Transcription

Lien and Bond Claims in the 50 States: 2020Published by:Foundation of the American Subcontractors Association, Inc.1004 Duke StreetAlexandria, VA 22314-3588Telephone: (888) 374-3133Fax: (888) 374-3133E-mail: ASAOffice@asa-hq.comWeb site: www.fasaonline.comCapitol Square, Suite 180065 E. State StreetColumbus, Ohio 43215-4294Donald W. Gregory, Esq.Eric B. Travers, Esq.General Counsel to the American Subcontractors AssociationCopyright 2020 American Subcontractors Association, Inc. All rights reserved. No part of thispublication may be reproduced, stored in a retrieval system or transmitted in any form or by anymeans, electronic, mechanical, photocopying, recording or otherwise, without obtaining priorwritten permission from the copyright owner.DISCLAIMER: This publication is for informational purposes only and does not contain legaladvice. Individual circumstances vary widely and state laws are continually changing, so readersshould not act on the information provided herein and should consult legal counsel for specificlegal advice.

AcknowledgmentsThank you to the construction law attorneys whoprepared the state updates for the 2020 edition ofLien and Bond Claims in the 50 States. The name ofthe attorney(s) who prepared each respective updateappear(s) on the upper-right corner of each statelisting. A contributors list, with contact information, isprovided in Appendix B. We appreciate the efforts ofthese attorneys in providing this important referencefor subcontractors and suppliers. We also want torecognize the contributions of Kegler Brown Hill Ritter summer associate Erica Bishop to thispublication.About ASA and FASAThe American SubcontractorsAssociation amplifies the voice ofand leads trade contractors toimprove the business environmentfor the construction industry and to serve as asteward for the community. The ideals and beliefsof ASA are ethical and equitable business practices,quality construction, a safe and healthy workenvironment, integrity and membership diversity.The Foundation of the AmericanSubcontractors Association, Inc., asection 501(c)(3) organization underthe U.S. Internal Revenue Code, is theeducational arm of ASA. FASA is an independententity devoted to development of quality educationalinformation.ii

