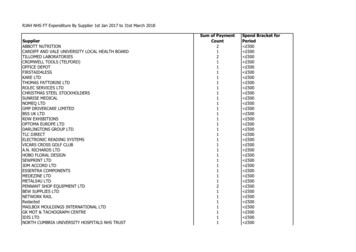

Transcription

S&P 500 Options Strategies1

About NSENational Stock Exchange of India Limited (NSE) is an electronic exchange with anationwide presence. It offers trading facility through its fully automated, screenbased trading system. A variety of financial instruments, which includes, equities,debentures, government securities, index futures, index options, stock futures, stockoptions, currency futures, Interest rate Futures etc. are traded on its electronicplatform.NSE is the largest stock exchange in India, with a significant market share inequities and in derivatives (equities/equity indices/currency). It is also one of theleading global exchanges. NSE uses a state of the art telecommunication network toprovide investors an efficient and transparent market.NSE has created new benchmarks in technology infrastructure, risk managementsystems, clearing and settlement systems, investor services and best marketpractices. It has been in the fore front offering newer products in equities andderivatives and also new asset classes for the investors to choose from.2

How to use this bookletEach strategy has an accompanying graph atlower right hand corner showing profit andloss at expiration. The vertical axis shows theprofit/loss scale.When pay-off line is below the horizontal axisit represents the loss/outlay for the strategy.The portion of the pay-off line above thehorizontal axis represents a credit or profit forthe position.The intersection of the pay-off line and thehorizontal axis is the break-even point (BEP)not including transaction costs, commissions,taxes, margin costs etc.Profit ( )Net Pay-offProfitS&P 500USD/INRLossBreakevenPointLoss ( )An illustrative example for the explainedstrategy and a pay-off table based on exampleare also provided for better understanding.Each contract used in the following exampleshas a lot size of 250 S&P 5003

Bullish Strategy : Long Call View : Very bullish on S&P 500Strategy : Buy call optionRisk: Limited to premiumReward : UnlimitedBreakeven :Strike price PremiumProfit, when: S&P 500 goes up and optionexercised Loss, when: S&P 500 does not go up andoption expires unexercisedS&P 500 onexpiry ( )PremiumPay-off ( )ExercisePay-off ( )Net Payoff ( 7500.008602.501450.00-8897.5030000.0021102.50Net Pay-off15000Example: Buy 1 Call Option*Profit ( )10000S&P 500Spot Price ( )1320.005000Break Even ( )1365.59-10000-15000Loss ( 1300-500012900128035.59S&P 5001270Premium ( )1330.001260Strike Price ( )1250*Lot size1 Contract 250 S&P 500

Bullish Strategy : Short PutS&P 500on expiry View : Bullish on S&P 500Strategy : Sell put optionRisk: UnlimitedReward : Limited to premiumBreakeven :Strike price – PremiumProfit, when: S&P 500 does not go down andoption expires unexercised Loss, when: S&P 500 goes down and optionexercised10000Example: Sell 1 Put Option*Net 775.0013507275.000.007275.00( )Net Pay-offProfit ( 30029.10S&P 500012901310.00600012801320.00-2000Premium ( )7275.001270Strike Price ( )12001260*Lot size1 Contract 250 S&P 500Spot Price ( )ExercisePay-off ( )( )1250S&P 500PremiumPay-off ( )-4000-6000Break Even ( )1280.90-8000-10000Loss ( )5

Bullish Strategy : Call Spread View : Moderately bullish on S&P 500 Strategy : Buying ITM Call and selling OTM callthereby reducing cost and breakeven of ITM call Risk: Limited to net premium paid Reward : Limited to the difference between the twostrikes minus net premium paid Breakeven :Strike price of purchased call Netpremium paid Max profit, when: both options exercised Max loss, when: both option unexercisedS&P 500on expiry( )Pay-off fromITM Callpurchased ( )Pay-offfrom OTMCall soldNet Payoff ( )( -off from ITM Call purchasedPay-off from OTM Call soldOTM Call Strike Price( )Call Premium ( )Break Even ( 41320Call Premium ( )013101310.001300ITM Call Strike Price ( )1290*Lot size1 Contract 250 S&P 500500012801320.00Net Pay-off1270Spot Price ( )1260S&P 500100001250Example: Buy 1 ITM Call Option and Sell 1 OTM CallOption *Profit ( )S&P 500-100001320.25-15000Loss ( )6

