Transcription

2021–2022CN Winter Plana l l i n to g e th er

22 0 2 1 –2 0 2 2 c n w i n t e r p l a n

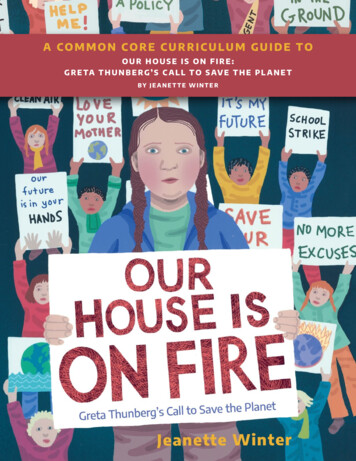

table ofcontents1. Message from JJ Ruest5Highlights of Winter Preparedness Measures72. 2020–2021 Results9Challenges of Winter 2020–202110Recurring Challenges11Lessons Learned133. The Plan for Winter 2021–202216Current Rolling Stock and Track/Yard Capacity16Current Procedure‑Induced Capacity18Projected New Capacity and Resilience204. Conclusion23Annexes25A. Toward a Strong and Lasting Recovery25B. Winter Impact on CN’s Network26p h o t o a b ov e :Geikie, ABc ov e r p h o t o :Hillsport, ON2021–2022 cn winter plan3

42021–2022 cn winter plan

1Message fromJJ RuestCN is pleased tosubmit its 2021–2022Winter Plan: Allin together.The objective of CN’s 2021–2022Winter Plan is to ensure that ourpeople and equipment remainready to face winter. It outlinesthe measures and investmentsCN has undertaken, and willcontinue to make, to meet therequirements of our customerssafely and efficiently duringthe harsh weather ahead.Additionally, a prudent and wellexecuted winter plan enhances Canada’s reputation as a reliable andquality supplier to international markets. This report keeps everyonefocused on moving freight and maintaining the integrity and smooth flowof supply chains even during the challenges of winter in Canada and thenorthern United States.The winter of 2020–2021 unfolded during the pandemic. It also markeda sharp, yet uneven, recovery in CN’s traffic volumes of the differentcommodity groups. During that time, CN reports having hauled 162 billiongross ton‑miles (GTM), representing our best performance ever. Thiswas the result of three main factors: the unrelenting dedication of ourrailroaders and the other players in the end‑to‑end supply chain; theimplementation of best practices to mitigate the effects of extreme cold;and the injection of more than 10 billion in capital investment over thelast three years, which enhanced our resilience, in addition to safetyand capacity.Moose Lake, BC2021–2022 cn winter plan5

“The objective ofCN’s 2021–2022Winter Plan isto ensure thatour people andequipmentremain readyto face winter.”Vegreville, ABthis photo was taken beforecovid‑19 restrictions.Because we understand our crucial role in keeping the economy runningsmoothly and the importance of investing to support future growth, weplan to invest nearly 3 billion in 2021. These investments include keyinfrastructure projects and equipment renewal, further improving ourrecoverability after disruptions.Extreme conditions are inevitable in Canada, and increasingly so as theplanet deals with a changing climate. Again this year, we are applyingthe many lessons learned in the past. We will work with our customersto create accurate and timely forecasts of volumes and shippingpatterns. These forecasts are essential to our resource and demandplanning, especially given the fluctuations in business levels during theseuncertain times. In that regard, we recognize the extremely dry conditionsexperienced by Western grain farmers in 2021 and the negative effectsthey have had on crop production for the start of the 2021–2022 cropyear. This will impact grain shipment volumes during winter 2021–2022.We will continue to align all components of the supply chain, frommanufacturers to ports and yards, for the benefit of our customers andthe economic recovery of Canada. And we will do so safely. We cannotoveremphasize that fact. The safety of our employees, our customers, andthe communities in which we operate remains a core value of our company.We are well positioned to overcome the challenges of the coming winter.We will move our customers’ goods, going all in together.JJ RuestPresident and CEO62021–2022 cn winter plan

