Transcription

Spring 2021A Publication of the California Mor tgage A sso ciation

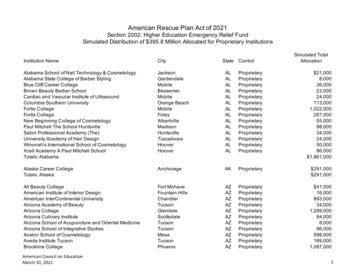

Elizabeth Knight – PresidentPLM Lender Services, Inc.A P u b l i c a t i o n o f t h e C a l i f o r n i a M o r tg a g e A s s o c i a t i o nMichelle Rodriguez – Vice PresidentR.C. Temme CorporationRichard Wachter – SecretaryWachter Investments, Inc.Inside This IssueFrom the President. 2Richard Selzer – TreasurerSelzer Home LoansFrom the Editor. 3David Herzer – Immediate Past PresidentHerzer Financial Services, Inc.Sacramento Summary. 5Steve BellevilleReal Estate Lending Group, Inc.Odell MurryMAI Financial Services, Inc.A “Wyatt” Standard for Insurance Brokers?. 7Mark ForbesF.E. Forbes Company, Inc.James PerryAlliance PortfolioCan Private Money Fuel the Recovery Once Again?.11Noah FurieBudget Mortgage CorporationLori RandichBay Laurel FinancialAngelica GardnerAsher Evan InvestmentsStephen RexrodeCushman Rexrode CapitalCorporationJoffrey LongSouthwestern MortgageSandy MacDougallMortgage Vintage, Inc.Pam SosaStandard Mortgage FinancialServices, Inc.Shafiq TaymureeStonecrestMichael Arnold & Michael Belote, Esq.Legislative AdvocatesT. Robert FinlayLegal CounselCMA HEADQUARTERS STAFFJennifer Blevins, CMPDirector of Management ServicesMichael CochranWebmaster / IT ManagerTeresa Excinia, MBAExecutive DirectorStephanie SchoenSpecial ProjectsJohn BerkowitzPublications DirectorTricia Schrum, CPAAccountingJen Gross, CMPMeeting PlannerNatalie SinclairSpecial ProjectsSpring 2021Am I a “Debt Buyer?” Understanding the NewWave of Debt Buyer Statutes and Their Impacton Servicing Non-Performing Mortgage Debt. 13Summer Seminar Save-the-Date.16Spring and Annual Sponsors. 17PAC Contributors.22Got Solar? Questions to Ask WhenUnderwriting a Home with Solar Power.24MEMBER SPOTLIGHT: Donald Hensel.26Stricktly Strickland.28Membership Application. 31is published by the CaliforniaMortgage Association, a voluntary trade associationserving California mortgage and trust deed brokersand lenders.2520 Venture Oaks Way, Suite 150Sacramento, CA 95833(916) 239-4080 – phone (916) 924-7323 – .comPage 1

Elizabeth M. Knight2020-2021 CMA Presidenthope as of this writing you are alldoing well; taking time to be with yourfamilies, taking time to take care ofyourself, staying healthy and enhancingand protecting your businesses from theongoing changes to the market and theenactment of new legislation.members perform many or all of thesefunctions themselves. Could any of youimagine simply performing one functionall day, every day? For the entrepreneurialCMA members, it would be a “roller coasteron a flat track.”As I had mentioned in the last Points ofInterest President’s message, I enjoy sharingquotes from famous people. This edition’squote best described my thoughts aboutCMA as a group since we are strong andbold:Yeah, life is complicated,but if it wasn’t complicated,it would be a roller coasteron a flat track. Wouldn’t bea ride worth taking.– Suspense writer Dean KoonzMany of the CMA members consist of smallenterprises which allow (or make) the Sometimes, although we ride a rollerowners to perform and perfect so many coaster ride every day, we want to make itdifferent functions of their business. Where wilder than it already is. Perhaps, it is not aa large company has a team of loan officers, conscious choice. It is just something thatprocessors, underwriters, loan committees wants us to feel bolder, more creative, justfor different types of loans, funders, closers, . more. But, when looking back, we thinkpost-close auditors, HR teams, accounting “What was I thinking? Why did I work withdepartments, marketing departments and that borrower? Why did I let them push mea myriad of other departments, our CMA into closing so quickly without performingPage 2as much due diligence as I normally do?Why did I step outside my knowledge basewithout further review or consult on thisloan?” Maybe it is because we want a bit ofthe shrieking highs and lows of any greatroller coaster to rise to the precipice, freefall and then soar again.Currently, the real estate market is, inmany areas, rising in value very quickly.Properties that sold last month for 1,250,000 are now selling for 1,450,000.We are seeing not just multiple offersbut unprecedented numbers of multipleoffers causing offers to exceed list priceby as much as 10%, maybe more in someareas. I was talking to one agent who had85 offers come in on one property andthe final accepted offer exceeded the listprice by 12%, all cash, and, the original listprice was at market. There are four drivingforces that create such an occurrence: Lowinventory, low interest rates, people whofeel they need to jump into the market,people with cash.But, as any of us know who have been inthis business many years, this is a cyclicalmarket and every time there is a downwardadjustment in the market it follows anaccelerated uptick. My message heretoday is to be especially cautious whencontinued on page 29Spring 2021

