Transcription

CONGRESS OF THE UNITED STATESCONGRESSIONAL BUDGET OFFICEACBOPAPERJUNE 2005 Royalty-free/CorbisPrices forBrand-NameDrugs UnderSelected FederalPrograms

ACBOPA P ERPrices for Brand-Name DrugsUnder Selected Federal ProgramsJune 2005The Congress of the United States O Congressional Budget Office

PrefaceFederal and state governments are large purchasers of pharmaceuticals, accounting forover 20 percent of total U.S. expenditures for outpatient prescription drugs in 2003. Acrossgovernment programs, drug prices can vary considerably. The prices that federal and stategovernments pay for drugs are determined by a combination of statutory rebates or discounts,supplemented by negotiations with drug manufacturers.This Congressional Budget Office (CBO) paper, prepared at the request of the Senate Majority Leader, describes the processes by which drug prices paid to manufacturers (and, in somecases, to wholesale distributors) are determined and the relative average prices that resultunder many federal programs. In keeping with CBO’s mandate to provide objective, nonpartisan analysis, this paper makes no recommendations.Julie Somers of CBO’s Microeconomic Studies Division and Anna Cook of CBO’s Healthand Human Resources Division prepared the paper under the supervision of Roger Hitchner,David Moore, Bruce Vavrichek, and James Baumgardner. (Roger Hitchner has since leftCBO.) Colin Baker analyzed rebates under the Medicaid program. James Bell and SusanLabovich assisted with data analysis. Tom Bradley served as CBO’s internal reviewer. Information and data were provided by the Department of Veterans Affairs, the Department ofDefense, and the Centers for Medicare & Medicaid Services. Julia Christensen, Philip Ellis,Tim Gronniger, Arlene Holen, Robert Murphy, Sam Papenfuss, Allison Percy, Eric Rollins,Frank Russek, and Shinobu Suzuki, all of CBO, provided thoughtful comments on drafts, asdid Joseph Antos of the American Enterprise Institute for Public Policy Research and John R.Nowak, RPh, of the Department of Veterans Affairs’ Pharmacy Benefits Management Strategic Healthcare Group. (The assistance of external reviewers implies no responsibility for thefinal product, which rests solely with CBO.)Christine Bogusz edited the paper, and Janey Cohen proofread it. Maureen Costantinodesigned the cover and Figure 2 and prepared the paper for publication. Lenny Skutnikprinted copies of the paper, and Annette Kalicki and Simone Thomas produced the electronicversion for CBO’s Web site (www.cbo.gov).Douglas Holtz-EakinDirectorJune 2005

CONTENTSSummary and Introduction 1Direct Federal Purchasers 5Federal Supply Schedule for PharmaceuticalsProgram 6The “Big Four” Federal Ceiling Price Program 8Department of Veterans Affairs 9Department of Defense 9Medicaid Rebate Program 10The Public Health Service’s 340B Drug Pricing Program 12Conclusion 12Appendix A: Data Used in This Analysis 13Appendix B: Methodology of This Analysis 15

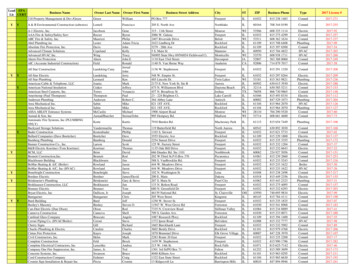

viPRICES FOR BRAND-NAME DRUGS UNDER SELECTED FEDERAL PROGRAMSTable1.Description and Estimates of Prices Paid to Manufacturers, Relative toList Price, for Brand-Name Drugs Under Selected FederalPrograms, 20034Estimated Prices Paid to Manufacturers, Relative to List Price, forBrand-Name Drugs Under Selected Federal Programs, 20033How Prices Paid to Manufacturers for Brand-Name Drugs AreDetermined Under Selected Federal Programs7An Analysis of Drug Pricing, Not Drug Spending2Figures1.2.Box1.