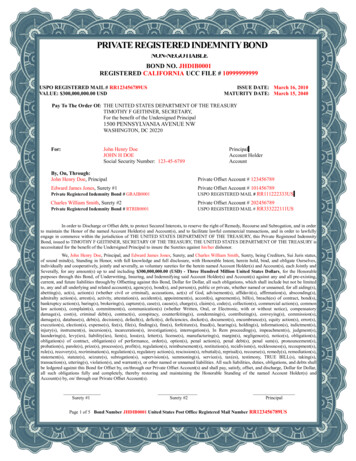

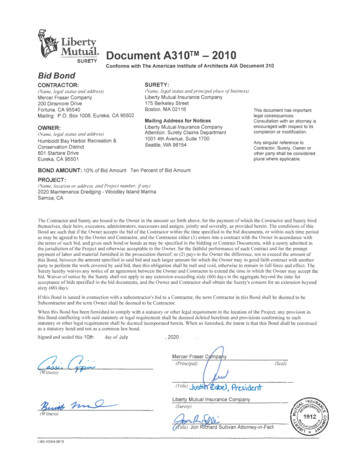

PrefaceA lien is a claim against property to secure adebt. Liens that secure payment of debts owedto construction subcontractors for the value ofwork performed, and materials furnished, on aconstruction project, are quite common in theUnited States, and generally arise by operationof state law based on the consent of the landowner to have his or her land improved. A lienmay be one of several legal tools at asubcontractor’s disposal to ensure payment,but a lien is generally the most effective toolbecause it encumbers the improved real estatein much the same fashion as a mortgage or ajudgment, effectively preventing resale.bond also serves as a prequalification device,because the surety effectively represents that ithas examined the principal and found theprincipal qualified to complete the obligationor undertaking in question, and thus worthy ofthe surety’s guarantee.Three kinds of bonds are common toconstruction: bid bonds, performance bondsand payment bonds. A bid bond guarantees that the bidder willenter into a contract for the bid amount. A performance bond guarantees to theowner that a prime contractor will performaccording to the contract referenced in thebond. A payment bond assures the owner that theprime contractor will pay its subcontractorsand suppliers, who might otherwise fileliens against the owner’s property.While all liens include the legal right to have adebt satisfied by forced sale of the propertyserving as security for the underlying debt, theprocedure to “perfect” a lien, that is, to makethe lien legally enforceable, varies greatly fromstate to state. Those differences cannot beignored, for the courts generally require strictcompliance with the applicable lien statutes ifthe lien is to be valid; “substantial compliance”does not suffice. For these reasons, there isprobably not an attorney in the country whowould claim to be an expert on all of the lienlaws of each of the 50 states and the District ofColumbia.Performance and payment bonds can beseparate documents or may be combined. Justas lien laws vary, statutes governing publicproject bonds vary from state to state.This publication is designed as a summary ofthe basic requirements of state law, but is not acomprehensive legal treatment of the statutesin the states. It does not contain legal advice.Because individual circumstances may varywidely and state laws are constantly changing,readers should consult their local attorneys forspecific advice. For easy reference, a roster ofcontributors appears as an appendix.A bond is a three-party instrument by whichone party (the surety) guarantees or promises asecond party (the owner or prime contractor)the successful performance of contractobligations owed to the second party by itsprincipal (the contractor or subcontractor). Aiii

Table of ContentsAcknowledgments. iiPreface. iiiFederal Government. 1States (and Washington, D.C.)Alabama . 2Alaska . 3Arizona. 5Arkansas . 10California . 14Colorado . 17Connecticut . 18Delaware . 21District of Columbia . 24Florida . 26Georgia . 29Hawaii . 33Idaho . 34Illinois . 37Indiana. 39Iowa. 42Kansas . 44Kentucky . 47Louisiana . 50Maine . 53Maryland . 56Massachusetts . 58Michigan . 61Minnesota. 63Mississippi . 65Missouri . 68Montana . 70Nebraska . 71Nevada . 74New Hampshire . 76New Jersey . 77New Mexico . 79New York . 81North Carolina . 84North Dakota . 85Ohio. 87iv

Oklahoma . 89Oregon. 91Pennsylvania . 94Rhode Island . 96South Carolina . 97South Dakota. 98Tennessee . 99Texas . 102Utah . 108Vermont . 110Virginia . 111Washington . 114West Virginia . 117Wisconsin. 119Wyoming. 122Appendix A: Lien and Bond Statutes in the 50 States and the District of Columbia . 125Appendix B: Contributors . 130v

Federal GovernmentBy Lawrence M. Prosen, Esq.provides written, third-party proof of service to thecontractor at any location where it maintains an office orconducts business; or at the prime contractor’s residence orin any other manner in which the U.S. marshal for thedistrict in which the public improvement is located mayeffectuate service of a summons.Private WorkNot applicable – Private Parties Cannot Lien FederalProperty.Suit Filing: All suits are to be filed in the name of the“United States for the use and benefit of (the claimant),”in the U.S. District Court in the district where thecontract is being performed, regardless of the amountsought. Suit may not be filed until the expiration of 90days from the date on which the claimant’s labor waslast performed or materials/services were supplied; butmust be filed no later than one year from that date.Public WorkRights Available: Suit on a payment bond.Who May Claim: Persons who have furnished labor ormaterial for performance of the work under the primecontract for which a payment bond is supplied pursuantto the Miller Act [40 U.S.C. § 3131 et seq.] and whohave not been paid in full before the expiration of 90days from the date that labor or materials were lastsupplied by claimant to the project for which the claimis made.Contractual Waivers:1. The Miller Act does not allow prospective waivers ofbond rights, as discussed below.2. The Miller Act does not discuss contingent paymentclauses. The Prompt Pay Act [31 U.S.C. § 3901 et seq.]does not require payment to a subcontractor until sevendays after a prime receives payment from the agency. Assuch, the best practice is to assume pay-if-paid clausesare enforceable and might waive bond rights.Type/Amount of Bond: Payment bonds are required forall federal construction projects exceeding 100,000.00.The payment bond amount must be equal to the totalamount payable under the prime contract’s terms, unlessthe contracting officer makes a written determination,with specific findings that the bond amount isimpractical, in which case the contracting officer shallset the bond amount. In no event, however, shall thepayment bond penal amount be less than that of theperformance bond provided for the project (i.e., anamount the contracting officer considers adequate toprotect the government).Waivers After Commencement of Work: Bond rightsmay not be waived prior to performance of one’s work,but there are other, limited circumstances in which one’sMiller Act bond rights may be waived. A waiver of theright to sue on a payment bond is void unless it is: In writing. Signed by the person whose rights are waived. Executed after that person has furnished labor ormaterials for use on the prime contract.However, waivers of bond rights are not required to beconditioned on payment.For projects exceeding 25,000 but not more than 100,000, other forms of payment security may beacceptable.Required Notice and Timing: Persons having a contractwith a subcontractor, but not directly with the primecontractor, must first give written notice to the primecontractor within 90 days from the date on which theclaimant last performed its labor or furnished/suppliedmaterials for which the claim is made. This notice muststate with “substantial accuracy” the amount sought and thename of the party to whom the labor or material wasprovided. This notice must be served by any means thatSpecial Warnings: As indicated above, notice must betimely and provided by any means that provides written,third-party proof of service to the contractor at any locationwhere it maintains an office or conducts business; or itsresidence or in any other manner in which the U.S. marshalfor the district in which the public improvement is locatedmay effectuate service of a summons.1

