Transcription

PrintResetAccount NumberPremiere Select Inherited IRA ApplicationFor spouses, non-spouse individuals (including minors), andestatesHelpful to Know This application is for individuals and estates only. Fortrusts and entities, use the applicable versions of theapplication. If the decedent was over 72 and had not taken his orher Required Minimum Distribution (RMD) in the year ofdeath, see Section 8. Spouse inheritors: You may be able to treat the inheritedIRA as your own by transferring the assets into yourown new or existing IRA, and base both the timing andamount of RMDs on your own age. (Note: You may besubject to the 10% early withdrawal penalty if you takedistributions that do not meet exceptions to the penalty.)RMD Rules for BeneficiariesRMD rules for your Inherited IRA will be based on severalfactors including the age of the original IRA owner at deathand your relationship to the original IRA owner.SPOUSE transferring to an inherited traditional IRA If the original IRA owner died prior to the requiredbeginning date (RBD) for taking RMDs, take distributionsbased on your life expectancy, redetermined annually. Note: If you are the sole beneficiary, you can defercommencing distributions until the later of: the end ofthe calendar year in which the original owner wouldhave reached age 72 or the end of the calendar yearfollowing the calendar year of the original owner’sdeath. If the original IRA owner was past the RBD for takingRMDs, take distributions based on your life expectancyor the remaining life expectancy of the original ownerreduced by one for each subsequent year, whichever islonger.SPOUSE transferring to an inherited Roth IRA If you are the sole beneficiary, take distributions overthe course of your single life expectancy, redeterminedannually, or the remaining life expectancy of theoriginal owner reduced by one for each subsequentyear, whichever is longer. If you are not the sole beneficiary, take distributionsover the course of the life expectancy of the oldestbeneficiary reduced by one for each subsequent year.1.9887257.101NON-SPOUSE individual transferring to an inheritedtraditional IRA If you are NOT an eligible designated beneficiary*,take distributions within 10 years following the death ofthe original IRA owner. If you are an eligible designated beneficiary, takedistributions over the course of your single lifeexpectancy reduced by one for each subsequent yearOR, if the original IRA owner died prior to the RBDfor taking RMDs, take distributions over the course ofyour single life expectancy or the remaining single lifeexpectancy of the original owner, whichever is longer,reduced by one for each subsequent year.* An eligible designated beneficiary is a beneficiary who is the survivingspouse or minor child of the original owner or who is disabled,chronically ill, or not more than 10 years younger than the original owner.NON-SPOUSE individual transferring to an inheritedRoth IRA If you are NOT an eligible designated beneficiary, takedistributions within 10 years following the death of theoriginal IRA owner. If you are an eligible designated beneficiary, takedistributions over the course of your single lifeexpectancy or the remaining single life expectancy ofthe original owner, whichever is longer, reduced by onefor each subsequent year.ESTATES If the deceased IRA owner died before reaching 72, theinherited IRA must be fully distributed by December31 of the calendar year containing the fifth anniversaryof the original IRA owner’s death. There are no annualdistribution requirements.– If the deceased IRA owner was 72 or older andtaking annual RMDs at time of death, then annualRMDs can continue to be taken but will becalculated using the remaining life expectancy of thedeceased IRA owner.Page 1 of 2

