Transcription

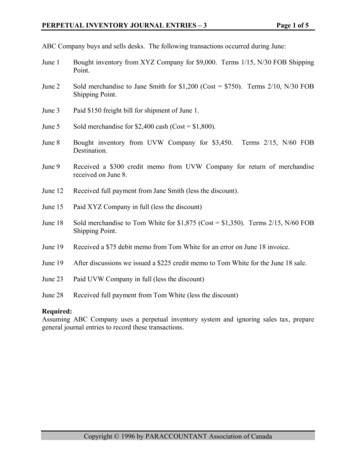

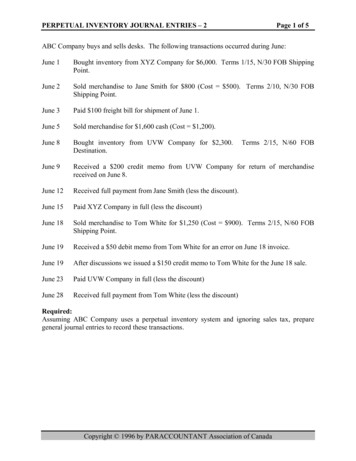

PERPETUAL INVENTORY JOURNAL ENTRIES – 2Page 1 of 5ABC Company buys and sells desks. The following transactions occurred during June:June 1Bought inventory from XYZ Company for 6,000. Terms 1/15, N/30 FOB ShippingPoint.June 2Sold merchandise to Jane Smith for 800 (Cost 500). Terms 2/10, N/30 FOBShipping Point.June 3Paid 100 freight bill for shipment of June 1.June 5Sold merchandise for 1,600 cash (Cost 1,200).June 8Bought inventory from UVW Company for 2,300.Destination.June 9Received a 200 credit memo from UVW Company for return of merchandisereceived on June 8.June 12Received full payment from Jane Smith (less the discount).June 15Paid XYZ Company in full (less the discount)June 18Sold merchandise to Tom White for 1,250 (Cost 900). Terms 2/15, N/60 FOBShipping Point.June 19Received a 50 debit memo from Tom White for an error on June 18 invoice.June 19After discussions we issued a 150 credit memo to Tom White for the June 18 sale.June 23Paid UVW Company in full (less the discount)June 28Received full payment from Tom White (less the discount)Terms 2/15, N/60 FOBRequired:Assuming ABC Company uses a perpetual inventory system and ignoring sales tax, preparegeneral journal entries to record these transactions.Copyright 1996 by PARACCOUNTANT Association of Canada

PERPETUAL INVENTORY JOURNAL ENTRIES – 2WorksheetDATEACCOUNTJune 1TYPEPage 2 of 5DEBITExplain:June 2Explain:June 3Explain:June 5Explain:June 8Explain:June 9Explain:June 12Explain:June 15Explain:June 18Explain:Copyright 1996 by PARACCOUNTANT Association of CanadaCREDIT

PERPETUAL INVENTORY JOURNAL ENTRIES – 2DATEJune 19ACCOUNTTYPEPage 3 of 5DEBITExplain:June 19Explain:June 23Explain:June 28Explain:Copyright 1996 by PARACCOUNTANT Association of CanadaCREDIT

PERPETUAL INVENTORY JOURNAL ENTRIES – 2AnswerDATEJune 1June 2June 3June 5June 8June 9June 12June 15June 18Page 4 of 5ACCOUNTInventoryA/P – XYZ CompanyBought Inventory on accountTYPEAssetLiabilityDEBIT6,000A/R – Jane SmithSalesCost of Goods SoldInventorySold Inventory on sh in BankAssetPaid freight bill for incoming inventory6,000800500500100100Cash in BankSalesCost of Goods SoldInventorySold Inventory for cashAssetRevenueExpenseAssetInventoryA/P – UVW CompanyBought Inventory on accountAssetLiability2,300A/P – UVW CompanyLiabilityInventoryAssetReceived Credit for Returned Inventory200Cash in BankAssetSales DiscountsRevenueA/R – Jane SmithAssetReceived Payment less Discount of 800 X 2% 16784161,6001,6001,2001,2002,300200800A/P – XYZ CompanyLiabilityInventoryAssetCash in BankAssetPaid Supplier less Discount of 6,000 X 1% 606,000A/R – Tom WhiteSalesCost of Goods SoldInventorySold Inventory on ,250900Copyright 1996 by PARACCOUNTANT Association of Canada900

PERPETUAL INVENTORY JOURNAL ENTRIES – 2DATEJune 19June 19June 23June 28Page 5 of 5ACCOUNTTYPEDEBITSalesRevenue50A/R – Tom WhiteAssetError on previous invoice – should have been 1,200Sales ReturnsRevenue150A/R – Tom WhiteAssetReduction in invoice price after discussion with Tom (Allowance)A/P – UVW CompanyLiability2,100InventoryAssetCash in BankAssetPaid Supplier less Return and Discount - (2,300 - 200) X 2% 42CREDIT50150422,058Cash in BankAsset1,029Sales DiscountsRevenue21A/R – Tom WhiteAsset1,050Invoice less Error less Allowance less Discount – (1,250 – 50 – 150) X 2%Copyright 1996 by PARACCOUNTANT Association of Canada

PERPETUAL INVENTORY JOURNAL ENTRIES – 2 Page 1 of 5 ABC Company buys and sells desks. The following transactions occurred during June: June 1 Bought inventory from XYZ Company for 6,000. Terms 1/15, N/30 FOB Shipping Point. June 2 Sold merchandise to Jane Smith for 800 (Cost 500). Terms 2/10, N/30 FOB Shipping Point.