for use inOTC first aid and anti-itch meds1980s1980s1980-1982 recessionsharp spike in PL OTC salesIbuprofen switch approved (1984) Nuprin, Advil, MotrinMany allergy, cough and cold ingredients approved forswitch bringing brands like Nyquil, Benadryl, Triaminic,and Actifed to marketLoperamide switch approved (Imodium)HDTK takes off with launch of new technologies1990s1990-1992 recessionPL penetration increases across all categoriesRobust switch activity: Naproxen sodium (Aleve)H2 antagonists (Tagamet HB, Pepcid AC, Zantac 75, and Axid AR), Antifungals (Lotrimin AF, Lamisil AT); Yeast infection (Monistat, Gyne-Lotrimin,Vagistat, Femstat), children’s Ibuprofen (Children’s Advil and Motrin),smoking cessation new category (Nicorette, Nicoderm CQ, Nicotrol,Habitrol), eye care (Naphcon-A, Vasocon-A, Opcon-A, Visine-A)Hair regrowth new category (Rogaine)2000sFewer switches create huge brandsLow and non-sedating antihistamines (Claritin, Zyrtec)PPIs (Prilosec OTC and Prevacid 24 Hour)Hyperosmotics (Miralax)Alli creates medicated weight loss marketPlan B creates OTC emergency contraceptive market2008 - great recession beginsconsumers highlycost-conscious, penetration of PL continuesTodayWidespread recalls impact market 2010-2013J&J and Novartis plants shut downFexofenadine (Allegra) switch approvedFDA issues NSURE InitiativeINS approvals (Nasacort, Flonase, Rhinocort)OAB approval (Oxytrol for Women)2lNSURE

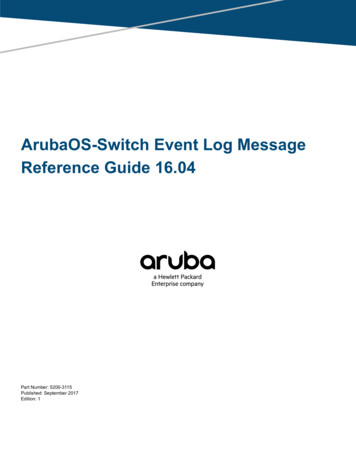

2Figure 2: U.S.Rx-to-OTC Switches, 2005-2015MiralaxPrevacid24HRZaditorYear ofApproval2005Plan BClaritinEye DropsAlawayZyrtecEye ra2010AlliZegeridOTCZyrtecOver the past decade, 17 Rx-to-OTC switch brandshave been approved by the FDA and launched to theOTC market.1 Over the same period of time, fourswitches failed attempts to switch statins for loweringcholesterol. Bristol-Myers Squibb partnered withBayer Consumer Care for an attempted switch ofPravachol (pravastatin) and was denied. Merckattempted to switch Mevacor (lovastatin) three timesand was also denied each time. In the case of lovastatin, the switch paradigm was for patients at moderatecardiovascular risk to receive the OTC product. In theend, FDA Advisory Committee members were skeptical that consumers could figure out whether they fellinto the moderate risk category, if they could assessthe efficacy of, follow the results of the medication,and if they could determine if they reached treatmentgoals.2012201320142015Nexium24 HRFlonaseAllergyReliefthe overwhelming clinical experience along with thecompelling data from the label comprehension andself-selection studies Merck presented, an FDA Advisory Committee voted 11-4 against OTC approval. Inthe discussion following the vote, the members of thecommittee expressed that they wanted to see moreinformation on the following key issues:Is there a need for another OTC product for thetreatment of allergic rhinitis?If available OTC, would asthmatics purchase it toself-treat their asthma, thus putting them at riskby taking them away from physician care?Even though labeled for age 18 and over, wouldadolescents age 15-17 be treated with it andplaced at risk for neuropsychological events?Most recently (May 2014), Merck attempted to switchthe blockbuster allergy/asthma drug Singulair and wasvoted down by an FDA Advisory Committee. 4 HR

