Transcription

netLABOR

OBAMAA sluggish U.S. recovery. VolatilityWorldMags.netin China. Uncertainty in Europe. Theglobal economy is struggling to pickup steam—but the year ahead maystill turn out better than you think.Here’s why. By Peter BILITYWorldMags.netCONSTRUCTION

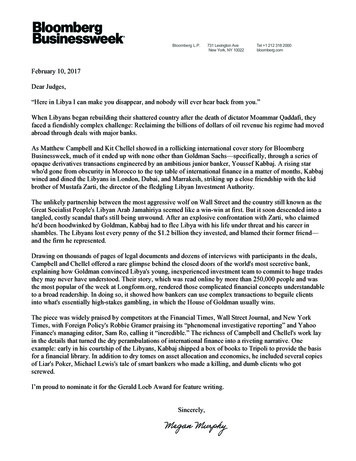

18changing, and downside risks persist,”the organization reports.The best place to start our tourd’horizon is Washington. That’s partlybecause the U.S. is the world’s largesteconomy and partly because two ofthe most important uncertainties on the Worldwide, the IMFA pickup in the U.S.an uptick independs on solvingglobal scene involve the Fed and Con- projectsGDP growth in 2014,the sequestergress. Business executives from Shanghai but nothing specialand debt ceilingto São Paulo are praying that Congress 2%and the White House will reach dealswith a minimum of additional fuss in2% to 4%4% to 6%January and February to fund the federal 6%government for the rest of the fiscal yearNo dataand raise the debt ceiling. And they’rehoping that Yellen can taper stimulusmeasures as adroitly as Ben Bernankelayered them on.Success in both missions could lift2014 growth in the U.S. above the middling 2.6 percent rate foreseen by economists surveyed by Bloomberg News.Failure threatens not only the U.S. butalso the entire world. In 2014 “the biggestrisk for us would be homemade troubles”coming out of Washington, says Jan Siegmund, chief financial officer of AutomaticData Processing, the payroll giant.“Right now we’re living in this uncertainty. The thing that business hates themost, maybe after taxes, is uncertainty,”says Harold Sirkin, a senior partner atBoston Consulting Group. The U.S. isemerging as one of the world’s lowcost manufacturing centers, but politicians could still screw things up bykeeping executives on pins and needles,Sirkin says. “Companies aren’t makingthe same level of investment,” he says.“They don’t want to hire people. If youtell them what the rules of the game are,they’re more likely to respond.”One reasonable scenario goes like this:Fiscal policy becomes less of a drag onthe U.S. economy in 2014. RepublicansStructural reformswill help Mexico,approve a debt-ceiling increase in Februas will exports toary in exchange for some hard-to-predictthe U.S.concession from the White House. Byspring, President Obama wins continuing resolutions that replace some of the interest rates and aggressive Fed bondscheduled budget caps and sequestration buying have failed to engender strongwith smaller cuts in other areas. In the economic growth. Monetary hawks sayNovember 2014 congressional elections, easy money will create bubbles in assetsthe GOP loses some seats but retains ranging from housing (again) to farmlandcontrol of the House. Divided govern- to junk bonds. The Fed is near a tippingment means less contraction because point at which stimulus becomes “an agentthe Republicans can’t win big spend- of financial recklessness,” and “none ofing cuts and the Democrats can’t get tax us really know where that tipping pointincreases. There’s little progress, though, is,” Richard Fisher, the president of theon restraining the long-term growth in Federal Reserve Bank of Dallas, said inentitlement spending.October. In 2014, Fisher becomes a votingOver at the Fed on Constitution member of the Federal Open Market ComAvenue, Yellen will face anguishing mittee—and a thorn in Yellen’s side.decisions as soon as she replaces BernankeBubbles are only one risk. The exas Fed chairman on Feb. 1, assuming she pansion could lose what little momenwinsWorldMags.netconfirmation. Years of near-zero tum it has next year if Yellen, to provePREVIOUS SPREAD: GETTY IMAGES(6); ALAMY(1)WorldMags.netOn Jan. 1, 2014, Latvia will adopt theeuro, and its lats currency will beno more. Farewell to the fulsomelybearded Krišjānis Barons, the collector of folk songs who graces the 100latu note. Goodbye to images of sailingships and maidens, oak trees and theDaugava River. The little Baltic nation isshucking a piece of its national heritagebecause its leaders think that joiningEurope’s somewhat troubled commoncurrency zone will lead to more trade,investment, and prosperity. “We arelooking to growth,” Finance MinisterAndris Vilks told reporters in June.There aren’t many other events in2014 that we can forecast with as muchconfidence as Latvia’s scheduled adoption of the euro. For decision-makersin global business, some big unknownsawait. Things you’d like to know: Willthe U.S. economy add jobs or assetbubbles with Janet Yellen as the nextchairman of the Federal Reserve? WillGerman Chancellor Angela Merkelbecome more generous toward Southern Europe if she forms a coalition withthe Social Democrats? Can Chinese President Xi Jinping and Premier Li Keqiangdefeat the forces of reaction and repairthe slowing engines of the world’s second-largest economy? And how aboutShinzō Abe, the iconoclastic Japaneseprime minister: Can he shrink budgetdeficits without pushing the economyback into deflation?This article sets the economic andgeopolitical stage for our special issue,The Year Ahead: 2014. In the pages tofollow, we’ll provide a preview of 2014for 55 global industries, from tech tobanking and energy to retail. We don’tclaim to be prescient, but we do believethat by wrestling with the hardest questions of the day we can help executivesmake decisions about where and whento deploy people and capital.Worldwide, 2014 should be betterthan 2013 but not great. Inflation andinterest rates are low in most of theworld, oil prices are expected to fall(page 22), companies are sitting on cash,and there’s plenty of pent-up consumerdemand. A Barclays measure of globalbusiness confidence reached a 31-monthhigh in October. But the world is havingtrouble accelerating after the 2009 globaldownturn. The International MonetaryFund projects global growth in grossdomestic product of 3.6 percent in 2014.That’s up from 2.9 percent this year, although not back to the 5 percent growthrates of 2005 to 2007. The IMF’s themefor 2014 is “transitions and tensions,”which sounds anxious. “Global growthis in low gear, the drivers of activity are