Highlights of Winter Preparedness MeasuresNearly 3 billion in capitalinvestments in 2021,Conforming to newtrain speedrestrictionsincluding lengthening sidings, addingsections of double track, expanding yardcapacity and modernizing rolling stock,in addition to regular maintenanceObtaining accurateand timely forecastsAdding track patrols,of volumes and shippingpatterns from our customersdeploying stand‑by engineering crewsKeeping consistent flow ofair through the brake linesMonitoringavalanches,landslides,water levelsby using more Distributed Braking Cars andby systematically changing the gaskets of airhose connectorsApplying ourthree‑tier trainlength systemAcquiring, in 2021–2022,75 additional AC locomotives andusing power efficiency technologyTaking delivery, in 2021–2022, of1,000 additional high‑capacitygrain hopper carsHavingsnow‑clearing andsnow‑melting equipmentreadyPutting in placeextreme weather readiness plans,inspection and audit programs, employeetraining programs, and strategiesinvolving non‑rail modes of transportAdjustingstaffing levelsApplying riskmanagement principlesto decision‑making processesrelated to operationsStagingemergencyballast andtrack panels2021–2022 cn winter plan7

82021–2022 cn winter plan

22020–2021ResultsWhen planning to meet the needs of itscustomers for winter 2021–2022, CN closelyexamined its 2020–2021 record and drew onthe lessons learned over the years.Overall, CN hauled 162 billion gross ton‑miles (GTM) during winter12020–2021, up 4.6% in comparison to the 2019–2020 winter, andup 1.8% from our previous record of 159 billion GTM moved duringwinter 2018–2019.The graph below shows CN’s GTM over time.CN’s GTM over Five Wintersbillions of 021— Total1Vegreville, ABthis photo was taken beforecovid‑19 restrictions.From a CN data collection point of view, winter runs from December 1 to March 31. However,from a CN operational standpoint, winter conditions often start in November (or as early asOctober in certain regions) and sometimes last well into April.2021–2022 cn winter plan9

Challenges of Winter 2020–2021Last year’s exceptional results were achieved while facing the following challenges specific to winter 2020–2021: COVID‑19. At its onset, the pandemic provokedstrong demand for Western Canadian grain, ascertain countries increased their inventories. However,all other commodity groups plunged dramaticallybefore starting to recover, with varying degrees ofintensity, in the fall of 2020. These uncertainties,along with significant transportation demandfluctuations during winter 2020–2021 forced CN toconstantly adjust its resource levels to meet customerdemand while implementing a comprehensive setof protectionary protocols against COVID‑19 withinits workforce. As a result, the timely availability ofcrews was sometimes compromised. Early snowstorm. In November 2020, WesternCanada experienced an unusual early winter storm,with a significant accumulation of snow in somesections of the network. This had the effect oftriggering CN’s winter season earlier than on thetypical date of December 1. Extreme cold. CN experienced a 10‑day sequenceof extreme cold in Western Canada (under ‑25 C)in February 2021, forcing a combination of smallertrains and stoppages for safety reasons.Coldest Points on CN’s Main Line 221/51/19— Daily Lows102021–2022 cn winter plan2/2— Daily Average2/163/23/163/30

