Transcription

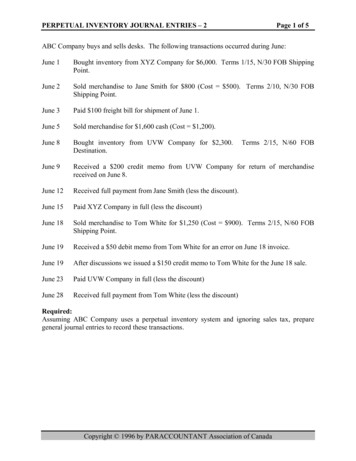

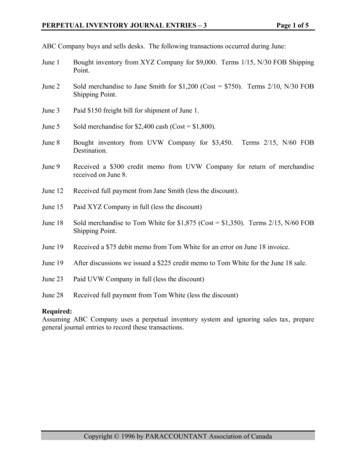

PERPETUAL INVENTORY JOURNAL ENTRIES – 3Page 1 of 5ABC Company buys and sells desks. The following transactions occurred during June:June 1Bought inventory from XYZ Company for 9,000. Terms 1/15, N/30 FOB ShippingPoint.June 2Sold merchandise to Jane Smith for 1,200 (Cost 750). Terms 2/10, N/30 FOBShipping Point.June 3Paid 150 freight bill for shipment of June 1.June 5Sold merchandise for 2,400 cash (Cost 1,800).June 8Bought inventory from UVW Company for 3,450.Destination.June 9Received a 300 credit memo from UVW Company for return of merchandisereceived on June 8.June 12Received full payment from Jane Smith (less the discount).June 15Paid XYZ Company in full (less the discount)June 18Sold merchandise to Tom White for 1,875 (Cost 1,350). Terms 2/15, N/60 FOBShipping Point.June 19Received a 75 debit memo from Tom White for an error on June 18 invoice.June 19After discussions we issued a 225 credit memo to Tom White for the June 18 sale.June 23Paid UVW Company in full (less the discount)June 28Received full payment from Tom White (less the discount)Terms 2/15, N/60 FOBRequired:Assuming ABC Company uses a perpetual inventory system and ignoring sales tax, preparegeneral journal entries to record these transactions.Copyright 1996 by PARACCOUNTANT Association of Canada

PERPETUAL INVENTORY JOURNAL ENTRIES – 3WorksheetDATEACCOUNTJune 1TYPEPage 2 of 5DEBITExplain:June 2Explain:June 3Explain:June 5Explain:June 8Explain:June 9Explain:June 12Explain:June 15Explain:June 18Explain:Copyright 1996 by PARACCOUNTANT Association of CanadaCREDIT

PERPETUAL INVENTORY JOURNAL ENTRIES – 3DATEJune 19ACCOUNTTYPEPage 3 of 5DEBITExplain:June 19Explain:June 23Explain:June 28Explain:Copyright 1996 by PARACCOUNTANT Association of CanadaCREDIT

PERPETUAL INVENTORY JOURNAL ENTRIES – 3AnswerDATEJune 1June 2June 3June 5June 8June 9June 12June 15June 18Page 4 of 5ACCOUNTInventoryA/P – XYZ CompanyBought Inventory on accountTYPEAssetLiabilityDEBIT9,000A/R – Jane SmithSalesCost of Goods SoldInventorySold Inventory on Cash in BankAssetPaid freight bill for incoming inventory9,0001,200750750150150Cash in BankSalesCost of Goods SoldInventorySold Inventory for cashAssetRevenueExpenseAssetInventoryA/P – UVW CompanyBought Inventory on accountAssetLiability3,450A/P – UVW CompanyLiabilityInventoryAssetReceived Credit for Returned Inventory3002,4002,4001,8001,8003,450300Cash in BankAsset1,176Sales DiscountsRevenue24A/R – Jane SmithAssetReceived Payment less Discount of 1,200 X 2% 24A/P – XYZ CompanyLiabilityInventoryAssetCash in BankAssetPaid Supplier less Discount of 9,000 X 1% 909,000A/R – Tom WhiteSalesCost of Goods SoldInventorySold Inventory on ,9101,8751,350Copyright 1996 by PARACCOUNTANT Association of Canada1,350

PERPETUAL INVENTORY JOURNAL ENTRIES – 3DATEJune 19June 19June 23June 28Page 5 of 5ACCOUNTTYPEDEBITSalesRevenue75A/R – Tom WhiteAssetError on previous invoice – should have been 1,800Sales ReturnsRevenue225A/R – Tom WhiteAssetReduction in invoice price after discussion with Tom (Allowance)A/P – UVW CompanyLiability3,150InventoryAssetCash in BankAssetPaid Supplier less Return and Discount - (3,450 - 300) X 2% 63CREDIT75225633,087Cash in BankAsset1,543.50Sales DiscountsRevenue31.50A/R – Tom WhiteAsset1,575.00Invoice less Error less Allowance less Discount – (1,875 – 75 – 225) X 2%Copyright 1996 by PARACCOUNTANT Association of Canada

PERPETUAL INVENTORY JOURNAL ENTRIES – 3 Page 1 of 5 ABC Company buys and sells desks. The following transactions occurred during June: June 1 Bought inventory from XYZ Company for 9,000. Terms 1/15, N/30 FOB Shipping Point. June 2 Sold merchandise to Jane Smith for 1,200 (Cost 750). Terms 2/10, N/30 FOB Shipping Point.