Transcription

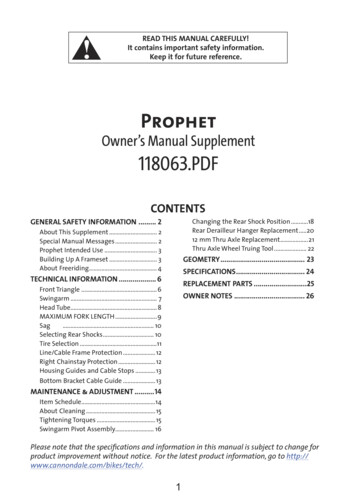

I N T E L L I G E N C E T H AT W O R K SIN T E L L IG E N C E T H AT WO R K SGreen Mountain Care Board:VT Hospital Quality Review and CapacityPlanning in Preparation for Value-Based CareOctober 27, 2021THINKBRG.COM

I N T E L L I G E N C E T H AT W O R K SAgenda Motivation/Background Key Findings from Data Analysis: Capacity & Quality Reimagining Care Delivery to Address Capacity & Quality Opportunities Methodology/Criteria Opportunities

I N T E L L I G E N C E T H AT W O R K SIN T E L L IG E N C E T H AT WO R K SMotivation/BackgroundTHINKBRG.COM

I N T E L L I G E N C E T H AT W O R K SHospital Sustainability in a Value-Based world Hospital sustainability is an important issue given current economicheadwinds Across the U.S., 181 rural hospitals have closed since 2005, according tothe Cecil G. Sheps Center for Health Services Research Last year, 20 of those hospitals closed, making 2020 a record year for ruralhospital closures Growing challenges rural hospitals face Declining populationsRising costsWorkforce shortagesRural bypass for larger community hospitals or Academic Medical CentersAging plantsNeeded investments in population health under value-based care modelsTechnological and clinical innovation requirements4

I N T E L L I G E N C E T H AT W O R K SSustainability Vermont hospitals have seen erosion in operating margins prior to the COVID19 pandemic Value-based care initiatives must be balanced with access to care for patientsacross the state Within existing facilities Through alternative methods that provide access to quality care5

I N T E L L I G E N C E T H AT W O R K STransitioning to Value-Based Care Hospitals will increasingly be held accountable for the cost and quality ofcare being provided This accountability may also be extended to the communities served bythe hospital, not just those patients admitted to the facility In value-based payment models, excess hospital capacity can lead tounnecessary costs being locked into the system and low volumeprograms have the potential to provide lower quality of care. Potential excess capacity needs to be balanced to ensure appropriateaccess to care. Poor quality outcomes impact population health, potentially threateningreimbursements and compromising financial sustainability.6

I N T E L L I G E N C E T H AT W O R K SWhy Value-Based Care? In a recent article from the Centers for Medicare and Medicaid Services(CMS) Administrator and the Director of the Center for Medicare andMedicaid Innovation (CMMI), CMS listed their priorities going forward: Drive accountable careAdvance health equitySupport innovationAddress affordabilityPartner to achieve system transformation.All supportive ofdriving valuebased paymentmodels In addition, commercial payers continue to move payments away fromfee-for-services into value-based models, including Accountable CareOrganizations, Bundled Payments, and increasing amounts of financialand clinical risk for participating providers7

I N T E L L I G E N C E T H AT W O R K SKey Findings fromData Analysis:Capacity & Quality8

I N T E L L I G E N C E T H AT W O R K SFactors in the Analysis BRG’s analysis focused on CY 2019 Although COVID-19 has caused changes to the healthcare delivery system and patientuse patterns, it is unclear how many of these trends are temporary vs permanent. Due to this ambiguity, BRG believes that utilizing CY 2019 is a reasonable approachwhen considering longer-term capacity needs. As part of the analysis, BRG did not have insight into the following factors thatcould potentially impact the conclusions: Clinical delivery model innovations occurring across providers and communities Strategic planning efforts of Vermont’s hospitals Specific state policies that may have an impact on current hospital capacity and futureplanning efforts The considerations highlighted in this presentation are intended to provokerobust discussion within the Vermont provider community regarding future needs,resources, and facility disposition. Additional discussion and analysis by Vermontpolicy makers will be required before any definitive decisions are made.9

