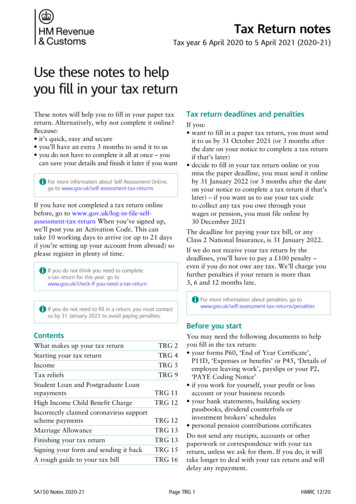

Transcription

FPSB Retirement and Tax PlanningSpecialist Guide

FPSB Retirement and Tax Planning Specialist Guide (valid through 31 March 2021)Copyright 2020, Financial Planning Standards Board Ltd. All rights reserved.Page 2 33

FPSB Retirement and Tax Planning Specialist Guide (valid through 31 March 2021)ContentsContents3About FPSB Ltd. and FPSB Programs in India4FPSB 5Retirement and Tax Planning Specialist OverviewStep 1: Education5Period for Course Completion6Education71. Self-Paced Education72. Instructor-Led Education83. Recognition of Prior Learning8Step 2. Exam9Step 3. Ethics12Ethics Attestation12Step 4. Initial and Ongoing Certification13Ongoing Certification Requirements13FPSB Coursework as Continuing Professional Development14Using your Badge and Certification Name Correctly14Appendix A. FPSB Retirement and Tax Planning Specialist Competency Profile15Module: Retirement Planning15Global Retirement Planning15India-Specific Retirement Planning16Module: Tax Planning and Optimization19Global Principles of Taxation19India-Specific Principles of Taxation20Appendix B. FPSB Certification Code of Ethics (for all FPSB certifications)28Appendix C. Pricing30Appendix D. Frequently Asked Questions31Copyright 2020, Financial Planning Standards Board Ltd. All rights reserved.Page 3 33

FPSB Retirement and Tax Planning Specialist Guide (valid through 31 March 2021)About FPSB Ltd. and FPSB Programs in IndiaFinancial Planning Standards Board Ltd. (FPSB) is the global standards setting body forfinancial planning and owner of the CFPCM, CERTIFIED FINANCIAL PLANNERCM andmarks outside the United States. FPSB is proud to offer FPSB’s Retirement and Tax PlanningSpecialist program, one of three pathway courses to CFP certification in India: FPSB Investment Planning SpecialistFPSB Risk and Estate Planning SpecialistFPSB Retirement and Tax Planning SpecialistEach certification carries its own stand-alone coursework, exam and credential. Importantly thecoursework required for FPSB’s pathway certifications also fulfills part of the required educationfor CFPCM certification in India.Interested professionals can begin their journey toward CFP certificating by registering withFPSB to begin the coursework for any of the three pathway certifications (in any order). Thisguide will focus on the FPSB Retirement and Tax Planning Specialist certification.For more information about FPSB and its certification programs in India, pleasevisit www.india.fpsb.org.Copyright 2020, Financial Planning Standards Board Ltd. All rights reserved.Page 4 33

FPSB Retirement and Tax Planning Specialist Guide (valid through 31 March 2021)FPSB Retirement and Tax Planning Specialist OverviewTake Your Career to the Next LevelTaken either online or with an instructor, the FPSB Retirement and Tax Planning Specialistcourse prepares you to develop strategies to help clients optimize their wealth accumulation andcash flow leading up to and during retirement, and to advise on the role of tax planning insupporting client goals.The course teaches you to consider your clients’ personal financial goals, risk tolerance and riskcapacity, asset locations, the structure and impact of public and private retirement plans, andhow taxation will affect your clients’ financial situation and goals. To be recognized byemployers, clients and the public for your superior skills and knowledge in retirement and taxplanning, complete the roadmap below to obtain FPSB Retirement and Tax Planning Specialistcertification in India.Steps to Initial CertificationThe requirements for FPSB Retirement and Tax Planning Specialist certification are as follows:1. Successfully complete FPSB’s education modules for:o Tax Planningo Retirement Planning2. Pass the FPSB Retirement and Tax Planning Specialist exam, which aligns to the topicsidentified in the FPSB Retirement and Tax Planning Specialist Competency Profile(Appendix A):3. Successfully complete the FPSB Ltd. Ethics Course4. Complete your certification application, which includes your agreement to comply withFPSB Ltd.’s Code of Ethics and payment of an annual certification feeStep 1: EducationFPSB Retirement and Tax Planning Specialist1) Education2) Exam3) Ethics4) CertificationApplication3 Education Modes-Self-Paced Learning-Instructor-ledLearning-Recognition of PriorLearningTopics-Tax Planning-RetirementPlanningFPSB Online EthicsCourseApplication forcertification2 hours75 multiple choicequestionsCopyright 2020, Financial Planning Standards Board Ltd. All rights reserved.Agreement to abideby FPSB Code ofEthicsPage 5 33