InstructionsTo open your Premiere Select Inherited IRA, read the instructions belowas you complete the application on the following pages.If you are a beneficiary of an IRA (including Traditional, Rollover, Roth,SEP, or SIMPLE), an Inherited IRA, or employer-sponsored retirement planaccount and the account owner is deceased, complete this application toestablish an account and to transfer your inherited assets into an account inyour name. Each beneficiary must complete a separate application.If the decedent was over 70½ in 2019 or 72 in 2020 and beyond andhad not withdrawn his or her total RMD in the year he or she died, asbeneficiary you must withdraw the appropriate amount by December 31 ofthe year the account owner died. The undistributed amount must be basedon the decedent’s RMD schedule but reported under the beneficiary’s taxID.NOTE: Contributions cannot be made to an Inherited IRA (other than directrollovers from an employer-sponsored retirement plan for a non-spousebeneficiary). If you would like to make contributions to a PremiereSelect IRA, you must establish a Traditional IRA or Roth IRA, asapplicable, by completing a Premiere Select IRA Application. If you are a spouse beneficiary, you have the option to transfer theinherited assets directly to your own IRA or to establish an InheritedIRA, as applicable. If you chose to transfer the inherited assets to yourown IRA, DO NOT COMPLETE THIS APPLICATION. To establish aPremiere Select IRA or Roth IRA, you must complete a Premiere SelectIRA Application. To transfer inherited Premiere Select IRA/Roth IRAassets to your own Premiere Select IRA/Roth IRA, you must completean IRA Transfer Request Form for Spouse Beneficiary form.Original Depositor Information and Registration.Provide information on the original account owner.Agreement SignatureBe sure to sign the application. We cannot process your applicationwithout your signature. For estates, executors must sign. For wards orminors, the guardian or custodian, as applicable, must sign.Submit the completed application and additional paperwork (describedbelow) to your investment advisor.Include a copy of the decedent’s death certificate.IMPORTANT Additional Paperwork Requirements:In addition to this application and a certified copy of the decedent’sdeath certificate, submit the paperwork indicated below that is applicableto the type of beneficiary establishing this account.Account SetupComplete the account owner’s information. If the Inherited IRA will beregistered in the name of an estate, provide the estate information.Executor/Guardian/Custodian InformationComplete this section only if the Inherited IRA is registered in the nameof an estate, a ward, or a minor.Account CharacteristicsComplete this section as appropriate.Beneficiary Designation—not applicable to minors or estatesComplete this section to designate beneficiaries to receive payment ofthe value of your Inherited IRA following your death.If the beneficiary is Include the estateCourt Order dated within 90 days, naming the executor ofthe estateNote: If more than one appointed executor exists and nolanguage in the court document indicates that the executorscan act independently, a Co-Fiduciary Certification form mustbe attached for each executor.a wardCourt Order dated within 90 days, naming the guardianNote: If more than one appointed guardian exists and nolanguage in the court document indicates that the guardianscan act independently, a Co-Fiduciary Certification form mustbe attached for each guardian.a minorFor a minor’s IRA that is being funded from an existingPremiere Select or Fidelity IRA, a copy of the Birth Certificatenaming the parent (Custodian) or a Court Order naming theGuardianFunding Your AccountCheck the appropriate box to fund your account.Note: Additional information may be necessary. Consult your investment advisor.1.9887257.101Page 2 of 2

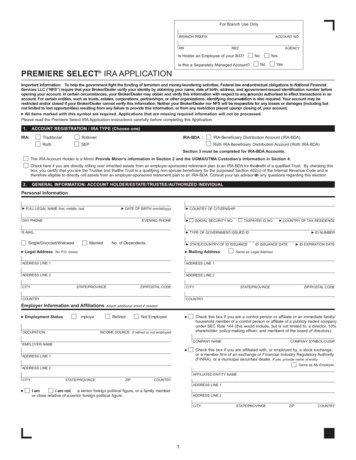

PrintResetAccount NumberPremiere Select Inherited IRA ApplicationFor spouses, non-spouse individuals (including minors), andestatesUse this application if you are a beneficiary of an IRA or a qualified retirement plan and the original account owner is deceased and you need toopen an Inherited IRA or Inherited Roth IRA. Type on screen or fill in using CAPITAL letters and black ink. If you need more room for information orsignatures, use a copy of the relevant page.For Authorized agent/Advisor Use OnlyTo provide information onmore Authorized agent(s)/Advisor(s), owners, etc.,make additional copies ofnecessary page(s).As defined in Article VIII1(d) of Premiere SelectIRA Custodial Agreementor Article IX 1(d) of thePremiere Select Roth IRACustodial Agreement.* For electronic confirms.For Advisor Use Only:Primary Authorized agent/AdvisorDTC Number*GAdditional Authorized agent/AdvisorG NumberAdditional Authorized agent/AdvisorG NumberAdditional Authorized agent/AdvisorG NumberAdditional Authorized agent/AdvisorG NumberGGGGAccount referred through Wealth Advisor Solutions program (Use WAS specific G Number in Primary Authorizedagent/Advisor G Number field above.)1. Original Depositor InformationRequired. Enter Original Depositor’s information.Include a certified copyof the decedent’s deathcertificate.Optional. Enter Inherited IRA Owner’s information.G NumberFirst NameDate of Birth MM DD YYYYRequiredMiddle NameDate of Death MM DD YYYYLast NameSocial Security NumberComplete the following ONLY if you are the beneficiary of Inherited IRA assets from an existing Inherited IRA/Roth IRA account owner:Full Name First, Middle Initial, LastDate of Birth MM DD YYYYDate of Death MM DD YYYYSocial Security/Taxpayer ID NumberRequiredSSNTIN2. RegistrationRequired.Check the type ofaccount(s) you areestablishing.Inherited IRAInherited Roth IRANote: Inherited assets from a Traditional, Rollover, SEP, or SIMPLE IRA, an Inherited IRA Account or an employersponsored retirement plan will be rolled over or transferred to, as applicable, a Premiere Select Inherited IRA, whichis subject to the terms and conditions of the Premiere Select Traditional IRA Custodial Agreement and DisclosureStatement. Inherited assets from a Roth IRA, Inherited Roth IRA Account or designated Roth account from anemployer-sponsored retirement plan will be rolled over or transferred to, as applicable, a Premiere Select InheritedRoth IRA, which is subject to the terms and conditions of the Premiere Select Roth IRA Custodial Agreement andDisclosure Statement.1.9887257.101Page 1 of 19038110101