Prices for Brand-Name DrugsUnder Selected Federal ProgramsSummary and IntroductionPurchases of pharmaceuticals by federal and state governments accounted for over 20 percent of total U.S. expenditures for outpatient prescription drugs in 2003.1 Because the prices that federal and state governments payfor drugs are determined by a variety of statutory rebatesor discounts, supplemented by negotiations with drugmanufacturers, drug prices can differ considerably acrossgovernment programs.This Congressional Budget Office (CBO) paper describesthe processes by which prices paid to manufacturers (and,in some cases, to wholesale distributors) are determinedand the relative average prices that result under the following federal programs:BThe Federal Supply Schedule (FSS) for pharmaceuticals, which is available to all direct federal purchasers;2BThe federal ceiling price (FCP) program, which isavailable to the Department of Veterans Affairs (VA),the Department of Defense (DoD), the Public HealthService (PHS), and the Coast Guard;BThe Department of Veterans Affairs’ pharmaceuticalprime vendor program;BThe Department of Defense’s TRICARE pharmaceutical program;1. Centers for Medicare & Medicaid Services, Office of the Actuary,National Health Statistics Group, “Table 3: National HealthExpenditures, by Source of Funds and Type of Expenditure:Selected Calendar Years 1998-2003,” available at . This paper uses the term “direct federal purchasers” to refer to federal agencies that buy drugs from wholesale distributors or frommanufacturers and that provide their own dispensing services.BThe Medicaid rebate program; andBThe Public Health Service’s 340B drug pricing program.The Medicare program, currently in transition with theimplementation of changes required under the MedicarePrescription Drug, Improvement, and Modernization Actof 2003 (MMA), is not included in the discussion.3CBO estimated the average price paid to manufacturers(and, in some cases, to wholesale distributors) underthose federal programs in 2003 for a sample of topselling brand-name prescription drugs relative to the listprice (in this paper, the average wholesale price, or AWP),based on the quantities of those drugs sold in the UnitedStates. The sample includes 130 drugs that accounted forabout 50 percent of U.S. sales through retail pharmaciesand about 70 percent of U.S. sales of brand-name drugsthrough retail pharmacies in 2003.4 The analysis is restricted to single-source drugs (brand-name drugs stillunder patent protection) for which purchasers do nothave access to generic alternatives.3. The Federal Employees Health Benefits (FEHB) program also isnot included in the discussion. For an analysis of discounts negotiated by pharmacy benefit managers on behalf of FEHB plans, seeGeneral Accounting Office, Pharmacy Benefit Managers: FEHBPPlans Satisfied with Savings and Services, but Retail PharmaciesHave Concerns, GAO/HEHS-97-47 (February 1997).4. Based on 2003 data from IMS Health’s National Sales Perspectives. In this paper, a brand-name drug is defined by its tradename (for example, Lipitor), and a brand-name drug product isdefined by its trade name, strength, and dosage form (for example,Lipitor 10 mg tablet). The analysis includes about 330 differentbrand-name drug products. See Appendix A for a description ofthe drug price data sets CBO used and Appendix B for an explanation of the price index methodology used to compare averageprogram prices relative to list price.

2PRICES FOR BRAND-NAME DRUGS UNDER SELECTED FEDERAL PROGRAMSBox 1.An Analysis of Drug Pricing, Not Drug SpendingDrug pricing, as examined in this paper, differs fromdrug spending in several ways. First, the prices paidto manufacturers for single-source brand-name prescription drugs under selected federal programs donot reflect the final cost of dispensing the drug to thepatient. In the Medicaid program, for example, theMedicaid net manufacturer price, or the net pricethat manufacturers receive for Medicaid sales—theaverage manufacturer price (AMP) minus the Medicaid rebate—averages about 51 percent of the average wholesale price (AWP). For further details, seeTable 1 and Figure 1 in the main text. However, thenet final price to Medicaid—that is, the payments topharmacies minus rebates from manufacturers—averages about 64 percent of the AWP. The differencebetween those two prices (13 percentage points) isthe amount retained by pharmacies and wholesaledistributors, who may use it to cover the costs involved in operating a pharmacy or warehouse, including distribution and dispensing costs, as well aspayments to owners or stockholders.1,2Second, the sample of brand-name drugs examinedin this paper is based on national consumption patterns and does not necessarily reflect purchases madeunder federal programs.3 This approach does notcapture important cost containment strategies usedThe prices paid to manufacturers for brand-name drugsare only one of several factors that determine total drugspending. The cost of dispensing the drug to the patient,the savings generated from the use of generic drugs, andother important factors that also affect total drug spending are summarized in Box 1. Those factors, although important, have not been included in this analysis.The prices paid to manufacturers vary substantially acrossgovernment programs (see Figure 1). CBO estimates thatthe average prices for single-source brand-name prescription drugs for the third quarter of calendar year 2003range from 53 percent of the list price in the case of theFederal Supply Schedule to 41 percent of the list price inthe case of DoD.5by federal purchasers. For example, through the useof drug formularies, certain purchasers, such as theDepartment of Veterans Affairs and the Departmentof Defense, attempt to steer utilization toward thosebrand-name drugs for which they get better prices.Most federal programs also encourage the use of generic drugs, when available.Other factors that affect drug spending over timeand that are not included in this analysis are changesin program participation and utilization rates andthe introduction of new drugs on the market.1. For an analysis of the difference between the total amountthat state Medicaid agencies paid to pharmacies and theamount that pharmacies and wholesalers paid to purchasethe drugs from manufacturers, see Congressional BudgetOffice, Medicaid’s Reimbursements to Pharmacies for Prescription Drugs (December 2004).2. Direct federal purchasers usually dispense drugs within theirown facilities, the cost of which is not reflected in thisanalysis.3. The sample is restricted to top-selling brand-name drugs forwhich no generic substitutes are available, weighted by thetotal number of tablets and capsules sold in the UnitedStates (see Appendix B for further details).The relationships among the prices reported in this paperare likely to hold only under current regulations and market conditions. Future changes in pricing regulationswould be likely to change the relationships among thoseprices. That is because the price charged to any one purchaser for a particular drug represents strategic decisionson the part of the manufacturer, and that price would belikely to change if it was extended to other purchasersthrough regulation. For example, when prices from theFederal Supply Schedule for pharmaceuticals programwere included in the calculation of Medicaid’s best prices(used to calculate Medicaid rebates), FSS prices rose.Moreover, the relationships do not apply to every drug.5. Results for other quarters in calendar year 2003 are similar.