I N T E L L I G E N C E T H AT W O R K SKey Findings – Emergency Department Use The emergency roomcontinues to be thesource for more than60% of acute carevolume at both criticalaccess hospitals (CAH)and at generalcommunity hospitals This represents apotential opportunity forimprovement to thedegree that this care ispotentially avoidable orcould be treated in alower cost settingHospital Service MorrisvilleNewportRandolphRutlandSpringfieldSt. AlbansSt. JohnsburyWhite River JctTotal:2019 Vermont Inpatient DischargesER Admit Non ER AdmitTotal%Discharges Discharges Discharges ER 7,45614,61442,07065.26%Data Source: VUHDDS Research FileNote: Excluded Neonatal and Newborn10

I N T E L L I G E N C E T H AT W O R K SKey Findings – Occupancy Rates BRG determined that overall occupancy rates for Vermonthospitals have remained relatively stable, but severalVermont hospitals are operating around 40% occupancy BrattleboroNorthwesternSouthwesternSpringfield While the overall occupancy rate for Vermont’s CAHs (64.5%)is above the national average (33.2%), there is still excessbed capacity at individual Vermont CAHs. Low occupancy rates may decrease efficiency and increasecosts.11

I N T E L L I G E N C E T H AT W O R K SKey Findings – Hospital Service Areas Of the total 42,000 admissionsfor Vermont residents,approximately 77% ofadmissions were servedwithin-HSA and 23% ofadmissions were servedoutside the HSA Nearly a quarter of the patientsadmitted bypassed the hospitalwithin their HSA.12

I N T E L L I G E N C E T H AT W O R K SKey Findings –Population-Driven Bed Need: Year 2026 While the overall population isprojected to decline, theelderly population isprojected to increase by2.6% per year. As a result,total discharges are projectedto increase from approximately48,000 to 51,000 discharges. Assuming stable dischargerates and stable length of stayacross all Vermont residents,the total number of occupiedbeds will increase from acensus of 676 to 719( 43 occupied beds). This projection assumes thatoutmigration of Vermontresidents to out-of-statehospitals will continue at thesame level as in CY2019. This projection also assumesthat inmigration will continue toaccount for 6,220 totaldischarges at Vermonthospitals.2019 ActualAge 0-64 Age 65 POPULATIONEstimated population% Change, 2019-2026VERMONT RESIDENTSDischarges per 1,000# Discharges, Vermont ResidentsAverage length of stay# Patient daysAverage daily census, VTNON-VERMONT VOLUME# Discharges, Non-VermontAverage length of stay# Patient daysAverage daily census, Non-VTTOTAL HOSPITAL VOLUME# DischargesAverage length of stay# Patient daysAverage daily 24,5515.00122,763337BED NEED# Staffed Beds, Year 2019Assume improved occupancy rate, Year 2026# Staffed Beds Required @ 70% Occupancy# Staffed Beds Required @ 75% Occupancy2026 ProjectionAge 0-64Age 65 .13262,5757191,0391,02895913

I N T E L L I G E N C E T H AT W O R K SKey Findings – Future Projections While the overall population inVermont is projected to decline,the aging of the population willdrive a significant increase inVermont resident discharges bythe Year 2026. Assuming stabledischarge rates, stable length ofstay, and a stable number of outof State patients, the totalnumber of occupied beds byVermont residents is projected toincrease from 676 occupiedbeds to 719 beds ( 43 occupiedbeds, or a 6% increase). Absent consolidation of inpatientcapacity or extension of specialtyprograms, several of the smallerVermont hospitals are projectedto have excess capacity in therange of 20-30 beds.14