FPSB Retirement and Tax Planning Specialist Guide (valid through 31 March 2021)Criteria to RegisterCandidates who are at least age18 and have completed HSC/12th pass (Std XII/HSC) mayregister with FPSB and begin the FPSB Retirement and Tax Planning Specialist educationcourse.Period for Course CompletionIndividuals must complete the FPSB Retirement and Tax Planning Specialist certificationprogram within three years of first registering with FPSB Ltd. and must renew their registrationon an annual basis. After three years in the system, FPSB Ltd. will consider the studentregistration invalid. Students should consider the feasibility of completing the program in thistimeline before registering.ModuleName and DescriptionThrough this module students will learn about key retirement principles and how toidentify their client’s retirement objectives and needs. Students will be prepared toRetirement develop strategies and use techniques for wealth accumulation and withdrawal duringPlanning retirement years; taking into consideration asset locations and the client’s personalfinancial goals, risk tolerance, risk capacity, and structure and impact of public andprivate retirement plans on the client’s financial plan.In this module, students will learn about taxes and the various tax strategies they canTax Planning apply with their clients. This course covers tax planning and optimization at the globaland local level.FPSB Ltd. Educational ResourcesFPSB Ltd. will provide program participants with digital textbooks, supplemental post-chapterpractice quizzes, post-module exams and supplemental course materials through its onlinelearning portal, MyFPSBlearning. All FPSB Ltd. education materials are aligned to the FPSBRetirement and Tax Planning Specialist learning objectives described in Appendix A. Allstudents, regardless of education mode, are required to purchase these materials.Global Modules/ChaptersRetirement PlanningTax Planning1.1 International Taxation2.1 International Taxation1.2 Time Value of Money2.2 Cross-Border and Source Rules1.3 Cash Flow Demands and Conflicts2.3 Tax Strategies1.4 Budget and Emergency Funds2.4 Accounting Standards and Research1.5 Retirement Cash Flow, Withdrawal Projectionsand StrategiesCopyright 2020, Financial Planning Standards Board Ltd. All rights reserved.Page 6 33

FPSB Retirement and Tax Planning Specialist Guide (valid through 31 March 2021)cRetirement PlanningTax Planning1.1 The Characteristic India Demography, Familyand the Retirement Preparedness1.1 India Tax Structure: Direct and IndirectTaxes1.2 Pension Reforms in India1.2 Income-tax Act, 1961: Concepts andTerminology1.3 Retirement Products in India1.3 Rules of Residency1.4 Employee Benefits on Superannuation1.4 What Constitutes Income From ‘Salary’?1.5 Various Allowances and Their ExemptionLimits1.6 Taxable Perquisites1.7 Income from House Property1.8 Income from Capital Gains1.9: Income from Other Sources1.10 Income Exempt from Tax1.11: Exemptions Available on Transfer ofLong-term Capital Assets1.12 Permissible Deductions from Gross TotalIncome1.13: Profits and Gains of Business orProfession1.14 Tax Treatment of Various Investmentsand Relative Advantage1.15 Various Other Provisions Available underTax Laws1.16 Computation of Taxable Income and Taxand Filing of ReturnsEducationCandidates may complete the FPSB Retirement and Tax Planning Specialist educationrequirement and become eligible to sit for the certification exam in one of three ways:1. Self-Paced EducationStudents who register with FPSB and select “Self-Paced Learning” will receive a password forFPSB’s online learning portal, MyFPSBlearning, where they can read and interact with FPSB’svarious learning materials at their own speed and test their knowledge with quizzes and moduletests to validate their learning experience. The self-paced education path may be mostCopyright 2020, Financial Planning Standards Board Ltd. All rights reserved.Page 7 33