WorldMags.netProjections of the International Monetary Fund’s October 2013 World Economic OutlookResource-rich Africashould continueto do better unlessChina stallsThe euro zone shouldimprove absent freshpolitical crisesHigher consumptiontaxes couldweaken growthin feeble JapanChina will try torely less on investment and more onconsumer spending19GRAPHIC BY BLOOMBERG BUSINESSWEEK. DATA: INTERNATIONAL MONETARY FUNDtnefil be d Cuplilw ordzilmeBra the W lus tim imu ionsorfst ec tand to elAntarctica well,actually, no onelives down hereher inflation-fighting bona fides, goesalong with premature withdrawal ofstimulus. The decline of the unemployment rate since 2009, to 7.3 percent inOctober, is misleading because it’s largelythe result of people giving up and notbeing counted among the unemployed,says Scott Clemons, chief investmentstrategist at Brown Brothers HarrimanWealth Management.The last recession ended in 2009, so bynext summer this run of growth, modestas it is, will have lasted longer than theaverage post-World War II expansion. Tokeep it alive, says one investor, it’s almostas likely that the Fed will increase stimulus as that it will finally begin its long-Weaker oil priceswill hurt energydependent Mideastgovernmentsanticipated taper. “Low demand forcredit, low inflation, and other indicators are signaling that deflation remainsa serious threat,” Daniel Arbess, a partnerin the investment and advisory firm PerellaWeinberg Partners, wrote in an e-mail.The Fed’s next move matters toeveryone because it remains the world’sde facto central bank. Other nationscomplained when low U.S. rates senthot money flooding their way in 2008,and they complained again this yearwhen hints of higher U.S. rates reversedthe tide. Yellen won’t focus too muchon that turmoil, though. Serving theU.S. economy is complicated enough.TheWorldMags.netlatest expectation of many marketCan India’s centralbank end highinflation withoutcrushing theeconomy?watchers is that the central bank willstart tapering bond purchases aroundMarch. But the Fed’s own rate settersdon’t foresee nudging up the federalfunds rate until 2015. That’s becausethe U.S. economy remains too weak towithstand it.All of which argues for caution. At thesprawling Port of Long Beach, Calif., workis proceeding on a 4 billion expansionthat by 2019 will increase capacity by onethird. Port officials aren’t so bullish aboutthe coming year, though. They’re projecting only 3 percent volume growth forLong Beach and the neighboring Port ofLos Angeles combined, the same as thisyear. Says Noel Hacegaba, the chief

