Transcription

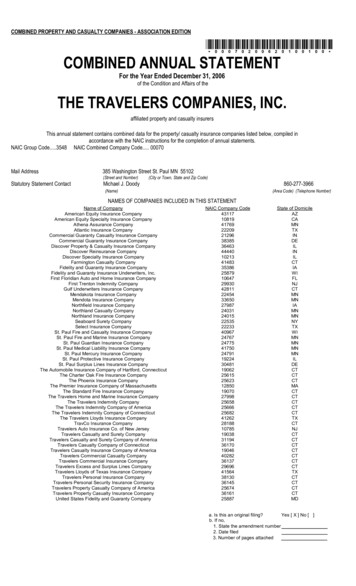

COMBINED PROPERTY AND CASUALTY COMPANIES - ASSOCIATION EDITION*00070200620100100*COMBINED ANNUAL STATEMENTFor the Year Ended December 31, 2006of the Condition and Affairs of theTHE TRAVELERS COMPANIES, INC.affiliated property and casualty insurersThis annual statement contains combined data for the property/ casualty insurance companies listed below, compiled inaccordance with the NAIC instructions for the completion of annual statements.NAIC Group Code.3548 NAIC Combined Company Code. 00070Mail Address385 Washington Street St. Paul MN 55102(Street and Number)Statutory Statement Contact(City or Town, State and Zip Code)Michael J. Doody860-277-3966(Name)(Area Code) (Telephone Number)NAMES OF COMPANIES INCLUDED IN THIS STATEMENTName of CompanyAmerican Equity Insurance CompanyAmerican Equity Specialty Insurance CompanyAthena Assurance CompanyAtlantic Insurance CompanyCommercial Guaranty Casualty Insurance CompanyCommercial Guaranty Insurance CompanyDiscover Property & Casualty Insurance CompanyDiscover Reinsurance CompanyDiscover Specialty Insurance CompanyFarmington Casualty CompanyFidelity and Guaranty Insurance CompanyFidelity and Guaranty Insurance Underwriters, Inc.First Floridian Auto and Home Insurance CompanyFirst Trenton Indemnity CompanyGulf Underwriters Insurance CompanyMendakota Insurance CompanyMendota Insurance CompanyNorthfield Insurance CompanyNorthland Casualty CompanyNorthland Insurance CompanySeaboard Surety CompanySelect Insurance CompanySt. Paul Fire and Casualty Insurance CompanySt. Paul Fire and Marine Insurance CompanySt. Paul Guardian Insurance CompanySt. Paul Medical Liability Insurance CompanySt. Paul Mercury Insurance CompanySt. Paul Protective Insurance CompanySt. Paul Surplus Lines Insurance CompanyThe Automobile Insurance Company of Hartford, ConnecticutThe Charter Oak Fire Insurance CompanyThe Phoenix Insurance CompanyThe Premier Insurance Company of MassachusettsThe Standard Fire Insurance CompanyThe Travelers Home and Marine Insurance CompanyThe Travelers Indemnity CompanyThe Travelers Indemnity Company of AmericaThe Travelers Indemnity Company of ConnecticutThe Travelers Lloyds Insurance CompanyTravCo Insurance CompanyTravelers Auto Insurance Co. of New JerseyTravelers Casualty and Surety CompanyTravelers Casualty and Surety Company of AmericaTravelers Casualty Company of ConnecticutTravelers Casualty Insurance Company of AmericaTravelers Commercial Casualty CompanyTravelers Commercial Insurance CompanyTravelers Excess and Surplus Lines CompanyTravelers Lloyds of Texas Insurance CompanyTravelers Personal Insurance CompanyTravelers Personal Security Insurance CompanyTravelers Property Casualty Company of AmericaTravelers Property Casualty Insurance CompanyUnited States Fidelity and Guaranty CompanyNAIC Company 813036145256743616125887State of CTCTTXCTCTCTCTMDa. Is this an original filing?Yes [ X ] No [ ]b. If no,1. State the amendment number2. Date filed3. Number of pages attached