Sillery, QCRecurring ChallengesEvery winter brings recurring and often inter‑relatedproblems, intrinsic to running a northern railroadduring that time of the year. They include: Physical properties of steel. Severe cold is hardon steel. It places extra stress on steel wheels, andwelded steel rails become less flexible.2 This canreduce the volumes CN is able to move, regardlessof the investments in infrastructure and experiencegained in optimizing cold weather service. Air brake system. At ‑25 C and below, frozengaskets leak air at brake hose couplings, airhoses freeze and air cannot move consistentlythrough the full length of the compressed air brakesystem, thus rendering the system vulnerable tomalfunction, forcing train length reductions. Snow. Although generally secondary to the effectof cold, snow can disrupt rail operations, forcingtrains to slow down and increasing the risk ofcongestion on the network. Snow clearing in railyards requires extra switching and resources. Terminal operations. Customers’ operations atterminals are also affected by winter. When thedestination terminal cannot accommodate railtraffic, CN must occasionally hold trains at originor along the route. That equipment then takeslonger to return for loading, creating delays anddisruptions in the supply chain upstream.Persistent heavy rainfall also affects terminaloperations. At the Port of Vancouver, ongoingheavy rainfall occasionally prevents some exportterminals from loading grain vessels. Consequently,CN must sometimes split and/or stage trains tomanage the supply chain fluidity issues that canresult from terminal operations issues.2In addition, ice crystals wear down wheel treads, all leading to more frequent rail breaks and associated delays. CN has proceeded to eliminate upto 38,319 joints since February 2019 on continuous welded rail and has produced a video titled “The Tipping Point,” which explains the impact ofwinter on rail operations �2022 cn winter plan11

Every winterbringsrecurringand ofteninter-relatedproblems,intrinsic torunning anorthernrailroad duringthat time ofthe year.Saint-Lambert, QC Closure of the Port of Thunder Bay and the locks of the St. LawrenceSeaway. These closures during winter remove up to 1,250 CN unloadsper week at peak demand for grain, significantly affecting the capacityof the entire system. Track disruptions. The very nature of any rail network makes itvulnerable to washouts, rock falls, landslides and other natural hazards.CN invests heavily in technology to detect and mitigate these events.Railroads are also facing the impacts of climate change on theirinfrastructure. Accordingly, while rail is part of the solution against climatechange3, the industry must adapt. For winter operations specifically,climate change is affecting the intensity, frequency, and duration of coldsnaps and precipitation. Washouts, persistent rain, floods, avalanchesand landslides are likely to become more common as well.Potential outcomes of climate change, including temperature extremes,flooding, hurricanes, and tornadoes, create physical risks to CN’snetwork as well as legal, policy and market impacts. Through itscross‑organizational risk assessment processes,4 CN identifies, monitorsand mitigates those risks. Mitigation measures include some of theinvestments and best practices presented in this document.3Shifting freight from truck to rail can reduce greenhouse gas emissions by up to 75%. A single train can allow to remove up to 300 trucks from theroads. Rail is approximately four times as fuel efficient as trucking, and CN continues to lead the industry, consuming 15% less locomotive fuel pergross ton‑mile, versus the average of its industry peers.4The likelihood of a risk occurring and its impacts if it does occur are ranked on a scale from low to high. CN then determines mitigation activitiesand assigns ownership of the risk to the appropriate level.122021–2022 cn winter plan

Lessons LearnedThis year’s Winter Plan incorporates important lessonslearned from past challenges.1The first lesson pertains to CN customerforecasts. In winter 2020–2021, CN experiencedchallenges sourcing crews in a timely fashionbecause of the uncertain demand brought on by thepandemic. This was due to:Railroads are alsofacing the impactsof climate change ontheir infrastructure.Accordingly, while railis part of the solutionagainst climate change,the industry must adapt. The uneven recovery across CN’s businesssegments, resulting in challenges in determiningwhen and how many crews to recall to best meetshifting demands. The time between the recall of furloughedemployees and the completion of the safetytraining refresher required as a condition of fullyresuming work.Customer forecasts are critical to having thenecessary resources in place to move customer trafficand to creating adaptive contingencies. Frequentand open communication with customers ensurescustomer forecast updates are shared, allowing CNto adjust plans accordingly. Furthermore, maintainingopen lines of communication fosters collaborationbetween CN’s team, customers and supply chainpartners, making it possible to balance customerdemand with supply chain capacity.Levis, QC2021–2022 cn winter plan13

