Transcription

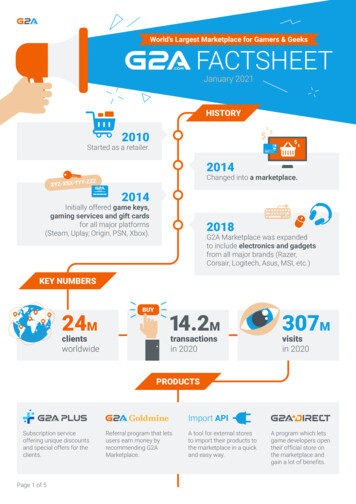

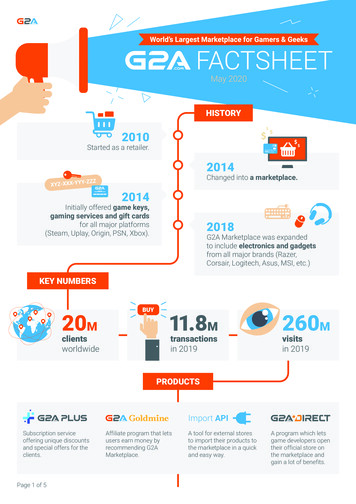

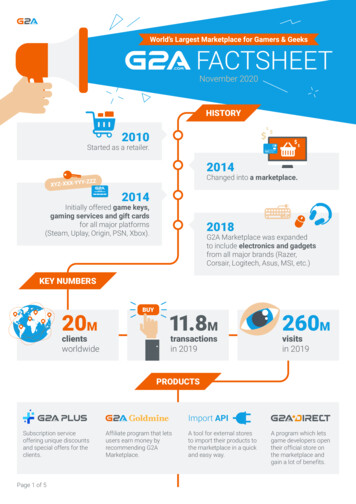

FACTSHEET31 May 2021TMB EASTSPRING China A Active FundTMBAM AssetManagement Co., Ltd.Which certified by CACTMB-ES-CHINA-AEquity FundFeeder FundFund investing primarily offshore withforeign investment related risks1

1.1 Investment Policy1.1.1 Underlying assetTMB EASTSPRING China A Active Fund (The fund) mainly invests in UBS (Lux) IS China A Opportunity (Master Fund), Class I-A2-acc not less than 80% onaccounting-year average of its net asset value. This class is offered to institutionalinvestors no dividend policy. Master funds have a policy to invest in equities ofcompanies which are domiciled in or are chiefly active in the People's Republic ofChina which is listed on the Luxembourg Stock Exchange and operating under theregulations of UCI (Undertaking for Collective Investment).The Master Fund hasbeen managed by UBS Fund Management (Luxembourg) S.A., and invested inUSD currency.The Management Company reserves the right to change the type andcharacteristics of the Fund in the future as a Fund of Funds or invest directly in theinstrument. And / or foreign securities without increasing the risk spectrum ofinvestment risk. This shall be at the discretion of the fund manager depending onthe market situation and must be for the best interest of the unit holders. In addition,the Management Company will notify the unitholders at least 30 days in advance viawww.tmbameastspring.com or any other way that the management companydetermines before making changes to such investments.The fund's investment in Master fund will be in the form of USD currency. The fundmay enter into FX swap transaction to hedge FX exposure pursuant to the FundManager's discretion.2

The fund may invest in derivatives to efficiently manage its portfolio (EPM) or mayinvest in the structure note. In addition, both domestic and foreign investment mayinvest in non-investment grade or unrated debt securities or unlisted equitysecurities.1.1.2 Master fund’s investment policyThe Master fund will invest at least 70% of its total net assets in equities,cooperative society shares and participation shares, participation certificates andwarrants of companies which are domiciled in or are chiefly active in the People'sRepublic of China.The majority of net assets are invested in Chinese A-shares. these A-shares aretraded on Chinese stock exchanges such as the Shanghai Stock Exchange and theShenzhen Stock Exchange.At least 51% of the value of the sub-fund shall be invested in equities that are notshares of investment funds and that are listed or traded on a "regulated market" asdefined in Directive 2004/39/EC of the European Parliament and of the Council of 21April 2004 on markets in financial instruments.In addition, Master fund may invest in derivatives for hedging purposes and forefficient portfolio management and to generate additional returns to the fundInvestors can view more Master Fund Information at https:// www.ubs.com/funds1.2 Management Style1.2.1 TMB EASTSPRING China A Active Fund aims to achieve return reflecting theperformance of the Master Fund (passive management)1.2.2 UBS (Lux) IS - China A Opportunity (Master Fund) applies an activemanagement strategy3