I N T E L L I G E N C E T H AT W O R K SKey Findings –Year 2026: Bed Need By Hospital The below demand forecast assumes that: Discharge rates remain stable Length of stay remains stable The number of out-of-state patients remains stable The distribution of discharges from each HSA across hospitals remains stable The outmigration rate to out-of-state hospitals remains stable The model highlights that the need for additional acute care bed capacity isheavily concentrated at the University of Vermont Medical Center, with additionalbed need projected for Central Vermont Medical Center and Mt Ascutney.Year 2026Population-Based Projection for Acute Care Bed Need, by HospitalAssumes stable use rate, stable length of stay and stable distribution across hospitalsAssumes stable number of out-of-state 2121Current Licensed Beds2026 Bed Reqt @ 70% occup2026 Bed Reqt @ 75% 028959# Bed Need, (Excess) @ 70%# Bed Need, (Excess) @ 75%# Bed Need, (Excess) @ (19)(22)(9)(10)(22)(24)(32)(35)2(0)(11)(80)Average Daily Census, 2026Average Daily Census, 2019Change in ADC, 2019-2026Gifford Grace Cott Mt Ausc N Country NEastern NWestern1312911132412128111322101112Porter Brattleb SWestern Springfield11173319101732181111TOTAL7196764415

I N T E L L I G E N C E T H AT W O R K SKey Findings –Impact of Length of Stay on Bed Need Vermont hospitals show a longer length of stay relative to benchmarks. Inparticular, the University of Vermont Medical Center shows a markedly high lengthof stay relative to benchmarks (1.73 days longer relative to benchmark). As bed need is projected, it will be important to factor in hospitals’ improvementtoward the benchmark, or reduction in avoidable hospital days. These avoidablehospital days are referred to here as ”excess days.” The reduction in excess days could translate into a significant reduction inaverage daily census. The table below shows the impact of a 30% reduction in thedifferential and the impact of a 50% reduction in the differential. 30% reduction in excess days 50% reduction in excess days53 fewer occupied beds84 fewer occupied beds This reduction in length of stay would likely require investment in home careresources and other alternative delivery models.16

I N T E L L I G E N C E T H AT W O R K SKey Findings –Impact of Dartmouth Hitchcock Bed Expansion on Need Dartmouth Hitchcock (DH) has announced a 130 million expansion witha new tower that could house up to 112 new beds. DH currently has 396 licensed beds The tower would include 64 new beds with shell space for an additional 48 as needarises 2019 Data Dartmouth Hitchcock (DH) had total discharges of 18,752 VCHURES data show that 4,353 DH discharges were from Vermont 822 were under 65 years old 3,531 were 65 or older Assumptions The percentage of patient migration for out-of-state care would increase; DHexpansion would likely draw more patients from the state, further reducing neededbed capacity 32 new DH beds are online by 2026 The number of VT discharges increases proportionally across VT HSAs17

I N T E L L I G E N C E T H AT W O R K SKey Findings –Impact of Dartmouth Hitchcock Bed Expansion on Need The table below presents the demand forecast for bed capacity by hospital. It is apopulation-driven forecast only, and assumes that: Discharge rates remain stableLength of stay remains stableThe distribution of discharges from each HSA across hospitals remains stableThe outmigration rate to out-of-state hospitals reflects the increase in beds planned atDartmouth Hitchcock, assuming that 32 new beds are online with a proportionalincrease in discharges from Vermont Assuming 75 percent occupancy, Vermont would need 8 fewer beds than underthe projection that outmigration is stable, with the largest effect on RutlandYear 2026Population-Based Projection for Acute Care Bed Need, by HospitalAssumes stable use rate, stable length of stay and stable distriution across hospitalsAssumes additional number of out-of-state discharges proportional to licensed bed increaseAverage Daily Census, 2026 with stable outmigrationAdditional bed reductions due to increasedoutmigration to D-H if 32 beds openedAverage Daily Census, 2026 new of D-H effectUVMC Rutland38889CVMCCopley Gifford Grace Cottage Mt. Ausc N Country NEastern NWestern Porter Brattleb SWestern Springfield 280111120241101160330196713Current Licensed BedsRevised 2026 Beds Needed @ 70% occupancyRevised 2026 Bed Needed @ 75% 91019951# Bed Need, (Excess) @ 70%# Bed Need, (Excess) @ 75%# Bed Need, (Excess) @ 9)(21)(11)(12)(24)(26)(32)(35)20(20)(88)5218

