Transcription

Insurance Analytics part 2:The business case for Data AnalyticsA Deloitte point of view on Data Analytics withinthe Dutch Insurance industry

Insurance Analytics A Deloitte point of view on Data Analytics within the Dutch Insurance industry2

Insurance Analytics A Deloitte point of view on Data Analytics within the Dutch Insurance industry“Insurers have invested in Data Analytics (DA) but see a limited returnin business value”. This is one of the outcomes of a research amongstInsurers in EMEA.1 This second blog on Data Analytics within theInsurance Industry focuses on the business case for Data Analytics.It describes an approach for setting up the business case, types ofrequired investments, expected benefits and provides guidelines.IntroductionInsurers want to become more insightdriven, but face a couple of challenges thatwe covered in our previous blog:1. There is no organization-wide visionand strategy for Data Analytics thatsupports the strategic goals andtherefore direction and drive forinitiatives is missing2. Data Analytics experts are scatteredacross the organization; each unit orfunction has their own expertise andactivities are not optimally coordinated3. The value of Data Analytics solutionsis not defined or not measuredstructurally, therefore it is unclear if theinvestment is justified4. There is a gap between Data Analyticsexpertise and business sense, resultingin solutions not fit for usage or lack ofconfidence in solutions at the business5. Data Analytics solutions are notimplemented into business processes,therefore using the solution is toocumbersome and people stop using it6. New technology developments like BigData and AI give even more potential ofusing Data Analytics. Insurers feel thatthey have to jump in to not get behindof competition or behind of InsurTechstartups, but forget that in order toprofit from these technologies they willneed a solid Data Analytics capabilityand Data foundation first1In our previous blog different operatingmodels for a Data Analytics capabilitywere described, including their respectivepros and cons. It was explained that thereis no one size that fits all. Furthermore,an approach was given to design andimplement an operating model.This second blog will address the challengethat it is often unclear if the investment andfor a Data Analytics capability is justified.The importance of defining and monitoringvalue has already been explained in thefirst blog, this second blog will focus on thefollowing topics: What are the type of investmentsrequired? What are the benefits of setting up a DataAnalytics capability and how can these bemeasured? Who could or should be the mainstakeholders in the process? Guidelines for creating a business caseSetting up a business case forData AnalyticsSetting up or structuring a Data Analyticsorganization requires a substantialinvestment. Before starting, it should bevery clear why it is necessary and howit will deliver value. A business case isa typical tool for this. When developinga strong business case for an AnalyticsOrganization, it can later on be used as astarting or reference point for the businesscase of individual Data Analytics solutions.Insurers and data analytics: a little less conversation, a lot more action; EMEA insurance data analyticsstudy; Deloitte; .html3