FPSB Retirement and Tax Planning Specialist Guide (valid through 31 March 2021)appealing to experienced investment professionals or self-starters who enjoy studying on theirown schedule.*Self-paced learners who do not pass all FPSB Retirement and Tax Planning Specialist moduleexams after the two attempts will be asked to pursue the instructor-led path by enrolling with anAuthorized Education Provider (AEP).2. Instructor-Led EducationCandidates who want an immersive educational experience with hands-on learning and accessto an FPSB Authorized Education Provider should register for “Instructor-Led Learning” whensigning up with FPSB. FPSB Authorized Education Providers offer both classroom and onlineeducation experiences. When registering with FPSB, individuals who sign up for instructor-lededucation will be asked to select from amongst FPSB’s authorized providers, which are alsolisted on the FPSB Ltd. website.Candidates who opt for FPSB’s instructor-led education can expect to receive the belowteaching hours per module.FPSB Retirement and Tax PlanningSpecialist ModulesEstimatedTeachingHoursTax Planning25Retirement Planning25Minimum Hours of Education503. Recognition of Prior LearningCandidates who have already completed alternative coursework that covers the FPSBRetirement and Tax Planning Specialist learning objectives may be eligible to have thatcoursework recognized by FPSB as meeting the education requirement of its FPSB Retirementand Tax Planning Specialist Certification without completing the FPSB Retirement and TaxPlanning Specialist course (either self-paced or instructor-led). Candidates wishing to have theirprior learning recognized must submit satisfactory evidence that their prior coursework meetsFPSB’s established learning objectives by holding any of the below qualifications orcertifications. Candidates will be asked to select “Recognition of Prior Learning” whenQualification/Certification Accepted for EducationRecognition1 IRDAI - IC 38 Licentiate Examination NISM Series XVIIRetirement Adviser Certification Examination2Chartered Accountant (CA)3IRDAI - IC 38 Licentiate Examination NISM Series XVIIRetirement Adviser Certification ExaminationProvider InstitutionInsurance Institute of India National Institute ofSecurities Markets (NISM)Institute of CharteredAccountants of IndiaInsurance Institute of India National Institute ofSecurities Markets (NISM)Copyright 2020, Financial Planning Standards Board Ltd. All rights reserved.Page 8 33

FPSB Retirement and Tax Planning Specialist Guide (valid through 31 March 2021)registering with FPSB and upload a copy of their current certificate in the MyFPSBlearningplatform.Step 2. ExamFPSB Retirement and Tax Planning Specialist1) Education2) Exam3) Ethics4) CertificationApplication3 Education Modes-Self-Paced Learning-Instructor-led Learning-Recognition of PriorLearningTopics-Retirement Planning-Tax PlanningFPSB OnlineEthics CourseApplication forcertification2 hours75 multiple choicequestionsAgreement to abideby FPSB Codeof EthicsUpon successful completion of the FPSB Retirement and Tax Planning Specialist educationrequirement, whether through an FPSB instructor-led or self-paced education course or throughrecognition of prior learning, candidates will be able to sit for the FPSB Retirement and TaxPlanning Specialist exam.The exam assesses the level of knowledge, skill and ability needed to earn the FPSBRetirement and Tax Planning Specialist credential, including the functions of collection, analysisand synthesis (detailed further below). Each question on the exam focuses primarily on aspecific element of competency from the FPSB Retirement and Tax Planning SpecialistCompetency Profile (Appendix A), and may require integration across several competencies.Exam Overview 75 multiple-choice questions (4 possible answer choices)Computer-based testing formatDuration - two hoursFinancial calculators permitted (data must be erased)There will be two possible marks: correct, with points allotted; or incorrect, for zeropoints. Students will not have points deducted (referred to as ‘negative marking’)Areas of PracticeThe exam will test the following areas of practice, which are also described to in more detail inthe FPSB Retirement and Tax Planning Specialist Competency Profile (Appendix A).FPSB Retirement and Tax Planning SpecialistAreas of PracticeRetirement PlanningTax PlanningCopyright 2020, Financial Planning Standards Board Ltd. All rights reserved.Page 9 33