Mayumi BowersEditor,pring has arrived which means new life, fresh starts, andnew opportunities. We can all agree that 2020 was achallenging year for a multitude of reasons. But 2021 isa new year with what looks like the promise of getting back tosomething that looks like normal again.It’s a time to let the spring showers rinse away all of the frustrationsand feed the new seeds of opportunity. The economy is pickingback up as things open back up, the vaccine is being distributed,and hope springs eternal.Spring 2021As we progress through this year, I suspect that there is going tobe a lot of change ahead in many aspects of our industry due tolegislation, the economy, and of course the ever-lingering effectsof Covid-19 but I am optimist that these changes, whatever theymay be, won’t come as a jolt but a gradual change (just like thechanges of the seasons).In this edition, we focus on a couple of those gradual changesthat may touch your business.Page 3

Page 4Spring 2021

By Michael J. Arnold & Michael D. Belote, Esq.CMA Legislative AdvocatesReal Estate IssuesFront and Center For 2021f the analogy was to a horse race, wemight say that the California Legislatureis “off and running” for 2021, the first yearof the new 2021-2022 session. During thepandemic, however, we really should saythat the state Senate and Assembly are“off and limping” to begin the legislativeyear, as 2021 is beginning in the sameremote fashion as last year. To be clear,the legislative process does not functionwell in a remote environment: in a recenthearing on evictions, an overwhelmedAT&T conference operator attemptedgamely to shepherd nearly 1000 landlordsand tenants wishing to testify on a bill. Theresult was exactly what would be expected,with barking dogs, crying babies, badconnections, disconnections, drunk callers,abusive callers, and even people calling inon the wrong bill.It turns out that legislating and lobbyingis both more effective and more efficientwhen done in-person. Who knew? Butin contrast to restaurants and baseballgames, which might be able to functionwith reduced capacity, the Capitol prettymuch has to be either open or closed.Because the building cannot accommodateunlimited visitors in the near-term, theremote environment is likely to continuefor some time.Several of the key issues of particular focusthis year have implications for CMA. OnSpring 2021evictions and foreclosures for example,a budget trailer bill already has beenenacted extending eviction protectionsuntil summer. Legislators believe, correctlyor incorrectly, that an unlawful detainertsunami will occur when the moratoriumends. Foreclosures are a good deal morenuanced, in that foreclosure rates are notrising significantly, forbearances largelyseem available for those affected by thepandemic, and property owners stillhave equity, because of the increases inhome values. But with the recent CFPBproposal on foreclosures, it is likely thatCalifornia legislators will want to visit theissue this year.A second key issue with ramificationsfor CMA members is housing andhomelessness. Of the over 2500 discreetpieces of legislation introduced for 2021,literally hundreds relate to housing insome fashion. Given the personal interestof Senate President Pro Tem Toni Atkins inthe housing shortage, it is very likely thatlegislation will be enacted this year. Buthousing has proven to be a veritable Rubik’sCube of complexity in the past, becauseof the multiplicity of interests involved,including local governments, NIMBYs,YIMBYs, lawyers, labor, environmentalists,builders, and more. Probably every subjectinvolving the creation of housing is thesubject of bills this year, including suchdisparate topics as local fair allocationsof housing needs, zoning, CEQA, finance,and many others.Third, Governor Newsom and thelegislature are concerned about wildfiresand homeowners insurance availability.As this column is written, the legislature isconsidering a budget trailer bill allocatingover 500 million for wildfire costs andprevention, including home hardening.Obviously nothing could derail a healthyreal estate market faster than the inabilityto obtain homeowner’s insurance, so thistoo is a big issue.Beyond these mega-issues, CMA is alsoinvolved in numerous individual bills,including the following: SB 373: Economic AbuseWould prohibit collection activitiesin situations where various personsspecified in the bill opine that thedebt is the result of “economic abuse,”broadly defined to include, amongother circumstances, defrauding thedebtor of money or assets, in theprovision of products and services.Real property-secured loans are notexempt.continued on page 29Page 5

