Transcription

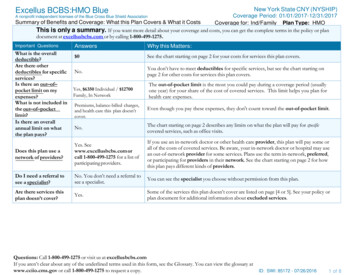

New York State CNY (NYSHIP)Excellus BCBS:HMO BlueCoverage Period: 01/01/2017-12/31/2017Summary of Benefits and Coverage: What this Plan Covers & What it CostsCoverage for: Ind/Family Plan Type: HMOThis is only a summary. If you want more detail about your coverage and costs, you can get the complete terms in the policy or plandocument at excellusbcbs.com or by calling 1-800-499-1275.A nonprofit independent licensee of the Blue Cross Blue Shield AssociationImportant QuestionsAnswersWhy this Matters: 0See the chart starting on page 2 for your costs for services this plan covers.No.You don’t have to meet deductibles for specific services, but see the chart starting onpage 2 for other costs for services this plan covers.What is the overalldeductible?Are there otherdeductibles for specificservices?Is there an out–of–pocket limit on myexpenses?What is not included inthe out–of–pocketlimit?Is there an overallannual limit on whatthe plan pays?Yes, 6350 Individual / 12700Family, In NetworkThe out-of-pocket limit is the most you could pay during a coverage period (usuallyone year) for your share of the cost of covered services. This limit helps you plan forhealth care expenses.Premiums, balance-billed charges,and health care this plan doesn’tcover.Even though you pay these expenses, they don't count toward the out-of-pocket limit.No.The chart starting on page 2 describes any limits on what the plan will pay for specificcovered services, such as office visits.Does this plan use anetwork of providers?Yes. Seewww.excellusbcbs.com orcall 1-800-499-1275 for a list ofparticipating providers.If you use an in-network doctor or other health care provider, this plan will pay some orall of the costs of covered services. Be aware, your in-network doctor or hospital may usean out-of-network provider for some services. Plans use the term in-network, preferred,or participating for providers in their network. See the chart starting on page 2 for howthis plan pays different kinds of providers.Do I need a referral tosee a specialist?No. You don’t need a referral tosee a specialist.You can see the specialist you choose without permission from this plan.Are there services thisplan doesn’t cover?Yes.Some of the services this plan doesn’t cover are listed on page [4 or 5]. See your policy orplan document for additional information about excluded services.Questions: Call 1-800-499-1275 or visit us at excellusbcbs.comIf you aren’t clear about any of the underlined terms used in this form, see the Glossary. You can view the glossary atwww.cciio.cms.gov or call 1-800-499-1275 to request a copy.ID: SWI: 85172 - 07/26/20161 of 8

Copayments are fixed dollar amounts (for example, 15) you pay for covered health care, usually when you receive the service. Coinsurance is your share of the costs of a covered service, calculated as a percent of the allowed amount for the service. For example, if theplan’s allowed amount for an overnight hospital stay is 1,000, your coinsurance payment of 20% would be 200. This may change if youhaven’t met your deductible. The amount the plan pays for covered services is based on the allowed amount. If an out-of-network provider charges more than the allowedamount, you may have to pay the difference. For example, if an out-of-network hospital charges 1,500 for an overnight stay and the allowedamount is 1,000, you may have to pay the 500 difference. (This is called balance billing.)This plan may encourage you to use in-network providers by charging you lower deductibles, copayments and coinsurance amounts.CommonMedical EventIf you visit a healthcare provider’s officeor clinicServices You May NeedYour Cost If YouUse anIn-networkProviderYour Cost IfYou Use anOut-ofnetworkProviderLimitations & ExceptionsPrimary care visit to treat an injury or illnessSpecialist visit 25.00 co-pay 40.00 co-payNot CoveredNot Covered------none-----------none------Other practitioner office visitPreventive care/screening/immunizationIf you have a testAcupuncture NotCoveredChiropractic 40.00co-payNo ChargeNot Covered------none------Not CoveredAdult Physical 1 Visit(s) per yearDiagnostic test (x-ray, blood work)X-Ray 40.00 copayLab Services NoChargeNot Covered------none------Imaging (CT/PET scans, MRIs) 40.00 co-payNot Covered------none------2 of 8