FPSB Retirement and Tax Planning Specialist Guide (valid through 31 March 2021) Retirement PrinciplesRetirement ObjectivesRetirement Needs Analysis and ProjectionsPotential Sources of Retirement Cash FlowRetirement Cash Flow, WithdrawalProjections and Strategies International TaxationCross-Border and Source RulesTax StrategiesAccounting Standards and ResearchIndia Specific Modules/ChaptersRetirement Planning The Characteristic India Demography, Familyand the Retirement PreparednessPension Reforms in IndiaRetirement Products in IndiaEmployee Benefits on SuperannuationTax Planning India Tax Structure: Direct and IndirectTaxesIncome-tax Act, 1961: Concepts andTerminologyRules of ResidencyWhat Constitutes Income From‘Salary’?Various Allowances and TheirExemption LimitsTaxable PerquisitesIncome from House PropertyIncome from Capital GainsIncome from Other SourcesIncome Exempt from TaxExemptions Available on Transfer ofLong-term Capital AssetsPermissible Deductions from GrossTotal IncomeProfits and Gains of Business orProfessionTax Treatment of Various Investmentsand Relative AdvantageVarious Other Provisions Availableunder Tax LawsComputation of Taxable Income andTax and Filing of ReturnsThe FPSB Retirement and Tax Planning Specialist exam will test the knowledge, skills andabilities from the FPSB Retirement and Tax Planning Specialist education modules in the belowproportions. However, there will not be specific sections allocated to the modules. Instead,questions relating to each module will appear in no specific order throughout the exam.Copyright 2020, Financial Planning Standards Board Ltd. All rights reserved.Page 10 33

FPSB Retirement and Tax Planning Specialist Guide (valid through 31 March 2021)Exam Breakdown byModule49%1. Tax Planning51%2. Retirement PlanningLikewise, although the FPSB Retirement and Tax Planning Specialist textbooks draw adistinction between “global” and “India-specific” education content, exam questions will not bespecifically identified as such, and will appear in no specific order throughout the exam.100%GlobalGlobal and India-specificExam Breakdown80%60%40%20%0%1. Retirement Planning2. Tax PlanningDifficulty LevelsThe FPSB Retirement and Tax Planning Specialist certification exam is designed to assessknowledge, skills and abilities in the areas of collection, analysis and synthesis in approximatelythe following proportions:EXAM DIFFICULTY yright 2020, Financial Planning Standards Board Ltd. All rights reserved.Page 11 33

FPSB Retirement and Tax Planning Specialist Guide (valid through 31 March 2021)Collection: gatheringinformation and identifyingrelated facts by makingrequired calculations andarranging clientinformation for analysis.During the collectionfunction, the corecompetency is to collectboth the quantitative andqualitative informationrequired to provideretirement advice.Analysis: considersissues, performs financialanalysis and assesses theresulting information to beable to develop strategiesfor the client. Thisincludes: (1) consideringpotential opportunities andconstraints in developingstrategies, and (2)assessing information todevelop strategies.Synthesis: integrates theinformation needed todevelop and evaluatestrategies to create aretirement plan.Step 3. EthicsFPSB Retirement and Tax Planning Specialist1) Education2) Exam3) Ethics4) CertificationApplication3 Education Modes-Self-Paced Learning-Instructor-led Learning-Recognition of PriorLearningTopics-RetirementPlanning-Tax Planning2 hours75 multiple choicequestionsFPSB Online EthicsCourseApplication forcertificationAgreement to abideby FPSB Codeof EthicsFPSB requires all individuals who hold one of its certifications to successfully complete theFPSB Ethics Course, which conducted online in MyFPSBlearning. This course is included withthe purchase of the FPSB Retirement and Tax Planning Specialist course materials. Theinteractive FPSB Ethics Course consists of recorded instruction that can be taken in one ormultiple sittings with knowledge checks throughout. Once completed, the FPSB Ethics Courseis valid for all FPSB Ltd. certifications offered in India.Ethics AttestationAfter candidates have passed the FPSB Ethic Course, they must, as part of the FPSBRetirement and Tax Planning Specialist certification process, attest and agree to abide by theFPSB Code of Ethics.Copyright 2020, Financial Planning Standards Board Ltd. All rights reserved.Page 12 33