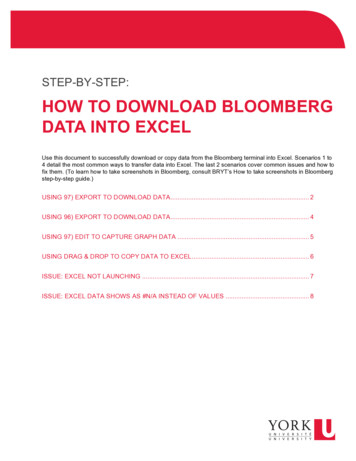

WorldMags.netthe Communist Party of China, probably in September or October. Li wantsto move China from investment to consumption as a source of growth, but thepop in growth this fall was achieved theold-fashioned way, by heavy lending thatfueled investment in plants, equipment,and infrastructure. The municipality ofBeijing is planning a financial district with80 skyscrapers, even though its existingFinancial Street is only about 15 years old.“We’re seeing tremendous inertia on thereform front, and the factional divides arevery pronounced,” Hoffman says.Xi and Li have declared war on corruption. The South China Morning Postsays Xi has taken a personal interest inallegations of graft against Zhou Yongkang, who was the head of internalsecurity until he retired last year. Thetrouble is that the leadership isn’t justcracking down on crime; it’s suppressing legitimate dissent by arresting professors and executives who defy it, saysRegina Abrami, co-author of a new bookCan China Lead? “The whole economy isbuilt on a foundation of moral hazard,”says Abrami, director of the LauderGlobal Program at the University ofPennsylvania’s Lauder Institute.China looks considerably healthier toMichael Silverstein, who, like Sirkin, is aBoston Consulting Group senior partner.“There are 300 bureaucrats that basicallyrun China as a meritocracy,” he says.They’re already starting work on the nextFive-Year Plan, which will cover 2016 to2020. “It’ll just blow you away,” Silverstein says. “I think they’re going to gethighly specific about the technologiesthey really want to try to own.” Corruption? “The current government is veryintent on knocking that out,” he says.No one knows for sure who’s right. InChina and elsewhere, predictability is athing of the past. For a few good years,roughly 2000 to 2007, life was easy forglobal investors, according to a recent presentation in New York by David Bloom,global head of foreign exchange strategyat HSBC. Practicing the time-honoredcarry trade, they would borrow in countries with low interest rates, such asJapan, and invest in those offering higherreturns, such as New Zealand. After theglobal financial crisis hit in 2008, the gamebecame “risk on/risk off.” In months when“risk on” was in fashion, money flowedinto risky, high-yielding securities; othermonths investors would flee for the safetyof U.S. Treasuries.The latest trend, which will continuein 2014, says Bloom, is for some investment money to travel the carry-tradeThis chart shows the change in current-account balances from 2007 through 2012. The currentaccount is the broadest measure of trade in goods and services plus investment income.20072012- 600b- 400b- 200b0 200b 400b 600bGermanyBecause of thefinancial crisis,Spain drastically cutimports, improvingits trade balance byalmost 150 billion.ChinaCste hina heits pest d ad thecou balan eclinecentinrun ry. Bu of anysatsur it stillplus.Saudi ArabiaSwitzerlandRussiaJapanTaiwanSouth KoreaHong KongItalyThe U.S. hadthe biggestimprovement in itsbalance, reducingits deficit by almost 250 billion.SpainIndonesiaTurkeyBrazilAustraliaJapan runs a deficit on trade and a bigsurplus in investment IC BY BLOOMBERG BUSINESSWEEK. DATA: HSBC20operating officer: “We see no clear signthat the recovery is picking up steam inthe immediate future.”China, the world’s No. 2 economy,won’t grow at its customary pace in 2014,either. Western drugmakers, whoseChinese sales rose 40 percent a yearas recently as 2011, might have to settlefor 14 percent to 15 percent growth nextyear, estimates London-based GlobalData(page 162). Economists surveyed by Bloomberg are looking for China’s deceleration tocontinue in the year ahead, with growthof 7.4 percent, vs. 7.6 percent in 2013.That may look boringly steady, but theseeming ability of China’s leadership tohit its targets masks economic and political volatility. “Nothing in China is as itappears,” says Gary Burnison, chief executive officer of recruiting company Korn/Ferry International. He lived in Shanghaithis past summer.To judge whether President Xi andPremier Li are gaining the upper hand,keep an eye on a few key events in 2014,advises David Hoffman, who lives inBeijing as managing director of the Conference Board’s China Center for Economics and Business. One is the 12thNational People’s Congress’s plenarymeeting in March. The other is a plenarysession of the 18th Central Committee of