Bullish Strategy : Put SpreadS&P 500 View : Moderately bullish on S&P 500on expiry Strategy : Sell OTM Put and buy further OTM put to( )protect downside1260.00 Risk: Limited to the difference between the two strikes1280.00minus net premium received1303.88 Reward : Limited to net premium received1320.00 Breakeven :Strike Price of short put -Net premiumreceived1340.00 Max profit, when: both options unexercised Max loss, when: both options exercisedProfit ( )8000S&P 500Spot Price ( )1320.004000*Lot size1 Contract 250 S&P 500Sell OTM Put strike price ( )1310.00Buy OTM Put strike price( )Put Premium ( )Break Even ( 00Pay-off from Put 2.98Net Payoff ( )Net Pay-off1250Put Premium ( )Pay-off fromPutpurchased ( )Pay-off from Put sold10000Example: Sell 1 OTM Put Option and Buy 1 OTM PutOption *Pay-offfrom Putsold( )S&P 500-6000-8000-10000Loss ( )7

Bullish Strategy : Synthetic CallS&P 500on expiry View : Conservatively bullish on S&P 500 Strategy : Buy future and buy put option to protectagainst unexpected fall Risk: Limited to Future Price Put Premium – PutStrike Price Reward : Unlimited Breakeven :Future Price Put Premium Profit, when: S&P 500 goes up Max loss, when: S&P 500 goes down and optionexercised( )Pay-offfromFuturespurchasedPay-offfrom PutoptionsNet Payoff ( )( )( 0Pay-off from Future purchasedExample: Buy 1 Future and 1 Put Option*Pay-off from Put purchased25000S&P 500Future Price ( )1340.00Profit ( )Net Pay-off200001500010000Strike Price ( )1310.00500029.10-5000Break Even ( 133013201310130012901280-100001270Premium ( )126001250*Lot size1 Contract 250 S&P 500S&P 500-20000-25000Loss ( )8

Bullish Strategy: Covered Call with Futures View : Moderately Bullish on existing long future inportfolio Strategy : Sell OTM call option to earn premium Risk: Unlimited if S&P 500 falls. Benefit to the extent ofpremium Reward : Limited to Strike price- Future Price Paid Premium received Breakeven :Future price paid –Premium Received Max profit, when: S&P 500 goes up and option exercised Loss, when: S&P 500 goes downPremium ( )Break Even ( fit ( )Net 13201340.001290.001310Strike Price ( )-9725.0013001340.007775.001290Future Price ( )( )-17500.0012801320.00( )Net Payoff ( )1270.001270Spot Price ( )Pay-offfromCall soldPay-off from Call sold150001260S&P 500*Lot size1 Contract 250 S&P 500( )Pay-offfromFuturesPay-off from Future1250Example: Existing 1 Long Future and Sell 1 OTMCall Option*S&P 500on expiry-10000S&P 500-15000-20000-25000Loss ( )9

Bullish Strategy : Collar View : Conservatively bullish Strategy : Buy futures, buy put to insure downside, sellcall option to partly finance put Risk: Limited Reward : Limited Breakeven :Purchase price of futures – Call premium Put premium Max profit, when: S&P 500 goes up and call optionexercised Max loss, when: S&P 500 goes down and put optionexercised15000Future Price ( )1340.00*Lot size1 Contract 250 S&P 500Put Strike Price ( )1300.005000Call Premium ( )Breakeven ( )Net Payoff ( 03750.005000.00Pay-off from Call soldProfit ( )Net 30.00Pay-offfromCallsold ( )Pay-off from Put purchasedS&P 500Call Strike Price ( )Pay-offfrom Putpurchased( )Pay-off from Future purchased10000Put Premium ( )Pay-offfromFuturespurchased( )1270.001250Example: Buy 1 Future and 1Put Option Contractand Sell 1 Call Option Contract*S&P 500 onexpiry ( )S&P 500-20000-25000Loss ( )10