FPSB Retirement and Tax Planning Specialist Guide (valid through 31 March 2021)IntroductionCodes of EthicsLearning ObjectivesLearning Objectives Explain why financial services professionals Identify the purposes of codes of ethicsshould study ethics Distinguish between the reasonableperson standard and the professional Describe the difference between values andpractice standardprinciples Identify the eight principles of FPSB’s Describe the relationship between ethicsCode of Ethicsand the law Apply the principles of FPSB’s Code of Describe a financial services professionalEthics to various case studies and Identify characteristics of a professionalexamples Evaluate the public perception of the Construct a personal code of ethicsfinancial services professionKnowledge Items Why financial services professionals shouldstudy ethics The difference between values andprinciples Ethics and the law Characteristics of a financial servicesprofessional Public perception of the financial servicesprofessionKnowledge Items The purpose of a code of ethics Business conduct standards Reasonable person standard Professional practice standard Eight principles of FPSB’s Code of Ethics Personal code of ethicsStep 4. Initial and Ongoing CertificationFPSB Retirement and Tax Planning Specialist1) Education2) Exam3) Ethics4) CertificationApplication3 Education Modes-Self-Paced Learning-Instructor-led Learning-Recognition of PriorLearningTopics-Retirement Planning-Tax PlanningFPSB Online EthicsCourseApplication forcertification2 hour75 multiple choicequestionsAgreement to abideby FPSB Codeof EthicsOngoing Certification RequirementsTo maintain the right to use the FPSB Retirement and Tax Planning Specialist credential,certification holders must maintain their professional skills, knowledge, and abilities throughongoing learning activities.Copyright 2020, Financial Planning Standards Board Ltd. All rights reserved.Page 13 33

FPSB Retirement and Tax Planning Specialist Guide (valid through 31 March 2021)FPSB Ltd. requires FPSB Retirement and Tax Planning Specialists to renew their certificationannually. To remain certified as an FPSB Retirement and Tax Planning Specialist certificationholder, you must: Commit to adhere to FPSB Ltd.’s Code of Ethics and any applicable laws andregulations. Obtain at least five Continuing Professional Development (CPD) hours/points. All pointsmust be completed before applying for renewal of certification. At least two CPDhours/points need to directly relate to FPSB Ltd.’s Code of Ethics.FPSB Coursework as Continuing Professional DevelopmentFPSB Retirement and Tax Planning Specialists who continue on as students with FPSB canmeet their annual CPD requirement through the coursework for FPSB’s other financialcertifications – as proven by registration in the FPSB Risk and Estate Planning Specialist, FPSBInvestment Planning Specialist, or CFPCM certification programs.Using your Badge and Certification Name CorrectlyFPSB will post guidance on how to correctly identify yourself as an FPSB Retirement and TaxPlanning Specialist. All certification holders will be required to abide by the guidance as part ofthe FPSB Code of Ethics.Copyright 2020, Financial Planning Standards Board Ltd. All rights reserved.Page 14 33

FPSB Retirement and Tax Planning Specialist Guide (valid through 31 March 2021)Appendix A. FPSB Retirement and Tax Planning Specialist Competency ProfileModule: Retirement PlanningGlobal Retirement PlanningChapter 1: Retirement PrinciplesLearning Objectives1-1 Explain the value of planning for retirement1-2 Analyze strategies for funding retirementKnowledge Items1.1 Value of early and consistent planning for retirement1.2 Investing for retirement1.2.1 Accumulation strategiesChapter 2: Retirement ObjectivesLearning Objectives2-1 Identify a client’s retirement objectives2-2 Evaluate the implications of a client’s attitudes toward retirement2-3 Evaluate trade-offs needed to meet a client’s retirement objectives2-4 Calculate capital required to fund a client’s retirementKnowledge Items2.1 Retirement goals and objectives2.1.1 Goals and needs2.1.2 Capital required for retirement2.1.3 High net worth clients2.2 Establishing retirement cash flow targets2.2.1 Conflicting goals and trade-offs2.3 Objectives in retirement2.4 Wealth transferChapter 3: Retirement Needs Analysis and ProjectionsLearning Objectives3-1 Identify the types of information to collect regarding a client’s estimated retirement expenses3-2 Analyze financial goals and obligations3-3 Calculate financial projections in retirement based on a client’s current financial position3-4 Calculate amounts required to fund retirement cash flow needs3-5 Analyze the impact of changes in assumptions on financial projectionsKnowledge Items3.1 Longevity risk, inflation and the impact on retirement cash flow needs3.2 Goal classification and funding3.2.1 Fixed and terminable3.2.2 Fixed and permanent3.2.3 Variable and terminable3.2.4 Variable and permanent3.3 Goal developmentCopyright 2020, Financial Planning Standards Board Ltd. All rights reserved.Page 15 33