Page 6Spring 2021

Mayumi BowersVintage Mortgage, Inc.A “Wyatt” Standardfor Insurance Brokers?n November of 1966, Joseph and Clarice Wyattwalked into the Stockton office of Union HomeMortgage to borrow 2,500.They had no idea that the loan(s) they would get,and the ultimate litigation, would be referencedin numerous lawsuits against brokers, well intothe next century.Union, as a broker, failed to draw Wyatt’sattention to specific, unfavorable clausesin the loan, allegedly “breaching theirfiduciary duty.” They were found, amongother allegations, to have engaged in a“conspiracy” against the borrower. The caseis often referenced in litigation, to indicatea broker’s duty to look out for the interestsof the borrower.Punitive damages were awarded againstthe broker – 200,000. That was “a lot ofmoney” in 1979, the year the broker losttheir appeal.In the world of insurance brokerage, a newdecision, Murray v. UPS Capital Management,seems to impose a “Wyatt-like” duty oninsurance brokers.Spring 2021Basically, Murray sued the insurance brokerfor failing to make the insurance policyunderstandable. (Can insurance brokersreally do that?) The policy he purchaseddidn’t even cover the ultimate loss againstwhich he sought to be insured.The decision considered that the broker,(UPS) held themselves out as specializing inthe type of insurance purchased by Murray.In lawsuits against mortgage brokers, Wyattv. Union Home Mortgage is cited in at leastone out of three cases. It’s interesting tosee Murry v. UPS as the “Wyatt” of insurancebrokerage. More important to us, it mayhelp expand our understanding of thecontinued on page 8Page 7

Wyatt – continued from page 7standards imposed by Wyatt, somethingwe should all be aware of.Consider Googling Wyatt v. Union HomeMortgage. Reading the first eight or soparagraphs will give you a good overviewof the issues.An interesting note, one of the attorneys inthe appellate case was Bruce H. Newman,who was the original General Counsel forCMA (before Phillip M. Adleson and now,Robert Finlay).A special thanks to Attorney Craig Forry,of Forry Law, author of the followingarticle about Murry v. UPS Capital InsuranceAgency, Inc. He was kind enough to allowus to provide his article along with thisintroduction. I’m fortunate to be on Mr.Forry’s e-mail list (www.ForryLaw.com).Murray believed he purchased appropriateinsurance to cover the loss, but the insurancecompany denied his claim.Murray sued his insurance broker, UPS CapitalInsurance Agency (UPS Capital), for breachof contract and negligence. He asserted UPSCapital owed him a special duty to make theinsurance policy language understandable toan ordinary person and to explain the scopeof coverage. The court granted UPS Capitalsummary judgment after concluding therewas no heightened duty of care and dismissedMurray’s lawsuit.On appeal, Murray asked to create a new rulethat brokers/agents, specializing in a specificfield of insurance, who hold themselves outas experts, are subject to a heightened dutyof care towards clients seeking that particularkind of insurance.That same day, Tokio Marine AmericaInsurance Company (Tokio) issued a MarineCertificate of Insurance (Certificate), whichMurray believed fully insured the shipmentin the event of any loss or damage byUPS. The Certificate contained a FreeFrom Particular Average (FPA) provision,providing a limitation on coverage.At some point during the shipment toTexas, UPS damaged the equipment andMurray submitted a 36,666.85 claim.Tokio rejected the claim on the groundsthe coverage Murray purchased did notcover the loss. Specifically, Tokio arguedthe Certificate’s FPA provision did not applyto the shipping damages.The appellate court declined the invitation tocreate a per se rule; however, it reversed thejudgment and remanded the matter, and indoing so confirmed some basic principles ofliability for insurance brokers/agents.Murray later learned the policy coveredonly catastrophic losses such as the entiredestruction of the vehicle in which theshipment was carried by UPS, and notdamage caused by factors other than acatastrophic loss such as mishandling thefreight or other causes.Forry ArticleIntroductionIn the recent decision in Murray v. UPSCapital Insurance Agency, Inc., the Californiaappellate court reversed the trial court’sgranting of summary judgment, andremanded the action for a jury trial, becauseMurray raised triable issues of fact as towhether UPS Capital undertook a specialduty by holding itself out as having expertisein inland marine insurance, and Murrayreasonably relied on its expertise.Murray purchased used computer equipmentworth nearly 40,000, which was damagedby the United Postal Service (UPS) while it wasbeing transported from California to Texas.Page 8In 2018, Murray contacted UPS Capitaland requested insurance coverage for ashipment that same day from Californiato Texas. He completed UPS Capital’s formapplication for a house policy coverage andpaid 350. On the form, Murray describedthe shipment as used computer equipmentvalued at 37,000.Murray sued UPS Capital, and his negligenceclaim was based on the premise UPS Capitalowed a special duty to the public and toMurray to exercise reasonable care in itsdealings including a duty of disclosure toinform Murray of the products availableto cover in-transit cargo loss and damagein the absence of a catastrophic loss andfurther to fully explain technical provisionssuch as the FPA provision.Murray maintained UPS Capital breached itsduty of care by failing to fully explain the FPAcontinued on page 9Spring 2021