Investor who would like to diversify their investment in offshore market for long-terminvestment and can accept risk of investing in securities or assets in foreign countries,Foreign exchange risk and price volatility of the Master Fund1. Investors who need to use money in the near future.2. Investors who are unable to accept the volatility of investment and returns,both short term and long term.For further clarification on this investment policy and potential risks,what should you do? Read the full prospectus or seek advice from the management company orits appointed selling agents. Do not invest without sufficient understanding on the characteristics andrisks of this Fund.4

Warnings & Recommendation1.TMB EASTSPRING China A Active Fund is not capital protection fund. Investorsmay have risk of losing initial investment.2. TMB EASTSPRING China A Active Fund may invest in the master fund in USdollars and enter into FX swap transaction to hedge FX exposure pursuant to theFund Manager's discretion. This is because the fund does not fully hedge, theinvestors may lose or gain value from foreign exchange or may receive return lessthan their initial investments.3. TMB EASTSPRING China A Active Fund and Master fund may invest inderivatives to efficiently manage its portfolio (EPM).Therefore, this fund has higherrisk than other funds, it thus suits the type of investor who can accept higher risk forhigher returns. Investors should invest in this Fund only when fully understand aboutderivatives and should consider the investing experience, investment objective andfinancial position before investing in this Fund.4. TMB EASTSPRING China A Active Fund may invest in the structure note withhigher risk than other funds, it thus suits the type of investor who prefer high returnsand can accept higher risks than other general invertors.5. TMB EASTSPRING China A Active Fund’s investment is highly concentrated inChina and therefore investors should consider diversify the risks in their portfolio.5

6. TMB EASTSPRING China A Active Fund may invest in non-investment grade orunrated debt securities or unlisted equity securities at the higher ratio than those ofother mutual funds, in which case, the investors may be exposed to higher risks, e.gthe issuer's default risk or liquidity risk.7. The master fund has a limited redemption of investment units of the master fundin the event that the unitholders of the master fund redeem the investment unitsmore than 10% of the net asset value of the master fund. The master fund willgradually receive a redemption order and allocate the redemption proportionately tothe unitholder who has issued the order to not redeem more than 10% of the netasset value of the master fund By redemption order that exceeds 10% of the netasset value of the master fund The master fund will perform the transaction on thenext business day. Which the said order will receive the right to allocate first.However, the management company does not restrict the redemption of investmentunits of the TMB East Spring Income Allocation Fund in any way, but only disclosesthe limitations of the master fund in the project details.8.To comply with the terms and conditions of the Master Fund, the Managementcompany reserves the right to submit unitholder information (including informationof previous unitholders of this fund) to the Master fund (which shall include relevantparties) and relevant government authorities, both local and foreign, when there is acase where such unitholder possesses (either directly or indirectly) more than 10 %of the fund, or when information is requested or required by the Master Fund. Thisincludes the request for additional information from the unitholder and/or fromselling agent (including LBDU) that the unitholder transacts through. In addition, theManagement Company reserves the right to suspend or terminate services and to6

proceed with the redemptions for unitholders who are un-cooperative or unitholderswith qualifications prohibited by the Master Fund, which is subject to change fromtime to time. It shall be deemed that TMBAM has already been received consentsfor TMBAM’s actions that stated above from the unitholders. It shall also be deemedthat TMBAM’s selling agents(including LBDU) has already received consents toprovide unitholders’ information to TMBAM, the Master Fund, and the relevantgovernment authorities, both local and foreign.9.TMBAM has an objective not to offer its fund units to or for the benefit of1) Citizens of the USA or residents of the USA [including the territories of oroccupied /controlled by the USA] including those who hold US passports or greencards.2) Legal entities organized under the US law including company LimitedPartnership, etc., as well as the branch of such entities.3) Organizations belonging to the US Government in the USA and outside the USA.4) Investors who contact or receive information or place order related to TMBAM'sfund or pay/receive payment with respect to TMBAM’s fund in the USA. This alsoincludes investors who use the agent/ manager in the USA to perform suchfunctions.5) The assets (such as private fund/trust) of the aforesaid persons or legal entities in1-4. As such, TMBAM reserve its right to deny or restrain subscription, allocationand/or transfer its fund unit for the above -mentioned investors, whether directly orindirectly.7

10.In the event that the Management Company has entered into an obligation oragreement with a foreign state and/or the government of a foreign state or if it isrequired to comply with a law or a regulation of a foreign state regard less of theeffective date of such obligation (e.g. the United States Foreign Account TaxCompliance Act (FATCA)),the Unitholder(s) acknowledge and agree that theManagement Company may act or perform its obligation according to the relevantlaw and/ or regulation to which Management Company is subject, including but notlimited to disclosing information of the Unitholder(s) or withholding and withholdable payment payable to the Unitholder(s),and may act or perform any other actionnecessary for complying such relevant Thai and foreign law and/or regulation towhich the Management Company is subject, and shall provide any information,document, and consent to Management Company upon request in performingsuch duty.*For further information at www.tmbameastspring.com8