Insurance Analytics A Deloitte point of view on Data Analytics within the Dutch Insurance industryThe process for setting up a business casedoes not differ substantially from businesscases of ‘normal’ projects. However, sinceData Analytics like other IT projects alsorequires technical investments, there canbe a wide range of cost types. For example,costs for business consultancy and datascientist hours are required, but alsocosts for Data Analytics tools, hardwareand perhaps even external data. In nextparagraph we will elaborate more on thedifferent costs.The first step in setting up the businesscase is to describe as factually as possiblewhy something needs to change. Whatdoes the current business environmentlook like? What are the problems andpain points? What would be the expectedimpact or effect of data analyticssolutions? What would the analyticalsolution /architecture look like? And mostimportantly how can data analytics drivevalue for the business.Secondly, describe on a high level the prosand cons of different options including a ‘donothing’ scenario. From these scenarios itshould at least be clear that doing nothingis a bad option. Since Analytics is a corecompetency of the Insurance Industry theopportunity for improving it is huge. Also,more and more pressure from Insurtechstartups is being built up, with DataAnalytics in most cases as the primarydifferentiator. The pros and cons of thescenarios will give a nice starting point forthe business case.Required investments to start up aneffective Insurance Analytics assetA business case for an Insurance analyticsasset differs from more typical businesscases in the sense that one needs tothink not only about finishing one productor project, but setting up an entireenvironment for the long term. This meansthat typically investments need to be madein five areas:4 Designing & preparing theorganization in line with the analyticsstrategy. Examples of deliverables are aData Analytics vision, Value Definition anda high level operating model. Especiallythe operating model is important, sincewith typical Insurers Data Scientists aswell as the data itself are scattered overthe organization. Please visit our previousblog on this topic Developing your people. This entailsmore than just recruiting some datascientists, it might include training therest of the organization to becomemore ‘insight driven’. Examples ofdeliverables are the organization design,learning curriculum and knowledgeexchange, culture change of seniorleadership. Designing & running processes thatenable smooth execution. Theseinclude ideation, prioritization processes,Agile development, and maintenance andsupport processes Acquiring and running the systemsand technologies that support theactivities. Think of licensing costs, butalso development costs that support theorganization in becoming insight driven; Optimizing your current data setsand obtaining new valuable data,for example by buying sets from a datavendor or connecting data from varioussource systems.One mistake often made is that companiesstart with building a Proof of Concept oralready with a complete solution, withoutthinking of how it will be ‘productionized’.Productionizing solutions encompassesa couple of topics. First it requires reengineering the business processesto incorporate the use of insights.For example, an acceptance processsupported with a rich customer profilefrom internal and external data sources,

Insurance Analytics A Deloitte point of view on Data Analytics within the Dutch Insurance industrywould require that that customer profileis readily available to the underwriter inhis workflow management system andthat the underwriter has specific rulesfor dealing with the different individualcustomers Secondly, the insight shouldbe understandable for the business. Incase of the acceptance process based ona customer profile, it is even required thatthe results on which the acceptance willbe based, are explainable and traceable.Furthermore, the solution needs tobe maintained and supported by DataAnalytics experts. The business needs toadapt to the changing culture, becominginsight driven. Finally the solutions requirescontinuous improvement, meaning thatcomplaints or improvement suggestionsfrom the business need to be incorporatedas well as the latest technology or datadevelopments2. When not thinking aboutthese aspects, the chance is that the DataAnalytics solution will end as a fancy toolthat is too difficult to understand, tooexpensive to maintain, to buggy to trust onor too cumbersome to use the insight on afrequent basis.Investing in all five areas described aboveis essential to deliver the expected benefitsfrom a Data Analytics solutions.Data Analytics value definition forInsuranceAs with all projects and especiallywith technology implementations, theinvestment is made before benefits willflow back from Data Analytics solutions.Setting up an organization to develop,implement and operate solutions willin most cases deliver no direct andtangible value to the organization. Eachimplemented solution however will. Inour previous blog we explained thereforethat the approach for setting up such anorganization should always go in parallelwith developing one or more use cases.23To define the value of Data Analyticssolutions, the best way is to start withthe strategy of the organization. Is themain target to win new customers, or todecrease cost, or perhaps both? From theorganization strategy downwards, concreteKey Performance Indicators can be takenfrom the strategic statement, or derivedfrom it, to make the impact on the strategictarget measurable. An example of a KPI canbe “ cost reduction in back office”.In some cases it can be difficult to relatethe benefits directly to the implementationof the Data Analytics solution. Theobjective should be to isolate the effectsof the solution as much as possible. Anexample is a data analytics solution thataims to increase the number of new clientsby offering a faster acceptance process(e.g. see this article for a solution thatachieves this by using a selfie to automatethe acceptance process3). The effect ofthe data analytics solution might not bedirectly clear, since other factors mightbe in place, like seasonal patterns or amarketing campaign. Isolating these eventsis important to get an accurate businesscase. In some cases, it might not even bepossible to isolate the effects. In that case,the business case should contain otherKPIs where the results of the solution canbe isolated.Another challenge is that some benefitsmight not be measurable in a reliableway. Take as an example a data analyticssolution aiming to improve customersatisfaction by offering a chatbot interfacefor 24 hour/day support. How can anincrease in customer satisfaction in thiscase be measured? Net promotor scoredoes not seem the best fitting measurein this case. The measure should havemore focus on the effect of the chatbotinterface. A survey amongst users of thechatbot asking for their satisfaction tml5