Wyatt – continued from page 8provision in the Certificate, by not disclosingother available insurance products toMurray, and by not giving Murray theopportunity to purchase insurance thatwould cover loss or damage caused byfactors other than a catastrophic loss.Murray argued an insurance agent mayassume additional duties by an expressagreement or holding itself out as being aspecialist. Because UPS Capital held itselfout as having expertise, it had a duty toinform Murray of the basic coverage detailsof the insurance policy.The trial court granted UPS Capital’s motionfor summary judgment and dismissed thelawsuit, concluding California law is wellsettled as to the limited duty of insurancebrokers, which is only to use reasonablecare, diligence, and judgment in procuringthe insurance requested by an insured.Murray contended the trial court erredbecause he presented facts establishingUPS Capital owed a heightened duty toadvise Murray that All-Risk insurance wasSpring 2021available and/or explain the limitations ofFPA coverage.limited coverage available to ship his usedgoods with UPS.The appellate court found no publishedcases on the issue of whether insurancebrokers, selling one kind of policy,automatically assume additional dutiessimply because they are specialists,implicitly holding themselves out as havingexpertise in that given field of insurance.Murray proposed it create a per se ruleimposing a heightened duty of care forall specialized agents/brokers.As a general rule, an insurance agentassumes only those duties found in anyagency relationship such as reasonablecare, diligence, and judgment in procuringthe insurance requested by an insured.While the appellate court declinedto institute such a rule, it concludedpublic policy supports the creation of areasonable inference of expertise whenthere is evidence the agent specializes ina particular field of insurance.The undisputed evidence of UPS Capital’sspecialization, in addition to Murray’sother evidence, created a triable issue ofmaterial fact that, if found true in Murray’sfavor, would show UPS Capital assumed aspecial duty to advise Murray about theAn insurance agent has no duty toaffirmatively advise an individual seekinginsurance about different or additionalcoverage. There is no fiduciary duty to (1)make available to them a particular kind ofinsurance, (2) advise them of the availabilityof such coverage elsewhere in the industry,or (3) advise them of inadequacies incoverage of which plaintiffs should, asreasonable persons, have themselvesbeen aware.However, an insurance agent may assumea greater duty to the insured when one ofthe following three exceptions arise: (a) theagent misrepresents the nature, extent orcontinued on page 10Page 9