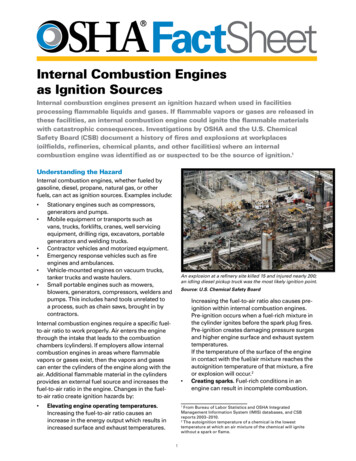

market riskstandard deviation : SDMarket Risk means the risk that the values of securities which the Fund has investedmay increase or decrease due to outside factors such as economic/ investmentsituations, political factors both internally and internationally which could beconsidered from the Standard Deviation (SD) of the Fund. If the Fund has a highSD, it is an indicator that the Fund has high a fluctuation from the changes in theprices of securities.High sector concentration riskRemark : The concentration occurs among Consumer StaplesHigh country concentration riskRemark : Remark : The concentration occurs among CHINA9

exchange rate riskCurrency Risk is the possibility that changes in exchange rate will affect the value ofinvestment units. For example, if a mutual fund invests in securities denominated inUS Dollar during Thai Baht depreciation and the units are subsequently sold whenThai Baht appreciates, the mutual fund will receive lower return in Thai Baht. On theother hand, if the same fund invests in securities denominated in US Dollar duringThai Baht appreciation and the units are subsequently sold when Thai Bahtdepreciates, the mutual fund will receive higher return in Thai Baht. Therefore,currency hedging techniques as follows are key tools to manage such risk. Hedging at discretion of the fund manager: Investors may be exposed to currencyrisk because it is the discretion of the fund manager whether to use a currencyhedging technique.* For further information at www.tmbameastspring.com10

Savings Deposit1.27Other Assets0.74Other Liabilities-2.46Equity Unit Trusts100.46date as of 31 May 2021Industrials0.27Health Care20.20ConsumerDiscretionary13.75Real estate1.19Consumer es5.45Master Fund Information as of 28 February 202111

NAME% Of NAVUBS (Lux) IS - China A Opportunity Fund100.46Information as of 31 May 2021* Fees affect the return on investment, investors should consider such feesbefore making an investment decision *Fees Charged to the Fund6.00Actual Fees% p.a. of NAV5.004.003.00Maximum not exceed2.5145Maximum not exceed2.14002.001.000.85600.00Management feeMaximum not exceed0.10700.0321Trustee feeMaximum not exceed0.2140Maximum not exceed0.05350.15100.0000Registrar feeOther1.0391Total12

More explanation :1. Fees charged to the fund (As % per annum of total asset value deducted by totalliabilities except for Management fee, Trustee Fee and Registrar Fee) (including VAT)2. Any other expenses are expectable expenses.3.Historical fee charged for the past 3 years can be found athttps://www.tmbameastspring.com/THDocs/QA/I31 02.pdf4.In the event that off-shore mutual fund (master fund) will partially return managementfee due to The Fund invest in master fund, called rebate fee, the managementcompany will transfer total amount of rebate fee to the fundDetailsFront-end Fee / Switching in FeeBack-end Fee / Switching out FeeSpreadTransfer FeeMaximum Charge1.50None0.25%5 baht per1,000 unitsActual Charge1.50NoneNo charge5 baht per1,000 unitsRemark : All above mentioned fees are inclusive of Value Added Tax or Specific BusinessTax or other taxes.More explanation :1.TMBAM reserves right to have different front-end fee scheme for each investor type2.Spread will be charged from unit holders when subscribe, redeem, or switching byincluding into offer,bid or switching prices.13

*Past performance is not a guarantee of future performance* Maximum drawdown of the investment in the last five years : -18.37 Standard deviation of the fund performance : 21.09 Fund category based on peer group fund performance : Greater China EquityFUNDYear to date 3 Months Percentile 6 Months Percentile 1 Year Percentile Since rd Deviation (FUND)Standard Deviation 69%Remark : All periods longer than one year are annualized.date as of 31 May 2021Investors can view the current information at www.tmbameastspring.comPeer group fund performance : Greater China Equity Date as of 31 May 2021Peer Percentile5th Percentile25th Percentile50th Percentile75th Percentile95th 7517.130.74Return (%)1Y3Y55.65 14.3548.35 11.3539.28 9.2255.65 14.3513.48 -1.303M17.0419.2522.6117.0437.54Standard Deviation (%)6M1Y3Y5Y16.17 17.64 16.55 14.6519.13 18.83 17.55 15.5321.94 21.04 18.93 16.3816.17 17.64 16.55 14.6528.91 26.30 21.76 17.5010Y14.8217.3619.3814.8222.4714

