Transcription

NEWS FROM NORTH AMERICAN BASINS2 016 MEDIA INFORMATION

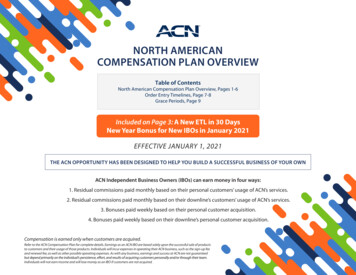

BOBTIPPEEBob Tippee has been Chief Editorof Oil & Gas Journal since January1999 and a member of the Journalstaff since October 1977. Beforejoining the magazine, he worked asa reporter at the Tulsa World andserved for four years as an officer inthe US Air Force. A native of St. Louis,he holds a degree in journalism fromthe University of Tulsa.PAULADITTRICKPaula Dittrick became UOGR Editorin November 2014 after havingcovered oil and gas from Houstonfor more than 20 years. She joinedOil & Gas Journal in February 2001where she developed a health,safety, and environment beat.Dittrick also is familiar with theindustry’s financial aspects andwrites the daily OGJ market story.Previously, she worked forDow Jones and United PressInternational. She began writingabout oil and gas as UPI’s WestTexas bureau chief during the1980s. She earned a Bachelor’s ofScience degree in journalism fromthe University of Nebraska in 1974.MATTZBOROWSKIMatt Zborowski has been Oil& Gas Journal’s resident StaffWriter since August 2013. Hisdaily responsibilities includefinding, writing, and editing news,managing those stories on OGJ’sweb site, and managing OGJ’sTwitter account, which boasts110,000 followers and counting.Born and raised in worldoil and gas capital and OGJheadquarters Houston, Zborowskibriefly left Texas to attain hisdegree in Print Journalism atLouisiana State University.Unconventional Oil & Gas Report provides detailed news coverage of North American shale and other tight‑formation playsand business developments within them. Unlike any other publication in the market, UOGR covers news of local interest on aplay-by-play basis including: permitting trends and totals, individual wells of special significance, production starts, technicaland geologic trends, discoveries, and other upstream news. It also covers important midstream and pipeline projects in each ofwww.uogreport.comthe plays.Beyond operational news, UOGR follows key personnel moves, local political developments, and financial stories. It publisheslocally focused features and stories based on interviews of key executives of companies involved in unconventional resourceplays. It is an important news publication for industry professionals, lively in presentation but serious in purpose.Each issue is organized by shale and basin, providing the audience a quick review of industry activity specific to each locale.The local focused coverage of important developments in each specific play is both professionally valuable to readers in thoseplays as well as professionally interesting to readers in other plays. This format is a publishing variation of the “think global/act local” business paradigm. It capitalizes on two practicalities of the continued expansion of unconventional resourcesdevelopment: 1) many companies and individuals operate in more than one play and thus have multiple local areas of interest;1and 2) professionals always look to other localities for alerts to problems and clues to solutions applicable where they work.