Based on recent switches, the FDA seems to be following a more conservative path in approving traditionaltypes of OTC products used for acute, self-limiting,non-life threatening conditions with readily recognizable symptoms that consumers can identify. Howev-er, the FDA is less inclined to approve products forpreventing chronic conditions like asthma or heartdisease that can be more life-threatening in nature.Current Switch Environment Outside the United StatesIn contrast to the FDA, regulatory agencies outside theUnited States have been much more aggressive inapproving switches for conditions outside the typicalOTC paradigm. The United Kingdom in particular takespride in being at the forefront of switching. U.K. Pharmacy Minister Earl Howe has continually stressed thatincreasing patient choice by making more medicinesavailable without a prescription is a priority for theBritish government. When speaking at the ProprietaryAssociation of Great Britain conference in London onJuly 5, 2012, he stated, “The United Kingdom leads theworld in the range of products available without aprescription—but more can always be done.” 3The push for greater access to medicines in the UnitedKingdom started in 2000 when the National HealthService (NHS) outlined its aim to make more medicines available without prescription in order to widenaccess to medicines and patient choice. The NHS is thepublicly funded healthcare system for England. It isthe largest and the oldest single-payer healthcaresystem in the world. In 2000, the NHS tasked the RoyalPharmaceutical Society of Great Britain (RPSGB) totake the lead in identifying potential therapeutic categories suitable for reclassification. At the same time,the Pharmaceutical Industry Competitiveness TaskForce (PICTF) agreed the process for reclassifyingprescription-only medicines should be streamlined.The new process was intended to make the wholeprocess quicker and easier for pharmaceutical companies and allow them to better plan their switches.4more proactive about switch than the United States.Triptans for the treatment of migraine have switchedin numerous countries including the United Kingdom,Germany, Sweden, and New Zealand. Sildenafil, theactive ingredient in Viagra was approved in October2014 as a special behind-the-counter product in NewZealand that can be sold without a prescription bypharmacists who have had special training. The pharmacist administers a screening tool that allows onlymen ages 35-70 without heart disease to purchase theproduct. The switch initiative was not led by Pfizer,but rather Douglas Pharmaceuticals, which is the company that markets this drug in New Zealand under thebrand name Silvasta. Therefore, the trade name isSilvasta and not Viagra and the switch sponsor in NewZealand is Douglas Pharmaceuticals.Below is a list of potential switches being consideredin the United Kingdom to switch from prescription-only medications (POM) to pharmacy sales (P) accordingto the RPSGB. The list of potential candidates for POMmedicines to P switches groups drugs together in therapeutic categories, based on chapters in the BritishNational Formulary (BNF). Some examples ofproposed changes are found on the following page.The United Kingdom is not the only country to be4l

RPSGB List: Potential Candidates for Switch in the United Kingdom 5Therapeutic categoryCARDIOVASCULAR SYSTEMStable anginaHypertensionCholesterol lowering therapyCENTRAL NERVOUS SYSTEMObesityMigraine treatmentAnxietyENDOCRINE SYSTEMPostmenopausal osteoporosisGASTROINTESTINAL SYSTEMGastro-esophogeal reflux diseaseINFECTIONSMalaria prophylaxisMUSCULOSKELETAL AND JOINT DISEASESRheumatic and arthritic painOBSTETRICS, GYNAECOLOGY AND ry incontinence (female only)RESPIRATORY SYSTEMChronic stable asthmaInfluenzaSKINAcneImpetigoInflammatory skin disordersExamples of productsBeta-blockersCalcium channel blockersDiureticsDrugs affecting the renin-angiotensin systemStatinsOrlistatSibutramine5HT1 agonistsBeta-blockersBisphosphonatesProton pump inhibitorsDoxycyclineMefloquineMalaroneCOX-2 specific NSAIDsOral contraceptivesHormone replacement therapyOxybutyninTolterodineSelective beta2-agonists (inhaled)Corticosteroids (inhaled)ZanamivirAmantadineTopical antibioticsTopical antibioticsModerate/potent topical corticoosteroids5l