Bullish Strategy : Long Combo View : Bullish on S&P 500Strategy : Sell OTM put and buy OTM call optionRisk: UnlimitedReward : UnlimitedBreakeven :Call strike Net premiumProfit, when : S&P 500 goes up and call optionexercised Loss, when : S&P 500- INR goes down and put optionexercisedExample: Sell 1 OTM Put Option and Buy 1OTM Call Option*Spot Price ( )1320.0015000*Lot size1 Contract 250 S&P 500Put Strike Price ( )1310.0010000Call Premium ( )Break Even ( )( )Pay-offfrom CallpurchasedNet Payoff ( )( 50.004250.0010000.00Pay-off from Call purchasedNet Pay-off-15000-20000Loss ( 50.00Profit ( )1250Call Strike Price( )Pay-offfrom Putsold ( )Pay-off from Put sold20000S&P 500Put Premium ( )S&P 500on expiryS&P 50011

Bearish Strategy : Long Put View : Bearish on S&P 500Strategy : Buy put optionRisk: Limited to premiumReward : UnlimitedBreakeven :Strike Price – PremiumProfit, when: S&P 500 goes down and optionexercised Max loss, when: S&P 500 goes up and option notexercisedExample: Buy 1 Put Option*8000S&P 500on expiryPremiumPay-offExercisePay-off( )( )( )Net Payoff ( 002500.00-4775.001320.00-7275.000.00-7275.00Net Pay-offProfit ( )60001280.901340S&P 500-4000Break Even ( )1330-2000132029.1001310Premium ( )200013001310.001290Strike Price ( )1280*Lot size1 Contract 250 S&P 500400012701320.001260Spot Price ( )1250S&P 500-6000-8000Loss ( )12

Bearish Strategy : Short Call View : Very bearish on S&P 500Strategy : Sell call optionRisk: UnlimitedReward : Limited to premiumBreakeven :Strike Price PremiumMax Profits, when: S&P 500 goes down and optionnot exercised Loss, when: S&P 500 goes up and option exercisedS&P 500on expiryPremiumPay-offExercisePay-off( )( )( )Net Payoff ( .00-3602.501400.008897.5017500.00-8602.50Net Pay-off15000Example: Sell 1 Call Option*Profit ( )100001320.005000Break Even ( 31035.5901300Premium ( )1330.001290Strike Price ( )1280*Lot size1 Contract 250 S&P 500S&P 5001410Spot Price ( )1400S&P 500-10000-15000Loss ( )13

Bearish Strategy : Call SpreadS&P 500on expiry View : Mildly Bearish on S&P 500 Strategy : Sell ITM Call and buy OTM Call option toprotect against unexpected rise Risk: Limited to the difference between the two strikesminus net premium Reward : Limited to the net premium received Breakeven :Strike Price of Short call Net premiumreceived Max profit, when: S&P 500 goes down and both optionsnot exercised Max loss, when: S&P 500 goes up and both 0-6377.501370.00-6102.50-275.00-6377.50Payoff from OTM Call PurchasedNet P 500200012901310.001280Sell ITM Call Strike Price ( )1270*Lot size1 Contract 250 S&P 500600012601320.00Break Even ( )1270.00Profit ( )1250Spot Price ( )Call Premium ( )Net Payoff ( )( )8000S&P 500Buy OTM Call Strike Price( )( )Pay-offfromOTM CallPurchasedPay-off from ITM Call SoldExample: Sell 1 ITM Call Option and Buy 1 OTM CallOption*Call Premium ( )Pay-offfromITM CallSold ( )Loss ( )14

Bearish Strategy : Put Spread View : Moderately Bearish on S&P 500 Strategy : Buy ITM Put and sell OTM Put option to reducecost and breakeven of ITM Put Risk: Limited to net premium paid Reward : Limited to the difference between the two strikesminus net premium paid Breakeven :Strike price of long Put -Net premium paid Max profit, when: S&P 500 goes down and both optionsexercised Max loss, when: S&P 500 goes up and both optionsunexercised15000Break Even ( 1360.00-8427.507275.00-1152.50Pay-off from Put purchasedPay-off from Put soldNet Pay-off10000500029.10-5000136001350S&P 5001300.001340Put Premium ( )-927.501330Sell OTM Put Strike Price( )33.711300.001320Put Premium ( )6347.5013101330.002275.001300Buy ITM Put Strike Price ( )( )1290*Lot size1 Contract 250 S&P 500( )Net Payoff ( )4072.5012801320.00Pay-offfromOTMPut sold1280.001270Spot Price ( )1260S&P 500( )Pay-offfrom ITMPutpurchasedProfit ( )1250Example: Buy 1 ITM Put Option and Sell 1 OTM PutOption*S&P 500onexpiry1325.39-10000Loss ( )15

