Transcription

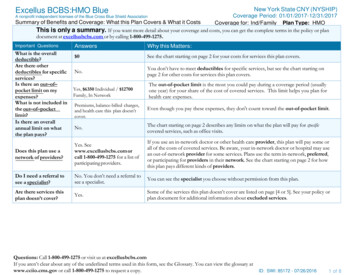

GHC-SCW Individual HMOACA Plans 2021Our plans are further organized into “Metals”based on the percentage of health care costsshared between you and GHC-SCW.Monthly PremiumOut-of-Pocket ExpensesPlatinumGoldSilverBronzeTerms to KnowCopayment – A fixed amount (for example, 15) you pay for a CoveredHealth Service. The amount can vary by the type of Covered HealthService.Coinsurance – The percentage of costs of Covered Health Services youpay after you’ve paid your Deductible.Deductible – The amount you owe for medical Covered Health Servicesand/or prescription drug services your health insurance or plan coversbefore your health insurance or plan begins to pay. For example, ifyour Medical Deductible is 1,000, your plan won’t pay anything untilyou’ve met your 1,000 Deductible for medical Covered Health Servicesthat are subject to the Deductible. The Deductible may not apply to allservices.Prescription Drug and Medical Combined Deductible – This is theamount you owe for both medical Covered Health Services andprescription drugs (that are subject to the Deductible) before yourhealth insurance or plan begins to pay.Medical Deductible – This is the amount you owe for medicalCovered Health Services (that are subject to the Deductible) beforeyour health insurance or plan begins to pay.Prescription Drug Deductible – This is the amount you owe forprescription drugs (that are subject to the Deductible) before yourhealth insurance or plan begins to pay.Maximum Out-of-Pocket (MOOP) – This is the limit to the amount youwill pay out-of-pocket during a policy period (typically one year long) forCovered Health Services. Once you’ve paid this maximum amount, yourhealth insurance plan will pay 100% of the allowed amount for CoveredHealth Services. This limit never includes your premium, balance-billedcharges or health care your health insurance does not cover. Somehealth insurance or plans don’t count all your Copayments, Deductibles,Coinsurance payments, Out-of-Network payments or other expensestoward this limit.Where to find Complete Description of Covered Health ServicesTo see a complete description of Covered Health Services, please seeyour Member Certificate, Benefit Summary and any Amendments toyour Benefit Plan at http://planfinder.ghcscw.com/. You can also see theGlossary of Health Coverage, Medical Terms and Summary of Benefitsand Coverage (SBC). If you have questions regarding GHC-SCW benefits,please call Member Services at (608) 828-4853 or (800) 605-4327.Preventive Health Services; when provided in a primary care setting byGHC-SCW Contracted Providers. To include preventive health proceduresas deemed appropriate by the United States Preventative Services TaskForce (USPSTF) criteria with respect to the age, sex and health status ofthe member. Services and/or testing for ongoing diagnosis and treatmentof a condition are not preventive services.In-Network – The facilities, providers and suppliers your health insureror plan has contracted with to provide Covered Health Services. Visitghcscw.com and select, “Clinic or Provider” to find In-Network Facilitiesand Providers.Embedded – Each individual member has his/her own Deductible andMaximum Out-of-Pocket (MOOP) for a benefit plan. In addition, there isa shared family Deductible and MOOP. The Affordable Care Act (ACA)guidelines for 2021 stipulate that an individual cannot pay more than 8,550 in out-of-pocket expenses in a plan year.Non-Embedded – (May also be referred to as Aggregate.) Every memberon your benefit plan shares one Deductible and one Maximum Out-ofPocket (MOOP).MK20-62-0(7.20)O