FPSB Retirement and Tax Planning Specialist Guide (valid through 31 March 2021)3.3.1 Establishing goals and timelines3.3.2 Determining goal priorities3.4 Selecting and administering long-term investment portfolios3.4.1 Risk, return and implications for retirement planningChapter 4: Potential Sources of Retirement Cash FlowLearning Objectives4-1 Identify details to collect of a client’s potential retirement cash flow sources4-2 Analyze retirement benefits provided by the government4-3 Analyze retirement benefits provided by employers4-4 Explain how annuities are used to provide retirement cash flowKnowledge Items4.1 Pension funds4.1.1 Government-sponsored4.1.1.1 Defined benefit plans4.1.2 Employer-sponsored4.1.2.1 Defined contribution plans4.2 Types of non-pension employee retirement benefits4.3 Individual retirement plans4.4 Annuities4.4.1 Types of annuities4.4.2 Settlement and payout optionsChapter 5: Retirement Cash Flow, Withdrawal Projections and StrategiesLearning Objectives5-1 Calculate and analyze financial projections for a client's retirement plan.5-2 Describe whether a client’s retirement objectives are realistic5-3 Describe the impact of changes in assumptions on financial projections5-4 Calculate, analyze, and explain factors impacting retirement account distributions.5-5 Apply retirement distribution strategiesKnowledge Items5.1 Sources of cash flow in retirement5.2 Portfolio distribution strategies5.3 Retirement distribution rates5.4 Sequence risk5.4.1 Portfolio distribution options5.5 Impact of taxes on retirement cash flowIndia-Specific Retirement PlanningChapter 1: The Characteristic India Demography, Family and the RetirementPreparednessLearning Objectives1-1 Understand India demography and potential disruptions in the future1-2 Compare fiscal constraints with social security programs1-3 Explain characteristics of the Indian family unitCopyright 2020, Financial Planning Standards Board Ltd. All rights reserved.Page 16 33

FPSB Retirement and Tax Planning Specialist Guide (valid through 31 March 2021)Topics1.1. A young India with low old age dependency ratio1.2. Improving Life Expectancies, other Potential Disruptions to India Demography1.3. Fiscal Constraints to deal with Large-scale Social Security Programs1.4. A typical Indian Family - Three generations living together is still more common1.5. Other Priority Goals and Obligations delay or disrupt retirement savings1.6. Late Marriages and subsequent goals blur usual Life StagesChapter 2: Pension Reforms in IndiaLearning Objectives2-1 Explain Old Age Social and Income Security (OASIS) Project2-2 Distinguish pension scenario and defined benefit schemesTopics2.1 Old Age Social and Income Security (OASIS) Project2.2 Pension Scenario – State Governments, Autonomous Bodies and Un-organized Sector2.3 Government – Decisive shifting away from Defined Benefit Schemes2.4 Mandatory contributory systemChapter 3: Retirement Products in IndiaLearning Objectives3-1 Understand employee provident funds and their digital transition3-2 Illustrate National Pension System’s (NPS) infrastructure, functioning and advantages3-3 Explain Public Provident Fund (PPF) and other voluntary institutional retirement products3-4 Evaluate annuities and reverse mortgage schemesTopics3.1 Provident Funds3.1.1 Employees’ Provident Fund and Employees’ Pension Scheme3.1.2 Other recognized Provident Fund Types3.1.3 Defined Contribution Plans – Institutional Framework and Investment Architecture3.1.4 Tax Benefits on Subscriptions and Withdrawals3.1.5 Universal Account Number (UAN) and Employer Portability3.2 National Pension Systems (NPS) - PFRDA (Pension Fund) Regulations, 20153.2.1 Signature Scheme of Pension Fund Regulatory and Development Authority (PFRDA)3.2.2 Unique Permanent Retirement Account Number (PRAN) and Portability Features3.2.3 Types of Accounts – Tier-I and Tier-II3.2.4 Tier-I Account (Meant for retirement savings)3.2.4.1 Tax Treatment – Exempt-Exempt-Taxed (EET)3.2.4.2 Withdrawal Limits on Retirement, Taxability and other Rules3.2.4.3 An Exclusive Additional Tax Deduction under Section 80CCD(1B)3.2.4.4 Other Features – Very Low Cost, Regulated and Funds based (AccumulatedUnits)3.2.4.5 Annuity Provisions and Annuity Service Providers (PFRDA empanelled)3.2.5 Tier-II Account (Voluntary savings facility)3.2.6 Investment or Portfolio options in NPS - Active and Auto choices3.2.7 Point of Presence (POP) Service Providers3.2.8 Central Recordkeeping Agency (CRA)Copyright 2020, Financial Planning Standards Board Ltd. All rights reserved.Page 17 33

