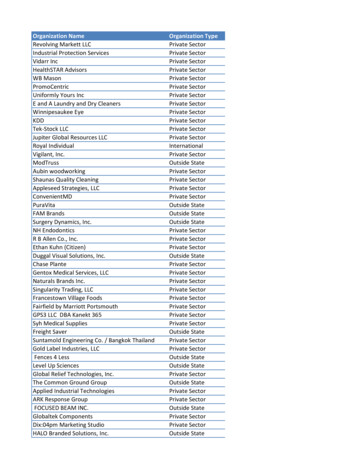

Transcription

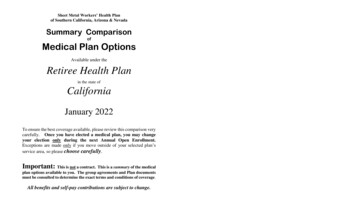

Sheet Metal Workers’ Health Planof Southern California, Arizona & NevadaSummary ComparisonofMedical Plan OptionsAvailable under theRetiree Health Planin the state ofCaliforniaJanuary 2022To ensure the best coverage available, please review this comparison verycarefully. Once you have elected a medical plan, you may changeyour election only during the next Annual Open Enrollment.Exceptions are made only if you move outside of your selected plan’sservice area, so please choose carefully.Important: This is not a contract. This is a summary of the medicalplan options available to you. The group agreements and Plan documentsmust be consulted to determine the exact terms and conditions of coverage.All benefits and self-pay contributions are subject to change.

Retiree – CA2022Plan FeatureUnited Healthcare HMONot Eligible forMedicare“MedicareAdvantage” Enrolledin MedicareHealth Net HMOKaiser HMO“SeniorAdvantage”Enrolled inMedicareNot Eligible forMedicareNot Eligible forMedicare“Seniority Plus”Enrolled in MedicareHumana PPO“Medicare Advantage”Both participant and Eligibledependent must be Enrolledin MedicareNone 500 per person, 1,000 familymaximum; Deductible appliesunless otherwise notedNoneNoneNone 147 per personAnnual Deductible 500 per person, 1,000family maximum; Deductibleapplies unless otherwisenotedAnnual Out of PocketMaximum on AllowableChargesPlan pays 100% after eligibleout-of-pocket costs reach 3,000 in a year ( 6,000 for afamily)Plan pays 100% afterco-payments reach 6,700in a yearPlan pays 100% after eligibleout-of-pocket costs reach 3,000 in a year ( 6,000 for afamily)Plan pays 100% after copayments reach 1,500 ina yearPlan pays 100% after eligibleout-of-pocket costs reach 3,000 in a year ( 6,000 for afamily)Plan pays 100% after copayments reach 3,400 in ayearPlan pays 100% after co-paymentsreach 147 in a yearInpatient Hospital CarePlan pays 80% afterdeductiblePlan pays 100%Plan pays 80% after deductiblePlan pays 100%Plan pays 80%Plan pays 100%Plan pays 100%Outpatient ProcedurePlan pays 80% afterdeductiblePlan pays 100%Plan pays 80% after deductibleYou pay 10 per visitPlan pays 80%Plan pays 100%Plan pays 100% after deductibleExtended Care Facility(Skilled Nursing)Plan pays 80% afterdeductible; 100 daysmaximum per calendar yearPlan pays 100%;100 days maximum percalendar yearPlan pays 80% after deductible;100 days maximum percalendar yearPlan pays 100%;100 days maximum percalendar yearPlan pays 100% for days 1-10,You pay 25 per day for days11-100;100 days maximumper calendar yearPlan pays 100%; 100 daysmaximum per benefit periodPlan pays 100%; 100 days maximumper calendar yearOffice VisitsNot subject to deductibleNot subject to deductiblePrimary Care VisitYou pay 30 per visitYou pay 5 per visitYou pay 30 per visitYou pay 10 per visitYou pay 30 per visitYou pay 5 per visitPlan pays 100% after deductibleSpecialistYou pay 50 per visitYou pay 5 per visitYou pay 45 per visitYou pay 10 per visitYou pay 50 per visitYou pay 5 per visitPlan pays 100% after deductiblePreventative Care Services(as required by the AffordableCare Act)Plan pays 100%; deductibledoes not applyPlan pays 100%Plan pays 100%; deductibledoes not applyPlan pays 100%Plan pays 100%Plan pays 100%Plan pays 100%Diagnostic X-ray & LabPlan pays 100%; deductibledoes not applyPlan pays 100%Plan pays 100% afterdeductiblePlan pays 100%Plan pays 100%Plan pays 100%Plan pays 100% after deductibleCAT Scans & MRI’sYou pay 100 per test afterdeductiblePlan pays 100%You pay 20% up to a maximumof 100 per test after deductiblePlan pays 100%You pay 100 per testPlan pays 100%Plan pays 100% after deductibleDurable Medical EquipmentPlan pays 80% afterdeductiblePlan pays 100%Plan pays 80%; deductible doesnot applyPlan pays 100%Plan pays 100%Plan pays 100%Plan pays 100% after deductibleHome Health CareYou pay 30 per visit, up to100 visits per calendar year;deductible does not applyPlan pays 100%Plan pays 100%, up to 100visits per calendar year;deductible does not applyPlan pays 100%You pay 30/visit starting the31st day, up to 100 visits/calendar year; requires priorauthorizationPlan pays 100%Plan pays 100%Physical Therapy orSpeech TherapyYou pay 30 per visit;deductible does not applyYou pay 5 per visitYou pay 30 per visit afterdeductibleYou pay 10 per visitYou pay 50 per visitPlan pays 100%Plan pays 100% after deductible