CommonMedical EventIf you need drugs totreat your illness orconditionMore informationabout prescriptiondrug coverage isavailable atexcellusbcbs.comServices You May NeedYour Cost If YouUse anIn-networkProviderYour Cost IfYou Use anOut-ofnetworkProviderLimitations & ExceptionsGeneric drugsRetail Prescription 10.00 co-payMail OrderPrescription 20.00co-payNot Covered30 day retail supply90 day mail order supplyPreferred brand drugsRetail Prescription 30.00 co-payMail OrderPrescription 60.00co-payNot Covered30 day retail supply90 day mail order supplyNon-preferred brand drugsRetail Prescription 50.00 co-payMail OrderPrescription 100.00 co-payNot Covered30 day retail supply90 day mail order supplyNot CoveredAfter initial fill, prescription must befilled by a participating SpecialtyPharmacy. Specialty drugs are noteligible for mail order.Specialty drugsRetailPrescription 10/ 30/ 50If you haveoutpatient surgeryFacility fee (e.g., ambulatory surgery center)Physician/surgeon fees 50.00 co-pay 40.00 co-payNot CoveredNot Covered------none------If you needimmediate medicalattentionEmergency room servicesEmergency medical transportation 100.00 co-pay 100.00 co-pay 100.00 co-pay 100.00 co-pay------none-----------none------Urgent care 35.00 co-payNot Covered------none------Facility fee (e.g., hospital room)No ChargeNot Covered------none------Physician/surgeon feeLesser of 200.00co-pay or 20% coinsuranceNot Covered------none------If you have ahospital stay------none------3 of 8

CommonMedical EventIf you have mentalhealth, behavioralhealth, or substanceabuse needsServices You May NeedMental/Behavioral health outpatient servicesMental/Behavioral health inpatient servicesSubstance use disorder outpatient services 40.00 co-payNo Charge 25.00 co-payNot CoveredNot CoveredNot ---Substance use disorder inpatient servicesNo ChargeNot Covered------none------Prenatal and postnatal careNo ChargeDelivery and all inpatient servicesPhysician Lesser of 200.00 co-pay or20% co-insuranceFacility No ChargeAnesthesia NoChargeNot Covered------none------Home health careNo ChargeNot Covered40 Visit(s) per contract yearNot CoveredOutpatient 30 Visit(s) per yearInpatient 60 Day(s) per yearNot Covered30 Visit(s) per yearIf you are pregnantIf you need helprecovering or haveother special healthneedsIf your child needsdental or eye careYour Cost IfYou Use anOut-ofnetworkProviderYour Cost If YouUse anIn-networkProviderNot CoveredLimitations & Exceptions------none------Habilitation servicesOutpatient 40.00co-payInpatient NoCharge 40.00 co-paySkilled nursing careNo ChargeNot Covered45 Day(s) per yearDurable medical equipment50% co-insuranceNot Covered------none------Hospice serviceNo ChargeNot Covered210 Day(s)per LifetimeFamily Bereavement 5 Visit(s) per yearEye examNot CoveredNot Covered------none------GlassesDental check-upNot CoveredNot CoveredNot CoveredNot on services4 of 8

Excluded Services & Other Covered Services:Services Your Plan Does NOT Cover (This isn’t a complete list. Check your policy or plan document for other excluded services.) AcupunctureCosmetic surgeryLong term care Routine foot care Weight loss programsPrivate-duty nursing Dental CareRoutine eye careOther Covered Services (This isn’t a complete list. Check your policy or plan document for other covered services and your costs for theseservices.) Bariatric SurgeryInfertility treatment Chiropractic careEmergency care when traveling outside theU.S. Hearing aids (Children up to age 19)Your Rights to Continue Coverage:If you lose coverage under the plan, then, depending upon the circumstances, Federal and State laws may provide protections that allow you to keep healthcoverage. Any such rights may be limited in duration and will require you to pay a premium, which may be significantly higher than the premium you paywhile covered under the plan. Other limitations on your rights to continue coverage may also apply.For more information on your rights to continue coverage, contact the plan at 1-800-499-1275. You may also contact your state insurance department, theU.S. Department of Labor, Employee Benefits Security Administration at 1-866-444-3272 or www.dol.gov/ebsa, or the U.S. Department of Health andHuman Services at 1-877-267-2323 x61565 or www.cciio.cms.gov.Your Grievance and Appeals Rights:If you have a complaint or are dissatisfied with a denial of coverage for claims under your plan, you may be able to appeal or file a grievance. Forquestions about your rights, this notice, or assistance, you can contact Customer Service at 1-800-499-1275. For group health coverage subject to ERISA, you can contact your plan at 1-800-499-1275. You can also contact the Department of Labor’sEmployee Benefits Security Administration at 1-866-444-EBSA (3272) or www.dol.gov/ebsa/healthreform. If coverage is insured, you can contactNew York State Department of Financial Services at 1-800-342-3736 For non-federal governmental group health plans and church plans that are group health plans, call 1-800-499-1275. If coverageis insured, you can contact New York State Department of Financial Services at 1-800-342-3736 Additionally, a consumer assistance program can help you file your appeal. Contact Community Health Advocates, the State’s consumer assistanceprogram, at 1-888-614-5400 or at www.communityhealthadvocates.org.5 of 8

Does This Coverage Provide Minimum Essential Coverage?The Affordable Care Act requires most people to have health care coverage that qualifies as "minimum essential coverage". This plan or policy doesprovide minimum essential coverage.Does This Coverage Meet The Minimum Value Standard?In order for certain types of health coverage (for example, individually purchased insurance or job-based coverage) to qualify as minimum essential coverage,the plan must pay, on average, at least 60 percent of allowed charges for covered services. This is called the "minimum value standard". This healthcoverage does meet the minimum value standard for the benefits it provides.Language Access Services:Español: Para obtener asistencia en Español, llame al 1-800-499-1275.Tagalog: Kung kailangan ninyo ang tulong sa Tagalog tumawag sa 1-800-499-1275.中 : 如果需要中 的帮助,请拨打这个号码 1-800-499-1275.Dine: Dinek'ehgo shika at'ohwol ninisingo, kwiijigo holne' �To see examples of how this plan might cover costs for a sample medical situation, see the next page.–––––––––––––6 of 8