2The second lesson relates to CN’s 10Bcapital investments over the past three years,including in rail infrastructure and rolling stock.In addition to regular maintenance, these investmentshave formed the building blocks upon which CN hasincreased — and continues to increase — its capacity,fluidity and resilience, while enhancing safety. Wintersare known to cause network disruptions. And whenthese occur, it becomes imperative to resume fulloperational status rapidly. What used to take CNapproximately 30 days to completely recover froma major network disruption four years ago can now beachieved in two weeks or less, due to the additionalresilience acquired by lengthening sidings, addingsections of double track, expanding yard capacity andmodernizing rolling stock. Technology also plays arole. For example, when algorithms can take over someof the workload associated with defect detection by thehuman eye, key personnel can devote their time andexpertise to recovery efforts and the repair of equipment.Les Coteaux, QC3The third lesson pertains to the importanceof supplementing a consistent flow of airthrough the brake lines of the train, the singlemost important factor in keeping our customers’shipments moving during winter. This is done usingDistributed Braking Cars5 and Distributed Powerlocomotives6. Both help to charge the brakingsystem, maintain pressure, and propagate brakingcommands from the lead locomotive all the wayto the end of the train. In cold temperatures, thisenables CN to maintain longer trains, unlockingcapacity. CN ensures these Distributed Braking Carsare strategically deployed along the network formaximum effect during periods of extreme cold. CNhas also analyzed data from the 2020–2021 winterseason to maximize the effectiveness of these cars,developing standards for air source configurationand location in train consists.4The fourth lesson is the importance of awell‑functioning supply chain. Aligning allcomponents of the supply chain and ensuringpartner infrastructure is well prepared for winter isalso key. Thanks to CN’s proactive approach, thereare now over 50 grain elevators in Western Canadaalone in addition to other industries equippedwith a ground air source, which makes it possiblefor their loaded freight cars to be released to CNwith air hoses already attached, allowing trains todepart more quickly from origin, thus improvingnetwork fluidity.5Distributed Braking Cars are CN‑modified boxcars containing air compressors and brake system associated equipment.6Distributed Power is a system installed on a locomotive that allows a train to be configured with additional locomotives in its middle and/or tail end,rather than only at the front.142021–2022 cn winter plan

Entwistle, ABthis photo was taken beforecovid‑19 restrictions.5The fifth lesson calls for strict adherence toCN’s three‑tier system, which prescribesspecific train length reductions in cold weather,per the chart shown in the next section. These lengthrestrictions have proven effective in keeping thenetwork safe and fluid.6The sixth lesson is regulation of train speeds.CN is pleased with the decision from theMinister of Transport to revisit the initialMinisterial Order regarding the speed of trainstransporting some crude oils and liquid petroleumgases in winter conditions. In its 2020–2021Winter Plan, CN raised the issue that the previousOrder, based on calendar dates, would have adverseunintended consequences on the fluidity of winteroperations7. The new version of the Order still limitsthe speed of these trains but, importantly, it does sobased on ambient temperature. This Ministerial Orderis in addition to CN’s self‑imposed speed restrictionthrough its Cold Weather Slow Policy, a standingoperating procedure that includes mandatory sloworders and bulletins to crews for train movement atspecific extreme cold temperatures.7The seventh lesson is the critical importanceof working in unison, especially during winterconditions. Therefore, CN temporarily locatesemployees from support sections in operation centresto assist chief dispatchers with troubleshooting. Thearrangement pools expertise, with beneficial results.Finally, CN’s customers must be just as ready forwinter. This is why CN meets with them prior to theonset of winter to explain how they can ensure thesafety of winter operations at their sites. CN alsomaintains a website (www.cn.ca/winter), wherecustomers can find videos, winter checklists, a trackinspection guide and a customer safety handbook.7The imposed slowing of these trains has the domino effect of slowing all subsequent trains on the network (similar to cars behind a snowplough onthe highway), which in turn reduces capacity and risks congestion at the time of year when rail already faces difficult operating conditions.2021–2022 cn winter plan15