Bearish Strategy: Protective Call/Synthetic Long Put View : Bearish on S&P 500 but keep protected againstany unexpected rise Strategy : Sell futures, buy call option to protectagainst rise in S&P 500 Risk: Limited to Call strike price -Futures price Premium Reward : Unlimited Breakeven :Futures price -Call premium Profit, when: S&P 500 goes down and option notexercised Max Loss, when: S&P 500 goes up and optionexercised25000Pay-offfrom Callpurchased( )Net Payoff ( 70.00-7500.00-275.00-7775.00Pay-off from Future soldProfit ( )Pay-off from Call purchasedNet Pay-off15000S&P 500Future Price ( )1340.0010000*Lot size1 Contract 250 S&P 500Buy Call Strike Price ( )1340.005000-10000-15000Loss ( 012701308.90-5000126031.10S&P 50001250Breakeven ( )Pay-off onFuturessold ( )20000Example: Sell 1 Future and Buy 1 Call Option*Call Premium ( )S&P 500 onexpiry( )

Bearish Strategy: Covered Put View : Neutral to Bearish on S&P 500 Strategy : Sell futures, Sell OTM put option toearn premium Risk: Unlimited Reward : Future price – Strike price Putpremium Breakeven :Futures price Premium received Max Profit, when: S&P 500 goes down andoption exercised Loss, when: S&P 500 goes up and option notexercisedS&P 500on expiry( )Pay-offfromFuturessold( )Pay-offfrom Putsold ( )Net Payoff ( 500.007275.00-5225.00Pay-off from Future sold25000Profit ( )Pay-off from Put soldNet Pay-off20000Breakeven ( 029.101330Put Premium ( )S&P 500013201310.001310Put Strike Price ( )50001300*Lot size1 Contract 250 S&P 5001000012901340.001280Future Price( )1270S&P 500150001260Example: Sell 1 Future and Sell 1 Put Option *-15000-20000Loss ( )17

Neutral Strategy: Long StraddleS&P 500 onexpiry ( ) View : S&P 500 will experience significant volatility Strategy : Buy call and buy put option of same strikeprice Risk: Limited to Premium paid Reward : Unlimited Breakeven :Upper BEP Strike Price of Long Call Net Premium PaidLower BEP Strike Price of Long Put - NetPremium Paid Profit, when: One of the option exercised Max Loss, when: Both the option not exercisedExample: Buy 1 Call & Buy 1 Put Option at same strike20000S&P 500Spot Price ( )1320.0015000*Lot size1 Contract 250 S&P 500Call and Put Strike Price ( )1350.0010000Put Premium ( )40.00-50001417.00-100001283.00Net Payoff ( 0.0018250.00-10000.008250.00Pay-off from Call purchasedPay-off from Put purchasedNet Pay-off500027.00Lower BEP ( )Pay-offfrom Putpurchased( )1250.00Profit ( )Call Premium ( )Upper BEP ( )Pay-offfrom Callpurchased( 3301320131013001290S&P 500-15000-2000012801270126012500Loss ( )18

Neutral Strategy: Short StraddleS&P 500 onexpiry ( ) View : S&P 500 will experience very little volatility Strategy : Sell Call and sell Put option of same strikeprice Risk: Unlimited Reward : Limited to Premium received Breakeven :Upper BEP Strike price of short call Net premium receivedLower BEP Strike price of short put - Net premiumreceived Max Profit, when: Both the options not exercised Loss, when: one of the options exercisedPay-offfrom Callsold ( -22000.0011250.00-10750.00Pay-off from Call soldPay-off from Put soldS&P 500Spot Price ( )1320.0020000*Lot size1 Contract 250 S&P 500Call and Put Strike Price ( )1340.0010000Upper BEP ( )1407.00Lower BEP ( )1273.005000S&P 500-15000-20000Loss ( 00Net Pay-off150001260Put Premium ( )Profit ( )125022.00Net Pay-off( )1250.00Example: Sell 1 Call & Sell 1 Put Option at same strikeCall Premium ( )Pay-offfrom Putsold ( )