UOGR 2016 CIRCULATIONCIRCULATION BY 721Mid-Continent4,006Southeast2,836West 41%Northwest11%13%6%Mid-ContinentWest CoastNortheast8%37%SouthwestSoutheastJOB FUNCTION20,52855.7%Exploration, Drilling, Development & Production Mgmt., Engineering Mgmt.7,88721.4%Purchasing, Consulting and Land Services3,5019.5%Field Professionals, including Superintendent, Foreman, Toolpusher2,7278.0%Geologist or Geophysical2,2115.4%36,854100%Oil & Gas Producing Companies14,88940.4%Engineering, Drilling, Completions, Consulting, Service Companies11,60931.5%Investor, Financial Services5,75015.6%Government, Regulatory, Manufacturer, Association4,60612.5%36,854100%TotalBUSINESS INDUSTRYTotalwww.uogreport.comExecutive Management (CEO, COO, CFO, President, VP, Partner, Director)2

RATES, SPECS, AND DISTRIBUTIONRATES All rates are represented in gross U.S. DollarsUnconventional Oil & Gas Report1X3X6X12X18x24XFull Page Tab12,80011,52510,2508,9758,3357,690Junior Full Page8,7257,8506,9756,2505,8805,3551/2 Page Spread9,7008,7507,7506,9006,5505,9501/2 Page Horizontal5,6755,1254,5504,0003,7153,4251/2 Page Vertical5,6755,1254,5004,0003,7153,4251/4 Page Vertical3,9753,5753,1502,8002,6002,400Full Page Tab Spread17,95016,15014,35012,85011,72510,900FULL PAGE TAB SPREADFULL PAGE TABJUNIOR FULL PAGE1/2 PAGE SPREAD1/2 PAGE HORIZONTAL1/2 PAGE VERTICAL1/4 PAGE VERTICAL20.25 x 12.5 514mm x 317mm9.375 x 12 7 x 9.5 20.25 x 6 9.25 x 6 4.625 x 12 4.625 x 6 238mm x 305mm178mm x 241mm514mm x 152mm235mm x 152mm118mm x 305mm118mm x 152mmAD SIZELIVE AREA(W H)TRIMBLEED20.75 x 13 527mm x 330mm21 x 13.25 533mm x 337mm10.375 x 13 263mm x 330mm10.625 x 13.25 270mm x 337mmEDITORIAL DISTRIBUTION CALENDARNOVEMBER/DECEMBER 2015AD CLOSE: Nov 11 MATERIAL DUE: Nov 16Bonus Distribution: Houston Oilfield Expo, Dec 9 – 10, Houston, TXNAPE Rockies, Dec 9 – 11, Denver, CO JANUARY/FEBRUARYAD CLOSE: Jan 7 Bonus Distribution: MATERIAL DUE: Jan 14SPE Hydraulic Fracturing, Feb 9 – 11, The Woodlands, TXWinter NAPE, Feb 10 – 12, Houston, TX IADC/SPE Drilling Conference, Mar 1 – 3, Fort Worth, TX SPE ICoTA, Mar 22 – 23, Houston, TX Ark-La-Tex Oilfield Expo, Mar 30 – 31, Shreveport, LA MARCH/APRILAD CLOSE: Mar 8 MATERIAL DUE: Mar 15Bonus Distribution: SPE Improved Oil Recovery Conference, Apr 9 - 13, Tulsa, OKGPA Annual Convention, Apr 10 – 13, New Orleans, LAOffshore Technology Conference, May 2 – 5, Houston, TXAD CLOSE: May 6 MATERIAL DUE: May 13Bonus Distribution: MAY/JUNEAAPG Annual Conference, Jun 19 – 22, Calgary, Canada IPAA Midyear Meeting, Jun 27 – 29, Colorado Springs, CO South Texas Oilfield Expo, July 2016, San Antonio, TX URTeC, Aug 1 – 3, San Antonio, TX TIPRO Summer Conference *TBDwww.uogreport.comJULY/AUGUSTAD CLOSE: Jul 6 Bonus Distribution:MATERIAL DUE: Jul 13NAPE South, Aug 10 – 11, Houston, TXPower-Gen Natural Gas, Aug 23 – 25, Columbus, OH Pipeline Week, Sept 20 – 22, The Woodlands, TX SPE ATCE, Sept 26 – 28, Dubai, UAE OKC Oilfield Expo *TBD10.625 x 7 270mm x 179mmHOW TO SUBMIT YOUR AD MATERIALSTo upload ad materials to our FTP site:Maximum file size is 250MB—please stuff or zip your files beforesending and wait to close your browser window until you get yourupload confirmation.1. Go to digitalads.pennwell.com2. Select print material option3. Select Unconventional Oil & Gas Report from publication list andclick next4. Fill in required information and optional comments.5. Click on select file and then click on upload file after you haveselected your file.6. Wait on upload confirmation before closing browser.Depending on speed of connection and file size, this may take some time.Please be patient.To email ad materials:For files under 10 MB, please e-mail your ad to: admaterial@ pennwell.com.Include advertiser name, publication name and issue date. SEPTEMBER/OCTOBERAD CLOSE: Sept 7 Bonus Distribution: MATERIAL DUE: Sept 14NAPE Rockies, Oct 12 – 13, Denver, COSEG Annual Meeting, Oct 16 - 21, Dallas, TX IPAA Annual Meeting, Nov 9 – 11, Sea Island, GA NOVEMBER/DECEMBER321 x 7 533mm x 179mmAD CLOSE: Nov 7 MATERIAL DUE: Nov 14Bonus Distribution: Houston Oilfield Expo *TBDTo mail ad materials:Send contract, insertion order(s), correspondence, proofs, copy andcomplete advertising materials to:Ad Traffic ManagerUnconventional Oil & Gas ReportPennWell Corporation1421 S. Sheridan RoadTulsa, OK 74112-6600