WorldMags.net 150 per barrel 125Growing supplyshould lowerprices, helping theglobal economyPrice of Brentcrude oil monthlyfutures contract 100Mfu arktu etre boi etslp oric nes 75 50 25 02002200420062008chief international economist for CapitalEconomics, wrote in a note to investors.That leaves Germany, which has runlarge trade surpluses throughout the European crisis. Merkel won election to a thirdfour-year term as chancellor in September, but her Christian Democratic Unionparty failed to garner enough votes toform a government by itself. Her mostlikely partner is the more EurocentricSocial Democratic Party. European growthcould accelerate in 2014 if a new Germancoalition government provides morefinancial aid to the rest of Europe andagrees to contribute more to recapitalizing weak banks in Spain and Italy. “Thisis not far-fetched,” says Andre Sapir, aneconomist and senior fellow at Bruegel,a Brussels-based think tank. “Germanydoesn’t want to go for the major clash andthe end of the euro.”On the other hand, ordinary Germansaren’t feeling a lot of gemütlichkeit—warmfuzzies—toward the people of Southern Europe, whom some describe asfreeloaders. Conservative Germans saythat if they make life too easy for Greece,Portugal, Italy, and Spain, the pressure2010201220142016on them to reform will be removed. IfGermany gets too hard-nosed, though,its policies could intensify a populistbacklash in debtor nations. A key eventto watch is the elections to the EuropeanParliament in May, where anti-Europeanparties threaten a strong showing. A surprise rate cut by the European CentralBank on Nov. 7 should boost growth. Onbalance, Sapir is mildly optimistic: “Iwould see 2014 as a year of transition. Buthopefully not a wasted year of transition.”Once you get past the world’s top foureconomies, you’re down to countriesthat are not fully masters of their ownfates. The rest of Europe takes its cuefrom Germany, although Britain, France,and Italy are players, too. The economiesof Russia and the Middle East dependon energy prices. Africa, primarily acommodity producer, lives and dies bythe swings in prices of raw materials.Ditto for most of South America, although Brazil is a major manufactureras well. Southeast Asia and Australiaare in China’s orbit, while Canada andMexico depend on the U.S. India is bigbut insular. Then there are the troublespots that could blow up in 2014—or not:the South China Sea, Kashmir, Yemen,and so on.The U.S. matters the most of all. If itgrows, the world will, too. In the easternU.S., railroad CSX is running moretrains laden with housing constructionmaterials, cars, and even crude oil fromNorth Dakota. “We are feeling more optimistic,” says CEO Mike Ward (page 36).“If you look at some of the broad indicators in the economy . we’re really seeingsome positive signs.” If more CEOs climbon board Ward’s optimism train, 2014WorldMags.netcould be a strong year after all. GRAPHIC BY BLOOMBERG BUSINESSWEEK. DATA: COMPILED BY BLOOMBERG22route, some to seek geopolitical safetyin the likes of the euro and the Britishpound (but not the suddenly scary U.S.dollar), and some to go toward placessuch as Hong Kong, Taiwan, and SouthKorea whose currencies look promisingbecause they have fat trade surpluses.“The FX world has gone from the simpleto the complicated,” Bloom wrote inan e-mail.One piece of good news on thecurrency front is that imbalances inglobal trade have been shrinking. American deficits and Chinese surpluses havefallen dramatically since 2007. But eventhat positive development will causeunnerving reverberations in 2014, predicts Stephen King, HSBC’s global headof economics and asset allocation.The recently dubbed Fragile Five—Brazil, India, Indonesia, South Africa,and Turkey—became addicted to inflowsof hot money caused in part by the Fed’seasy monetary policy. They ran up tradedeficits. Now those deficits are gettingsmaller, which is healthy in the long run.But they’re dwindling too rapidly andin a sickly way, i.e., through currencydepreciation that makes imports unaffordable and through high interest ratesthat chill demand, says King.Mathematically, if the Fragile Five arereducing their deficits, some other countries must run bigger deficits or smallersurpluses. If they don’t want to, the riskis a beggar-thy-neighbor currency war.A big question for 2014: Which countrywill break out of a mercantilist mindsetand accept smaller surpluses? China ismoving slowly toward an overall balancein trade despite its huge surplus vs. theU.S. Then come Japan and Germany.Japan’s Abe is in a pickle. He needs toboost growth but can’t afford a big stimulus and is promising a sales tax hikein April. So Abe is counting on ignitinggrowth through higher inflation. Thatweakens the yen, which suppressesimports. “It is hard to see any solutionto Japan’s problems that does not involvea significantly weaker yen,” Julian Jessop,

GRAPHIC BY BLOOMBERG BUSINESSWEEK. DATA: HSBC operating o cer: We see no clear sign that the recovery is picking up steam in the immediate future. China, the world s No. economy, won t grow at its customary pace in , either. Western drugmakers, whose Chinese sales