The RPSGB list contained all the therapeutic categories and product groups they identified as worthy ofconsideration for POM medicines-to-P reclassification. The Society noted that the list did not necessarilyindicate those products most suitable for reclassification and added that the safety profile for each productwould need to be considered. Erring on the side ofinclusiveness, the list contained medicines for bothacute and chronic conditions including migraine,weight loss, birth control, hormone replacement therapy, flu treatments, erectile dysfunction, and heartdisease prevention. Additional momentum for switchwas added in 2003 when the Medicines and Healthcare Products Regulatory Agency (MHRA) set a targetfor doubling the rate of switches. 6As a result of these initiatives, the United Kingdom hasswitched products such as triptans for migraines,statins for cholesterol reduction, alpha blockers forBPH, and antibiotics for chlamydia and cystitis. Inaddition to these switches, the United Kingdom alsohas a special program known as the Patient GroupDirective (PDG). Under the PDG, Boots, the pharmacychain, has conducted a special pilot program offeringnon-prescription sales of sildenafil (Viagra) for erectiledysfunction and finesteride (Propecia) for malepattern hair loss in three of its retail stores in Manchester, England. Under the guidelines of this specialpilot program, pharmacists are allowed to dispenseprescription medications without a prescription ifthey follow strict guidelines including a pharmacistadministered questionnaire to determine eligibilityfor men to purchase the medicine.7Below is a list of medications that have been switchedfrom prescription-only to pharmacy sales in theUnited Kingdom since 2002 when the British government took a proactive stance in switch.PAGB U.K. Switch History, 2002 to 2015 2Year2002200220022003IngredientAdenosineAzelastine hydrochloride eyedropsFluticasone propionate 0.05%nasal sprayGriseofulvin 1% topical sprayAspirin/Aloxiprin2003Diclofenac sodium (topical)2003Diclofenac diethylammonium(topical)Hyoscine 1.5 mg transdermalpatches20022004IndicationFor vitamin and mineral deficiency.Treatment of seasonal or perennial allergic conjunctivitis inadults and children aged 12 years and above.Prophylaxis and treatment of allergic rhinitis in those aged 18years and over for a maximum period of three months.Treatment of tinea pedis (athlete’s foot).Age restriction—not to be given to children under 16 years ofage, unless on the advice of a doctor.Local symptoma c relief of mild to moderate pain and inflammation following acute blunt trauma of small and mediumsized joints and peri-articular structures, such as trauma oftendons, ligaments, muscles and joints (e.g., due to sprainsand strains).Addition to existing indication: for the relief of the pain ofnon-serious arthritic conditions.Prevention of travel sickness symptoms (e.g., nausea, vomiting, vertigo). For use in those aged 10 years or over.Continued6l

Year2004IngredientSimvastatin 10 mg tablets2005Chloramphenicol 0.5% eye drops2005Trimethoprim 200mg tablets20052006Zolmitriptan 2.5mg tabletsPenciclovir 10mg/g (topical)2006Amorolfine hydrochloride 5%(topical)2006Sumatriptan 50 mg tablets2007Chloramphenicol 1% eye ointment20072008Levonorgestrel 1.5mg tabletNaproxen 250 mg tablets2008Azithromycin 500 mg tablets2008Diclofenac potassium 12.5mgtablets2008Nitrofurantoin 100mg2009Orlistat 60mgContinuedIndicationTo reduce the risk of a first major coronary event (non fatal myocardial infar on and Coronary Heart Disease [CHD]deaths) in people who are likely to be at moderate risk (approximately 10-15% 10 year risk of a first major event) of CHD.Treatment should be taken as part of a program of ac ons toreduce the risk of CHD.Treatment of acute bacterial conjunc v s in adults and children aged two years and over.Treatment of uncomplicated acute bacterial cys s in womenaged 16-70 years, who have had a previous diagnosis of thesame confirmed by a doctor.For the acute treatment of migraine with or without aura.For the treatment of cold sores (herpes labialis) in adults andchildren over 12 years and above.Treatment of mild cases of distal and lateral subungal onychomycoses caused by dermatophytes, yeasts and mold limitedup to two nails in those aged over 18 years.For the acute relief of migraine attacks, in those aged 18-65years of age with or without aura in patients who have stablewell established pattern of symptoms, for a max period of oneday.Treatment of acute bacterial conjunctivitis in adults and children aged two years and over.Oral contraceptive.Primary dysmenorrhoea (menstrual pain) in women aged between 15 and 50 years.Treatment of known or suspected asymptomatic Chlamydiatrachoma s genital infec on in those aged 16 years and over.Short term relief of headache, dental pain, period pain, rheuma c and muscular pain, backache and the symptoms of coldand flu, including fever in adults and adolescents aged 14years and over.For the treatment of uncomplicated acute bacterial cys s inwomen aged between 16 and 70 years of age who have hadthe condition on a previous occasion when a physician confirmed the diagnosis.For weight loss in adults with a body mass index of 28 or more,and should be taken in conjunc on with a reduced calorie,lower-fat diet. The recommended dose of Alli (brand name)is one 60 mg capsule three mes a day with meals containingthe recommended amount of fat. This was the first centrallyapproved European switch.7l