HOW UNCONVENTIONAL OIL & GAS REPORTAUDIENCES CONSUME DIGITAL MEDIA67% COMPUTERVIEW OUR MEDIAON WEB BROWSERS ON AANNUAL INCREMENTALGOVERNMENT REVENUE*160130FederalrevenueBENTEK’S ESTIMATED INTERNAL RATE OF RETURN AT VARIOUS WTI PRICES*State andlocal revenue 50/bbl 60/bbl 70/bbl40352014%30201510UintaBarnettPiceanceUtica dryDuvernayHaynesvilleFayettevilleGreen RiverPowder RiverGranite WashMarcellus dryCana WoodfordArkoma WoodfordSCOOPBakkenUtica wetMontney BCAnadarkoMississippianEagle Ford oilMarcellus wetDenver-JuesburgPermian MidlandPermian Delaware*June 9 price assumptions: Gas 12-month forward cure for each regional pricing unit ( range 1.86-2.95/Mcf ). NGLs weighted average /bbl, 12-month forward average Mont Belvieu, Tex., prices (range 2005-27.10/bbl). For oil, Bentek’s model used the 12-month forward curve average for West Texas Intermediate plus or minus a basin price diferential (range 48.06-66.17/bbl) depending on the basinand its diferential.Source: Slide presented at Benposium 2015 hosted by Bentek Energy, a unit of Platts.mated IRR for a typical well. The Bentek analysis forecasts the relative viability of each region.The IRR generally drives rig movements and drilling activity, Comptonacknowledged “exogenous factors” suchas hedging also influence well economics.Bentek’s IRR estimates, which cover some 20 basins, are unadjusted forhedges. The IRR model analyzes information from earnings calls, investorpresentations, financial statements, andnews releases.The model devised by Bentek con-siders drilling and completion (D&C)costs, operating expenses, initial production rates, decline curves, production taxes, and royalty rates.As of June, Bentek said D&C costsranged from 4-12 million/well depending upon the unconventional play.The June IRR analysis was based onfirst-quarter results.“The IRR is largely driven by whatproducers are reporting,” Comptonsaid. Price assumptions included the12-month forward curve average for regional gas pricing. For NGLS, Bentekused the 12-month forward curve aver-age for Mont Belvieu, Tex., by productprices applied to each basin’s individualNLGs composition.For oil, Bentek’s model used the12-month forward curve average forWest Texas Intermediate plus or minus a basin differential. As of June 9,the oil price range was 48.06-66.17/bbl depending on the basin and its differential.“We can get a smaller level than justthe basin level,” Compton said, addingBentek has been hired to provide suchanalysis for specific areas within a particular play.Study outlines policy strategy for unconventional developmentUnconventional oil and gas presentsperhaps the single largest opportunity to improve the trajectory of the USeconomy, said a report released by Harvard University Business School (HBS)and Boston Consulting Group Inc.(BCG).Economic benefits can be achievedwhile mitigating environmental risksfrom horizontal drilling and hydraulic fracturing, researchers said, notingthat “unproductive, divisive, and oftenmisinformed debate about our energystrategy” currently threatens economicgoals.The report was written by Harvardbusiness professor Michael E. Porterand BCG partner and managing director David S. Gee in Washington, DC,181507uogr 18 18SPECIAL REPORT T H EJ O U R N A LO FE N E R G YF R O MI N N O V A T I O NVOLUME 3 NUMBER 4JULY/AUGUST 2015Dakota Prairie Refining sells diesel, mulls expansionPaula DittrickEditorDakota Prairie Refining LLC officialshosted a grand opening in late June tocelebrate the start up of the first US refinery in about 40 years. DPR startedselling commercial diesel from production at its recently commissioned refinery west of Dickinson, ND, in StarkCounty during May.Impetus behind the refinery, whichprocesses Bakken crude oil, was accelerated by North Dakota’s increasing demand for diesel fuel for trucks and in-dustrial demand. Much of that increasestemmed from activities associated withBakken formation oil and gas development.“An opportunity like this only happens once in a lifetime–to be at a newstartup refinery,” Mary Trost, DPR plantmanager, told reporters during the June29 grand opening. “Everything was builtat once, everything was sized correctly,it all fits together.”She compared that to working withrefineries that have been upgraded asneeded throughout the life of the plant.