3The Plan forWinter 2021–2022CN has prepared this Winter Plan inaccordance with the requirements of Canada’sTransportation Modernization Act and with inputfrom key stakeholders. This section explainshow CN is getting ready for this coming winterthrough various investments and best practices.Current Rolling Stock and Track/Yard CapacityCN’s capital investments over the past three years included severalmulti‑year maintenance and capacity‑boosting projects, aligned tomarket demand. These projects have significantly enhanced safety andincreased CN’s resilience in dealing with and recovering from severeweather, network disruptions and other events that can alter networkfluidity. More precisely, those investments included: 260 additional locomotives, for a total of more than 2,200winter‑prepped locomotives. Locomotives tend to lose traction due toice, snow and water, resulting in wheel slippage. To deal with that issue,these locomotives are 100% alternating current and, as such, havebetter traction than direct current systems8. 101 Distributed Braking Cars, allowing to maintain train lengths incold temperatures. Delivery of 1,500 high‑capacity grain hopper cars9 purchased in 2020,bringing the total number of such cars in service between 2018 and thepresent to 3,500.Oban, SK162021–2022 cn winter plan8These locomotives can maintain greater horsepower by disabling the wheel that sensesslippage and rebalancing the horsepower among the remaining traction motors.9Each car will move more grain due to its increased volume (5,431 cubic feet vs. 5,150); reducedlength, making it possible to attach more hopper cars per train; and reduced weight, meaningCN can haul more grain per car.

Winnipeg, MB Addition and lengthening of sidings (up to 12,000 feet long), wheretwo trains can meet and pass safely without impacting network fluidity. Total of 150 miles of double track on CN’s mainline, building capacityto move more traffic. Major yard expansion projects in key locations for greater throughput. Ten automated track inspection cars,10 which can operate at trackspeed. This creates network capacity because track time is no longerconsumed by inspection vehicles. It enhances safety as inspections areundertaken more frequently, and, by leveraging technology instead ofthe human eye, performed more consistently.Theseprojects havesignificantlyenhanced safetyand increasedCN’s resiliencein dealing withand recoveringfrom severeweather,networkdisruptions andother eventsthat can alternetwork fluidity. Seven automated inspection portals (AIP),11 allowing for the fullinspection of a train at track speed versus a roll‑by inspection at traindeparture from a yard. This feature will significantly improve safety,fluidity and yard capacity when, from a regulatory standpoint, AIPs areallowed to replace human inspections.10These cars are equipped with the latest sensor and artificial intelligence technology, allowing CN to assess, as trains go by, track gauge, geometry,and alignment to identify defects before they become an issue.11The portals have high-resolution imaging hardware coupled with powerful machine learning software.2021–2022 cn winter plan17

Current Procedure‑Induced CapacityCN has implemented the following operational procedures — or best practices — which also increase capacityand resilience, and maximize network fluidity while improving safety: Establishing a three‑tier system to determine the maximum permissible train length allowed at certaintrackside temperatures as per the chart below:Maximum Train Length (in Feet) Allowed at Specific Temperaturesa – dp (1 1 0)tierleveltemperature c fconventionalheadto midmidto end– additionalb – dp (1 0 1) c airsourcesheadto end3rd, 4th, 5thair sourceNon Intermodal, Non Single Commodity Bulk TrainsTier 1‑25‑137,0006,6673,33310,000Tier 2‑31‑245,0005,0002,5007,500Tier 3‑36 orlower‑33 orlower4,0004,0002,0006,000Intermodal and Single Commodity Bulk TrainsTier 1‑25‑138,0008,0004,00012,000Tier 2‑31‑246,0005,6672,8338,500Tier 3‑36 orlower‑33 orlower4,5004,5002,2006,700Notes:1. For the purposes of this table, Distributed Power (DP) can be remotelocomotives or Distributed Braking Cars.2. For manifest trains running DP 1x0x1, the maximum length allowedfrom head end to DP remote is 7,500 feet.182021–2022 cn winter planFor each air sourceadded beyondthe configurationcorresponding tocolumns A and B,train length canbe increased by2,000 feet (2,500for Intermodal andSingle CommodityBulk Trains) peradditional air source,up to a maximumlength of 12,000 feet.A maximum of fiveair sources to beused on a train.3. Iron ore trains on the former DMIR territory are excluded fromthese restrictions.4. The specified temperatures refer to the coldest forecastedtemperatures between the train’s origin and destination.5. Column C does not apply to key trains.