gredientIndicationProton pump inhibitor. Short-term treatment of reflux sympPantoprazoletoms (e.g., heartburn, acid regurgitation) in adults. Also acentrally approved European switch.Alclometasone dipropionate 0.05% Short term treatment and control of patches of eczema andderma s including atopic eczema and primary irritant andallergic dermatitis in adults and children 12 years and above.cTamsulosin hydrochloride 0.4mgFor the treatment of func onal symptoms of benign prohyperplasia (BPH) for use in men 45-75 years of age.Domperidone 10mg tabletsFor the relief of nausea and vomiting of less than 48 hours(Motilium 10)duration (addi onal indica on).Tranexamic acid 500 mg tabletsFor the treatment of heavy menstrual bleeding in women aged18 to 45 years with a history of regular and heavy menstrualbleeding over several consecutive menstrual cycles. Treatmentated only once heavy bleeding has started.Diclofenac sodium 140mg (patch) For local symptomatic treatment of pain in acute strains,sprains, or bruises of the extremities following blunt trauma(e.g., sport injuries).(Algopain-Eze 140 mg medicatedFor topical analgesia.plaster)Pariet Pharmacy 10mg Gastro-Re- For the short-term symptomatic treatment of reflux like sympsistant tablet (Rabeprazole 10mg) toms (e.g., heartburn) in sufferers aged 18 and over. Centrallyauthorized European switch.Ibusol lotion (Ibuprofen 1% w/w,For the relief of pain associated with mild to moderate sunisopropyl myristate 10% w/w)burn.Esomeprazole 20mg (Nexium Con- Proton-pump inhibitor for the short-term treatment of refluxtrol)symptoms (e.g., heartburn and acid regurgita on) in adults(centrally authorized European switch).Ulipristal acetate (ellaOne)Emergency contraceptive used to pr event unintended pregnancy if taken within 120 hours (five days) of unprotectedintercourse or if a contraceptive method has failed (centrallyauthorized European switch).To assist pharmacists in evaluating whether or not apatient is a candidate for a BTC product or not, questionnaires regarding the patient’s health backgroundhave been developed. Please find appendices at theback of this document with questionnaires for ZocorHeart Pro cholesterol medication from the United8lKingdom and Sumagran Active migraine medication inNew Zealand.The table below lists switches for categories that havenot switched in the United States, but have switchedoutside the country.

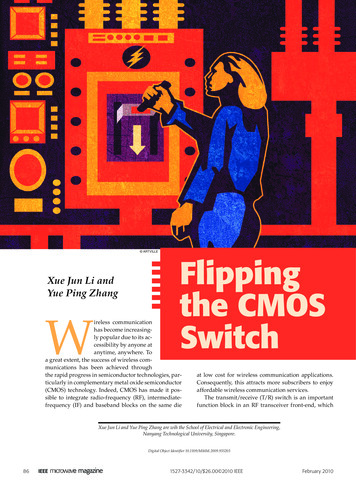

Select Rx-to-OTC Switches Outside the United States Grouped by CategoryCategoryBenign rolErectile dysfunctionErectile dysfunctionErectile dysfunctionErectile dysfunctionMale pattern baldnessMigraineCountryUnited KingdomBrandFlomax Relief United KingdomGreeceNew ZealandSpainUnited KingdomUnited KingdomFranceZocorZocorZocor Heart , CBTCBTCBTCMigraineGermanyImigran, AmergeMigraineItalyImigran, AmergeMigrainePolandImigran, AmergeMigraineSpainImigran, AmergeMigraineMigraineMigraineSwedenSwedenUnited KingdomImigranMaxaltImigran TCBTCBTCa- Brand withdrawn from the market due to low sales.b- Nonprescription sales of these drugs being tested at select retailers.Why the Disparity in the United States?One of the main reasons for the disparity in switchesin the United States compared to the rest of the worldis tied directly to the classification of medications. TheUnited States is unique in that it has just has two classes of medications: prescription (Rx) and over-thecounter (OTC). Most other countries have an additional third class of drugs, generally known asbehind-the-counter (BTC). The additional categoryenables pharmacists to function as an informed intermediary in assisting the consumer with the properself-selection and safe use of the nonprescriptionmedication.In the United Kingdom, for example, there are threeclassifications of medicines:9l