3. Account SetupFor Inherited IRAs registered in the name of an estate, provide the full legal name of the estate. Estate accounts require a Taxpayer ID number forthe estate. For estate, ward with guardian or minor with custodian accounts you must also complete the Executor/Guardian/Custodian Informationsection for all executors, or the guardian, or custodian named on the account below as applicable.Account OwnerRelationship of Beneficiary to the Original DepositorRequired. Check one.Enter full name as evidenced by agovernment-issued,unexpired document (e.g.,driver’s license, passport,permanent resident card).Provide phone number(s)to be used to verify and/or authorize transactions.Provide an email addressto be used to authorizetransactions and/or forelectronic delivery ofdocuments.SpouseNon-Spouse IndividualEstateWard with GuardianMinor with CustodianFirst NameMiddle NameLast NameEstate NameSocial Security NumberDate of Birth MM DD YYYYPrimary PhoneSecondary PhoneMobileNumberMobileNumberEmail*U.S. Mail—Send the following document types to me by U.S. mail instead of electronically:Monthly Account StatementImmediate and Quarterly Trade ConfirmTax Documents and Related DisclosuresProspectuses, other financial reports, etc.*F idelity will use this email address for electronic delivery of account documents. Unless U.S. Mail is checked for all documenttypes, you will receive a follow-up email from Fidelity and will need to consent to begin receiving documents electronically.See Document Delivery and Frequency section for more information regarding eDelivery.Address of RecordRequired for all accounts. Unless otherwise indicated, account documentation will be delivered to the account owner at the account mailingaddress. The mailing address should not be your Authorized agent’s/Advisor’s address.Permanent Address of Account Cannot be a P.O. Box or Mail Drop.Mailing Address of Account Complete if different than Permanent Address.AddressAddressCityState/ProvinceZip/Postal CodeCountryCityState/ProvinceZip/Postal CodeCountryCitizenshipIndicate your citizenship status.Choose one. OR U.S. Skip to Income SourceForeign citizen Information in this box must be completed.Country of CitizenshipPermanent U.S. ResidentNon-Permanent U.S. ResidentNon-Resident of U.S.Government IdentificationUnexpired ID mustinclude reference numberand photo. Attach copyof ID.PassportOther Government-Issued IDID NumberCountry of IssuanceCountry of Tax ResidenceU.S.CountryOthercontinued on next page1.9887257.101Page 2 of 19038110102

3. Account SetupcontinuedIncome Source Industry regulations require us to ask for this information.Check one.EmployedNot EmployedEmployer/Income Source required for margin privilegesRetired List Income Source if Retired or Not stal CodeCountryAssociationsAs a person associatedwith a member firm, youare obligated to receiveconsent from that firm.Fidelity has existingconsent agreements with many firms for theiremployees to maintainaccounts with Fidelity andto deliver transactionaldata. If your firm is notone of them, Fidelity willattempt to contact yourfirm’s compliance office.If you are employed by or associated with a broker-dealer, stock exchange, exchange member firm, the FinancialIndustry Regulatory Authority (FINRA), a municipal securities dealer, or other financial institution, or are the spouse oran immediate family member residing in the same household of someone who meets the aforementioned employmentcriteria, provide the company’s name and address below. By providing this information and completing this form,you hereby authorize Fidelity to provide the associated person’s employer with duplicate copies of confirmations andstatements, or the transactions data contained therein, for your account(s) and any accounts you choose to have on aconsolidated statement for purposes of their compliance review.Company NameCompany AddressCityStateZip/Postal CodeCountryAffiliationsIf you, your spouse, or any of your relatives (including parents, in-laws and/or dependents, etc.), living in your home (at thesame address), is a member of the board of directors, is a 10% shareholder, or is a policy-making officer or can direct corporatemanagement of policies of a publicly traded company (an “Affiliate”), you must provide the information below.Company NameCUSIP or SymbolCompany NameCUSIP or SymbolCompany NameCUSIP or Symbolcontinued on next page1.9887257.101Page 3 of 19038110103