You pay 5 per visit,maximum of 12 visits percalendar yearChiropractic CareNot CoveredHearing AidsPlan pays 80%; maximumbenefit of 5,000 every 3years; deductible does notapply 500 allowance every 3yearsPlan pays 80% afterdeductiblePlan pays 100%, maximumof 190 days per lifetimeNot CoveredNot CoveredNot CoveredYou pay 5 per visit,maximum of 20 visits percalendar yearPlan pays 100% after deductible(Medicare-covered services)Maximum benefit of 50 for routinehearing exams every 2 years;maximum benefit of 3,000 for bothhearing aid(s) (all types) up to 2 every 3years; deductible does not applyNot CoveredNot CoveredNot CoveredNot CoveredPlan pays 80% after deductiblePlan pays 100%Plan pays 80%Plan pays 100%Plan pays 100%; maximum of 190 daysper lifetimeYou pay 15 per group session( 5 for substance abuse groupsession), or 30 per individualsession; deductible does notapplyYou pay 5 per group visitor 10 per individual visitYou pay 15 per groupsession, or 30 per individualsessionYou pay 5 per visitPlan pays 100% after deductibleMental Health andSubstance Abuse CareInpatientOutpatientYou pay 40 per visit;deductible does not applyMustPrescription DrugsIncluded in Medical Out-of-pocketlimitShort-term(outpatient)You pay 5 per visitobtainedataparticipatingHMOpharmacyYou pay 7 per generic and 14 per brand nameprescription, up to a 30-daysupplyNot subject to deductibleYou pay 15 per generic and 35 per brand nameprescription, up to a 30-daysupplyYou pay 10 perprescription, up to a 100day supplyYou pay 20 per generic, 40per brand name, and 60 pernon-preferred prescription, upto a 30-day supplyMail order- You pay 2 copays per prescription, up toa 90-day supplyMail order- You pay 2 co-paysper prescription, up to a100-day supplyMail order- You pay 10per prescription, up to a100-day supplyMail order- You pay 40 pergeneric, 100 per brand name,and 150 per non-preferredprescription, up to a 90-daysupplyVision CareYou pay 30 for exam, lenses& frames not covered;deductible does not applyYou pay 5 for exam, limitof 1 exam every 12 months; 130 frame allowanceevery 24 monthsNo charge for routine exam,lenses & frames not covered;deductible does not applyYou pay 10 for exam; 150 frame allowanceevery 24 monthsYou pay 30 for exam; lenses& frames not coveredYou pay 5 for exam, limitof 1 exam every 12 months; 100 frame allowanceevery 24 monthsPlan pays 100% after deductible(Medicare-covered services)Dental CareNot CoveredNot CoveredNot CoveredNot CoveredNot CoveredRefer to Dental BrochurePlan pays 100% after deductible(Medicare-covered services)AmbulanceYou pay 100 per transport;deductible does not applyPlan pays 100%Plan pays 100% afterdeductiblePlan pays 100%You pay 100 per transportPlan pays 100%Plan pays 100% after deductibleYou pay 250 co-pay afterdeductible (co-paymentwaived if admitted to hospital)You pay 50(co-payment waived ifadmitted to hospital)You pay 125 co-pay afterdeductible (co-payment waivedif admitted to hospital)You pay 20(co-payment waived ifadmitted to hospital)You pay 250 co-pay afterdeductible (co-paymentwaived if admitted to hospital)You pay 20(co-payment waived ifadmitted to hospital)Plan pays 100%Maintenance(30-day supply or more)Emergency Room CareNot subject to deductibleYou pay 20 per generic, 40per brand name, and 60 pernon-preferred prescription, upto a 30-day supplybeMail order- You pay 50 pergeneric, 100 per brandname, and 150 per nonpreferred prescription, up to a90-day supplyYou pay 5 per generic, 15 per brand name, and 35 per non-formularyprescription, up to a 30-daysupplyMail order- You pay 2 copays per prescription, up toa 90-day supplyNot subject to deductible; Notincluded in Medical Out-of-pocketlimitYou pay 5 per generic, 20 perpreferred brand name, 50 per nonpreferred prescription, and 80 perSpecialty Tier, up to a 30-day supplyMail order- You pay 0 per generic, 40 per preferred brand name, 100per non-preferred prescription, up to a90-day supplyTHIS IS ONLY A SUMMARY: The above Plan benefits show only a partial summary of benefits. Please refer to the applicable Evidence of Coverage (EOC) booklet or Summary Plan Description booklet for prior-authorizationrequirements and specific restrictions, exclusions, and limitations.R- CA 11/21

