Transcription

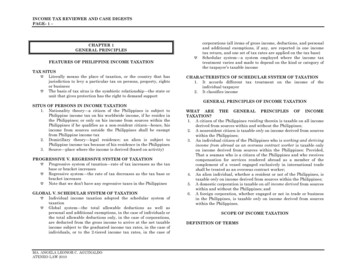

Mamalateo Reviewer (Taxation 1)INCOME TAX1. INCOME TAX Tax on all yearly profits arising from property, professions, trades or offices, or as a tax on aperson’s income, emoluments, profits and the like (Fisher v. Trinidad).Income tax is a direct tax on actual or presumed income (gross or net) of a taxpayer received,accrued or realized during the taxable year.2. WITHHOLDING TAX It is not an internal revenue tax but a mode of collecting income tax in advance on income of therecipient of income thru the payor of income. [NOTE: Sec. 21, NIRC enumerates variousinternal revenue taxes.]There are 2 types of withholding taxes, namely: (1) final withholding tax; and (2) creditablewithholding tax.3. FINAL WITHHOLDING INCOME TAX FWT withheld by the payor of income (e.g., 20% FWT on interest income on bank deposits)represents FULL payment of income tax due on such income of the recipient.Income payee (or recipient of income) does not report income subjected to FWT in his incometax return, although income is reflected in his audited financial statements for the year.However, he is not allowed to claim any tax credit on income subjected to FWT.Withholding agent files the withholding tax return, which includes the FWT deducted from theincome payee, and pays the tax to the BIR. There is no Certificate of Tax Withheld issued toincome payee.No Certificate of Tax Withheld (BIR Form 2307) is attached to the income tax return of recipientof income because he does not claim any tax credit in his tax return.INCOME TAX SYSTEMS1. GLOBAL TAX SYSTEM Compensation income not subject to FWTBusiness and/or professional incomeCapital gains not subject to FWTPassive investment income not subject to FWTOther income not subject to FWT2. SCHEDULAR TAX SYSTEM Compensation income subject to FWT (salary of OBU expat)Capital gains subject to FWT (real property in the Phil and shares of domestic corporation)Passive investment income subject to FWT (interest on bank deposit)Other income subject to FWT (auto won on X’mas raffle)3. The Philippines adopted the semi-global or semi-schedular tax system. Either the global or schedularsystem, or both systems may apply to a taxpayer.1

Mamalateo Reviewer (Taxation 1)2FORMULAGLOBAL SYSTEMGross sales/revenueLess: Cost of sales/serviceGross incomeLess: DeductionsPAE (for individual)Net taxable incomeMultiplied by applicable rate (graduated or flat)Income tax dueLess: Creditable WTBalanceSCHEDULAR SYSTEMGross selling price or fair market value, whicheveris higher times applicable tax rate Tax due(real property)Gross selling price less cost or adjusted basis Capital gain times applicable tax rate Tax due(shares of dom corp)Gross income times applicable rate Tax due(passive inv income)NATURE OF ASSET1. ORDINARY ASSET Inventory if on hand at end of taxable yearStock in trade held primarily for sale or for lease in the course of trade or businessAsset used in trade or business, subject to depreciationReal property used in trade or business2. CAPITAL ASSET All other assets, whether or not used in trade or business, other than the above assetsKINDS OF TAXPAYERS1. INDIVIDUALa. CITIZEN Resident – Taxable on worldwide incomeNon-resident – Taxable on income from sources within the Phil– Immigrant or permanent worker – NRC from date of departure from the Phil– OFW (seamen) – NRC if his aggregate stay outside the Phil is more than 183 daysb. ALIEN – Taxable on income from sources within the Phil ResidentNon-resident– Engaged in trade or business (more than 180 days in the Phil)– Not engaged in trade or business (180 days or less stay in Phil)2. CORPORATIONa. DOMESTIC – Taxable on worldwide income