“You don’t have a lot of the problems [as] with an older refinery,” gettingequipment to fit in a plant built decadesearlier, Trost said, adding “You have allthis work to do,” in a typical modernization.Named DPR plant manager in January, she has 25 years of experience inrefining and petrochemicals, most recently as operations manager at BP PLC’sCherry Point Refinery in Blaine, Wash.Another difference between DPR andother refineries is that DPR processescrude oil produced regionally vs. crudeoil delivered by tankers or interstatepipelines. Trost noted she welcomesworking with oil produced regionally, ashift from her previous jobs at refineriesin Washington and Texas.“To be out here where all these wellsare–you have a much closer interactionwith the people doing the drilling andproduction,” Trost said. “That’s been fantastic.”DPR also is evaluating the potential forimplementing modifications that couldincrease the plant’s crude throughputcont’d on p. 3Dakota Prairie Refining built a large tank farm to hold Bakken crude oil for processing and also to temporarily store products. Photo from MDU Resources Group Inc.p. 14p. 19PRSRT STDUS POSTAGEPAIDLEBANONJUNCTION KY PERMIT#848ELECTRONIC SERVICE REQUESTEP.O. Box 3264, Northbrook, IL 60065-3261507uogr 1 1FGE:US shale shows resilence as OPEC reactsPOINT OF VIEW: Volker sees Whiting Petroleumrigged to run and prosper at 50-60 oil7/27/15 3:07 PM2030Source: Boston Consulting Group and Harvard Business School CompetitiveImpacts Model (please refer to Appendix 1 for detailed methodology) inreport entitled “America’s Unconventional Energy Opportunity” by MichaelE. Porter, David S. Gee, and Gregory J. ages/unconventional-energy.aspx502020*From unconventional oil and gas**Figures include incremental impacts from possibly reversing the ban oncrude oil exports as well as incremental impacts from LNG exports.Government revenues include personal and corporate taxes. State and localtaxes also include severance and ad valorem taxes. Revenues includeincome generated from federal royalties and lease payments to privatelandowners. Figures are rough estimates.25along with Gregory J. Pope, BCG principal in San Francisco.Researchers outlined a policy strategy for unconventional oil and gas development. The report, entitled “America’sUnconventional Energy Opportunity,”concentrated on shale plays and tightoil. Researchers excluded oil sands,extra-heavy oil, coal-to-gas conversion,and coalbed methane from the report.Previously, HBS launched a US Competitiveness Project, which showed thebusiness environment’s overall quality has declined in key areas, including skills, infrastructure, cost of doingbusiness, and corporate tax structure.Among various reasons, HBS blamed“partisan political gridlock.”Unconventional oil and gas presents“a once-in-a-generation opportunity tochange the nation’s economic and energy trajectory,” the HBS-BCG reportsaid. So far, much of the unconventional focus has been on the upstream.“With proper policies and actionsby the industry and other stakeholders,this economic opportunity can furtherspread into downstream industries, suchas petrochemicals and energy-intensiveindustries, and more broadly throughout the economy,” the report said.Threats to energy developmentLow commodity prices are unlikelyto hinder a fundamental US competitive advantage over the next severaldecades, researchers noted. But publicsupport for unconventional develop-ment, and especially hydraulic fracturing, appears to be declining and is considered a threat.Opposition reflects both legitimateconcerns and widespread confusion, researchers said. The HBS-BCG report listed the following issues that the US mustaddress to ensure its unconventional oiland gas potential can be achieved: Continue timely development of additional pipelines, gathering systems, and processing plants. Deliver a skilled workforce across awide variety of occupations. Eliminate outdated restrictions ongas and oil exports. Minimize local environmental risksto water, air, land, and communities. Develop transparent and consistentUnconventional Oil & Gas Report July/August 20157/27/15 3:08 PMenvironmental performance data. Set robust regulatory standards tospeed adoption of industry-bestpractices. Strengthen regulatory enforcementand producer compliance.Significant progress has been madein improving regulatory standards inmost energy-producing states, the report said.