Wyatt – continued from page 9scope of the coverage being offered or provided, (b) there is arequest or inquiry by the insured for a particular type or extentof coverage, or (c) the agent assumes an additional duty by eitherexpress agreement or by holding himself out as having expertisein a given field of insurance being sought by the insured.Whether a duty of care exists is a question of law for the court.Also, whether, and the extent to which, a new duty is recognizedis ultimately a question of public policy. Any extension of theexisting exceptions or creation of a new duty is ultimately aquestion of public policy.The appellate court found no case law specifically defining thephrase “holding themselves out as having expertise,” but itdiscussed the factors that should be considered when applyingthis exception, as discussed in the 1997 decision in Fitzpatrick.The Fitzpatrick first of three exceptions, when the agentmisrepresents the nature, extent or scope of the coveragebeing offered or provided, was based on the court‘s analysis ofthree cases: Nacsa – agent misrepresented policy provided fullcoverage to replace business personal property in case of totalloss; Desai – agent misrepresented insured getting 100 percentreplacement cost coverage with real property insurance policy;and Free – homeowner specifically inquired if coverage limitsadequate to rebuild home.inquiry), Murray’s evidence raised a triable issue of material factregarding application of the third exception (holding itself outas having expertise).The case was remanded to permit a jury to resolve the triableissue of material fact as to whether UPS Capital was holding itselfout as having expertise in a specialized area of insurance, andtherefore, assumed a heightened duty of care.LESSONS:1. The duty of insurance brokers/agents is limited to those foundin any agency relationship such as reasonable care, diligence,and judgment in procuring the insurance requested by aninsured.2. An insurance agent may assume a greater duty to the insuredwhen one of the following three exceptions arise: (a) the agentmisrepresents the nature, extent or scope of the coveragebeing offered or provided, (b) there is a request or inquiry bythe insured for a particular type or extent of coverage, or (c) theagent assumes an additional duty by either express agreementor by holding himself out as having expertise in a given fieldof insurance being sought by the insured.Craig B. Forry, Esq., FORRY LAW GROUP, (818) 361-1321 ForryLaw@Aol.com.The second exception, when “there is a request or inquiry by theinsured for a particular type or extent of coverage”, was based onWestrick, where an insurance agent failed to disclose facts aboutimmediate coverage for a recently purchased truck in responseto a specific inquiry about coverage. The court determined theagent had a duty to explain a limiting provision to the insuredbecause the insured made prior inquiries regarding coverage of awelding truck under his existing policy and the agent had superiorknowledge of the scope of the policy’s automatic coverage clause.The third exception applied when “the agent assumes an additionalduty by either express agreement or by ‘holding himself out’ ashaving expertise in a given field of insurance being sought bythe insured.The appellate court concluded in Murray that neither caseauthority nor public policy support creation of a per se ruleregarding specialists, but rather courts must utilize a totality ofthe circumstances approach.Evidence of specialization at a minimum creates a presumptionthe agent/broker anticipates their clients will rely on theiracknowledged expertise, and supports courts imposing anextended duty.While UPS Capital’s evidence adequately refuted applicationof the second exception (applicable when there is a request/Page 10Spring 2021

Odell MurryMAI FinancialServices, Inc.Can Private Money Fuelthe Recovery Once Again?As the Pandemic Retrenches, Private Money Steps Upn comparing the 2020 COVID -19Pandemic to the Great Recession of2007, there are some major differences,but some similarities. During the GreatRecession of 2007 institutional lenderswere quick to batten down the hatches, themoney stopped flowing, and the resultinghasty retreat of institutional lenders allowedprivate lenders to get involved to keepthe gears of the real estate sector of theeconomy from locking up completely. Astraditional lenders backed away, privatelenders seized the moment and steppedin to fill the void.Today’s economic indicators and the moodmay feel reminiscent of the lead-up to theGreat Recession of 2007. Like with thateconomic disaster, the stock market hasremained stubbornly strong throughoutthe COVID-19 pandemic, despite concernsof a record number of people out of work.The lock-down has hampered much ofregular economic activity, but at the sametime, it has led to record levels of personalsavings. At the start of 2021, there aresome 10 million Americans behind on theirrent and mortgages, and it appears thatgovernment programs are the only thingpreventing a massive crisis in the housingmarket, but that crisis showed signs ofbubbling up to the surface as indicated byfalling rental prices in pricey coastal metrosSpring 2021during late fall and early winter. Since thenrent prices have already begun to climbagain, but it is still too soon to tell if thatrally will be sustainable without continuedgovernment intervention.It can be said that the federal governmentcertainly has intervened more quicklyin this case than in the Great Recession.The Federal Reserve swiftly dropped theFederal funds rate to near-zero, resumedprograms to purchase massive amountsof securities, backstopped money marketmutual funds, and vastly expandedthe scope of its repurchase agreementoperations. Congress approved a 1.8trillion package on March 27, 2020, whichincluded 500 billion in direct payments toAmericans, 208 billion in loans to majorindustries, and 300 billion in Small BusinessAdministration loans. Nine months later,a 2.3 trillion spending package, whichincluded a second round of stimulus, wassigned into law.The question is, what happens if the marketsperceive that government funding dries up,or that the funding provided simply isn’tenough to stave off calamity? Institutionallenders do not manage upheaval the waythat private lenders can. As a result, theopportunity for private lenders may behere again. It may then be up to privatelenders to once again “Save the Day,” as theprivate lending industry did so admirablyin 2007 and 2008.Collapse of EmploymentThe unemployment figures have been dire,as whole sectors of the service economywere paused or diminished because ofCOVID-19 lock-down policies. In April2020, the U.S. unemployment rate peakedat 14.7%, and it has only scaled down to6.4% in January 2021. As we all know, thosenumbers likely are worse among people ofcolor and women, who economists say arebearing the brunt of this economic disaster.Even a short-term interruption in employment can have disastrous consequenceson credit scores for some potential homebuyers, as bills become past due. If federalrecovery programs fail to keep pace witheconomic need, the credit picture for manyhome-buyers, at least with institutionallenders, may grow even murkier.Reshaping of the Real Estate SectorWe are likely to see a dramatic reshapingof the real estate outlook, and it may havereal ramifications for institutional andprivate lenders. Office, retail, vacation, andhospitality real estate all saw a significantcontinued on page 12Page 11