Mamalateo Reviewer (Taxation 1)b. FOREIGN – Taxable on income from sources within the Phil Resident (e.g., Phil branch of foreign corporation) Non-residentc. TEST FOR TAX PURPOSES: Law of incorporationPARTNERSHIPSTAXABLE Partnerships, no matter how created or organized, including joint ventures or consortiumsEXEMPTGeneral professional partnership (GPP), but partners are taxed on their share of partnership profitsactually or constructively paid during the yearJoint venture or consortium undertaking construction activity or energy-related activities withoperating contract with the governmentRESIDENT FOREIGN CORPS1. TAXABLE Ordinary branch of a foreign corporation in the Phil (30% of net taxable income from sourceswithin the Phil)PEZA- & SBMA-registered branch are exempt from branch profit remittance taxRegional operating headquarters (ROHQ) – 10% of net taxable income from sources within thePhilOffshore banking unit (OBU) and foreign currency deposit unit (FCDU) [ING Bank Manila v.CIR] – 10% on gross interest income on foreign currency loansInternational carriers by air or water – 2.5% of Gross Phil BillingsForeign contractor or sub-contractor engaged in petroleum operations in the Phil – 8% of grossincome2. EXEMPT Representative officeRegional headquarters (RHQ)SOURCES OF INCOME1. Interest – Interest from sources within Phil and interest on bonds and obligations of residents,corporate or otherwise2. Dividend – From domestic corporation and from foreign corporation, unless less than 50% of grossincome of foreign corporation for 3 years prior to declaration of dividends was derived from sourceswithin the Phil; hence, apply only ratio of Phil-source income to gross income from all sources3

Mamalateo Reviewer (Taxation 1)43. Services – Place where services are performed, except in case of international air carrier and shippinglines which are taxed at 2.5% on their Gross Phil Billings. Revenues from trips originating from the Philare considered as income from sources within the Philippines, while revenues from inbound trips aretreated as income from sources outside the Philippines.4. Rentals and royalties – Location or use of property or property right in Phil5. Sale of real property – Located in the Philippines6. Sale of personal property – Located in the Philippines7. Gain from sale of shares of stocks of a domestic corporation is ALWAYS treated as incomefrom sources within the Philippines.8. Other intangible property – Mobilia sequuntur personam – it follows domicile of ownerGROSS INCOMESALE OF GOODSGross SalesLess: Cost of Sales:Beg. Inventory PurchasesTotal available for sale- Ending inventoryCost of SalesGross incomeTimes 2%MCITSALE OF SERVICESGross RevenueLess: Cost of Serviceconsisting of all directcosts and expensesGross incomeTimes 2%MCITNOTE: MCIT is imposed beginning on the 4th taxableyear immediately following the year in which the corpcommenced bus operations (Sec 27(E)(1), NIRC)NOTE: MCIT is now computed on quarterly basis. If Pay MCIT after 4 years immediately following the yearquarterly MCIT than RCIT, excess MCIT of prior bank commenced bus operations (Manila Bank v CIR,year is not allowed.GR 168118, Aug 28, 2006)INCOME INCOME means cash or its equivalent coming to a person within a specified period, whether aspayment for services, interest or profit from investment. It covers gain derived from capital, from labor,or from both combined, including gain from sale or conversion of capital assets.– FBT is a tax on fringe benefits received by employees, although the tax is assumed by theemployer-payor of income.Return of capital is exempt from income tax (e.g., tax-free exchange of property).To be taxable, there must be income, gain or profit; gain is received, accrued or realized during the year;and it is not exempt from income tax under the Constitution, treaty or law.– Mere increase in the value of property does not constitute taxable income. It is not yet realizedduring the year.– Transfer of appreciated property to the employee for services rendered is taxable income.

Mamalateo Reviewer (Taxation 1)TEST IN DETERMINING INCOME1. Realization test–There must be separation from capital of something of exchangeable value (e.g., sale of asset)2. Claim of right doctrine–CIR v. Javier, 199 SCRA 8243. Economic benefit test––Stock option given to the employeePayment of real property that has appreciated in value by employer to its employee4. Income from whatever source–All income not expressly exempted from income, irrespective of voluntary or involuntary actionof taxpayer in producing incomeNATURE OF INCOME1. COMPENSATION INCOME Existence of employer-employee relationship2. BUSINESS AND/OR PROFESSIONAL INCOME NO employer-employee relationship3. CAPITAL GAIN Real property in the Phil and shares of stock of domestic corporationOther sources of capital gain4. PASSIVE INVESTMENT INCOME Interest, dividend, and royalty incomeBIR cannot compute compounded interest on delay in payment of promissory notes in theabsence of stipulation in contract (CIR v. Isabela Cultural Corp, GR 172231, Feb 12, 2007).5. OTHER INCOME Prizes and winningsAll other income, gain or profit not covered by the above classesGROSS PHIL BILLINGSA. GPB applies on revenue from transport of passengers, cargoes or mail originating from the Philippines INTERNATIONAL AIR CARRIER5