PRICES FOR BRAND-NAME DRUGS UNDER SELECTED FEDERAL PROGRAMSFigure 1.Estimated Prices Paid to Manufacturers, Relative to List Price, for Brand-NameDrugs Under Selected Federal Programs, 2003(Percent)Average Manufacturer PriceNonfederal Average Manufacturer PriceBest PriceFederal Supply Schedule PriceMedicaid Net Manufacturer Price340B Ceiling PriceFederal Ceiling PricePrice Available to the "Big Four"VA Average PriceDoD's Military Treatment Facility Average Price0102030405060708090100Source: Congressional Budget Office.Notes: In this analysis, the list price is the average wholesale price.The first three bars in the figure are manufacturer-reported private-sector prices.The study sample includes 130 single-source brand-name prescription drugs that accounted for about 50 percent of U.S. sales throughretail pharmacies and about 70 percent of U.S. sales of brand-name drugs through retail pharmacies in 2003. The estimates of averageprice are based on the quantities of those drugs sold in the United States and, with the exception of the federal ceiling price (FCP), arefor the third quarter of 2003. (The FCP is calculated annually, so the estimate of average price is for calendar year 2003.) Results forother quarters in 2003 are similar. Prices exclude dispensing costs (see Box 1).The “Big Four” are the four largest federal purchasers of pharmaceuticals: the Department of Veterans Affairs (VA), the Department ofDefense (DoD), the Public Health Service, and the Coast Guard.For instance, although the FSS price is lower relative tothe AWP than the best price, on average, the FSS price ishigher than the best price for about one-fifth of the drugsexamined in this analysis.The AWP is a publicly available, suggested list price forsales of a drug by a wholesaler to a pharmacy or otherprovider; it is reported in publications such as ThomsonMicromedex’s Red Book and First DataBank’s Blue Book.However, the AWP is not the actual price that wholesalerscharge but is more like a sticker price in the automobileindustry.The AWP was chosen as the main price reference for thispaper because it is frequently used to set payment rates inpharmaceutical transactions. For example, state Medicaidagencies, pharmacy benefit managers, and other thirdparty payers frequently use the AWP to set payment ratesto retail pharmacies for providing single-source brandname drugs to their beneficiaries. In addition, studieshave reported savings from the Medicare drug discount3