Recovery – continued from page 11dip in value in 2020, and the bottom forthat dip isn’t predicted to come for sometime, according to a recent BloombergNews Report. Also, people are rethinkingwhere they are living and working, bothbecause of the pandemic and becausecompanies have been forced to realize thattechnology allows a dispersed workforce towork effectively and, in some cases, moreefficiently than they would in an office.This means that investments in urban andoffice real estate, once sure bets, are nowon shakier ground.All this may spook institutional investorsfrom putting money down on large-scaleprojects. However, there may be a needfor more small-scale lending for housing inthe suburbs and rural America, as peopleflee to places with more space and are nolonger tied geographically to their jobs.Filling the VoidPrivate lenders have proven they can stepin when institutional lenders waver. WhilePage 12the Great Recession was devastating for thereal estate market, it was private money –gathered from private individuals, pensionfunds, IRA’s, and other private investors –which proved a source of key capital duringthe recovery. For example, In 2012, privatelyfunded multifamily property loans in theUnited States went up 22% over 2011, andprivately funded loans for retail propertyincreased by 17%.These are indeed turbulent times, and it isimpossible to predict fully what the close of2021 will look like in the economy or the U.S.real estate market. What we can say withsome confidence is that history has shownthat private investors may be the lubricantthat keeps the gears of the real estate sectorfrom locking up in times of crisis, and theylikely will be called on to play a large rolein this latest recovery effort.Private lenders are able to navigate moreturbulent terrain because their definitionsof risk and success are fundamentallydifferent from traditional mortgage lending.Private loans are typically based on theamount of equity in a property, rather thanon the borrower’s individual credit score,for example. And private investors aremore concerned with seeing a solid planfor a good rate of return on investmentthan with credit scores, and that may leadthem to find good investments wheninstitutional investors turn their back oncertain borrowers in the real estate market.Odell Murry is founder and president of MAIFinancial Services Inc., a private-mortgagecompany and institutional commercialmortgage broker. He is also a board memberand past president of the California MortgageAssociation. Murry originates institutionaland private-mortgage loans on apartments,industrial, retail and most other incomeproducing commercial real estate. He alsoserves as chairman of the National AdvisoryBoard of the University of MassachusettsW.E.B. Du Bois Center. You can contact OdellMurry at OMurry@MAIFunding.com or (866)MAI-FUND.Spring 2021

Zachary J. Fiene, Esq.Wright, Finlay & Zak, LLPT. Robert Finlay, Esq.Wright, Finlay & Zak, LLPAm I a “Debt Buyer?”Understanding the New Wave of DebtBuyer Statutes and Their Impact onServicing Non-Performing Mortgage DebtThe financial goal of every debt buyeris uniform – maximize your returnon investment. As the debt buyingmarketplace expands, states are enactinglaws to regulate the industry and protectconsumers. The only thing more damagingto your bottom line than a poorer thanexpected return on a purchased debt isfinding yourself in a lawsuit where yourexposure is in the tens of thousands ofdollars because you unknowingly violateda new state law. California and Texas aretwo states who have recently passed“debt buyer statutes” aimed at companiespurchasing charged-off debt on thesecondary market. This article exploresthe impact of those laws on debt buyers,the potential applicability to residentialmortga

For the entrepreneurial CMA members, it would be a “roller coaster on a flat track.” Sometimes, although we ride a roller coaster ride every day, we want to make it wilder than it already is. Perhaps, it i