Combined Statement for the year 2006 of theTHE TRAVELERS COMPANIES, INC.ASSETS1Current Year2AssetsNonadmittedAssets3Net AdmittedAssets(Cols. 1 - 2)Prior Year4NetAdmitted Assets1.Bonds (Schedule D). .57,121,961,455 .0 .57,121,961,455 .53,968,784,0132.Stocks (Schedule D):3.4.2.1Preferred stocks. .445,152,636 .0 .445,152,636 .521,814,1882.2Common stocks. .1,378,995,757 .38,636,638 .1,340,359,120 .1,367,916,732Mortgage loans on real estate (Schedule B):3.1First liens. .54,094,331 .0 .54,094,331 .117,075,7703.2Other than first liens. .0 .0 .0 .29,185,354Real estate (Schedule A):4.1Properties occupied by the company (less .0encumbrances). .253,757,652 .0 .253,757,652 .260,243,8984.2Properties held for the production of income (less .0encumbrances). .623,211,132 .0 .623,211,132 .579,640,3474.3Properties held for sale (less .0 encumbrances). .0 .0 .0 .05.Cash ( .(550,997,864), Sch. E-Part 1), cash equivalents ( .171,448,771,Sch. E-Part 2) and short-term investments ( .2,262,324,316, Sch. DA). .1,882,792,009 .16,787 .1,882,775,222 .1,849,939,1526.Contract loans (including .0 premium notes). .2,093,317 .2,093,317 .0 .07.Other invested assets (Schedule BA). .2,863,986,488 .34,348,943 .2,829,637,545 .2,447,685,0748.Receivables for securities. .9,377,222 .0 .9,377,222 .571,641,2929.Aggregate write-ins for invested assets. .(56,282) .0 .(56,282) .010. Subtotals, cash and invested assets (Lines 1 to 9). .64,635,365,717 .75,095,684 .64,560,270,033 .61,713,925,82211. Title plants less .0 charged off (for Title insurers only). .0 .0 .0 .012. Investment income due and accrued. .744,322,006 .0 .744,322,006 .689,760,22213. Premiums and considerations:13.1 Uncollected premiums and agents' balances in course of collection. .1,344,680,919 .156,981,738 .1,187,699,182 .1,139,045,53813.2 Deferred premiums, agents' balances and installments booked but deferredand not yet due (including .110,916,753 earned but unbilled premiums). .4,598,525,589 .36,956,080 .4,561,569,509 .4,388,886,33913.3 Accrued retrospective premiums. .246,017,897 .7,168,535 .238,849,362 .339,007,83214. Reinsurance:14.1 Amounts recoverable from reinsurers. .1,283,635,876 .0 .1,283,635,876 .1,356,463,49114.2 Funds held by or deposited with reinsured companies. .137,165,169 .0 .137,165,169 .169,392,30214.3 Other amounts receivable under reinsurance contracts. .0 .0 .0 .015. Amounts receivable relating to uninsured plans. .0 .0 .0 .016.1 Current federal and foreign income tax recoverable and interest thereon. .(0) .0 .(0) .53,271,44816.2 Net deferred tax asset. .2,902,483,434 .1,740,555,147 .1,161,928,286 .1,368,444,43417. Guaranty funds receivable or on deposit. .62,611,388 .0 .62,611,388 .71,551,65318. Electronic data processing equipment and software. .76,045,213 .594,812 .75,450,401 .65,295,67119. Furniture and equipment, including health care delivery assets ( .0). .134,147,648 .134,147,647 .0 .020. Net adjustment in assets and liabilities due to foreign exchange rates. .0 .0 .0 .021. Receivables from parent, subsidiaries and affiliates. .43,620,598 .0 .43,620,598 .27,013,15722. Health care ( .0) and other amounts receivable. .0 .0 .0 .023. Aggregate write-ins for other than invested assets. .1,338,011,137 .712,144,220 .625,866,917 .784,858,12524. Total assets excluding Separate Accounts, Segregated Accounts and ProtectedCell Accounts (Lines 10 to 23). .77,546,632,591 .2,863,643,864 .74,682,988,727 .72,166,916,03425. From Separate Accounts, Segregated Accounts and Protected Cell Accounts. .0 .0 .0 .026. TOTALS (Lines 24 and 25). .77,546,632,591 .2,863,643,864 .74,682,988,727 .72,166,916,034DETAILS OF WRITE-INS0901. Combined write-ins for Assets Line 9. .(56,282) .0 .(56,282) .00902. . . . . .0903. . . . . .0998. Summary of remaining write-ins for Line 9 from overflow page. . . . .0999. Totals (Lines 0901 thru 0903 plus 0998) (Line 9 above). .(56,282) .0 .(56,282) .02301. Combined write-ins for Assets Line 23. .1,338,011,137 .712,144,220 .625,866,917 .784,858,1252302. . . . . .2303. . . . . .2398. Summary of remaining write-ins for Line 23 from overflow page. . . . .2399. Totals (Lines 2301 thru 2303 plus 2398) (Line 23 above). .1,338,011,137 .712,144,220 .625,866,917 .784,858,1252

Combined Statement for the year 2006 of theTHE TRAVELERS COMPANIES, INC.LIABILITIES, SURPLUS AND OTHER FUNDS1Current Year2Prior Year1.Losses (Part 2A, Line 34, Column 8). .32,855,947,348 .33,714,327,8952.Reinsurance payable on paid loss and loss adjustment expenses (Schedule F, Part 1, Column 6). .56,704,806 .27,876,0203.Loss adjustment expenses (Part 2A, Line 34, Column 9). .7,183,568,771 .7,260,918,7504.Commissions payable, contingent commissions and other similar charges. .650,223,775 .621,329,9205.Other expenses (excluding taxes, licenses and fees). .543,651,561 .387,814,8296.Taxes, licenses and fees (excluding federal and foreign income taxes). .470,221,565 .560,678,3207.1Current federal and foreign income taxes (including .109,052,107 on realized capital gains (losses)). .185,818,616 .07.2Net deferred tax liability. .0 .08.Borrowed money .400,056 and interest thereon .30,640. .430,696 .1,545,4639.Unearned premiums (Part 1A, Line 37, Column 5) (after deducting unearned premiums for ceded reinsurance of .1,047,074,199and including warranty reserves of .0). .9,261,075,422 .8,951,517,44710.Advance premiums. .68,555,849 .71,127,10311.Dividends declared and unpaid:11.1 Stockholders. .0 .011.2 Policyholders. .28,586,744 .30,101,10512.Ceded reinsurance premiums payable (net of ceding commissions). .603,993,150 .622,991,15113.Funds held by company under reinsurance treaties (Schedule F, Part 3, Column 19). .398,792,576 .341,848,94914.Amounts withheld or retained by company for account of others. .994,066,462 .1,000,497,98315.Remittances and items not allocated. .339,543,165 .323,752,18216.Provision for reinsurance (Schedule F, Part 7).

Mendakota Insurance Company 22454 MN Mendota Insurance Company 33650 MN Northfield Insurance Company 27987 IA Northland Casualty Company 24031 MN Northland Insurance Company 24015 MN Seaboard Surety Company 22535 NY Select Insurance Company 22233 TX St. Paul Fire and Casualty Insurance Company 40967 WI St. Pa