INDIVIDUAL HMO ACA PLANS 2021CLICK ON THE PLAN NAME FORDETAILED PLAN DESCRIPTIONSPlan Number on MarketplacePlan Number off Marketplace (Direct)Platinum No Ded/2000MOOPPlatinum 500 Ded/1500MOOP2111116211111021311162131110Plan Offered Direct and/or on the MarketplaceDirect & MarketplaceDirect & MarketplaceDeductible - Medical (Based on Calendar Year) 0/Individual or 0/Family 500/Individual or 1,000/FamilyDeductible - Prescription (Based on Calendar Year) 0/Individual or 0/Family 0/Individual or 0/FamilyN/AN/AEmbeddedEmbedded20%20% 2,000/Individual or 4,000/Family 1,500/Individual or 3,000/FamilyDeductible - Medical & Prescription Combined (Basedon Calendar Year)Embedded/Non-EmbeddedPolicy CoinsuranceMaximum Out-of-Pocket Prescription & MedicalCombined (MOOP)Eligible DependentsDependents are covered until the end of the month in whichthey turn 26Clinic ServicesPrimary Care Office Visits 10Chiropractic Office Visits 10 20No ChargeNo ChargePreventive Health Examinations 20Specialist Care Office Visits 20 40Preventitive ImmunizationsNo ChargeNo ChargePrenatal and Postnatal Maternity CareNo ChargeNo ChargeDiagnostic X-Ray and Laboratory Test20% after Deductible20% after DeductibleAdvanced Radiology20% after Deductible20% after DeductibleEmergency and Urgent CareUrgent Care Visits 10 2020% after Deductible20% after Deductible 400 100Tier 1 10 10Tier 2 30 30Tier 3 60 60Emergency Ambulance Service (air/ground)Emergency Room VisitsPrescription DrugsTier 4 30% after Pharmacy Deductible 30% after Pharmacy DeductibleThe Prescription Drugs Benefit is administered by GHC-SCW Clinic pharmacies and Navitus. Prescription Drugs are NOT COVERED outside of theGHC-SCW network of providers. For a list of formulary drugs, tier ( ) placement, prior authorization requirements and other limitations that mayapply, see ghcscw.com.Copayments: 79 initial visit of Acupuncture, 75 initial visit of Naturopathy,one-hour personal sessions for Acupuncture, Massage Therapy and Reiki.Complementary Medicine 49 ForHSA/HDHP plans, Member pays the full cost of service before theDeductible is met, then Copayment applies.Hospital ServicesInpatient Hospital Services: Physician Services,Surgery, Facility Fees20% after Deductible20% after DeductibleOutpatient Hospital Surgical/Non-Surgical Services:Facility Fees20% after Deductible20% after DeductibleSkilled Nursing Facility Services20% after Deductible20% after DeductibleNo ChargeNo ChargeVision ServicesVision ExaminationsMental Health & Substance Use DisorderOutpatient Services 10 20Inpatient Services20% after Deductible20% after DeductibleTransitional Services20% after Deductible20% after DeductibleDO NOT CANCEL YOUR INSURANCE. COVERAGE IS NOT IN EFFECT UNTIL WRITTEN APPROVAL IS ISSUED.2

INDIVIDUAL HMO ACA PLANS 2021CLICK ON THE PLAN NAME FORDETAILED PLAN DESCRIPTIONSPlan Number on MarketplacePlan Number off Marketplace (Direct)Gold Simple Choice1600 Ded/5400 MOOPGold 2500 Ded/2500MOOP HSAGold 2500 Ded/6500MOOPGold 1500 121021312162131220Plan Offered Direct and/or on the MarketplaceDirect & MarketplaceDirect & MarketplaceDirect & MarketplaceDirect & MarketplaceDeductible - Medical (Based on Calendar Year) 1,600/Individual or 3,200/FamilyN/A 2,500/Individual or 5,000/FamilyN/AN/A 0/Individual or 0/FamilyN/AN/A 2,500/Individual or 5,000/FamilyN/A 1,500/Individual or %0%30%30% 5,400/Individual or 10,800/Family 2,500/Individual or 5,000/Family 6,500/Individual or 13,000/Family 8,550/Individual or 17,100/FamilyDeductible - Prescription (Based on Calendar 0/Individual or 0/FamilyYear)Deductible - Medical & Prescription Combined(Based on Calendar Year)Embedded/Non-EmbeddedPolicy CoinsuranceMaximum Out-of-Pocket Prescription & MedicalCombined (MOOP)Eligible DependentsDependents are covered until the end of the month in which they turn 26Clinic ServicesPrimary Care Office Visits 25No Charge after Deductible 30Chiropractic Office Visits 25No Charge after Deductible 30 10No ChargeNo ChargeNo ChargeNo ChargeSpecialist Care Office Visits 65No Charge after Deductible 60 120Preventitive ImmunizationsNo ChargeNo ChargeNo ChargeNo ChargePreventive Health Examinations 10Prenatal and Postnatal Maternity CareNo ChargeNo ChargeNo ChargeNo ChargeDiagnostic X-Ray and Laboratory Test20% after DeductibleNo Charge after Deductible30% after