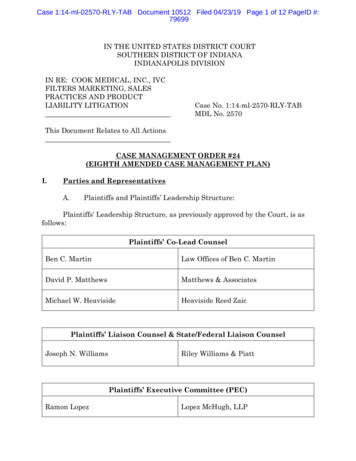

Insurance Analytics A Deloitte point of view on Data Analytics within the Dutch Insurance industrythe customer service before and afterusing the chatbot could be a solution, butcan be quite cumbersome. Making andagreeing on a clear plan on the expectedeffects and how to measure thesebeforehand prevents dissatisfaction withthe intangibility of the results afterwards.Basically, business value should flow froman increased revenue, lower operatingcosts and increased capital efficiency.An increase in revenue can be reachedfor example by an insight-driven pricingand retention management strategy. Aconcrete solution for this is our ‘DynamicPricing Engine’4. An analytical solution forreducing costs can for example be foundin an interactive claims dashboard weremanagers or analysts can easily analyzeclaims and find opportunities for reducinglosses. Our next blog will elaborate on thisspecific Data Analytics solution for claimsmanagement.Within Deloitte a much used framework fordefining business value is the EnterpriseValue Map (EVM). The EVM linkstangible business results back to highlevel shareholder value and is developedbased on KPI frameworks of thousandsof companies all over the world. A specificEVM is available for each industry. Basedon our experience in setting up DataAnalytics organizations and buildingsolutions, we have made a specific EVM forInsurance Analytics. Below is a snapshot ofthis framework.Shareholder valueRevenue growthCustomer valueOperating MarginSocietal valueCapital mentreturnsAcquisitionand maintenance costsBenefit costsIncome engthsAcquire newcustomersRetain andgrow currentcustomersImprovePricingImprove cyImprove claims& reservemanagementImprove risktransferImprove Mngt& s Marketing &Sales Customer Policy chargemanagementoptimization Distribution Cross-Sell /managementUp- Sell DemandManagement Portfolioacquisition Underwriting& PriceOptimization Product& serviceinnovation Retention Marketing, IT, Telecom & Claimsadvertising &InfraManagementSalesstructure Reserving Customer Real EstateManagementservice & HumanSupportResources Policy ProcurementAdministration BusinessManagement ce-outlook-2017dynamic-pricing.html Reinsurance PolicyholderRisk transferExternalfactors

Insurance Analytics A Deloitte point of view on Data Analytics within the Dutch Insurance industryThe value that is most important dependson the insurer and typically its product anddistribution channel mix.Who could or should be the mainstakeholders in the process?A vital step in setting up the businesscase for Data Analytics is involvingbusiness stakeholders. All value should beobtained by business improvements andtherefore a large dependency exists onthese stakeholders wanting to implementData Analytics solutions. Defining targetsfor business value also helps in makingbusiness a partner in the implementationprocess since they will need that valueimprovement for their ow

it will deliver value. A business case is a typical tool for this. When developing a strong business case for an Analytics Organization, it can later on be used as a starting or reference point for the business case of individual Data Analytics solutions. 1 Insurers and data analytics: a little less conversation, a lot more action; EMEA insurance data analytics