AlabamaBy Edward P. Meyerson, Esq.and Stephen K. Pudner, Esq.Lien Waivers: it is possible for lien rights to beexpressly waived in a contract, and partial waivers maywaive security for uncompleted work, retainage, extrasand claims. There is a refutable presumption that theright to lien exists if the claimant has complied with lienstatutes.Private WorkRights Available: Mechanics and materialmen lien.Who May Claim: The contractor, subcontractor,materialman, laborer and lessor of machinery andequipment. (Foreign corporations not qualified to dobusiness in Alabama may not enforce a lien in Alabamacourts.)Special Warning: Subcontractors, laborers, materialmen and lessors of machinery and equipment have liensonly to the extent of the unpaid balance due thecontractor from the owner at the time of notice unless,prior to furnishing work or materials, the claimantnotified the owner in writing of its intent to furnishcertain specified materials at specified prices.Required Notice and Timing: Every person, except theoriginal contractor, must give written notice to the ownerprior to filing the verified lien statement that sets forththe amount claimed, what is being claimed, and fromwhom. After such notice, any unpaid balance in thehands of the owner is subject to such a lien.Public WorkRights Available: Suit on a payment bond.Notice is unnecessary if, prior to furnishing materials forthe project, a person has notified the owner in writingthat such material, at a specified price, would beprovided. In this event, the supplier would have a lienfor the full purchase price if the owner does not notifysupplier that it will not be responsible.Who May Claim: The subcontractor, materialman,laborer or any other person who furnishes labor,materials or supplies on a public project.Type/Amount of Bond: A payment bond is required forall contracts of 50,000 or more in an amount not lessthan 50 percent of the contract price. A performancebond is required in the full amount of the contract price.Lien Filing:1. The original contractor must file a verified lienstatement within six months after its last performance oflabor or after last furnishing materials.Required Notice and Timing: No civil action shall beinstituted on said bond until after 45 days’ written noticeby registered or certified mail to the surety of the amountclaimed and the nature of the claim.2. Journeymen and day laborers must file a verified lienstatement within 30 days after they last performed workon the project.3. All other claimants must file a verified lien statementwithin four months after their last performance of laboror after last supplying materials on the project.Suit Filing: Suit must be filed not later than one yearfrom the date of final settlement of the contract.Lien Available: No.Suit Filing: Any action for the enforcement of a lienmust be commenced within six months after thematurity of the entire indebtedness secured by the lien.2

AlaskaBy James T. Yand, Esq.and Alejandro MonarrezRights Available: Mechanics’ lien is the exclusiveremedy for unpaid labor or goods invoices. Alaska Stat.§ 34.35.050. In the case of past-due invoices, a stoplending notice is also available. Alaska Stat.§ 34.35.062.within the period above, granting an additional 6months. Alaska Stat. § 34.35.080(a). A lien with anextended duration is void as against a person whoacquires an interest in the subject property after thecommencement of the action, unless notice of the actionhas been duly filed before the person’s conveyance.Alaska Stat.

Type/Amount of Bond: Payment bonds are required for all federal construction projects exceeding 100,000.00. The payment bond amount must be equal to the total amount payable under the prime contract’s terms, unless the contracting officer makes a written determination, with s