Deductible30% after DeductibleAdvanced Radiology20% after DeductibleNo Charge after Deductible30% after Deductible30% after DeductibleEmergency and Urgent Care 65No Charge after Deductible 30 10Emergency Ambulance Service (air/ground)Urgent Care Visits20% after DeductibleNo Charge after Deductible30% after Deductible30% after DeductibleEmergency Room Visits20% after DeductibleNo Charge after Deductible 300 750Tier 1 15No Charge after Deductible 20 5Tier 2 55No Charge after Deductible 40 80Tier 3 75No Charge after Deductible 80 150Tier 430% after PharmacyDeductibleNo Charge after Deductible30% after PharmacyDeductible 450Prescription DrugsThe Prescription Drugs Benefit is administered by GHC-SCW Clinic pharmacies and Navitus. Prescription Drugs are NOT COVERED outside of the GHC-SCW network of providers. For a list of formularydrugs, tier ( ) placement, prior authorization requirements and other limitations that may apply, see ghcscw.com.Complementary MedicineCopayments: 79 initial visit of Acupuncture, 75 initial visit of Naturopathy, 49 one-hour personal sessions for Acupuncture, MassageTherapy and Reiki. For HSA/HDHP plans, Member pays the full cost of service before the Deductible is met, then Copayment applies.Hospital ServicesInpatient Hospital Services: Physician Services,Surgery, Facility Fees20% after DeductibleNo Charge after Deductible30% after Deductible30% after DeductibleOutpatient Hospital Surgical/Non-SurgicalServices: Facility Fees20% after DeductibleNo Charge after Deductible30% after Deductible30% after DeductibleSkilled Nursing Facility Services20% after DeductibleNo Charge after Deductible30% after Deductible30% after DeductibleNo ChargeNo Charge after DeductibleNo ChargeNo ChargeOutpatient Services 25No Charge after Deductible 30 10Inpatient Services20% after DeductibleNo Charge after Deductible30% after Deductible30% after DeductibleTransitional Services20% after DeductibleNo Charge after Deductible30% after Deductible30% after DeductibleVision ServicesVision ExaminationsMental Health & Substance Use DisorderDO NOT CANCEL YOUR INSURANCE. COVERAGE IS NOT IN EFFECT UNTIL WRITTEN APPROVAL IS ISSUED.3

INDIVIDUAL HMO ACA PLANS 2021CLICK ON THE PLAN NAME FOR Silver 8000X Ded/8550DETAILED PLAN DESCRIPTIONSMOOPPlan Number on MarketplacePlan Number off Marketplace (Direct)2111367Silver 4900 Ded/7900MOOPSilver Simple Choice4550X Ded/7900 MOOPSilver 4300 Ded/4300MOOP an Offered Direct and/or on the MarketplaceDirect & MarketplaceDirect & MarketplaceDirect & MarketplaceDirect OnlyDeductible - Medical (Based on Calendar Year) 7,400/Individual or 14,800/FamilyN/A 4,000/Individual or 8,000/FamilyN/ADeductible - Prescription (Based on CalendarYear) 600/Individual or 1,200/FamilyN/A 550/Individual or 1,100/FamilyN/ADeductible - Medical & Prescription Combined(Based on Calendar Year)N/A 4,900/Individual or 9,800/FamilyN/A 4,300/Individual or 20%0% 8,550/Individual or 17,100/Family 7,900/Individual or 15,800/Family 7,900/Individual or 15,800/Family 4,300/Individual or 8,600/FamilyEmbedded/Non-EmbeddedPolicy CoinsuranceMaximum Out-of-Pocket Prescription & MedicalCombined (MOOP)Eligible DependentsDependents are covered until the end of the month in which they turn 26Clinic ServicesPrimary Care Office Visits 35 30 40No Charge after DeductibleChiropractic Office Visits 35 30 40No Charge after DeductibleNo ChargeNo ChargeNo ChargeNo ChargePreventive Health ExaminationsSpecialist Care Office Visits 125 75 90No Charge after DeductiblePreventitive ImmunizationsNo ChargeNo ChargeNo ChargeNo ChargePrenatal and Postnatal Maternity CareNo ChargeNo ChargeNo ChargeNo ChargeDiagnostic X-Ray and Laboratory Test30% after Deductible30% after Deductible20% after DeductibleNo Charge after DeductibleAdvanced Radiology30% after Deductible30% after Deductible20% after DeductibleNo Charge after DeductibleEmergency and Urgent Care 35 30 90No Charge after DeductibleEmergency Ambulance Service (air/ground)Urgent Care