Detecting defects on bearings, wheels and variouscomponents. Sensor systems embedded in tracksgenerate alarms when defects are detected. Thistechnology allows for preventive action, such as thereplacement of suspect wheels in preparation forwinter, before component failure. Using advanced weather forecasts to plan anddevelop contingencies for extreme weather events.With early warning, resources can be moved intothe regions that are going to get hit the hardest byextreme weather, with emphasis on keeping yardsfluid and preventing congestion. Actively managing the fleet by deploying carsoutside the areas impacted by extreme weather toavoid causing more congestion. Re‑routing traffic when disruptions occur,including over other railways’ lines at CN’s expenseto meet the Company’s commitments. Managing the Vancouver Gateway by holdingtraffic outside of the Lower Mainland until space isavailable and by encouraging terminal owners toproactively manage the flow of inbound railcars,thereby reducing congestion. Monitoring of avalanches, landslides, high‑waterlevels, and other natural hazards is performedby detectors and warning devices located on thetracks or adjacent to the right of way. These includeelectro‑sensors, knock‑over posts, trip wire fencesor water level sensors that trigger an alarm whenabnormal conditions occur. CN also performsactive control of avalanche zones with containedand safe blasting. Planning weather‑related restrictions throughdaily severe weather forecasts, with overnightupdates. CN’s Winter Situation Report13 also relaysreal‑time notices for severe weather that areintegrated into the Company’s rail traffic controlsystem, allowing immediate response, such asadjustments of staffing levels to ensure the snowremoval equipment has operators when needed. Deploying generators across the network to makesure that safety or track equipment, such as railwaysignals, will not be affected by power failures due tocold weather. Systematically changing the gaskets of air hoseconnectors as part of normal car inspections toprevent leaks of air from the brake system. Asnoted, severe cold exacerbates wear.12Winnipeg, MB12CN continues research to identify and implement additional options and new materials that can increase the efficiency of gaskets in cold on-report/2021–2022 cn winter plan19

Preparing snow‑clearing equipment throughinspections, maintenance, repairs, andprepositioning of critical equipment — in advanceof winter — in terminals and areas wheresnow‑clearing needs are most likely, based onhistorical data. CN also uses forced air engines thatprovide quick and thorough cleaning of switches,along with nearly 1,400 snow melters, switchheaters, and other devices meant to keep criticalswitches clear of snow and ice buildup. Responding to uncontrolled events withcontingencies such as adding track patrols, deployingstand‑by engineering crews to remove debris orsnow from the track, and staging emergency ballastand track panels so that CN can respond quickly inthe event of a washout or other track damage.Redpass, BCProjected New Capacity and ResilienceAs part of this year’s plan, CN is adjusting itsresourcing/hiring. Last year, there was significantuncertainty about the course of the pandemic,making it difficult for CN to plan crew resources andmake reasonable assumptions about economicrecovery. This year, with a considerably more reliabledemand forecast in hand, CN is in a better position tocalculate resource requirements.In addition to the existing rolling stock, track andprocedure‑induced capacity described in theprevious section, CN is planning to make new capitalinvestments of nearly 3 billion in 2021. The ongoinginvestments contribute to increasing resilience, akey factor of successful winter operations, especiallywhen recovery from a disruption is in order.They include: More than 1.5B on track maintenance, includingthe replacement of rail and ties, carryingout bridge improvements, and other generaltrack maintenance. More than 250M on double tracks, sidings, andyard track expansion projects, the vast majorityof which being in Western Canada (west ofEdmonton), with, for example, more than 15 miles ofadditional double tracks.202021–2022 cn winter plan