FPSB Retirement and Tax Planning Specialist Guide (valid through 31 March 2021)3.2.9 Pension (NPS) Fund Managers – Roles and Responsibilities3.2.10 NPS Trust3.2.11 Trustee Bank3.2.12 Retirement Advisers and Aggregators3.2.13 NPS Models3.2.13.1 All Citizen Model3.2.13.2 Government Sector and Corporate Model3.2.13.3 Atal Pension Yojana (APY)3.3 Public Provident Fund (PPF) under the Public Provident Fund Act, 19683.3.1 Structure and Administration3.3.2 Subscription – Minimum/Maximum and Frequency3.3.3 Tenure, Rules of Partial Withdrawal and Loan Facility3.3.4 Taxability – Exempt- Exempt- Exempt (EEE)3.3.5 Maturity Profile of PPF and Roll-over Facility – With or Without Subscription3.3.6 Viability of PPF Scheme – A Credible Aggregator of Retirement Corpus3.4 Pension Plans from Mutual Funds and Insurance Companies3.4.1 Pension plans from Mutual Funds3.4.1.1Tax Benefit and Lock-in Period, Systematic Monthly/Annual Investments inUnits3.4.1.2Lock-in Period and Withdrawal prior to Retirement3.4.1.3Systematic Withdrawal on Retirement akin to Annuity with Benign Taxation3.4.2 Pension plans from insurance companies3.4.2.1Unit Linked Pension Plans3.4.2.2Mortality and Tax Benefits3.4.2.3Lock-in Period and Flexible Plan Tenure3.5 Annuities3.5.1 Provided by Life Insurers (Regulated by Insurance Regulatory and DevelopmentAuthority of India – IRDAI)3.5.2 Minimum Limits for Annuities3.5.3 Immediate and Deferred Annuities3.5.4 Types – Period Certain, Life Certain and Life with Period Certain, With or WithoutReturn of Purchase price3.6 Government sponsored regular income schemes3.6.1 Senior Citizens Savings Scheme (SCSS)3.6.2 Post Office Monthly Income Scheme (POMIS)3.7 Reverse Mortgage3.7.1 Rules of Reverse Mortgage in India and Regulator National Housing Bank (NHB)3.7.2 Lump sum payment, Credit Line and Fixed Annuity3.7.3 Reverse Mortgage Loan Enabled Annuity (RMLeA)Chapter 4: Employee Benefits on SuperannuationLearning Objectives4-1 Understand Payment of Gratuity Act, 19724-2 Discuss other superannuation benefits and some government schemesTopics4.1 Payment of Gratuity Act, 19724.1.1 Applicability of the Act4.1.2 Payment on Superannuation, Disability and Resignation from Employment4.1.3 Special Provisions and Calculation of Gratuity payable on DeathCopyright 2020, Financial Planning Standards Board Ltd. All rights reserved.Page 18 33

FPSB Retirement and Tax Planning Specialist Guide (valid through 31 March 2021)4.1.4 Determination of the Amount of Gratuity – Formula and Other Rules4.1.5 Notice for Payment, Period mandated, Recovery and Penalties4.1.6 Tax-exempt Amount of Gratuity for Employees covered under the A

Financial Planning Standards Board Ltd. (FPSB) is the global standards setting body for financial planning and owner of the CFP CM, CERTIFIED FINANCIAL PLANNER CM and marks outside the United States. FPSB is proud to offer FPSB’s Retirement and Tax Planning Specialist program, one of th