Master Fund PerformanceYear to date3 Months6 Months1 YearSince inceptionShare 2%13.40%57.03%15.18%Master Fund Calendar year Performance202020192018Share 0%Information as of 31 May 2021View current performance at www.tmbameastspring.comThe Fund’s Benchmark The Fund’s Benchmark MSCI China A Onshore (net) dividendreinvestment in USD currency with adjusted by USD/THB exchange rate, as of theNAV calculation dateDividend policy :NoneTrustee :Bangkok Bank Public Company LimitedRegistration Date :5 March 2020Fund Maturity :Subscription and RedemptionindefiniteSubscription Date : every working daysWithin : 8.30 hrs.15

To : 15.30 hrs.IPO (Baht) : 10 BahtMinimum Initial Subscription : 1 BahtMinimum Subsequent Subscription : 1 BahtRedemption Date : every working dayWithin : 8.30 hrs.To : 15.30 hrs.Settlement Period : The management company willarrange to pay the redemption of investment unitswithin 5 business days1 from the redemption date.(Generally within 4 business days after the tradingday (T * 4 business days)Note:1Foreign holidays of foreign fund managementbusinesses shall not be counted in the samemanner as mutual fund management businessesThe mutual fund management company hasspecified the foreign holidays as mentioned in theprospectus.Investors can view daily NAV at website : www.tmbameastspring.comPortfolio Turnover Ratio188.05 %Subscription or RedemptionBank of TMB PCL.(All branches) Tel. 0-2299-1111Supporting Agentsor the appointed selling agents. Investors can Findmore information at www.tmbameastspring.comFund Manager :Ms. Pornsajee WorasuttipisitStart Date 5 March 2020TMB Asset Management Co., Ltd.Enquiry for Prospectus/9th floor, Mitrtown Office Tower 944 Rama 4 Road,Complaints :Wangmai Pathumwan, Bangkok 1033016

Tel : 0-2838-1800website : www.tmbameastspring.comcitizens of the USA or residents Noof the USAPotential conflict of interestCompany shall refrain from any transactionspertaining conflict of interests and related party.Find more information atwww.tmbameastspring.comOther InformationMaster Fund Details : UBS (Lux) IS - China AOpportunityClass I-A2-accInception Date : 23 November 2017Bloomberg Code : UBCIA2A LX EquityFund Policy:The Master fund will invest at least70% of its total net assets in equities, cooperativesociety shares and participation shares,participation certificates and warrants ofcompanies which are domiciled in or are chieflyactive in the People's Republic of China.Themajority of net assets are invested in Chinese Ashares. these A-shares are traded on Chinesestock exchanges such as the Shanghai StockExchange and the Shenzhen Stock Exchange.At least 51% of the value of the sub-fund shall beinvested in equities that are not shares ofinvestment funds and that are listed or traded on a"regulated market" as defined in Directive2004/39/EC of the European Parliament and of theCouncil of 21 April 2004 on markets in financialinstruments. In addition, Master fund may invest inderivatives for hedging purposes and for efficient17

portfolio management and to generate additionalreturns to the fundInvestor can access the information of the Masterfund which is available and can be obtained fromhttps:// www.ubs.com/fundsInvestment Manager :UBS Fund Management(Luxembourg) S.A.,R.C.S. Luxembourg B 154.210Custodian Bank: Northern Trust Global ServicesSE,6, rue Lou Hemmer, L-1748 Senningerberg.Management fee : 0.92% of NAV Investing in Investment Units is not a money deposit and is not under the protectionsof the Deposit Protection Agency. Therefore, investment in Mutual Fund involves riskincluding possible loss of the principal amount invested. The fund is approved by The office of the SEC. The draft prospectus for This Fund does not indicate that The office of the SEChas certified the accuracy of the information contained in the prospectus norguaranteed the price or return on investment for such fund. The ManagementCompany has reviewed the information in this summary prospectus as at3 1 May 2 0 2 1 with professional care as the party responsible for themanagement of the fund and certifies that the above information is correct,true and not misleading.18

China A Opportunity (Master Fund), Class I-A2-acc not less than 80% on accounting-year average of its net asset value. This class is offered to institutional investors no dividend policy. Master funds have a policy to invest in equities of co