Excellus BCBS: HMOBlueNew York State CNY (NYSHIP)Coverage Period: 01/01/2017-12/31/2017Coverage for: Ind/FamilyPlan Type: HMOCoverage ExamplesAbout these CoverageExamples:These examples show how this plan might covermedical care in given situations. Use theseexamples to see, in general, how much financialprotection a sample patient might get if they arecovered under different plans.This isnot a costestimator.Don’t use these examples toestimate your actual costsunder this plan. The actualcare you receive will bedifferent from these examples,and the cost of that care willalso be different.See the next page forimportant information aboutthese examples.Having a babyManaging type 2 diabetes(normal delivery)(routine maintenance ofa well-controlled condition)Amount owed to providers: 7,540Plan pays: 7,030Patient pays: 510Sample care costs:Hospital charges (mother)Routine obstetric careHospital charges (baby)AnesthesiaLaboratory testsPrescriptionsRadiologyVaccines, other preventiveTotalPatient pays:DeductiblesCopaysCoinsuranceLimits or exclusionsTotal 2,700 2,100 900 900 500 200 200 40 7,540 0 360 0 150 510Amount owed to providers: 5,400Plan pays: 3,790Patient pays: 1,610Sample care costs:PrescriptionsMedical Equipment and SuppliesOffice Visits and ProceduresEducationLaboratory testsVaccines, other preventiveTotal 2,900 1,300 700 300 100 100 5,400Patient pays:DeductiblesCopaysCoinsuranceLimits or exclusionsTotal 0 1,570 0 40 1,610Questions: Call 1-800-499-1275 or visit us at excellusbcbs.comIf you aren’t clear about any of the underlined terms used in this form, see the Glossary. You can view the glossary atwww.cciio.cms.gov or call 1-800-499-1275 to request a copy.7 of 8

Excellus BCBS: HMO BlueNew York State CNY (NYSHIP)Coverage Period: 01/01/2017-12/31/2017Coverage for: Ind/FamilyPlan Type: HMOCoverage ExamplesQuestions and answers about the Coverage Examples:What are some of theassumptions behind theCoverage Examples? Costs don’t include premiums.Sample care costs are based on nationalaverages supplied by the U.S. Departmentof Health and Human Services, and aren’tspecific to a particular geographic area orhealth plan.The patient’s condition was not anexcluded or preexisting condition.All services and treatments started andended in the same coverage period.There are no other medical expenses forany member covered under this plan.Out-of-pocket expenses are based only ontreating the condition in the example.The patient received all care from innetwork providers. If the patient hadreceived care from out-of-networkproviders, costs would have been higher.What does a Coverage Exampleshow?Can I use Coverage Examples tocompare plans?For each treatment situation, the CoverageExample helps you see how deductibles,copayments, and coinsurance can add up. Italso helps you see what expenses might be leftup to you to pay because the service ortreatment isn’t covered or payment is limited. Yes. When you look at the Summary ofDoes the Coverage Examplepredict my own care needs? No. Treatments shown are just examples.The care you would receive for thiscondition could be different based on yourdoctor’s advice, your age, how serious yourcondition is, and many other factors.Does the Coverage Examplepredict my future expenses? No. Coverage Examples are not costestimators. You can’t use the examples toestimate costs for an actual condition. Theyare for comparative purposes only. Yourown costs will be different depending onthe care you receive, the prices yourproviders charge, and the reimbursementyour health plan allows.Benefits and Coverage for other plans,you’ll find the same Coverage Examples.When you compare plans, check the “Patient Pays” box in each example. Thesmaller that number, the more coverage theplan provides.Are there other costs I shouldconsider when comparingplans? Yes. An important cost is the premiumyou pay. Generally, the lower yourpremium, the more you’ll pay in out-ofpocket costs, such as copayments,deductibles, and coinsurance. Youshould also consider contributions toaccounts such as health savings accounts(HSAs), flexible spending arrangements(FSAs) or health reimbursement accounts(HRAs) that help you pay out-of-pocketexpenses.Questions: Call 1-800-499-1275 or visit us at excellusbcbs.comIf you aren’t clear about any of the underlined terms used in this form, see the Glossary. You can view the glossary atwww.cciio.cms.gov or call 1-800-499-1275 to request a copy.8 of 8

Excellus BCBS: HMOBlue New York State CNY (NYSHIP) Coverage Examples Coverage Period: 01/01/2017-12/31/2017 Coverage for: Ind/Family Plan Type: HMO Questions: Call 1-800-499-1275 or visit us at excellusbcbs.com If you aren’t clear about any of the underlined terms used in this form, see the