3. Account SetupcontinuedTrusted Contact Optional.Fidelity will contact this individual if there are questions or concerns about your health or welfare due to potentialdiminished capacity, financial exploitation or abuse, endangerment, and/or neglect. We will:– Provide the trusted contact with information about you and/or your account(s), but not the ability to transact onyour account(s).– Inquire about your current contact information or health status.– Inquire about whether another person or entity has legal authority to act on your behalf (e.g., legal guardian orconservator, or trustee).Enter information if youwant to designate aperson who is 18 yearsor older for this account.Name, Phone, andAddress are all required.First NameMiddle NameEmailLast NameRelationship to OwnerSelectPhoneExtensionCheck here if phone number is a mobile number.This cannot be a P.O. box,Mail Drop, or C/O.AddressCityState/ProvinceZip/Postal CodeCountry1.9887257.101Page 4 of 19038110104

4. Executor/Guardian/Custodian InformationComplete this section only if the Inherited IRA is registered in the name of an estate, ward, or minor. If there is more than one guardian orexecutor, add at the end of the application.Enter full name as First NameMiddle NameLast Nameevidenced by agovernment-issued,unexpired document (e.g.,Social Security NumberDate of Birth MM DD YYYYdriver’s license, passport,permanent resident card).Primary PhoneSecondary PhoneProvide phone number(s)MobileMobileto be used to verify and/NumberNumberor authorize transactions.Email*Provide an email addressto be used to authorizetransactions and/or forelectronic delivery ofU.S. Mail—Send the following document types to me by U.S. mail instead of electronically:documents.Monthly Account StatementImmediate and Quarterly Trade ConfirmTax Documents and Related DisclosuresProspectuses, other financial reports, etc.*F idelity will use this email address for electronic delivery of account documents. Unless U.S. Mail is checked for all documenttypes, you will receive a follow-up email from Fidelity and will need to consent to begin receiving documents electronically.See Document Delivery and Frequency section for more information regarding eDelivery.Address of RecordRequired for all accounts. Unless otherwise indicated, account documentation will be delivered to the account owner at the account mailingaddress. The mailing address should not be your Authorized agent’s/Advisor’s address.Permanent Address of Account Cannot be a P.O. Box or Mail Drop.Mailing Address of Account Complete if different than Permanent Address.AddressAddressCityState/ProvinceZip/Postal CodeCountryCityState/ProvinceZip/Postal CodeCountryCitizenshipIndicate your citizenship status.Choose one. OR U.S. Skip to Income SourceForeign citizen Information in this box must be completed.Country of CitizenshipPermanent U.S. ResidentNon-Permanent U.S. ResidentNon-Resident of U.S.Government IdentificationUnexpired ID mustinclude reference numberand photo. Attach copyof ID.PassportOther Government-Issued IDID NumberCountry of IssuanceCountry of Tax ResidenceU.S.CountryOthercontinued on next page1.9887257.101Page 5 of 19038110105

4. Executor/Guardian/Custodian InformationcontinuedIncome Source Industry regulations require us to ask for this information.Check one.EmployedNot EmployedEmployer/Income Source required for margin privilegesRetired List Income Source if Retired or Not stal CodeCountryAssociationsAs a person associatedwith a member firm, youare obligated to receiveconsent from that firm.Fidelity has existingconsent agreements with many firms for theiremployees to maintainaccounts with Fidelity andto deliver transactionaldata. If your firm is notone of them, Fidelity willattempt to contact yourfirm’s compliance office.If you are employed by or associated with a broker-dealer, stock exchange, exchange member firm, the FinancialIndustry Regulatory Authority (FINRA), a municipal securities dealer, or other financial institution, or are the spouse oran immediate family member residing in the same household of someone who meets the aforementioned employmentcriteria, provide the company’s name and address below. By providing this information and completing this form,you hereby authorize Fidelity to provide the associated person’s employer with duplicate copies of confirmations andstatements, or the transactions data contained therein, for your account(s) and any accounts you choose to have on aconsolidated statement for purposes of their compliance review.Company NameCompany AddressCityStateZip/Postal CodeCountryAffiliationsIf you, your spouse, or any of your relatives (including parents, in-laws and/or dependents, etc.), living in your home (at thesame address), is a member of the board of directors, is a 10% shareholder, or is a policy-making officer or can direct corporatemanagement of policies of a publicly traded company (an “Affiliate”), you must provide the information below.Company NameCUSIP or SymbolCompany NameCUSIP or SymbolCompany NameCUSIP or Symbolcontinued on next page1.9887257.101Page 6 of 19038110106

4. Executor/Guardian

Statement. Inherited assets from a Roth IRA, Inherited Roth IRA Account or designated Roth account from an employer-sponsored retirement plan will be rolled over or transferred to, as applicable, a Premiere Select Inherited Roth IRA, which is subject to the terms and condition