I N T E L L I G E N C E T H AT W O R K SKey Findings –Total Impact of Projected Bed Need Some VT hospitals have significant projected declines compared to current licensedbedsHospitalCurrent Licensed BedsProjected ReductionBrattleboro47-26Grace Cottage19-18North r25-12Southwestern68-35 These reductions should be balanced against current lower occupancy rates at manyof these facilities19

I N T E L L I G E N C E T H AT W O R K SCMS Quality Pay for Performance ProgramsValue BasedPurchasing (VBP)HospitalReadmissionReduction Program(HRRP)Hospital AcquiredCondition ReductionProgram (HACRP) Mortality and ComplicationsPatient Perception HCAHPSInfectionsEfficiency – Cost per BeneficiaryMedicare FFSRevenue /-2% 30-day, all-cause Readmissions 6 clinical conditions-3% AHRQ Patient Safety Indicator Composite CDC/NHSN Healthcare AssociatedInfections-1%CAH do not participate in VBP, HRRP or HACRP. CAH do participate in MBQIP – Medicare Beneficiary Quality ImprovementProject. Data was not publicly available for the measures included in the project.20

I N T E L L I G E N C E T H AT W O R K SKey Findings – Hospital Quality Performance Under CMS Pay for Performance Programs, half of the Vermont hospitals havenet rewards while half have net penalties (does not include CAHs) 5 of 6 Hospitals have HRRP penalties 5 of 6 Hospitals have HVBP rewards 2 hospitals have HACRP penalties Within VBP, Vermont hospitals perform well on HCAHPS Areas of opportunity for improvement include: 30-Day Mortality for AMI and 30-Day Mortality for Heart Failure 3 of 6 Hospitals are worse than Peer Group performance for 30 Day Readmissions forTHA/TKA 2 of 6 Hospitals are worse than Peer Group performance for 30 Day Readmissions forAMI, COPD and Heart Failure CAH are exempt from Pay for Performance Programs but voluntarily participatein a quality program specific to CAH; data was not available to review theseresults21

I N T E L L I G E N C E T H AT W O R K SKey FindingsSummary of Performance for Publicly ReportedPrograms – FY 2021Payment PolicyHRRPUniversity of Vermont Medical CenterRutland Regional Medical CenterCentral Vermont Medical CenterSouthwestern Vermont Medical CenterNorthwestern Medical CenterBrattleboro Memorial HospitalNational Best QuartileNational 2nd QuartileNational 3rd QuartileNational Worst QuartileHACRP211432312344VBP Clinical CareVBP Clinical Mort-30- Mort-30- Mort-30- Mort-30- HIPEfficiencyCareAMIHFPNCOPD 114HRRPPenalty onlyHACRPPenalty onlyVBP( 155,000) 0 176,000Rutland Regional Medical Center 0 0 166,000Central Vermont Medical Center( 7,000) 0 297,000Southwestern Vermont Medical Center( 214,000) 0 116,000Northwestern Medical Center( 57,000)( 124,000) 16,000Brattleboro Memorial Hospital( 10,000)( 85,000)( 1,000)NotApplicableFY 2021 Payment ImpactUniversity of Vermont Medical Center– All but 1 hospital receiveda penalty for readmissionsin HRRP– All but 1 hospital receiveda reward under VBP– 2 Hospitals receivedpenalties in HACRP121323Critical Access Hospitals112422Not applicable22

I N T E L L I G E N C E T H AT W O R K SKey Findings – Prevention Quality IndicatorsPQI 90 Overall Composite Vermont’s 10.71 PQIs/1000 residents isbelow (favorable) AHRQ benchmark of 13.06 3 HSAs are above the AHRQ dules/pqi resources.aspx#techspecsSource: Vermont Health Care Uniform Reporting and Evaluation System wnloads/Modules/PQI/V2020/Version 2020 Benchmark Tables PQI.pdf23

I N T E L L I G E N C E T H AT W O R K SIN T E L L IG E N C E T H AT WO R K SReimagining CareDelivery to AddressCapacity & QualityOpportunitiesTHINKBRG.COM24