Visits30% after Deductible30% after Deductible20% after DeductibleNo Charge after DeductibleEmergency Room Visits30% after Deductible30% after Deductible20% after DeductibleNo Charge after DeductibleTier 1 25 40 25No Charge after DeductibleTier 2 65 80 65No Charge after DeductibleTier 3 20030% after Deductible 200No Charge after DeductibleTier 450% after PharmacyDeductible30% after Deductible50% after PharmacyDeductibleNo Charge after DeductiblePrescription DrugsThe Prescription Drugs Benefit is administered by GHC-SCW Clinic pharmacies and Navitus. Prescription Drugs are NOT COVERED outside of the GHC-SCW network of providers. For a list of formularydrugs, tier ( ) placement, prior authorization requirements and other limitations that may apply, see ghcscw.com.Complementary MedicineCopayments: 79 initial visit of Acupuncture, 75 initial visit of Naturopathy, 49 one-hour personal sessions for Acupuncture, MassageTherapy and Reiki. For HSA/HDHP plans, Member pays the full cost of service before the Deductible is met, then Copayment applies.Hospital ServicesInpatient Hospital Services: Physician Services,Surgery, Facility Fees30% after Deductible30% after Deductible20% after DeductibleNo Charge after DeductibleOutpatient Hospital Surgical/Non-SurgicalServices: Facility Fees30% after Deductible30% after Deductible20% after DeductibleNo Charge after DeductibleSkilled Nursing Facility Services30% after Deductible30% after Deductible20% after DeductibleNo Charge after DeductibleNo ChargeNo ChargeNo ChargeNo Charge after DeductibleOutpatient Services 35 30 40No Charge after DeductibleInpatient Services30% after Deductible30% after Deductible20% after DeductibleNo Charge after DeductibleTransitional Services30% after Deductible30% after Deductible20% after DeductibleNo Charge after DeductibleVision ServicesVision ExaminationsMental Health & Substance Use DisorderDO NOT CANCEL YOUR INSURANCE. COVERAGE IS NOT IN EFFECT UNTIL WRITTEN APPROVAL IS ISSUED.4

INDIVIDUAL HMO ACA PLANS 2021CLICK ON THE PLAN NAME FORDETAILED PLAN DESCRIPTIONSPlan Number on MarketplacePlan Number off Marketplace (Direct)Bronze Simple Choice6850 Ded/8200 MOOPBronze 7000 Ded/7000MOOP HSABronze 4000 Ded/8500MOOPBronze 8550 140421314012131416Plan Offered Direct and/or on the MarketplaceDirect & MarketplaceDirect & MarketplaceDirect & MarketplaceDirect & MarketplaceDeductible - Medical (Based on Calendar Year)N/AN/A 4,000/Individual or 8,000/FamilyN/ADeductible - Prescription (Based on CalendarYear)N/AN/A 0/Individual or 0/FamilyN/ADeductible - Medical & Prescription Combined(Based on Calendar Year) 6,850/Individual or 13,700/Family 7,000/Individual or 14,000/FamilyN/A 8,550/Individual or 40%0% 8,200/Individual or 16,400/Family 7,000/Individual or 14,000/Family 8,500/Individual or 17,000/Family 8,550/Individual or 17,100/FamilyEmbedded/Non-EmbeddedPolicy CoinsuranceMaximum Out-of-Pocket Prescription & MedicalCombined (MOOP)Eligible DependentsDependents are covered until the end of the month in which they turn 26Clinic ServicesPrimary Care Office Visits 35No Charge after Deductible 125Chiropractic Office Visits 35No Charge after Deductible 125 125No ChargeNo ChargeNo ChargeNo ChargeSpecialist Care Office Visits 150No Charge after Deductible 250 175Preventitive ImmunizationsNo ChargeNo ChargeNo ChargeNo ChargePreventive Health Examinations 125Prenatal and Postnatal Maternity CareNo ChargeNo ChargeNo ChargeNo ChargeDiagnostic X-Ray and Laboratory Test40% after DeductibleNo Charge after Deductible40% after DeductibleNo Charge after DeductibleAdvanced Radiology40% after DeductibleNo Charge after Deductible40% after DeductibleNo Charge after DeductibleEmergency and Urgent Care 75No Charge after Deductible 125 125Emergency Ambulance Service (air/ground)Urgent Care Visits40% after DeductibleNo Charge after Deductible40% after DeductibleNo Charge after DeductibleEmergency Room Visits40% after DeductibleNo Charge after Deductible40% after DeductibleNo