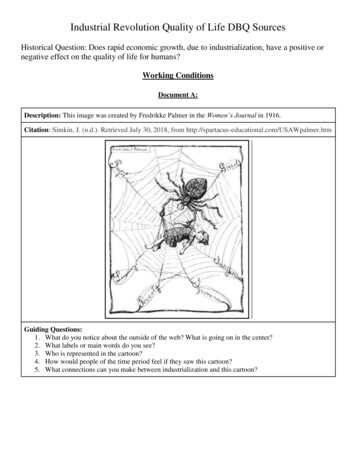

Transcription

SourcesSources ofof Funds:Funds:EquityEquity andand DebtDebt

The “Secrets” to SuccessfulFinancing1. Choosing the right sources of capital is adecision that will influence a company for alifetime.2. The money is out there; the key is knowingwhere to look.3. Creativity counts. Entrepreneurs have to be ascreative in their searches for capital as they arein developing their business ideas.

The “Secrets” to SuccessfulFinancing(continued)4. The World Wide Web puts at entrepreneur’sfingertips vast resources of information thatcan lead to financing.5. Be thoroughly prepared before approachinglenders and investors.6. Entrepreneurs should not underestimate theimportance of making sure that the“chemistry” between themselves, theircompanies, and their funding sources is a goodone.

Three Types of CapitalCapital is any form of wealth employed to produce morewealth for a firm.nnnFixed - used to purchase the permanent orfixed assets of the business (e.g., buildings, land,equipment, etc.)Working - used to support the small company’snormal short-term operations (e.g., buyinventory, pay bills, wages, salaries, etc.)Growth - used to help the small businessexpand or change its primary direction.

Equity CapitalnnnnRepresents the personal investment of theowner(s) in the business.Is called risk capital because investorsassume the risk of losing their money if thebusiness fails.Does not have to be repaid with interest likea loan does.Means that an entrepreneur must give upsome ownership in the company to outsideinvestors.

Sources of EquityFinancingPersonal savingsn Friends and family membersn Angelsn Partnersn Corporationsn Venture capital companiesn Public stock salen

Personal SavingsnnnThe first place an entrepreneurshould look for money.The most common source of equitycapital for starting a business.Outside investors and lendersexpect the entrepreneur to putsome of her own capital into thebusiness before investing theirs.

Friends and Family MembersnnnAfter emptying her own pockets, anentrepreneur should turn to thosemost likely to invest in the business –friends and family members.Survey: 10% of business owners turnto family and friends for capital.Careful!!! Inherent dangers lurk infamily/friendly business deals,especially those that flop.

Friends and Family MembersnGuidelines for Family and FriendshipFinancing Deals:w Consider the impact of the investment oneveryone involved. Keep the arrangement“strictly business.”w Settle the details up front.w Create a written contract.w Treat the money as “bridge financing.”w Develop a payment schedule that suits bothparties.

AngelsAngels - private investors who backemerging entrepreneurial companieswith their own money.n Fastest growing segment of the smallbusiness capital market.n An excellent source of “patient money”for investors needing relatively smallamounts of capital – often less than 500,000.n

AngelsKey: finding them!n Angels almost always invest their moneylocally and can be found through“networks.”n The typical angel accepts 30% of theproposals presented to him and hasinvested an average of 131,000 in 3.5businesses.n

Corporate Venture Capital30% of all venture capital investmentscome from corporations.n About 900 large corporations across theglobe invest in start-up companies.n Capital infusions are just one benefit;corporate partners may share marketingand technical expertise.n

Venture Capitalist CompaniesMore than 3,000 venture capital firmsoperate across the United States.n Most venture capitalists seek investmentsin the 3,000,000 - 10,000,000 range incompanies with high-growth and highprofit potential.n Business plans are subjected to anextremely rigorous review – less than 1%accepted.n

Venture Capitalist CompaniesMost venture capitalists take an activerole in managing the companies in whichthey invest.n Many venture capitalists focus theirinvestments in specific industries withwhich they are familiar.n Most often, venture capitalists invest in acompany across several stages.n