I N T E L L I G E N C E T H AT W O R K SReimagining Care Delivery Models Although BRG’s analysis reflected projections based on existingneed and future demographic changes, other clinical deliverymodels exist that could meet the needs of Vermont’s residentswhile also providing care in a more cost-effective and clinicallyappropriate setting BRG believes there is opportunity to provide care to Vermont’sresidents utilizing some of these alternative clinical deliverymodels In many cases this could be done by reimagining the current roleof an acute care hospital in the community and how to best meetthe needs of the community that it serves

I N T E L L I G E N C E T H AT W O R K SHospital at Home In March 2020, CMS announced the Hospitals Without Walls program Hospitals were able to transfer patients to outside facilities, such as ambulatorysurgery centers, inpatient rehabilitation hospitals, hotels, and dormitories, while stillreceiving hospital payments under Medicare In November 2020, CMS created the Acute Hospital Care at Home program Participating hospitals are required to have appropriate screening protocols beforecare at home begins to assess both medical and non-medical factors, includingworking utilities, assessment of physical barriers and screenings for domesticviolence concerns Beneficiaries will only be admitted from emergency departments and inpatienthospital beds, and an in-person physician evaluation is required prior to startingcare at home Hospital at Home has the potential to reduce total cost of care (by 30-40%),reduce labs and other services, increase patient satisfaction and reducereadmission rates As hospital at home models increase, there will be less need for bed capacityso current projected bed needs are likely overstated.Source: (https://pubmed.ncbi.nlm.nih.gov/31842232/; https://pubmed.ncbi.nlm.nih.gov/29411238/; 21-07052-5).26

I N T E L L I G E N C E T H AT W O R K SReimagining Acute Care Micro hospitals Small-scale, inpatient facilities with eight to 15 short-stay beds They perform many of the same acute-care and emergency services doneat larger hospitals (lower acuity), but are cheaper to operate Began appearing as an outgrowth of freestanding emergency departments Freestanding Emergency Departments Emergency facility that is not physically connected to inpatient services Must be affiliated (satellite) with a hospital in order to be reimbursed byCMS Varying definitions and regulatory structures around the country Freestanding Medical Facilities (Outpatient Hospitals)27

I N T E L L I G E N C E T H AT W O R K SFreestanding Medical Facilities (Outpatient Hospitals) Regulatory designation in Maryland to allow former acute care facilitiesto be decommissioned and transitioned into a different clinical deliverymodel Services include an emergency department, observation beds, mentalhealth, and robust outpatient services Example – Bon Secours Hospital in Baltimore City Rapidly aging physical plant Government payers and uninsured patients comprised vast majority ofvolume State subsidies were annually required to keep the hospital operating Located in an underserved area of Baltimore City Transformed and reopened as Grace Medical Center28

I N T E L L I G E N C E T H AT W O R K SFreestanding Medical Facilities (cont.) Grace Medical Center offers: emergency care inpatient and outpatient mentalhealth renal dialysis diagnostic services Offsite locations provide: primary care drug treatment outpatient mental health services29

I N T E L L I G E N C E T H AT W O R K SRural Emergency Hospital New designation being proposed by CMS; regulations have not yet beenestablished Eligibility Eligible hospitals include CAHs and hospitals with 50 beds or less that are locatedin a county (or equivalent unit of local government) that is in a rural area definedusing the Office of Management and Budget (OMB) designation of non-metropolitanstatistical area (MSA), or a hospital with 50 beds or less that is re-classified by CMSas rural REH’s must: not exceed an annual per patient average length of stay of 24 hours be staffed 24 hours-a-day, seven days-a-week by a physician, nurse practitioner,clinical nurse specialist, or physician assistant meet the licensure requirements and staffing responsibilities of an ED have a transfer agreement in place with a level I or II trauma center meet conditions of participation applicable to CAH emergency services and hospitalEDs (as determined applicable by the Secretary of the Department of Health andHuman Services) meet the distinct part unit (DPU) requirements if the REH has a skilled nursingfacility (SNF) DPU.Source: rural-health/30