Charge after DeductibleTier 1 35No Charge after Deductible 50 35Tier 235% after DeductibleNo Charge after Deductible 200No Charge after DeductibleTier 340% after DeductibleNo Charge after Deductible 300No Charge after DeductibleNo Charge after Deductible50% after PharmacyDeductibleNo Charge after DeductiblePrescription DrugsTier 445% after DeductibleThe Prescription Drugs Benefit is administered by GHC-SCW Clinic pharmacies and Navitus. Prescription Drugs are NOT COVERED outside of the GHC-SCW network of providers. For a list of formularydrugs, tier ( ) placement, prior authorization requirements and other limitations that may apply, see ghcscw.com.Complementary MedicineCopayments: 79 initial visit of Acupuncture, 75 initial visit of Naturopathy, 49 one-hour personal sessions for Acupuncture, MassageTherapy and Reiki. For HSA/HDHP plans, Member pays the full cost of service before the Deductible is met, then Copayment applies.Hospital ServicesInpatient Hospital Services: Physician Services,Surgery, Facility Fees40% after DeductibleNo Charge after Deductible40% after DeductibleNo Charge after DeductibleOutpatient Hospital Surgical/Non-SurgicalServices: Facility Fees40% after DeductibleNo Charge after Deductible40% after DeductibleNo Charge after DeductibleSkilled Nursing Facility Services40% after DeductibleNo Charge after Deductible40% after DeductibleNo Charge after DeductibleNo ChargeNo Charge after DeductibleNo ChargeNo ChargeOutpatient Services 35No Charge after Deductible 125 125Inpatient Services40% after DeductibleNo Charge after Deductible40% after DeductibleNo Charge after DeductibleTransitional Services40% after DeductibleNo Charge after Deductible40% after DeductibleNo Charge after DeductibleVision ServicesVision ExaminationsMental Health & Substance Use DisorderDO NOT CANCEL YOUR INSURANCE. COVERAGE IS NOT IN EFFECT UNTIL WRITTEN APPROVAL IS ISSUED.5

General Health Plan Limitations and ExclusionsThis is an outline of the Limitations and Exclusions for the Group Health Cooperative of South Central Wisconsin (GHC-SCW) group andindividual health plans. It is designed for reference only. Consult the Policy, Policy Amendments, Certificate of Coverage, and BenefitsSummary for a complete list of Limitations and Exclusions.The following services and expenses are not covered, and no benefits will be payable unless stated otherwise for expenses arising from:Medical care or services provided by anon-GHC-SCW Provider, whether or notunder contract with GHC-SCW. Using anon-GHC-SCW Provider or an Out-of-PlanProvider is not covered and the Member willbe financially responsible for full payment ofcare and services unless: written approvalfor Out-of-Plan care and services has beenobtained from GHC-SCW’s Care ManagementDepartment prior to obtaining the medicalcare; or, service is for an EmergencyCondition or an Urgent Condition when theMember is outside of the GHC-SCW ServiceArea; or, the plan provides for the use ofnon-GHC-SCW ProvidersDental services not specifically coveredunder the Policy or Certificate of CoverageInsulin injection pens not included in theGHC-SCW formularyDrug screening, except as specificallycovered under the Policy or Certificate ofCoverageKeratorefractive surgeryDuplicate servicesMental Health and Substance Use Disorderservices beyond the services specified in thePolicy or Certificate of CoverageServices that are not Medically Necessary,are experimental, investigative, or forresearch purposesEmergency Outpatient Services when aMember leaves the emergency room prior toseeing a physicianBilled amounts that are over and above theGHC-SCW Reasonable and Customary Feesand Charges for covered benefitsEnd of Life Services not specifically includedunder the Policy or Certificate of CoverageItems or services required as a result of war orany act o

Therapy and Reiki. For HSA/HDHP plans, Member pays the full cost of service before the Deductible is met, then Copayment applies. . DO NOT CANCEL YOUR