Mamalateo Reviewer (Taxation 1) From Phil to foreign destination–Continuous and uninterrupted flight–Transhipment of passenger in another country on another foreign airline: GPBtax applies only on aliquot portion of revenue on Philippine leg (Phil to foreigncountry)From foreign country to the Phil– This is treated as income from foreign sources; hence, exempt from Phil incometaxINTERNATIONAL SHIPPING LINE From Phil to final foreign destination is taxable From foreign country to Phil is exemptB. ORDINARY INCOME Demurrage fees (for late return of containers) are akin to rental income subject to ordinarycorporate income tax rate based on net taxable income from sources within the PhilippinesINTEREST INCOMETYPES OF INTEREST INCOME1. Subject to FWT: Interest income on bank deposits, deposit substitutes, trust and other similararrangements 20% FWT – peso deposit7.5% FWT – foreign currency deposit2. NOT subject to FWT but subject to regular tax rates (5%-32%, if individual; 30%, if corporation):All other interest income or financing income3. Exempt income: Long-term deposit or investment by individuals4. Taxable income:Preferential tax rate – Pre-termination of long-term deposit by individual (20%: 1- less than3 yrs; 12%: 3 yrs-less than 4 yrs; 5%: 4 yrs-less than 5 yrs); and interest on foreign loan Regular tax rate (30%) – All other cases5. DIVIDEND INCOME REQUISITES FOR DIVIDEND DECLARATION–––Presence of retained earningsNo prohibition to declare dividend in loan agreementDeclaration of dividend by Board of Directors6

Mamalateo Reviewer (Taxation 1) 7TYPES OF DIVIDENDSa. Taxable Cash dividend Property dividendb. Exempt Stock dividend (except when there is change in proportionate interest amongstockholders and there is subsequent cancellation or redemption of sharesdeclared as stock dividend) Liquidating dividend – distribution of assets to stockholdersTaxable on the part of stockholder under the global tax system Inter-corporate dividend: Exempt from tax–– Corporation paying dividend: Domestic corporationRecipient of dividend: Another domestic corporation or resident foreign corporationDividend paid to non-resident foreign corporation–––Corporation paying dividend: Domestic corporationRecipient of dividend Foreign head office makes direct investment in Phil company: 15% FWT Phil branch of foreign corporation makes investment in Phil company:Exempt from income taxTax-sparing provision If foreign country does not impose income tax on dividend paid by foreigncorporationOTHER INCOMEIncome from any source whatever The words “income from any source whatever” discloses a legislative policy to include all income notexpressly exempted from the class of taxable income under our laws (Madrigal vs. Rafferty, supra;Commissioner vs. BOAC). The words “income from any source whatever” is broad enough to covergains contemplated here. These words disclose a legislative policy to include all income notexpressly exempted within the class of taxable income under our laws, irrespective of the voluntaryor involuntary action of the taxpayer in producing the gains (Gutierrez vs. Collector, CTA Case 65,Aug. 31, 1955).Any economic benefit to the employee whatever may have been the mode by which it is effected istaxable. Thus, in stock options, the difference between the fair market value of the shares at thetime the option is exercised and the option price constitutes additional compensation income to theemployee (Commissioner vs. Smith, 324 U.S. 177).EXCLUSIONS1. Life insurance proceeds

Mamalateo Reviewer (Taxation 1)2. Amount received by insured as return of premium3. Gifts, bequests and devises4. Compensation for injuries or sickness5. Income exempt under treaty6. Retirement benefits, pensions, gratuities R.A. 7641 (5 yrs & 60 yrs) and R.A. 4917 (10 yrs & 50 yrs)– Interest income of employee trust fund or accredited retirement plan is exempt fromFWT (CIR v. GCL Retirement Plan, 207 SCRA 487)Amount received as a consequence of separation because of death, sickness (that will endangerlife of employee) or other physical disability or for any cause beyond the control of employee7. Miscellaneous items Income of foreign governmentIncome of government or its political subdivisions from any public utility or exercise ofgovernmental functionEXEMPT ASSOCIATIONS The phrase “any of their activities conducted for profit” does not qualify the word“properties.”-- The phrase “any of their activities conducted for profit” does not qualify the word“properties.” This makes income from the property of the organization taxable, regardless of how thatincome is used – whether for profit or for lofty non-profit purposes. Thus, the income derived fromrentals of real property owned by the Young Men’s Christian Association of the Philippines, Inc.(YMCA), established as a welfare, education and charitable non-profit corporation, is subject toincome tax. The rental income cannot be exempted

Mamalateo Reviewer (Taxation 1) 1 INCOME TAX 1. INCOME TAX Tax on all yearly profits arising from property, professions, trades or offices, or as a tax on a person’s income, emoluments, profits and the like (Fisher v. Trinidad). Income tax is a direct tax on actual or