I N T E L L I G E N C E T H AT W O R K SAmbulatory Surgery Centers Vermont has the lowest number of ASCs inthe country Factors influencing the growing number ofMedicare-certified ASCs: Medicare beneficiaries' coinsurance istypically lower in ASCs than hospitaloutpatient departments Medicare now reimburses for total kneereplacement in ASCs Hospital system and insurers are moreinterested in surgical center investment dueto the emphasis on value-based care Orthopedics is the largest ASC specialty in thecountry (36% of -ascs-2020.htmlHospitalsASCs31

I N T E L L I G E N C E T H AT W O R K SIN T E L L IG E N C E T H AT WO R K SMethodology/CriteriaTHINKBRG.COM32

I N T E L L I G E N C E T H AT W O R K SMethodology and Criteria In order to determine opportunities to improve hospitalsustainability and prepare for a value-based world, BRG revieweddata across a range of factors Each of these factors is critical to sustainability in a value-basedcare framework, both in aggregate (State of Vermont) as well as atthe individual hospital level BRG created criteria for each of the factors to determine wherethere may be areas of opportunity, recognizing that policy makersin Vermont will need to work closely with industry leaders todetermine the best course of action going forward

I N T E L L I G E N C E T H AT W O R K SCriteria Inpatient occupancy rates – adults and pediatrics Inpatient occupancy rates – intensive care units Projected bed need 2026 ED use per 1,000 residents Prevention Quality Indicator (PQI) per 1,000 residents Case mix adjusted average cost per inpatient discharge (all payers) CMS Star Rating Drive time to nearest VT hospital Age of plant34

I N T E L L I G E N C E T H AT W O R K SHospitalCriteria #1:MemorialInpatient Occupancy Rates – BrattleboroHospitalCentral VermontAdults and PediatricsMedical CenterCopley Hospital BRG compared 2019 occupancy ratesfor each of the hospitals to identifyhospitals with lower occupancy rates Facilities with lower occupancy ratesmay be eligible for “right-sizing,”consolidation with other facilities, ortransitioned to a different care deliverymodelGifford Medical CenterInpatient Occupancy Rates Adults and Peds(%)36.1%77.0%56.3%58.4%Grace Cottage HospitalMt. AscutneyNorth CountryNortheastern RegionalNorthwestern MedicalCenterPorter Medical Center56.6%78.8%80.1%82.0%40.4%66.6%78.0%Yellow 50-75%Rutland RegionalSouthwestern VermontMedical CenterSpringfield HospitalGreen Greater than 75%UVM Medical Center81.0%Red less than 50%43.4%45.8%35

I N T E L L I G E N C E T H AT W O R K SCriteria #2:Inpatient Occupancy Rates –Intensive Care Units BRG compared 2019 occupancy ratesfor each of the hospitals to identifyhospitals with lower occupancy ratesHospitalBrattleboro MemorialHospitalCentral VermontMedical CenterCopley HospitalGifford Medical CenterRed less than 50%Yellow 50-75%Green Greater than 75%*ICU beds were notreported in MedicareCost Reports but ourunderstanding fromcommunications with theGMCB is that NW has 4bed ICUN/A58.1%N/A32.3%Grace Cottage HospitalMt. Ascutney Facilities with lower occupancy ratesmay be eligible for “right-sizing,”consolidation with other facilities, ortransitioned to a different care deliverymodelInpatient Occupancy Rate Intensive Care Unit (%)North CountryNortheastern RegionalNorthwestern MedicalCenterPorter Medical CenterN/AN/A8.2%46.4%N/A*N/ARutland RegionalSouthwestern VermontMedical CenterSpringfield Hospital26.2%UVM Medical Center67.0%47.9%N/A36

I N T E L L I G E N C E T H AT W O R K SCriteria #3:Projected BedNeed 2026 Calculated projected bedneed in 2016, including theadditional of additionalcapacity at DartmouthHitchcock Hospitals with reduced bedneed may presentopportunities for efficiencyHospitalBrattleboro Memorial Hospital-26Central Vermont Medical CenterCopley Hospital1-9Gifford Medical CenterGrace Cottage HospitalMt. AscutneyNorth CountryNortheastern RegionalNorthwestern Medical CenterPorter Medical CenterRed - bed reductionProjected Bed Need 2026-8-182-10-9-21-12Rutland RegionalSouthwestern Vermont MedicalCenterSpringfield Hospital-8-350UVM Medical Center60Yellow - no changeGreen - bed increase37