1,8001,6001,4001,2001,000800600400200- 20.0 15.0 10.0 5.0 -19951996Billions of 199719981999Number of Deals2000Number of Deals ount Financed (inBillions of )Venture Capital Financing

What Do Venture CapitalCompanies Look For?Competent managementn Competitive edgen Growth industryn Viable exit strategyn “Intangibles”n

Going PublicInitial public offering (IPO) - when acompany raises capital by selling sharesof its stock to the public for the first time.n Typical year: about 550 companies makeIPOs.n Few companies with sales below 10million in annual sales make IPOs.n

999Number of IPOs1000 80.0 70.0 60.0 50.0 40.0 30.0 20.0 10.0 0.0Money Raised ( billions)Initial Public OfferingsNumber Raised (Billions)

Advantages of “Going Public”nnnnnnAbility to raise large amounts ofcapitalImproved corporate imageImproved access to future financingAttracting and retaining keyemployeesUsing stock for acquisitionsListing on a stock exchange

Disadvantages of “Going Public”nnnnnnnnDilution of founder’s ownershipLoss of controlLoss of privacyReporting to the SECFiling expensesAccountability to shareholdersPressure for short-termperformanceTiming

The Registration ProcessChoose the underwritern Negotiate a letter of intentn Prepare the registration statementn File with the SECn Wait to “go effective”n Meet state requirementsn

Debt FinancingnnnnMust be repaid with interest.Is carried as a liability on thecompany’s balance sheet.Can be just as difficult to secure asequity financing, even though sourcesof debt financing are more numerous.Can be expensive, especially for smallcompanies, because of the risk/returntradeoff.

Sources of Debt CapitalnCommercial banks

Commercial Banks.the heart of the financial market for small businesses!nShort-term loansw Commercial loansw Lines of creditw Floor planningnIntermediate and long-termloansw Installment loans and contracts

Sources of Debt CapitalCommercial banksn Asset-based lendersn

Asset-Based Borrowingn Discounting accountsreceivablen Inventory financingAccountsReceivable

Sources of Debt CapitalCommercial banksn Asset-based lendersn Trade creditn Equipment suppliersn Commercial finance companiesn Saving and loan associationsn

Sources of Debt Capital(continued)Stock brokerage housesn Insurance companiesn Credit unionsn Bondsn Private placementsn Small Business Investment Companies(SBICs)n Small Business Lending Companies(SBLCs)n

Sources of Debt Capital(concluded)Federally Sponsored Programs:nnnnnnnEconomic Development Administration (EDA)Department of Housing and Urban Development(HUD)U.S. Department of Agriculture’s Rural BusinessCooperative ServiceLocal Development Companies (LDCs)Small Business Innovation Research (SBIR)Small Business Technology Transfer programsSmall Business Administration (SBA)

Small Business AdministrationLoan ProgramsLow Doc Loan Programn SBAExpress Programn 7(A) Loan Guarantee Program – themost popular SBA loan programn CAPLine Programn International Trade Programsnw Export Working Capital Programw International Trade Program

SBA Loan ProgramsSection 504 Certified DevelopmentCompany Programn Microloan Programn Prequalification Loan Programn Disaster Loansn 8(A) Loan Programn

State and Local Loan ProgramsCapital Access Programs (CAPs) – nowoffered in 22 states and are designed toencourage lenders to make loans tobusinesses that do not qualify fortraditional financing.n Revolving Loan Fund (RLFs) – combineprivate and public funds to make smallbusiness loans.n

Internal Methods of FinancingFactoring - selling accounts receivableoutrightn Leasing assets rather than buying themn Credit cardsn

nDiscounting accounts receivable Accounts Receivable nInventory financing. Sources of Debt Capital nCommercial banks nTrade credit nEquipment suppliers nCommercial finance companies nSaving and loan associations nAsset-based lenders Sources of Debt Capital nStock brokerage houses nInsurance companies nCredit unions nBonds nPrivate placements nSmall Business Investment