“There is no inherent trade-off between environmental protection andcompany profitability. With sound regulation and strong compliance, the costof good environmental performanceis modest and gives companies a levelplaying field,” HBS-BCG said.59% PDFVolker: Whiting Petroleum rigged to runand prosper at 50-60/bbl oilPaula DittrickEditorWhiting Petroleum Corp. has positioned itself to make money at 50-60/bbl oil, said James Volker, Whiting chiefexecutive officer, adding he believes thecompany can prosper at current oilprices and still boost production.“We have good assets, and we areimproving efficiencies through newtechnologies,” Volker said during aninterview with UOGR at Whiting’s corporate “We have used geoscience, reservoir, and operations engineering tomake our company work at 50-60/bbloil. We have approximately 133,500boe/d and 7,450 good locations in theBakken. We were taken there by corework to be where we can produce frommore than one zone. We study old vertical wells and then do core work on thenew wells we drill.”Whiting’s production and reservesare more than 80% light, sweet crudeoil, Volker said, adding he believes thecompany is one of the most oil-focusedindependents in North America.He attributed the company’s owncore lab at corporate headquarters forenabling Whiting to capture the sweetspots in the Bakken/Three Forks ofNorth Dakota and the Niobrara innortheastern Colorado.Core samples analyzed by Whiting’slab technicians and decisions madeFROM DOWNLOADABLE“The sale was consistent with ourplans to sell mature properties havinghigher lease operating expenses (LOE)per barrel of oil equivalent than ourcore Bakken and Niobrara assets,” Volker said. “LOE for the properties averaged 25/boe vs. 6.50/boe in the Bakken and 9/boe in our core Niobrara.”Whiting develops, acquires, andproduces oil, gas, and natural gas liquids primarily in the Bakken/ThreeForks plays in North Dakota, the Redtail Niobrara play in the northeasternDenver-Julesburg basin of Colorado,and an enhanced oil recovery field inthe Permian basin.POINT OF VIEWRedtail is promisingRedtail field is Whiting’s “economic sweet spot in the Niobrara,” Volkersaid, adding it’s about a 3-hr drive fromdowntown Denver to Weld County,Colo.Whiting has assembled 184,348gross (134,027 net) acres in Redtailwith an average working interest of73%. It has established production infour zones: the Niobrara A, B, C, andthe Codell/Fort Hays formations. As ofDec. 31, 2014, the independent had amix of 960 and 640-acre spacing unitsand 6,685 potential drillsites in the D-Jbasin oil window.During the first quarter, Whiting’sRedtail assets produced 13,000 boe/d,James Volker,Whiting Petroleum chairman, president, and chief executive officerwithin 48 hr while the rig remains inthe field are credited with saving thousands of dollars and eliminating theneed to move rigs back and forth pending executive decisions, he said.During April, Whiting sold older, conventional properties to a private buyerfor 108 million. The properties spanned4,000 wells, including several multiwellunits in 187 fields across 14 states.C O L O R A D O BRIEFSLilis Energy upsizesWattenberg dealLilis Energy Inc. of Denver amendedits agreement with a private seller andagreed to acquire an additional 375 netacres, bringing total undeveloped acreage being acquired in the transactionto 1,015 net acres in the core area ofWattenberg field, targeting the Niobraraand Codell formations.The additional acreage includesan average working interest of 4.48%and a total drilling commitment of 3.2million. In May, Lilis announced plansto acquire nonoperated leaseholdworking int

OKC Oilfield Expo *TBD SEPTEMBER/OCTOBER AD CLOSE: Sept 7 MATERIAL DUE: Sept 14 Bonus Distribution: NAPE Rockies, Oct 12 – 13, Denver, CO SEG Annual Meeting, Oct 16 - 21, Dallas, TX IPAA Annual Meeting, Nov 9