Neutral Strategy: Long StrangleS&P 500on expiry( ) View : S&P 500 will experience significant volatilityStrategy : Buy slight OTM call and put option.Risk: Limited to premium paidReward : UnlimitedBreakeven :Upper BEP Strike Price of Long Call Net Premium PaidLower BEP Strike Price of Long Put - Net PremiumPaid Profit, when: One of the option exercised Max Loss, when: Both the option not exercisedExample: Buy 1 Call & 1 Put Option at same strikeS&P 500Spot Price ( )1320.0020000*Lot size1 Contract 250 S&P 500Call Strike Price ( )1335.001500033.2910000Upper BEP ( )Lower BEP ( 7837.506340.00Pay-off from Call purchasedPay-off from Put purchasedNet Pay-offS&P 500-15000-20000Loss ( 0001315.001250.3614662.501245Put Premium ( )Net Payoff ( )-8322.501235Put Strike Price ( )Pay-off fromput purchased( )1225.00Profit ( )1225Call Premium ( )Pay-off fromcallpurchased ( )

Neutral Strategy: Short StrangleS&P 500 onexpiry ( ) View : S&P 500 will experience very little volatility.Strategy : Sell OTM Call and Put optionRisk: UnlimitedReward : Limited to premium receivedBreakeven :Upper BEP Strike Price of Long Call Net Premium ReceivedLower BEP Strike Price of Long Put - Net PremiumReceived Max Profit, when: Both the options not exercised Loss: When one of the options exercisedPay-offfrom callsold ( 00-14177.507837.50-6340.00100001315.005000Upper BEP ( )1399.64-10000Lower BEP ( )1250.36-15000-20000Loss ( 5-5000130531.35S&P 50001295Put Premium ( )33.291285Put Strike Price ( )150001275Call Premium ( )Net Pay-off12651335.001255Call Strike Price ( )Pay-off from Put soldProfit ( )1245*Lot size1 Contract 250 S&P 5002000012351320.00Pay-off from Call sold1225Spot Price ( )Net Pay-off( )1225.00Example: Sell 1 Call & Sell 1 Put Option at same strikeS&P 500Pay-offfrom putsold ( )

Neutral Strategy : Long Call ButterflyS&P 500on expiry( )Pay-off from2 ATM CallsSold ( er BEP ( )1338.29-15000Lower BEP ( )1301.71-20000Loss ( )S&P 01300.00133015000132040.5031.10Call Premium ( )Net Pay-off200001310Buy OTM Call Strike ( )Payoff from 1 OTM Call PurchasedProfit ( )1300Call Premium ( )1320.00250001280Buy ITM Call Strike ( )Payoff from 1 ITM Call Purchased1320.001270Call Premium ( )Pay-off from 2 ATM Calls Sold1260Sell ATM Call Strike ( )Net Payoff ( )-12902.501250*Lot size1 Contract 250 S&P 500Spot PricePayoff from 1OTM Callpurchased ( )20250.00Example Sell 2 ATM Call, Buy 1 ITM Call, Buy 1 OTM CallS&P 500Payoff from 1ITM Callpurchased ( )1270.001290 View : Neutral on S&P 500 direction and bearish on volatility Strategy : Sell 2 ATM Call, Buy 1 ITM Call and Buy 1 OTMCall Risk: Limited to net premium paid Reward : Limited to difference between adjacent strikesminus net premium debit Breakeven : Upper BEP Higher Strike Price - NetPremiumLower BEP Lower Strike Price Net Premium Profit, when: ITM call exercised and other options notexercised Max Loss:, when: all options exercised or all options notexercised