HMO PlansThe(Health Maintenance Organizations) provide quality care under a managed care environment, within a defined service area. Whenyou enroll in an HMO plan, you must use their medical providers and hospitals for all of yourmedical care and prescription medication needs. No benefits are provided if you, or youreligible dependents, use non-HMO providers or providers of a different HMO, except forcertain medical emergencies.There are no claim forms to fill out, and the Fund pays the HMO directly for your health careneeds. Most routine health care services are provided to you for specified co-payment amountsat the time of service, but deductibles and co-insurances apply to others if you are not eligiblefor Medicare.Each HMO’s service area is defined in their enrollment packet. To enroll in an HMO, youmust reside in and have all medical services performed within their defined service area. If youenroll in an HMO and frequently travel, there may be no benefits available while you areoutside of your selected plan’s service area.Medicare Advantage PlanTheparticipant authorizes Medicare to paytheir benefits directly to the insurance company and the insurance company decides howbenefits are covered under each plan for Medicare Part A and B benefits. Generally, coverageunder a Medicare Advantage plan is more generous than the coverage provided throughOriginal Medicare. Most Medicare Advantage plans also include Medicare-approvedprescription drug coverage.For specific benefits available, please call the appropriate Member Service numbersindicated below.Member Service Phone NumbersKaiser PermanenteSenior AdvantageUnited HealthcareMedicare Advantage HMOHealth NetSeniority PlusHumana Medicare Advantage 6800-522-0088800-275-4737800-733-9064

Your Monthly Self-Pay ContributionsPlease refer to the “Retiree Self-Pay Rates for Calendar Year 2022" for your appropriatemonthly self-pay contribution. These rates are current as of the printing of this material, andare subject to change. All rates are currently based on the retiree’s years of Pension Credit, andwhether the retiree and/or his eligible dependents are eligible for Medicare.Self-pay contributions will be deducted from your monthly pension benefit check. If yourpension benefit is not large enough for the self-pay deduction, however, you will be required toremit monthly payments to the Administrative Office, in order to continue coverage under theRetiree Health Plan. All payments for coverage are due in the Administrative Office no laterthan the 20th of the month prior to the month of coverage. Failure to remit a timely paymentwill result in a termination of coverage.These rates apply only to retirees and surviving spouses who have elected and continuouslymaintained coverage under the Sheet Metal Workers’ Retiree Health Plan. These rates do notapply to retirees or surviving spouses who have initially declined or previously terminatedtheir coverage. For current “Reinstate Rates”, please contact the Administrative Office.Eligible for Medicare?If you (or an eligible dependent) are eligible for Medicare, you (or the dependent) must enrollin Medicare Parts A and B. In addition, you (or the dependent) must enroll in your HMO’sMedicare plan - Kaiser’s Senior Advantage, United Healthcare’s Medicare Advantage HMO,Health Net’s Seniority Plus, or Humana’s Medicare Advantage PPO, and assign your (or thedependent’s) Medicare benefits to your HMO or PPO. Failure to comply may result in atermination of your coverage under the Retiree Health Plan! If your HMO Plan does notcontract with Medicare in your area, it may be necessary for you to change plans upon your (orthe dependent’s) Medicare eligibility date. If there is no contracted Plan in your area, yourcoverage may be terminated

Moving?Please contact the Eligibility Department at the AdministrativeOffice immediately if you change your mailing address! If youare enrolled in an HMO, a change of residence could result in alapse of coverage!Please review and retain this Summary.The informationcontained within includes the current plans available, as well as the currentbenefits effective January 1, 2022. All benefits and self-pay contributions aresubject to change.Sheet Metal Workers’ Health Plan ofSouthern California, Arizona & NevadaP.O. Box 10067Manhattan Beach, CA 90266phone 800-947-4338 or 310-798-6572fax 310-798-0766smbpac.orgR- CA11/21

“Seniority Plus” . you must use their medical providers and hospitals for all of your medical care and prescription medication needs. . Health Net 800-522-0088 Seniority Plus 800-275-4737 Humana Medicare Advanta