Vancouver, BC vancouver fraser port authority / john sinal photography inc. Recognizing the importance of its West Coast trade gateways inVancouver and Prince Rupert, CN has committed more than 150M tothis area. This amount is supplemented by funds from the Governmentof Canada and the Ports of Vancouver and Prince Rupert, and isearmarked for several multi‑year capacity‑related initiatives underTransport Canada’s National Trade Corridors Fund (NTCF). TheBurnaby–North Shore Rail Corridor Improvement Project, with itscomponents, falls under the NTCF:14 The Thornton Rail Tunnel Ventilation Upgrades, consisting in anew system of ventilation with the addition of jet fans to improvenetwork fluidity and reduce tunnel passage wait time. The Rail Corridor Improvements, consisting in a new 18,000‑footsiding track running from the Willingdon Junction to Piper Avenue.The ongoinginvestmentscontribute toincreasingresilience, akey factor ofsuccessfulwinteroperations,especially whenrecovery froma disruptionis in order. More than 100M on strategic technology projects to enable the nextcompetitive level of modern railroading operation. Rolling stock:15 1,000 new‑generation, high‑capacity grain hopper carsthat will expand capacity and help meet the growing needsof North American grain farmers, as well as demands ofgrain customers. The acquisition of 75 high‑horsepower, fuel‑efficient locomotives,in addition to the 260 already received.14Refer to the 2021 CN Vancouver Plan (https://otc-cta.gc.ca/sites/default/files/cn vancouver congestion plan 2021 - reference binder.pdf) fordetails and a more complete list of projects.15Delivery of the rolling stock may extend into early 2022 but will be completed in the timeframe covered under this plan (Dec.1 – Mar. 31).2021–2022 cn winter plan21

222 0 2 1 –2 0 2 2 c n w i n t e r p l a n

4ConclusionThe punishing cold of Canadian wintersis simply a fact of life. CN is ready. ItsWinter Plan is a comprehensive strategy borneof experience and expert analysis of howsevere cold can disrupt a rail network.CN is committed to innovation and investment. As outlined in this Plan,CN’s level of investments has enhanced its resilience. The Companyis prepared for winter. The added miles of double track, new andlengthened sidings and additional alternative current and distributedpower locomotives and air distribution cars are particularly valuable inthis regard.In 2021, CN is planning to invest nearly 3 billion of additional capitalacross its network. It will also maintain and enhance its proven bestpractices. CN will also continue to encourage and assist its customersand partners to adopt winter‑ready infrastructure and to frequentlycommunicate their latest business forecasts.CN appreciates its customers’ willingness to work closely with itsrailroaders to manage the challenges of winter. Customers expect theservice to meet their needs throughout the year, and they expect CN tobe able to recover quickly when disruptions occur, while keeping theminformed of the status of their shipments. This Winter Plan provides thebasis to fulfill those expectations.Yes, CN is ready for winter 2021–2022. This does not mean that its futurewinter plans cannot be improved. Therefore, CN welcomes continuousinput, which is always seriously considered. To that effect, all feedbackcan be sent to contact@

customers for winter 2021–2022, CN closely examined its 2020–2021 record and drew on the lessons learned over the years. Overall, CN hauled 162 billion gross ton‑miles (GTM) during winter 1 2020–2021, up 4.6% in comparison to the 2019–2020 winter, and up 1.8% from our previous record of 159 bi