Neutral Strategy : Short Call Butterfly View : Neutral on S&P 500 direction and bullish on volatility Strategy : Buy 2 ATM Call, Sell 1 ITM Call and Sell 1 OTMCall Risk: Limited to difference between adjacent strikes minusnet premium received Reward :Limited to net premium received Breakeven : Upper BEP Higher Strike Price - NetPremium Lower BEP Lower Strike Price Net Premium Max Profit, when: all options exercised or all options notexercised Loss, when: ITM call exercised and other options notexercisedS&P 500on expiryPay-off from2 ATM CallsPurchased ( )Payoff from 1ITM Call .50( )( )Example: Buy 2 ATM Call, Sell 1 ITM Call, Sell 1 OTM Call-1000031.10-15000Upper BEP ( )1338.29-20000Lower BEP ( )1301.71-25000Call Premium ( )S&P 500Loss ( ell OTM Call Strike ( )100001300.001330Call Premium ( )Net Pay-off150001320Sell ITM Call Strike ( )40.50Payoff from 1 OTM Call SoldProfit ( )1310Call Premium ( )2000013001320.001290Buy ATM Call Strike ( )( )Payoff from 1 ITM Call Sold1280*Lot size1 Contract 250 S&P 500NetPay-offPay-off from 2 ATM Calls Purchased12701320.001260Spot Price1250S&P 500Payoff from 1OTM Callsold ( )

Neutral Strategy : Long Call Condor View : Range bound market Strategy : Buy 1 ITM Call (Lower strike “A”), Sell 1 ITM Call(Lower middle “B”), Sell 1 OTM Call (Higher middle “C”),Buy 1 OTM Call (Higher strike “D”) Risk: Limited to difference between the lower strike spreadless the higher strike spread less premium paid Reward :Limited. Max profit when S&P 500 between “B” and“C” Breakeven : Upper BEP Highest Strike Price - NetPremium. Lower BEP Lowest Strike Price Net Premium Max Profit, when: option “A & B” exercised Max Loss, when: all options exercised or all options notexercisedS&P 500Spot Price1320.00*Lot size1 Contract 250S&P 500Buy ITM Call Strike “A” ( )1315.00Call Premium ( )-6750.00 -1000.001305.00-11250.008750.008250.00-6750.00 .00-8750.008750.008250.00-6750.00 1500.001335.00-6250.006250.008250.00-6750.00 0-1250.001250.003250.00-4250.00 -1000.001375.003750.00-3750.00-1750.00750.00 -1000.001325.0035.00Profit ( )10000Pay-offfrom “C”( )Pay-off fromPay-off fromPay-off fromPay-off fromNet Pay-offPay-offfrom “D”( )Net Payoff ( )0.000.00lower strike "A" purchasedlower middle strike "B" soldhigher middle strike "C" soldhigher strike "D" purchased50001335.0027.00Upper BEP ( )1341.00Lower BEP ( 3.001325Buy OTM Call Strike “D” ( )8250.0045.00Pay-offfrom “B”( )1315Call Premium ( )8750.001305Sell OTM Call Strike “C” ( )-11250.001295Call Premium ( )1285.001285Sell ITM Call Strike “B” ( )Pay-offfrom “A”( )1275Call Premium ( )S&P 500on expiry( )S&P 500-10000-15000Loss ( )24

Neutral Strategy : Short Call Condor View : Market will break-out trading range, but direction isuncertain Strategy : Sell 1 ITM Call (Lower strike “A”), Buy 1 ITM Call(Lower middle “B”), Buy 1 OTM Call (Higher middle “C”), Sell1 OTM Call (Higher strike “D”) Risk: Limited. Max loss when S&P 500 between “B” and “C” Reward :Limited. Price move above the “D” or below “A” Breakeven : Upper BEP Highest Strike Price - Net PremiumLower BEP Lowest Strike Price Net Premium Max Profit, when: all options exercised or all options notexercised Max Loss, when: option “A & B” exercisedS&P 500Spot Price1320.00*Lot size1 Contract 250S&P 500Sell ITM Call Strike “A” ( )1315.0011250.00-8750.00-8250.006750.00 008750.00-8750.00-8250.006750.00 -1500.001335.006250.00-6250.00-8250.006750.00 001250.00-1250.00-3250.004250.00 1000.001375.00-3750.003750.001750.00-750.00 1000.000.000.00Pay-off from lower middle strike "B" purchased15000Pay-off from higher middle strike "C" purchasedProfit ( )Pay-off from higher strike "D" soldNet Pay-off100001335.00Upper BEP ( )1341.00Lower BEP ( )1319.000-5000Loss ( )138527.0013751345.005000136533.001355Call Premium ( )1305.001345Sell OTM Call Strike “D” ( )6750.00 1000.001335Call Premium ( )Net Payoff ( )-8250.001325Buy OTM Call Strike “C” ( )35.00Pay-offfrom “D”( )-8750.001315Call Premium ( )Pay-offfrom “C”( )Pay-off from lower strike "A" sold45.001325.00Pay-offfrom “B”( )11250.001305Buy ITM Call Strike “B” ( )Pay-offfrom “A”( )1285.001295Call Premium ( )S&P 500on expiry( )S&P 500-1000025