4PRICES FOR BRAND-NAME DRUGS UNDER SELECTED FEDERAL PROGRAMSTable 1.Description and Estimates of Prices Paid to Manufacturers, Relative toList Price, for Brand-Name Drugs Under Selected Federal Programs, 2003Average Priceas a Percentageof List PricePriceDescription of Price and Associated Federal ProgramAverage Wholesale Price (AWP)The AWP is a publicly available, suggested list price for sales of a drug by a wholesaler to apharmacy or other provider. It is not the actual price that wholesalers charge but servesmore like a sticker price in the automobile industry. It was chosen as the reference price forthis analysis because it is commonly used in pharmaceutical transactions.100Average Manufacturer Price (AMP)The AMP is used to calculate the rebates that manufacturers are required to give to federaland state governments for sales to Medicaid beneficiaries. The AMP is the average price paidto a manufacturer for drugs distributed through retail and mail-order pharmacies. The AMPdoes not include rebates paid by the manufacturer to third-party payers. Both the AMP andthe nonfederal average manufacturer price exclude sales to direct federal purchasers.79Nonfederal Average ManufacturerPrice (Non-FAMP)The non-FAMP is used to calculate the maximum price that manufacturers can charge the "BigFour"---the Department of Veterans Affairs (VA), the Department of Defense (DoD), the PublicHealth Service (PHS), and the Coast Guard---for brand-name drugs. The non-FAMP is theaverage price paid to the manufacturer by wholesalers (or others who purchase directly fromthe manufacturer) for drugs distributed to nonfederal purchasers, taking into account anycash discounts or similar price reductions given to those purchasers but not taking intoaccount any prices paid by the federal government. The non-FAMP does not reflect rebatespaid by the manufacturer to third-party payers.79Best PriceThe best price is used to calculate the rebates that manufacturers are required to give tofederal and state governments for sales to Medicaid beneficiaries. The best price is thelowest price paid by any private-sector purchaser for the drug product, and it includesdiscounts, rebates, chargebacks, and other pricing adjustments.63Federal Supply Schedule (FSS) PriceAll direct federal purchasers of pharmaceuticals can purchase drugs at prices listed in theFederal Supply Schedule for pharmaceuticals (FSS prices). The VA negotiates FSS prices withmanufacturers on the basis of the prices that manufacturers charge their most-favoredcommercial customers under comparable terms and conditions. Furthermore, during amultiyear contract period, those FSS prices may not increase faster than inflation.53Medicaid Net Manufacturer PriceThe Omnibus Budget Reconciliation Act of 1990 requires manufacturers to pay a rebate to theMedicaid program. For brand-name drugs, the basic rebate is equal to the greater of 15.1percent of the AMP or the difference between the AMP and the best price. There is anadditional rebate if the AMP rises faster than inflation. The Medicaid net manufacturer price isthe AMP minus all rebates.51340B Ceiling PriceSection 340B of the Public Health Service Act of 1992 extends the Medicaid drug rebateprogram to PHS-funded clinics and disproportionate share hospitals. Eligible entities are freeto negotiate steeper discounts than the Medicaid rebate amount. Not all eligible entities chooseto participate in the program, however.51Continued

PRICES FOR BRAND-NAME DRUGS UNDER SELECTED FEDERAL PROGRAMSTable 1.ContinuedAverage Priceas a Percentageof List PricePriceDescription of Price and Associated Federal ProgramFederal Ceiling Price (FCP)The FCP is the maximum price that manufacturers can charge the Big Four for brand-namedrugs. It is calculated annually. In the first year of an FSS contract, the FCP equals 76percent of the previous fiscal year's non-FAMP minus an additional discount if the non-FAMPrises faster than inflation. In subsequent years of a multiyear contract, the FCP also cannotexceed the previous year's FSS price, increased by inflation.50Price Available to the Big FourUnder the federal ceiling price program, the Big Four purchase brand-name drugs at a pricethat cannot exceed the FCP. About two-thirds of the brand-name drug products on the FSShave one FSS price (which cannot exceed the FCP). The remaining one-third of the brandname drug products have both an FSS price, offered to all non-Big Four purchasers, and anFSS Big 4 price, offered to the Big Four. The price available to the Big Four is the FSS Big 4price when it exists and is the FSS price offered to all federal purchasers otherwise.49VA Average PriceThe VA average price for a drug may be lower than the price available to the Big Fourbecause VA negotiates further price reductions using its preferred formulary. The VA averageprice takes into account all the various pricing schedules and contracts under which VApurchases drugs, and it includes discounts from the prime vendor that averaged about 3percent of the contract price in 2003, or about 1.4 percent of the AWP.42DoD's Military Treatment Facility(MTF) Average PriceThe DoD military treatment facility average price for a drug may be lower than the priceavailable to the Big Four because DoD negotiates further price reductions using its preferredformularies. The MTF average price takes into account all the various pricing schedules andcontracts under which DoD purchases drugs.41Source: Congressional Budget Office.Notes: In this analysis, the list price is the average wholesale price.The study sample includes 130 single-source brand-name prescription drugs that accounted for about 50 percent of U.S. sales throughretail pharmacies and about 70 percent of U.S. sales of brand-name drugs through retail pharmacies in 2003. The estimates of averageprice are based on the quantities of those drugs sold in the United States and, with the exception of the FCP, are for the third quarterof 2003. (The FCP is calculated annually, so the estimate of average price is for calendar year 2003.) Results for other quarters in 2003are similar. Prices exclude dispensing costs (see Box 1 on page 2).card program (which began June 1, 2004) in terms ofpercentage discounts off of the AWP.6 Finally, pharmaciesoften use the AWP as a basis for pricing prescriptions to6. The AWP also had been used in the Medicare program to calculate

4. Based on 2003 data from IMS Health’s National Sales Perspec-tives. In this paper, a brand-name drug is defined by its trade name (for example, Lipitor), and a brand-name drug product is defined by its trade name, strength, and dosage form (for example, Lipitor 10 mg tablet). The analys