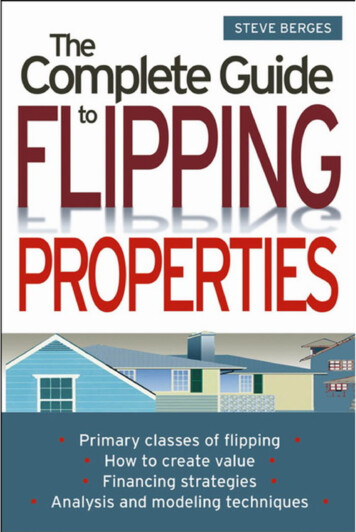

Prescription-only medicines (POM)Pharmacy without prescription (P), under thesupervision of a pharmacistGeneral sale list (GSL), sold in general retailoutlets without the supervision of a pharmacistNew medicines are usually approved for use as POMs.After some years of use, if there is enough evidence tosupport the safe use of the product without a doctor’ssupervision a medicine may be reclassified to P. Pharmacy medicines which have been safely used forseveral years and do not require a pharmacist’s oversight may be reclassified as GSL.The Consumer Healthcare Products Association(CHPA),10 the trade group representing OTC andsupplement manufacturers based in Washington, D.C.,reports that OTC medications save U.S. consumers 102 billion annually with approximately 77 billion insaved costs of visits to physicians and diagnostic tests,and an estimated 25 billion per year in savings giventhe lower prices of OTC drugs compared with prescription drug costs.Why the United States Does NotHave a Third Class of DrugsNot having this middle classification requiring a pharmacist’s supervision is what sets the United Statesapart from a majority of other countries. During thesecond Advisory Committee meeting for Mevacor, amajority of the committee members said that theywould have voted in favor of approval if there weresome way the product could be kept behind the pharmacy counter and only dispensed by a pharmacist.Another major reason for the disparity between theUnited States and other markets is the makeup ofhealthcare payers. In the U.S. healthcare system,there are a variety of payers, both private as well asgovernment payers. However, in many other markets—particularly in the United Kingdom—there aresingle payer healthcare systems where the governments are largely responsible for funding the healthcare system and therefore are more progressive whenit comes to switching medications from prescriptionto nonprescription status as a means to curb expenditures and shift costs to consumers.A team of researchers (Miller, et al) studied theEconomic Impact of a Triptan Rx-to-OTC Switch in SixEU Countries⁹ and their findings were published in thejournal PLOS in December 2013. The conclusion of thisresearch is that the nonprescription use of triptans forthe treatment of migraine in six markets in Europe(France, Germany, Italy, Poland, Spain, and the UnitedKingdom) resulted in savings of 75 million per year.RPh Assn in favorGAO finds nobenefts fromBTC class whereit existsNO BTCCLASSIN U.S.AMA andPharma againstPayers, retailers andconsumersneutralOver the years, there has been much debate aboutcreating a third class of BTC drugs in the United States.During these discussions, the FDA has repeatedlyclaimed it lacks the legal authority to create a pharmacist-supervised classification and that it would takecongressional legislation in order for it to gain thatauthority.Such was the case with pseudoephedrine, which issometimes used to illegally manufacture methamphetamine (crystal meth). In 2006, Congress enactedmore stringent requirements for products regarded asprecursor chemicals to the production of crystal methas part of the USA PATRIOT Improvement and Reauthorization Act (P.L. 109-177). As a result, OTC10lLegalissues/Actof CongressRequired