Neutral Strategy : Long Box or Conversion To take advantage of temporary mis-pricing ofoptions in the market. Strategy : Long Call “A”, short Call “B”, longPut “B” and Short Put “A”; Where B A Risk: None, No effect of price change Reward : Fixed ((B-A)-Net Premium Debit) Max Profit, when: Always Max Loss, when: No effect of price changeExample: Buy 1 Call ,Sell 1 Call, Buy 1 Put & Sell 1Put *S&P 500Spot Price*Lot size1 Contract 250 S&P 500Premium for CallStrike Price 1310 ( )40.00Premium for CallStrike Price 1340 ( )33.00Premium for PutStrike Price 1340 ( )44.20Premium for PutStrike Price 1310 ( )31.00S&P500 onexpiry( )Pay offfrom CallBought( )Pay offfrom CallSold ( )Pay offfrom PutBought( 750.002450.00Pay-off fromPay-off fromPay-off fromPay-off fromNet Pay-off1320.00Profit ( )15000Pay offfrom PutSold ( )NetPay-off( )Call purchasedCall soldPut purchasedPut sold100005000S&P 500-10000Loss ( 3001290128012701260-500012500

Neutral Strategy : Short Box or Conversion To take advantage of temporary mis-pricing ofoptions in the market. Strategy : Long Call “B”, Short Call “A”, Long Put“A” and Short Put “B”; Where B A Risk: None, No effect of price change Reward : Fixed ((B-A)-Net Premium Credit) Max Profit, when: Always Max Loss, when: Never. No effect of price changeExample: Buy 1 Call ,Sell 1 Call, Buy 1 Put & Sell 1Put *S&P 500Spot Price*Lot size1 Contract 250 S&P 500Premium for CallStrike Price 1310 ( )47.00Premium for CallStrike Price 1340 ( )28.00Premium for PutStrike Price 1340 ( )46.00Premium for PutStrike Price 1310 ( )29.10S&P500 onexpiry( )Pay offfrom CallBought ( )Pay offfrom CallSold ( )Pay offfrom PutBought( )Pay offfrom PutSold ( )NetPay-off( .00-7275.001475.00Pay-off fromPay-off fromPay-off fromPay-off fromNet Pay-off1320.0015000Profit ( )Call soldCall purchasedPut soldPut 13301320131013001290128012701260-500012500S&P 500Loss ( )27

Neutral Strategy : Put-Call Parity To take advantage of temporary mis-pricing of options in themarket. Relation: Call PV (Strike) Put PV (Futures) Strategy : Sell Call & Invest in Bond and Buy Put & Futures ifCall PV (Strike) Put Futures Sell Put & Futures and Buy Call & Invest in Bond ifCall PV (Strike) Put Futures Risk: None, No effect of price change Reward : Limited to the price difference Max Profit, when: Always Max Loss, when: No effect of price changeS&P 500on expiry( )Pay- offfrom Future( )Pay-offfrom Put( )Pay-offfrom Call( )NetPay-off( 00.00-6250.00

Max loss, when: both option unexercised Example: Buy 1 ITM Call Option and Sell 1 OTM Call Option * S&P 500 Spot Price ( ) 1320.00 *Lot size 1 Contract 250 S&P 500 ITM Call Strike Price ( ) 1310.00 Call Premium ( ) 45.84 OTM Call Strike Price( ) 1330.00 Call Premium ( ) 35.59 Break Even (