I N T E L L I G E N C E T H AT W O R K SCriteria #4:ED Use Rate per 1kresidents for HSA Calculated ED use rates on apopulation basis for each HSAHospitalBrattleboro MemorialHospitalCentral Vermont MedicalCenterCopley HospitalGifford Medical CenterGrace Cottage Hospital Compared ED use rates vsthe VT average to determineHSAs with higher ED userates, potentially indicatingneed for greater ambulatoryservices accessRed - above VT averageGreen - below VT averageVT average 340.4Mt. AscutneyNorth CountryNortheastern RegionalNorthwestern MedicalCenterPorter Medical CenterRutland RegionalSouthwestern VermontMedical CenterSpringfield HospitalUVM Medical CenterED Use Rate (per 1,000 population) for attleboro (GraceCottage is in same HSAas BrattleboroMemorial Hospital)White River JctNewportSt. JohnsburySt. 49477.54494.94411.93422.75446.94238.2638

I N T E L L I G E N C E T H AT W O R K SCriteria #5:Prevention QualityIndicator (PQI)per 1k residents Calculated PQI Compositeuse rates on a populationbasis for each HSA Compared use rates to anAHRQ benchmarkHospitalBrattleboro Memorial HospitalBarreMorrisvilleGifford Medical CenterRandolphGrace Cottage HospitalMt. AscutneyNorth CountryNorthwestern Medical CenterGreen - lower than AHRQbenchmarkBrattleboroCentral Vermont Medical CenterCopley HospitalNortheastern RegionalRed - greater than AHRQbenchmarkPQI Overall Composite for Hospital's HSA (per 1kresidents)Porter Medical CenterRutland RegionalSouthwestern Vermont MedicalCenterSpringfield HospitalAHRQ benchmark - 13.06Brattleboro(GraceCottage is insame HSA asBrattleboroMemorialHospital)White RiverJctNewportSt. JohnsburySt. BurlingtonUVM Medical Center5.9639

I N T E L L I G E N C E T H AT W O R K SCriteria #6:Case Mix AdjustedAverage Cost perInpatient Discharge(All payers) Utilized information providedby Burns and AssociatesHospitalBrattleboro Memorial HospitalCentral Vermont Medical CenterCopley HospitalGifford Medical CenterGrace Cottage HospitalMt. Ascutney Created cut points to showoutliers Although cost differentiationexists by payer, stratificationby all payer demonstratesdistinct differences acrosshospitalsRed - greater than 16,000Yellow - 12,000 - 16,000Green - lesss than 12,000Case Mix Adjusted Average Cost perInpatient Discharge (All Payers) 14,683 14,846 11,733 13,947North CountryNortheastern RegionalNorthwestern Medical CenterPorter Medical Center 18,485 22,004 9,422 14,115 12,441 10,582Rutland RegionalSouthwestern Vermont MedicalCenterSpringfield Hospital 15,624UVM Medical Center 19,228 9,681 9,72540

I N T E L L I G E N C E T H AT W O R K SCriteria #7:CMS Star RatingHospital Utilized CMS Star Ratings as a proxy forhospital quality Not all hospitals had CMS Star Ratingsas noted in the chartBrattleboro MemorialHospitalCentral VermontMedical CenterCopley HospitalGifford Medical CenterMt. AscutneyNortheastern RegionalNorthwestern MedicalCenterPorter Medical CenterYellow 3Green 4 or 52543Grace Cottage HospitalNorth CountryRed 1 or 2CMS Star RatingRutland RegionalSouthwestern VermontMedical CenterSpringfield HospitalUVM Medical CenterN/A4233344N/A541

I N T E L L I G E N C E T H AT W O R K SCriteria #8:Drive Time toNearest VT Hospital Calculated the drive timebetween VT hospitals

Oct 27, 2021 · Green Mountain Care Board: VT Hospital Quality Review and Capacity Planning in Preparation for Value-Based Care October 27, 2021 . Value-based care initiatives must be balanced with access to care for patients . 60% of acute care volume at both critical