medicines containing pseudoephedrine must be keptbehind the pharmacy counter and only be dispensedin limited quantities. 11cists’ expertise. Furthermore, cost savings to the overall system would be realized from fewer physicianvisits and a decline in drug prices once they are nolonger prescription only.Legislation to create a third class has been carefullyconsidered. In 1995, Representative John Dingell, theranking member of the House Committee on Commerce ordered the U.S. Government AccountabilityOffice (GAO) to conduct a study on creating an additional class of drugs and determine if there are significant benefits or costs form such a class. The GAOreviewed the drug distribution systems in ten countries and the European Union. The conclusion of theGAO study was that the United States is the only country examined at that time that did not have a thirdclass, but that reliable and valid studies that examinethe impact of drug distribution systems do not exist,that consumer utilization of BTC medications is limited, and there is no evidence to support the contentionthat major benefits are being obtained in countriesthat have a third class.12GAO also noted that opponents to BTC are concernedabout it becoming a default for all switches, therebypreventing some drugs from becoming OTC. Furthermore, they question whether pharmacists can deliverhigh quality healthcare. With regards to cost savings,they raise the possibility of consumers out-of-pocketcost actually going up if third-party payers elect not tocover BTC medications.Once again the results of the GAO study focused onthe short comings of having a BTC classification in theUnited States. As a conclusion they state pharmacist,infrastructure, and cost-related issues would have tobe addressed before a BTC class could be established.For example, ensuring pharmacists provide BTC counseling and that pharmacists have infrastructure toprotect consumer privacy would be important. Issuesrelated to the cost of BTC drugs would also requireconsideration. For example, the availability ofthird-party coverage for BTC drugs would impactconsumers’ out of pocket expenditures and pharmacists’ compensation for providing BTC services wouldalso need to be addressed.13Talks of a third class died down after the 1995 GAOreport. However, discussions began to resurfacefollowing the Mevacor Advisory Committee meetingin 2005 in which many of the committee memberssuggested they would approve Mevacor without aprescription if there was a third class available.The momentum for a third class continued; in November 2007, the FDA held an open public hearing on BTC.There were thirty speakers who provided testimonywith approximately half being favorable and halfbeing unfavorable. In general, pharmacists and pharmacy groups were the ones providing favorable comment and physicians and physician groups (includingthe American Medical Association) were unfavorable.Following the GAO report, the momentum for BTCseemed to vanish and there has been little publicdebate or discussion since. Although a large opportunity for BTC legislation did come along when congresspassed the Affordable Care Act in March 2010. Thispiece of legislation was designed to give more Americans access to healthcare and medications and wouldhave been an ideal opportunity to pass legislationrelative to a third class of pharmaceuticals. Given itsexclusion, BTC is likely off the table for the foreseeablefuture. Additionally, the wide disparity by major stakeholder groups in the U.S. healthcare system are likelyreasons why the BTC discussion has not progressed.For example, while some pharmacists groups are infavor of a BTC class most physicians associations andthe pharmaceutical industry in general are not.There was very little public debate following the FDAhearing. However, as a follow up to the hearing, theGAO was ordered to conduct an update of its 1995report on BTC. In their updated report published inFebruary 2009, the GAO cited the FDA hearing andnoted that proponents argued that BTC wouldenhance public health through increased availabilityof nonprescription drugs and greater use of pharma-11l

Nonprescription Safe Usage Regulatory Expansion (NSURE) InitiativeWhile it appears that the FDA is no longer pursuingBTC, it has announced a new OTC program known asthe Nonprescription Safe Usage Regulatory Expansion(NSURE) initiative. The program is designed to encourage the use of technology to assist consumers in theappropriate self-selection and use of OTC medications. The way the program is designed, it has thepotential to allow even greater access of nonprescription medications in the United States than the BTCparadigm.Published on February 28, 2012, the novel programexplores how new and different switches may cometo market through the use of new technologies andhow pharmacists and healthcare professionals cancreate an environment conducive to consumers usingadditional medications in a safe setting. Ultimately,the program is all about the use of technology to assistconsumers in the appropriate self selection, as well asthe on-going safe use of nonprescription medicationsin the United States.The first OTC switch product to include technologymaking it more than a “pill in a box” was alli, a weightloss medication from GlaxoSmithKline. Approved inFebruary 2007, well before NSURE was announced,the packaging for alli included a link to a web siteoffering a comprehensive program for weight loss,including tracking weight. Although the technologywas not considered part of the labeling or a conditionfor approval, members of the FDA Advisory Committee for alli made numerous favorable commentsabout the web site which certainly aided in their decision to vote favorably for approval of the product. Allimay have even triggered the FDA’s thought process inthe development of NSURE.At a meeting sponsored by American ConferenceInstitute on OTC drugs in New York City on October29, 2013, the technical lead for FDA’s NSURE initiative,Riken Mehta, encouraged firms interested in pursuinginnovative Rx-to-OTC switches to start a dialogue withFDA now, rather than waiting for the agency to furtherdevelop its new paradigm for expanding the availability of nonprescription drugs. Mehta further noted thatFDA reviewers are open to discussing what can bedone to facilitate switches under the current switchparadigm on a product-by-product basis and that OTCdrug manufacturers do not have to wait for the paradigm to mature to suggest a role for new technologyor health care providers in an Rx-to-OTC switch.From a legal perspective, it appears as though NSUREwill not require congressional approval. Nevertheless,there is the potential for legal challenges down theroad. Therefore, the FDA is vetting the programthrough the legal system by publishing the initiative inthe Federal Register. The text below representsexcerpts from the NSURE i

Flipping the Switch: Disparity between the United States and Rest of World What Disparity? allergy treatment by both Sanofi’s Nasacort Allergy 24 Over the past five years, a fair number of switches has been introduced to the U.S. market; however,